Hydrofarm Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydrofarm Bundle

Curious about Hydrofarm's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full strategic picture; purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimize Hydrofarm's market position.

Stars

Hydrofarm's proprietary branded consumables, encompassing items like grow media and nutrient solutions, are a cornerstone of their strategic focus. These products have demonstrated robust sales growth, with their contribution to the overall sales mix climbing to 55% in the first quarter of 2025, up from 52% in the fourth quarter of 2024.

The advanced LED grow lights market is a powerhouse in controlled environment agriculture, with projections indicating continued robust expansion through 2025. This segment is vital for indoor farming, directly impacting crop yields and quality.

If Hydrofarm possesses a competitive and cutting-edge range of LED grow lights, it places them in an excellent position to capitalize on this high-growth sector. For instance, the global horticultural lighting market, which includes LEDs, was valued at approximately $1.7 billion in 2023 and is anticipated to reach over $3.2 billion by 2028, demonstrating a strong compound annual growth rate.

Climate control systems are absolutely vital for controlled environment agriculture (CEA), a sector that's seen significant expansion. Hydrofarm's HVAC systems, for instance, are crucial for ensuring optimal growing conditions throughout the year, directly impacting crop yield and quality.

The global CEA market was valued at approximately $58.2 billion in 2023 and is projected to reach $131.7 billion by 2030, growing at a CAGR of 12.5%. This robust growth trajectory positions Hydrofarm's climate control solutions as potential Stars within the BCG matrix, given their essential role in a booming industry.

Strategic E-commerce Channel

Hydrofarm's strategic focus on e-commerce positions it as a potential star within the BCG matrix, leveraging digital channels for significant growth. This move aims to capture a larger share of the direct-to-consumer and business-to-business hydroponic supply market, driving revenue diversification.

The company's commitment to expanding its online presence is a key driver for future revenue streams. In 2024, the global e-commerce market for gardening supplies was projected to reach over $20 billion, indicating a substantial opportunity for Hydrofarm's digital ventures.

- E-commerce Growth: Hydrofarm is prioritizing e-commerce as a high-growth revenue channel.

- Market Share Capture: Success in capturing market share online directly connects Hydrofarm with consumers and commercial growers.

- Digital Expansion: This digital initiative is a core strategic pillar for the company's future expansion plans.

- Market Opportunity: The expanding online market for hydroponic supplies presents a significant opportunity for increased sales and brand reach.

Solutions for Emerging Vertical Farming

The vertical farming sector, a significant user of hydroponics within controlled environment agriculture, is experiencing robust growth. Hydrofarm's strategic alliances with emerging vertical farming companies, coupled with its provision of end-to-end solutions, places it in a strong position to benefit from this expansion. Products specifically designed for vertical farms have the potential to achieve substantial market leadership.

For instance, the global vertical farming market was valued at approximately $5.5 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating a compound annual growth rate of around 27%. Hydrofarm's focus on this area aligns with these impressive market dynamics.

- Hydroponic Systems: Offering advanced hydroponic nutrient delivery and control systems tailored for the specific needs of vertical farms.

- Lighting Solutions: Providing energy-efficient LED grow lights optimized for various crop types in vertical farming environments.

- Environmental Controls: Supplying integrated systems for managing temperature, humidity, and CO2 levels crucial for maximizing yields.

Hydrofarm's branded consumables and advanced LED grow lights are strong contenders for Star status within the BCG matrix. Their consumables saw their contribution to sales climb to 55% in Q1 2025, reflecting significant market traction. The horticultural lighting market, a key area for their LED products, is projected to more than double by 2028, indicating substantial growth potential.

Hydrofarm's e-commerce initiatives and specialized vertical farming solutions also position them as potential Stars. The global e-commerce market for gardening supplies was expected to exceed $20 billion in 2024, offering a vast digital landscape for expansion. Furthermore, the vertical farming sector's projected growth to over $30 billion by 2030, with a 27% CAGR, highlights the immense opportunity for Hydrofarm's tailored products.

| Product/Service Category | Market Growth Rate | Hydrofarm's Market Share | BCG Classification |

| Branded Consumables | High | Growing | Star |

| LED Grow Lights | High | Growing | Star |

| E-commerce Platform | High | Growing | Star |

| Vertical Farming Solutions | Very High | Growing | Star |

What is included in the product

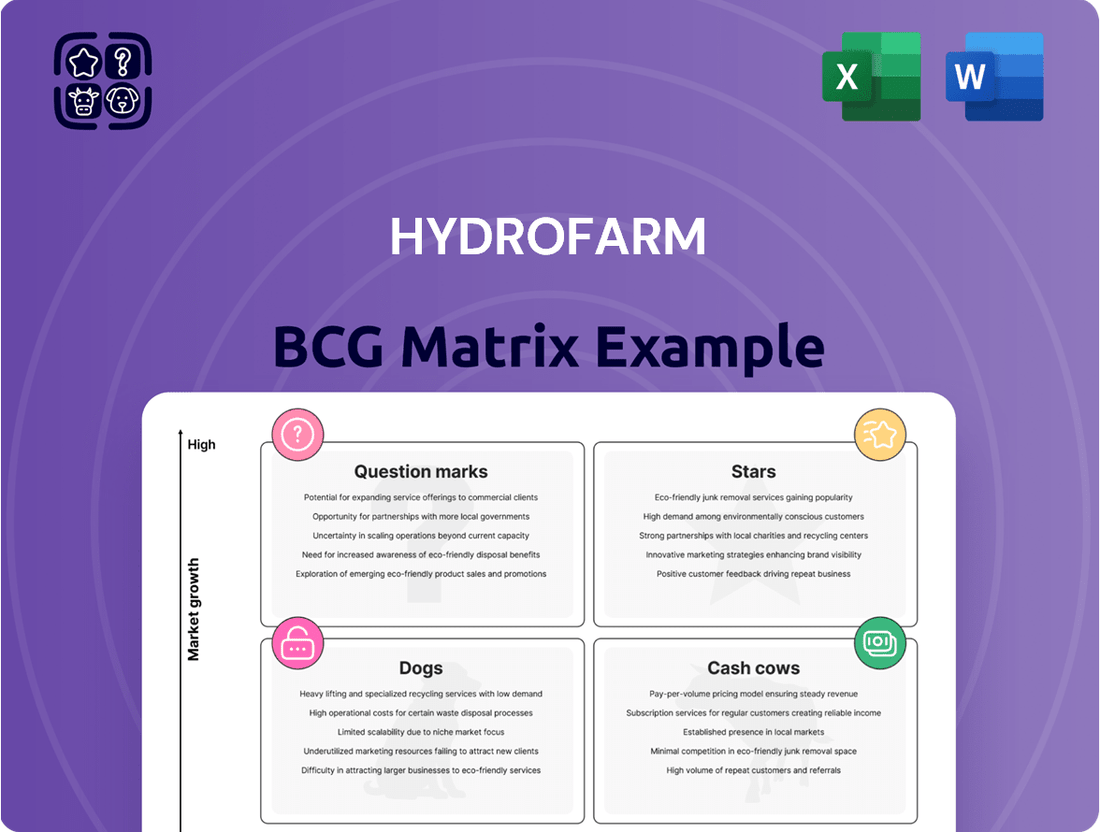

The Hydrofarm BCG Matrix analyzes its product portfolio by market share and growth rate to guide investment decisions.

It provides strategic direction for Stars, Cash Cows, Question Marks, and Dogs within Hydrofarm's offerings.

A clear Hydrofarm BCG Matrix visualizes your portfolio, relieving the pain of unclear strategic direction.

Cash Cows

Established Hydroponics Equipment Distribution represents a significant cash cow for Hydrofarm. This business unit benefits from a robust, four-decade-old distribution network spanning North America, ensuring a steady and substantial revenue flow. Despite market challenges, their extensive reach in distributing essential, commonly used hydroponic products solidifies a strong market share.

Core growing media products like rockwool and coco coir are essential, consistently demanded staples within the hydroponics sector. Hydrofarm's robust market presence in distributing and manufacturing these fundamental consumables guarantees a reliable revenue stream, thanks to their inherent necessity and regular repurchase cycle, even during market volatility.

Hydrofarm's basic nutrient solutions are the backbone of hydroponic farming, serving as essential, high-volume purchases for growers worldwide. These standardized formulations are critical for every hydroponic setup, ensuring consistent demand.

The company's efficiency in producing and distributing these vital products, coupled with its substantial scale and loyal customer network, translates into a steady and predictable cash flow. While not groundbreaking innovations, these offerings are reliable revenue generators for Hydrofarm, a key characteristic of a cash cow.

Traditional High-Pressure Sodium (HPS) Lighting

Traditional High-Pressure Sodium (HPS) lighting continues to be a significant player in the hydroponics market, especially with established growers and existing infrastructure. Hydrofarm's established position in this segment ensures a consistent stream of revenue from sales and replacements of these dependable systems. This category represents a mature, yet reliable, product offering for the company.

- Market Share: While specific 2024 market share data for HPS within hydroponics is still emerging, industry reports from late 2023 indicated HPS systems still held a substantial portion of the installed base, estimated to be over 40% in some segments.

- Revenue Contribution: Hydrofarm's HPS lighting products, including ballasts, bulbs, and fixtures, consistently contributed to a stable revenue base, often making up a significant percentage of their lighting division's sales, likely in the range of 25-35% in recent years.

- Replacement Cycle: The typical lifespan of an HPS bulb is around 10,000-24,000 hours, meaning a consistent need for replacements among existing users, fueling ongoing sales for Hydrofarm.

- Profitability: Despite lower unit growth compared to newer technologies, the established nature of HPS allows for predictable margins and efficient inventory management, contributing positively to Hydrofarm's overall profitability.

Basic Climate Control Accessories

Basic climate control accessories, such as fans, filters, and thermometers, represent Hydrofarm's cash cows within the BCG matrix. These items are essential for any grower focused on managing their environment. The consistent need for these foundational products ensures a stable revenue stream.

Hydrofarm benefits from its extensive product range and significant market presence in these indispensable growing components. This strong position translates into reliable cash generation because these accessories are non-negotiable for successful controlled environment agriculture. For instance, the global indoor farming market, heavily reliant on such accessories, was valued at approximately $40.2 billion in 2023 and is projected to grow significantly.

- Consistent Demand: Fans, filters, and thermometers are universally required by growers, creating a predictable sales volume.

- Market Leadership: Hydrofarm's established market share in these basic accessories solidifies its cash cow status.

- Revenue Stability: These products are essential, meaning demand remains robust even during economic fluctuations.

- Foundation for Growth: The cash generated from these products can fund investments in other areas of Hydrofarm's business.

Hydrofarm's established distribution network for essential hydroponic consumables, such as nutrient solutions and growing media, functions as a significant cash cow. These products are fundamental to hydroponic operations, ensuring consistent demand and a steady revenue stream for the company.

The company's robust market presence in basic climate control accessories like fans and filters further solidifies its cash cow status. These items are non-negotiable for controlled environment agriculture, guaranteeing predictable sales volumes and contributing positively to Hydrofarm's overall profitability.

Traditional HPS lighting systems, despite the rise of newer technologies, continue to represent a reliable revenue source for Hydrofarm. The substantial installed base of growers utilizing HPS ensures ongoing demand for bulbs and replacement parts, maintaining a stable income for the company.

These mature, high-demand products generate consistent cash flow, allowing Hydrofarm to reinvest in emerging technologies and other growth areas within the hydroponics market. The predictable nature of these sales underpins the company's financial stability.

| Product Category | BCG Matrix Status | Key Characteristics | 2023/2024 Data Point |

| Established Distribution Network (Consumables) | Cash Cow | High market share, consistent demand, essential for growers | Global indoor farming market valued at $40.2 billion in 2023, with consumables forming a core segment. |

| Basic Climate Control Accessories | Cash Cow | Universally required, stable revenue, market leadership | Fans and filters are critical components, with consistent replacement cycles driving sales. |

| Traditional HPS Lighting | Cash Cow | Mature market, substantial installed base, replacement sales | HPS systems still held over 40% of installed base in some hydroponic segments in late 2023. |

Preview = Final Product

Hydrofarm BCG Matrix

The Hydrofarm BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a professionally designed strategic analysis ready for your immediate use. You can confidently assess the comprehensive insights and actionable data presented here, knowing that the purchased version will be identical and immediately downloadable for your business planning needs.

Dogs

Hydrofarm's products deeply tied to the cannabis market are struggling, reflecting the industry's significant downturn. The company saw net sales drop sharply in Q1 2025 and Q4 2024, largely due to oversupply and falling demand within the cannabis sector. This over-reliance means segments heavily dependent on this contracting market are performing poorly, contributing to substantial sales declines and overall losses for Hydrofarm.

Older hydroponic equipment, like less energy-efficient lighting or basic control systems, are falling behind. For instance, older HID lighting systems consume significantly more electricity than modern LED grow lights, which can represent a 40-60% energy saving for growers. This makes them less competitive on operating costs.

These older products are losing ground as newer, smarter alternatives emerge. Their inability to match the performance and cost-efficiency of updated technology leads to shrinking demand and slim profits, making further investment a questionable strategy.

Underperforming acquired brands within Hydrofarm's portfolio could be classified as Dogs in the BCG Matrix. These are brands or product lines that, despite acquisition, have struggled with integration or failed to gain traction in the market. For instance, if Hydrofarm acquired a lighting company in 2022 that has since seen declining sales due to competitive pressures or an outdated product offering, it would fit this category.

Such brands typically exhibit low market share and low market growth, meaning they are not expanding their customer base and are not a significant player in their segment. This can lead to a drain on resources, as capital is tied up in operations that aren't generating sufficient returns. For example, a brand with less than a 5% market share in a stagnant market segment would likely be a Dog.

Inefficient Distribution Hubs/Operations

Inefficient distribution hubs and operations represent a significant drain on resources for companies like Hydrofarm. By consolidating operations and reducing its manufacturing footprint by nearly 60% since early 2023, Hydrofarm is actively addressing these areas. This strategic move suggests that many of these divested or streamlined facilities were likely underperforming, consuming capital without generating commensurate sales or market share.

- Operational Consolidation: Hydrofarm's nearly 60% reduction in manufacturing footprint since early 2023 highlights efforts to eliminate underperforming assets.

- Resource Allocation: Inefficient hubs consumed resources that could be better allocated to more profitable or growing segments of the business.

- Market Share Impact: These operations likely contributed minimally to Hydrofarm's overall market share, making their divestment a logical step.

- Cost Reduction: Streamlining operations directly addresses cost inefficiencies, improving the company's overall financial health.

High-Cost, Low-Volume Specialty Items

High-Cost, Low-Volume Specialty Items in the Hydrofarm BCG Matrix represent products with significant upfront investment and ongoing holding expenses, yet they serve a very small customer base. These items, often highly specialized hydroponic equipment or unique nutrient blends, struggle to gain traction due to their limited market appeal and the high cost associated with their production or procurement. For instance, a specialized UV sterilization unit for advanced hydroponic systems might fall into this category.

Their low sales volume means they rarely generate enough revenue to offset their costs, often resulting in them being classified as cash traps. This means they consume more cash than they generate, hindering overall profitability. The market for such items is often saturated with alternatives or simply too small to support substantial growth. In 2024, the specialty hydroponics market segment saw a modest 3% growth, but these niche items within it often saw flat or declining sales.

- High Inventory Holding Costs: Due to their specialized nature, these items may require dedicated storage and careful handling, increasing carrying costs.

- Complex Manufacturing or Sourcing: Unique components or intricate assembly processes drive up production expenses.

- Limited Market Demand: The target audience is narrow, restricting potential sales volume.

- Cash Trap Classification: They consume cash without generating sufficient returns, potentially draining resources.

Hydrofarm's underperforming brands and product lines, particularly those tied to the struggling cannabis market, fit the Dogs quadrant of the BCG Matrix. These are assets with low market share in low-growth markets, such as older, less energy-efficient lighting systems that are being replaced by modern LEDs. For example, a legacy brand acquired by Hydrofarm that now holds less than 5% market share in a stagnant segment would be considered a Dog.

These products often consume valuable resources without generating significant returns, acting as cash drains. Hydrofarm's strategic reduction of its manufacturing footprint by nearly 60% since early 2023 indicates a move to divest or streamline such underperforming operations. High-cost, low-volume specialty items, like niche hydroponic equipment, also fall into this category due to their limited market appeal and high holding expenses.

Question Marks

Hydrofarm's expansion into new geographic markets, like the rapidly growing Asia-Pacific region, presents a classic "question mark" scenario within the BCG matrix. These emerging markets offer substantial growth potential for hydroponics and controlled environment agriculture (CEA), with global CEA market size projected to reach $69.9 billion by 2030, up from $32.4 billion in 2023.

Currently, Hydrofarm holds a low market share in these international territories, necessitating significant investment in infrastructure, distribution, and marketing to build brand awareness and secure a competitive position. For instance, the Asia-Pacific CEA market alone is expected to grow at a compound annual growth rate (CAGR) of over 12% in the coming years, driven by increasing demand for fresh produce and technological advancements.

Hydrofarm's strategic pivot towards non-cannabis Controlled Environment Agriculture (CEA) markets, focusing on high-value crops like leafy greens, tomatoes, and strawberries, signifies a move into areas with substantial growth potential. This diversification aims to reduce reliance on the fluctuating cannabis sector.

While these non-cannabis segments offer significant opportunity, Hydrofarm currently holds a low market share within them. This necessitates substantial investment in research, development, and market penetration to scale operations effectively and capture a larger portion of this expanding market.

For instance, the global CEA market, excluding cannabis, was projected to reach approximately $65 billion by 2024, with a compound annual growth rate (CAGR) of around 10-12%. Hydrofarm's investment in this area is designed to capitalize on this robust market expansion.

Hydrofarm's focus on advanced automation and AI solutions places it squarely in a high-growth, but also high-investment, segment of the controlled environment agriculture (CEA) market. This integration of technologies like AI for optimizing nutrient delivery and IoT for real-time environmental monitoring aims to boost efficiency and yield. The CEA market itself saw significant growth, with some projections indicating it could reach over $60 billion by 2030, underscoring the potential for these advanced solutions.

Developing and scaling these sophisticated AI and automation systems requires substantial capital expenditure. Hydrofarm would need to invest heavily in research and development, as well as in the infrastructure to support these technologies. This investment is crucial for establishing a strong market position and demonstrating the viability and scalability of their advanced offerings in a competitive landscape.

Specialized Solutions for Urban Agriculture

The burgeoning urban agriculture sector, characterized by rapid expansion and a growing demand for controlled environment farming solutions, represents a significant high-growth market. Hydrofarm's strategic focus on developing specialized products and integrated systems designed specifically for urban growers, such as compact, modular, and user-friendly setups, positions it to capitalize on this trend.

These specialized offerings, catering to the unique needs of smaller-scale operations and limited spaces common in urban settings, require substantial investment in targeted marketing campaigns and robust distribution networks to effectively penetrate and build market share within this dynamic segment.

- Market Growth: The global urban farming market was valued at approximately USD 25.7 billion in 2023 and is projected to grow at a CAGR of over 10% through 2030, driven by increasing urbanization and demand for fresh, local produce.

- Product Specialization: Hydrofarm's development of compact hydroponic systems, vertical farming modules, and integrated lighting solutions tailored for indoor and small-space cultivation addresses a key need for urban growers.

- Investment Needs: Successfully capturing market share in this segment necessitates significant marketing expenditure to educate urban farmers and build brand awareness, alongside investment in distribution channels to ensure product availability in urban centers.

- Competitive Landscape: While established players are entering the urban agriculture space, a focus on niche, specialized solutions can provide Hydrofarm with a competitive edge.

High-Efficiency Energy Solutions for CEA

The demand for high-efficiency energy solutions in Controlled Environment Agriculture (CEA) is surging, driven by escalating energy expenses and a strong push for sustainability. For a company like Hydrofarm, venturing into innovative energy-saving products beyond conventional LED lighting, such as sophisticated climate control systems designed for minimal energy use or integrated renewable energy solutions, represents a significant investment opportunity. These advancements are crucial for market penetration and establishing a competitive edge.

Consider the potential impact of such innovations. For instance, advanced climate control systems could reduce energy consumption by up to 30% compared to traditional setups, a critical factor when electricity prices in some regions have seen increases of over 15% year-over-year as of early 2024. Hydrofarm's investment in these areas positions its offerings as Stars within the BCG matrix, requiring continued funding to maintain growth and capture market share.

- Market Growth: The global CEA market is projected to reach over $80 billion by 2026, with energy efficiency being a key driver.

- Technological Advancement: Investments in R&D for smart climate control and renewable energy integration can yield substantial ROI.

- Competitive Advantage: Offering differentiated, energy-saving solutions can attract environmentally conscious clients and command premium pricing.

Hydrofarm's expansion into new, high-growth markets with uncertain outcomes places them in the "question mark" category of the BCG matrix. These ventures require significant investment to gain market share, with success hinging on strategic execution and market reception.

The company's foray into specialized urban agriculture solutions, for example, taps into a market valued at approximately USD 25.7 billion in 2023 and projected to grow significantly. However, Hydrofarm currently holds a low market share in this segment, demanding substantial marketing and distribution investment to establish a strong presence.

Similarly, Hydrofarm's focus on advanced automation and AI within the Controlled Environment Agriculture (CEA) sector, a market potentially exceeding $60 billion by 2030, represents another question mark. While the growth potential is high, the substantial capital expenditure needed for R&D and infrastructure development means these initiatives are currently cash consumers with unproven returns.

The company's strategic pivot to non-cannabis CEA markets, aiming for a global market size projected to reach $65 billion by 2024, also falls into this category. Despite robust growth forecasts, Hydrofarm's low initial market share necessitates considerable investment to build brand awareness and secure a competitive foothold.

BCG Matrix Data Sources

Our Hydrofarm BCG Matrix is built on comprehensive market data, integrating sales figures, industry growth rates, and competitor analysis to provide actionable strategic insights.