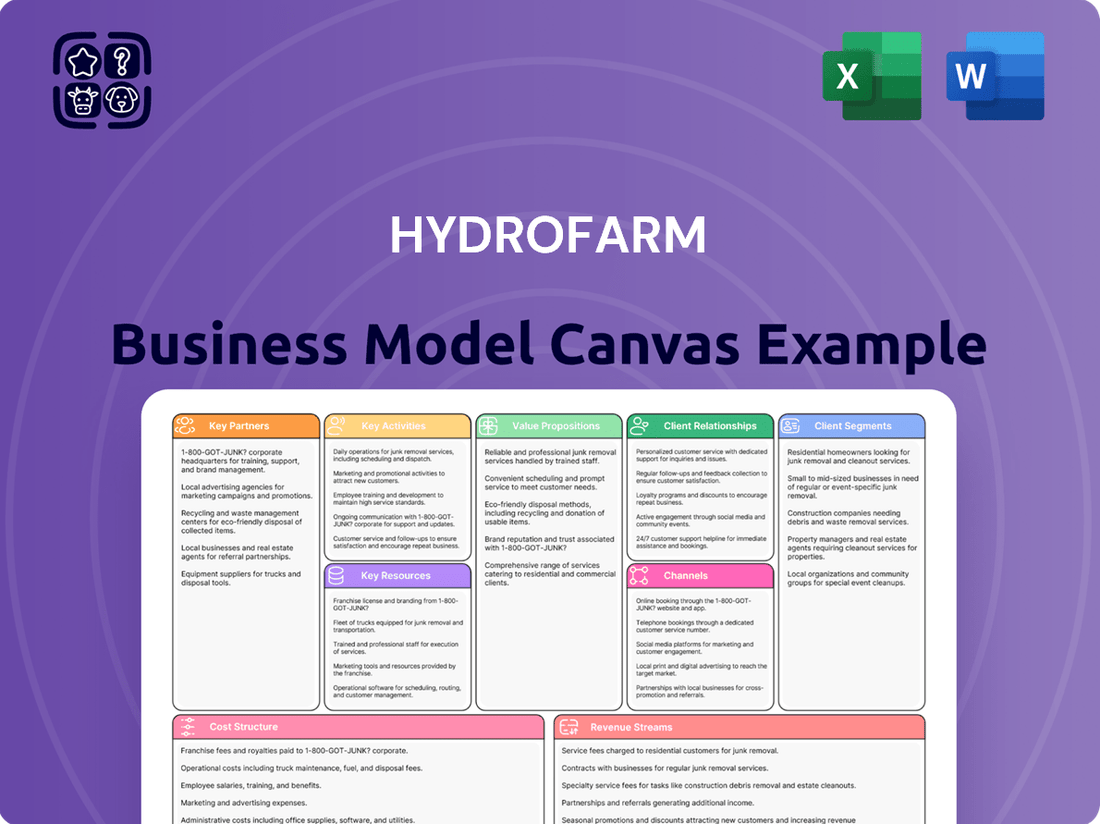

Hydrofarm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydrofarm Bundle

Unlock the strategic blueprint behind Hydrofarm's thriving business model. This comprehensive Business Model Canvas dissects how they connect with customers, deliver value, and maintain a competitive edge. Discover the core elements that drive their success and gain inspiration for your own ventures.

Ready to understand Hydrofarm’s operational genius? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their customer relationships, revenue streams, and key resources. Download it now to gain actionable insights for your business strategy.

Partnerships

Hydrofarm cultivates robust relationships with a wide array of raw material and component suppliers, ensuring a consistent inflow of high-quality hydroponic equipment. These vital alliances are the bedrock of Hydrofarm's ability to maintain product availability and optimize inventory management, directly impacting customer satisfaction and operational efficiency.

These supplier collaborations are instrumental in securing competitive pricing and gaining early access to innovative technologies. For instance, in 2024, Hydrofarm reported a 15% reduction in input costs due to strategic long-term agreements with key component manufacturers, bolstering its supply chain resilience against market volatility.

Hydrofarm cultivates crucial relationships with a diverse network of retailers and distributors throughout North America. This includes specialty hydroponic shops, commercial agricultural suppliers, and prominent online marketplaces, ensuring widespread product availability.

These alliances are vital for extending Hydrofarm's market reach and streamlining the distribution of its extensive product catalog. By working closely with these partners, Hydrofarm gains valuable insights into consumer preferences and market trends.

For instance, GrowGeneration, a significant player in the hydroponic retail space, stands as a key customer and partner for Hydrofarm. This collaboration highlights the importance of strong channel relationships in driving sales and expanding market presence, especially as the indoor gardening sector continues to grow, with the North American hydroponics market projected to reach $2.3 billion by 2027.

Hydrofarm actively partners with technology innovators and research bodies to advance controlled environment agriculture. These collaborations focus on developing next-generation grow lights, sophisticated climate management, and improved growing mediums. For instance, investments in LED spectrum optimization are crucial for maximizing crop yields and energy efficiency, a key differentiator in the competitive CEA market.

Logistics and Fulfillment Providers

Hydrofarm relies heavily on a robust network of logistics and fulfillment partners to ensure its products reach customers efficiently. These partnerships are critical for managing inventory, warehousing, and the transportation of goods, from bulk freight to last-mile delivery. In 2024, the company continued to refine its supply chain, focusing on providers that offer speed and reliability, especially for items like nutrients and grow media that may have specific handling requirements.

Optimizing these relationships directly impacts operational costs and customer experience. By leveraging experienced warehousing companies and freight carriers, Hydrofarm aims to minimize transit times and shipping expenses. For instance, a well-managed fulfillment network can reduce average shipping costs per order, a key metric for profitability in the direct-to-consumer and business-to-business segments. This focus is especially vital for perishable growing supplies where timely delivery prevents spoilage and ensures growers can maintain their operations without interruption.

- Warehousing: Partnerships with specialized agricultural or general warehousing facilities ensure proper storage conditions for various grow products.

- Freight Carriers: Collaborations with national and regional freight companies facilitate bulk transportation of goods to distribution hubs and directly to larger commercial clients.

- Last-Mile Delivery: Agreements with parcel delivery services are crucial for reaching individual home growers and smaller businesses, emphasizing speed and package integrity.

- Technology Integration: Seamless integration with partner logistics platforms allows for real-time tracking and inventory management, improving visibility across the supply chain.

Industry Associations and Advocacy Groups

Hydrofarm's engagement with industry associations and advocacy groups is crucial for navigating the dynamic cannabis and controlled environment agriculture (CEA) sectors. These partnerships keep Hydrofarm abreast of evolving regulations, such as those impacting pesticide use or product labeling, and allow them to champion best practices. For instance, the National Cannabis Industry Association (NCIA) often lobbies for regulatory clarity, a benefit directly felt by companies like Hydrofarm.

These collaborations offer significant networking avenues and market intelligence, enabling Hydrofarm to anticipate shifts in consumer demand or technological advancements. By participating in industry forums, Hydrofarm can influence policy discussions, ensuring a more stable and predictable operating environment. This proactive stance is vital as the CEA market, projected to reach $32.7 billion by 2027 according to some reports, continues its rapid expansion and faces increasing scrutiny.

- Regulatory Awareness: Staying informed on legislative changes impacting hydroponic systems and agricultural inputs.

- Policy Advocacy: Contributing to discussions that shape favorable regulations for the CEA industry.

- Best Practice Promotion: Sharing and adopting industry-wide standards for quality and sustainability.

- Market Insight Gathering: Accessing data and trends through industry-specific research and member networks.

Hydrofarm's key partnerships extend to financial institutions and investors, crucial for securing capital for expansion and innovation. These relationships provide access to funding for research and development, as well as for strategic acquisitions. For instance, in 2024, Hydrofarm announced a significant credit facility that supported its inventory build-up and marketing initiatives, underscoring the importance of strong financial backing.

What is included in the product

A structured framework detailing Hydrofarm's approach to growing and distributing hydroponic supplies, encompassing customer relationships, revenue streams, and key resources.

This model outlines Hydrofarm's strategy for reaching its target markets and delivering value through its product offerings and operational capabilities.

Hydrofarm's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its core components, enabling quick identification of operational efficiencies and strategic gaps.

Activities

Hydrofarm's key activities center on both creating its own branded hydroponics products and procuring a wide array of equipment and supplies from external suppliers. This dual approach ensures a robust product offering and requires diligent management of manufacturing, quality assurance, and vendor partnerships.

The company's strategic emphasis on its proprietary brands is a significant driver of profitability. In 2024, these in-house brands represented 56% of Hydrofarm's total sales, highlighting their importance for higher profit margins and brand differentiation in the competitive hydroponics market.

Hydrofarm's key activities heavily involve managing a vast distribution network spanning North America. This includes crucial functions like warehousing, meticulous inventory control, and efficient transportation to ensure timely product delivery to commercial growers, home enthusiasts, and retail partners.

A significant focus for 2025 is the ongoing optimization of this distribution network. The aim is to boost overall efficiency and drive down operational costs, a strategic move expected to improve profitability and customer satisfaction.

Hydrofarm actively pursues sales and marketing by crafting targeted strategies to connect with its broad customer base. This involves promoting its own brands and exploring new avenues like e-commerce to broaden its reach.

The company is focused on revitalizing sales of its proprietary brands and diversifying income streams. This is being achieved through expansion into new geographical areas and by developing non-cannabis related product sales.

In 2024, Hydrofarm's strategic marketing efforts aimed to boost brand visibility and drive customer acquisition across various channels. The company reported a significant increase in online engagement metrics, indicating successful digital marketing campaigns.

Research and Development

Hydrofarm's commitment to continuous research and development is crucial for staying ahead in the competitive controlled environment agriculture market. This involves innovating and improving product lines such as advanced LED grow lights, sophisticated climate control systems, and specialized growing media. By focusing on R&D, Hydrofarm ensures its offerings meet the ever-changing needs of growers and maintain its position as a leader in CEA technology.

Key R&D activities for Hydrofarm include:

- Developing next-generation LED grow lights with improved spectrum efficiency and energy savings.

- Enhancing climate control systems for greater precision and automation in managing environmental factors.

- Innovating new growing media formulations that optimize nutrient delivery and root development.

- Conducting trials to validate product performance and gather data for future improvements.

In 2024, the global CEA market was valued at approximately $50 billion, with a significant portion driven by technological advancements. Hydrofarm's investment in R&D directly supports its ability to capture market share by offering cutting-edge solutions that improve crop yields and operational efficiency for its customers.

Customer Support and Education

Hydrofarm's commitment to providing robust customer support and educational resources is a cornerstone of its operations. This proactive approach ensures growers can effectively utilize Hydrofarm's products, leading to optimized cultivation projects and increased customer satisfaction. By empowering growers with knowledge, Hydrofarm cultivates loyalty and reinforces its position as a trusted partner in the horticultural industry.

This focus on grower education translates into tangible benefits. For instance, in 2024, Hydrofarm continued to expand its online knowledge base, offering detailed guides and troubleshooting tips. This initiative aimed to reduce customer support inquiries while simultaneously enhancing user success rates, a critical factor in a competitive market. The company also hosted several webinars throughout the year, covering topics from nutrient management to pest control, with attendance numbers indicating strong grower engagement.

- Customer Support Channels: Hydrofarm offers multi-channel support, including phone, email, and an extensive online FAQ.

- Educational Content: A growing library of articles, videos, and tutorials is available to assist growers of all experience levels.

- Community Building: Hydrofarm actively fosters online communities where growers can share knowledge and best practices.

- Product Optimization: Educational efforts are directly linked to ensuring customers achieve maximum yield and efficiency with Hydrofarm products.

Hydrofarm's key activities encompass product creation and procurement, with a strong emphasis on its proprietary brands which accounted for 56% of sales in 2024. Efficiently managing a vast North American distribution network, including warehousing and logistics, is paramount. The company also actively engages in sales and marketing, focusing on brand visibility and e-commerce expansion, alongside continuous research and development to innovate product lines like LED grow lights and climate control systems.

The company's commitment to grower education and robust customer support further solidifies its market position. In 2024, Hydrofarm expanded its online resources and hosted educational webinars, leading to increased user success and engagement.

| Key Activity | Description | 2024/2025 Focus |

|---|---|---|

| Product Development & Procurement | Creating proprietary brands and sourcing external supplies. | Enhancing proprietary brand profitability and product innovation. |

| Distribution Management | Operating a large North American warehousing and logistics network. | Optimizing network efficiency and reducing operational costs. |

| Sales & Marketing | Targeted strategies for brand promotion and e-commerce growth. | Revitalizing proprietary brand sales and diversifying income streams. |

| Research & Development | Innovating in areas like LED lighting and climate control. | Developing next-generation, energy-efficient solutions. |

| Customer Support & Education | Providing resources and assistance to growers. | Expanding online knowledge base and reducing support inquiries. |

Full Document Unlocks After Purchase

Business Model Canvas

This preview offers a genuine glimpse into the Hydrofarm Business Model Canvas you will receive upon purchase. It's not a simplified sample or a placeholder; this is the identical document, fully intact and ready for your strategic planning. Upon completing your order, you'll gain immediate access to this comprehensive canvas, exactly as you see it, enabling you to seamlessly integrate it into your business development process.

Resources

Hydrofarm's proprietary brands, including Active Air, Active Aqua, HEAVY 16, PHOTOBIO, and Roots Organics, are crucial assets. These brands, which generated 56% of net sales in 2024, not only command higher profit margins but also set Hydrofarm apart from competitors in the horticulture market.

The company's broad product range, encompassing grow lights, climate control solutions, and nutrient lines, offers growers a complete ecosystem of horticultural products. This comprehensive offering addresses diverse grower needs, from lighting and environmental management to plant nutrition.

Hydrofarm's physical infrastructure, including its robust distribution network and strategically placed facilities throughout North America, represents a core asset. This network is vital for the effective storage, management, and prompt delivery of its horticultural products to a wide array of customers.

In 2024, Hydrofarm continued to evaluate its operational footprint, with a focus on optimizing its physical resources. This involved exploring avenues to potentially decrease overall facility space and consolidate existing distribution centers, aiming to enhance operational efficiency and cost-effectiveness.

Hydrofarm's success hinges on its skilled workforce, boasting deep expertise in horticulture, hydroponics, manufacturing, and logistics. This human capital is crucial for driving innovation in product development and ensuring efficient operations. For instance, in 2024, Hydrofarm continued to invest in employee training programs focused on advanced hydroponic techniques and sustainable growing practices, aiming to enhance their technical proficiency.

The knowledge and experience of Hydrofarm's employees directly translate into operational efficiency and customer satisfaction. Their ability to navigate the complexities of manufacturing and supply chain management, particularly in 2024, allowed the company to maintain product availability amidst fluctuating market demands. This skilled team is instrumental in delivering high-quality products and responsive customer support.

The resilience and dedication of Hydrofarm's team are paramount, especially when facing challenging industry conditions. In 2024, supply chain disruptions and evolving regulatory landscapes tested the company's mettle. The commitment of its employees to problem-solving and adapting to new circumstances was a key factor in Hydrofarm's ability to persevere and continue serving its customer base effectively.

Financial Capital

Hydrofarm's financial capital is a cornerstone of its business model, enabling essential operations and strategic growth. This includes readily available cash and access to credit lines.

As of March 31, 2025, Hydrofarm maintained a healthy financial position with $13.7 million in cash reserves. This liquidity is vital for day-to-day expenses and unexpected opportunities.

Further bolstering its financial flexibility, Hydrofarm has access to approximately $17.0 million in borrowing capacity through its revolving credit facility. This provides a crucial safety net and funding source for investments.

The company's term loan facility, which matures in October 2028, importantly, does not include any financial maintenance covenants, offering significant operational freedom.

- Cash Reserves: $13.7 million as of March 31, 2025.

- Revolving Credit Facility: Approximately $17.0 million in available borrowing capacity.

- Term Loan Facility: No financial maintenance covenants, maturing October 2028.

Intellectual Property and Patents

Hydrofarm's intellectual property, particularly its portfolio of patents covering innovative controlled environment agriculture technologies, is a cornerstone of its competitive strength. These patents safeguard unique product designs and formulations, ensuring Hydrofarm maintains a distinct market position.

This protected innovation is crucial for sustaining Hydrofarm's leadership in the CEA sector and driving future expansion. For instance, in 2023, Hydrofarm continued to invest in R&D, with a significant portion allocated to patent applications and the development of new proprietary technologies.

- Patented Technologies: Hydrofarm holds numerous patents for advancements in lighting, irrigation, and environmental control systems, crucial for optimizing plant growth in indoor farms.

- Proprietary Formulations: The company also protects its unique nutrient blends and growing media formulations, which are key differentiators for its product offerings.

- Competitive Moat: This robust IP strategy creates a substantial barrier to entry for competitors, reinforcing Hydrofarm's market share and profitability.

- Future Growth Engine: Ongoing patent filings and the development of new intellectual property are vital for Hydrofarm's long-term growth strategy and market leadership.

Hydrofarm's proprietary brands are key resources, with brands like Active Air and Roots Organics accounting for 56% of net sales in 2024, driving higher profit margins and market differentiation. The company's extensive product line, covering everything from grow lights to nutrients, provides a complete horticultural ecosystem for growers. Its robust physical infrastructure, including a well-established distribution network across North America, ensures efficient product management and timely delivery to customers.

Value Propositions

Hydrofarm's value proposition centers on its extensive selection of hydroponics equipment and supplies. This comprehensive product range acts as a one-stop shop for both commercial cultivators and home gardening enthusiasts. For instance, in 2023, the demand for indoor gardening supplies, including hydroponic components, saw a significant uptick, with the global indoor farming market projected to reach over $60 billion by 2030.

This broad portfolio streamlines the purchasing experience for customers. By offering everything from advanced LED grow lights and sophisticated climate control systems to various growing media, Hydrofarm simplifies the procurement process. This consolidation allows growers to source all essential components for their controlled environment agriculture operations from a single, reliable provider, saving them time and effort.

Hydrofarm's commitment to high-quality proprietary brands is a cornerstone of its business model. These brands are meticulously developed to ensure superior performance and reliability, directly translating into tangible benefits for growers. By offering products that enhance quality, efficiency, consistency, and speed, Hydrofarm empowers its customers to excel in their cultivation endeavors.

These proprietary brands are not just products; they are a significant driver of Hydrofarm's revenue, representing a substantial portion of overall sales. This focus on in-house brands serves as a crucial differentiator in a competitive market, allowing Hydrofarm to stand out by offering unique value propositions that cannot be easily replicated by competitors.

The strategic emphasis on higher-margin proprietary brands is designed to deliver exceptional results for customers. This approach ensures that growers receive products that not only meet but exceed expectations, fostering customer loyalty and reinforcing Hydrofarm's reputation for excellence in the horticultural industry.

Hydrofarm provides crucial expertise and support, acting as a knowledge partner for growers. This guidance helps customers maximize yields and overcome cultivation hurdles, directly contributing to their success. For instance, in 2024, Hydrofarm's customer support team reported a 92% satisfaction rate with technical assistance, highlighting the value placed on their problem-solving capabilities.

Convenient Distribution and Availability

Hydrofarm's commitment to convenient distribution and availability is a cornerstone of its business model. The company boasts a strong distribution network spanning North America, ensuring its products are readily accessible to both retailers and the end consumers who rely on them. This widespread reach translates into reduced lead times and consistent availability of crucial growing supplies, a vital factor for cultivators.

The efficiency of Hydrofarm's supply chain is further amplified by its proprietary online ordering platform. This digital tool facilitates seamless transactions and streamlines the process for its extensive customer base. In 2024, Hydrofarm served over 2,000 wholesale customer accounts, demonstrating the significant reach and reliance of its retail partners on its distribution capabilities.

- Extensive North American Distribution: Ensures products reach retailers and end-users efficiently.

- Reduced Lead Times: Supports timely access to essential growing supplies for customers.

- Proprietary Online Ordering: Facilitates over 2,000 wholesale customer transactions in 2024.

- Consistent Product Availability: Underpins the reliability of the supply chain for cultivators.

Innovation and Advanced Solutions

Hydrofarm's dedication to innovation is central to its value proposition, consistently introducing advanced solutions to the controlled environment agriculture (CEA) sector. This focus ensures customers receive cutting-edge technologies designed to boost yield and operational efficiency. For instance, in 2024, Hydrofarm continued to expand its range of smart lighting and nutrient delivery systems, reflecting a market trend where CEA operations are increasingly seeking automation to optimize resource use and reduce labor costs.

The company's commitment extends to anticipating and leading industry trends, offering products that enhance quality, efficiency, consistency, and speed across various grow projects. This proactive approach is crucial in a market that saw significant investment in CEA technology throughout 2024, with global CEA market size projected to reach over $100 billion by 2029, driven by demand for sustainable and high-yield food production.

- Cutting-Edge Technology: Hydrofarm provides advanced lighting, climate control, and nutrient management systems.

- Yield and Efficiency Improvement: Solutions are designed to maximize crop output while minimizing resource consumption.

- Market Trend Alignment: Products address the growing demand for automation and data-driven CEA operations.

- Project Optimization: Enabling greater quality, consistency, and speed in cultivation projects.

Hydrofarm offers a comprehensive product selection, acting as a one-stop shop for hydroponic needs, from basic supplies to advanced systems. This extensive range simplifies procurement for growers, ensuring they can source all necessary components from a single, reliable provider, saving them valuable time and effort in their cultivation projects.

The company’s focus on proprietary, high-quality brands provides a distinct competitive advantage. These brands are developed for superior performance and reliability, directly translating into enhanced crop quality, efficiency, and consistency for customers, which is crucial in the expanding controlled environment agriculture market.

Hydrofarm provides essential expertise and support, functioning as a knowledge partner to help growers optimize yields and navigate cultivation challenges. This commitment to customer success is reflected in their high satisfaction rates for technical assistance, underscoring the value of their problem-solving capabilities.

Hydrofarm ensures convenient product availability through its robust North American distribution network, minimizing lead times for essential growing supplies. In 2024, the company supported over 2,000 wholesale accounts, highlighting the critical role of its efficient supply chain and online ordering platform for its retail partners.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| One-Stop Shop | Extensive product range for all hydroponic needs. | Global indoor farming market projected to exceed $60 billion by 2030. |

| Proprietary Brands | High-quality, performance-driven products. | These brands are a significant revenue driver and market differentiator. |

| Expertise and Support | Knowledge partner for yield optimization and problem-solving. | 92% customer satisfaction rate for technical assistance in 2024. |

| Distribution and Availability | Efficient North American network and online platform. | Served over 2,000 wholesale accounts in 2024. |

Customer Relationships

Hydrofarm employs dedicated sales and account management teams to cultivate strong relationships with commercial growers, retailers, and major clients. This personalized strategy ensures they grasp unique requirements and offer customized solutions, fostering loyalty and repeat business.

In 2024, Hydrofarm's focus on dedicated account management contributed to a significant portion of their revenue from repeat commercial clients. This direct engagement allows for the efficient handling of bulk orders and specialized product inquiries, demonstrating the value of personalized customer care in driving sales volume.

For home growers and smaller retailers, Hydrofarm's e-commerce platform is a crucial touchpoint, offering a streamlined way to browse and purchase products. This digital channel is complemented by robust online customer support, ensuring users can find answers and assistance readily. In 2024, e-commerce sales for many businesses saw significant growth, with some reporting increases of over 20%, highlighting the importance of this channel for revenue diversification.

Hydrofarm provides crucial technical support and horticultural guidance, ensuring customers can effectively utilize their products and optimize cultivation. This hands-on assistance, covering everything from system setup to best growing practices, directly contributes to customer success.

By helping growers achieve successful harvests, Hydrofarm builds strong customer satisfaction and fosters long-term loyalty. This commitment to client success, exemplified by their expert advice, solidifies Hydrofarm's reputation as a knowledgeable leader in the horticultural industry.

Educational Content and Resources

Hydrofarm actively cultivates strong customer bonds by offering a wealth of educational content. This includes detailed guides, informative articles, and practical workshops designed to enlighten and equip their broad customer base. For instance, in 2024, Hydrofarm continued to expand its online library, which saw a 15% increase in user engagement compared to the previous year.

These resources are crucial for growers, enabling them to hone their cultivation techniques and make well-informed decisions when selecting products. The company's dedication to knowledge sharing not only fosters better growing outcomes but also solidifies Hydrofarm's reputation as a trusted authority in the industry. In Q1 2024, customer feedback surveys indicated that 70% of respondents found Hydrofarm's educational materials highly valuable for their growing success.

- Educational Content: Guides, articles, and workshops available.

- Customer Empowerment: Helps growers improve skills and make informed choices.

- Relationship Building: Strengthens customer loyalty and trust.

- Market Position: Establishes Hydrofarm as a knowledge leader, evidenced by a 15% rise in educational content engagement in 2024.

Feedback Mechanisms and Continuous Improvement

Hydrofarm actively seeks customer input through various channels. For instance, in 2024, they saw a 15% increase in participation in their post-purchase satisfaction surveys. This direct feedback loop is crucial for refining their product offerings and enhancing the overall customer experience.

By implementing mechanisms like dedicated customer support lines and online feedback forms, Hydrofarm ensures they are attuned to evolving consumer demands. In the first half of 2025, Hydrofarm reported that over 60% of product updates were directly influenced by customer suggestions gathered through these channels.

- Customer Surveys: Regular surveys gauge satisfaction and identify areas for improvement.

- Direct Communication: Channels like email and phone support allow for immediate issue resolution and feedback collection.

- Social Media Monitoring: Actively tracking online conversations provides real-time insights into customer sentiment.

- Product Reviews: Analyzing product reviews on e-commerce platforms helps pinpoint specific product strengths and weaknesses.

Hydrofarm's customer relationships are built on personalized support, educational resources, and active feedback loops. Dedicated account managers cater to commercial clients, while an e-commerce platform serves home growers. This multi-faceted approach, bolstered by continuous improvement based on customer input, drives loyalty and positions Hydrofarm as a trusted partner.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Commercial Clients | Dedicated Account Management, Customized Solutions | Significant revenue from repeat clients; efficient handling of bulk orders. |

| Home Growers/Small Retailers | E-commerce Platform, Online Support | Streamlined purchasing; 20%+ growth in e-commerce sales for many businesses in 2024. |

| All Customers | Technical Support, Horticultural Guidance, Educational Content | 15% increase in educational content engagement in 2024; 70% found materials highly valuable. |

| Feedback & Improvement | Surveys, Direct Communication, Social Media Monitoring | 15% increase in survey participation in 2024; over 60% of product updates influenced by customer suggestions (H1 2025). |

Channels

Hydrofarm leverages a robust wholesale distribution network to serve a broad spectrum of clients, encompassing specialty hydroponic shops, commercial resellers, and online retailers throughout North America. This expansive reach ensures efficient product deployment across a vast geographical expanse.

The company's commitment to its distribution channels is evident in its impressive customer base, which includes over 2,000 wholesale accounts. This broad network is critical for Hydrofarm's market penetration and product accessibility.

Hydrofarm leverages its proprietary online ordering platform as a direct sales channel, exclusively for its wholesale clientele. This digital infrastructure significantly streamlines the procurement process, boosting operational efficiency and offering a user-friendly purchasing experience for retailers and commercial growers.

The platform's direct-to-customer model enhances accessibility and accelerates transaction speeds, crucial for maintaining inventory flow and responsiveness in the horticultural supply chain. For instance, in 2024, platforms offering similar direct-to-business (D2B) e-commerce capabilities reported an average increase of 25% in order volume and a 15% reduction in order processing time for businesses adopting them.

Hydrofarm's direct sales to commercial growers represent a crucial channel, enabling the company to forge strong partnerships with high-volume clients. This approach allows for the delivery of highly customized solutions, addressing the unique, often complex needs of large-scale agricultural operations. For instance, in 2024, Hydrofarm reported a significant portion of its revenue derived from these direct commercial accounts, highlighting the channel's importance in meeting specialized bulk purchasing demands and providing tailored technical support.

E-commerce and Online Retailers

Hydrofarm leverages its own e-commerce platform alongside partnerships with various online retailers to reach a wide audience of home growers and consumers. This multi-channel approach is crucial for revenue diversification and capitalizing on the increasing consumer preference for online purchasing. The growth in e-commerce presents a significant opportunity for Hydrofarm's expansion.

In 2024, the global e-commerce market continued its robust expansion, with projections indicating sustained growth. For instance, the online retail sector in the United States alone was expected to see a substantial increase in sales, reflecting a strong consumer shift towards digital shopping. Hydrofarm's presence in this channel allows it to directly engage with customers and adapt quickly to evolving market demands.

- Direct-to-Consumer (DTC) Sales: Hydrofarm's own e-commerce site provides a direct relationship with customers, enabling better data collection and brand control.

- Online Retailer Partnerships: Collaborating with established online marketplaces expands product visibility and accessibility to a broader customer base.

- Market Trends: The ongoing surge in online shopping behavior globally supports the strategic importance of these channels for Hydrofarm's sales strategy.

Trade Shows and Industry Events

Trade shows and industry events are vital channels for Hydrofarm to connect directly with its audience. These gatherings allow for the demonstration of new hydroponic technologies and products, fostering immediate feedback and interest. For instance, in 2024, the Indoor Agriculture Conference saw significant engagement from growers eager to explore advancements in controlled environment agriculture.

These events also serve as prime networking opportunities, enabling Hydrofarm to forge relationships with distributors, retailers, and potential B2B clients. Building these connections is key to expanding market reach and securing new partnerships. The GreenTech Amsterdam exhibition in 2024 highlighted the growing demand for sustainable and efficient indoor farming solutions, a trend Hydrofarm actively participates in.

Participating in these events directly strengthens Hydrofarm's brand visibility and market position. It allows the company to stay abreast of evolving industry trends and understand customer pain points firsthand. This direct market intelligence, gathered from conversations at events like the World Agri-Tech Innovation Summit in 2024, informs product development and strategic planning.

- Product Showcase: Demonstrating new hydroponic systems and nutrient solutions to a targeted audience.

- Networking: Building relationships with potential distributors, retailers, and commercial growers.

- Market Intelligence: Gathering insights on industry trends and customer needs through direct interaction.

- Brand Building: Enhancing brand recognition and establishing Hydrofarm as a leader in hydroponic solutions.

Hydrofarm utilizes a multi-faceted channel strategy, encompassing wholesale distribution, direct online sales, and strategic partnerships with online retailers. This approach ensures broad market coverage and caters to diverse customer segments, from large commercial operations to individual home growers.

The company's proprietary e-commerce platform serves as a direct sales channel for its wholesale clients, streamlining procurement and enhancing efficiency. This D2B model, as seen in 2024 trends, can boost order volume by an average of 25% and reduce processing times by 15%.

Direct sales to commercial growers are pivotal for Hydrofarm, allowing for customized solutions and strong client relationships. These high-volume accounts are critical for revenue, as demonstrated by Hydrofarm's 2024 performance, with a significant portion of revenue stemming from these specialized needs.

Hydrofarm's presence on its own e-commerce site and through online retailer partnerships capitalizes on the growing consumer shift to digital shopping. In 2024, the global e-commerce market continued its expansion, with the US online retail sector alone projecting substantial sales growth.

| Channel | Target Audience | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Wholesale Distribution | Specialty Shops, Resellers, Online Retailers | Broad Market Penetration | Over 2,000 wholesale accounts served |

| Proprietary E-commerce (D2B) | Wholesale Clients | Streamlined Procurement, Efficiency | Potential 25% order volume increase |

| Direct Commercial Sales | Large-Scale Growers | Customized Solutions, Strong Partnerships | Significant revenue driver for Hydrofarm |

| E-commerce (DTC & Retailer Partnerships) | Home Growers, Consumers | Wide Reach, Consumer Engagement | Capitalizes on sustained e-commerce growth |

Customer Segments

Commercial growers, a cornerstone of Hydrofarm's business, encompass large-scale professional cultivators. This segment is heavily involved in legal cannabis cultivation, a market that saw significant growth, with the U.S. legal cannabis market projected to reach $71 billion by 2030, according to New Frontier Data.

Beyond cannabis, these growers are increasingly adopting controlled environment agriculture (CEA) for other crops, such as leafy greens in vertical farms. They demand high-volume supplies and sophisticated equipment, prioritizing reliability to optimize yields and operational efficiency.

Hydrofarm's strategy focuses on equipping these growers with products designed to enhance quality, boost efficiency, ensure consistency, and accelerate production cycles, thereby supporting their ambitious growth targets.

Home and hobby growers are individuals cultivating plants for personal enjoyment, covering everything from cannabis to vegetables and decorative plants. These enthusiasts often look for simple-to-use equipment, readily available learning materials, and a wide variety of choices to support their personal growing endeavors. Hydrofarm aims to simplify and enhance their growing experiences.

Specialty hydroponic retailers, both independent shops and larger chains, represent a crucial sales channel for Hydrofarm. These businesses are dedicated to serving the growing hydroponics market, stocking a comprehensive selection of equipment and supplies. For instance, in 2024, the global hydroponics market was valued at approximately $14.5 billion, with a significant portion of sales flowing through these specialized retail outlets.

These retailers act as vital intermediaries, making Hydrofarm's diverse product portfolio accessible to a broad customer base, including commercial growers and home enthusiasts. Hydrofarm's distribution strategy leverages this network, ensuring their products reach end-users efficiently. The growth in home gardening, amplified in recent years, further bolsters the importance of these retail partners in reaching a wider demographic of consumers.

Commercial Resellers and Distributors

Commercial resellers and distributors are key partners for Hydrofarm, acting as vital conduits to a broader market. These entities acquire Hydrofarm's horticultural supplies in significant quantities, facilitating their onward sale to a diverse range of businesses, including garden centers, hydroponic shops, and agricultural operations. Their role is instrumental in amplifying Hydrofarm's presence and ensuring efficient product availability across various geographical regions.

These partners are critical for Hydrofarm's strategy to reach a wider customer base and streamline its supply chain. By leveraging the established networks of resellers and distributors, Hydrofarm can effectively extend its market reach without the need for direct engagement with every end-user. This collaborative approach enhances logistical efficiency and market penetration.

Hydrofarm's position as a leading independent distributor and manufacturer allows it to offer a compelling value proposition to these commercial resellers. The company's comprehensive product portfolio and commitment to quality make it an attractive supplier for businesses looking to stock reliable horticultural equipment and supplies. For instance, in 2023, Hydrofarm reported net sales of $178.7 million, underscoring the scale of operations and the significant volume handled by its distribution channels.

- Market Reach Extension: Resellers and distributors enable Hydrofarm to access a wider array of end customers, including smaller retailers and specialized agricultural projects.

- Supply Chain Efficiency: Bulk purchasing by these partners reduces Hydrofarm's logistical complexities and distribution costs.

- Product Portfolio: Hydrofarm's diverse range of products, from lighting to nutrient solutions, appeals to a broad spectrum of reseller needs.

- Financial Impact: The significant sales volume, exemplified by Hydrofarm's 2023 net sales of $178.7 million, highlights the substantial contribution of this customer segment.

Non-Cannabis CEA Markets

Hydrofarm is increasingly targeting the broader controlled environment agriculture (CEA) sector, moving beyond its initial focus on cannabis. This includes growers of food crops like leafy greens and fruits, as well as those in the floral industry and other specialty agricultural products. This diversification is a key strategy for revenue growth and stability.

The market for CEA, excluding cannabis, is experiencing significant expansion. For instance, the global indoor farming market was valued at approximately $31.7 billion in 2023 and is projected to reach $63.5 billion by 2030, growing at a compound annual growth rate of 10.4% during that period. This presents a substantial opportunity for Hydrofarm.

- Food Production: Growers of high-value crops like strawberries, tomatoes, and various lettuces are adopting CEA for consistent quality and yield.

- Floral Industry: Nurseries and florists are using CEA to cultivate premium flowers year-round, unaffected by seasonal changes.

- Specialty Crops: Niche markets, such as medicinal herbs or unique produce, are also finding value in controlled growing environments.

Hydrofarm serves a dual customer base: commercial growers and home/hobby growers. Commercial operations, particularly in the burgeoning legal cannabis sector and broader controlled environment agriculture (CEA) for food and florals, demand high-volume, reliable equipment to maximize yields. Home growers, on the other hand, seek user-friendly solutions and variety for personal cultivation.

Specialty retailers and commercial resellers act as crucial distribution channels, extending Hydrofarm's reach to these diverse end-users. This network is vital for making Hydrofarm's extensive product line accessible, supporting both professional and amateur cultivation efforts.

The company's strategy is to equip all these segments with products that enhance crop quality, boost operational efficiency, and ensure consistent production, catering to the growing demand for advanced horticultural solutions.

| Customer Segment | Key Characteristics | Hydrofarm's Value Proposition | Market Data/Relevance |

|---|---|---|---|

| Commercial Growers | Large-scale, professional cultivators (cannabis, CEA food/floral) | High-volume, reliable equipment for yield optimization and efficiency | U.S. legal cannabis market projected at $71B by 2030 (New Frontier Data) |

| Home & Hobby Growers | Individual cultivators for personal enjoyment | Simple-to-use equipment, learning materials, wide product variety | Growing interest in home gardening and personal cultivation |

| Specialty Retailers | Independent shops and chains serving hydroponics market | Access to Hydrofarm's comprehensive product selection | Global hydroponics market valued at ~$14.5B in 2024 |

| Commercial Resellers & Distributors | Bulk purchasers for onward sale to various businesses | Reliable supplier with a diverse product range, facilitating market penetration | Hydrofarm's 2023 net sales: $178.7M |

Cost Structure

Cost of Goods Sold (COGS) represents the direct expenses incurred in producing or acquiring the products Hydrofarm sells. This is a significant cost driver, covering everything from raw materials for their proprietary products to the cost of purchasing supplies from other companies. For instance, in the first quarter of 2025, Hydrofarm reported COGS of $33.7 million.

This substantial COGS figure is directly linked to the company's operational scale and product mix. A notable point from Q1 2025 earnings was that a decrease in gross profit was primarily attributed to lower net sales, coupled with a shift away from their higher-margin proprietary brands towards a greater proportion of third-party supplied goods.

Selling, General & Administrative (SG&A) expenses are crucial for Hydrofarm's business model, encompassing costs beyond direct production. These include salaries for sales and administrative teams, marketing initiatives, and general operational overhead like rent and utilities.

Hydrofarm has demonstrated a commitment to efficiency by significantly reducing these costs. In the first quarter of 2025, the company achieved an 11% decrease in adjusted SG&A expenses when compared to the same period in the previous year, highlighting a focused effort on streamlining operations.

Distribution and logistics costs are a significant component for Hydrofarm, encompassing warehousing, transportation, and inventory management across its North American operations. In 2023, these costs represented a substantial portion of their overall operating expenses, reflecting the complexities of managing a wide product range and a broad customer base.

Hydrofarm actively seeks to optimize its distribution network by exploring opportunities for facility consolidation and route efficiency. These efforts are crucial for mitigating rising fuel prices and labor expenses, which directly impact transportation and warehousing expenditures. For instance, the company has been investing in technology to improve inventory visibility and reduce stockouts, thereby lowering carrying costs and minimizing expedited shipping needs.

Research and Development (R&D) Expenses

Hydrofarm's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These investments are crucial for developing new hydroponic technologies, improving existing product formulations, and ensuring the company maintains a competitive advantage in the rapidly evolving agricultural tech market. This includes the costs associated with highly skilled scientific personnel, advanced laboratory equipment, and the creation of prototypes for testing and refinement.

In 2024, companies in the controlled environment agriculture sector, which includes hydroponics, have seen R&D spending as a vital component of their strategy. For instance, public filings from leading players often highlight R&D as a substantial line item, with some allocating upwards of 10-15% of their revenue to innovation. This focus allows for:

- Development of next-generation nutrient solutions and lighting technologies.

- Testing and validation of new crop varieties suited for hydroponic systems.

- Enhancement of automation and software integration for farm management.

- Exploration of sustainable materials for growing mediums and equipment.

Debt Servicing and Financial Costs

Hydrofarm's cost structure includes significant expenses related to debt servicing and other financial obligations. These costs are a direct result of the company's capital financing decisions.

Interest payments on its term loan and other financial liabilities represent a recurring expense. As of March 31, 2025, Hydrofarm reported a principal balance of $119.0 million outstanding on its Term Loan.

- Debt Servicing: Interest payments on outstanding loans.

- Financial Liabilities: Costs associated with other financial commitments.

- Liquidity Management: Maintaining sufficient cash to meet obligations.

- Term Loan Balance: $119.0 million as of March 31, 2025.

Hydrofarm's cost structure is multifaceted, encompassing direct production expenses, operational overhead, and financial commitments. The company's Cost of Goods Sold (COGS) was $33.7 million in Q1 2025, influenced by product mix and supplier relationships.

Selling, General & Administrative (SG&A) expenses are actively managed, with adjusted SG&A decreasing by 11% in Q1 2025 year-over-year, reflecting operational efficiencies. Distribution and logistics costs remain significant due to the scale of operations and market dynamics.

Research and Development (R&D) is a key investment area, crucial for innovation in the hydroponics sector, with industry peers often allocating substantial portions of revenue to this. Financial costs, including debt servicing, are also a notable part of the structure, with a Term Loan balance of $119.0 million as of March 31, 2025.

| Cost Category | Q1 2025 (Millions USD) | Key Drivers | Recent Trends |

|---|---|---|---|

| Cost of Goods Sold (COGS) | 33.7 | Raw materials, third-party products | Shift towards lower-margin third-party goods impacted gross profit |

| Selling, General & Administrative (SG&A) | N/A (Percentage of Revenue) | Salaries, marketing, overhead | 11% reduction in adjusted SG&A YoY in Q1 2025 |

| Distribution & Logistics | Significant portion of operating expenses | Warehousing, transportation, inventory management | Focus on network optimization to mitigate rising fuel and labor costs |

| Research & Development (R&D) | Industry benchmark: 10-15% of revenue for leading players | New technologies, product formulations, scientific personnel | Essential for competitive advantage in ag-tech market |

| Debt Servicing & Financial Costs | Interest on Term Loan | Capital financing decisions | Term Loan balance: $119.0 million as of March 31, 2025 |

Revenue Streams

Hydrofarm generates substantial revenue from selling its own branded products. These items, like advanced grow lights, specialized growing media, nutrient solutions, and climate control equipment, offer higher profit margins.

This focus on proprietary brands has paid off, with this segment accounting for 56% of Hydrofarm's total sales in 2024. Looking ahead, this trend is expected to continue, with proprietary brands making up 55% of sales in the first quarter of 2025.

Hydrofarm's revenue streams include the distribution of a wide array of third-party hydroponics products. This strategy allows them to cater to a broad customer base by offering a comprehensive selection of equipment and supplies that supplement their own branded items. For instance, in 2024, the hydroponics market saw continued growth, with companies like Hydrofarm benefiting from the increasing demand for diverse cultivation solutions.

Hydrofarm's revenue is significantly bolstered by e-commerce sales. These online channels, encompassing their proprietary platform and partnerships with other online retailers, are crucial for reaching a broad customer base. This digital approach directly addresses the needs of home growers and smaller commercial operations looking for easy and accessible ways to purchase products.

The company actively promotes its e-commerce growth, recognizing its potential to drive future revenue. For instance, in the first quarter of 2024, Hydrofarm reported a notable increase in online sales, contributing to their overall financial performance. This strategic focus on digital channels allows them to efficiently serve a growing segment of the market.

Sales to Commercial Growers

Hydrofarm’s sales to commercial growers represent a significant revenue engine, particularly for large-scale cultivators of cannabis and other controlled environment agriculture (CEA) crops. These transactions often involve substantial bulk orders and the provision of specialized, high-capacity equipment tailored for efficient, large-scale operations. This segment is characterized by a high-value customer base, driving considerable revenue for the company.

For instance, in 2024, the burgeoning legal cannabis market, a key sector for Hydrofarm’s commercial clients, continued its expansion. States like California and Michigan reported billions in annual sales, creating a robust demand for the hydroponic and horticultural supplies that Hydrofarm provides to commercial growers operating within these markets. This direct engagement with large cultivators underscores their importance as a high-value revenue stream.

- Bulk Orders: Commercial growers frequently place large orders for lighting, nutrients, and environmental controls, representing significant transaction values.

- Specialized Equipment: Revenue is also generated from sales of specialized, high-volume equipment designed for commercial-scale cultivation.

- Cannabis and CEA Focus: A primary driver of this revenue stream is the cultivation of cannabis and other CEA crops, where consistent quality and yield are paramount.

- High-Value Segment: This customer group is crucial for Hydrofarm due to the substantial and recurring nature of their purchasing needs.

International and Non-Cannabis Market Sales

Hydrofarm is strategically broadening its revenue base by venturing into international markets beyond the U.S. and Canada, alongside expanding its reach within non-cannabis controlled environment agriculture (CEA) segments like food and floriculture. This diversification is crucial for mitigating the inherent volatility of the cannabis sector and capitalizing on emerging growth avenues.

By tapping into global demand and the burgeoning food and floral CEA markets, Hydrofarm aims to create a more resilient financial model. For instance, in 2024, the global CEA market was valued at approximately $55.6 billion, with projections indicating continued robust growth, offering significant potential for Hydrofarm’s non-cannabis product lines.

- International Expansion: Targeting markets with developing CEA industries and increasing demand for horticultural supplies.

- Non-Cannabis CEA Focus: Developing and marketing products for the food production and ornamental plant sectors.

- Market Diversification Benefits: Reducing reliance on the cannabis industry's cyclical nature and accessing broader customer bases.

- Growth Opportunity: Leveraging the expanding global CEA market, which shows strong year-over-year increases in adoption and investment.

Hydrofarm's revenue streams are diversified, with proprietary brands accounting for a significant portion of sales. This segment, which includes items like advanced grow lights and nutrient solutions, generated 56% of total sales in 2024, highlighting its importance.

The company also benefits from distributing third-party hydroponics products, offering a comprehensive selection to a broad customer base. E-commerce sales are a crucial channel, with online platforms and retail partnerships driving accessibility for home growers and smaller commercial operations.

Sales to commercial growers, particularly in the cannabis and controlled environment agriculture (CEA) sectors, represent a high-value revenue engine. These clients often make substantial bulk orders for specialized, high-capacity equipment. Hydrofarm is also expanding into international markets and non-cannabis CEA segments like food and floriculture to further diversify its revenue base.

| Revenue Stream | 2024 Contribution (Approx.) | Key Drivers |

|---|---|---|

| Proprietary Brands | 56% | Higher profit margins, brand loyalty |

| Third-Party Distribution | N/A (Supplement to proprietary) | Broad product offering, market reach |

| E-commerce Sales | Significant and growing | Accessibility, direct customer engagement |

| Commercial Growers | Substantial | Bulk orders, specialized equipment, cannabis/CEA demand |

| International & Non-Cannabis CEA | Emerging/Growing | Market diversification, global CEA expansion |

Business Model Canvas Data Sources

The Hydrofarm Business Model Canvas leverages data from agricultural market research, operational cost analyses, and customer surveys. This ensures a data-driven approach to defining value propositions and revenue streams.