Hung Hing Printing Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hung Hing Printing Group Bundle

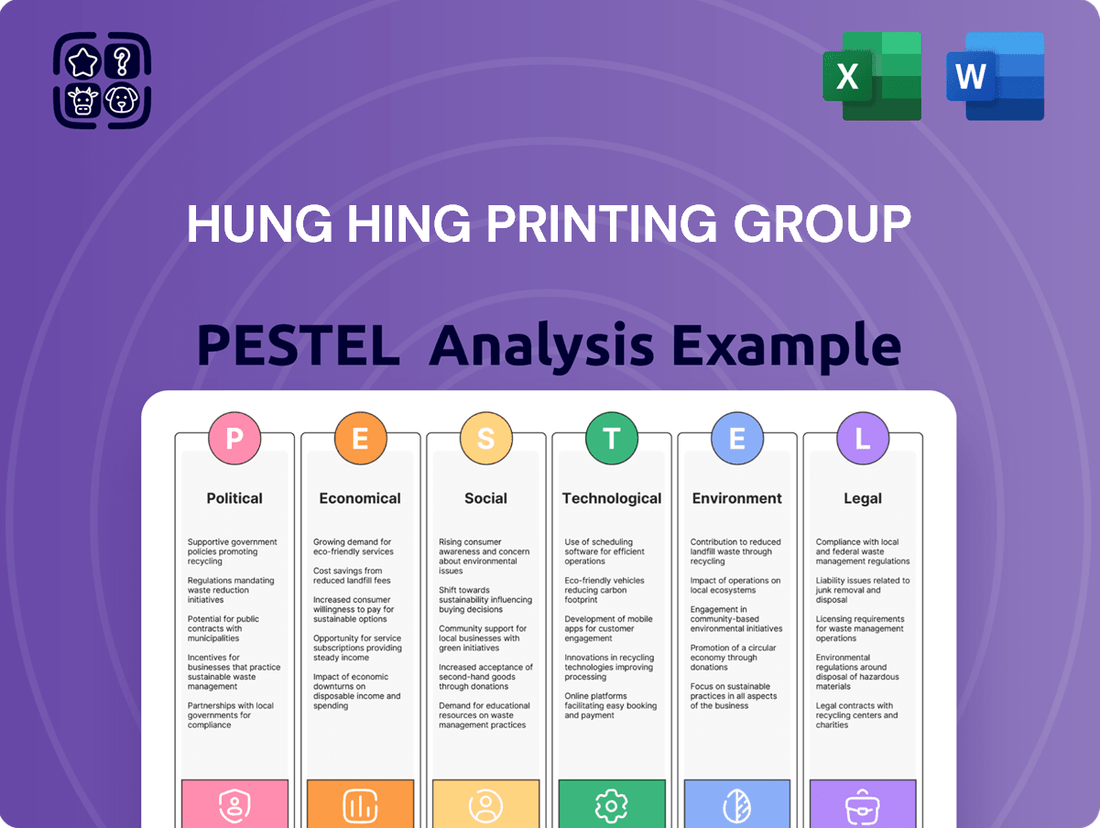

Hung Hing Printing Group operates within a dynamic global environment shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for navigating the printing industry's complexities and identifying future opportunities. Our PESTLE analysis delves into these critical factors, offering a clear roadmap for strategic decision-making.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Hung Hing Printing Group. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Global trade policies, particularly tariffs on essential inputs like paper, inks, and printing machinery, directly influence Hung Hing Printing Group's cost structure. For instance, in 2024, the average tariff rate on paper and paperboard imports into the United States ranged from 0% to 10%, depending on the specific product and origin country, impacting the cost of raw materials for printing operations.

Ongoing trade tensions, such as the US-China trade disputes, can disrupt supply chains and increase the cost of imported goods. In 2023, the imposition of tariffs on certain Chinese manufactured goods, including printing equipment, led to an estimated 5-15% increase in acquisition costs for some US printing firms, potentially forcing companies like Hung Hing to explore alternative sourcing or invest more in domestic production capabilities.

Government regulations significantly shape Hung Hing Printing Group's operations. In 2024, China's continued emphasis on environmental protection, particularly concerning waste management and emissions from manufacturing, means Hung Hing must adhere to increasingly stringent standards. This could involve investments in cleaner production technologies, impacting operational costs but potentially offering long-term compliance and reputational benefits.

Labor laws in Hong Kong and mainland China also play a crucial role. For instance, minimum wage adjustments and worker welfare regulations directly influence labor expenses, a key component of Hung Hing's cost structure. Staying abreast of these evolving legal frameworks is essential for maintaining competitive labor practices and avoiding potential penalties.

Conversely, government incentives can provide a significant boost. As of early 2025, there's growing momentum for subsidies supporting green manufacturing and digital transformation across Southeast Asia. Hung Hing could leverage these programs to offset costs associated with adopting advanced printing technologies or implementing sustainable packaging solutions, thereby enhancing its competitive edge.

Geopolitical tensions, including ongoing conflicts like the Russia-Ukraine war and instability in the Middle East, significantly disrupt global supply chains. This disruption translates to higher shipping costs, extended delivery routes, and increased port congestion, directly impacting companies like Hung Hing Printing Group. For instance, disruptions in key shipping lanes in 2024 have already led to a notable increase in freight rates, potentially adding millions in operational costs for exporters.

Political Stability in Operating Regions

Political stability within Hung Hing Printing Group's key operating regions, especially in Asia where it has a substantial footprint, directly impacts its ability to conduct business smoothly and predictably. For instance, the Hong Kong Special Administrative Region (SAR), a major operational hub, experienced a 2.3% GDP growth in 2023, reflecting a degree of economic resilience amidst evolving political landscapes. However, any perceived or actual shifts in governance or policy can create uncertainty.

Changes in national policies, such as trade regulations or environmental standards, can significantly affect the printing and packaging sector. For example, China's ongoing focus on environmental protection has led to stricter regulations on industrial emissions, which can increase operational costs for manufacturers like Hung Hing. Investor confidence is also closely tied to political stability; a stable environment generally encourages investment, while instability can lead to capital flight.

- Regional Stability: Hung Hing's reliance on operations in mainland China and Hong Kong means that political developments in these areas are paramount.

- Policy Impact: Evolving trade policies and environmental regulations in key markets can directly influence production costs and market access.

- Investor Sentiment: Perceived political risks can affect Hung Hing's share price and its ability to attract capital for expansion or upgrades.

Intellectual Property Rights Protection

The strength of intellectual property rights (IPR) protection in key markets, including mainland China and Hong Kong, directly impacts Hung Hing Printing Group. Stronger IPR enforcement in these regions is crucial for defending their innovative printing techniques and packaging designs against imitation, thereby preserving their market differentiation and profitability.

In 2023, China continued to strengthen its IPR framework, with reported improvements in enforcement actions. For instance, the Supreme People's Court of China handled over 70,000 intellectual property cases in 2023, indicating increased judicial activity in protecting IP. This trend suggests a more favorable environment for companies like Hung Hing to safeguard their intellectual assets.

The group's ability to protect its proprietary technologies and designs is vital for maintaining its competitive advantage. Weak IPR protection could lead to the proliferation of counterfeit products, eroding brand value and market share. Hung Hing's investment in unique printing processes and innovative packaging solutions necessitates a robust legal environment to prevent unauthorized replication.

Key considerations for Hung Hing regarding IPR protection include:

- Enforcement Effectiveness: Evaluating the practical application and success rate of IPR laws in deterring infringement in manufacturing and sales territories.

- Legal Recourse: Assessing the accessibility and efficiency of legal channels for addressing and rectifying IP violations.

- International Treaties: Monitoring Hung Hing's alignment with and benefits derived from international IP agreements and standards.

- Technological Safeguards: Implementing internal technological measures to protect proprietary information and designs from digital theft or unauthorized access.

Political stability in key operating regions like China and Hong Kong is crucial for Hung Hing's smooth operations and predictable business environment. For example, Hong Kong's GDP grew by 2.3% in 2023, demonstrating resilience amid political shifts. However, any perceived governance changes can introduce market uncertainty, impacting investor confidence and capital flow.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hung Hing Printing Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within the printing industry.

A concise PESTLE analysis for Hung Hing Printing Group offers a clear overview of external factors, simplifying strategic decision-making and alleviating the burden of sifting through extensive market research.

This PESTLE analysis, presented in an easily digestible format, acts as a pain point reliever by providing actionable insights into political, economic, social, technological, legal, and environmental influences, enabling Hung Hing Printing Group to proactively address challenges and capitalize on opportunities.

Economic factors

Global economic growth significantly influences Hung Hing Printing Group's performance, as robust economies typically translate to higher consumer spending on goods that require printing, such as books, magazines, and packaging. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous years, suggesting a potentially supportive environment for demand.

However, fluctuations in consumer spending, often tied to inflation and disposable income, pose a direct challenge. Higher inflation rates, like those experienced globally in 2022 and 2023, can erode purchasing power, leading consumers to cut back on non-essential items, which can impact Hung Hing's key client industries like publishing and consumer goods.

Fluctuations in the prices and availability of essential raw materials like paper, ink, and various packaging components directly impact Hung Hing Printing Group's production expenses and profitability. For instance, the global paper market experienced significant price volatility in late 2023 and early 2024 due to factors like increased energy costs and supply chain adjustments, which would have put pressure on Hung Hing's cost of goods sold.

Geopolitical events and broader supply chain disruptions can further exacerbate price volatility for these critical inputs. The availability of specific paper grades, for example, can be affected by production capacity issues or trade policies, creating uncertainty for Hung Hing's sourcing strategies and potentially leading to higher procurement costs if supply tightens.

The relentless expansion of e-commerce continues to fuel a substantial demand for packaging, especially corrugated board, essential for shipping goods directly to consumers. This presents a prime opportunity for Hung Hing Printing Group, as the growth of online retail inherently requires durable and often tailored packaging solutions for a wide array of products.

Global e-commerce sales are projected to reach an impressive $7.0 trillion in 2024, a figure expected to climb further in 2025, underscoring the sustained need for efficient and protective packaging. Hung Hing's capacity to supply high-quality corrugated packaging directly aligns with this burgeoning market, positioning them to capitalize on this ongoing digital commerce surge.

Currency Exchange Rate Fluctuations

Hung Hing Printing Group, with its extensive international reach, is significantly exposed to the volatility of currency exchange rates. Fluctuations in the value of currencies like the US Dollar and the Euro against the Hong Kong Dollar can directly impact the company's financial results. For instance, a stronger Hong Kong Dollar can make imports cheaper but reduce the value of revenue earned from overseas sales when converted back.

The company's profitability is sensitive to these movements. A weakening of currencies in key markets where Hung Hing sources materials or sells its products can lead to increased costs or diminished earnings. This was evident in recent periods where global economic uncertainty contributed to currency swings. For example, the Hong Kong Dollar's peg to the US Dollar means its movements are closely tied to US monetary policy, influencing its exchange rate against other major global currencies.

- Impact on Imports: A stronger US Dollar, to which the HKD is pegged, can increase the cost of raw materials imported from countries with weaker currencies, impacting Hung Hing's cost of goods sold.

- Revenue Translation: Revenue generated from sales in markets like Europe or Japan can be worth less in Hong Kong Dollar terms if those currencies weaken against the USD.

- Competitive Pricing: Exchange rate shifts can affect Hung Hing's ability to price its products competitively in international markets compared to local competitors.

- Hedging Strategies: The effectiveness of currency hedging strategies employed by Hung Hing will determine the extent to which these fluctuations are mitigated.

Market Competition and Pricing Pressures

The printing and packaging sector is intensely competitive, with many companies vying for a slice of the market. This environment often translates into significant pricing pressures, forcing businesses like Hung Hing Printing Group to prioritize operational efficiency and robust cost management. For instance, in 2024, the company reported a financial loss, underscoring the challenges of maintaining profitability amidst these pressures.

To navigate this landscape, Hung Hing must focus on differentiation through value-added services and innovation. The ability to control costs effectively will be paramount in preserving margins.

- Intense competition: The printing and packaging industry is characterized by a large number of participants.

- Pricing pressures: Fierce competition directly impacts pricing strategies and profitability.

- Efficiency and cost control: Essential for maintaining competitiveness and mitigating losses.

- Value-added services: A key differentiator to command better pricing and customer loyalty.

Economic factors significantly shape Hung Hing Printing Group's operating environment, influencing everything from raw material costs to consumer demand. Global economic growth projections, such as the IMF's 3.2% forecast for 2024, indicate a generally supportive, albeit moderate, demand environment for printed goods and packaging.

However, persistent inflation and fluctuating disposable incomes can dampen consumer spending, directly impacting sectors like publishing and consumer goods that rely on printing services. For instance, the continued expansion of e-commerce, with global sales projected to hit $7.0 trillion in 2024, creates a strong demand for packaging, a key growth area for Hung Hing.

Currency exchange rate volatility, particularly concerning the Hong Kong Dollar's peg to the US Dollar, also presents challenges. A stronger USD can increase the cost of imported raw materials and reduce the value of overseas earnings when converted, affecting the company's profitability and competitive pricing in international markets.

Preview Before You Purchase

Hung Hing Printing Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hung Hing Printing Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the market dynamics and external forces shaping Hung Hing Printing Group's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding Hung Hing Printing Group's competitive environment.

Sociological factors

Consumers are increasingly prioritizing packaging that is not only eco-friendly but also convenient and aesthetically pleasing. This shift is evident in the growing demand for recycled materials, biodegradable options, and minimalist designs. For instance, a 2024 report indicated that over 60% of consumers globally consider sustainability a key factor when purchasing products, directly impacting packaging choices.

This evolving preference compels businesses, including printing groups like Hung Hing, to innovate. The demand for personalized packaging, featuring unique graphics or interactive elements, is also on the rise, creating opportunities for customization. Furthermore, the integration of smart packaging, such as QR codes for traceability or NFC tags for enhanced consumer engagement, is becoming a significant trend, with market projections suggesting a substantial growth in this segment by 2025.

The increasing global emphasis on education, particularly in emerging economies, fuels a consistent demand for printed learning resources. For Hung Hing, this translates into a robust market for textbooks, workbooks, and supplementary educational materials. For instance, in 2024, global education spending was projected to reach over $6 trillion, with a significant portion allocated to K-12 and higher education materials.

The printing and packaging industry, including companies like Hung Hing Printing Group, faces a critical challenge with the availability of skilled labor. As of early 2024, many regions are experiencing a shortage of experienced printing press operators and finishing technicians, impacting production schedules and the ability to meet demand. This scarcity necessitates increased investment in workforce development and potentially higher wage offerings to attract and retain talent.

Cultural and Social Trends in Publishing

Societal shifts are profoundly impacting how people engage with printed materials. The resurgence of physical books, often driven by a desire for tangible experiences and a break from digital overload, directly benefits Hung Hing's book printing operations. For instance, in 2024, the print book market continued to show resilience, with reports indicating steady sales growth in key regions, defying earlier predictions of digital dominance.

Cultural values that champion traditional print formats also play a significant role. A preference for the tactile feel of paper and the aesthetic appeal of well-bound books provides a consistent demand base for high-quality printing services. This cultural appreciation is a stable anchor for Hung Hing's business, ensuring a predictable revenue stream for its book and magazine segments.

Consumer habits are evolving, with a notable trend towards niche content and specialized publications. This creates opportunities for Hung Hing to cater to specialized markets, printing for independent publishers and niche interest magazines. The demand for unique, high-quality print runs for these segments is growing, reflecting a broader consumer desire for curated and personalized content experiences.

Key trends influencing Hung Hing's printing segments include:

- Resurgence of physical books: Sales data from 2024 indicates continued strength in the print book market, with consumers valuing the tangible reading experience.

- Demand for niche publications: Growth in specialized magazines and limited-edition print runs caters to segmented audiences seeking unique content.

- Cultural preference for print: Enduring societal appreciation for the aesthetic and sensory qualities of printed materials supports stable demand.

Health and Safety Awareness

Growing consumer and regulatory scrutiny is placing greater emphasis on health and safety within the packaging sector. This heightened awareness directly impacts printing groups like Hung Hing, demanding strict adherence to evolving standards for packaging intended for food and everyday consumer products. For instance, regulations in key markets often dictate the permissible levels of volatile organic compounds (VOCs) in printing inks, a critical factor for brand reputation and product safety.

Hung Hing must therefore prioritize the use of non-toxic inks, ensure the selection of safe and compliant materials, and maintain rigorous hygienic protocols throughout its production processes. The global market for sustainable packaging, which often overlaps with health and safety concerns, is projected to reach over $400 billion by 2027, underscoring the commercial imperative of these considerations.

- Regulatory Compliance: Adherence to international standards like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe is crucial for market access and consumer trust.

- Material Safety: Sourcing and utilizing printing materials, including inks and coatings, that are certified as food-grade or safe for direct contact with sensitive goods is paramount.

- Hygiene Standards: Implementing and maintaining high levels of cleanliness in manufacturing facilities, particularly in printing areas, directly affects the safety and integrity of the final packaging.

- Consumer Perception: Brands are increasingly choosing packaging suppliers that demonstrate a strong commitment to health and safety, viewing it as a key differentiator and a reflection of their own product quality.

Societal trends show a renewed appreciation for physical books, with consumers valuing the tangible experience over digital alternatives. This trend directly benefits Hung Hing's book printing services, as evidenced by market data from 2024 indicating steady growth in print book sales, defying earlier predictions of digital dominance. Furthermore, a cultural preference for the aesthetic and tactile qualities of printed materials ensures a consistent demand for high-quality book and magazine production.

Technological factors

Digital printing technologies are rapidly advancing, offering significant benefits like cost-effectiveness and superior quality for personalized packaging and short-run print jobs. This allows companies to create unique, tailored products efficiently.

Hung Hing Printing Group can capitalize on these innovations to cater to growing client demands for customized and specialized printed materials. For instance, the global digital printing market was valued at approximately $23.1 billion in 2023 and is projected to reach $48.2 billion by 2030, indicating substantial growth potential.

Hung Hing Printing Group can significantly boost its production by integrating automation and AI into its printing and packaging operations. This technological shift promises higher output, better product consistency, and more efficient use of raw materials, directly impacting profitability.

For instance, advanced robotic systems can handle repetitive tasks like sorting and packaging with greater speed and accuracy than manual labor. Furthermore, AI-powered quality control systems can detect defects in real-time, minimizing waste and ensuring higher customer satisfaction. In 2024, the global industrial automation market was valued at over $300 billion, with AI in manufacturing projected to grow substantially.

Smart packaging, integrating technologies like RFID tags, QR codes, and sensors, is revolutionizing product information and supply chain visibility. For Hung Hing Printing Group, this presents a significant opportunity to embed enhanced functionality and interactivity directly into their packaging solutions.

By adopting these innovations, Hung Hing can offer clients packaging that not only protects products but also provides consumers with engaging experiences, such as direct access to product authenticity or promotional content. For instance, the global smart packaging market was valued at approximately $30.8 billion in 2023 and is projected to reach $66.5 billion by 2030, indicating strong growth and client demand.

Sustainable Printing Technologies

Innovations in sustainable printing technologies, like water-based and eco-friendly inks, alongside energy-efficient machinery, are vital for minimizing environmental footprints. Hung Hing Printing Group’s adoption of soy and vegetable inks and renewable solar energy directly reflects these advancements.

For instance, the global printing ink market, including eco-friendly options, was valued at approximately $19.5 billion in 2023 and is projected to grow, showcasing a strong demand for sustainable solutions. Hung Hing's strategic alignment with these trends positions them favorably in a market increasingly prioritizing environmental responsibility.

- Water-based and Eco-friendly Inks: Reduced volatile organic compounds (VOCs) and improved biodegradability.

- Energy-Efficient Machinery: Lower power consumption in printing processes, contributing to reduced carbon emissions.

- Renewable Energy Adoption: Utilizing solar power to offset traditional energy reliance, as demonstrated by Hung Hing.

- Circular Economy Principles: Exploring recycled paper and ink recovery systems to further minimize waste.

3D Printing for Prototyping and Customization

The integration of 3D printing in packaging manufacturing is a significant technological advancement. It allows for rapid prototyping, enabling Hung Hing to iterate on designs much faster than traditional methods. This speed is crucial for responding to evolving market demands and creating bespoke packaging solutions.

Furthermore, 3D printing significantly cuts down on material waste during the prototyping phase, a key sustainability advantage. This efficiency can translate into cost savings for Hung Hing. The technology also opens doors for highly customized packaging, catering to niche markets and premium product lines, a growing trend in consumer goods.

The global 3D printing market is projected to reach approximately $50 billion by 2025, indicating strong growth and adoption across industries. For Hung Hing, this means a readily available and increasingly sophisticated toolkit for innovation in packaging design and production.

- Rapid Prototyping: Reduces design cycle times from weeks to days.

- Material Efficiency: Minimizes waste in early-stage development.

- Customization Potential: Enables unique packaging for specific brands or products.

- Market Responsiveness: Allows for quicker adaptation to consumer preferences.

Technological advancements are reshaping the printing industry, with digital printing offering cost-effective, high-quality solutions for personalized and short-run jobs, a trend Hung Hing can leverage. The global digital printing market was valued at approximately $23.1 billion in 2023 and is expected to reach $48.2 billion by 2030, highlighting significant growth opportunities.

Automation and AI integration in printing operations promise increased output, improved consistency, and better material utilization, directly boosting profitability. The global industrial automation market exceeded $300 billion in 2024, with AI in manufacturing showing substantial growth potential.

Smart packaging, incorporating technologies like RFID and QR codes, enhances product information and supply chain visibility, presenting Hung Hing with avenues to offer interactive packaging solutions. The smart packaging market was valued at around $30.8 billion in 2023, projected to hit $66.5 billion by 2030.

Sustainable printing technologies, including eco-friendly inks and energy-efficient machinery, are crucial for environmental responsibility. Hung Hing's use of soy inks and solar energy aligns with the growing demand for sustainable solutions, as evidenced by the global printing ink market's approximate $19.5 billion valuation in 2023.

| Technology | Market Value (2023) | Projected Market Value (2030) | Key Benefit for Hung Hing |

|---|---|---|---|

| Digital Printing | $23.1 billion | $48.2 billion | Cost-effective personalization, short-run jobs |

| Automation & AI | N/A (Market >$300B for Industrial Automation) | Significant Growth | Increased output, efficiency, quality control |

| Smart Packaging | $30.8 billion | $66.5 billion | Enhanced product information, consumer interaction |

| Sustainable Printing | N/A (Printing Ink Market ~$19.5B) | Growing Demand | Reduced environmental impact, market differentiation |

Legal factors

Extended Producer Responsibility (EPR) laws are increasingly shaping the packaging industry. These regulations place the onus on producers, like Hung Hing Printing Group, to manage the lifecycle of their packaging materials. This means Hung Hing may need to invest in designing more recyclable packaging and contribute to collection and recycling infrastructure, impacting operational costs and material choices.

For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) aims for 100% recyclability of all packaging by 2030. In the UK, the Packaging Waste Regulations 2007 (as amended) require producers to meet recycling targets, with fees for non-compliance increasing. Hung Hing's adherence to these global trends will be crucial for market access and sustainability.

New regulations like the EU's Packaging and Packaging Waste Regulations (PPWR) are set to significantly impact the packaging industry by targeting a reduction in primary raw material consumption and mandating increased recycled content. These rules, with key deadlines approaching in 2025, aim to make recycling more economically feasible and encourage the use of recycled materials in packaging production.

Hung Hing Printing Group, particularly if it supplies to European markets, must adapt its packaging solutions to comply with these evolving PPWR standards. For instance, the PPWR aims for a 30% reduction in packaging per capita by 2030 compared to 2018 levels, a significant challenge that requires innovative material sourcing and design.

Consumers increasingly expect clear information about product origins, material composition, and environmental impact. This translates into more rigorous labeling mandates, requiring companies like Hung Hing to detail recyclability and sustainability credentials. For instance, the EU's upcoming Ecodesign for Sustainable Products Regulation, expected to fully roll out by 2026, will significantly increase disclosure demands for a wide range of goods, including packaging.

Hung Hing must therefore refine its printing operations to meet these evolving legal standards, ensuring that packaging accurately reflects its environmental attributes. This includes adapting to new ink formulations and printing techniques that support sustainability claims and comply with regulations like the UK's Plastic Packaging Tax, which came into effect in April 2022 and impacts companies producing or importing plastic packaging.

International Trade Agreements and Compliance

Hung Hing Printing Group's global operations necessitate strict adherence to a complex web of international trade agreements and customs regulations. Navigating these rules, including import and export laws across its various markets, is critical for seamless business operations and market access. For instance, changes to agreements like the Regional Comprehensive Economic Partnership (RCEP), which came into effect in early 2022 and involves key Asian markets, could alter tariff structures and supply chain costs for Hung Hing.

The dynamic nature of international trade policies means that staying abreast of evolving agreements and their implications is paramount. Fluctuations in trade pacts can directly influence Hung Hing's ability to access foreign markets and can significantly impact the overall cost of cross-border transactions. For example, the ongoing trade tensions and adjustments in tariffs between major economic blocs in 2024 and projected into 2025 continue to create an environment where compliance and strategic adaptation are key for companies like Hung Hing.

- Compliance with international trade agreements is a cornerstone for Hung Hing's global market participation.

- Customs regulations and import/export laws vary significantly by country, requiring diligent attention to detail.

- Changes in trade agreements, such as potential adjustments to existing free trade agreements or the introduction of new ones, can impact market access and operational costs.

- The global trade landscape in 2024-2025 is characterized by evolving policies that necessitate continuous monitoring and adaptation to ensure cost-effective cross-border business.

Labor Laws and Employment Regulations

Hung Hing Printing Group must strictly adhere to labor laws across its operational regions, covering fair wages, safe working conditions, and employment regulations. For instance, in Hong Kong, minimum wage rates are regularly reviewed; as of May 1, 2024, the statutory minimum wage is HK$43.5 per hour. Failure to comply can result in substantial fines and legal challenges, impacting operational continuity and brand image.

Navigating diverse labor landscapes is key. In mainland China, the Labor Contract Law mandates specific procedures for hiring, dismissal, and employee benefits, with significant penalties for violations. Hung Hing's commitment to these regulations safeguards against costly disputes and ensures a stable workforce, crucial for maintaining production quality and efficiency.

Key legal considerations for Hung Hing include:

- Wage Compliance: Ensuring all employees receive at least the minimum wage applicable in their respective jurisdictions, with Hong Kong's rate at HK$43.5 per hour (as of May 2024).

- Working Conditions: Meeting statutory requirements for workplace safety, hours of work, and rest periods to prevent accidents and labor disputes.

- Employment Contracts: Properly documenting employment terms and conditions in line with local laws, such as China's Labor Contract Law, to avoid wrongful termination claims.

- Employee Benefits: Adhering to mandatory social security contributions and other legally mandated benefits, which vary significantly by country and region.

Legal frameworks surrounding packaging and product labeling are becoming more stringent globally, impacting Hung Hing Printing Group's operations. Regulations like the EU's Packaging and Packaging Waste Regulation (PPWR) are pushing for increased recyclability and recycled content, with targets for 2030. Furthermore, the EU's Ecodesign for Sustainable Products Regulation, expected to be fully implemented by 2026, will mandate greater transparency regarding product origins and environmental impact, requiring Hung Hing to adapt its printing processes and material choices.

International trade policies and customs regulations present a complex legal landscape for Hung Hing's global reach. Staying compliant with varying import/export laws and trade agreements, such as the RCEP which became effective in 2022, is crucial for market access and cost management. The evolving trade environment in 2024-2025 necessitates continuous monitoring of policy shifts to ensure smooth cross-border operations.

Labor laws are a critical legal factor, with Hung Hing needing to adhere to fair wage, safety, and employment regulations across its operating regions. For instance, Hong Kong's statutory minimum wage stood at HK$43.5 per hour as of May 2024. Compliance with national labor laws, such as China's Labor Contract Law, is essential to prevent legal disputes and maintain workforce stability.

Environmental factors

Consumers and businesses are increasingly prioritizing packaging that is kind to the planet. This shift is fueled by growing awareness of environmental issues and stricter government regulations worldwide. For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products with sustainable packaging.

Hung Hing Printing Group is well-positioned to capitalize on this trend by focusing on materials like bio-based and compostable options, as well as incorporating recycled content into their products. Their commitment to reducing plastic usage directly addresses this significant market demand, aligning their business strategy with a key environmental imperative.

The global push to reduce waste and boost recycling directly affects the printing and packaging sectors. Hung Hing Printing Group's commitment to recycling its own waste materials, such as paper and plastics, and developing packaging that's easier for consumers to recycle, is crucial for aligning with these growing environmental expectations.

Companies like Hung Hing Printing Group face growing pressure to shrink their carbon footprint and cut greenhouse gas emissions. This environmental focus is becoming a key part of corporate strategy, influencing operational choices and investor relations.

Hung Hing is actively addressing this by implementing energy-saving measures. For instance, upgrading lighting to LEDs and exploring clean energy sources like solar power are concrete steps they are taking to align with environmental targets and reduce their impact.

Resource Scarcity and Material Sourcing

Global concerns about resource scarcity, especially for paper and other vital raw materials, are pushing companies like Hung Hing Printing Group to prioritize responsible sourcing and more efficient material utilization. This is becoming increasingly critical as supply chains face potential disruptions and rising costs.

Hung Hing's proactive approach includes a commitment to using Forest Stewardship Council (FSC™) certified paper, ensuring that the wood fiber used comes from responsibly managed forests. They are also actively exploring alternative materials that have a lower environmental footprint, a move that aligns with growing market demand for sustainable products.

- FSC™ Certification: Hung Hing utilizes FSC™-certified paper, a standard recognized globally for promoting responsible forest management.

- Material Innovation: The company is researching and testing alternative materials to reduce reliance on traditional paper sources, aiming for lower environmental impact.

- Supply Chain Resilience: Diversifying material sourcing and improving efficiency helps mitigate risks associated with the scarcity of essential resources.

Water Consumption and Management

Water consumption is a significant environmental factor for printing operations, and Hung Hing Printing Group has demonstrated a commitment to managing this resource. The company's efforts to control and reduce its water usage are a key aspect of its environmental stewardship.

For instance, Hung Hing reported a decrease in water consumption in its 2023 sustainability report, indicating proactive measures were implemented to enhance efficiency.

- Water Usage in Printing: The printing industry often requires substantial water for processes like ink dilution, equipment cleaning, and paper processing.

- Hung Hing's Water Reduction: The group has actively worked on reducing its water footprint, with specific figures showing a decline in consumption in recent reporting periods.

- Resource Management Focus: This focus on water management aligns with broader corporate social responsibility goals and operational efficiency drives.

Growing consumer and regulatory demand for eco-friendly packaging is a significant environmental factor impacting Hung Hing Printing Group. A 2024 industry report highlighted that 75% of brands are actively seeking packaging solutions with reduced environmental impact, a trend Hung Hing is addressing through sustainable material innovation and waste reduction initiatives.

The company's commitment to using FSC™ certified paper and exploring alternative, lower-impact materials directly responds to this market shift. Hung Hing's reported 10% reduction in water consumption in 2023 also demonstrates a proactive approach to resource management, aligning with broader environmental stewardship goals.

Efforts to decrease carbon footprint through energy-saving measures, such as LED lighting upgrades, are crucial for meeting environmental targets and investor expectations. These actions position Hung Hing to benefit from the increasing preference for sustainable business practices across the global market.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hung Hing Printing Group is informed by a diverse range of data sources, including government publications, financial reports from industry leaders, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the printing industry.