Hung Hing Printing Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hung Hing Printing Group Bundle

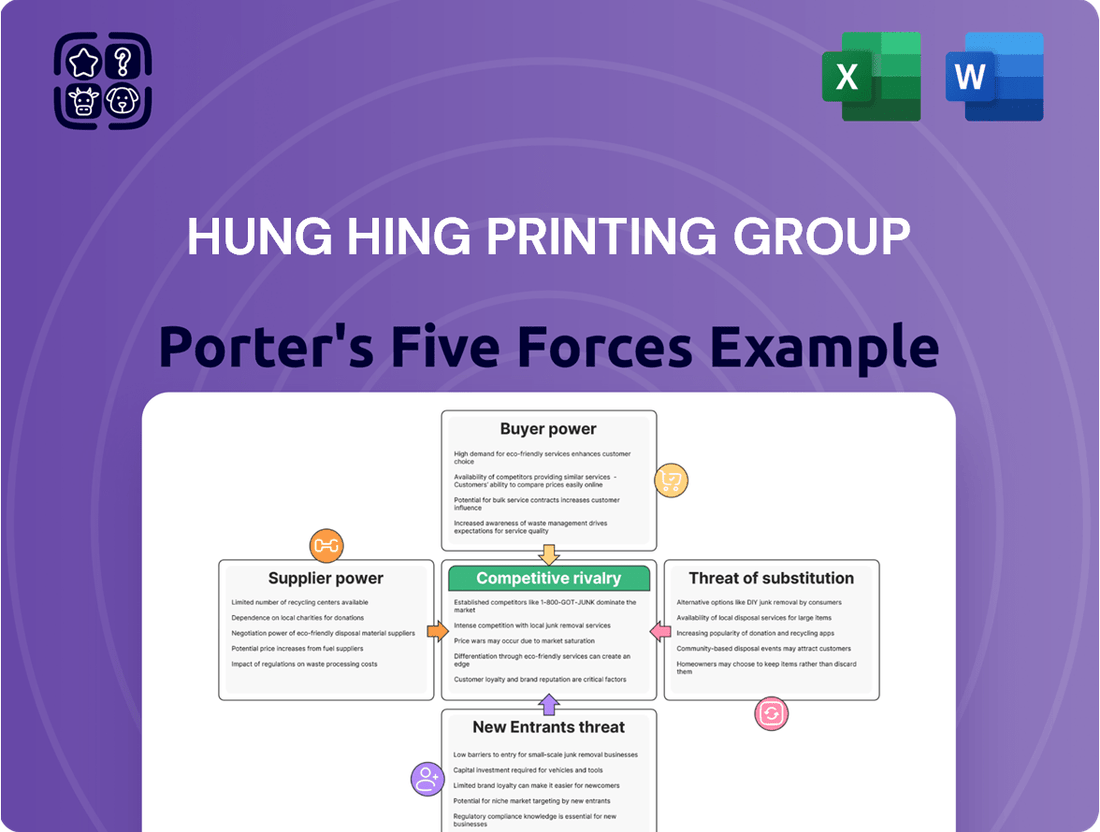

Hung Hing Printing Group faces moderate buyer power due to industry fragmentation, but intense rivalry among printers can shift this balance. The threat of new entrants is also a significant factor, as barriers to entry are relatively low in this sector.

The complete report reveals the real forces shaping Hung Hing Printing Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The printing industry, including companies like Hung Hing Printing Group, is dependent on essential inputs such as paper, ink, and specialized printing equipment. If a limited number of suppliers control these crucial markets, they gain considerable leverage, allowing them to dictate pricing and contract terms to Hung Hing Printing Group. For instance, in 2024, global paper prices saw fluctuations due to supply chain disruptions, impacting printing companies' cost structures.

Furthermore, the degree of uniqueness or proprietary technology associated with certain inks or specialized machinery significantly amplifies a supplier's bargaining power. When Hung Hing Printing Group requires inputs that are not readily available from alternative sources, or possess unique qualities, suppliers can command higher prices and more favorable terms, potentially squeezing profit margins.

The bargaining power of suppliers for Hung Hing Printing Group is significantly influenced by switching costs. If Hung Hing faces substantial expenses when moving from one paper supplier to another, such as the need for retooling printing presses or re-calibrating ink mixing systems, this increases the supplier's leverage. These costs can make it challenging for Hung Hing to seek more competitive pricing or better quality from alternative sources, thereby strengthening the supplier's position.

Suppliers might become a threat if they can move into the printing and packaging sector, directly competing with Hung Hing. This risk is amplified if these suppliers have superior technology or established distribution channels, potentially disrupting Hung Hing's market position.

For instance, a major paper supplier with advanced digital printing capabilities could decide to offer finished printed products, bypassing Hung Hing altogether. In 2024, the global printing and packaging market saw significant investment in digital technologies, with companies like HP and Canon expanding their offerings, indicating a potential for supplier forward integration.

Importance of Hung Hing to the Supplier

Hung Hing Printing Group's significance to its suppliers directly shapes their bargaining power. If Hung Hing constitutes a minor segment of a supplier's sales, that supplier might be less inclined to offer preferential pricing or terms. Conversely, a substantial customer like Hung Hing can wield considerable influence.

For instance, consider the paper industry, a critical input for Hung Hing. If a particular paper mill derives a significant percentage of its revenue from Hung Hing, that mill is more likely to accommodate Hung Hing's demands for better pricing or customized paper specifications. In 2024, global paper prices experienced fluctuations due to supply chain disruptions and demand shifts, making strong customer relationships even more vital for securing favorable terms.

- Supplier Dependence: The degree to which a supplier relies on Hung Hing for its revenue is a primary determinant of its bargaining power.

- Market Conditions: In 2024, the paper market, for example, saw increased volatility, potentially shifting leverage towards larger buyers like Hung Hing if they represent a significant portion of a supplier's client base.

- Alternative Suppliers: The availability of comparable suppliers for essential materials influences how much power Hung Hing has in negotiations; fewer alternatives mean less leverage for Hung Hing.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier power for companies like Hung Hing Printing Group. If alternative raw materials or technologies can be adopted without substantial compromises in quality or cost, then the leverage held by traditional material suppliers diminishes. For instance, the printing industry has seen advancements in digital printing technologies and the use of recycled or alternative fiber papers, offering viable substitutes to conventional paper and ink. This diversification of material sourcing options means suppliers of specific traditional inputs cannot unilaterally dictate terms.

In 2024, the global paper and pulp market, a key input for printing, experienced fluctuating prices due to various factors including energy costs and supply chain disruptions. However, the increasing adoption of digital media and the growing demand for sustainable packaging solutions have also spurred innovation in paper production and alternative materials. For Hung Hing, this translates to a broader range of sourcing options, thereby reducing reliance on any single supplier of traditional paper or ink.

- Reduced Supplier Leverage: The existence of readily available substitutes for paper and ink weakens the bargaining power of existing suppliers.

- Material Diversification: Hung Hing can explore alternative paper types (e.g., recycled, synthetic) and ink formulations (e.g., soy-based, UV-cured) to mitigate supplier price increases.

- Technological Advancements: Innovations in printing technology, such as digital printing, can decrease reliance on traditional ink and paper suppliers.

- Market Responsiveness: Hung Hing's ability to switch to substitutes allows it to respond effectively to shifts in raw material availability and pricing.

The bargaining power of suppliers for Hung Hing Printing Group is moderate, influenced by the availability of alternative inputs and the concentration of key suppliers. While paper and ink are essential, the industry has seen a rise in substitute materials and technologies, such as recycled paper and digital printing, which can limit the pricing power of traditional suppliers. However, specialized inks or machinery can still grant significant leverage to their respective providers.

In 2024, global paper prices remained a critical factor, with fluctuations driven by energy costs and supply chain issues. For instance, the average price of printing and writing paper in North America saw an increase in early 2024 compared to the previous year, impacting printing firms. This volatility means that while Hung Hing may have some options, securing consistent and cost-effective supply remains a key negotiation point.

The threat of supplier forward integration, where suppliers might enter the printing market themselves, is also a consideration. Companies investing in digital printing capabilities, as observed in 2024 with significant market expansion by players like Canon and HP, could potentially shift the competitive landscape and alter supplier dynamics.

| Factor | Impact on Hung Hing | 2024 Relevance |

|---|---|---|

| Availability of Substitutes | Weakens supplier power | Growing adoption of recycled paper and digital printing |

| Supplier Concentration | Increases supplier power | Dependence on a few key paper mills or ink manufacturers |

| Switching Costs | Increases supplier power | Costs associated with retooling for new materials |

| Supplier Forward Integration | Potential threat | Digital printing advancements by equipment providers |

What is included in the product

This analysis explores the competitive forces impacting Hung Hing Printing Group, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the printing industry.

A dynamic, interactive model to simulate the impact of competitive shifts on Hung Hing's profitability, offering relief from uncertainty.

Customers Bargaining Power

Hung Hing Printing Group's customer base spans diverse sectors like publishing, education, and consumer goods. If a small number of major clients contribute a large chunk of the company's income, those clients gain significant leverage. This allows them to push for reduced prices, enhanced service levels, or tailored product offerings.

The bargaining power of these concentrated customers is further amplified by Hung Hing's reported revenue decline in 2024. This downturn could make the company more reliant on its key accounts, potentially increasing their ability to dictate terms and secure more favorable deals.

The bargaining power of Hung Hing Printing Group's customers is significantly influenced by switching costs. If customers can easily move to another printer with little hassle or expense, their ability to demand better pricing or terms increases. For instance, if a client can switch providers with minimal setup fees and no significant disruption to their operations, they hold more leverage.

Customer price sensitivity is a significant factor for Hung Hing Printing Group, particularly within its core markets. Publishing, education, and consumer goods sectors often exhibit high price sensitivity, especially for large-volume print runs or more standardized products. This means customers can exert considerable pressure on Hung Hing to reduce prices, which directly impacts the company's profitability. In 2024, the Book and Packaging Printing segment faced particularly intense price competition, making this sensitivity a critical element in Hung Hing's strategic considerations.

Availability of Substitute Products/Services for Customers

Customers wield significant power when readily available alternatives exist for their printing and packaging requirements. For instance, the proliferation of digital media, such as e-books and online publications, directly diminishes the demand for printed books and magazines, a core offering for companies like Hung Hing Printing Group. Large corporations also increasingly explore in-house printing solutions, further reducing their dependence on external suppliers.

The digital printing sector, in particular, is experiencing robust growth, offering customers more flexible and often cost-effective options compared to traditional methods. This trend is amplified by the ongoing digital transformation across various industries.

- Digital Alternatives: The shift towards digital content for publications like books and magazines directly competes with traditional print services.

- In-House Capabilities: Large corporations may invest in their own printing facilities, bypassing external providers.

- Digital Printing Growth: The market for digital printing solutions is expanding, providing customers with more choices and potentially lower costs. In 2023, the global digital printing market was valued at approximately USD 20.5 billion and is projected to grow further.

Customer's Information Asymmetry

When customers possess significant market information, such as competitor pricing, product specifications, and service quality, their bargaining power increases. This knowledge allows them to identify alternatives and negotiate more favorable terms with Hung Hing Printing Group. For instance, readily available online data on printing costs and industry benchmarks empowers buyers to challenge Hung Hing's pricing and service offerings.

- Information Access: Customers can easily compare Hung Hing's pricing and service levels against industry averages and competitor benchmarks.

- Negotiation Leverage: Access to competitor data enables customers to demand better pricing, faster turnaround times, or enhanced quality.

- Market Transparency: The general availability of pricing and capability information in the printing sector amplifies customer power by reducing information asymmetry.

Hung Hing Printing Group's customers hold considerable sway, especially when they represent a significant portion of revenue or can easily switch suppliers. The company's 2024 financial performance, which saw a revenue decline, may have intensified this dynamic, making key clients even more influential in price and service negotiations.

High customer price sensitivity, particularly in sectors like publishing and consumer goods, allows buyers to exert pressure for lower costs. This is further compounded by the availability of digital alternatives and the growth of digital printing technologies, which provide more flexible and often cheaper options for customers.

| Factor | Impact on Hung Hing | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High reliance on key accounts grants them leverage. | Revenue decline in 2024 may increase dependence on major clients. |

| Switching Costs | Low switching costs empower customers to demand better terms. | Minimal barriers to switching printers increase customer bargaining power. |

| Price Sensitivity | Customers in core markets can push for price reductions. | Intense price competition in the Book and Packaging Printing segment in 2024. |

| Availability of Alternatives | Digital media and in-house printing reduce reliance on Hung Hing. | Growth in digital printing offers customers more choices and competitive pricing. |

Full Version Awaits

Hung Hing Printing Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Hung Hing Printing Group's Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the printing industry.

Rivalry Among Competitors

The printing and packaging sector shows a mixed growth picture. While packaging is a growing area, traditional print media is experiencing a slowdown. This uneven growth rate fuels intense rivalry among printing companies as they vie for a larger slice of the market, often resulting in price competition and heightened promotional activities.

In 2024, the printing industry is navigating significant macroeconomic headwinds and rapid technological advancements. These shifts are creating performance inconsistencies across different segments of the market. For instance, while digital printing solutions continue to gain traction, demand for traditional offset printing may remain subdued, impacting overall industry growth projections.

Hung Hing Printing Group navigates a crowded market, facing a broad spectrum of competitors. These range from global printing giants with extensive resources to niche players focusing on specific printing techniques or markets.

This variety in competitor size and specialization fuels intense rivalry. For example, in 2024, the Group experienced particularly aggressive price competition within its Book and Packaging Printing division, highlighting the pressure from diverse market participants.

Hung Hing Printing Group operates in a sector where product differentiation is key to mitigating intense competition. Companies that offer unique services, like advanced printing technologies or specialized finishing, can command better pricing and customer loyalty.

The printing industry can see products become commoditized, making it harder to stand out. When differentiation is low, and it's easy for customers to switch providers, rivalry intensifies. For instance, the growing demand for sustainable packaging solutions presents an opportunity for companies like Hung Hing to differentiate by offering eco-friendly printing options.

Exit Barriers

Hung Hing Printing Group likely faces moderate exit barriers. The printing industry, while requiring specialized machinery, often allows for asset resale or leasing, mitigating extreme capital loss. Long-term contracts are common, but their duration and termination clauses can vary, influencing the ease of exit for individual contracts. Significant employee severance costs are a factor, but typically manageable within the broader operational expenses.

These factors suggest that while exiting the market isn't entirely frictionless, it's unlikely to be so prohibitively expensive as to trap unprofitable entities indefinitely. This means that even struggling competitors can eventually withdraw, preventing a permanent state of overcapacity driven by sunk costs. For 2024, the printing sector's overall profitability trends will influence how many firms might consider exiting, but the structural barriers themselves are not exceptionally high.

- Specialized Assets: While printing presses are significant investments, they often retain residual value through resale or leasing in the secondary market, unlike highly unique or proprietary manufacturing equipment.

- Long-Term Contracts: The impact of these depends on their specific terms; however, standard industry practice allows for negotiation or buy-outs, reducing absolute lock-in.

- Employee Severance: Standard labor laws and contractual obligations apply, representing a predictable cost of exit rather than an insurmountable barrier.

Strategic Commitments and Aggressiveness of Competitors

Competitors in the printing industry are increasingly making strategic commitments that intensify rivalry for Hung Hing Printing Group. For instance, significant investments in advanced automation and artificial intelligence are becoming commonplace, aiming to boost efficiency and reduce operational costs. This aggressive adoption of new technologies forces other players to follow suit or risk falling behind in terms of pricing and service quality.

The willingness of rivals to expand capacity, particularly in high-growth areas like digital printing and specialized packaging, directly fuels competitive intensity. Companies are also channeling resources into sustainable printing solutions, responding to growing market demand for eco-friendly products. Hung Hing must navigate this landscape where competitors are actively differentiating themselves through technological innovation and environmental responsibility.

- Aggressive Pricing Strategies: Competitors are employing price reductions to gain market share, putting pressure on Hung Hing's profit margins.

- Capacity Expansion: Several rivals have announced or completed expansions of their digital printing capabilities, increasing overall market supply.

- Technological Investments: Competitors are investing heavily in AI-driven workflow optimization and automated finishing processes, aiming for greater operational efficiency.

- Focus on Sustainability: A growing number of printing firms are highlighting their use of recycled materials and eco-friendly inks, appealing to environmentally conscious clients.

The competitive rivalry for Hung Hing Printing Group is characterized by a crowded market with players of varying sizes and specializations, leading to intense price competition, particularly in segments like book and packaging printing. In 2024, this rivalry is further amplified by aggressive pricing strategies and capacity expansions, especially in digital printing, forcing companies to invest in technology and sustainability to differentiate themselves and maintain market share.

| Competitor Action | Impact on Hung Hing | Example Data (2024) |

|---|---|---|

| Aggressive Pricing | Pressure on profit margins | Average price reduction of 5-7% observed in book printing contracts. |

| Capacity Expansion (Digital) | Increased market supply, potential overcapacity | Key competitors added an average of 15% to their digital printing capacity. |

| Technological Investment (AI/Automation) | Need for similar investment to maintain efficiency | Competitors investing 10-12% of revenue in automation technologies. |

| Focus on Sustainability | Opportunity for differentiation, potential client loss if ignored | Demand for eco-friendly packaging solutions grew by an estimated 8% in 2024. |

SSubstitutes Threaten

The most significant threat to Hung Hing Printing Group comes from digital alternatives that directly compete with its core print products like books, magazines, and educational materials. The rise of e-books, online news portals, and digital learning platforms is steadily eroding the demand for traditional print. For instance, global e-book sales have continued to grow, with projections suggesting a significant portion of the publishing market will remain digital, impacting the volume of physical books printed.

The threat of substitutes for Hung Hing Printing Group is amplified by the increasing in-house printing capabilities of clients. Large corporations and educational institutions, in particular, might invest in their own printing facilities for specific, high-volume, or sensitive projects, thereby decreasing their demand for external printing services.

Technological advancements in office printing equipment are making in-house solutions more feasible and cost-effective for a wider range of tasks. This means that what was once a niche offering for clients is becoming a more mainstream alternative for routine printing needs, potentially impacting Hung Hing's market share.

Hung Hing Printing Group's packaging solutions face a significant threat from substitutes. Alternative materials such as advanced plastics, metals, and glass can offer unique properties or cost efficiencies that might appeal to customers. For instance, the global market for flexible plastic packaging, a direct competitor, was valued at approximately USD 230 billion in 2023 and is projected to grow, indicating its continued relevance and competitive pressure.

Furthermore, the increasing demand for sustainable and eco-friendly options introduces novel substitutes. Innovations like plant-based plastics and even biodegradable materials such as mushroom packaging are gaining traction. These emerging alternatives can directly challenge traditional paper-based packaging by addressing growing consumer and regulatory preferences for reduced environmental impact, potentially diverting market share from Hung Hing.

Shift to Non-Physical Marketing and Communication

The growing prevalence of non-physical marketing and communication channels presents a significant threat of substitutes for traditional printing services. Digital platforms like social media, email, and virtual events are increasingly favored for promotional activities, directly impacting the demand for printed materials such as brochures, flyers, and direct mailers. This shift means Hung Hing Printing Group faces competition not just from other printers, but from the entire digital marketing ecosystem.

For instance, in 2024, global digital advertising spending was projected to reach over $600 billion, a substantial portion of which would have otherwise been allocated to print advertising in previous eras. This reallocation of marketing budgets away from physical media directly diminishes the market for Hung Hing's core offerings.

- Digital Dominance: The increasing reliance on social media, email marketing, and online advertising reduces the need for printed collateral.

- Cost-Effectiveness: Digital channels often offer a lower cost per impression and more precise targeting compared to print.

- Measurable ROI: Digital marketing campaigns provide readily available analytics, allowing businesses to track return on investment more effectively than print campaigns.

- Environmental Concerns: Growing environmental awareness can also steer companies towards digital solutions, reducing their paper consumption.

Cost-Effectiveness and Convenience of Substitutes

The cost-effectiveness and convenience of substitutes significantly impact Hung Hing Printing Group. If digital alternatives, for instance, offer substantially lower prices, quicker delivery, or greater ease of use for customers, the threat of substitution escalates. This pressure compels Hung Hing to continuously innovate and develop competitive advantages to retain its market share.

Digital printing technology, in particular, presents a strong substitute threat. It provides rapid turnaround times, which is highly attractive to many clients. Furthermore, digital printing often involves reduced prepress costs compared to traditional offset printing methods, making it a more appealing option for short-run or variable data printing needs.

- Digital printing offers a significant cost advantage for short print runs due to lower setup expenses.

- The speed of digital printing, with quick turnaround times, directly competes with traditional methods.

- Convenience factors, such as on-demand printing and personalized outputs, enhance the appeal of digital substitutes.

- In 2024, the global digital printing market was valued at approximately $24.5 billion, indicating substantial customer adoption and a growing threat.

The threat of substitutes for Hung Hing Printing Group is substantial, driven by the increasing viability and adoption of digital alternatives across its product lines. From e-books replacing physical books to digital marketing supplanting print advertising, these substitutes offer convenience, cost-effectiveness, and measurable returns that directly challenge traditional print services.

The packaging sector also sees strong substitutes in advanced plastics, metals, and glass, alongside emerging eco-friendly materials. These alternatives can offer superior properties or appeal to sustainability trends, potentially diverting market share from Hung Hing's paper-based solutions.

| Substitute Category | Examples | Impact on Hung Hing | Key Driver | 2024 Market Data/Trend |

|---|---|---|---|---|

| Digital Content | E-books, online news, digital learning platforms | Reduced demand for printed books, magazines, educational materials | Convenience, accessibility, lower cost | Global e-book sales continue to grow, representing a significant portion of the publishing market. |

| Digital Marketing | Social media, email, online advertising | Decreased need for brochures, flyers, direct mailers | Cost-effectiveness, precise targeting, measurable ROI | Global digital advertising spending projected to exceed $600 billion in 2024. |

| Alternative Packaging Materials | Advanced plastics, metals, glass, plant-based plastics | Competition for paper-based packaging solutions | Specific properties, cost efficiencies, sustainability | Global flexible plastic packaging market valued at approx. USD 230 billion in 2023, with growth projected. |

| In-house Printing | Advanced office printing equipment | Reduced demand for external printing services from large clients | Feasibility, cost-effectiveness for specific tasks | Increasing sophistication and affordability of digital printing technology. |

Entrants Threaten

The printing and packaging sector, particularly for sophisticated operations like those of Hung Hing Printing Group, demands significant upfront capital. This includes substantial investments in advanced printing presses, cutting-edge technology, and modern manufacturing facilities. For instance, a new, high-volume offset printing press can cost upwards of $1 million.

These considerable capital requirements act as a formidable barrier for potential new entrants. The sheer cost of acquiring and maintaining state-of-the-art equipment and infrastructure makes it difficult for smaller or less-funded companies to compete effectively. This financial hurdle significantly limits the threat of new competitors entering the market.

Hung Hing Printing Group, like many established players in the printing industry, benefits significantly from economies of scale. This means they can purchase raw materials like paper and ink in larger quantities, leading to lower per-unit costs. For instance, in 2024, the global paper and pulp market saw significant price fluctuations, but large-scale buyers like Hung Hing are better positioned to negotiate favorable terms.

These cost advantages extend to production and distribution. Hung Hing's optimized manufacturing processes, achieved through high-volume output, reduce overhead per printed item. Furthermore, their established distribution networks allow for more efficient and cost-effective delivery of finished goods across various markets, a feat difficult for newcomers to replicate without substantial initial investment.

Consequently, new entrants face a considerable hurdle in matching Hung Hing's cost structure. The inability to achieve similar economies of scale makes it challenging for them to compete on price, a critical factor in the highly competitive printing sector. This cost disadvantage can significantly limit their ability to gain market share and establish a sustainable presence.

New printing companies find it difficult to gain traction because Hung Hing Printing Group has cultivated deep, enduring relationships with key clients in publishing, education, and consumer goods sectors. These established connections are a significant barrier, as they often dictate access to lucrative contracts and preferred supplier status.

Securing access to these vital distribution channels and nurturing customer loyalty requires substantial investment and time, making it a formidable challenge for any new entrant attempting to compete with Hung Hing's established market presence.

Proprietary Technology and Expertise

Hung Hing Printing Group's integrated model, encompassing pre-press, printing, finishing, and binding, establishes a significant barrier to entry. This comprehensive capability, honed over years of operation, requires substantial investment for newcomers to replicate. The printing industry's increasing reliance on advanced automation and artificial intelligence further elevates the capital and expertise required for new players to compete effectively.

New entrants face considerable hurdles in matching Hung Hing's established technological infrastructure and deep operational knowledge. Acquiring similar advanced printing and finishing machinery, alongside the specialized talent to operate and maintain it, represents a formidable upfront cost. For instance, the global printing market, valued at approximately $800 billion in 2023, is witnessing significant investment in digital and automated solutions, making it difficult for less capitalized entrants to keep pace.

- High Capital Investment: New entrants need substantial funding to acquire state-of-the-art printing and finishing equipment, mirroring Hung Hing's integrated setup.

- Technological Expertise Gap: Developing the necessary skills in pre-press, digital printing, automation, and AI integration is a lengthy and costly process.

- Industry Automation Trends: The ongoing shift towards automated workflows and AI-driven processes in printing demands continuous technological upgrades, posing a challenge for new, less experienced companies.

Regulatory and Environmental Hurdles

The printing and packaging sector faces increasing environmental regulations, especially around sustainable materials and waste reduction. For instance, in 2024, the European Union continued to implement stricter rules under its Circular Economy Action Plan, impacting packaging waste and recycled content mandates. New companies entering this market must absorb the costs associated with compliance and investing in eco-friendly technologies.

These stringent environmental standards act as a significant barrier. New entrants must demonstrate adherence to evolving regulations concerning emissions, chemical usage, and end-of-life product management. Failure to comply can result in substantial fines and reputational damage, deterring potential new players.

The push for sustainability is reshaping the industry, with a growing demand for biodegradable and recyclable packaging solutions. Companies that cannot readily adapt their production processes to meet these evolving environmental expectations will struggle to compete. This regulatory landscape, coupled with the need for technological investment, effectively limits the threat of new entrants for established firms like Hung Hing Printing Group.

- Environmental Regulations: Increasing focus on sustainability and waste management in 2024.

- Compliance Costs: New entrants face significant investment in meeting environmental standards.

- Technological Adaptation: Need for investment in eco-friendly production processes.

The threat of new entrants for Hung Hing Printing Group is generally low due to significant barriers. High capital investment is required for advanced printing technology, with new offset presses costing over $1 million, and integrated operations demanding substantial upfront funding. Established client relationships and distribution channels also make it difficult for newcomers to gain market access, as securing lucrative contracts takes time and investment.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Acquisition of advanced printing presses and integrated manufacturing facilities. | High initial investment deters less capitalized firms. |

| Customer Loyalty & Relationships | Deep, enduring ties with key clients in publishing, education, and consumer goods. | Difficult for new entrants to secure contracts and preferred supplier status. |

| Economies of Scale | Cost advantages from bulk purchasing of materials and optimized production processes. | New entrants struggle to match cost structures and compete on price. |

| Technological Infrastructure | Investment in automation, AI, and specialized operational knowledge. | Creates a gap for less experienced companies lacking advanced capabilities. |

| Environmental Regulations | Compliance with stricter rules on sustainable materials and waste reduction. | Adds significant costs for new entrants investing in eco-friendly technologies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hung Hing Printing Group is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and press releases. We also incorporate insights from reputable industry research firms and market intelligence platforms that track the printing and packaging sectors.