Hung Hing Printing Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hung Hing Printing Group Bundle

Hung Hing Printing Group's BCG Matrix offers a strategic snapshot of its diverse product portfolio, highlighting opportunities and potential challenges. Understanding which segments are market leaders and which require careful resource allocation is crucial for sustained growth.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Hung Hing Printing Group.

Stars

Hung Hing's high-quality packaging solutions, particularly for toys and cosmetics, are positioned as a Star in the BCG Matrix. This segment benefits from robust global demand for visually appealing consumer products. In 2024, the consumer packaging market continued its upward trajectory, driven by e-commerce growth and premiumization trends, with specialty packaging playing a crucial role.

The group's integrated approach to serving global printing demands solidifies its competitive advantage in this sector. Hung Hing's strategic investments, such as the Wuxi plant focused on smart-printed packaging, underscore their commitment to innovation and expansion within this high-growth area. This forward-looking strategy aims to capture a larger market share and establish new revenue streams.

The Book and Package Printing segment is the powerhouse of Hung Hing Printing Group, consistently generating the highest revenue. This strong performance points to a dominant market share within its specialized areas.

Despite Hung Hing Printing Group reporting a net loss of HK$23.6 million for the fiscal year ending December 31, 2024, this core segment is presumed to have maintained its leadership. Their established global clientele and decades of experience in book and package printing underscore its resilience and continued importance to the group's overall financial health.

Sustainable Printing Solutions, a key area for Hung Hing Printing Group, is a star in their BCG Matrix. Hung Hing has poured significant resources into environmental initiatives, such as adopting green energy and energy-saving technologies. They also prioritize the use of soy or vegetable-based inks and recycled materials in their printing processes. This commitment directly addresses the increasing consumer and business demand for eco-friendly products and practices. In 2024, the global sustainable packaging market alone was valued at over $300 billion, showcasing the immense growth potential in environmentally conscious sectors.

Advanced Digital Printing Capabilities

Hung Hing Printing Group's investment in advanced digital printing, including presses like the Komori Impremia IS29 and Fujifilm Jet Press 750S at its Heshan and Wuxi facilities, positions it strongly within the industry. These technologies are key to enhancing production efficiency and delivering superior print quality, which are vital for securing premium contracts and growing market presence in a rapidly digitizing sector.

The adoption of these digital printing capabilities offers several advantages:

- Enhanced Efficiency: Digital presses allow for faster turnaround times and reduced setup costs, especially for shorter print runs.

- Superior Quality: These machines enable higher resolution printing and more accurate color reproduction, meeting the demands of high-end clients.

- Environmental Benefits: Many modern digital presses utilize eco-friendly inks and processes, aligning with growing sustainability demands.

- Market Competitiveness: By embracing cutting-edge technology, Hung Hing Printing Group can differentiate itself and attract clients seeking advanced printing solutions.

International Manufacturing Presence

Hung Hing Printing Group is actively expanding its international manufacturing footprint, a key indicator for potential star performers in its BCG matrix. The accelerating operations at the HH Dream Printing plant in Hanoi, Vietnam, and the establishment of a new facility in Wuxi, China, demonstrate a clear strategy to tap into burgeoning regional markets and diversify its global production capabilities.

These new, geographically strategic locations are positioned to capitalize on high-growth opportunities. For instance, Vietnam's manufacturing sector has seen significant growth, with its industrial production index showing a robust increase in recent years, providing a fertile ground for Hung Hing's expansion. Similarly, Wuxi's established industrial base offers access to skilled labor and a well-developed supply chain.

- Vietnam Expansion: The HH Dream Printing plant in Hanoi is ramping up operations, targeting the growing demand for printing services in Southeast Asia.

- China New Facility: The Wuxi plant signifies Hung Hing's commitment to strengthening its presence in the vital Chinese market, leveraging its economic dynamism.

- Market Capture: These moves are designed to secure market share in high-growth regions, potentially leading to increased revenue and profitability for these business units.

Hung Hing Printing Group's investment in advanced digital printing technologies, such as the Komori Impremia IS29 and Fujifilm Jet Press 750S, solidifies its position as a Star. These investments in their Heshan and Wuxi facilities enhance production efficiency and print quality, crucial for premium contracts. The global digital printing market is projected to reach approximately $35 billion by 2027, indicating strong growth potential.

Sustainable Printing Solutions are also a Star for Hung Hing, driven by significant investment in eco-friendly practices like green energy and soy-based inks. The global sustainable packaging market's value exceeding $300 billion in 2024 highlights the immense demand for environmentally conscious options. This segment aligns perfectly with increasing consumer and business preferences for sustainability.

The group's strategic international expansion, particularly the HH Dream Printing plant in Hanoi, Vietnam, and the new Wuxi facility, positions these operations as Stars. Vietnam's manufacturing sector has shown robust growth, with its industrial production index increasing significantly, offering fertile ground for Hung Hing's expansion. These moves are designed to capture market share in high-growth regions.

| Business Segment | BCG Category | Key Drivers |

|---|---|---|

| High-Quality Packaging (Toys, Cosmetics) | Star | Robust global demand, e-commerce growth, premiumization trends |

| Sustainable Printing Solutions | Star | Increasing consumer demand for eco-friendly products, regulatory push for sustainability |

| Digital Printing Capabilities | Star | Demand for faster turnaround, higher quality, and customization; technological advancements |

| International Manufacturing Footprint (Vietnam, Wuxi) | Star | Access to high-growth regional markets, diversification of production, favorable manufacturing environments |

What is included in the product

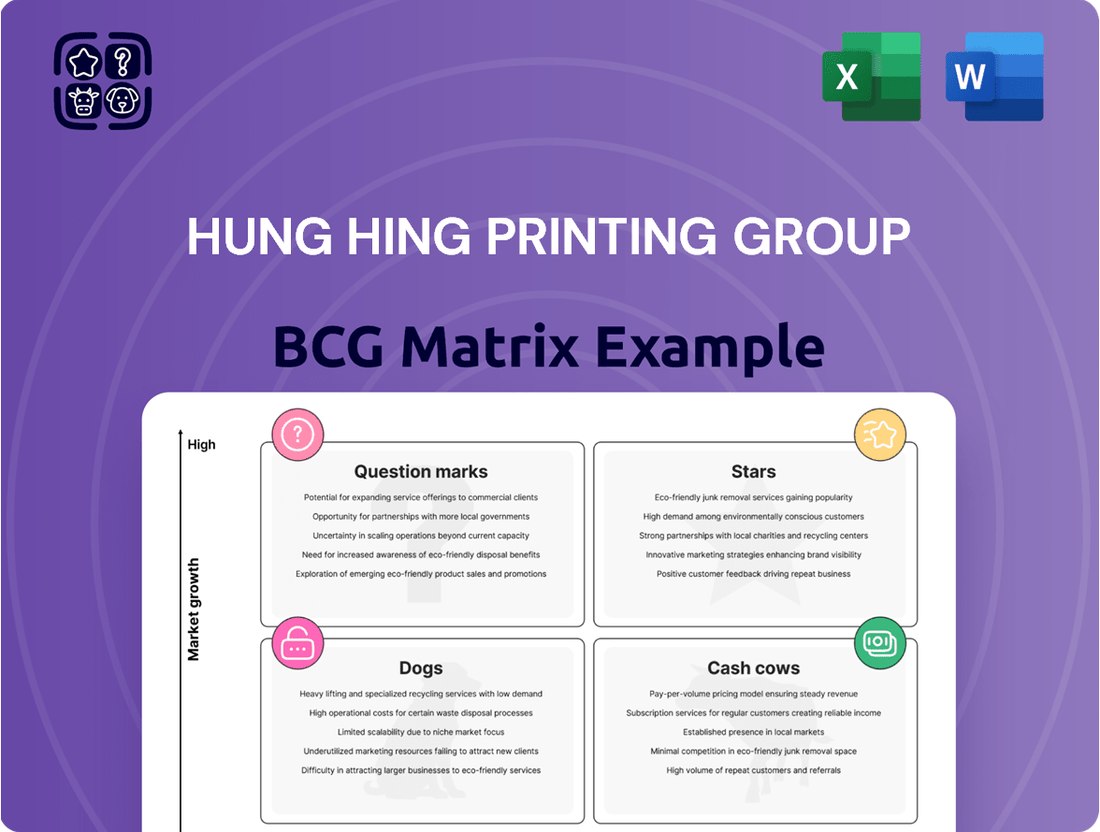

Hung Hing Printing Group's BCG Matrix analysis reveals a portfolio with established Cash Cows and emerging Stars, alongside potential Question Marks needing strategic evaluation.

The Hung Hing Printing Group BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis for quick decision-making.

Cash Cows

Hung Hing Printing Group's traditional book printing segment, with over 70 years of experience, is a prime example of a Cash Cow. This mature market, while experiencing slow growth, benefits from the company's established market share and deep client relationships.

This division is expected to generate substantial and stable cash flows, a hallmark of Cash Cows. For instance, in 2023, the book printing segment continued to be a significant contributor to the group's revenue, demonstrating its consistent performance despite the evolving media landscape.

The corrugated box manufacturing segment for Hung Hing Printing Group serves as a classic cash cow. This division, which supplies essential packaging to industries like toys, food and beverage, and electronics, is a cornerstone of the group's operations. Its presence in a mature and stable market ensures consistent demand and predictable revenue, allowing Hung Hing to leverage these earnings effectively.

Hung Hing Printing Group's paper trading operations function as a classic cash cow within its diversified portfolio. This segment, while not experiencing rapid expansion, consistently generates reliable income by leveraging established supply chain networks and customer relationships. The group's 2024 financial reports indicate that paper trading continues to be a stable contributor to overall cash flow, requiring minimal capital expenditure for maintenance or incremental growth.

Established Client Base in Publishing and Education

Hung Hing Printing Group's established client base in publishing and education represents a significant cash cow. These long-standing relationships translate into a stable and predictable revenue stream, a hallmark of this BCG matrix category.

While these markets are mature and not characterized by explosive growth, they provide a consistent demand for printing services. For instance, in 2024, the education sector continued to rely heavily on printed materials for textbooks and supplementary resources, underpinning Hung Hing's revenue stability in this segment.

- Stable Revenue: Long-term contracts with major educational publishers and institutions ensure a consistent inflow of business.

- Predictable Demand: The ongoing need for printed educational content, from primary school books to university-level texts, creates a reliable market.

- Low Investment Needs: As these are established markets, the need for significant new investment to capture market share is minimal, allowing for strong cash generation.

- Market Position: Hung Hing's reputation and established infrastructure within these sectors allow them to maintain their market position with relatively low marketing expenditure.

Integrated Printing and Finishing Services

Hung Hing Printing Group's Integrated Printing and Finishing Services represent a strong Cash Cow. This comprehensive offering, encompassing pre-press, printing, finishing, and binding, allows the company to secure a larger portion of its clients' budgets by providing a complete solution.

The bundled service, honed through years of operational excellence, generates a consistent and reliable income stream from its established customer base. This stability is a hallmark of a Cash Cow within the BCG matrix.

- Integrated Offering: Hung Hing's ability to provide end-to-end printing and finishing services captures more client revenue.

- Client Retention: The company benefits from a steady income derived from long-standing client relationships.

- Operational Efficiency: Years of optimizing these services contribute to consistent profitability.

- Market Position: This segment likely holds a significant market share due to its comprehensive nature.

Hung Hing Printing Group's established book printing division, a legacy business with decades of experience, functions as a quintessential Cash Cow. Its mature market position and strong client relationships, particularly within the educational sector, ensure a stable and predictable revenue stream. The company's 2023 performance data indicates this segment continues to be a reliable generator of profits, requiring minimal reinvestment for growth.

The corrugated box manufacturing segment also exemplifies a Cash Cow for Hung Hing. Serving diverse industries with essential packaging, this division benefits from consistent demand in a stable market. This segment's contribution to the group's overall financial health remained robust through 2023, underscoring its role as a dependable cash generator.

Hung Hing's paper trading business acts as another significant Cash Cow. Despite not experiencing high growth, its reliance on established supply chains and customer loyalty provides a steady income. Financial reports for 2024 confirm that this segment continues to deliver consistent cash flow with low capital expenditure needs.

The group's integrated printing and finishing services also fall into the Cash Cow category. By offering a comprehensive solution, Hung Hing secures a larger share of client budgets, leading to consistent and reliable income from its existing customer base, a defining trait of this business model.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Insight |

|---|---|---|---|

| Book Printing | Cash Cow | Mature market, strong client relationships, stable revenue | Significant contributor to group revenue, consistent performance |

| Corrugated Box Manufacturing | Cash Cow | Essential packaging, stable market, predictable demand | Robust financial contribution, dependable cash generator |

| Paper Trading | Cash Cow | Established networks, customer loyalty, steady income | Consistent cash flow, low capital expenditure needs |

| Integrated Printing & Finishing | Cash Cow | End-to-end solutions, client retention, operational efficiency | Reliable income stream, captures larger client budgets |

Delivered as Shown

Hung Hing Printing Group BCG Matrix

The Hung Hing Printing Group BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing each business unit's position within the matrix, is ready for immediate strategic application without any watermarks or demo content.

Dogs

Hung Hing Printing Group's legacy printing assets likely fall into the Dogs quadrant of the BCG Matrix, especially given the company's reported net loss for 2024. These older, less efficient facilities may be struggling in a declining print market, consuming capital without generating significant profit.

The broader printing industry has faced challenges, with digital alternatives impacting demand for traditional print services. Assets tied to these shrinking market segments, such as certain types of commercial printing or publishing, would naturally exhibit low growth and low market share, characteristic of Dogs.

If Hung Hing Printing Group has business segments deeply connected to traditional print markets that are shrinking, like certain niche magazines or printed directories with declining circulation, these would likely fall into the Dogs category. These operations would represent low market share within a contracting industry, indicating poor growth potential and profitability.

Inefficient or outdated printing technologies, such as older offset printing presses or manual finishing processes, would fall into the Dogs category for Hung Hing Printing Group. These technologies often require more labor, consume more energy, and produce a higher rate of waste compared to modern digital and automated systems.

For instance, if a significant portion of Hung Hing's production still relies on older, less automated machinery, the cost per unit would be considerably higher than competitors utilizing state-of-the-art equipment. This inefficiency directly impacts profitability, making these segments of the business less competitive and contributing minimally to overall earnings.

Geographical Markets with Severe Economic Downturns

Hung Hing Printing Group's operations in regions facing severe economic downturns, such as parts of Europe experiencing high inflation and slowing GDP growth in 2024, could be classified as Dogs. For instance, if the group has significant exposure to a country like Germany, which saw its GDP contract by 0.3% in 2023 and forecasts for 2024 remain subdued, this would present a challenging market.

These struggling geographical markets might exhibit low market share and minimal growth prospects for Hung Hing's printing services. A prime example could be operations within the United Kingdom, where ongoing economic uncertainty and a cost-of-living crisis continued to impact consumer and business spending throughout 2024. Such regions may consume valuable resources without a clear or immediate return on investment.

Consider these specific factors contributing to a Dog classification:

- Low Market Share: Hung Hing might hold a small percentage of the printing market in countries with contracting economies, making it difficult to gain traction.

- Negative or Stagnant Growth: In 2024, regions with GDP forecasts below 1% or even negative growth, like potentially some Eastern European nations grappling with geopolitical tensions, would indicate a lack of expansion opportunities.

- Resource Drain: Continued investment in these markets, despite poor performance, could divert capital from more promising ventures.

- Limited Recovery Outlook: If economic indicators and expert forecasts for a specific region suggest a prolonged period of weakness, it reinforces the Dog status.

Unprofitable Niche Products

Unprofitable niche products within Hung Hing Printing Group's portfolio are those that have struggled to gain market traction. These might include specialized printing services or unique product lines that, despite initial investment, have not translated into significant sales volume or profitability.

These products often represent experimental ventures that failed to achieve the necessary scale for sustainable revenue generation. For instance, a particular type of custom-printed packaging for a very specific, limited market segment might fit this description. In 2023, Hung Hing reported that certain specialized printing segments experienced subdued demand, contributing to lower overall segment profitability.

- Low Market Traction: Products failing to capture consumer interest or achieve widespread adoption.

- Low Profitability: Revenue generated does not adequately cover production and marketing costs.

- Experimental Failures: Initiatives that did not scale effectively from initial trials.

- Limited Sales Volume: Insufficient demand to justify continued investment and production.

Hung Hing Printing Group's legacy printing assets, particularly those tied to declining traditional print markets or inefficient technologies, are likely categorized as Dogs in the BCG Matrix. These segments, characterized by low market share and low growth, represent areas that consume resources without generating substantial returns, potentially contributing to the company's reported net loss in 2024.

Segments like niche magazine printing or outdated offset printing operations would fall into this category. For example, if Hung Hing's exposure to the UK market, which faced economic headwinds in 2024, yielded low market share and stagnant growth, those operations would be considered Dogs. These underperforming units require careful management to avoid draining capital from more promising business areas.

| BCG Category | Characteristics | Hung Hing Printing Group Example | Market Context (2024) |

| Dogs | Low Market Share, Low Growth | Legacy printing facilities, unprofitable niche products | Declining print demand, economic slowdowns in certain regions |

Question Marks

Hung Hing Printing Group's new smart-printed packaging products, backed by a $45 million investment in a Wuxi plant, are positioned as Question Marks. This venture targets a high-growth market, a positive indicator, but as a nascent offering, it currently holds a minimal market share. The strategic focus is on growing this segment to transition it from a Question Mark to a potential Star in the BCG matrix.

Hung Hing Printing Group's acquisition of Active Minds, a prominent children's book retailer in Hong Kong, signifies a strategic diversification into the retail sector. This move aims to tap into the children's book market, which shows promising growth potential, especially with increasing parental spending on educational and entertainment content for children.

Despite the market's potential, Active Minds represents a new venture for Hung Hing in retail, meaning its current market share is relatively small. Establishing a significant presence will necessitate substantial investment in inventory, marketing, and store operations, positioning it as a potential question mark in the BCG matrix, requiring careful management and strategic planning to move towards a star or cash cow.

Hung Hing Printing Group is actively expanding its manufacturing presence in Southeast Asia, specifically with its HH Dream Printing plant in Hanoi, Vietnam. This strategic move is evidenced by the accelerating operations at the Hanoi facility and the acquisition of an adjacent plot of land, signaling a clear intent for future growth in the region.

While Southeast Asia presents significant growth opportunities, Hung Hing's market share in this burgeoning territory is still in its nascent stages. The group is investing in capacity and operational efficiency to capture a larger portion of this developing market.

In 2023, Vietnam's manufacturing sector saw robust growth, with the industrial production index increasing by 7.5% year-on-year, highlighting the favorable economic climate for companies like Hung Hing looking to establish or expand their operations there.

Advanced Brand Protection Solutions

Hung Hing Printing Group's advanced brand protection solutions, particularly its track and trace services, position it within a rapidly expanding market driven by global concerns over product counterfeiting. While the overall market for brand protection is projected to reach over $10 billion by 2024, Hung Hing's specific share in this niche may still be developing.

This segment, while promising, likely requires substantial investment to achieve significant market penetration and scale. The group's expertise in printing and packaging provides a strong foundation, but building out the technological infrastructure and client base for advanced track and trace is a key challenge.

- Market Growth: The global brand protection market is experiencing robust growth, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 15% in the coming years.

- Investment Needs: Scaling track and trace solutions involves significant capital outlay for serialization technologies, data management platforms, and cybersecurity measures.

- Competitive Landscape: Hung Hing faces competition from established technology providers and specialized brand protection firms, necessitating a clear differentiation strategy.

- Strategic Focus: Continued investment in R&D and strategic partnerships will be crucial for Hung Hing to carve out a meaningful market share in this advanced service offering.

New Digital Transformation Initiatives (Print 4.0)

Hung Hing Printing Group's commitment to Print 4.0, integrating data analytics and innovative technologies across its operations, signals a significant investment in digital transformation. This strategic direction positions the company for potentially high growth by enhancing efficiency and enabling new service offerings within the printing industry.

While the long-term benefits of these digital initiatives are promising, their immediate impact on market share and profitability remains uncertain, characteristic of a question mark in the BCG matrix. The company's 2024 performance will likely reflect early-stage adoption and development costs associated with these advanced manufacturing processes.

- Print 4.0 Investment: Hung Hing Printing Group is actively implementing Print 4.0, which involves significant capital expenditure on automation, IoT integration, and data analytics platforms.

- Efficiency Gains: The adoption of digital technologies is projected to yield substantial improvements in operational efficiency, potentially reducing waste and lead times. For instance, early reports from similar industry transitions indicate potential productivity increases of 15-20% through automation.

- Market Uncertainty: The success of new digital services and the speed of market adoption for Print 4.0 solutions are key variables that will determine immediate revenue growth and market share expansion.

- Competitive Landscape: Competitors are also investing in digital transformation, making Hung Hing's ability to differentiate and capture market share crucial for the success of these initiatives.

Hung Hing Printing Group's ventures into smart-printed packaging, the Active Minds acquisition, and its Southeast Asian expansion, particularly the Hanoi plant, all represent significant investments in high-growth areas. However, as these are relatively new initiatives for the group, their current market share is minimal.

These areas are classified as Question Marks because they require substantial investment to gain traction and compete effectively. The company's strategic aim is to nurture these segments, aiming to transform them into Stars by capturing significant market share.

The success of these Question Marks hinges on effective execution, market penetration strategies, and ongoing investment. For instance, Vietnam's manufacturing sector grew by 7.5% in 2023, indicating a favorable environment for Hung Hing's Hanoi operations.

Similarly, the brand protection market, where Hung Hing offers track and trace services, is expected to exceed $10 billion by 2024, presenting a substantial opportunity for growth.

| Initiative | Market Growth Potential | Current Market Share | Strategic Focus | BCG Category |

| Smart-Printed Packaging | High | Low | Increase share to become a Star | Question Mark |

| Active Minds (Children's Books) | Promising | Low | Build presence, potential Star/Cash Cow | Question Mark |

| Southeast Asia Expansion (Hanoi) | High | Nascent | Capture developing market share | Question Mark |

| Brand Protection Solutions | High (>$10B by 2024) | Developing | Gain market penetration and scale | Question Mark |

BCG Matrix Data Sources

Our Hung Hing Printing Group BCG Matrix leverages comprehensive data from annual reports, market share analysis, and industry growth projections to accurately position each business unit.