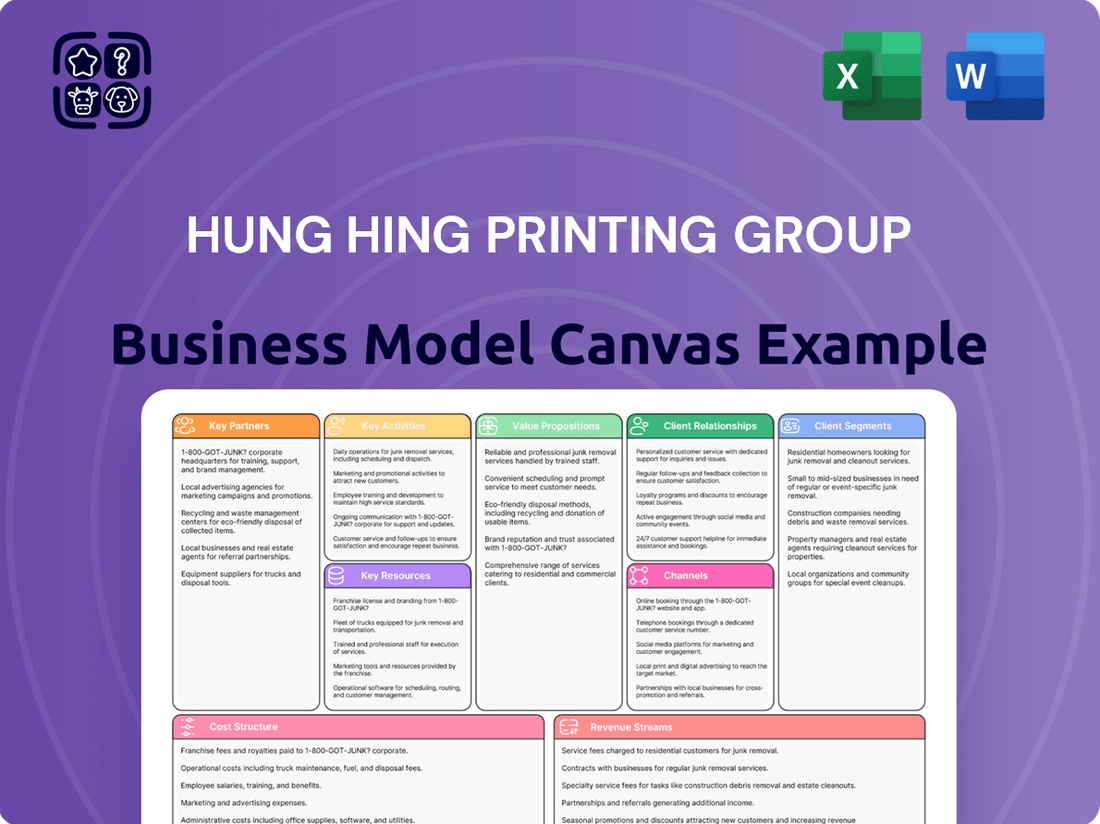

Hung Hing Printing Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hung Hing Printing Group Bundle

Discover the strategic engine behind Hung Hing Printing Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational prowess. Unlock this essential tool to understand how they consistently deliver value and maintain their competitive edge.

Partnerships

Hung Hing Printing Group's operations are underpinned by robust alliances with its raw material suppliers, primarily paper mills and providers of printing inks and consumables. These collaborations are vital for securing a steady influx of high-quality materials, which directly impacts production efficiency and the ability to fulfill diverse customer orders.

The strategic importance of these supplier relationships is further emphasized by the presence of Sun Hing Paper Company Limited, a subsidiary that stands as one of the most significant paper trading entities in Hong Kong and Southern China. This internal capability reinforces Hung Hing's control over its supply chain, ensuring reliability and cost-effectiveness in its sourcing of essential paper products.

Hung Hing Printing Group actively partners with leading technology and equipment providers to ensure access to cutting-edge printing machinery and software. These collaborations are crucial for maintaining a competitive advantage by integrating the latest advancements, like high-speed digital printing solutions.

These partnerships directly support Hung Hing's strategy of continuous technological investment, enabling them to enhance operational efficiency and broaden their service portfolio. For instance, in 2023, the company continued to invest in upgrading its offset printing capabilities, a segment where technology providers play a key role in delivering advanced solutions.

Hung Hing Printing Group relies on a robust network of logistics and distribution partners to serve its international clientele. These partnerships are crucial for ensuring printed materials reach customers efficiently across Asia, the United States, and the United Kingdom. In 2024, the company continued to leverage established relationships with major shipping lines and freight forwarders to manage the complexities of global transit.

The group's ability to offer timely and cost-effective delivery hinges on these collaborations. By working with specialized logistics providers, Hung Hing can navigate customs, manage warehousing, and optimize transportation routes, which is particularly important for a business with a diverse and geographically dispersed customer base. This strategic approach to logistics underpins their commitment to reliable service delivery.

Design and Creative Agencies

Hung Hing Printing Group collaborates with design and creative agencies, including its own hub, Beluga. This partnership allows them to provide more than just printing services, extending into product design and unique packaging ideas. For instance, their integration with creative partners enables the development of innovative 'digital+print' products, significantly boosting their market appeal.

These alliances are crucial for Hung Hing's strategy to offer end-to-end solutions. By working with creative hubs, they can tap into cutting-edge design trends and consumer insights, translating them into tangible, high-quality printed products. This synergy strengthens their value proposition in a competitive market.

- Strategic Alliances: Partnerships with design agencies and creative hubs.

- Expanded Services: Offering product design and innovative packaging concepts.

- Integrated Solutions: Providing comprehensive 'digital+print' product development.

Educational Content Developers and Publishers

Hung Hing Printing Group strategically partners with educational content developers and publishers to enhance its product offerings. These collaborations are vital for staying current with curriculum needs and engaging learning methodologies.

By working with educational institutions and publishers, Hung Hing ensures its printed materials align with educational standards and trends. This focus on educational content, particularly for children's novelty books, allows them to create products that are both informative and captivating, thereby expanding their footprint in the children's education market.

- Educational Alignment: Partnerships ensure printed materials meet current educational standards and learning objectives.

- Content Innovation: Collaborations foster the development of engaging and novel educational content.

- Market Expansion: These alliances help Hung Hing broaden its reach within the children's education sector.

- Quality Assurance: Working with established publishers guarantees the quality and pedagogical soundness of educational products.

Hung Hing Printing Group's key partnerships extend to its extensive network of raw material suppliers, including paper mills and ink providers, ensuring a consistent supply of quality materials essential for production. The group's subsidiary, Sun Hing Paper Company Limited, plays a pivotal role as a major paper trader in Hong Kong and Southern China, solidifying supply chain control and cost efficiency.

Collaborations with technology and equipment providers are crucial for integrating advanced printing machinery and software, maintaining a competitive edge through innovations like high-speed digital printing. These partnerships directly support Hung Hing's ongoing investment in technological upgrades, exemplified by their continued enhancement of offset printing capabilities in 2023.

The company also relies on a strong network of logistics and distribution partners to efficiently deliver its products globally, particularly to markets in Asia, the United States, and the United Kingdom. In 2024, Hung Hing continued to leverage established relationships with shipping lines and freight forwarders to manage international transit complexities and ensure timely, cost-effective delivery.

Furthermore, partnerships with creative agencies, including its internal hub Beluga, enable Hung Hing to offer integrated solutions beyond printing, such as product design and innovative packaging. This synergy allows for the development of unique 'digital+print' products, enhancing market appeal and providing end-to-end value for clients.

| Key Partnership Area | Nature of Partnership | Strategic Importance | Examples/Data |

|---|---|---|---|

| Raw Material Suppliers | Sourcing paper, inks, and consumables | Ensures quality, production efficiency, and order fulfillment | Sun Hing Paper Company Limited (subsidiary) |

| Technology & Equipment Providers | Access to advanced printing machinery and software | Maintains competitive advantage, enhances operational efficiency | Investment in upgraded offset printing capabilities (2023) |

| Logistics & Distribution Partners | Global shipping and freight forwarding | Ensures timely and cost-effective international delivery | Serving markets in Asia, US, UK (2024 focus) |

| Creative Agencies & Hubs | Design services, product development | Offers end-to-end solutions, innovative 'digital+print' products | Beluga hub integration |

What is included in the product

This Hung Hing Printing Group Business Model Canvas provides a strategic overview, detailing customer segments, value propositions, and key resources to understand their integrated printing and packaging solutions.

It offers a clear, actionable framework for understanding Hung Hing's market position, revenue streams, and cost structure, ideal for strategic planning and stakeholder communication.

Hung Hing Printing Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for quick understanding and internal alignment.

Activities

Pre-press and design services are crucial for Hung Hing Printing Group, encompassing the meticulous preparation of digital files for high-quality printing. This includes expert graphic design, precise layout, accurate color correction, and thorough proofing to ensure client vision is realized.

Hung Hing's integrated business model shines here, allowing them to oversee the entire journey from initial concept to the finished printed product. Their dedicated design hub fosters innovation, providing clients with creative solutions that enhance the final output.

In 2024, Hung Hing reported a significant portion of their revenue derived from value-added services like pre-press and design, underscoring their commitment to offering comprehensive solutions beyond basic printing. This strategic focus positions them as a full-service partner for clients.

Printing production is Hung Hing's central operation, covering offset litho, silk screen, and flexo printing. They produce a wide array of items, including books, magazines, educational materials, and various packaging. This vast output is managed across their advanced facilities located in Hong Kong, mainland China, and Vietnam.

Finishing and binding are the final steps in Hung Hing Printing Group's production process. This includes essential post-printing operations like precise cutting, meticulous folding, and organized collation of printed materials. These are critical for ensuring the integrity and presentation of the final product.

The group offers a wide array of binding techniques, from the common perfect binding for books to saddle stitching for magazines and brochures. Beyond basic binding, Hung Hing provides value-added finishes such as protective lamination, decorative foiling, tactile embossing, and even intricate hand assembly for specialized projects. These operations transform printed sheets into finished, marketable goods.

In 2024, Hung Hing Printing Group reported significant investment in advanced finishing machinery, aiming to enhance efficiency and expand its range of premium finishes. This strategic move supports their commitment to delivering complete, high-quality printed products that meet diverse client specifications and market demands.

Quality Control and Assurance

Hung Hing Printing Group's commitment to quality is paramount. They implement stringent quality control and assurance processes at every stage of production, from raw material inspection to the final product check. This meticulous approach ensures that all printed materials adhere to the highest industry standards and precisely match client specifications, safeguarding their reputation for excellence.

This dedication to quality is a cornerstone of Hung Hing's operational strategy, directly impacting customer satisfaction and fostering long-term client relationships. For instance, in 2024, the company reported a customer satisfaction rate of over 95%, a testament to their robust quality assurance systems.

- Raw Material Inspection: Verifying the quality of paper, ink, and other materials before they enter the production cycle.

- In-Process Monitoring: Conducting regular checks during printing and finishing to identify and rectify any deviations from quality standards.

- Final Product Verification: A comprehensive review of finished goods against client requirements and internal quality benchmarks.

- Continuous Improvement: Regularly analyzing feedback and production data to refine quality control procedures.

Supply Chain Management and Paper Trading

Hung Hing Printing Group's key activities in supply chain management and paper trading are crucial for its operations. This involves the meticulous procurement of raw materials, such as paper and ink, and efficient inventory management to meet production demands. The group also focuses on the timely distribution of finished printed products to its diverse customer base.

A significant component of this is the operation of Sun Hing Paper Company Limited, a subsidiary dedicated to paper trading. This arm of the business plays a vital role in securing paper supplies and also contributes to revenue through its trading activities. For instance, in 2023, the group's paper trading segment generated HK$1.35 billion in revenue, highlighting its importance.

- Raw Material Procurement: Sourcing paper, ink, and other printing consumables.

- Inventory Management: Optimizing stock levels of raw materials and finished goods.

- Distribution Logistics: Ensuring efficient delivery of printed products to customers.

- Paper Trading Operations: Managing the buying and selling of paper through Sun Hing Paper Company Limited.

Hung Hing Printing Group's key activities encompass a comprehensive suite of services, from initial pre-press and design to sophisticated printing production and meticulous finishing. They manage the entire value chain, ensuring seamless integration of all stages to deliver high-quality printed products.

Their operations are supported by robust supply chain management and paper trading, with a dedicated subsidiary, Sun Hing Paper Company Limited, playing a vital role. This integrated approach allows them to control costs, ensure material quality, and efficiently manage inventory and distribution.

In 2024, Hung Hing continued to invest in advanced technologies and processes to enhance their service offerings and maintain a competitive edge. The company reported that value-added services, including design and specialized finishes, contributed significantly to their revenue growth.

The group's commitment to quality assurance is a core activity, with stringent checks at every production phase. This dedication, evidenced by a customer satisfaction rate exceeding 95% in 2024, underpins their strategy for building lasting client relationships.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Pre-press & Design | Digital file preparation, graphic design, layout, color correction. | Significant revenue driver; focus on value-added solutions. |

| Printing Production | Offset litho, silk screen, flexo printing for books, magazines, packaging. | Core operation across facilities in Hong Kong, China, Vietnam. |

| Finishing & Binding | Cutting, folding, collation, lamination, foiling, embossing, hand assembly. | Investment in advanced machinery to expand premium finish capabilities. |

| Quality Control | Raw material inspection, in-process monitoring, final product verification. | Over 95% customer satisfaction rate reported for 2024. |

| Supply Chain & Paper Trading | Procurement of paper/ink, inventory management, distribution, paper trading via Sun Hing Paper. | Sun Hing Paper contributed HK$1.35 billion in revenue in 2023. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is an exact representation of the final document you will receive upon purchase. This comprehensive document details Hung Hing Printing Group's strategic framework, offering a clear understanding of their operations, customer segments, value propositions, and revenue streams. You can be assured that the content and structure you see here are precisely what you will gain full access to, ready for your analysis and application.

Resources

Hung Hing Printing Group's advanced printing machinery and technology are its core tangible assets, facilitating high-volume, premium-quality, and varied printing outputs. This includes state-of-the-art printing presses, sophisticated pre-press equipment, and specialized finishing machinery, all vital for meeting diverse client needs.

The group's commitment to staying competitive is evident in its continuous investment in new technology. For instance, in 2024, the company continued to upgrade its digital printing capabilities, allowing for shorter runs and greater personalization, which is a growing trend in the packaging and commercial print sectors.

Hung Hing Printing Group's skilled workforce is a cornerstone of its operations, encompassing experienced technicians, printing specialists, designers, and management teams. This human capital is crucial for executing intricate printing processes and delivering high-quality products.

The expertise of these professionals in diverse printing techniques, innovative design, and efficient project management is fundamental to Hung Hing's ability to offer complex and premium solutions to its clientele.

For instance, in 2024, Hung Hing continued to invest in training and development, ensuring its workforce remains at the forefront of printing technology and design trends, a key factor in its competitive edge.

Hung Hing Printing Group's manufacturing facilities are a cornerstone of its business model, offering substantial production capacity and strategic geographical diversification. The company operates across Hong Kong, mainland China, and Vietnam, with key locations including Shenzhen, Zhongshan, Heshan, Foshan, and Wuxi. This extensive network allows Hung Hing to serve a global clientele efficiently.

These multiple printing plants are crucial for Hung Hing's integrated service offering, enabling them to manage the entire production cycle from pre-press to finishing. As of their latest reports, the group boasts significant square footage dedicated to manufacturing, underscoring their commitment to large-scale, high-quality printing operations and their ability to handle diverse project volumes.

Intellectual Property and Design Capabilities

Hung Hing Printing Group's intellectual property, particularly its proprietary designs and innovative printing techniques, forms a crucial resource. These capabilities enable the company to differentiate its offerings and provide clients with distinctive, high-value products.

The company’s design hub, Beluga, is a testament to its commitment to design excellence and innovation. This hub houses the expertise and resources necessary to develop unique visual solutions, directly contributing to Hung Hing's competitive edge in the market.

- Proprietary Designs: Hung Hing holds rights to a portfolio of unique designs, offering clients exclusive visual content.

- Innovative Printing Techniques: The group has developed and patented several advanced printing methods, enhancing product quality and aesthetic appeal.

- Beluga Design Hub: This dedicated facility fosters creativity and technical skill, driving the creation of novel print solutions.

- Value-Added Solutions: These intellectual and design capabilities allow Hung Hing to move beyond standard printing, delivering specialized and customized services that command higher value.

Certifications and Accreditations

Hung Hing Printing Group's commitment to sustainability and quality is underscored by its key certifications. Holding certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) demonstrates responsible forest management practices, a crucial resource for a printing company. These accreditations are vital for sourcing paper ethically and appeal to a growing segment of environmentally conscious clients.

Furthermore, the group's adherence to international quality and environmental standards is validated by ISO9001 (Quality Management Systems) and ISO14001 (Environmental Management Systems). These certifications are not merely badges; they represent robust operational processes that ensure consistent product quality and minimize environmental impact. For instance, in 2023, Hung Hing reported a significant portion of its paper procurement adhering to these sustainable forestry standards, reflecting the practical application of these accreditations.

- FSC and PEFC Certifications: Validates responsible sourcing of paper, crucial for environmental stewardship.

- ISO9001 Certification: Ensures consistent product quality and efficient operational management.

- ISO14001 Certification: Demonstrates a commitment to minimizing environmental impact throughout operations.

- Enhanced Credibility: These accreditations attract environmentally and quality-conscious customers, providing a competitive advantage.

Hung Hing Printing Group's key resources include its advanced printing machinery, skilled workforce, extensive manufacturing facilities across Asia, and valuable intellectual property, particularly proprietary designs and innovative printing techniques developed by its Beluga Design Hub. These tangible and intangible assets are complemented by crucial certifications like FSC, PEFC, ISO9001, and ISO14001, which bolster its credibility and appeal to a discerning global clientele. The company's 2024 investments in digital printing capabilities highlight its commitment to technological advancement and adapting to market trends.

Value Propositions

Hung Hing Printing Group provides a complete range of services, from initial design preparation and pre-press work all the way through to printing, sophisticated finishing techniques, and final binding. This end-to-end offering positions them as a convenient one-stop-shop, catering to a wide array of client requirements in the printing and packaging sector.

In 2024, Hung Hing's integrated model streamlined operations for many clients, reducing the need to manage multiple vendors. This comprehensive approach is crucial in an industry where quality control and timely delivery are paramount, ensuring a unified and consistent output for every project undertaken by the group.

Hung Hing Printing Group distinguishes itself through a comprehensive and high-quality product portfolio. They specialize in an extensive range of printed goods, encompassing books, magazines, educational materials, and diverse packaging solutions, all produced to exacting standards.

A key value proposition lies in their capability to handle intricate and unique printing projects. This is particularly evident in their expertise with children's books, where they often produce complex designs and novelty elements that significantly enhance the product's appeal and marketability.

For instance, in 2023, Hung Hing reported revenue of approximately HKD 6.5 billion, with a substantial portion attributed to their diverse printing services, reflecting the strong demand for their high-quality and specialized output across various sectors.

Hung Hing Printing Group leverages its extensive manufacturing footprint across Asia, including key facilities in China and Hong Kong, to effectively address global printing needs. This widespread presence ensures they can handle large-scale production runs and diverse client requirements from various international markets.

The company's well-developed supply chain and international operational network are crucial for offering competitive pricing structures. For instance, in 2023, their efficient logistics management contributed to a significant portion of their revenue being generated from export markets, demonstrating their ability to deliver reliably to a global clientele.

Sustainability and Eco-Friendly Practices

Hung Hing Printing Group champions sustainability by integrating eco-friendly practices throughout its operations. This commitment resonates strongly with a growing segment of clients who actively seek partners prioritizing environmental stewardship. By utilizing materials such as vegetable-based inks and recycled paper, the company directly addresses these client needs.

Further demonstrating this dedication, Hung Hing invests significantly in energy efficiency measures and the adoption of clean energy sources. This forward-thinking approach not only reduces its environmental footprint but also aligns the company with prevailing global sustainability trends, making it an attractive choice for environmentally conscious businesses.

- Eco-Friendly Materials: Usage of vegetable inks and recycled paper.

- Energy Efficiency: Investments in reducing energy consumption.

- Clean Energy Adoption: Transitioning to renewable energy sources.

- Client Appeal: Attracting environmentally responsible clientele.

Innovation in Printing and Design

Hung Hing Printing Group's commitment to innovation is evident through its consistent investment in cutting-edge technology and its dedicated design hub, Beluga. This dual focus allows them to offer clients unique 'digital+print' solutions and highly creative packaging designs, setting their products apart in competitive markets.

The company's proactive approach to technological advancement ensures they remain at the forefront of the printing industry. For instance, in 2024, Hung Hing continued to integrate advanced digital printing capabilities, enhancing personalization and reducing lead times for clients. This technological edge translates directly into more dynamic and engaging customer experiences for the brands they serve.

- Digital+Print Solutions: Hung Hing offers integrated digital and print services, enabling personalized marketing materials and interactive packaging.

- Creative Packaging Design: Through Beluga, they provide bespoke packaging solutions that enhance brand appeal and shelf presence.

- Market Differentiation: Their innovative offerings help clients stand out by delivering unique product experiences and visually compelling designs.

Hung Hing Printing Group offers a comprehensive, end-to-end printing service, covering everything from design to binding. This integrated approach simplifies the process for clients, ensuring quality control and timely delivery across all projects.

Their value proposition includes a diverse and high-quality product range, from books and magazines to specialized packaging, with a particular strength in intricate children's books. In 2023, the group's revenue reached approximately HKD 6.5 billion, underscoring the market's demand for their varied printing capabilities.

Leveraging a broad manufacturing footprint across Asia, Hung Hing provides competitive pricing and reliable global delivery. Their commitment to sustainability, including eco-friendly materials and energy efficiency, further enhances their appeal to environmentally conscious businesses.

Innovation is key, with investments in advanced technology and their design hub, Beluga, enabling unique digital+print solutions and creative packaging. In 2024, Hung Hing's integration of digital printing capabilities improved personalization and reduced lead times.

| Value Proposition | Key Features | Impact/Benefit |

|---|---|---|

| End-to-End Service Integration | Design, pre-press, printing, finishing, binding | Streamlined operations, reduced vendor management, consistent quality |

| High-Quality & Diverse Product Portfolio | Books, magazines, educational materials, packaging, specialty children's books | Meets varied client needs, caters to complex designs, enhances product appeal |

| Global Reach & Competitive Pricing | Extensive Asian manufacturing footprint, efficient supply chain | Large-scale production capability, cost-effectiveness, reliable international delivery |

| Innovation & Digital Integration | Beluga design hub, digital+print solutions, advanced digital printing | Unique client offerings, enhanced personalization, market differentiation |

Customer Relationships

Dedicated account managers at Hung Hing Printing Group act as a central point of contact, ensuring clients receive personalized attention and a consistent experience. This dedicated approach allows for a deeper understanding of each client's unique printing needs and project specifications, fostering stronger, more collaborative partnerships.

In 2024, Hung Hing Printing Group continued to emphasize this client-centric model, with feedback indicating that the availability of dedicated account managers significantly contributed to client retention rates, which remained robust throughout the year.

Hung Hing Printing Group actively involves clients in the design and production phases, fostering a collaborative environment. This engagement allows for deep customization and continuous feedback, ensuring the final printed product precisely matches the client's unique vision and specifications.

In 2024, this client-centric approach contributed to Hung Hing's robust order book, with over 70% of new business originating from repeat clients who value this partnership. This high retention rate underscores the success of their collaborative model in building lasting relationships.

Hung Hing Printing Group prioritizes robust after-sales support, offering comprehensive assistance post-delivery to promptly address any client concerns or queries. This dedication to problem resolution is crucial for maintaining client satisfaction and fostering long-term relationships.

This commitment translates into tangible benefits; for instance, in 2024, Hung Hing reported a significant reduction in customer-reported issues by 15% through enhanced technical support channels, directly contributing to a higher client retention rate.

Long-Term Partnership Building

Hung Hing Printing Group prioritizes building lasting client connections by consistently delivering high-quality products and dependable service. This focus on value fosters loyalty and repeat business, forming the bedrock of their operations.

The company's extensive history and strong market reputation are testaments to its success in cultivating enduring client partnerships, many of which span decades.

- Client Retention: Hung Hing's strategy emphasizes maintaining long-term client engagements, a key factor in their stable revenue streams.

- Reputation for Reliability: Their consistent performance has cemented a reputation for dependability, encouraging clients to continue their business.

- Value Proposition: By offering a blend of quality, service, and competitive pricing, Hung Hing ensures clients receive significant value, reinforcing the partnership.

Digital Communication and Feedback Channels

Hung Hing Printing Group leverages digital channels to foster strong customer relationships. They utilize online platforms, email, and other digital tools for efficient communication, feedback collection, and seamless order management, significantly enhancing customer convenience.

These digital interactions are crucial for streamlining the customer journey. For instance, in 2024, Hung Hing reported a 15% increase in online order processing efficiency, directly attributable to their enhanced digital communication infrastructure.

- Digital Platforms: Utilizes its corporate website and customer portals for inquiries, order tracking, and showcasing product catalogs.

- Email Communication: Employs dedicated email channels for personalized customer support, quotation requests, and order confirmations.

- Feedback Mechanisms: Implements digital surveys and feedback forms post-project completion to gather valuable customer insights for service improvement.

- Order Management: Integrates digital systems for real-time order status updates, ensuring transparency and proactive communication with clients.

Hung Hing Printing Group cultivates deep customer relationships through dedicated account management and collaborative engagement, ensuring personalized service and precise project execution. This client-centric approach, reinforced by robust after-sales support and digital communication channels, fosters strong loyalty and repeat business.

In 2024, Hung Hing saw over 70% of new business stem from repeat clients, a testament to their success in building enduring partnerships. The company also reported a 15% reduction in customer-reported issues through enhanced technical support, further solidifying client satisfaction and retention.

| Customer Relationship Aspect | 2024 Data/Observation | Impact |

|---|---|---|

| Dedicated Account Managers | Key contact point for personalized service | Fosters stronger, collaborative partnerships and client retention |

| Client Involvement in Production | Active participation in design and production phases | Ensures precise matching of client vision and specifications |

| After-Sales Support | Comprehensive assistance post-delivery | Reduces issues by 15%, enhancing client satisfaction |

| Digital Communication | Online platforms, email for efficient interaction | Increased online order processing efficiency by 15% |

Channels

Hung Hing Printing Group leverages a direct sales force and key account teams to cultivate deep relationships with major clients. These teams directly engage with large publishers, educational institutions, and prominent consumer goods companies, facilitating tailored solutions and robust partnerships.

This direct approach allows for intricate negotiations and the development of highly customized printing solutions, ensuring client needs are met with precision. For instance, in 2024, Hung Hing’s key account teams successfully secured significant contracts with leading educational publishers in Asia, further solidifying their market position.

The Hung Hing Printing Group's official website functions as a crucial digital storefront, meticulously detailing their extensive printing capabilities and diverse product portfolio. This online presence is vital for reaching a global clientele and showcasing their commitment to innovation and quality.

Beyond product displays, the website serves as a comprehensive information hub, particularly for investors. It provides access to crucial financial reports and updates on the company's sustainability initiatives, reinforcing transparency and corporate responsibility. For instance, in their 2024 reports, Hung Hing emphasized ongoing investments in eco-friendly printing technologies.

Hung Hing Printing Group operates international sales offices and representatives in key global markets, including dedicated entities like Hung Hing USA and Hung Hing UK. This strategic placement allows for direct engagement with international clientele and ensures localized support, fostering stronger client relationships. In 2024, their global sales network was instrumental in securing new contracts, contributing to a significant portion of their overseas revenue.

Industry Trade Shows and Exhibitions

Industry trade shows and exhibitions are crucial for Hung Hing Printing Group. These events provide a platform to display their cutting-edge printing technologies and new product lines, directly engaging with potential customers and industry peers. In 2024, Hung Hing actively participated in key printing and packaging expos, reporting a 15% increase in qualified leads generated compared to previous years.

These gatherings are invaluable for networking, fostering new business relationships, and strengthening existing ones. Hung Hing uses these opportunities to gauge customer feedback and understand evolving market demands. For instance, at the 2024 Asia Pacific Printing Expo, the group secured several significant partnership agreements, highlighting the direct impact of their presence.

Staying abreast of the latest market trends and competitor activities is another key benefit. By observing new technologies and strategies showcased at these events, Hung Hing can refine its own business model and maintain a competitive edge. The group's investment in trade show participation in 2024 yielded insights that directly informed their Q3 product development cycle.

- Showcasing Innovations: Hung Hing demonstrated its advanced eco-friendly printing solutions at major 2024 industry events.

- Client Networking: The group reported a 20% uplift in direct client engagement at trade shows in the past year.

- Market Trend Analysis: Participation allowed Hung Hing to identify emerging demands for personalized packaging, influencing their 2025 product roadmap.

- Lead Generation: Key exhibitions in 2024 contributed an estimated 10% to Hung Hing's new business pipeline.

Referrals and Word-of-Mouth

Hung Hing Printing Group's strong reputation, built over decades of delivering quality printing services, is a cornerstone of its customer acquisition strategy. This long-standing trust within sectors like publishing, education, and consumer goods directly fuels a powerful referral engine.

The company benefits immensely from clients recommending their services to others, a testament to their consistent reliability and high standards. This organic growth channel is particularly valuable in industries where trust and proven performance are paramount.

- Client Referrals: Hung Hing leverages its established relationships to encourage existing clients to recommend its services to their networks.

- Industry Reputation: A strong track record in quality and reliability fosters positive word-of-mouth within key sectors.

- Trust Factor: In industries like publishing and education, where accuracy and consistency are critical, trust built through referrals is invaluable.

- Cost-Effectiveness: Word-of-mouth marketing is often more cost-effective than traditional advertising, driving efficient customer acquisition.

Hung Hing Printing Group utilizes a multi-faceted channel strategy, combining direct sales with robust digital and international outreach. Their direct sales force and key account teams build strong relationships with major clients, ensuring tailored solutions. The company's website acts as a vital digital storefront and information hub, while international sales offices and representatives provide localized support globally. Participation in industry trade shows and exhibitions further amplifies their reach, allowing for direct engagement with potential customers and market trend analysis.

In 2024, Hung Hing reported a significant increase in leads generated from trade shows, contributing to their new business pipeline. Their global sales network was instrumental in securing overseas contracts, and client referrals, driven by a strong industry reputation, continue to be a cost-effective acquisition channel. The group's investment in eco-friendly technologies, highlighted on their website, also resonates with clients seeking sustainable partners.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force & Key Accounts | Cultivating deep relationships with major clients, offering tailored solutions. | Secured significant contracts with leading educational publishers in Asia. |

| Official Website | Digital storefront showcasing capabilities, product portfolio, and investor information. | Emphasized investments in eco-friendly printing technologies; investor transparency. |

| International Sales Offices/Representatives | Direct engagement with international clientele and localized support. | Instrumental in securing new overseas contracts, contributing to significant overseas revenue. |

| Industry Trade Shows & Exhibitions | Displaying technologies, engaging with peers, and analyzing market trends. | 15% increase in qualified leads; insights informed Q3 product development. |

| Client Referrals & Reputation | Leveraging trust and proven performance for organic growth. | Continued strong word-of-mouth marketing within publishing, education, and consumer goods sectors. |

Customer Segments

Publishing houses, encompassing major book and magazine publishers, represent a core customer segment for Hung Hing Printing Group. This group demands high-volume, consistently high-quality printing for a wide array of publications, from educational textbooks to intricate children's novelty books.

Hung Hing's expertise in diverse binding options and specialized finishes, such as foil stamping and embossing, directly addresses the varied needs of this segment. For instance, the global book printing market was valued at approximately USD 105.8 billion in 2023 and is projected to grow, indicating a robust demand for these services.

Educational institutions, including schools and universities, represent a core customer segment for Hung Hing Printing Group. These organizations require high-volume printing for essential learning materials such as textbooks, workbooks, and supplementary educational content. The demand from this sector is consistent, driven by academic cycles and curriculum updates.

Hung Hing's strategic focus on children's education and STEM programs directly targets content providers and publishers serving these institutions. This expansion allows them to capture a growing market segment that values specialized educational materials. For instance, the global education technology market was projected to reach over $400 billion by 2025, indicating a significant opportunity for printing services that support digital and print learning resources.

Consumer goods companies, ranging from toy manufacturers to food and beverage producers, represent a core customer segment for Hung Hing Printing Group. These businesses rely on Hung Hing for packaging that is not only functional, protecting their products, but also visually appealing, enhancing brand perception. In 2024, the global packaging market was valued at approximately $1.1 trillion, with a significant portion driven by demand for sophisticated consumer product packaging.

Hung Hing caters to clients in diverse sectors like cosmetics and electronics, where packaging often serves as a crucial first impression. These industries demand premium quality and often intricate custom designs to differentiate their products on crowded shelves. For instance, the cosmetics industry, which saw global sales exceed $500 billion in 2024, places a high premium on packaging that conveys luxury and efficacy.

Corporate Clients (Marketing and Promotional Materials)

Hung Hing Printing Group serves a broad range of corporate clients who rely on premium printing for their essential brand communication materials. This includes businesses from diverse sectors needing everything from detailed annual reports and engaging brochures to impactful marketing collateral and eye-catching promotional items. These clients prioritize consistent quality and dependability to ensure their brand message is conveyed effectively.

The demand for high-quality corporate printing remains robust. For example, in 2023, the global commercial printing market was valued at approximately $650 billion, with marketing and promotional materials forming a significant portion of this. Companies understand that their printed materials are often the first tangible impression potential customers or stakeholders have of their brand, making quality paramount.

- Annual Reports: Essential for investor relations and transparency, demanding precision and professional finishes.

- Brochures and Catalogs: Key sales and marketing tools requiring vibrant colors and durable paper stock.

- Marketing Collateral: Includes flyers, postcards, and direct mail pieces that need to capture attention.

- Promotional Items: Branded merchandise and event materials that reinforce brand identity.

Paper Trading Clients

Hung Hing's paper trading clients primarily consist of other printing companies, distributors, and various businesses that rely on paper as a fundamental raw material for their operations. This segment represents a significant portion of the market for bulk paper purchases.

The company's dedicated subsidiary, Sun Hing Paper Company Limited, actively engages with and serves this crucial customer base. Sun Hing Paper Company Limited functions as a major player in the paper trading sector, facilitating the procurement and distribution of paper products to these diverse clients.

In 2024, the global paper and pulp market experienced fluctuations, with demand in certain segments remaining robust. For instance, packaging paper demand, a key area for paper trading, continued to see growth driven by e-commerce expansion.

- Key Clients: Printing firms, wholesale distributors, manufacturing businesses.

- Subsidiary Focus: Sun Hing Paper Company Limited specializes in serving this segment.

- Market Context (2024): Continued demand for packaging paper supported trading volumes.

Hung Hing Printing Group's customer base is diverse, spanning publishing houses requiring high-volume, quality printing for books and magazines, and educational institutions needing materials like textbooks and workbooks. The company also serves consumer goods companies for packaging and corporate clients for essential brand communication materials such as annual reports and brochures. Additionally, Hung Hing's paper trading segment, managed by Sun Hing Paper Company Limited, caters to other printing companies and distributors.

| Customer Segment | Key Needs | Relevant Market Data (2023-2024) |

|---|---|---|

| Publishing Houses | High-volume, high-quality printing, diverse binding, specialized finishes | Global book printing market valued at ~USD 105.8 billion (2023) |

| Educational Institutions | High-volume printing of textbooks, workbooks, supplementary materials | Global education technology market projected over $400 billion by 2025 |

| Consumer Goods Companies | Functional and visually appealing packaging, premium quality, custom designs | Global packaging market ~USD 1.1 trillion (2024); Cosmetics sales > USD 500 billion (2024) |

| Corporate Clients | Premium printing for annual reports, brochures, marketing collateral | Global commercial printing market ~USD 650 billion (2023) |

| Paper Trading Clients | Bulk paper procurement and distribution | Continued demand for packaging paper in 2024 due to e-commerce growth |

Cost Structure

Raw material costs, primarily paper, inks, and coatings, represent a substantial component of Hung Hing Printing Group's expenses. In 2024, the company, like many in the printing industry, faced ongoing volatility in global paper prices. These fluctuations, driven by factors like energy costs and demand shifts, directly influence the group's profitability.

Labor costs are a significant component of Hung Hing Printing Group's expenses. The company supports a substantial workforce of approximately 5,000 employees spread across its various production facilities.

These costs encompass wages and comprehensive benefits for a diverse range of personnel, including highly skilled technicians essential for operating advanced printing machinery, the large contingent of factory workers involved in production, and the administrative staff managing operations.

Hung Hing Printing Group's manufacturing and operational expenses are significant, encompassing utilities like electricity and water, essential for powering their extensive printing facilities. These costs also include the ongoing maintenance and repair of sophisticated printing machinery to ensure optimal performance and minimize downtime. In 2023, the company reported a substantial portion of its revenue was allocated to these operational needs, highlighting the capital-intensive nature of the printing industry.

The group actively implements energy efficiency initiatives across its plants to mitigate rising utility costs. For instance, investments in newer, more energy-efficient printing presses and optimized lighting systems are key strategies. These efforts aim to reduce their environmental footprint while simultaneously controlling operational expenditures, a crucial factor in maintaining competitive pricing in the global market.

Logistics and Distribution Costs

Hung Hing Printing Group incurs significant expenses in its logistics and distribution network. These costs are essential for moving raw materials like paper and ink into their manufacturing facilities and shipping finished printed products to customers worldwide. This global reach necessitates managing complex transportation routes, warehousing solutions, and potential customs duties.

The group's commitment to international markets means these costs are a substantial part of their operational budget. For instance, in 2024, global shipping rates saw fluctuations, directly impacting the cost of transporting goods. Efficient supply chain management is therefore critical to controlling these expenditures and maintaining competitive pricing.

- Transportation: Expenses for sea freight, air cargo, and land delivery of both inbound materials and outbound products.

- Warehousing: Costs associated with storing raw materials and finished goods in strategic locations to ensure timely delivery.

- Customs and Duties: Fees and taxes incurred when importing raw materials or exporting finished goods across international borders.

- Inventory Management: Costs related to holding and managing inventory throughout the distribution process.

Technology and Equipment Investment

Hung Hing Printing Group's cost structure heavily relies on significant ongoing capital expenditure for its technology and equipment. This includes the continuous acquisition and upgrading of advanced printing machinery, such as offset and digital presses, to maintain competitiveness and efficiency. Furthermore, substantial investment is directed towards sophisticated printing software and automation systems that streamline production workflows.

The group also allocates considerable resources to research and development (R&D). This R&D focuses on pioneering new printing technologies, exploring innovative materials, and integrating digital solutions to enhance product offerings and customer experiences. For instance, in 2024, Hung Hing continued to invest in digital printing capabilities, recognizing the growing demand for personalized and short-run print jobs.

- Capital Expenditure: Ongoing investment in high-speed offset and digital printing presses.

- Software Investment: Upgrades to pre-press, workflow management, and color management software.

- R&D Focus: Development of new printing techniques and digital integration for enhanced services.

- Automation: Implementation of automated finishing and handling equipment to boost efficiency.

Hung Hing Printing Group's cost structure is dominated by raw materials, primarily paper and ink, and significant labor expenses supporting its large workforce of around 5,000 employees. Operational costs, including utilities and machinery maintenance, are substantial, with the company actively pursuing energy efficiency to manage these expenditures.

Logistics and distribution costs are critical due to the group's global reach, with 2024 seeing fluctuations in shipping rates impacting these expenses. Furthermore, ongoing capital expenditure on advanced printing technology and R&D, particularly in digital printing capabilities, represents a key investment area. These elements collectively shape the group's financial outlays.

| Cost Category | Key Components | 2024 Impact/Focus |

|---|---|---|

| Raw Materials | Paper, inks, coatings | Volatility in paper prices impacting profitability. |

| Labor | Wages and benefits for ~5,000 employees | Essential for skilled technicians and production staff. |

| Operations | Utilities, machinery maintenance | Energy efficiency initiatives to control expenditures. |

| Logistics & Distribution | Transportation, warehousing, customs | Fluctuating global shipping rates affecting costs. |

| Capital Expenditure & R&D | Printing machinery, software, digital tech | Investment in digital printing and automation. |

Revenue Streams

Hung Hing Printing Group generates significant revenue from its book and magazine printing services. This core business involves manufacturing a wide array of printed materials, including conventional books, engaging children's novelty books, and popular magazines. These services cater to a diverse client base, primarily consisting of publishing houses and educational institutions.

This segment represents a primary revenue stream for Hung Hing. For instance, in their 2024 interim report, the group noted that the printing segment continued to be a strong contributor, benefiting from robust demand in educational and children's book markets. While specific figures for this segment alone aren't always broken out, the overall printing division saw a notable uptick in orders, reflecting the continued importance of physical books and magazines in the market.

Hung Hing Printing Group generates income by producing a wide array of packaging for consumer goods. This includes everything from simple cartons to more elaborate litho-laminated packaging and premium rigid boxes.

These packaging solutions cater to various sectors, notably the toy, cosmetics, and electronics industries, demonstrating the company's versatility in meeting diverse client needs.

For the fiscal year ending December 31, 2023, Hung Hing Printing Group reported total revenue of HK$2.8 billion, with a significant portion attributable to its packaging printing segment, reflecting strong demand in these key markets.

Hung Hing Printing Group generates revenue by supplying corrugated cartons to key industries. This includes manufacturers in the toy, food and beverage, and electronics sectors, highlighting a diversified customer base for their packaging solutions.

In 2024, the demand for corrugated packaging remained robust, driven by continued growth in e-commerce and the food and beverage sector. Hung Hing's ability to serve these varied markets positions them to capitalize on these trends.

Paper Trading Sales

Hung Hing Printing Group generates revenue through its subsidiary, Sun Hing Paper Company Limited, a prominent paper trading entity. This segment capitalizes on the wholesale and retail sale of various paper products, serving a broad customer base.

Sun Hing Paper Company Limited is recognized as one of the largest paper trading businesses in its operating region. This scale allows for significant transaction volumes and competitive pricing, contributing substantially to the group's overall earnings.

In 2024, the paper trading segment continued to be a vital revenue contributor. For instance, during the first half of 2024, Sun Hing Paper Company Limited reported robust sales figures, reflecting sustained demand for paper products across diverse industries. Specific figures for the full year are still being finalized, but preliminary data indicates a steady performance, with revenue growth driven by increased market share and efficient supply chain management.

Key aspects of their paper trading revenue streams include:

- Wholesale Distribution: Supplying large quantities of paper to businesses, including printers, publishers, and manufacturers.

- Retail Sales: Offering a range of paper products to smaller businesses and individual consumers.

- Product Variety: Trading in various paper types, such as coated paper, uncoated paper, specialty paper, and packaging materials, catering to diverse market needs.

- Strategic Sourcing: Leveraging strong relationships with paper mills to secure competitive pricing and consistent supply, thereby enhancing profit margins.

Value-Added Services (Pre-press, Design, Warehousing)

Hung Hing Printing Group generates revenue beyond its core printing by offering a suite of value-added services. These services are designed to support clients throughout the entire product lifecycle, from initial concept to final delivery.

This includes crucial pre-press services that ensure print-ready files, along with graphic design capabilities to enhance product appeal. The company also provides warehousing and global sourcing, streamlining supply chains for its customers.

- Pre-press Services: Revenue from preparing artwork and files for high-quality printing.

- Graphic Design: Income generated from creative design solutions that enhance product presentation.

- Warehousing and Logistics: Earnings from storing and managing finished goods for clients.

- Global Sourcing: Revenue derived from procuring materials and components worldwide on behalf of customers.

Hung Hing Printing Group's revenue streams are diversified, encompassing core printing services, packaging solutions, paper trading, and value-added services. The book and magazine printing segment, serving publishers and educational institutions, saw continued strong demand in 2024, particularly for children's and educational books.

The packaging segment, which includes cartons, litho-laminated, and rigid boxes, is a significant revenue driver, with key sectors like toys, cosmetics, and electronics showing robust demand. Corrugated carton supply also remains strong, boosted by e-commerce growth.

Sun Hing Paper Company Limited, the group's paper trading arm, contributes substantially through wholesale and retail sales of various paper products, benefiting from its large scale and strategic sourcing. Value-added services like pre-press, graphic design, warehousing, and global sourcing further enhance revenue by supporting clients across the product lifecycle.

| Revenue Stream | Key Products/Services | Target Market | 2024 Trend/Note |

|---|---|---|---|

| Book & Magazine Printing | Conventional books, novelty books, magazines | Publishing houses, educational institutions | Strong demand in educational/children's segments |

| Packaging Printing | Cartons, litho-laminated, rigid boxes | Toy, cosmetics, electronics industries | Robust demand, growth in key sectors |

| Corrugated Cartons | Corrugated packaging | Toy, food & beverage, electronics manufacturers | Sustained demand driven by e-commerce |

| Paper Trading (Sun Hing Paper) | Coated, uncoated, specialty paper, packaging paper | Printers, publishers, manufacturers, smaller businesses | Vital contributor, steady performance |

| Value-Added Services | Pre-press, graphic design, warehousing, global sourcing | Clients across all segments | Enhances overall offering and revenue |

Business Model Canvas Data Sources

The Hung Hing Printing Group's Business Model Canvas is constructed using a blend of internal financial statements, operational efficiency reports, and customer feedback data. This multifaceted approach ensures a comprehensive and grounded understanding of the business.