Humana Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

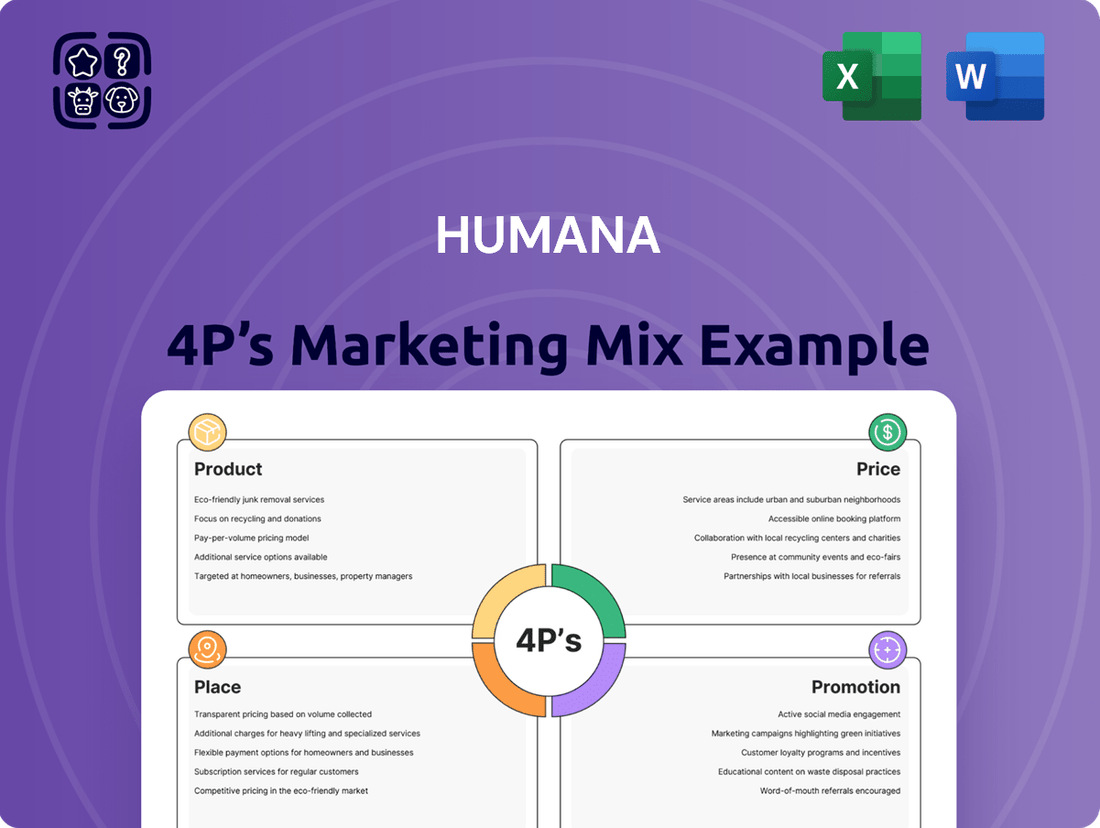

Humana's marketing mix is a carefully orchestrated symphony of Product, Price, Place, and Promotion designed to resonate with diverse healthcare needs. Discover how their innovative health insurance plans, competitive pricing structures, extensive network of providers, and targeted communication strategies create a powerful market presence.

Go beyond the surface—gain access to an in-depth, ready-made Marketing Mix Analysis covering Humana's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights into a leading healthcare provider.

Product

Humana's comprehensive health insurance plans, encompassing medical, dental, and vision, are designed to meet the diverse needs of individuals and families. In 2024, Humana continued to emphasize simplifying healthcare access and encouraging proactive wellness, aiming to reduce out-of-pocket costs for members. These offerings are a cornerstone of their product strategy.

The company's approach to product development prioritizes an integrated care model. This includes seamless coordination with pharmacy benefits, home-based care services, and a network of clinical providers. This holistic strategy, evident in their 2024 offerings, aims to improve member health outcomes and manage chronic conditions more effectively.

Humana's Medicare Advantage (MA) plans are a cornerstone of its product strategy, offering a bundled approach to healthcare that includes Original Medicare benefits plus extras like prescription drug coverage, dental, vision, and hearing. This comprehensive offering aims to simplify healthcare for seniors.

For the 2025 plan year, Humana is significantly broadening its reach for MA plans, now available in 48 states, Washington D.C., and Puerto Rico. This expansion means Humana's MA plans will be accessible in 89% of U.S. counties, demonstrating a strong commitment to serving a vast majority of the Medicare-eligible population.

The product provides considerable flexibility, with some plans allowing members to choose both in-network and out-of-network providers, offering greater freedom in healthcare decisions. Furthermore, specialized options like the Humana USAA Honor Giveback plans cater to specific needs, such as military veterans and their families.

Humana's stand-alone Prescription Drug Plans (Part D) offer essential medication coverage for those with Original Medicare. For 2025, these plans are enhanced with $0 copays and $0 deductibles for preferred pharmacies on Tier 1 and Tier 2 drugs, simplifying costs for commonly used medications. The elimination of the coverage gap and a $2,000 annual out-of-pocket maximum further improve affordability and predictability for beneficiaries.

Government-Sponsored Programs

Humana's engagement with government-sponsored programs, particularly Medicare and Medicaid, forms a cornerstone of its marketing strategy. The company offers specialized plans designed to meet the unique requirements of beneficiaries in these programs.

A key area of focus is Dual-Eligible Special Needs Plans (D-SNPs), catering to individuals eligible for both Medicare and Medicaid. Humana is strategically expanding its D-SNP footprint, with new states like North Dakota set to see offerings in 2025, reflecting a commitment to this segment.

- Government Contracts as Core Strategy: Humana prioritizes securing and expanding government contracts, recognizing their significant contribution to revenue and market share.

- Medicare and Medicaid Participation: The company actively participates in both Medicare and Medicaid programs, tailoring its product portfolio to diverse beneficiary needs.

- Expansion of D-SNPs: Humana is broadening its reach in the Dual-Eligible Special Needs Plans (D-SNPs) market, with expansion into North Dakota in 2025 highlighting this growth initiative.

- Targeting Dual-Eligibles: A significant portion of Humana's strategy involves serving individuals who qualify for both Medicare and Medicaid, a growing and complex demographic.

Integrated Care Services (CenterWell)

Humana's CenterWell segment represents a significant evolution beyond traditional health insurance, focusing on integrated care delivery. This strategy encompasses primary care, pharmacy services, and home health, aiming to provide a more comprehensive and coordinated patient experience. This integrated model is particularly beneficial for managing the health of high-cost patient populations, a key strategic pillar for Humana in its pursuit of improved health outcomes.

CenterWell's expansion is a direct response to market trends and Humana's strategic vision. By 2024, Humana reported significant growth in its CenterWell segment, with revenues reflecting the increasing demand for these integrated services. For instance, CenterWell Home Health alone saw substantial year-over-year revenue increases in early 2024, underscoring the market's positive reception to this model. This growth is fueled by a commitment to patient-centric care, aiming to reduce hospital readmissions and improve overall patient well-being.

- Primary Care Expansion: CenterWell has been actively acquiring and building primary care practices, aiming to offer a seamless patient journey from preventative care to chronic disease management.

- Pharmacy Integration: By integrating pharmacy services, CenterWell can better manage medication adherence and costs, directly impacting patient health and reducing overall healthcare expenditure.

- Home Health Focus: The provision of home health services allows for continued care and monitoring post-hospitalization, a critical component in managing complex health needs and improving recovery.

- Value-Based Care Alignment: CenterWell's integrated model is designed to align with value-based care initiatives, rewarding providers for quality outcomes rather than volume of services.

Humana's product strategy centers on comprehensive, integrated health solutions, particularly within government-sponsored programs like Medicare Advantage. For 2025, their MA plans are available in 89% of U.S. counties, reflecting a broad market penetration. This includes specialized offerings like Dual-Eligible Special Needs Plans (D-SNPs), with expansion into new states such as North Dakota for 2025, targeting a vital demographic.

The product portfolio extends to stand-alone Prescription Drug Plans (Part D), enhanced for 2025 with $0 copays for preferred pharmacies on certain drug tiers and an annual out-of-pocket maximum of $2,000. This focus on affordability and ease of access is crucial for member retention and acquisition.

Humana's CenterWell segment signifies a strategic pivot towards direct care delivery, encompassing primary care, pharmacy, and home health services. This integrated approach aims to improve patient outcomes and manage costs, especially for high-need populations, with significant revenue growth reported in early 2024 for its home health division.

| Product Area | 2024/2025 Focus | Key Features/Data |

|---|---|---|

| Medicare Advantage (MA) | Broad Geographic Expansion | Available in 89% of U.S. counties for 2025; expansion into 48 states, D.C., Puerto Rico. |

| Dual-Eligible Special Needs Plans (D-SNPs) | Targeted Growth | Expansion into North Dakota for 2025; serves individuals eligible for Medicare and Medicaid. |

| Prescription Drug Plans (Part D) | Enhanced Affordability | 2025: $0 copays for preferred pharmacies on Tier 1 & 2 drugs; $2,000 annual out-of-pocket maximum. |

| CenterWell (Integrated Care) | Care Delivery Expansion | Focus on primary care, pharmacy, home health; significant revenue growth in CenterWell Home Health in early 2024. |

What is included in the product

This analysis offers a comprehensive examination of Humana's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Humana's market approach.

Provides a clear, concise overview of Humana's 4Ps, easing the burden of deciphering their competitive positioning.

Place

Humana leverages a direct sales force alongside a robust network of licensed brokers and agents to connect with potential members. This multi-channel approach ensures personalized support, especially for intricate offerings like Medicare Advantage plans, where beneficiaries often require detailed guidance. For instance, in 2024, Humana continued to emphasize agent training and support to navigate the complexities of health insurance enrollment, aiming to improve member satisfaction and retention.

Humana heavily utilizes its digital ecosystem, including Humana.com and the MyHumana mobile app, to provide comprehensive plan information, facilitate enrollment, and offer member support. This digital infrastructure is vital for enhancing member experience by enabling easy provider searches, access to detailed plan benefits, and streamlined healthcare management. In 2023, Humana reported that its digital channels handled a significant portion of member interactions, demonstrating a strong reliance on these platforms for customer engagement and service delivery.

Humana is significantly broadening its reach, planning to offer Medicare Advantage plans across 48 states, Washington D.C., and Puerto Rico for the 2025 plan year. This extensive geographic expansion is designed to capture a larger share of the market and make its services accessible to millions more Americans.

This strategic move targets increased market penetration by covering a substantial portion of U.S. counties, aiming to serve a more diverse and widespread customer base. The company's commitment to geographic expansion underscores its ambition to be a leading provider in the Medicare Advantage space.

Strategic Partnerships and Retail Locations

Humana's strategic partnerships, notably with Walmart, exemplify a forward-thinking approach to expanding healthcare accessibility. These collaborations place health services directly within everyday retail environments, making care more convenient for consumers.

This integration into locations like Walmart Supercenters not only boosts Humana's brand visibility but also taps into a vast customer base already accustomed to these shopping hubs. By 2024, Walmart had over 4,600 stores in the U.S., providing a significant footprint for Humana's services.

- Walmart Health Centers: Humana's presence in Walmart Health Centers offers primary care, dental, vision, and audiology services.

- Enhanced Accessibility: These retail locations provide convenient access to healthcare for millions of Americans.

- Brand Synergy: The partnership leverages Walmart's established retail presence to increase Humana's market penetration and brand recognition.

- 2024 Data Point: Humana reported a significant increase in member engagement in areas where these retail health centers are operational.

Mail-Delivery Pharmacies

Humana's mail-delivery pharmacy, CenterWell Pharmacy, offers a crucial component of their marketing mix by providing convenient and safe mail-order services for both prescription and over-the-counter medications. This service directly addresses the 'Place' aspect by extending Humana's reach beyond traditional brick-and-mortar locations, making healthcare more accessible.

This channel is designed to improve medication adherence for Humana members. By delivering medications directly to their homes, it removes potential barriers like transportation or the need to visit a physical pharmacy, thereby enhancing the overall member experience and promoting better health outcomes.

As of early 2024, Humana reported significant growth in its home delivery pharmacy services. CenterWell Pharmacy experienced a substantial increase in prescription volume, with millions of prescriptions filled annually through its mail-order channels, underscoring its importance in Humana's distribution strategy.

- Convenience: Home delivery eliminates the need for in-person pharmacy visits.

- Accessibility: Reaches members in rural or underserved areas.

- Adherence: Facilitates consistent medication management.

- Cost-Effectiveness: Often provides competitive pricing for members.

Humana's "Place" strategy emphasizes broad accessibility through multiple channels. This includes a direct sales force and a vast network of brokers, complemented by a strong digital presence via its website and mobile app. Furthermore, strategic partnerships, like those with Walmart, and its mail-delivery pharmacy, CenterWell Pharmacy, significantly extend its reach, making healthcare services and medications more convenient for members across diverse locations.

| Channel | Description | Reach/Impact | 2024/2025 Data Point |

|---|---|---|---|

| Direct Sales & Broker Network | Personalized guidance and enrollment assistance | Covers intricate plans like Medicare Advantage | Continued emphasis on agent training for 2024 |

| Digital Ecosystem (Humana.com, MyHumana App) | Information, enrollment, member support | Enhances member experience, streamlines management | Significant portion of member interactions in 2023 |

| Geographic Expansion | Offering Medicare Advantage plans across 48 states, D.C., Puerto Rico | Targets larger market share, increased accessibility | Expansion planned for 2025 plan year |

| Walmart Partnerships | Health services in retail locations (e.g., Walmart Health Centers) | Convenience, brand visibility, taps into vast customer base | Walmart had over 4,600 U.S. stores in 2024 |

| CenterWell Pharmacy (Mail Delivery) | Home delivery of prescription and OTC medications | Improves adherence, removes barriers, enhances experience | Significant growth in home delivery services reported by early 2024 |

Preview the Actual Deliverable

Humana 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Humana 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can confidently assess the quality and content, knowing it's exactly what you'll get.

Promotion

Humana's marketing strategy truly puts the customer first, leveraging deep dives into market research and sophisticated data analytics. This allows them to craft services and messages that resonate with what each individual needs, fostering a strong sense of trust and encouraging long-term loyalty within their broad customer base.

Humana leverages a robust digital marketing strategy, maintaining an active presence across platforms like Facebook, Instagram, YouTube, and Twitter to connect with its audience. This engagement is crucial for building brand loyalty and disseminating health-related information.

Their search engine optimization (SEO) efforts are comprehensive, focusing on targeted keyword research and on-page optimization to ensure Humana appears prominently in online searches for health insurance and related services. In 2024, the digital health market continued its rapid expansion, with consumers increasingly relying on online resources for healthcare decisions, making strong SEO vital for patient acquisition.

Humana leverages a multi-channel advertising approach, utilizing television, print, and digital platforms to highlight its offerings and unique selling points. For instance, their recent 'Invite' campaign effectively promotes active aging by showcasing engaging activities such as pickleball, aiming to resonate with a health-conscious audience.

Public Relations and Community Engagement

Humana's promotional strategy heavily emphasizes public relations and deep community engagement, as detailed in their 2024 Impact Report. These efforts are designed to build a positive brand image and cultivate strong relationships within the communities they serve.

Key initiatives include direct support for local organizations and a commitment to improving social determinants of health. For instance, in 2023, Humana employees contributed over 100,000 volunteer hours, demonstrating a tangible commitment to community well-being. The company also provided $25 million in grants to various non-profits focused on health equity and community development.

- Employee Volunteerism: Over 100,000 volunteer hours contributed by Humana employees in 2023.

- Community Grants: $25 million in grants awarded to organizations addressing health equity.

- Social Determinants of Health: Targeted programs aimed at improving access to care, nutrition, and housing.

- Brand Enhancement: Fostering goodwill and strengthening brand reputation through visible community support.

Educational Programs and Wellness Initiatives

Humana actively promotes member wellness through its Go365 program, a key component of its marketing mix. This initiative incentivizes healthy behaviors and preventive care, directly aligning with the Product and Promotion elements by offering tangible value. For instance, in 2024, Go365 members could earn rewards for activities like completing health assessments and participating in fitness challenges, fostering a proactive approach to health management.

The company supplements these rewards with a wealth of educational content focused on healthy living and nutrition. This educational aspect of the Promotion strategy aims to empower individuals with the knowledge needed to make informed health decisions. By providing resources on topics ranging from meal planning to chronic disease management, Humana seeks to enhance member engagement and improve health outcomes.

- Go365 Program: Rewards members for healthy activities and preventive screenings, encouraging proactive health management.

- Educational Content: Offers resources on healthy living and nutrition to empower members.

- Wellness Focus: Initiatives aim to improve overall member health and well-being.

Humana's promotional strategy is multifaceted, focusing on digital engagement, community involvement, and direct member incentives. Their robust SEO efforts in 2024 ensured visibility in a growing digital health market, while campaigns like 'Invite' promoted active aging through relatable activities.

Community engagement is a cornerstone, with Humana employees contributing over 100,000 volunteer hours in 2023 and the company providing $25 million in grants to health equity initiatives. This commitment builds brand goodwill and strengthens community ties.

The Go365 program is a key promotional tool, rewarding members for healthy behaviors and preventive care, thereby reinforcing the product's value and encouraging long-term engagement. This program, alongside extensive educational content, empowers members to manage their health proactively.

| Promotional Tactic | Key Activities/Focus | Impact/Data Point (2023-2024) |

|---|---|---|

| Digital Marketing & SEO | Social media presence, targeted keywords | Increased online visibility for health insurance searches in 2024 |

| Advertising | Multi-channel approach (TV, print, digital) | 'Invite' campaign promoting active aging |

| Public Relations & Community Engagement | Local organization support, social determinants of health | 100,000+ employee volunteer hours (2023), $25M in community grants (2023) |

| Member Wellness Programs | Go365 incentives, educational content | Rewards for health assessments and fitness challenges (2024) |

Price

Humana positions its pricing to be competitive, aiming for accessibility while aligning with the value customers perceive in its health insurance offerings. This strategy involves constant monitoring of market demand and the actions of competitors to make necessary adjustments.

For instance, in 2024, Humana's average premium for Medicare Advantage plans varied significantly by region, with some plans offering premiums as low as $0, while others could exceed $100 monthly, reflecting a deliberate approach to market segmentation and competitive positioning. This dynamic pricing ensures they remain attractive in a crowded marketplace.

Humana's pricing strategy, a key element of its marketing mix, reflects significant variation in plan premiums and deductibles. These costs are not static and are influenced by a multitude of factors including the specific insurance product chosen, the enrollee's geographic location, and the plan type itself, such as Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) structures.

For the upcoming 2025 period, projections indicate that the average monthly premium for prescription drug coverage under Part D is estimated to be around $46.50. Furthermore, the average monthly cost for a Medicare Advantage plan is anticipated to be approximately $17, showcasing a tiered approach to affordability across different coverage levels.

Humana's pricing strategy is centered on a benefit structure designed for long-term value for its members. This means finding the right balance between offering robust coverage and keeping costs manageable. For 2025, Humana has updated its Medicare Advantage plans, which includes some changes to benefits and, in select instances, increased premiums to reflect these adjustments and market conditions.

Discounts and Cost-Saving Programs

Humana actively uses discounts and cost-saving programs to enhance the value proposition of its health insurance offerings. For instance, certain Part D plans feature $0 copays for Tier 1 and Tier 2 medications when filled at preferred pharmacies, making prescription drugs more affordable. This directly addresses the price element of the marketing mix by reducing out-of-pocket expenses for members.

Further cost savings are realized through strategic partnerships. Humana provides special cost reductions for members who utilize in-network preferred Walmart pharmacies, creating a tangible financial incentive for choosing specific providers. This strategy aims to drive member utilization towards cost-effective network options.

Many Humana Medicare Advantage plans also incorporate $0 telehealth copays for in-network primary care physician appointments. This not only lowers immediate costs for members accessing care but also encourages the adoption of convenient and potentially lower-cost virtual care options.

- $0 Copays: Available for Tier 1 and Tier 2 medications at preferred pharmacies on select Part D plans.

- Walmart Pharmacy Savings: Special cost reductions for using in-network preferred Walmart pharmacies.

- Telehealth Convenience: $0 copays for telehealth visits with in-network primary care physicians on many Medicare Advantage plans.

Consideration of External Factors and Financial Guidance

Humana's pricing strategies are deeply influenced by external market dynamics, including competitor pricing, fluctuating market demand for health insurance, and broader economic conditions that impact consumer affordability. These elements are crucial in shaping how Humana positions its services and sets premiums to remain competitive and accessible.

Looking ahead to 2025, Humana projects a robust financial performance. The company has provided an initial adjusted earnings per share (EPS) outlook between $19.00 and $21.00. This forecast is underpinned by anticipated membership growth and ongoing initiatives aimed at effectively managing healthcare costs, which directly influences pricing flexibility and profitability.

- Competitor Pricing: Humana continuously monitors rival insurers' premium structures and benefit offerings.

- Market Demand: Understanding the demand for specific health plans helps tailor pricing to consumer needs.

- Economic Conditions: Inflationary pressures and employment rates affect the ability of individuals and businesses to pay for health insurance.

- 2025 EPS Outlook: The $19.00-$21.00 adjusted EPS forecast reflects confidence in growth drivers and cost management.

Humana's pricing strategy is a dynamic interplay of competitive positioning and value-based offerings, with a keen eye on affordability. For 2024, Medicare Advantage premiums varied widely, from $0 to over $100 monthly, demonstrating market segmentation. Projections for 2025 suggest average Part D prescription drug coverage premiums around $46.50 and Medicare Advantage plans near $17, indicating a tiered approach to cost.

Humana enhances its value by offering $0 copays for certain preferred pharmacy medications and telehealth visits, alongside specific discounts at preferred providers like Walmart pharmacies. This focus on reducing out-of-pocket expenses is a core component of their pricing approach.

The company's 2025 adjusted EPS outlook of $19.00 to $21.00 reflects a strategy that balances membership growth with effective cost management, which directly impacts pricing flexibility and the overall affordability of their plans.

| Key Pricing Factors (2024-2025) | Details |

| 2024 Avg. Medicare Advantage Premium Range | $0 - $100+ (regionally dependent) |

| 2025 Projected Avg. Part D Premium | ~$46.50/month |

| 2025 Projected Avg. Medicare Advantage Plan Premium | ~$17/month |

| $0 Copay Examples | Tier 1 & 2 medications at preferred pharmacies; Telehealth for in-network PCP visits |

| 2025 Adjusted EPS Outlook | $19.00 - $21.00 |

4P's Marketing Mix Analysis Data Sources

Our Humana 4P's Marketing Mix analysis leverages a comprehensive suite of data, including Humana's official financial disclosures, investor relations materials, and product information available on their corporate website. We also incorporate insights from reputable healthcare industry reports and competitive analysis to ensure a holistic view of their strategy.