Humana Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

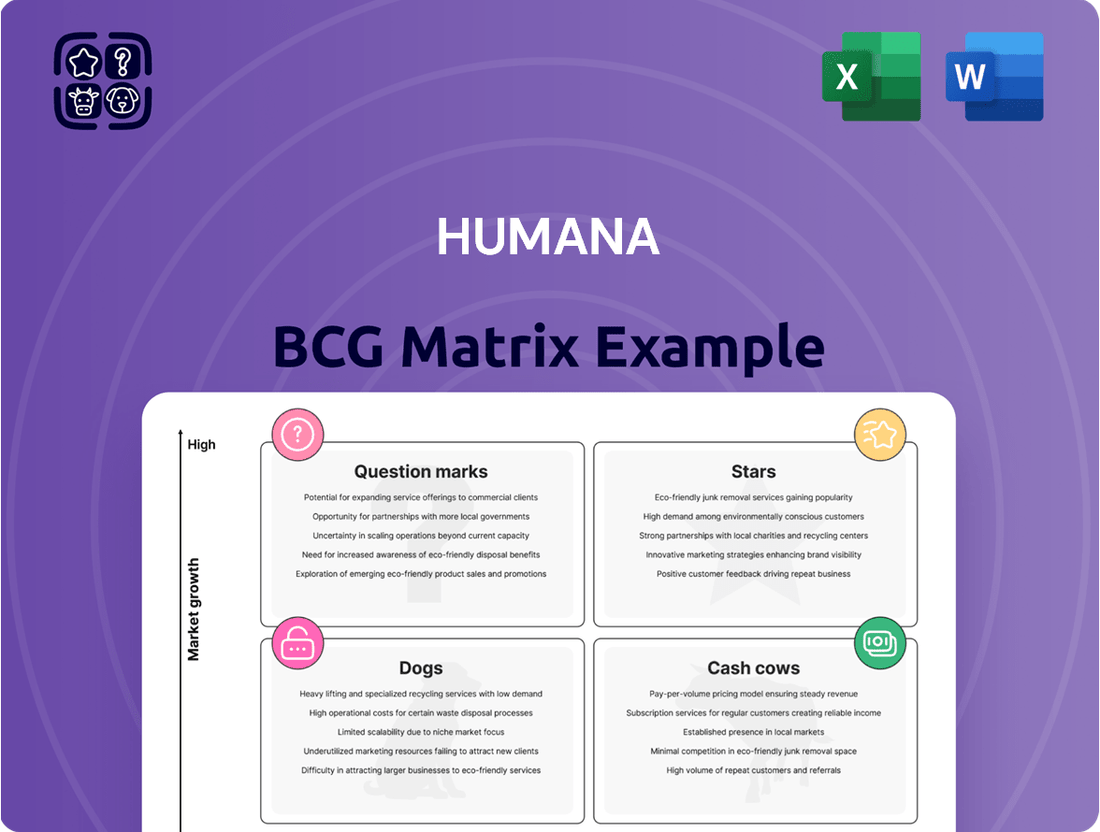

Curious about how a company's products stack up in the market? Our BCG Matrix preview highlights key areas, but the full report unlocks a comprehensive understanding of Stars, Cash Cows, Dogs, and Question Marks. Gain actionable insights and strategic direction to optimize your portfolio.

This glimpse into the BCG Matrix is just the beginning. Purchase the complete report to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and product decisions. Don't miss out on the strategic clarity you need to thrive.

Unlock the full potential of strategic analysis with our complete BCG Matrix. Beyond this overview, you'll find quadrant-by-quadrant insights and strategic takeaways that offer a shortcut to competitive clarity in today's dynamic market.

Stars

Humana is a major player in the Medicare Advantage (MA) market, currently holding the second-largest share. This sector is booming, thanks to more people becoming eligible and choosing these plans. Humana's strong position here means it's investing heavily to grow, which is typical for a Stars category business.

The company's commitment to Medicare Advantage is evident in the wide variety of plans it offers across many counties. This broad reach allows Humana to target a significant portion of the expanding MA enrollment, aiming for substantial future returns on its investments in this high-potential segment.

Humana's CenterWell and Conviva senior primary care brands are strategically expanding, with plans to launch 20-30 new centers in 2025. This aggressive growth targets key metro areas and existing states, reflecting a strong belief in the high-growth senior primary care market. The expansion is underpinned by a value-based care model, aiming to enhance patient outcomes and control healthcare expenditures.

Special Needs Plans (SNPs) are a rapidly expanding segment within Medicare Advantage. Enrollment in SNPs saw a notable increase from 2024 into 2025, reflecting a growing demand for tailored healthcare solutions. Humana is strategically focusing on this high-growth area, particularly its SNP offerings for dual-eligible individuals and those managing chronic conditions.

Humana's investment in SNPs is designed to capitalize on this demographic shift. The company is actively broadening its SNP portfolio to meet the surging demand, positioning itself to secure and enhance its market leadership in this specialized and lucrative market. This expansion is a direct response to the increasing need for coordinated care among vulnerable Medicare beneficiaries.

Integrated Care Model Development

Humana is making significant investments in its integrated care delivery model, a strategic move that encompasses pharmacy, home-based care, and clinical services. This holistic approach is designed to enhance patient health outcomes and streamline the overall healthcare journey.

This integrated care model is positioned as a high-growth area, aligning with the industry's broader shift towards value-based care and coordinated service delivery. For instance, Humana’s focus on home-based care saw a substantial increase in utilization, with a reported 15% rise in home health visits during 2023 as they expanded their capabilities.

The company is actively integrating these diverse services to create a unique market differentiator and secure a greater share of the dynamic healthcare landscape. This strategy is supported by their continued expansion of primary care centers and telehealth offerings, aiming to provide seamless, patient-centric care.

- Investment in Integrated Care: Humana is prioritizing its integrated care model, combining pharmacy, home, and clinical services.

- Industry Alignment: This model aligns with the healthcare industry's move towards value-based care and coordinated services.

- Strategic Differentiation: The integration aims to set Humana apart and capture market share in a changing environment.

- Growth Potential: The company sees significant growth opportunities in these coordinated care offerings.

Technological Advancements and Digital Health

Humana is channeling substantial resources into digital health, a move that positions its technological advancements firmly in the Stars category of the BCG Matrix. This includes significant investments in artificial intelligence, advanced data analytics, and telehealth platforms. These initiatives are designed to boost member engagement, make operations smoother, and deliver more personalized healthcare experiences.

The healthcare landscape is changing rapidly, making this focus on digital innovation crucial. Humana's commitment to these advanced solutions signals a belief in their high-growth potential. For instance, by mid-2024, telehealth utilization continued to show strong growth, with many providers reporting double-digit percentage increases in virtual visits compared to pre-pandemic levels, indicating a sustained shift in patient behavior.

These strategic investments are not just about keeping pace; they are about leading. Humana aims to improve operational efficiency, drive down costs, and offer unique services that set it apart. This proactive approach is expected to secure future market share gains. In 2023, digital health startups raised over $10 billion globally, underscoring the massive investor confidence in this sector's growth trajectory.

- AI-driven predictive analytics for early disease detection and personalized treatment plans.

- Telehealth expansion offering convenient access to care, with projections indicating continued double-digit annual growth through 2027.

- Data analytics platforms to enhance member understanding and optimize care pathways, leading to improved health outcomes.

- Digital engagement tools designed to empower members in managing their health proactively.

Humana's Medicare Advantage business, particularly its Special Needs Plans (SNPs), represents a prime example of a Star in the BCG Matrix. The significant growth in SNP enrollment from 2024 into 2025, driven by demand for tailored healthcare, positions these offerings as high-growth, high-market-share assets. Humana's strategic expansion of its SNP portfolio, especially for dual-eligible individuals and those with chronic conditions, directly addresses this burgeoning market need.

What is included in the product

The Humana BCG Matrix categorizes business units by market share and growth, guiding strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Humana BCG Matrix offers a clear, visual roadmap to strategically allocate resources, alleviating the pain of indecision regarding underperforming or overperforming business units.

Cash Cows

Humana's established Medicare Advantage (MA) portfolio, particularly its high-performing plans, functions as a significant cash cow. These mature offerings consistently generate substantial revenue and profit, underpinning the company's financial strength. For instance, in fiscal year 2023, Humana reported approximately $92.8 billion in total revenue, with its government business segment, heavily weighted towards Medicare Advantage, being a primary contributor.

CenterWell Pharmacy Services functions as a robust cash cow within Humana's business portfolio. Its consistent generation of substantial revenue and profit stems from its role as a high-volume fulfillment pharmacy.

This segment handles a wide array of medications, notably including a rising volume of limited distribution drugs, which solidifies its position as a stable, high-volume operation.

While operating in a mature market, CenterWell Pharmacy leverages Humana's extensive member base and strategic alliances. In 2023, Humana reported that its retail pharmacies, including CenterWell, filled over 100 million prescriptions, underscoring its significant contribution to the company's overall cash flow.

Humana's core insurance segment, particularly its health insurance offerings, showcases remarkable financial stability and a robust benefit ratio, a testament to its enduring market presence and operational expertise.

Despite evolving market conditions, this segment commands a significant market share across numerous geographical areas, consistently generating substantial and dependable cash flows for Humana. For example, in the first quarter of 2024, Humana reported total revenue of $29.4 billion, with its insurance segments forming a significant portion of this, demonstrating sustained revenue generation.

The inherent operational efficiencies and economies of scale achieved within this segment directly translate into healthy profit margins, solidifying its position as a foundational cash cow that underpins Humana's overall financial strength and strategic flexibility.

Medicare Prescription Drug Plans (PDPs)

Humana's Medicare Prescription Drug Plans (PDPs) are a cornerstone of its business, fitting the profile of a Cash Cow within the BCG Matrix. These plans operate in a mature market, meaning growth might be slower, but they command a significant market share and a large member base. In 2024, Humana continued to be a major player in the Medicare Part D market, offering a wide array of plans designed to meet diverse prescription needs.

The consistent revenue and strong cash flow generated by these PDPs are vital for Humana's overall financial health. This stability is underpinned by the company's expansive pharmacy network and its deep-rooted experience in serving the Medicare population. For instance, Humana's commitment to managing drug costs and providing member value through its PDP offerings has historically translated into predictable financial contributions.

- Significant Member Base: Humana's PDPs serve millions of beneficiaries, ensuring a steady stream of premiums.

- Mature Market Stability: While growth may be moderate, the established nature of Medicare Part D provides reliable revenue.

- Extensive Pharmacy Network: Humana leverages its broad network to manage costs and enhance member access to medications.

- Consistent Cash Flow: The predictable nature of these plans allows them to generate substantial and consistent cash flow for the company.

Mature Value-Based Care Arrangements

Humana's mature value-based care arrangements, especially within its existing primary care clinics, are prime examples of cash cows. These operations have become highly efficient, consistently reducing costs and generating reliable profits by focusing on preventive care and better health outcomes for patients. This strategic shift translates directly into lower medical expenses and enhanced financial returns over the long term.

These established value-based models are designed to deliver a steady cash flow. They achieve this by optimizing how care is delivered to a stable, predictable patient base. For instance, Humana reported that its value-based care revenue reached $23.4 billion in 2023, a significant portion of its total revenue, underscoring the profitability of these mature programs.

- Consistent Profit Generation: Mature value-based care models, like those in Humana's primary care clinics, are optimized for cost reduction and steady profit generation.

- Focus on Prevention: Emphasis on preventive care and improved patient health outcomes directly contributes to lower medical costs and increased financial returns.

- Stable Cash Flow: These mature arrangements provide a reliable stream of cash by efficiently managing care for a consistent patient population.

- Financial Impact: Humana's 2023 financial results highlighted the substantial contribution of value-based care, with this segment driving significant revenue and profitability.

Humana's established Medicare Advantage (MA) plans serve as significant cash cows, consistently generating substantial revenue and profit. These mature offerings benefit from a large, stable member base and a strong market presence. In fiscal year 2023, Humana's government business, dominated by MA, was a key contributor to its $92.8 billion in total revenue.

CenterWell Pharmacy Services also operates as a robust cash cow, driven by its high-volume prescription fulfillment. This segment handles a growing volume of specialized medications, reinforcing its role as a stable, high-return operation. In 2023, Humana's retail pharmacies, including CenterWell, dispensed over 100 million prescriptions, highlighting their significant cash flow contribution.

Humana's core health insurance segment, particularly its traditional health insurance products, demonstrates remarkable financial stability and consistent cash flow generation. Despite market shifts, this segment maintains a significant market share, underpinning its role as a foundational cash cow. The company's Q1 2024 revenue of $29.4 billion further illustrates the sustained financial contribution from its insurance operations.

Humana's Medicare Prescription Drug Plans (PDPs) are a prime example of cash cows, operating in a mature market with a substantial member base. These plans provide consistent revenue and strong cash flow, supported by Humana's extensive pharmacy network and experience. Humana remains a major player in the Medicare Part D market in 2024, offering diverse plans.

Humana's mature value-based care arrangements, especially within its primary care clinics, are strong cash cows. These operations are highly efficient, reducing costs and generating reliable profits through a focus on preventive care. In 2023, value-based care revenue reached $23.4 billion, showcasing the profitability of these mature programs.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Medicare Advantage (MA) Plans | Cash Cow | Mature, high market share, stable member base, consistent profitability. | Significant portion of $92.8B total revenue (Govt. segment). |

| CenterWell Pharmacy Services | Cash Cow | High-volume prescription fulfillment, growing specialized drug segment, stable revenue. | Contributes to overall revenue through >100M prescriptions filled in 2023. |

| Core Health Insurance | Cash Cow | Established market presence, significant market share, operational efficiencies, dependable cash flow. | Forms a substantial part of $29.4B Q1 2024 revenue. |

| Medicare Prescription Drug Plans (PDPs) | Cash Cow | Mature market, large member base, consistent revenue, extensive pharmacy network. | Steady, predictable financial contributions. |

| Value-Based Care Arrangements | Cash Cow | Efficient operations, cost reduction focus, preventive care emphasis, reliable profit generation. | $23.4B in 2023 revenue. |

Preview = Final Product

Humana BCG Matrix

The Humana BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document is designed to provide actionable insights into Humana's product portfolio, allowing for informed strategic decision-making without any alterations or watermarks.

Dogs

Humana's strategic exit from certain employer group commercial medical products aligns with a BCG Matrix approach, targeting underperforming segments. These divested businesses likely represented 'Dogs' – low market share and low growth areas, draining resources without significant returns. For instance, in 2023, Humana reported a decline in its employer group commercial segment's revenue, prompting such strategic realignments.

Humana's strategic rebalancing includes exiting certain Medicare Advantage plans and counties for 2025. These areas likely represent 'Dogs' in its BCG Matrix for the MA segment due to low market share or profitability issues. For instance, in 2024, Humana announced it would not renew contracts in 15 counties for its Medicare Advantage PPO plan, impacting approximately 4,000 beneficiaries. This move allows Humana to redirect resources towards stronger markets and improve overall financial performance.

Certain legacy or non-strategic health insurance product lines within Humana, particularly those experiencing declining enrollment in low-growth markets, fit the Dogs category in the BCG Matrix. These offerings often lack a significant competitive advantage and demand substantial resources for their limited market share and future prospects. Humana's strategic pivot towards government-sponsored programs like Medicare Advantage and Medicaid, along with a focus on integrated care models, further signals a de-emphasis on these older, less profitable segments.

Challenged Medicaid Contracts

Some of Humana's Medicaid contracts might be facing headwinds. This could be due to shifts in state policies, the ongoing redetermination of eligibility for beneficiaries, or rising costs per person enrolled. For instance, in 2024, several states continued their Medicaid redetermination processes, impacting enrollment numbers and contract profitability for managed care organizations.

These particular contracts, especially if they represent a smaller portion of Humana's market share within a difficult regulatory landscape, could be classified as Dogs in the BCG matrix. This means they require close attention and possibly a strategic overhaul to ensure they remain profitable or to decide on their future.

- Medicaid Contract Challenges: Humana's Medicaid business, while growing, faces potential difficulties in certain existing contracts.

- Contributing Factors: State policy changes, eligibility redeterminations, and rising per-enrollee costs are key drivers of these challenges.

- BCG Matrix Classification: Contracts with low market share in challenging environments may be categorized as Dogs, needing careful management or restructuring.

- Market Dynamics: The fluid nature of Medicaid markets means that contracts previously performing well can become problematic over time.

Inefficient Legacy Administrative Processes

Older, less efficient administrative processes and systems that consume significant resources without providing a competitive advantage can be considered 'Dogs' in terms of operational efficiency.

Humana's strategic focus on modernizing its prior authorization processes, leveraging AI and electronic systems, directly addresses the inefficiencies of previous manual or outdated methods. This modernization effort highlights the low return on investment and high operational costs associated with these legacy systems.

- Legacy systems are resource-intensive: Older administrative processes often require substantial human capital and time, diverting resources from more strategic initiatives.

- Lack of competitive advantage: These outdated systems do not offer any unique benefits or efficiencies that would differentiate Humana in the market.

- High operational costs: Manual processes and legacy technology contribute to elevated operating expenses due to errors, rework, and slower processing times.

- Investment in modernization: Humana's commitment to AI and electronic systems for prior authorization signals a move away from inefficient legacy operations to improve speed and reduce costs. For instance, by 2024, many healthcare providers are reporting significant time savings through digitized prior authorization, often exceeding 30% reduction in administrative burden.

Humana's divestment of certain employer group commercial medical products and strategic exits from specific Medicare Advantage counties highlight a clear application of the BCG Matrix, targeting 'Dogs'. These segments, characterized by low market share and growth, often drain resources. For instance, Humana's 2023 financial reports indicated a revenue dip in its employer group commercial segment, necessitating such strategic realignments. By shedding these underperforming assets, Humana can reallocate capital to more promising areas.

| Business Segment | BCG Classification (Likely) | Rationale | Relevant Data/Event |

|---|---|---|---|

| Employer Group Commercial Medical Products | Dogs | Low market share, declining revenue, reduced strategic focus. | Revenue decline in the employer group commercial segment reported in 2023. |

| Specific Medicare Advantage Counties/Plans | Dogs | Low market share, profitability challenges, or competitive disadvantages in select areas. | Non-renewal of contracts in 15 counties for Medicare Advantage PPO plan in 2025, affecting ~4,000 beneficiaries. |

| Legacy Administrative Systems | Dogs | High operational costs, inefficiency, lack of competitive advantage. | Investment in AI and electronic systems for prior authorization to replace outdated, resource-intensive processes. |

Question Marks

Humana's recent Medicaid contract expansions in Virginia, Georgia, and Texas represent significant new market opportunities. In 2024, these states are crucial for Humana as they aim to build member bases and establish profitability in areas where their presence is still nascent.

These new ventures demand considerable investment and strategic effort to gain traction and achieve financial success. The ultimate outcome remains uncertain, positioning these expansions as potential stars or question marks within Humana's portfolio, depending on their ability to capture market share and manage costs effectively.

CenterWell Senior Primary Care's expansion into Augusta and Savannah, Georgia, and Wichita, Kansas, highlights its strategic move into markets with substantial untapped potential. These new locations are positioned as Question Marks within the BCG matrix, signifying their high-growth prospects but also their nascent stage and the inherent uncertainties involved.

Initial patient volumes in these new metro areas are understandably low, reflecting the early phase of market penetration. Significant upfront capital is being deployed for essential infrastructure, talent acquisition, and brand building. For example, Humana reported in its 2024 earnings calls that investments in new market build-outs are a key focus, though specific figures for these individual expansions are not yet publicly detailed.

The success of these ventures hinges on effectively converting these investments into substantial patient growth and market share. The ability of CenterWell to capture these new markets, overcome initial hurdles, and establish a strong presence will determine whether these Question Marks evolve into Stars or remain underperforming assets.

Humana is actively investing in emerging digital health and AI applications, such as advanced data analytics for personalized care and AI-driven claims processing to streamline operations. These initiatives are positioned within high-growth technological sectors, reflecting a strategic focus on innovation. For instance, Humana reported a 15% increase in its digital health segment revenue in 2024, signaling strong early traction.

These cutting-edge solutions, including enhanced telehealth platforms and AI for predictive diagnostics, are categorized as question marks in the BCG matrix. While they represent significant future potential for improved patient outcomes and operational efficiencies, their long-term market adoption and profitability are still being established. The company anticipates these investments will drive substantial long-term value, though initial returns may be modest.

Strategic Partnerships for Innovation

Humana's strategic partnerships, like the one with Veda to enhance provider directory accuracy, are designed to tap into external expertise. These collaborations are crucial for improving operational efficiency and the member experience within an increasingly digital healthcare landscape.

These initiatives are currently in a phase where their full impact on market share and profitability is still unfolding. They represent potential future Stars in the BCG matrix, contingent on generating significant competitive advantages.

- Veda Partnership: Focuses on improving the accuracy of Humana's provider directories, a critical component for member satisfaction and network utilization.

- Digital Ecosystem Growth: These partnerships are integral to Humana's strategy of strengthening its presence and capabilities within the expanding digital health market.

- Potential for Stars: While current contributions are being assessed, successful partnerships have the potential to elevate Humana's offerings, driving growth and market leadership.

Specialty Pharmacy Limited Distribution Drug Access

CenterWell Specialty Pharmacy's recent success in securing access to 17 new limited distribution drugs places it firmly in the 'Question Mark' quadrant of the BCG Matrix. This signifies entry into a high-growth, high-value pharmaceutical segment, suggesting significant future revenue potential.

The acquisition of these drugs, often characterized by complex treatment protocols and high patient impact, positions CenterWell to capture a share of a rapidly expanding market. For instance, the specialty drug market, which includes treatments for conditions like cancer, autoimmune diseases, and rare genetic disorders, was projected to exceed $300 billion globally by 2024.

- High Growth Potential: The limited distribution model for specialty drugs inherently targets niche, high-demand therapeutic areas with significant unmet needs, driving market growth.

- Evolving Market Position: While access has been gained, building substantial market share and optimizing the complex operational requirements for these specific drugs remain key challenges.

- Investment Requirement: Significant investment in specialized infrastructure, clinical support, and patient services will be necessary to effectively manage and monetize these limited distribution drugs.

- Strategic Focus: CenterWell's strategic objective will be to convert these 'Question Marks' into 'Stars' by efficiently managing patient care and supply chains, thereby solidifying its position in this lucrative market segment.

Humana's new Medicaid expansions in Virginia, Georgia, and Texas, alongside CenterWell Senior Primary Care's entry into Augusta, Savannah, and Wichita, are prime examples of Question Marks. These initiatives require substantial investment and face market uncertainties, but they hold high growth potential if successful.

Similarly, Humana's digital health and AI investments, including advanced data analytics and AI-driven claims processing, are also categorized as Question Marks. While showing early traction, as evidenced by a 15% increase in digital health segment revenue in 2024, their long-term market adoption and profitability are still being established.

CenterWell Specialty Pharmacy's acquisition of access to 17 new limited distribution drugs places it in this quadrant, targeting a high-growth specialty drug market projected to exceed $300 billion globally by 2024. Success hinges on converting these investments into market share and profitability.

| Initiative | BCG Quadrant | Key Characteristics | 2024 Data/Outlook |

|---|---|---|---|

| Medicaid Expansions (VA, GA, TX) | Question Mark | High growth potential, nascent presence, requires significant investment, uncertain outcomes | Crucial for building member base and establishing profitability in new markets. |

| CenterWell Senior Primary Care Expansion (Augusta, Savannah, Wichita) | Question Mark | Untapped market potential, high growth prospects, early stage, inherent uncertainties | Initial patient volumes are low; significant upfront capital deployed for infrastructure and talent. |

| Digital Health & AI Investments | Question Mark | High-growth technological sectors, significant future potential, market adoption still evolving | Reported 15% increase in digital health segment revenue in 2024; initial returns may be modest. |

| CenterWell Specialty Pharmacy (Limited Distribution Drugs) | Question Mark | High-growth, high-value segment, complex protocols, significant future revenue potential | Secured access to 17 new drugs; specialty drug market projected to exceed $300 billion globally by 2024. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.