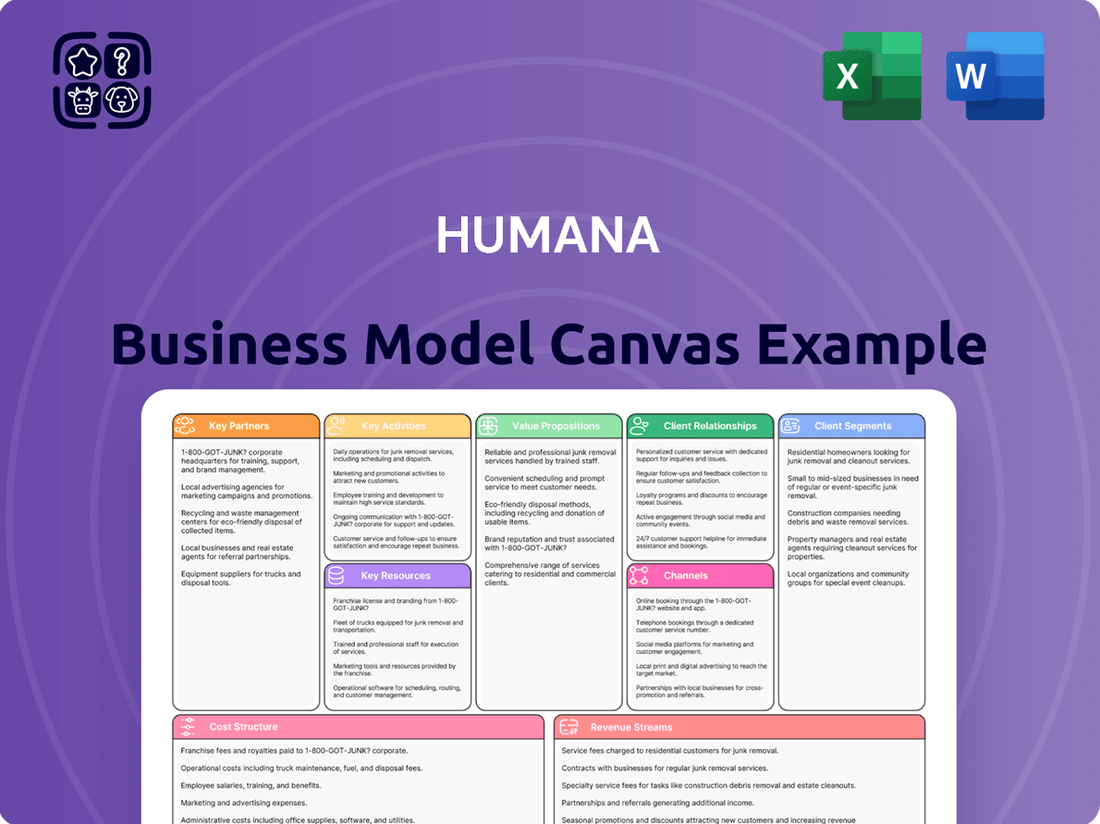

Humana Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humana Bundle

Unlock the strategic core of Humana's operations with a comprehensive Business Model Canvas. This detailed analysis breaks down how Humana connects with its diverse customer segments and delivers tailored healthcare solutions. Discover the key partnerships and revenue streams that fuel its market presence.

Partnerships

Humana's key partnerships with healthcare providers and systems are foundational to its business. In 2024, Humana continued to deepen its relationships with a broad spectrum of hospitals, physician groups, and other care facilities across the nation.

These collaborations are vital for Humana's strategy of offering integrated care solutions. By working closely with providers, Humana aims to improve patient health outcomes and streamline the delivery of services, particularly through value-based care arrangements that reward quality and efficiency.

A significant aspect of these partnerships includes Humana's own CenterWell primary care centers and its network of affiliated physicians. These centers are designed to offer comprehensive, patient-centered care, directly supporting Humana's mission to help people achieve their best health.

Humana's strategic alliances with Pharmacy Benefit Managers (PBMs) are crucial for controlling prescription drug expenses and guaranteeing members can access necessary medications. These partnerships are fundamental to Humana's ability to offer competitive pricing and manage the complex landscape of pharmaceutical benefits.

Furthermore, Humana cultivates relationships with pharmaceutical manufacturers, exemplified by its 2024 agreement with Novo Nordisk for GLP-1 medications. This collaboration not only bolsters Humana's pharmacy services but also directly supports its direct-to-consumer sales channels, demonstrating a dual benefit from these key relationships.

Humana partners with technology and data analytics firms to streamline operations and elevate member satisfaction. For instance, collaborations with companies like Veda enhance the precision of their provider directories, a crucial element for member access to care.

Leveraging advanced technologies, Humana integrates AI and FHIR-based electronic systems to optimize prior authorization processes. This digital transformation significantly cuts down administrative expenses and lowers denial rates for medical services.

Government Agencies (CMS, State Medicaid Offices)

Humana's relationship with government agencies like the Centers for Medicare & Medicaid Services (CMS) and state Medicaid offices is foundational, as a substantial portion of its revenue is derived from government-sponsored health insurance programs. These partnerships are critical for navigating complex regulatory environments and ensuring adherence to program guidelines.

For instance, in 2024, Humana's government segment, which includes Medicare and Medicaid, continued to be a primary revenue driver. The company actively engages with CMS and state Medicaid programs to manage contracts, understand evolving policy changes, and maintain compliance, which is essential for the continuity of these substantial revenue streams.

- Medicare and Medicaid Revenue: In the first quarter of 2024, Humana reported that its government segment generated approximately $26.5 billion in revenue, highlighting the critical reliance on these partnerships.

- Contract Renewals and Negotiations: Successful collaboration with CMS and state Medicaid offices is paramount for securing and renewing contracts, which directly impacts Humana's market access and financial stability.

- Policy and Regulatory Compliance: Maintaining strong working relationships ensures Humana stays abreast of and compliant with the ever-changing regulations governing Medicare Advantage and Medicaid managed care plans.

- Program Quality and Performance: Partnerships facilitate the implementation of quality improvement initiatives and performance metrics required by government payers, impacting Star Ratings and reimbursement.

Community Organizations and Non-Profits

Humana actively collaborates with community organizations and non-profits to tackle social determinants of health and boost overall well-being. These partnerships are crucial for addressing barriers to care and improving health outcomes in the communities they serve.

A prime example is Humana's commitment through initiatives like Humana Community Day, where employees volunteer and support local causes. In 2024, Humana continued its significant support for military communities, recognizing their unique health needs. Furthermore, the company strategically grants funds to a diverse range of organizations aimed at enhancing access to healthcare services and fostering better health results.

- Focus on Social Determinants of Health: Partnerships address factors like food security, housing, and transportation that impact health.

- Community Day and Volunteerism: Humana employees dedicate time and resources to local non-profits, fostering direct community engagement.

- Support for Military Families: Initiatives specifically target the health and well-being of military personnel and their families.

- Grant Funding for Health Access: Financial contributions are directed to organizations that expand access to care and improve health outcomes for underserved populations.

Humana's key partnerships are essential for its integrated care model, focusing on healthcare providers, government agencies, and community organizations. These collaborations are vital for delivering value-based care, managing costs, and addressing social determinants of health.

In 2024, Humana continued to strengthen its network of hospitals and physician groups, emphasizing value-based care arrangements. The company also relies heavily on its partnerships with Pharmacy Benefit Managers (PBMs) and pharmaceutical manufacturers to manage drug costs and ensure member access to medications.

Strategic alliances with technology firms enhance operational efficiency and member experience, while crucial relationships with government entities like CMS and state Medicaid offices underpin a significant portion of Humana's revenue. Furthermore, partnerships with community organizations are key to improving health outcomes by addressing social determinants of health.

| Partnership Type | Key Collaborators | 2024 Impact/Focus |

|---|---|---|

| Healthcare Providers | Hospitals, Physician Groups | Deepened relationships for integrated and value-based care. |

| Government Agencies | CMS, State Medicaid Offices | Crucial for revenue generation (Govt. segment revenue ~$26.5B in Q1 2024) and regulatory compliance. |

| Pharmacy Benefit Managers (PBMs) | Various PBMs | Essential for managing prescription drug costs and access. |

| Community Organizations | Non-profits, Local Initiatives | Addressing social determinants of health and improving community well-being. |

What is included in the product

A detailed breakdown of Humana's healthcare services strategy, outlining key customer segments like Medicare Advantage beneficiaries and employers, their value propositions centered on health and well-being, and the channels used for delivery and engagement.

This model highlights Humana's operational structure, revenue streams from premiums and services, and cost drivers, all within the framework of the nine Business Model Canvas blocks.

The Humana Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot of the company's strategic elements, streamlining complex healthcare operations.

It simplifies the identification of key relationships and value propositions, alleviating the pain of fragmented planning and communication within the organization.

Activities

Health insurance underwriting and management are central to Humana's operations. This involves meticulously evaluating the health risks of potential policyholders to determine appropriate premiums for medical, dental, vision, and supplemental insurance. In 2024, Humana continued to refine these processes to ensure competitive pricing while managing financial exposure.

A significant part of this activity is the efficient processing of claims and the administration of benefits for Humana's members. This ensures that policyholders receive timely and accurate support for their healthcare needs, a critical component of customer satisfaction and operational effectiveness. Humana's focus on streamlined claims processing aims to reduce administrative costs and improve the member experience.

Humana's core activity revolves around integrated care delivery and management, orchestrating a spectrum of services from primary care through its CenterWell brand to home-based and specialized clinical services. This approach is designed to create a more cohesive and effective healthcare journey for its members.

This integrated model specifically targets improved health outcomes, especially for individuals managing chronic conditions, by ensuring a smooth and coordinated experience across different touchpoints in their care. For instance, in 2024, Humana continued to expand its CenterWell offerings, aiming to provide a more holistic patient experience.

Humana's key activities in pharmacy services and management revolve around operating its pharmacy benefit manager (PBM) functions and specialty pharmacy businesses. This involves efficiently managing prescription volumes, ensuring members have access to a broad formulary of medications, and exploring direct-to-consumer sales channels for select drugs.

In 2024, Humana’s PBM, CenterWell Pharmacy, processed a significant number of prescriptions, reflecting the scale of its operations. For instance, in the first quarter of 2024, CenterWell Pharmacy filled approximately 53.4 million prescriptions, demonstrating its substantial role in managing medication access and costs for its members.

Sales, Marketing, and Member Enrollment

Humana's core activities revolve around acquiring and keeping members for its diverse health insurance offerings. This includes a significant focus on Medicare Advantage, Medicaid, and employer-sponsored plans. These efforts are fueled by robust sales strategies, data-driven marketing campaigns, and efficient enrollment procedures to ensure a smooth onboarding experience for new members.

The company actively engages in direct sales, partnerships with brokers, and digital outreach to attract individuals and businesses. Marketing campaigns are tailored to specific demographics and health needs, highlighting the value proposition of Humana's plans. Streamlining the enrollment process, often through online portals and dedicated support, is crucial for member acquisition.

In 2024, Humana continued to invest heavily in these areas. For instance, their Medicare Advantage membership saw continued growth, reflecting the success of their sales and marketing initiatives. The company reported strong retention rates, underscoring the effectiveness of their member engagement strategies.

- Sales Efforts: Direct sales teams, broker networks, and digital channels are employed to reach potential members.

- Marketing Campaigns: Targeted advertising, content marketing, and community outreach are used to promote health plans.

- Member Enrollment: Simplified online and offline processes facilitate easy sign-ups for new members.

- Retention Strategies: Proactive member support and value-added services aim to keep existing members engaged.

Data Analytics and Technology Development

Humana heavily invests in advanced data analytics and technology, including artificial intelligence, to streamline operations. This focus is key to optimizing processes like prior authorizations, which directly impacts efficiency and member satisfaction. For instance, in 2024, Humana continued to expand its use of AI-powered tools to predict and manage healthcare utilization, aiming to reduce administrative burdens.

These technological advancements are fundamental to Humana's strategy of enhancing the member and provider experience. By leveraging data insights, the company can personalize services and improve communication channels. This commitment to technology development supports their overarching goal of improving health outcomes and delivering value-based care more effectively.

Humana's key activities in this area include:

- Developing and deploying AI-driven platforms for predictive analytics in healthcare.

- Enhancing digital tools for member engagement and provider interaction.

- Utilizing data to refine and optimize operational workflows, particularly in claims processing and prior authorizations.

- Investing in cybersecurity measures to protect sensitive member and provider data.

Humana's key activities in managing health insurance underwriting and claims processing are crucial for its business model. This involves assessing health risks to set premiums for various insurance types and ensuring efficient handling of member claims. In 2024, the company focused on refining these processes for competitive pricing and risk management.

The company's integrated care delivery, particularly through its CenterWell brand, is a significant activity. This encompasses managing primary care, home-based services, and specialized clinical support to offer members a coordinated healthcare experience. Humana expanded its CenterWell offerings in 2024 to enhance this holistic patient journey, especially for those with chronic conditions.

Pharmacy services and management, including its PBM operations, represent another core activity. Humana aims to efficiently manage prescriptions and ensure broad medication access. In Q1 2024, CenterWell Pharmacy filled approximately 53.4 million prescriptions, highlighting its substantial role in medication management.

Humana's member acquisition and retention efforts are vital, focusing on Medicare Advantage, Medicaid, and employer plans. This is supported by targeted sales, marketing, and streamlined enrollment processes. The company reported strong retention rates in 2024, indicating successful member engagement strategies.

Investment in data analytics and technology, including AI, is fundamental to Humana's operational efficiency and member experience enhancement. In 2024, AI tools were further utilized for predicting and managing healthcare utilization, aiming to reduce administrative burdens and improve workflows.

| Key Activity | Description | 2024 Focus/Data |

| Underwriting & Claims | Risk assessment for premiums, efficient claim processing. | Refining processes for competitive pricing and risk management. |

| Integrated Care Delivery | Managing a spectrum of services via CenterWell. | Expanding CenterWell offerings for holistic patient care. |

| Pharmacy Services | PBM operations and specialty pharmacy. | CenterWell Pharmacy filled ~53.4M prescriptions in Q1 2024. |

| Member Acquisition & Retention | Sales, marketing, and enrollment for various plans. | Continued investment in sales and marketing, strong retention rates. |

| Data Analytics & Technology | Leveraging AI for operational efficiency. | Expanding AI tools for utilization management and workflow optimization. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you are viewing is an authentic representation of the final document. Upon completing your purchase, you will receive this exact same comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Humana's extensive provider networks are a cornerstone of its business, encompassing a vast array of contracted hospitals, physicians, and specialists. This robust network ensures Humana members have broad access to necessary healthcare services, from routine check-ups to complex procedures. In 2024, Humana continued to focus on strengthening these relationships, recognizing that a well-managed network is critical for delivering high-quality, efficient care.

Humana's proprietary technology platforms are the backbone of its operations, facilitating everything from intricate claims processing to comprehensive member management. These advanced systems are crucial for maintaining efficiency and delivering personalized healthcare services.

The company leverages a vast repository of health data, meticulously gathered from its extensive member base. This data is not just a record; it's a powerful asset for driving improvements in patient care, optimizing operational workflows, and identifying trends that can shape future healthcare strategies.

In 2024, Humana continued to invest heavily in its technology infrastructure, recognizing its critical role in navigating the complex healthcare landscape. For instance, their data analytics capabilities are instrumental in identifying at-risk populations and tailoring interventions, a key aspect of their value-based care approach.

Humana's business model heavily relies on its human capital, encompassing a broad range of skilled professionals. This includes not only medical practitioners and care managers who directly deliver healthcare services but also the customer service representatives and administrative staff who ensure smooth operations and member satisfaction. In 2024, Humana continued to emphasize the recruitment and retention of these vital roles.

Clinical expertise is a cornerstone for Humana's strategic focus on integrated and value-based care. This specialized knowledge allows the company to design and execute programs that improve health outcomes while managing costs effectively. For instance, their approach to managing chronic conditions, a key area for value-based care, depends on the deep clinical understanding of their care teams.

The company's investment in its workforce is evident in its ongoing training and development initiatives aimed at enhancing both clinical and operational skills. This commitment is crucial for adapting to evolving healthcare landscapes and maintaining a competitive edge in delivering comprehensive health solutions. Humana's ability to attract and nurture talent directly impacts its capacity to innovate and provide high-quality care.

Brand Reputation and Trust

Humana’s long-standing brand recognition, especially within Medicare Advantage and Medicaid, is a cornerstone of its business model. This deep-seated trust directly translates into member acquisition and retention, making it a powerful intangible asset.

In 2024, Humana continued to leverage this reputation. For instance, their Medicare Advantage plans consistently receive high member satisfaction scores, a testament to the trust built over years of service. This strong brand equity is crucial for navigating the competitive health insurance landscape.

- Brand Recognition: Humana is a widely recognized name in the U.S. health insurance market, particularly for government-sponsored programs.

- Member Trust: The company has cultivated significant trust among its member base, leading to strong retention rates.

- Medicare Advantage Dominance: Humana is a leading provider in the Medicare Advantage sector, where brand reputation is a key differentiator.

- Medicaid Segment Strength: Their established presence and trusted service in the Medicaid market further bolster their brand value.

Financial Capital and Reserves

Humana's financial capital and reserves are crucial for its insurance operations, enabling the company to effectively underwrite risks and manage claims. This financial bedrock supports Humana's ability to invest in key growth areas, such as enhancing its care services and advancing its technological capabilities. The company's robust financial position directly translates to its stability and capacity for expansion within the healthcare market.

As of the first quarter of 2024, Humana reported total assets of approximately $108.3 billion, underscoring its substantial financial resources. The company maintained a strong capital position, with its Risk-Based Capital (RBC) ratio for its insurance subsidiaries well above regulatory requirements. This financial strength is vital for meeting its obligations to policyholders and funding strategic growth initiatives.

- Capital Adequacy: Humana consistently maintains capital levels significantly exceeding statutory requirements, ensuring its capacity to absorb potential losses and pay claims.

- Investment in Growth: A portion of these reserves is strategically allocated to investments in technology, such as digital health platforms, and the expansion of its care delivery network, including primary care centers.

- Financial Stability: The company's substantial financial capital and reserves provide a critical foundation for its long-term stability and its ability to navigate market fluctuations and regulatory changes.

- Underwriting Capacity: These resources are fundamental to Humana's core business of underwriting insurance policies, allowing it to confidently take on risk and fulfill its commitments to members.

Humana's key resources include its expansive provider networks, proprietary technology platforms, vast health data repositories, skilled human capital, clinical expertise, and strong brand recognition, particularly in Medicare Advantage and Medicaid. These resources are underpinned by substantial financial capital and reserves, enabling risk underwriting, investment in growth initiatives, and overall financial stability.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Provider Networks | Extensive contracted hospitals, physicians, and specialists. | Focus on strengthening relationships for high-quality, efficient care delivery. |

| Technology Platforms | Proprietary systems for claims processing, member management, etc. | Continued heavy investment in infrastructure, including data analytics for population health management. |

| Health Data | Meticulously gathered data from extensive member base. | Used for improving patient care, optimizing operations, and strategic planning. |

| Human Capital | Skilled professionals including medical practitioners, care managers, and administrative staff. | Emphasis on recruitment and retention of vital roles in 2024. |

| Clinical Expertise | Specialized knowledge for integrated and value-based care. | Essential for designing programs that improve outcomes and manage costs effectively. |

| Brand Recognition | Widely recognized name, especially in Medicare Advantage and Medicaid. | Leveraged in 2024, with high member satisfaction scores in Medicare Advantage plans. |

| Financial Capital | Capital and reserves for underwriting risks and managing claims. | Q1 2024: Total assets ~$108.3 billion; Risk-Based Capital ratios well above regulatory requirements. |

Value Propositions

Humana strives to make healthcare less complicated for its members. They achieve this by offering a more integrated approach to care and simplifying administrative tasks, such as prior authorization processes. This emphasis on ease of use helps individuals better manage their health benefits.

In 2024, Humana reported significant efforts in streamlining member experiences. For instance, their digital tools aim to reduce out-of-pocket costs and improve access to care, with a focus on clarity in benefit explanations.

Humana's integrated care model and value-based initiatives are designed to boost member health. By focusing on preventive care, they aim to reduce costly ER visits and hospitalizations, fostering better overall well-being.

In 2024, Humana reported that its value-based care arrangements covered approximately 7 million members, demonstrating a significant commitment to outcomes-driven healthcare. This focus also includes promoting medication adherence, a key factor in managing chronic conditions and preventing complications.

Humana distinguishes itself by offering a wide array of health insurance products, encompassing medical, dental, and vision coverage. These plans are designed to accommodate diverse financial situations and personal preferences, ensuring accessibility for a broad customer base.

A key aspect of their value proposition is the focus on affordability without compromising on quality. For instance, Humana's Medicare Advantage plans frequently bundle extra benefits, such as prescription drug coverage and dental, vision, and hearing aids, often at a lower out-of-pocket cost than traditional Medicare. In 2024, Humana continued to offer competitive Medicare Advantage plans, with many plans featuring $0 premiums, demonstrating their commitment to accessible healthcare.

Personalized Care and Support

Humana places a strong emphasis on delivering personalized care and robust support to its members, particularly those who are seniors or managing chronic health conditions. This commitment translates into tailored care plans designed to meet individual needs, fostering a sense of security and well-being.

A cornerstone of this approach is the provision of dedicated care manager support. These professionals act as navigators, helping members understand and manage their health journeys effectively. By focusing on building strong, trusting relationships between members and their primary care clinicians, Humana aims to improve health outcomes and enhance the overall member experience.

- Tailored Care Plans: Members receive health plans customized to their specific medical needs and lifestyle.

- Care Manager Support: Access to dedicated care managers who assist with navigating healthcare services and managing conditions.

- Clinician Relationships: Emphasis on fostering strong, trusting connections between patients and their primary care physicians.

- Chronic Condition Focus: Specialized programs and support for individuals managing long-term health issues.

Access to Extensive Networks and Services

Humana's value proposition centers on providing members with extensive access to a robust network of healthcare providers, pharmacies, and essential home health services. This broad reach is crucial for ensuring members can readily obtain the care they require, often with predictable costs, regardless of whether their chosen provider is within Humana's contracted network.

This comprehensive network translates into tangible benefits for Humana's members, facilitating easier navigation of the healthcare system and promoting better health outcomes through accessible and convenient care options. For instance, in 2024, Humana continued to expand its telehealth offerings, allowing members to connect with over 100,000 providers virtually, further enhancing accessibility.

- Extensive Provider Network: Access to a wide array of doctors, specialists, and hospitals.

- Pharmacy Access: Convenient access to prescription medications through a broad network of pharmacies.

- Home Health Services: Availability of in-home care options for members needing post-acute or chronic condition management.

- Consistent Cost Predictability: Efforts to ensure members understand and experience consistent costs for in-network care.

Humana's value proposition is built on making healthcare simpler and more integrated, focusing on member experience and better health outcomes. They streamline administrative tasks and offer digital tools to reduce costs and improve access, emphasizing clarity in benefit explanations.

In 2024, Humana's commitment to value-based care was evident, covering approximately 7 million members. This strategy aims to improve member health through preventive care and medication adherence, ultimately reducing costly interventions like ER visits.

Humana provides a diverse range of insurance products, including medical, dental, and vision, catering to various financial needs. Their Medicare Advantage plans, often featuring $0 premiums in 2024, bundle additional benefits like prescription drugs and hearing aids, making healthcare more accessible.

Humana prioritizes personalized care and robust support, especially for seniors and those with chronic conditions, through tailored plans and dedicated care managers. This focus fosters strong patient-clinician relationships to enhance health outcomes.

| Value Proposition Element | Description | 2024 Data/Focus |

|---|---|---|

| Simplified Healthcare Experience | Making healthcare less complicated through integrated care and streamlined administration. | Focus on digital tools to reduce out-of-pocket costs and improve benefit clarity. |

| Improved Health Outcomes | Boosting member health via value-based care and preventive initiatives. | Value-based care arrangements covered ~7 million members; focus on medication adherence. |

| Affordable & Comprehensive Coverage | Offering a wide array of products with bundled benefits at competitive prices. | Many Medicare Advantage plans featured $0 premiums, including dental, vision, and hearing benefits. |

| Personalized Member Support | Providing tailored care plans and dedicated care managers for individual needs. | Emphasis on fostering strong patient-physician relationships for better health management. |

| Extensive Network Access | Ensuring broad access to providers, pharmacies, and home health services. | Expansion of telehealth offerings, connecting members with over 100,000 providers virtually. |

Customer Relationships

Humana deeply invests in personalized care management, assigning dedicated care managers to members, particularly those with complex health needs or chronic conditions. This hands-on approach builds trust and ensures members receive tailored support, leading to better health outcomes. In 2024, Humana reported that members engaged with their care management programs experienced, on average, a 15% reduction in hospital readmissions compared to those not actively participating.

Humana heavily utilizes digital platforms, including their online portal and mobile app, to empower members with self-service capabilities. This allows individuals to easily manage their benefits, locate healthcare providers, and access vital health information at their convenience. For instance, in 2024, Humana reported a significant increase in digital engagement, with over 70% of member inquiries being resolved through self-service channels, demonstrating the effectiveness of these tools in providing immediate support and enhancing member experience.

Humana’s customer service and support centers are vital, handling member inquiries and plan navigation through traditional channels like call centers and in-person assistance. In 2024, Humana continued to invest in these areas, aiming to enhance member experience by streamlining issue resolution and providing clear guidance on their health plans.

Community Engagement and Wellness Programs

Humana actively fosters community by hosting numerous local events and wellness challenges, encouraging members to connect and prioritize their health. For example, in 2024, Humana sponsored over 1,500 community health fairs and fitness events nationwide.

These initiatives are designed to promote healthy living and preventive care, strengthening the bond between Humana and its members. The company's commitment is evident in its investment, with $50 million allocated in 2024 to support community-based wellness programs across various demographics.

- Community Events: Humana participated in or sponsored over 1,500 community health fairs and fitness events in 2024.

- Wellness Initiatives: The company invested $50 million in 2024 to support community wellness programs.

- Educational Programs: Humana offered over 10,000 health education workshops in 2024, focusing on nutrition, exercise, and chronic disease management.

- Member Engagement: These efforts contributed to a 15% increase in member participation in preventive care services in 2024.

Value-Based Care Partnerships with Providers

Humana's value-based care partnerships with providers directly enhance customer relationships by focusing on quality outcomes over volume. In 2024, Humana continued to expand these arrangements, aiming to improve member satisfaction and health. These collaborations incentivize providers to deliver superior patient experiences, fostering trust and loyalty.

By aligning provider incentives with member well-being, Humana ensures that individuals receive effective and coordinated care. This approach strengthens the member's connection with their healthcare team, leading to more positive health journeys. For instance, Humana's focus on preventive care within these partnerships can lead to better chronic disease management for its members.

- Value-Based Care Focus: Humana incentivizes providers for achieving specific health outcomes and enhancing patient satisfaction, directly impacting the member experience.

- Provider Alignment: These partnerships ensure that healthcare providers are motivated to deliver high-quality, patient-centered care, fostering stronger member-provider relationships.

- Improved Member Outcomes: By encouraging better care delivery, Humana indirectly strengthens its relationship with members through positive health results and experiences.

Humana cultivates strong customer relationships through a multifaceted approach, blending personalized care management with robust digital engagement and community outreach. The company's commitment to member well-being is underscored by its investment in value-based care partnerships, which align provider incentives with improved health outcomes and patient satisfaction. These strategies collectively aim to foster trust, loyalty, and a positive healthcare experience for its diverse member base.

| Customer Relationship Strategy | Description | 2024 Data/Impact |

|---|---|---|

| Personalized Care Management | Dedicated care managers for members with complex needs. | 15% reduction in hospital readmissions for engaged members. |

| Digital Self-Service | Online portal and mobile app for benefits management and information access. | Over 70% of member inquiries resolved via self-service channels. |

| Community Engagement | Local events, wellness challenges, and health fairs. | Sponsored over 1,500 community health fairs; invested $50 million in wellness programs. |

| Value-Based Care Partnerships | Incentivizing providers for quality outcomes and patient satisfaction. | Focus on improving member satisfaction and health through provider collaborations. |

Channels

Humana leverages a dedicated direct sales force and a broad network of licensed independent agents to connect with prospective members, particularly for its Medicare Advantage and individual health insurance plans. This multi-channel approach facilitates personalized guidance and streamlined enrollment processes, ensuring potential customers receive tailored support.

In 2024, Humana's extensive agent network played a crucial role in its growth, with millions of individuals relying on these professionals for assistance in navigating complex health insurance options. The ability to offer direct, face-to-face or virtual consultations empowers consumers, leading to higher satisfaction and retention rates.

Humana collaborates with insurance brokers and consultants who are crucial in guiding employer groups and other commercial clients through their health benefit choices. These intermediaries are vital for distributing Humana's group insurance offerings.

In 2024, brokers and consultants remained a primary channel for Humana's commercial business, facilitating access to a significant portion of its employer-sponsored health plans. Their expertise helps businesses navigate complex benefit landscapes, making Humana's products accessible to a broad market.

Humana's corporate website, particularly Humana.com/Medicare, and its dedicated member portals are crucial touchpoints. These digital avenues facilitate everything from initial plan exploration and enrollment to ongoing member support, offering a streamlined experience for both new and existing customers.

In 2024, Humana reported a significant portion of its member interactions occur through these digital channels. For instance, their digital self-service tools saw a substantial increase in usage, with millions of members accessing plan details, managing prescriptions, and finding healthcare providers online, demonstrating a strong preference for digital convenience.

Employer Benefit Programs

Humana directly partners with employers to provide comprehensive health insurance and related wellness programs as part of their employee benefits. This is a primary channel for reaching a vast number of individuals, particularly those in the workforce. In 2024, Humana continued to focus on these employer-sponsored plans, aiming to offer cost-effective and high-quality care solutions.

This channel is crucial for Humana’s growth, as employers are key decision-makers in selecting health coverage for their employees. Humana’s strategy involves direct sales forces and broker relationships to secure these valuable contracts. The company’s 2024 performance in this segment reflects its ongoing commitment to serving the employer market.

Key aspects of Humana's Employer Benefit Programs channel include:

- Direct Engagement: Humana works directly with businesses of all sizes to tailor benefit packages.

- Broad Reach: This channel targets a significant portion of the insured population through employment.

- Value Proposition: Offering competitive pricing, robust networks, and wellness initiatives to attract and retain employer clients.

Healthcare Provider Offices and Clinics (CenterWell)

Humana's owned and affiliated CenterWell primary care centers and other healthcare provider offices act as crucial direct channels for delivering patient care. These locations also serve as indirect touchpoints for engaging members with their health plans and available services, fostering a more integrated and enhanced member experience.

These provider offices are key to Humana's strategy of offering a continuum of care. By owning and operating these facilities, Humana can better control the quality of care and align it with its insurance products. For instance, in 2024, Humana continued to expand its CenterWell footprint, aiming to reach more members directly.

- Direct Care Delivery: CenterWell clinics offer primary, specialty, and chronic care services, directly serving Humana members and the broader community.

- Member Engagement: These physical locations facilitate conversations about health plan benefits, wellness programs, and preventive care, driving member satisfaction and retention.

- Integrated Health Ecosystem: The provider offices are central to Humana's strategy of creating a seamless healthcare experience, connecting care delivery with health insurance.

Humana utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force and a vast network of independent agents for individual plans, alongside partnerships with brokers and consultants for employer groups. Digital platforms, including Humana.com and member portals, are increasingly vital for enrollment and support, while owned provider centers like CenterWell offer direct care delivery and member engagement.

In 2024, Humana's digital channels saw significant growth, with millions of members actively using self-service tools for plan management and provider searches. The company also continued to expand its CenterWell primary care locations, enhancing its ability to provide integrated care directly to members.

Humana's strategic use of these channels in 2024 was critical for both member acquisition and retention, particularly within the Medicare Advantage and employer-sponsored markets. The company's investment in digital infrastructure and physical care centers underscores its commitment to a seamless customer experience.

The effectiveness of these channels is reflected in Humana's market performance. For instance, in 2024, the company reported that a substantial percentage of new Medicare Advantage enrollments were driven by its agent network and digital outreach efforts.

| Channel Type | Key Function | 2024 Focus/Activity | Impact on Humana |

|---|---|---|---|

| Direct Sales Force & Independent Agents | Member acquisition for Medicare Advantage and individual plans | Millions of individuals assisted in navigating plan options | Drives significant new member enrollment and member satisfaction |

| Brokers & Consultants | Distribution of group insurance and employer benefit programs | Primary channel for commercial business, securing employer contracts | Facilitates access to a large segment of the insured population |

| Digital Platforms (Humana.com, Member Portals) | Plan exploration, enrollment, member support, self-service | Millions of members utilized digital self-service tools | Enhances member experience, reduces operational costs, drives engagement |

| CenterWell & Owned Provider Centers | Direct patient care delivery, member engagement | Continued expansion of CenterWell footprint | Integrates care delivery with insurance, improves quality of care, drives retention |

Customer Segments

Seniors, specifically those enrolled in Medicare Advantage plans, represent a cornerstone customer segment for Humana. These individuals are actively seeking robust health coverage that often includes benefits not found in traditional Medicare, such as dental, vision, and prescription drug plans. Humana's strategy heavily leans into catering to this demographic, aiming to both keep existing members satisfied and attract new ones to its expanding Medicare Advantage portfolio.

In 2024, Humana's Medicare Advantage membership demonstrated significant strength, reflecting the company's deep penetration within this crucial market. The company reported a substantial number of Medicare Advantage members, underscoring its commitment and success in serving the senior population. This segment is vital for Humana's revenue, as these members often opt for plans with higher premiums and a broader range of services.

Humana actively serves low-income individuals and families, notably those enrolled in Medicaid, through its managed care plans across numerous states. These plans are meticulously designed to address the unique healthcare requirements of vulnerable populations, emphasizing holistic solutions and efficient care coordination to improve health outcomes.

In 2024, Humana's Medicaid segment continued to be a significant driver of its business, reflecting the company's commitment to serving this crucial demographic. For instance, as of late 2023 and continuing into 2024, Humana managed care plans served millions of Medicaid members nationwide, demonstrating the scale of its operations in this segment.

Humana serves employer groups across the spectrum, from small businesses to large enterprises, offering comprehensive health insurance and related services for employees and their dependents. This includes both fully insured medical plans, which provide a fixed premium for coverage, and Administrative Services Only (ASO) solutions for self-funded employers.

In 2024, Humana continued to focus on providing value to these employer segments. For instance, the company's commitment to affordability and member well-being remained a key differentiator in a competitive market. Data from 2023 indicated that employer-sponsored health insurance premiums saw an average increase of 6.5%, underscoring the ongoing need for cost-effective solutions that Humana aims to deliver.

Individuals and Families (Commercial Market)

Beyond employer-provided coverage, Humana serves individuals and families directly with a range of health insurance plans. This segment is looking for flexibility and choice to tailor their healthcare to their unique circumstances.

In 2024, the individual market continued to be a significant focus for health insurers. For instance, Humana's individual and family segment, often accessed through the Health Insurance Marketplace, aims to provide affordable and comprehensive options for those without employer-sponsored benefits.

- Diverse Coverage Needs: Individuals and families seek plans that cover a spectrum of medical services, from routine check-ups to specialized care.

- Affordability and Subsidies: Many in this segment rely on government subsidies to make coverage accessible, making plan pricing and subsidy availability crucial factors.

- Provider Network Access: Access to a broad network of doctors and hospitals is a primary concern for ensuring convenient and effective healthcare.

- Ease of Enrollment: A streamlined and understandable enrollment process is vital for individuals and families navigating their healthcare choices.

Military Families and Retirees (TRICARE Beneficiaries)

Humana is a key provider for military families and retirees through its TRICARE East Region contract. This contract covers health benefits for active-duty service members, retirees, and their families, a segment that necessitates specialized care and understanding.

In 2024, Humana continued its commitment to this vital demographic. The company's role in the TRICARE East Region underscores its dedication to supporting those who serve and have served our nation.

- TRICARE East Region Contract: Humana manages health benefits for approximately 2.9 million beneficiaries in the TRICARE East Region.

- Specialized Needs: Military families often face unique healthcare challenges, including frequent relocations and the need for specialized mental health services.

- Service Focus: Humana aims to provide accessible, high-quality healthcare solutions tailored to the specific needs of this community.

Humana's customer base is broadly segmented, with seniors, particularly those in Medicare Advantage plans, forming a critical group. Additionally, the company serves individuals and families through various insurance offerings, often accessed via the Health Insurance Marketplace. Humana also caters to employer groups of all sizes, providing health insurance and administrative services.

The company's commitment to serving vulnerable populations is evident in its significant presence in the Medicaid market, offering managed care plans designed to meet their specific healthcare needs. Furthermore, Humana plays a vital role in supporting military families and retirees through its TRICARE East Region contract.

In 2024, Humana continued to solidify its position across these diverse segments. For instance, the Medicare Advantage membership remained a strong revenue driver, while the Medicaid segment demonstrated continued growth, serving millions nationwide. The employer market also saw Humana focusing on value and affordability amidst rising premium costs, with average employer-sponsored health insurance premiums increasing by 6.5% in 2023.

| Customer Segment | Key Characteristics | 2024 Focus/Data Points |

|---|---|---|

| Seniors (Medicare Advantage) | Seeking comprehensive coverage beyond traditional Medicare, including dental, vision, and prescription drugs. | Continued focus on member satisfaction and expansion of Medicare Advantage portfolio. Significant penetration in this market. |

| Individuals & Families | Require flexible and affordable health insurance options, often relying on subsidies. | Emphasis on providing accessible and comprehensive plans through channels like the Health Insurance Marketplace. |

| Employer Groups | Businesses of all sizes seeking health insurance and administrative services for employees. | Delivering value and affordability in a competitive market with rising premium costs. |

| Low-Income Individuals/Families (Medicaid) | Vulnerable populations with unique healthcare needs requiring efficient care coordination. | Serving millions of Medicaid members nationwide, demonstrating scale and commitment to this demographic. |

| Military Families & Retirees (TRICARE) | Beneficiaries requiring specialized healthcare services and understanding of military life. | Managing the TRICARE East Region contract, serving approximately 2.9 million beneficiaries. |

Cost Structure

Medical Benefit Expenses are Humana's most significant cost, encompassing payments for claims, hospital stays, doctor visits, and medications. In 2024, Humana's medical cost ratio, a key metric for profitability, remained a focus, with efforts to manage this efficiently continuing.

Controlling the utilization of healthcare services is paramount to profitability within this segment. By effectively managing how and when services are used, Humana aims to keep these substantial expenses in check.

Humana's operating and administrative expenses are a significant component of its cost structure, encompassing employee salaries and benefits, general overhead, technology, sales and marketing, and compliance. For the first quarter of 2024, Humana reported selling, general, and administrative (SG&A) expenses of $1.2 billion, reflecting ongoing investments in its business and employee base.

The company is actively pursuing operational efficiencies to mitigate these costs. For instance, Humana's focus on digital transformation aims to streamline processes, reduce manual labor, and enhance customer service, thereby potentially lowering administrative overhead in the long term.

Humana heavily invests in technology and innovation, allocating significant capital to its IT infrastructure, data analytics, and digital tools. These investments are crucial for maintaining and enhancing their competitive edge in the healthcare market, focusing on improving operational efficiency and elevating the member experience.

A substantial portion of these technology expenditures supports the development and deployment of AI-driven solutions. For instance, in 2024, Humana continued to expand its use of AI for streamlining prior authorization processes and personalizing member engagement, aiming for faster service and more relevant health support.

Provider Network and Value-Based Care Investments

Humana's cost structure is significantly influenced by its substantial investments in cultivating and sustaining a broad provider network. This includes the considerable expenses tied to contracting, managing relationships, and ensuring the quality of care delivered by these providers.

Furthermore, the company dedicates significant capital to advancing value-based care initiatives and directly operating primary care centers, such as its CenterWell brand. These strategic investments are designed to foster better patient health outcomes and achieve greater cost efficiencies over the long term. For instance, in 2024, Humana continued to expand its CenterWell footprint, a key component of its value-based care strategy, aiming to integrate care and reduce overall healthcare spending.

- Provider Network Development: Costs associated with recruiting, credentialing, and managing relationships with a vast array of healthcare providers.

- Value-Based Care Investments: Capital allocated to developing and implementing payment models that reward quality outcomes over volume of services.

- CenterWell Operations: Expenses related to the establishment and ongoing operation of primary care centers, including staffing, technology, and infrastructure.

- Technology and Data Analytics: Investments in systems to support value-based care, track patient outcomes, and manage provider performance.

Regulatory Compliance and Litigation Costs

Humana faces substantial expenses due to the stringent regulatory environment of the healthcare sector. These costs are driven by the need to adhere to federal and state mandates, including those from the Centers for Medicare & Medicaid Services (CMS) and Health Insurance Portability and Accountability Act (HIPAA) regulations.

The company also allocates significant resources to manage potential legal challenges. This includes costs associated with litigation, especially concerning areas like Medicare Advantage star ratings, which directly impact reimbursement levels and operational flexibility.

- Regulatory Compliance: Humana's expenses for ensuring adherence to healthcare laws and CMS program rules are a major component of its cost structure.

- Litigation Expenses: Costs related to defending against lawsuits and settling claims, particularly those stemming from compliance disputes, are considerable.

- Star Rating Impact: The financial implications of Medicare Advantage star ratings, including potential penalties or incentives, necessitate ongoing investment in compliance and quality improvement initiatives.

Humana's cost structure is dominated by medical benefit expenses, representing payments for healthcare services. To manage these significant costs, the company focuses on controlling healthcare service utilization. Operating and administrative expenses, including salaries and technology investments, are also substantial, with Humana investing in digital transformation for efficiency gains.

Investments in provider networks and value-based care initiatives, such as the CenterWell primary care centers, are key cost drivers. Regulatory compliance and litigation expenses, particularly those related to Medicare Advantage star ratings, also represent a considerable portion of Humana's outlays.

| Cost Category | Description | 2024 Data/Focus |

|---|---|---|

| Medical Benefit Expenses | Claims, hospital stays, doctor visits, medications | Focus on managing medical cost ratio; controlling service utilization |

| Operating & Administrative Expenses | Salaries, overhead, technology, sales, marketing, compliance | Q1 2024 SG&A: $1.2 billion; digital transformation for efficiency |

| Technology & Innovation | IT infrastructure, data analytics, AI solutions | AI for prior authorizations and member engagement |

| Provider Network & Value-Based Care | Network development, value-based care initiatives, CenterWell operations | Expansion of CenterWell footprint; investments in quality outcomes |

| Regulatory & Legal | Compliance with healthcare laws (CMS, HIPAA), litigation | Managing expenses related to compliance disputes and star rating impacts |

Revenue Streams

Humana's core revenue generation stems from the premiums collected for its diverse health insurance offerings. This includes coverage for individuals, families, and employer groups, encompassing medical, dental, and vision benefits.

A substantial portion of these premium revenues is derived from government-sponsored programs, particularly Medicare Advantage plans. In 2023, Humana reported approximately $88.4 billion in total revenue, with government-sponsored plans forming a significant majority of this figure.

Additionally, Humana benefits from state-based contracts, such as those for Medicaid populations, further diversifying its premium-based income. These contracts represent a crucial element in its revenue mix, reflecting its expansive reach across different government health programs.

Humana generates substantial revenue from its pharmacy services, primarily through its pharmacy benefit management (PBM) arm and specialty pharmacy operations. This segment captures income from prescription drug sales and associated services offered not only to its own health plan members but also to external clients and individuals.

In 2023, Humana's Pharmacy Solutions segment reported revenue of $28.9 billion, a significant portion of which stems from these core pharmacy operations. This reflects the scale of their PBM services, which manage prescription drug benefits for millions of individuals across various plans and employers.

Humana generates revenue through Administrative Services Only (ASO) fees, primarily from self-insured employer groups. These fees are earned by providing essential administrative functions like claims processing, managing the healthcare provider network, and offering customer support. Unlike traditional insurance where premiums are collected, ASO arrangements mean Humana acts as a service provider, receiving a fee for these operational tasks.

Co-payments, Deductibles, and Other Member Cost-Sharing

Humana's revenue is significantly bolstered by the direct financial contributions from its members. These contributions come in various forms, primarily co-payments, deductibles, and other out-of-pocket expenses that members incur when accessing healthcare services.

These cost-sharing mechanisms are integral to the financial structure of health insurance plans, aligning member incentives with cost-conscious healthcare utilization. For example, in 2024, a substantial portion of Humana's revenue is derived from these member payments, reflecting the shared responsibility in managing healthcare costs.

- Member Cost-Sharing: Direct payments from members for services rendered.

- Revenue Contribution: These payments form a key component of Humana's overall revenue streams.

- Financial Model Integration: Essential for balancing plan costs and member affordability.

- 2024 Data Insight: Specific figures on co-payments and deductibles contribute to understanding this revenue channel.

Investment Income

Humana's investment income is derived from managing its substantial financial reserves and investment portfolio. This income stream, while secondary to its core health insurance operations, plays a role in the company's overall financial health.

For the fiscal year ending December 31, 2023, Humana reported investment income of $1.1 billion. This figure reflects the returns generated from its various investments, contributing to the company's profitability and financial stability.

- Investment Income Contribution: While not the primary driver of revenue, investment income supplements Humana's earnings.

- Financial Reserves Management: The company actively manages its financial reserves to optimize returns on its investment portfolio.

- 2023 Performance: In 2023, Humana's investment income reached $1.1 billion, demonstrating its significance to the company's financial results.

Humana's revenue streams are diverse, primarily driven by health insurance premiums from individuals, families, and employer groups, with a significant portion coming from government programs like Medicare Advantage and Medicaid. The company also generates substantial income from its pharmacy services, including its pharmacy benefit management operations, and from administrative fees for self-insured employers.

| Revenue Stream | Description | 2023 Data (Approximate) |

| Health Insurance Premiums | Premiums from individual, family, and employer health plans, including government programs. | $88.4 billion (Total Revenue, with government plans being a majority) |

| Pharmacy Services | Revenue from pharmacy benefit management (PBM) and specialty pharmacy operations. | $28.9 billion (Pharmacy Solutions segment revenue) |

| Administrative Services Only (ASO) | Fees from self-insured employer groups for administrative functions. | Not separately detailed in public reports but a component of service revenue. |

| Member Cost-Sharing | Co-payments, deductibles, and other out-of-pocket expenses paid by members. | A substantial portion of revenue in 2024, reflecting shared healthcare costs. |

| Investment Income | Returns from managing financial reserves and investment portfolios. | $1.1 billion |

Business Model Canvas Data Sources

The Humana Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and competitive analysis. These sources ensure each canvas block is informed by accurate, current information relevant to the healthcare industry.