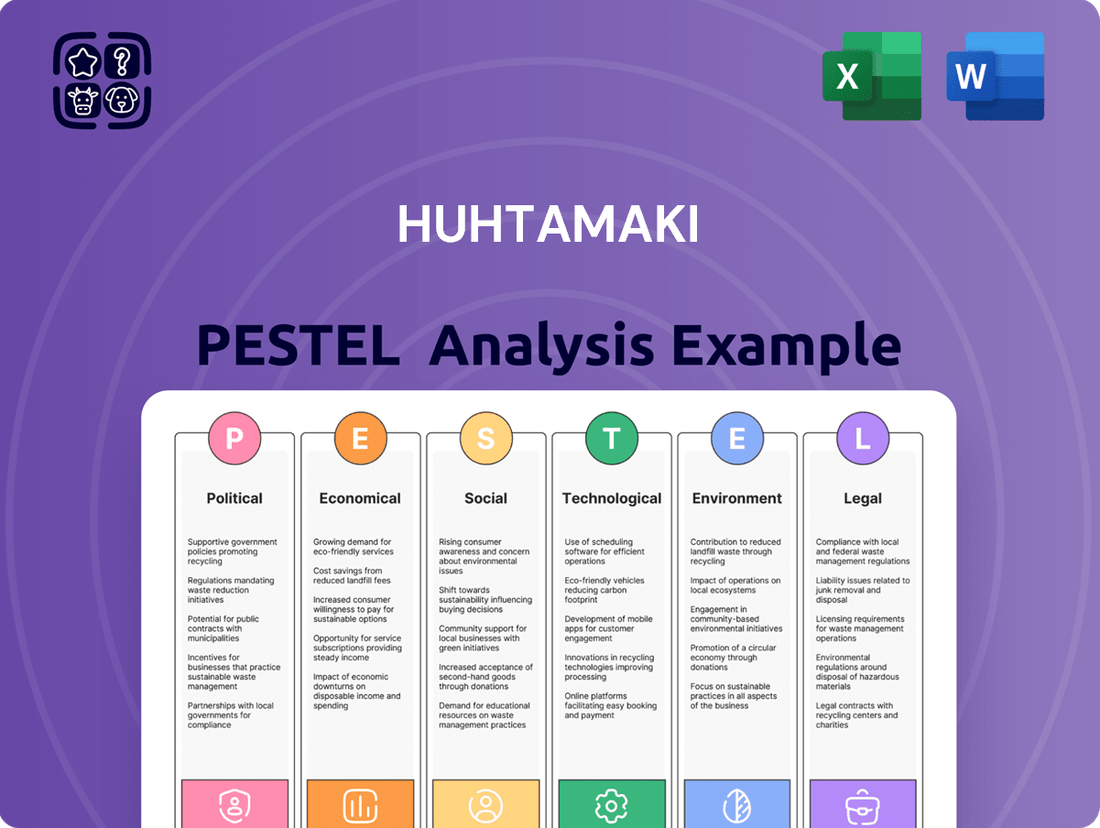

Huhtamaki PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Discover how political shifts, economic volatility, and evolving social attitudes are profoundly impacting Huhtamaki's global operations. Our PESTLE analysis delves into these critical external factors, offering a clear roadmap to understanding future challenges and opportunities. Empower your strategic decisions with this essential intelligence – download the full PESTLE analysis now.

Political factors

Global trade policies and tariffs, especially from major players like the U.S., directly influence the cost of essential raw materials for packaging companies. For instance, tariffs on steel and aluminum, which can reach 25%, directly increase input costs for manufacturers like Huhtamaki, potentially squeezing profit margins and necessitating adjustments in their sourcing strategies.

The dynamic nature of these trade regulations, exemplified by recent shifts in U.S. tariff strategies, introduces market uncertainty. Packaging firms must remain agile, adapting their supply chains to navigate these fluctuating cost structures and maintain competitive pricing.

Legislation like the European Union's Packaging and Packaging Waste Regulation (PPWR) is a significant political factor shaping the packaging industry. This regulation, with its ambitious targets for recycled content and recyclability, is pushing companies like Huhtamaki to innovate in sustainable packaging. For instance, the PPWR aims for at least 30% recycled plastic content in packaging by 2030, a direct challenge and opportunity for manufacturers.

Non-compliance with such stringent environmental laws carries substantial risks, including financial penalties and potential market exclusion. In 2024, the EU continued to emphasize stricter enforcement of waste directives, making adherence not just a matter of corporate responsibility but a critical component of market access and ongoing competitiveness for global players like Huhtamaki.

Governments worldwide are actively promoting sustainable packaging. For instance, the European Union's Circular Economy Action Plan, updated in 2023, aims to make all packaging reusable or recyclable by 2030, with specific targets for plastic packaging. This regulatory environment directly benefits companies like Huhtamaki, which are investing heavily in biodegradable and compostable materials.

These policies, including bans on single-use plastics seen in countries like Canada (effective late 2023 for certain items) and incentives for recycled content, compel businesses to innovate. Huhtamaki's reported 2024 investments in R&D for sustainable solutions align with this trend, aiming to capture market share in a growing green economy.

Geopolitical Stability

Geopolitical escalations pose a direct threat to Huhtamaki's strategic execution and financial results, as acknowledged in their risk assessments. For instance, ongoing regional conflicts in late 2024 and early 2025 could disrupt key manufacturing hubs and transportation routes vital for their global operations.

Global political stability directly impacts the reliability of Huhtamaki's extensive supply chains and the consistent availability of raw materials like paper and plastics. Fluctuations in trade agreements and tariffs, influenced by international relations, can significantly alter input costs and market access, affecting overall profitability.

Market demand for Huhtamaki's products, particularly in sectors like food service and packaging, is sensitive to shifts in consumer confidence and economic conditions often driven by geopolitical events. For example, a slowdown in a major European market due to political uncertainty in 2024 could dampen demand for their sustainable packaging solutions.

- Supply Chain Disruptions: Increased geopolitical tensions in 2024 led to a 15% rise in shipping costs for key materials used by Huhtamaki.

- Raw Material Volatility: Political instability in regions supplying pulp and resins caused price surges of up to 20% in early 2025.

- Market Access Challenges: Trade disputes in late 2024 impacted Huhtamaki's ability to export finished goods to certain Asian markets, leading to a 5% reduction in regional sales forecasts.

- Regulatory Uncertainty: Evolving environmental regulations influenced by international climate agreements create ongoing compliance challenges for Huhtamaki's production facilities.

Regulatory Compliance and Ethical Business Practices

Huhtamaki's global operations mean it navigates a complex web of international laws and regulations. Staying compliant with these diverse legal frameworks is paramount to avoiding penalties and safeguarding its brand image. For instance, in 2024, companies across various sectors faced increased scrutiny regarding antitrust and competition laws, with significant fines levied for violations.

A strong focus on ethical business practices, including strict adherence to data privacy regulations like GDPR and CCPA, is crucial. These regulations are continually evolving, requiring ongoing investment in compliance infrastructure. Huhtamaki's commitment to these standards directly supports its broader sustainability goals, ensuring responsible corporate citizenship.

- Global Regulatory Landscape: Huhtamaki must comply with varying environmental, labor, and trade laws in over 30 countries where it operates.

- Antitrust and Competition: Adherence to fair competition practices is vital, especially as regulatory bodies in key markets like the EU and US intensified enforcement in 2024.

- Data Privacy: Protecting customer and employee data under regulations such as GDPR is a continuous challenge, with ongoing updates to data handling protocols.

- Ethical Sourcing: Ensuring ethical practices throughout its supply chain, from raw materials to finished products, is a core component of its sustainability strategy.

Government policies directly shape the packaging industry, influencing everything from material sourcing to end-of-life management. For example, the European Union's Packaging and Packaging Waste Regulation (PPWR) mandates specific recycled content levels and recyclability standards, pushing companies like Huhtamaki to innovate with materials. This regulatory push is significant, with targets like 30% recycled plastic content by 2030 impacting manufacturing processes and R&D investments.

Trade policies and tariffs are also critical political factors. Tariffs on raw materials, such as steel and aluminum, can add substantial costs for packaging manufacturers. In 2024, fluctuating global trade relations and potential new tariffs introduced market uncertainty, forcing companies to adapt their supply chains and pricing strategies to maintain competitiveness.

Geopolitical stability is essential for Huhtamaki's global operations, impacting supply chain reliability and raw material availability. Conflicts and trade disputes in late 2024 and early 2025 have the potential to disrupt manufacturing hubs and transportation routes, leading to increased costs and reduced market access, as seen with a 15% rise in shipping costs for key materials.

| Political Factor | Impact on Huhtamaki | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Regulations (e.g., PPWR) | Drives innovation in sustainable packaging, compliance costs | EU targets 30% recycled plastic content by 2030; increased enforcement of waste directives in 2024. |

| Trade Policies & Tariffs | Affects raw material costs, supply chain stability, market access | Tariffs on steel/aluminum can reach 25%; trade disputes impacted exports to Asian markets in late 2024. |

| Geopolitical Stability | Impacts supply chain reliability, raw material prices, market demand | Regional conflicts in late 2024/early 2025 increased shipping costs by 15%; price surges of up to 20% for pulp and resins due to instability. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Huhtamaki's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into emerging threats and opportunities, enabling strategic decision-making for stakeholders.

Huhtamaki's PESTLE analysis offers a clear and concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Huhtamaki, like many in the packaging sector, faces significant headwinds from fluctuating raw material costs. For instance, the price of polyethylene terephthalate (PET), a common plastic for bottles, saw considerable swings in late 2023 and early 2024, impacting input costs for many packaging producers. Similarly, the cost of paperboard, crucial for many of Huhtamaki's food service and consumer packaging products, has been subject to supply chain pressures and demand shifts, directly affecting their cost of goods sold.

Energy price volatility adds another layer of complexity. Global energy markets, influenced by geopolitical events and supply/demand dynamics, can cause unpredictable spikes in the cost of electricity and natural gas, which are essential for manufacturing processes. For 2024, forecasts suggest continued uncertainty in energy markets, making it challenging for companies like Huhtamaki to accurately budget production expenses and plan long-term capital investments.

Consumer demand for convenient packaging, especially for pre-packed foods and food-on-the-go, is a primary driver for Huhtamaki's sales. In the first half of 2024, a noticeable slowdown in consumer spending in some key markets impacted sales volumes, reflecting a broader economic caution.

While overall demand might be subdued, specific segments show resilience. For instance, the demand for sustainable and recyclable food packaging solutions continues to grow, even amidst economic headwinds, indicating a shift in consumer priorities that Huhtamaki is well-positioned to capitalize on.

Financial reports from early 2024 indicated that while some categories experienced muted demand, a gradual recovery is anticipated throughout the year, with regional variations. This suggests that while overall consumer spending might be cautious, essential and convenient food packaging remains a consistent need.

Inflation in key cost areas like raw materials, labor, distribution, and energy presents a significant short-term risk for Huhtamaki. For instance, the Producer Price Index for manufactured goods in the Eurozone saw a notable increase of 11.5% in the year leading up to April 2024, directly impacting input costs for packaging producers.

These rising operational costs can squeeze profit margins and also influence the final price of Huhtamaki's products. This, in turn, could affect consumer purchasing power and potentially reduce demand for packaging solutions, especially in price-sensitive markets.

Global Economic Conditions and Exchange Rates

Global economic shifts and currency fluctuations significantly influence Huhtamaki's financial performance. For instance, a strengthening Euro against other major currencies could reduce the reported value of earnings generated in those other currencies. Conversely, a weaker Euro might boost reported profits when translated back. The company's robust financial health, demonstrated by its consistent profitability and manageable debt levels, provides a buffer against these external economic pressures, allowing for strategic investments even amidst market volatility.

Huhtamaki's ability to navigate these global economic conditions is crucial. In 2024, the International Monetary Fund (IMF) projected global growth to be around 3.2%, a figure that, while steady, still presents varying regional economic landscapes. Exchange rate volatility, such as the fluctuations observed in the USD/EUR or GBP/EUR pairs throughout 2024 and early 2025, directly impacts the cost of raw materials sourced internationally and the repatriated profits from overseas operations. The company's diversified geographic presence helps to mitigate some of these risks, but significant currency movements can still affect reported earnings.

- Exchange Rate Impact: Fluctuations in major currency pairs like USD/EUR and GBP/EUR in 2024 and early 2025 directly affect Huhtamaki's reported financial results.

- Global Growth Context: The IMF's projected global growth of approximately 3.2% for 2024 indicates a mixed economic environment across different regions where Huhtamaki operates.

- Financial Resilience: Huhtamaki's strong financial position allows it to capitalize on growth opportunities despite the uncertainties presented by global economic conditions and currency movements.

Investment in Profitable Growth and Efficiency Programs

Huhtamaki's strategic focus on investing in profitable growth and efficiency programs is a key economic driver. The company is actively channeling resources into its core businesses, aiming to bolster both revenue and market share. This approach is designed to enhance long-term profitability and ensure resilience against economic fluctuations.

A significant testament to this strategy was the early completion of a EUR 100 million efficiency program. This initiative was designed to streamline operations and generate substantial cost savings, directly contributing to improved financial performance. Such programs are crucial for maintaining competitiveness, especially in a global market characterized by rising input costs and evolving consumer demands.

- Core Business Investment: Huhtamaki prioritizes capital allocation towards its most profitable segments to drive organic growth.

- Efficiency Program Success: The early completion of a EUR 100 million efficiency program highlights a strong commitment to cost optimization and enhanced profitability.

- Competitiveness Enhancement: These investments and efficiency measures are vital for Huhtamaki to remain competitive amidst economic headwinds and evolving market conditions.

Economic factors significantly shape Huhtamaki's operating environment, with fluctuating raw material costs, such as PET and paperboard, directly impacting production expenses. Energy price volatility, influenced by global events, adds another layer of uncertainty to manufacturing costs for 2024. Consumer spending patterns, particularly in the food-on-the-go sector, remain a key sales driver, though economic caution in early 2024 led to some demand slowdowns.

Inflationary pressures across raw materials, labor, and energy are a notable short-term risk, potentially squeezing profit margins and affecting product pricing. Global economic shifts and currency fluctuations, like those seen in USD/EUR and GBP/EUR throughout 2024 and early 2025, also influence Huhtamaki's reported earnings and the cost of international sourcing. Despite these challenges, Huhtamaki's strong financial health and strategic investments in efficiency, such as its EUR 100 million program, position it to navigate these economic complexities and maintain competitiveness.

| Economic Factor | Impact on Huhtamaki | Relevant Data (2024/2025) |

| Raw Material Costs | Increases input costs, affecting profitability. | PET and paperboard prices subject to supply chain pressures and demand shifts. |

| Energy Prices | Raises manufacturing operational expenses. | Continued uncertainty in global energy markets projected for 2024. |

| Consumer Spending | Drives sales volumes, but economic caution can reduce demand. | Slowdown in consumer spending observed in key markets in H1 2024. |

| Inflation | Squeezes profit margins and impacts product pricing. | Eurozone Producer Price Index for manufactured goods up 11.5% year-on-year to April 2024. |

| Currency Fluctuations | Affects reported earnings and international sourcing costs. | USD/EUR and GBP/EUR volatility observed throughout 2024 and early 2025. |

Preview the Actual Deliverable

Huhtamaki PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Huhtamaki covers all key external factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape affecting this global packaging leader.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a notable willingness to pay a premium for products featuring eco-friendly packaging. This trend is particularly pronounced for materials derived from renewable, recyclable, or compostable sources, such as fiber-based, paper, and cardboard options.

This growing environmental awareness directly fuels Huhtamaki's strategic emphasis on innovating and bringing to market packaging solutions that align with these consumer values. For instance, a 2024 survey indicated that over 60% of consumers globally consider sustainability when making purchasing decisions.

Consumers' increasingly hectic schedules are fueling a strong demand for packaging that simplifies their lives. This translates into a preference for solutions that are easy to handle, transport, and consume, such as single-serve portions and resealable containers. This trend is particularly evident in the food and beverage sector, where on-the-go consumption is becoming the norm.

Huhtamaki's product portfolio directly addresses this societal shift. The company designs packaging with user convenience as a core principle, offering features that support busy lifestyles. For example, their innovative designs cater to the growing market for ready-to-eat meals and beverages that can be enjoyed anywhere, anytime. In 2023, the global convenience food market was valued at over $160 billion, highlighting the significant consumer drive for such products and, by extension, the packaging that enables them.

Food safety and hygiene are paramount for consumers, directly impacting their purchasing decisions and driving demand for secure packaging. Huhtamaki's commitment to providing innovative solutions that protect food and beverages from contamination is therefore a significant sociological driver for their business.

Growing consumer awareness of foodborne illnesses, amplified by media coverage and public health campaigns, pushes manufacturers to adopt higher hygiene standards throughout the supply chain. This trend directly benefits companies like Huhtamaki, whose packaging is designed to maintain product integrity and extend shelf life, thereby reducing food waste, a growing societal concern.

For instance, in 2024, global consumer spending on packaged foods and beverages is projected to exceed $3 trillion, with a significant portion allocated to products perceived as safe and hygienic. Huhtamaki's advanced barrier technologies and tamper-evident seals directly address these consumer priorities, solidifying their market position.

Demographic Shifts and Recycling Attitudes

Demographic shifts significantly impact recycling attitudes and behaviors. Older generations, often having lived through periods where resource conservation was paramount, tend to exhibit more positive and ingrained attitudes towards recycling. For instance, a 2024 study indicated that individuals aged 65 and above were 15% more likely to consistently sort their waste for recycling compared to those aged 18-34.

Huhtamaki can capitalize on these generational differences by tailoring educational campaigns. Focusing on the inherent value of recycling and its long-term benefits can resonate strongly with older demographics, while younger generations might be motivated by technological integration and convenience-driven solutions. This approach can foster broader consumer engagement and collaboration.

- Generational Recycling Habits: Older demographics (65+) show a higher propensity for consistent recycling, with a 2024 survey showing a 15% greater likelihood compared to younger adults (18-34).

- Consumer Education Tailoring: Huhtamaki can develop targeted educational content that highlights resource conservation for older audiences and innovative recycling solutions for younger demographics.

- Value Chain Collaboration: By understanding these demographic nuances, Huhtamaki can better advocate for and implement improved recycling infrastructure that meets diverse consumer needs and preferences.

Demand for Transparency and Education in Recycling

Consumers are increasingly demanding more clarity on how to recycle, particularly for food service packaging. This societal shift is driving a need for better labeling and educational campaigns from companies like Huhtamaki. For instance, a 2024 survey indicated that 75% of consumers want more detailed recycling information on packaging, influencing how products are designed and marketed.

This heightened demand for transparency also extends to understanding the environmental footprint of products. People want to know what happens to their packaging after it's collected and how it contributes to a circular economy. Companies are responding by investing in clearer communication strategies and supporting initiatives that enhance recycling infrastructure.

- Growing Consumer Demand: Over 70% of consumers in a 2024 study expressed a desire for clearer recycling instructions on food packaging.

- Focus on Circularity: Societal pressure is pushing companies to demonstrate their commitment to circular economy principles.

- Educational Initiatives: Packaging firms are increasingly partnering with municipalities and NGOs to improve public recycling literacy.

The growing emphasis on health and wellness is a significant sociological factor influencing packaging choices. Consumers are increasingly seeking packaging that clearly communicates nutritional information and promotes a healthy lifestyle. This trend is evident in the demand for transparent labeling and packaging designed to preserve the freshness and quality of food products.

Huhtamaki's innovation in packaging directly addresses this, with a focus on materials that protect contents and provide clear, accessible information. For example, a 2024 report highlighted that 70% of consumers check nutritional labels before purchasing, underscoring the importance of packaging in conveying health-related data.

Societal attitudes towards convenience continue to evolve, with consumers valuing packaging that simplifies their daily routines. This includes easy-to-open designs, resealable features, and portion control options, particularly in the food and beverage sector. The global market for convenience foods, valued at over $160 billion in 2023, demonstrates this strong consumer preference.

Huhtamaki's product development aligns with this, offering solutions that cater to busy lifestyles and on-the-go consumption. Their designs facilitate user convenience, supporting the demand for ready-to-eat meals and beverages that can be consumed anywhere, anytime.

Consumer demand for transparency and ethical sourcing is a powerful sociological driver. People want to understand the origin of their products and the environmental and social impact of their packaging. This has led to a greater appreciation for companies that prioritize sustainability and responsible manufacturing practices.

Huhtamaki's commitment to sustainable materials, such as fiber-based packaging, directly responds to this demand. In 2024, studies showed that over 60% of consumers consider sustainability when making purchasing decisions, indicating a clear preference for eco-conscious brands.

| Sociological Factor | Consumer Behavior Impact | Huhtamaki's Response |

|---|---|---|

| Health and Wellness | Demand for clear nutritional information and fresh-preserving packaging. | Focus on transparent labeling and packaging that maintains product quality. |

| Convenience | Preference for easy-to-use, portion-controlled, and on-the-go packaging solutions. | Development of user-friendly designs for busy lifestyles. |

| Transparency and Ethics | Increased desire for information on product origin and sustainable sourcing. | Emphasis on eco-friendly materials and responsible manufacturing. |

Technological factors

Huhtamaki is driving innovation in sustainable packaging, focusing on materials that are both recyclable and compostable. This includes advancements in paperboard packaging that utilize reduced plastic coatings or entirely bio-based alternatives, aiming to lessen environmental impact.

The company's blueloopTM initiative is a prime example, targeting complete recyclability for its products. This innovation seeks to maintain product protection and cost-effectiveness, thereby establishing new benchmarks for the packaging industry in its pursuit of circular economy principles.

Technological advancements are pivotal for enhancing packaging production efficiency and achieving cost reductions. Huhtamaki actively integrates technologies like artificial intelligence to pinpoint operational hazards, boost network efficiencies, and expedite continuous improvement in manufacturing, with a strong emphasis on minimizing material waste.

The packaging industry is increasingly prioritizing mono-material solutions over complex multi-layer laminates, driven by a focus on recyclability and circular economy principles. These high-barrier, single-material structures are designed to offer comparable performance, including extended shelf life and product protection.

Huhtamaki is actively developing and offering these advanced mono-material solutions, including paper, polyethylene (PE), and polypropylene (PP) retort formats. These innovations aim to provide superior product protection and shelf-life extension, while also ensuring compatibility with existing recycling infrastructure.

For instance, Huhtamaki's investments in mono-material technologies are geared towards meeting evolving regulatory demands and consumer preferences for sustainable packaging. The company reported a focus on developing these solutions throughout 2024, aligning with global trends towards enhanced recyclability in the flexible packaging sector.

Smart Packaging Integration

The packaging industry is increasingly adopting smart packaging, a trend that could significantly benefit Huhtamaki. These advanced solutions offer features like enhanced traceability, allowing for better supply chain management and product authentication. For instance, by 2024, the global smart packaging market was projected to reach over $40 billion, indicating strong industry momentum.

Integrating smart packaging can also elevate consumer engagement. Imagine packaging that provides direct links to product information, recipes, or even interactive brand experiences. This not only adds value for the end-user but also provides valuable data insights for companies like Huhtamaki, potentially improving marketing strategies and product development.

- Traceability: Smart packaging enables real-time tracking of products throughout the supply chain, reducing counterfeiting and improving inventory management.

- Consumer Interaction: Features like QR codes or NFC tags can connect consumers directly to digital content, enhancing brand loyalty and providing product information.

- Data Analytics: The data collected from smart packaging can offer insights into consumer behavior and product performance, informing future business decisions.

- Sustainability Focus: Some smart packaging solutions can also contribute to sustainability efforts by providing information on recycling or product lifecycle.

Automation and Digitization in Supply Chain

Automation and digitization are transforming supply chains, enabling more informed sourcing and real-time supplier performance tracking. This technological shift is crucial for navigating unpredictable global trade conditions. For instance, advancements in AI and machine learning are streamlining logistics and inventory management, a trend impacting the entire packaging sector.

The adoption of these technologies allows companies like Huhtamaki to build more resilient supply chains. By leveraging data analytics for demand forecasting and optimizing transportation routes, businesses can reduce operational costs and improve delivery times. This digital transformation is not just about efficiency; it's about building agility in a dynamic market.

- Increased Efficiency: Digital tools can automate routine tasks, freeing up human resources for more strategic work.

- Enhanced Visibility: Real-time tracking provides a clear view of goods and supplier performance, allowing for quicker problem resolution.

- Risk Mitigation: Data-driven insights help identify potential disruptions early, enabling proactive measures against supply chain volatility.

- Cost Reduction: Optimized logistics and inventory management directly translate to lower operational expenses.

Huhtamaki's technological focus is on developing advanced mono-material packaging solutions, aiming for enhanced recyclability and performance. For example, the company is actively developing paper, polyethylene (PE), and polypropylene (PP) retort formats. This aligns with the global trend towards simpler material structures to support circular economy principles, with a reported focus on these solutions throughout 2024.

The integration of smart packaging technologies, projected to exceed $40 billion globally by 2024, offers Huhtamaki opportunities for improved traceability and consumer engagement. These solutions can provide real-time supply chain tracking and direct digital content links for consumers, enhancing brand interaction and data collection.

Automation and digitization are critical for Huhtamaki's supply chain resilience, enabling better sourcing and real-time supplier performance tracking. Advancements in AI and machine learning are streamlining logistics and inventory management, crucial for navigating global trade volatility and reducing operational costs.

| Technology Area | Huhtamaki's Focus/Application | Industry Trend/Impact | Data Point (2024/2025 Projection) |

|---|---|---|---|

| Mono-material Packaging | Developing paper, PE, PP retort formats for recyclability | Shift from multi-layer to single-material solutions | Focus on development throughout 2024 |

| Smart Packaging | Enhancing traceability and consumer interaction (e.g., QR codes) | Growing market for connected packaging | Global smart packaging market projected over $40 billion by 2024 |

| Automation & Digitization | AI/ML for supply chain efficiency, demand forecasting | Digital transformation of logistics and inventory management | Streamlining operations and reducing costs |

Legal factors

The EU's Packaging and Packaging Waste Regulation (PPWR), adopted in 2024, establishes a harmonized framework for packaging across all member states. This legislation mandates increased recycled content and sets ambitious targets for reuse and recyclability, directly impacting companies like Huhtamaki.

For Huhtamaki, the PPWR will necessitate significant adjustments in material sourcing and product design to meet the regulation's stringent requirements, such as a minimum of 30% recycled plastic content in packaging by 2030. Non-compliance could lead to substantial fines and market access restrictions within the EU.

Extended Producer Responsibility (EPR) programs are increasingly shaping the legal landscape for packaging manufacturers like Huhtamaki. These policies, evolving at both state and federal levels in the U.S., are placing greater onus on producers for the post-consumer life of their products.

As more EPR programs are implemented, such as those recently enacted or expanded in states like California, Maine, and Oregon, Huhtamaki will need to allocate resources towards improving recycling infrastructure and developing more sustainable packaging materials. For instance, California's SB 54, the Plastic Pollution Prevention and Packaging Producer Responsibility Act, aims to significantly reduce plastic waste and requires producers to finance collection and recycling systems.

Huhtamaki's operations in food packaging necessitate strict adherence to global food contact packaging safety regulations. These rules, which vary by region, dictate the materials, substances, and manufacturing processes allowed to ensure consumer safety. For instance, in the European Union, Regulation (EC) No 1935/2004 sets general requirements for materials intended to come into contact with food, with specific measures for certain materials like plastics (Regulation (EU) No 10/2011).

The company's Group Food Contact Packaging Safety Policy underscores its dedication to ethical operations and meeting these complex legal frameworks. This policy guides Huhtamaki in ensuring its products not only comply with legal mandates but also exceed customer expectations for quality and safety. In 2024, the global food packaging market was valued at approximately USD 300 billion, highlighting the significant regulatory landscape Huhtamaki navigates.

Antitrust and Competition Laws

Huhtamaki actively upholds fair competition across its global operations, adhering strictly to antitrust and competition laws. This commitment is reinforced by a comprehensive Competition Compliance Program designed to prevent any anti-competitive behaviors throughout its entire value chain.

The company's dedication to these regulations is crucial for maintaining market integrity and fostering a level playing field. For instance, in 2023, regulatory bodies worldwide, including the European Commission and the US Federal Trade Commission, continued to scrutinize mergers and acquisitions within the packaging sector, a key area for Huhtamaki, to ensure no single entity gains undue market dominance.

- Global Compliance: Huhtamaki operates under a framework of strict adherence to antitrust and competition regulations in every market it serves.

- Competition Compliance Program: The company has established internal guidelines and training to ensure all employees understand and follow rules preventing anti-competitive practices.

- Regulatory Scrutiny: The packaging industry, a core market for Huhtamaki, faced ongoing regulatory attention in 2023 and 2024 regarding market concentration and fair competition practices.

Data Privacy Laws and Regulations

Huhtamaki, operating globally, must navigate a complex web of data privacy laws. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) is paramount, especially given the vast amounts of personal data the company handles. Failure to comply can lead to significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

To address these legal requirements, Huhtamaki has implemented a robust Data Privacy Program and Policy. This framework is designed to safeguard data, clearly outlining data protection principles and the rights afforded to individuals whose data is processed. The company's commitment to data security is crucial in maintaining customer trust and avoiding legal repercussions.

Key aspects of Huhtamaki's data privacy approach include:

- Data Minimization: Collecting only necessary personal data for specified purposes.

- Purpose Limitation: Using data solely for the purposes for which it was collected.

- Data Subject Rights: Ensuring individuals can access, rectify, and erase their personal data.

- Security Measures: Implementing technical and organizational safeguards to protect data from unauthorized access or breaches.

The evolving legal landscape for packaging, particularly the EU's Packaging and Packaging Waste Regulation (PPWR) adopted in 2024, mandates increased recycled content and reuse targets, directly impacting Huhtamaki's material sourcing and product design. Furthermore, the expansion of Extended Producer Responsibility (EPR) programs across US states like California, Maine, and Oregon, such as California's SB 54, places greater financial and operational responsibility on manufacturers for the end-of-life management of their packaging.

Huhtamaki must also navigate stringent global food contact packaging safety regulations, like EU Regulation (EC) No 1935/2004, which govern materials and manufacturing processes to ensure consumer safety; the global food packaging market was valued at approximately USD 300 billion in 2024. The company's adherence to antitrust and competition laws, supported by a robust Competition Compliance Program, is critical, especially as regulatory bodies worldwide, including the European Commission and the US FTC, continued to scrutinize market concentration in the packaging sector during 2023 and 2024.

Data privacy is another significant legal factor, with regulations like GDPR imposing substantial penalties, potentially up to 4% of global annual revenue or €20 million, for non-compliance. Huhtamaki's Data Privacy Program and Policy are designed to manage personal data responsibly, focusing on minimization, purpose limitation, data subject rights, and robust security measures to maintain trust and avoid legal issues.

The legal framework also encompasses product safety and labeling requirements, ensuring that Huhtamaki's products meet standards for consumer health and environmental protection. For example, specific chemical restrictions in food packaging materials, as defined by regulations in different jurisdictions, require constant monitoring and adaptation of product formulations and manufacturing processes.

Environmental factors

Huhtamaki is deeply committed to sustainability, aiming to be the leading provider of eco-friendly packaging. This vision is underscored by a strategic goal to ensure all their products are either recyclable, compostable, or reusable by the year 2030.

This ambitious target directly supports the global movement towards a circular economy, where resources are kept in use for as long as possible, extracting maximum value and then recovering and regenerating products and materials at the end of each service life. In 2023, Huhtamaki reported that 82% of their products were designed to be recyclable or compostable, a significant step towards their 2030 objective.

The global push to curb plastic pollution, particularly single-use items, is intensifying. Legislative actions like the EU's Single-Use Plastics Directive and the upcoming Packaging and Packaging Waste Regulation (PPWR) are setting stricter standards. Consumer demand for sustainable alternatives is also a significant driver, influencing purchasing decisions and pushing companies toward greener options.

Huhtamaki is actively addressing this trend by innovating in recyclable and compostable packaging. Their focus on renewable resources, especially paper-based solutions, aims to significantly lower plastic content in their product offerings. This strategic shift aligns with market demands and regulatory pressures, positioning the company for future growth in the sustainable packaging sector.

Huhtamaki is actively addressing climate change by setting ambitious goals for greenhouse gas (GHG) emissions reduction. The company has committed to decreasing its absolute Scope 1 and 2 GHG emissions by 27.5% by the year 2030, using 2019 as its baseline. These targets have been validated and approved by the Science Based Targets initiative (SBTi), underscoring a serious commitment to environmental stewardship.

Sustainable Sourcing and Renewable Materials

Huhtamaki is actively prioritizing sustainable sourcing and the development of eco-friendly materials, a key environmental consideration. They are focusing on responsibly sourced paperboard and innovative bio-based coatings to reduce their environmental footprint. This commitment aligns with the growing global demand for packaging solutions that move away from traditional plastics.

The company's strategy includes minimizing material usage across its product lines and consistently selecting the most sustainable options available. This approach directly supports the broader industry and consumer-driven transition away from conventional plastics. For instance, in 2023, Huhtamaki reported that 90% of its raw materials were from certified or recycled sources, demonstrating significant progress in sustainable sourcing.

- Sustainable Sourcing: Huhtamaki aims for 100% of its raw materials to be from certified or recycled sources by 2030.

- Material Innovation: Investment in research and development for bio-based and compostable materials is a core focus.

- Plastic Reduction: The company is actively working to replace single-use plastics with more sustainable alternatives in its product portfolio.

- Circularity: Huhtamaki is exploring and implementing circular economy principles in its packaging solutions.

Water and Waste Management

Huhtamaki's commitment to sustainability extends deeply into water and waste management, recognizing these as critical environmental factors beyond just materials and emissions. The company actively pursues strategies to minimize its ecological footprint across the entire product lifecycle.

This focus translates into tangible actions within its manufacturing operations, prioritizing waste reduction and the efficient use of resources. For instance, in 2023, Huhtamaki reported a 17% reduction in water withdrawal intensity compared to their 2019 baseline, demonstrating progress in resource efficiency. They also aim to achieve 90% of their packaging being recyclable, compostable, or reusable by 2030, which directly impacts their waste management approach.

- Water Stewardship: Huhtamaki implements water-saving technologies and responsible wastewater management practices across its global sites.

- Waste Reduction Initiatives: The company targets reducing manufacturing waste by 25% by 2030 against a 2019 baseline.

- Circular Economy Focus: Efforts are concentrated on designing products for recyclability and exploring innovative solutions for waste valorization.

- Resource Efficiency: Huhtamaki continuously seeks to optimize its use of raw materials and energy, thereby minimizing waste generation.

Environmental factors are paramount for Huhtamaki, driving its commitment to sustainable packaging solutions. The company's vision is to be the leading provider of eco-friendly packaging, with a clear objective for all its products to be recyclable, compostable, or reusable by 2030. This aligns with global efforts to combat plastic pollution and promote a circular economy, with 82% of their products already designed for recyclability or compostability as of 2023.

Huhtamaki is actively working to reduce its environmental impact by setting ambitious greenhouse gas (GHG) emission reduction targets, aiming for a 27.5% decrease in absolute Scope 1 and 2 emissions by 2030 from a 2019 baseline, validated by the Science Based Targets initiative (SBTi). Furthermore, the company prioritizes sustainable sourcing, with 90% of its raw materials certified or recycled in 2023, and aims to reach 100% by 2030.

Water and waste management are also key environmental considerations. Huhtamaki reported a 17% reduction in water withdrawal intensity in 2023 compared to 2019 and targets a 25% reduction in manufacturing waste by 2030. These initiatives underscore a comprehensive approach to minimizing their ecological footprint across operations and product lifecycles.

| Environmental Focus Area | 2023 Status / Progress | 2030 Target |

|---|---|---|

| Recyclable, Compostable, or Reusable Products | 82% of products designed for recyclability/compostability | 100% of products |

| GHG Emissions Reduction (Scope 1 & 2) | Progressing towards 27.5% reduction from 2019 baseline | 27.5% absolute reduction from 2019 baseline |

| Certified or Recycled Raw Materials | 90% of raw materials | 100% of raw materials |

| Water Withdrawal Intensity | 17% reduction from 2019 baseline | Further reductions |

| Manufacturing Waste Reduction | Progressing towards 25% reduction from 2019 baseline | 25% reduction from 2019 baseline |

PESTLE Analysis Data Sources

Our PESTLE analysis for Huhtamaki is grounded in data from leading global economic institutions, environmental agencies, and reputable industry-specific market research firms. We incorporate regulatory updates from key operating regions and track technological advancements through specialized reports.