Huhtamaki Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

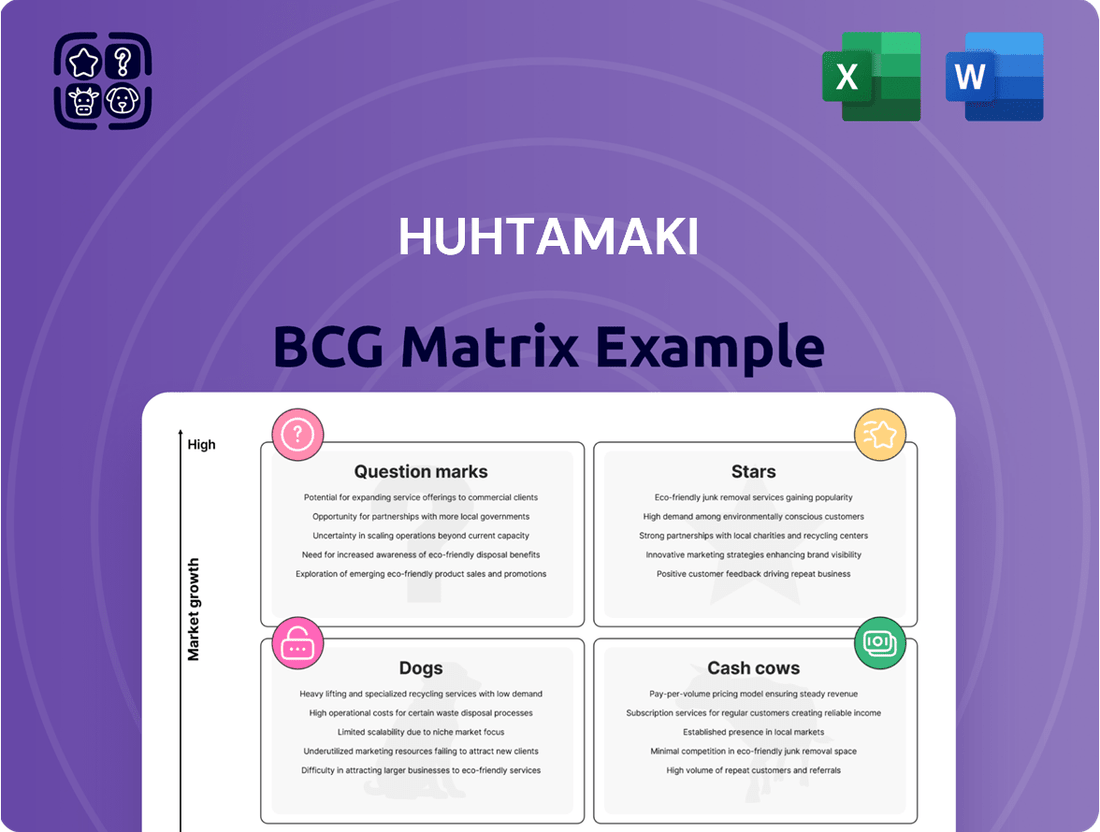

Curious about Huhtamaki's product portfolio performance? Our BCG Matrix preview highlights key areas of strength and potential challenges, offering a glimpse into their market positioning.

Unlock the full strategic picture by purchasing the complete Huhtamaki BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Stars

Huhtamaki's Fiber Packaging segment is a clear Star in its BCG matrix. In Q1 2025, this segment achieved a notable 10% comparable growth, fueled by both strategic pricing and increased sales volumes.

The segment's financial performance is equally impressive, with adjusted EBIT soaring by 40% to EUR 12.3 million, reflecting a healthy 12.8% margin. This robust growth is underpinned by the expanding molded fiber packaging market, which is expected to grow from USD 9.602 billion in 2024 to USD 14.624 billion by 2032, with a compound annual growth rate of 5.4%.

This market expansion is largely attributed to stricter environmental regulations and a growing consumer preference for sustainable packaging solutions, positioning Huhtamaki's Fiber Packaging segment for continued success and market leadership.

Huhtamaki is making significant strides in sustainable and recyclable packaging, developing solutions from renewable resources to meet increasing consumer and regulatory demand. This focus positions them well within the burgeoning sustainable packaging market.

The sustainable packaging market is anticipated to expand from an estimated USD 301.8 billion in 2025 to USD 530.4 billion by 2035, demonstrating a robust compound annual growth rate of 5.8%. Huhtamaki's investment in innovative materials, such as paperboard alternatives to plastic and formulations with less plastic coating, directly addresses this high-growth sector.

The bio-based plastic packaging sector is a star performer, with an anticipated compound annual growth rate of 17.7% from 2025 to 2034. This market is expected to reach around USD 100.4 billion by 2034, driven by strong demand for sustainable alternatives.

Huhtamaki's investment in bio-based packaging, including their popular spout pouches, aligns perfectly with this upward trend. This focus capitalizes on the increasing consumer preference and regulatory pressure to move away from conventional plastics.

North American Operations in Foodservice Packaging

In 2024, Huhtamaki's North American operations within foodservice packaging demonstrated resilience, outperforming other regions despite subdued overall market volumes. This strategic focus is underscored by substantial investments aimed at expanding capacity, signaling a commitment to capturing growth in this key market. The region's performance suggests a strong market position, likely translating to a significant market share in a segment experiencing varied but overall positive regional trends.

Huhtamaki's strategic investments in North America for foodservice packaging in 2024 are a clear indicator of its Stars position. The company has been actively expanding its manufacturing capabilities, with particular emphasis on high-growth segments like sustainable foodservice solutions. For instance, the company announced plans to increase production capacity for molded fiber products in North America, a move that directly addresses the growing demand for eco-friendly packaging alternatives.

- North American foodservice packaging volumes in 2024 showed relative strength compared to other global regions.

- Huhtamaki has strategically allocated significant capital for business expansion and capacity increases in North America.

- This regional performance suggests Huhtamaki holds a substantial market share in a segment that, while regionally diverse, exhibits promising growth potential.

Advanced Recycling Technologies and Partnerships

Huhtamaki is actively involved in collaborations to boost circular economy practices, aligning with the industry's push for advanced recycling technologies. This strategic focus places them in a rapidly expanding market segment.

The global market for recyclable packaging is projected to grow significantly, reaching USD 50.93 billion by 2034 from USD 33.11 billion in 2025, at a compound annual growth rate of 4.9%. Investments in these innovative recycling methods are vital for Huhtamaki to sustain its leadership in the sustainable packaging sector.

- Circular Economy Focus: Huhtamaki's partnerships drive the adoption of advanced recycling, crucial for a sustainable future.

- Market Growth Potential: The recyclable packaging market's projected expansion highlights the opportunity in advanced recycling.

- Technological Investment: Continued investment in advanced recycling technologies is key to maintaining market competitiveness.

Huhtamaki's Fiber Packaging segment is a definite Star, showing a 10% comparable growth in Q1 2025. This is driven by smart pricing and increased sales, leading to a 40% jump in adjusted EBIT to EUR 12.3 million. The broader molded fiber packaging market is also expanding, expected to reach USD 14.624 billion by 2032 from USD 9.602 billion in 2024, thanks to environmental regulations and consumer demand for sustainable options.

| Segment | 2024 Market Size (USD Billion) | 2025 Market Size (USD Billion) | 2025-2034 CAGR | Huhtamaki's Position |

|---|---|---|---|---|

| Fiber Packaging | 9.602 | N/A | 5.4% (Molded Fiber) | Star |

| Sustainable Packaging | 301.8 | 316.7 (estimated) | 5.8% (2025-2035) | Star |

| Bio-based Plastic Packaging | N/A | N/A | 17.7% (2025-2034) | Star |

What is included in the product

This Huhtamaki BCG Matrix overview offers clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A Huhtamaki BCG Matrix overview simplifies complex portfolio decisions, acting as a pain point reliever for strategic planning.

Cash Cows

Huhtamaki's Flexible Packaging business, a mature segment, is positioned as a Cash Cow. Despite some market volatility, this division has demonstrated a strong commitment to enhancing its profit margins, a strategy that bore fruit in the first quarter of 2025 with notable improvements.

The global flexible packaging market is a substantial and growing sector, anticipated to reach nearly USD 400 billion by 2029. Key drivers for this expansion include increasing consumer demand for sustainable packaging solutions and stringent requirements for food safety, areas where Huhtamaki has a strong presence.

While the growth trajectory of flexible packaging may not match that of more nascent market segments, its established position and Huhtamaki's strategic focus on operational efficiency ensure a steady and reliable generation of cash flow. This consistent performance underpins its Cash Cow status within the BCG matrix.

Huhtamaki's foodservice packaging, a core part of its business, demonstrates stability in mature markets. Sales in Q1 2025 mirrored the prior year, signaling a consistent market position. This segment, while mature, benefits from Huhtamaki's established strength, suggesting it acts as a reliable source of cash flow.

The broader sustainable foodservice packaging market is projected to reach USD 117.2 billion by 2034. While this indicates future growth potential, Huhtamaki's current solid footing within this segment solidifies its role as a cash cow, generating dependable revenue streams for the company.

Traditional paperboard-based solutions are a cornerstone of Huhtamaki's business, fitting squarely into the Cash Cows quadrant of the BCG matrix. Paper and paperboard materials currently hold a significant 40% of the sustainable packaging market share as of 2024, underscoring their enduring relevance and widespread adoption.

Huhtamaki's robust portfolio of fiber packaging, particularly in segments like egg cartons which experienced a notable surge in demand throughout 2024, forms a stable and predictable revenue stream. These mature products require minimal further investment for growth and are likely to continue generating substantial and consistent cash flow for the company.

Packaging for On-the-Shelf Food and Beverages

Packaging for on-the-shelf food and beverages represents a significant portion of Huhtamaki's revenue, aligning with its Cash Cow status in the BCG Matrix. This segment benefits from consistent consumer demand for everyday food items, translating into stable sales for Huhtamaki's packaging solutions. Their established market presence and focus on product protection and food safety solidify their high market share in this mature industry.

Huhtamaki's commitment to innovation in food packaging, particularly for products displayed prominently on retail shelves, underpins its Cash Cow designation. For instance, in 2023, Huhtamaki reported total sales of €4.7 billion, with a substantial portion attributed to its Foodservice E&I segment, which includes many on-the-shelf applications. The recurring nature of consumer purchasing for packaged foods ensures a predictable revenue stream.

- Market Dominance: Huhtamaki holds a strong position in the on-the-shelf food packaging market due to established relationships with major food brands.

- Stable Revenue: The consistent demand for packaged food products provides a reliable and predictable income for this business unit.

- Food Safety Focus: Investments in technologies that enhance food preservation and safety contribute to customer loyalty and market share.

- Mature Market Dynamics: While growth may be moderate, the large market size and recurring sales make it a dependable source of profit.

Efficiency Programs and Cost Savings

Huhtamaki's commitment to efficiency is a cornerstone of its cash cow strategy. The company's ongoing efficiency programs have proven remarkably effective, delivering approximately EUR 87 million in cost savings by the end of the first quarter of 2025. This substantial achievement has been instrumental in offsetting the impact of high cost inflation, demonstrating the resilience and profitability of its mature business segments.

These initiatives directly bolster the profitability of Huhtamaki's established operations. By streamlining processes and reducing operational expenditures, the company enhances its profit margins. This increased profitability translates into stronger cash flow generation from its existing business units, a defining characteristic of a successful cash cow.

- Efficiency Programs: Huhtamaki's ongoing efficiency initiatives have yielded significant cost savings.

- Cost Savings Achieved: By the end of Q1 2025, these programs generated approximately EUR 87 million in savings.

- Impact on Profitability: Improved operational efficiency and cost reduction directly contribute to higher profit margins.

- Cash Flow Generation: The savings enhance cash flow from existing, mature business operations, aligning with cash cow characteristics.

Huhtamaki's established segments, such as flexible packaging and foodservice packaging, are firmly positioned as Cash Cows. These mature businesses benefit from consistent consumer demand and Huhtamaki's strong market presence, generating a reliable stream of income with minimal need for significant reinvestment.

The company's focus on operational efficiency, evidenced by EUR 87 million in cost savings by Q1 2025, directly enhances the profitability of these mature units. This efficiency strengthens their ability to generate substantial and predictable cash flow, reinforcing their Cash Cow status.

Huhtamaki's fiber packaging, particularly for everyday items like egg cartons, also contributes to its Cash Cow portfolio. The significant market share of paper and paperboard in sustainable packaging, around 40% in 2024, highlights the enduring demand for these solutions.

On-the-shelf food and beverage packaging, a substantial revenue driver for Huhtamaki, exemplifies a Cash Cow. With total sales of €4.7 billion in 2023, a significant portion comes from these stable, recurring revenue streams, supported by a focus on food safety and brand relationships.

| Huhtamaki Business Segment | BCG Matrix Position | Key Supporting Data |

| Flexible Packaging | Cash Cow | Global market projected to reach nearly USD 400 billion by 2029. Q1 2025 saw profit margin improvements. |

| Foodservice Packaging | Cash Cow | Global market projected to reach USD 117.2 billion by 2034. Q1 2025 sales mirrored prior year, indicating stability. |

| Fiber Packaging (e.g., Egg Cartons) | Cash Cow | Paper & paperboard hold 40% of the sustainable packaging market share (2024). Experienced surge in demand in 2024. |

| On-the-Shelf Food Packaging | Cash Cow | Contributes significantly to Huhtamaki's €4.7 billion total sales (2023). Benefits from consistent consumer demand. |

Preview = Final Product

Huhtamaki BCG Matrix

The Huhtamaki BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase, offering a comprehensive strategic overview of their business units. This document is ready for immediate application, providing actionable insights without any watermarks or demo content. You'll gain access to a professionally designed analysis, perfect for informing your own strategic planning and decision-making processes.

Dogs

Legacy Plastic Packaging Solutions, characterized by their non-recyclable and non-sustainable nature, are increasingly becoming a liability in the current market. With global regulations tightening on single-use plastics and a strong consumer push for eco-friendly alternatives, demand for these older packaging types is in sharp decline. For instance, reports from 2024 indicate a significant drop in market share for conventional plastic packaging in many developed economies, driven by bans and taxes on non-recyclable materials.

Huhtamaki might have specific product lines in niche packaging segments facing decline. For instance, certain types of rigid plastic packaging for products with diminishing consumer demand or those replaced by lighter, more sustainable materials could fall into this category. These specialized offerings, often with a limited market share, represent potential 'Dogs' in the BCG matrix if their growth prospects remain dim.

In Q1 2025, Huhtamaki observed a dip in their foodservice segment, with retail tableware being a key area of decline. This suggests certain product lines within this category might be struggling to keep pace with market demands.

If these specific retail tableware items continue to see falling sales volumes and hold a low market share, especially those not incorporating eco-friendly materials or designs, they could be categorized as Dogs within the BCG matrix.

For instance, a product line with a projected annual sales decline of 5% and a market share below 1% would strongly indicate a Dog status, requiring careful evaluation of future investment or potential divestment.

High-Cost, Low-Volume Custom Packaging

High-Cost, Low-Volume Custom Packaging within Huhtamaki's BCG Matrix represents products that demand substantial investment in specialized production machinery and intricate design processes. Despite these high expenditures, these offerings cater to niche markets, resulting in limited sales volumes. For instance, a particular line of bespoke, high-barrier food packaging for a specialty cheese producer might fall into this category. In 2024, such a product line, while technically advanced, might only represent 0.5% of Huhtamaki's total revenue but consume disproportionately high R&D and capital expenditure.

These products often struggle to generate adequate returns on investment and may not offer significant long-term strategic advantages or growth potential. They can tie up valuable resources, including capital and manufacturing capacity, that could be better allocated to more promising segments. For example, if a custom packaging solution for a limited-edition luxury cosmetic line requires a dedicated, high-cost production run and the market demand is only a few thousand units, it fits this profile. Such items might have a gross margin of 40%, but the low volume means the overall profit contribution is minimal, potentially even negative when considering the upfront setup costs.

- High Investment: Requires significant capital for specialized molds, printing plates, and unique material sourcing.

- Low Sales Volume: Targets niche markets or limited production runs, leading to fewer units sold.

- Resource Drain: Consumes R&D, manufacturing, and marketing resources without commensurate returns.

- Limited Growth Potential: Lacks scalability and often faces high competition or obsolescence risk.

Outdated Manufacturing Technologies or Facilities

Facilities or production lines that are stuck with older technologies can be a real drain. Think of them as the 'Dogs' in Huhtamaki's BCG Matrix for asset management. These older setups often mean higher operating costs because they're less energy-efficient and require more manual labor compared to newer, automated systems. For instance, a plant still using 1990s-era injection molding machines might have significantly higher energy consumption per unit produced than a facility with 2020s technology.

This inefficiency directly impacts profitability. When a company has a lot of capital tied up in these outdated assets, it's like having money sitting in a low-yield savings account instead of being invested in growth opportunities. These 'Dog' assets might not be generating enough revenue or profit to justify their continued use, especially when compared to the potential returns from modernizing or divesting.

Consider the broader industry context. In 2024, many manufacturing sectors are seeing a push towards Industry 4.0 technologies, including AI-driven optimization and advanced robotics. Companies that haven't kept pace risk falling behind competitors who benefit from lower production costs and greater flexibility. For example, if a competitor can produce a comparable product at a 15% lower cost due to automation, the older facility becomes a significant competitive disadvantage.

- Higher Operational Costs: Outdated machinery often consumes more energy and requires more maintenance, increasing per-unit production expenses.

- Lower Efficiency: Slower production speeds and higher defect rates are common with older technologies, impacting overall output and quality.

- Capital Inefficiency: Significant investment in obsolete facilities yields diminishing returns, tying up capital that could be used for innovation or expansion.

- Competitive Disadvantage: Competitors with modern facilities can often offer lower prices or higher quality, eroding market share.

Dogs in Huhtamaki's BCG matrix represent products or business units with low market share and low growth potential. These are often legacy products facing declining demand or intense competition, requiring significant investment to maintain but offering little return. For instance, certain non-recyclable plastic packaging solutions, like those used for niche food items, might fit this description if market trends shift away from them, as seen with increasing regulations in 2024.

These 'Dogs' can consume resources without contributing significantly to overall growth or profitability. Identifying them is crucial for strategic decision-making, allowing the company to decide whether to divest, harvest, or invest minimally to maintain them. For example, a specific line of custom packaging for a product with a shrinking consumer base would be a prime candidate for this classification.

The challenge with Dogs lies in their ability to tie up capital and management attention that could be better utilized elsewhere. Huhtamaki's Q1 2025 dip in retail tableware, particularly for items not embracing eco-friendly designs, highlights a potential area where such 'Dog' products might exist, demanding careful analysis and potential restructuring.

A clear indicator of a 'Dog' status would be a product line experiencing a consistent annual sales decline, say 5%, coupled with a market share below 1% as observed in certain segments during 2024. This scenario necessitates a strategic review to determine the best course of action, whether it's phasing out the product or finding a very niche, low-cost way to sustain it.

| Product Category Example | Market Share (Est.) | Market Growth (Est.) | Profitability | Strategic Recommendation |

| Legacy Non-Recyclable Plastic Packaging | Low (e.g., <1%) | Declining (e.g., -5% annually) | Low to Negative | Divest or Phase Out |

| Certain Retail Tableware (Non-Eco) | Low (e.g., 0.5%) | Stagnant to Declining | Low | Evaluate for Divestment or Niche Focus |

| High-Cost, Low-Volume Custom Packaging | Niche (<2%) | Limited (<3%) | Low (due to high costs) | Harvest or Divest |

Question Marks

Huhtamaki's commitment to emerging bio-polymers and plant-based materials positions them in a high-growth segment of the sustainable packaging market. These innovative materials are crucial for meeting increasing consumer demand for eco-friendly solutions.

The bio-based plastic packaging market is a prime example of this trend, with projections indicating a robust compound annual growth rate (CAGR) of 17.7% between 2025 and 2034. This significant growth underscores the potential for these materials to become mainstream.

While the growth trajectory is promising, Huhtamaki's current market share within these specific, advanced bio-polymer and plant-based material categories might still be developing. Capturing leadership in these cutting-edge areas will likely necessitate substantial investment in research, development, and production capabilities.

Huhtamaki's advanced digital printing and smart packaging solutions, integrating technologies like RFID and QR codes, are positioned as a high-growth area. These innovations boost traceability and consumer interaction, crucial for modern brands. While the market for these data-driven packaging solutions is expanding rapidly, Huhtamaki's current market share in this niche is likely still building, necessitating focused investment to capitalize on this evolving segment.

The e-commerce boom, with its projected 23% share of global retail sales by 2027, creates a substantial need for specialized packaging. Huhtamaki's flexible packaging segment is well-positioned to address this, but the company can further capitalize by developing innovative, lightweight, and tamper-evident solutions specifically designed for the unique demands of online retail.

Innovative Solutions for Extended Shelf Life and Food Waste Reduction

The market for packaging that extends food shelf life and tackles waste is booming, driven by consumer demand for safety and eco-friendly options. Huhtamaki's innovation in high-barrier films and advanced materials fits perfectly into this high-growth segment, potentially representing a Stars category in their BCG matrix.

These advanced materials are crucial for preserving food quality and reducing spoilage throughout the supply chain. For instance, the global food packaging market is projected to reach over $400 billion by 2027, with a significant portion attributed to solutions addressing food waste.

- High-Barrier Films: Huhtamaki's advancements in materials that create superior oxygen and moisture barriers are key to extending product freshness.

- Sustainability Focus: The company's commitment to developing recyclable and compostable solutions within this category aligns with growing environmental regulations and consumer preferences.

- Market Opportunity: This segment is experiencing rapid growth, offering Huhtamaki a chance to capture significant market share with continued investment and innovation.

- Investment Rationale: Supporting these innovative packaging solutions with dedicated R&D and production capacity is essential for solidifying Huhtamaki's position as a leader in combating food waste.

Geographical Expansion in High-Growth Emerging Markets

Huhtamaki's strategic push into burgeoning economies in Asia-Pacific and Latin America, characterized by rapid urbanization and industrial growth, aligns with a Question Mark approach in the BCG Matrix.

These markets, while presenting substantial opportunities for sustainable packaging solutions, require significant investment to build market presence and compete effectively with established local and international competitors. For instance, the Asia-Pacific packaging market was projected to reach over $270 billion by 2024, indicating a dynamic but competitive landscape.

Huhtamaki's success in these regions hinges on its ability to adapt its product offerings to local needs and regulatory environments while navigating potential price sensitivities. The company's investments in these areas are aimed at capturing future market share, acknowledging the inherent risks and the need for substantial capital to achieve dominance.

- Geographical Focus: Asia-Pacific and Latin America, driven by urbanization and industrialization.

- Market Potential: High growth prospects for sustainable packaging solutions.

- Competitive Landscape: Significant presence of existing players requiring strategic market entry.

- Investment Strategy: Capital intensive, focused on building market share and long-term growth.

Huhtamaki's expansion into emerging economies like Asia-Pacific and Latin America represents a classic Question Mark scenario. These regions offer substantial growth potential for sustainable packaging, with the Asia-Pacific packaging market alone projected to exceed $270 billion by 2024.

However, establishing a strong foothold requires significant investment to navigate local market dynamics and competition. The company's strategic capital allocation to these areas is a calculated risk to secure future market share.

Success will depend on adapting products to regional needs and regulatory landscapes, a common challenge for Question Marks aiming for Star status.

The company's venture into these high-potential but uncertain markets is a key element of its long-term growth strategy.

| BCG Category | Huhtamaki Segment | Market Growth | Relative Market Share | Strategic Implication |

| Question Mark | Emerging Economies (Asia-Pacific, Latin America) | High (e.g., APAC packaging market > $270B by 2024) | Low to Medium | Requires significant investment to build market share; potential to become a Star if successful. |

| Sustainable Packaging Solutions in Emerging Markets | High | Developing | Focus on adapting products and navigating local competition. | |

| New Bio-polymer & Plant-based Materials | Very High (e.g., Bio-based plastics CAGR 17.7% 2025-2034) | Low | Invest in R&D and production to capture leadership in a nascent, high-growth area. |

BCG Matrix Data Sources

Our Huhtamaki BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.