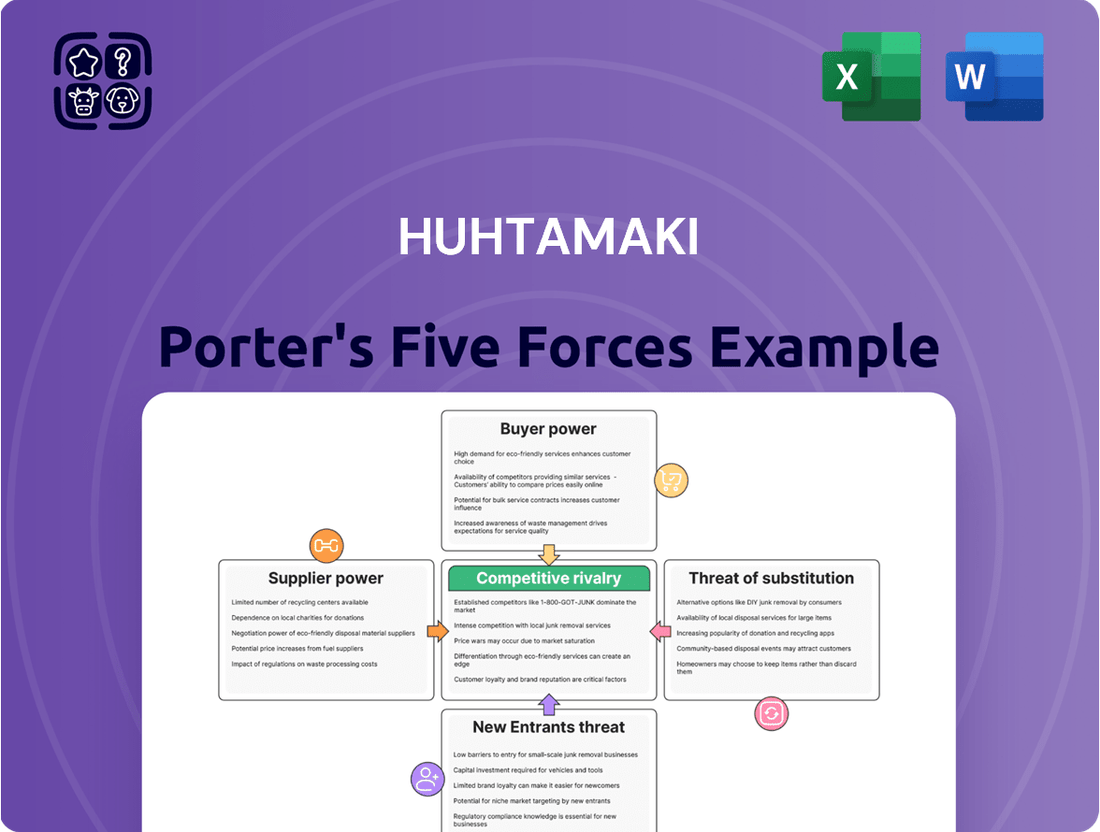

Huhtamaki Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Huhtamaki's competitive landscape is shaped by the powerful forces of buyer bargaining power, the threat of new entrants, and the intensity of rivalry within the packaging industry. Understanding these dynamics is crucial for navigating its market position.

The complete report reveals the real forces shaping Huhtamaki’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Huhtamaki's reliance on key raw materials such as plastics, paper, and fiber exposes it to significant price volatility. These fluctuations, influenced by global economic health, geopolitical events, and supply chain snags, directly impact production expenses and profit margins. For instance, the corrugated box market saw price increases in late 2024 due to hurricane disruptions and strong demand, before stabilizing as supply chains recovered.

Huhtamaki's commitment to sustainable packaging directly impacts the bargaining power of suppliers, especially those providing eco-friendly and recyclable materials. As demand for these materials grows, suppliers who can reliably offer them gain leverage. For instance, the market for recycled PET (rPET) has seen significant price fluctuations, with prices for food-grade rPET increasing in 2024 due to high demand and limited supply, giving these suppliers more power.

The transition to sustainable materials often requires substantial investment in new technologies and processes for Huhtamaki. This can increase reliance on specialized suppliers who possess the necessary expertise or proprietary materials. For example, suppliers of advanced bioplastics or novel biodegradable compounds might command higher prices or more favorable terms, reflecting the unique value and R&D investment they bring to the table.

Supplier concentration is a key factor influencing bargaining power. If Huhtamaki relies on a few dominant suppliers for essential packaging materials or specialized components, these suppliers gain leverage. This concentration means fewer alternatives for Huhtamaki, potentially leading to less favorable pricing and contract terms. For instance, if the market for specific bioplastics or advanced barrier films is controlled by a handful of producers, their ability to dictate terms to Huhtamaki increases significantly.

While precise data on Huhtamaki's supplier concentration isn't publicly detailed, the company's reliance on a diverse range of raw materials, from paper and board to plastics and aluminum, means that concentration in any single material category could pose a risk. The general volatility in commodity prices, as seen in the fluctuations of pulp and resin markets throughout 2024, underscores the potential for suppliers to exert influence when their supply is critical and less substitutable.

Switching Costs for Huhtamaki

The costs Huhtamaki incurs when switching from one supplier to another significantly influence supplier bargaining power. These costs can include retooling specialized machinery to accommodate new materials or components, the expense and time involved in re-certifying materials to meet quality and safety standards, and the potential disruption to production schedules during the transition. For instance, if Huhtamaki relies on highly specific, custom-engineered packaging materials, the investment in new molds or processing equipment could be substantial, making a switch prohibitive.

High switching costs can lock Huhtamaki into existing supplier relationships, increasing its dependence. This dependence grants suppliers leverage, allowing them to potentially dictate terms or increase prices. Huhtamaki's ongoing commitment to innovation, evident in its 2024 investments in advanced manufacturing technologies and expanded production capacity, often necessitates specialized inputs. This deep integration of supplier materials into its proprietary processes further elevates the switching costs.

- Retooling Costs: Investments in new machinery or modifications to existing lines to process alternative materials.

- Re-certification Expenses: Costs associated with testing and approving new raw materials or components for compliance and quality.

- Production Disruption: Lost revenue and increased operational costs due to downtime during supplier transitions.

- Supplier Integration: The degree to which a supplier's product is embedded in Huhtamaki's manufacturing processes and R&D.

Forward Integration Threat by Suppliers

Suppliers can wield significant bargaining power if they possess a credible threat of forward integration, meaning they could start manufacturing packaging themselves. This is particularly relevant for suppliers of highly specialized components rather than basic raw materials. For instance, if a supplier of a unique, high-performance coating for food packaging were to enter the packaging production business, it would directly challenge existing players like Huhtamaki.

Consider the potential impact on Huhtamaki's cost structure. If a key supplier of advanced barrier films, essential for extending shelf life in food packaging, were to integrate forward, they could potentially dictate terms or even capture a larger share of the value chain. This would force Huhtamaki to either pay higher prices for these critical materials or compete directly with their own supplier.

- Forward Integration Threat: Suppliers moving into packaging manufacturing increases their leverage over existing packaging companies.

- Specialized Components: This threat is more pronounced for suppliers of unique or high-value components.

- Impact on Costs: Increased supplier power can lead to higher input costs for packaging manufacturers.

- Competitive Landscape: Suppliers integrating forward can become direct competitors, altering market dynamics.

Huhtamaki's suppliers, particularly those providing specialized sustainable materials or key components, hold considerable bargaining power. This is amplified by factors like supplier concentration, high switching costs, and the potential for forward integration. For example, the market for recycled PET (rPET), crucial for many food-grade packaging applications, saw price increases in 2024 due to strong demand and limited supply, giving rPET suppliers more leverage.

The company's reliance on specific, advanced materials, such as those for high-performance barrier films, further strengthens supplier positions. Switching to alternative materials can involve significant costs for retooling machinery and re-certifying products, making suppliers of these specialized inputs more influential. As of late 2024, the costs for pulp and certain plastic resins remained volatile, indicating ongoing supplier influence in these segments.

| Factor | Impact on Huhtamaki | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant suppliers | Concentration in bioplastics or advanced films market |

| Switching Costs | Reduced ability to change suppliers | Retooling, re-certification, production disruption |

| Forward Integration Threat | Potential for suppliers to become competitors | Suppliers of specialized coatings entering packaging production |

| Material Volatility | Direct impact on production costs | rPET price increases due to demand/supply imbalance |

What is included in the product

This analysis unpacks the competitive forces impacting Huhtamaki, examining industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly assess competitive pressures across the packaging industry, enabling Huhtamaki to proactively mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Huhtamaki's customer base is diverse, spanning industries like food and beverage. However, its bargaining power is significantly influenced by large clients, such as major food corporations or prominent foodservice chains, who procure products in substantial quantities. These high-volume purchasers can effectively negotiate pricing and terms, leveraging their significant order sizes.

In 2024, the demand for pre-packed food, particularly egg packaging, and flexible packaging experienced notable growth. This trend highlights segments where large customers, due to their consistent and considerable orders, are likely to wield considerable influence over suppliers like Huhtamaki, potentially driving down margins or dictating specific product features.

The availability of substitute packaging significantly empowers customers in their dealings with Huhtamaki. Consumers and businesses can readily source packaging from numerous other manufacturers, diluting the reliance on any single supplier. This competitive landscape means Huhtamaki must remain price-competitive and innovative to retain its customer base.

Furthermore, the increasing variety of packaging materials and formats available on the market amplifies customer choice. Innovations in reusable, compostable, and even edible packaging offer viable alternatives to traditional options. For instance, the global market for sustainable packaging, which includes many of these alternatives, was valued at approximately $274 billion in 2023 and is projected to grow substantially in the coming years, demonstrating a clear shift in consumer preference and increasing the bargaining power of those seeking eco-friendly solutions.

Customer switching costs are a key factor in how much power customers have over Huhtamaki. If it's easy and cheap for a customer to switch to another packaging supplier, they have more leverage. For instance, if a customer can easily find a new supplier without needing to redesign their packaging, re-certify the new supplier, or make significant changes to their production lines, their bargaining power increases.

Conversely, when these switching costs are high, customer power is diminished. For Huhtamaki, this might involve situations where their specialized packaging solutions require significant investment or time for a customer to replicate with a competitor. For example, if a customer has integrated Huhtamaki's unique material science or proprietary sealing technology into their product, the cost and effort to switch to a supplier offering a less advanced or different solution would be substantial, thereby reducing the customer's bargaining power.

Price Sensitivity of Customers

In highly competitive packaging markets, customers often exhibit significant price sensitivity, particularly for standardized products. This means Huhtamaki must be vigilant about its pricing strategies to remain competitive, even when facing increased input costs.

For instance, in 2024, Huhtamaki observed a decrease in its sales prices. This was directly linked to the company passing on lower raw material costs to its customers, highlighting the direct impact of price sensitivity on revenue streams.

- Price Sensitivity Impact Customers' focus on price forces companies like Huhtamaki to offer competitive rates, directly affecting profit margins.

- 2024 Pricing Trends Huhtamaki experienced lower sales prices in 2024 due to the pass-through of reduced raw material expenses, demonstrating customer pressure to benefit from cost savings.

- Market Dynamics In markets with many suppliers, customers have more options, intensifying the need for price competitiveness.

Backward Integration Threat by Customers

Customers, especially large ones, can exert significant bargaining power by threatening to backward integrate, meaning they might consider producing their own packaging if it becomes more cost-effective or strategically beneficial. This looming possibility, even if never fully acted upon, puts pressure on suppliers like Huhtamaki to maintain competitive pricing and service levels.

For instance, a major food and beverage manufacturer, representing a substantial portion of a packaging supplier's revenue, might analyze the cost of setting up its own internal packaging production. If the projected internal costs, including capital expenditure and operational overhead, approach or fall below current supplier prices, the threat of backward integration becomes credible. This can lead to demands for lower prices or more favorable contract terms from existing suppliers.

- Customer Bargaining Power: Large customers can leverage the threat of backward integration to negotiate better terms.

- Strategic Advantage: Customers may consider in-house production if it offers cost savings or greater control over supply chain.

- Cost Analysis: For a major client, the decision to backward integrate hinges on a thorough cost-benefit analysis of internal production versus external sourcing.

- Market Pressure: This threat, whether realized or not, forces packaging manufacturers to remain highly competitive in pricing and innovation.

Huhtamaki's customers, particularly large corporations, possess considerable bargaining power due to their substantial order volumes and the availability of numerous alternative packaging suppliers. This power is amplified by customers' price sensitivity and the potential for backward integration, forcing Huhtamaki to maintain competitive pricing and innovation to retain business.

| Factor | Impact on Huhtamaki | 2024 Data/Trend |

|---|---|---|

| Customer Concentration | High-volume buyers can negotiate favorable terms. | Growth in pre-packed food and flexible packaging segments increases leverage for large clients. |

| Availability of Substitutes | Numerous suppliers dilute reliance, increasing customer choice. | The global sustainable packaging market, offering alternatives, was valued at ~$274 billion in 2023. |

| Switching Costs | Low switching costs empower customers to change suppliers easily. | Easy integration of new packaging designs without production line changes increases customer leverage. |

| Price Sensitivity | Customers demand competitive pricing, impacting margins. | Huhtamaki saw lower sales prices in 2024 due to passing on reduced raw material costs. |

| Threat of Backward Integration | Customers may produce packaging in-house if cost-effective. | Major clients analyze internal production costs, creating pressure on suppliers for better terms. |

Full Version Awaits

Huhtamaki Porter's Five Forces Analysis

This preview showcases the complete Huhtamaki Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the packaging industry. The document you see here is precisely what you will receive immediately after purchase, providing actionable insights without any alterations or missing sections. You can trust that the professionally formatted analysis, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry, is ready for your immediate use.

Rivalry Among Competitors

Huhtamaki operates in a highly competitive global food packaging market. Key rivals include major players such as Amcor, Sonoco, Berry Global, Sylvamo, MM Group, International Paper, and Packaging Corporation of America, all of whom possess significant market share and resources.

The sheer number of both global and regional competitors intensifies this rivalry, forcing companies to constantly innovate and optimize their offerings to maintain a competitive edge.

The global food packaging market is experiencing robust growth, with projections indicating a healthy expansion. This upward trend, particularly in the flexible packaging segment which is both the largest and fastest-growing, can sometimes temper intense rivalry. However, despite the overall market expansion, fierce competition for dominance within specific niches remains a significant factor.

The financial landscape for food packaging is compelling. In 2024, the market generated a substantial USD 400,278.7 million. Looking ahead, it's anticipated to reach USD 562,322.7 million by 2030, reflecting a compound annual growth rate of 5.8%. This growth suggests opportunities, but also highlights the potential for increased competition as more players vie for a share of this expanding pie.

Huhtamaki actively differentiates itself through a strong emphasis on sustainable, innovative, and recyclable packaging solutions. This focus is crucial in a market where consumers increasingly demand eco-friendly options.

However, the competitive landscape is intense, with rivals also pouring significant resources into research and development. For instance, competitors are exploring novel materials like water-soluble packaging and mushroom-based alternatives, alongside advancements in mono-material designs, all of which demand Huhtamaki’s continuous innovation to stay ahead.

Switching Costs for Customers

The packaging industry generally experiences relatively low switching costs for customers. This means that a client can switch from one packaging supplier to another without incurring significant expenses or facing major disruptions. For instance, a food manufacturer can easily change their primary packaging provider if another company offers a slightly lower price or a more convenient delivery schedule. This ease of switching directly fuels competitive rivalry.

This low switching cost environment compels companies like Huhtamaki to differentiate themselves beyond just price. They must cultivate strong customer relationships, ensuring exceptional service quality and consistently innovating their product offerings. This focus on value-added services and product development is crucial for retaining customers in a market where switching is straightforward.

- Low Switching Costs: Customers in the packaging sector can readily switch suppliers, often driven by price or service variations, intensifying competition.

- Competitive Response: This dynamic pressures companies like Huhtamaki to prioritize customer loyalty through superior service and ongoing product enhancement.

- Industry Trend: In 2024, the emphasis on sustainability and customized packaging solutions further influences customer decisions, making supplier responsiveness a key retention factor.

Exit Barriers

Huhtamaki likely faces moderate exit barriers. While the company operates globally with significant investments in production facilities, the specialized nature of some of its assets and potential contractual obligations could make exiting certain markets or product lines challenging. This can lead to companies remaining in operation even when unprofitable, potentially intensifying price competition.

The company's substantial asset base, including numerous manufacturing plants worldwide, suggests that divesting or closing these facilities might incur significant costs. For instance, Huhtamaki's 2023 annual report highlights its extensive network of production sites across various continents, implying considerable capital tied up in physical assets. These fixed costs and potential write-downs associated with asset disposal act as a deterrent to exiting, thereby influencing competitive dynamics.

- High capital investment in specialized machinery for packaging production.

- Long-term supply and customer contracts that may carry penalties for early termination.

- Geographical diversification of assets, making a complete global exit complex and costly.

- Potential for significant write-offs on specialized, non-transferable equipment.

Competitive rivalry within the food packaging industry is intense, driven by a large number of global and regional players vying for market share. The market's substantial growth, projected to reach USD 562,322.7 million by 2030, attracts new entrants and encourages existing companies to innovate aggressively. Low switching costs for customers further amplify this rivalry, compelling firms like Huhtamaki to focus on differentiation through sustainability and service quality to retain business.

The food packaging market in 2024 is a dynamic arena with significant competitive pressures. Companies must navigate the challenge of numerous rivals, including giants like Amcor and Sonoco, who also invest heavily in R&D for sustainable solutions. This environment necessitates continuous innovation to meet evolving consumer demands for eco-friendly packaging, making differentiation a critical survival strategy.

Huhtamaki faces considerable competitive rivalry, exacerbated by low customer switching costs and substantial investments in R&D by its peers. The global food packaging market, valued at USD 400,278.7 million in 2024, is expected to grow, but this expansion also intensifies competition as players like Amcor and Sonoco push for market dominance through sustainable innovations and advanced materials.

SSubstitutes Threaten

The growing focus on sustainability and the circular economy is fueling the adoption of reusable packaging solutions, presenting a significant threat to traditional single-use options. These alternatives, such as returnable containers and refillable systems, are designed for longevity and multiple uses.

The reusable packaging market is projected to expand, with an estimated compound annual growth rate of 6.1% between 2024 and 2032. This trend indicates a clear shift in consumer and business preferences towards more environmentally friendly packaging, directly impacting companies reliant on disposable materials.

Edible packaging, leveraging innovations like seaweed-based films and edible coatings, presents a growing threat of substitution, especially for single-use applications in the food sector. These sustainable alternatives offer a biodegradable and consumable option that directly competes with conventional materials.

The food on-the-go market is particularly vulnerable, as companies actively develop these disruptive solutions. For instance, by 2024, the global edible packaging market was projected to reach over $1.5 billion, indicating significant consumer and industry interest in these alternatives.

The increasing consumer and regulatory pressure to reduce packaging altogether presents a significant threat of substitutes for companies like Huhtamaki. This manifests in trends like bulk buying and package-free stores, where consumers bypass traditional packaged goods entirely. For instance, the global zero-waste market was valued at approximately $24.4 billion in 2023 and is projected to grow substantially, indicating a rising demand for unpackaged alternatives.

Alternative Materials and Formats

The threat of substitutes for Huhtamaki's packaging solutions is growing, particularly from alternative materials. Beyond traditional plastics and paper, innovations like mushroom-based foams, plant-based polymers, and advanced fiber-based formats are entering the market. These new materials aim to tackle environmental concerns and offer distinct functional advantages, presenting a challenge to conventional packaging.

For instance, the bioplastics market, a key area for substitutes, saw significant growth. In 2023, the global bioplastics production capacity reached approximately 2.7 million metric tons, with projections indicating a steady increase. This expansion directly impacts sectors where Huhtamaki operates, as businesses increasingly seek sustainable alternatives for their product packaging.

These emerging substitutes offer a range of benefits that could sway customer preference:

- Environmental Appeal: Many substitutes are biodegradable or compostable, aligning with growing consumer demand for eco-friendly products.

- Novel Functionality: Some new materials provide unique properties such as enhanced insulation or specific barrier capabilities not easily achieved with traditional options.

- Regulatory Tailwinds: Increasing government regulations on single-use plastics globally create a more favorable environment for the adoption of these alternative materials.

- Cost Competitiveness: As production scales up, the cost of these innovative materials is becoming more competitive with conventional plastics and paper, reducing a key barrier to adoption.

Digital Solutions and Smart Packaging

Smart packaging, while not a direct material replacement, poses a threat by potentially reducing demand for traditional packaging functions. Technologies that monitor freshness or extend shelf life could lessen the need for certain barrier properties offered by Huhtamaki. For instance, active packaging that releases antimicrobial agents, a segment seeing significant innovation, could diminish reliance on conventional material barriers for spoilage prevention.

The increasing sophistication of digital solutions integrated into packaging also presents a substitute threat. Features like QR codes offering detailed product information or supply chain transparency can reduce the need for certain informational or functional aspects traditionally provided by the packaging itself. By 2024, the global smart packaging market was projected to reach over $40 billion, indicating substantial growth and adoption of these technologies.

- Smart Packaging Innovation: Technologies like modified atmosphere packaging (MAP) and ethylene absorbers are extending product shelf life, potentially reducing the need for high-barrier films in certain food applications.

- Digital Integration: The rise of track-and-trace systems and consumer engagement platforms via QR codes on packaging can substitute some of the information-delivery functions previously handled by specialized packaging materials.

- Market Growth: The global smart packaging market is expected to continue its upward trajectory, with projections indicating continued strong growth through 2025, driven by demand for enhanced product safety and consumer interaction.

The threat of substitutes for Huhtamaki's packaging is significant, driven by innovations in materials and a growing demand for sustainable alternatives. Reusable packaging, edible films, and even unpackaged solutions are gaining traction, directly challenging traditional single-use formats.

The reusable packaging market is projected for robust growth, with an estimated compound annual growth rate of 6.1% between 2024 and 2032. Edible packaging is also a notable disruptor, with the global market expected to exceed $1.5 billion by 2024, particularly impacting the food sector.

Beyond these, new material substitutes like mushroom-based foams and plant-based polymers offer distinct environmental advantages. The bioplastics market, for instance, had a global production capacity of approximately 2.7 million metric tons in 2023, showcasing the expanding landscape of alternative materials.

Furthermore, smart and digitally integrated packaging solutions are emerging, potentially reducing the need for certain functional aspects of traditional packaging. The global smart packaging market was projected to surpass $40 billion by 2024, highlighting the increasing adoption of technology-driven alternatives.

| Substitute Category | Key Innovation | Market Projection/Data Point |

|---|---|---|

| Reusable Packaging | Returnable containers, refillable systems | CAGR of 6.1% (2024-2032) |

| Edible Packaging | Seaweed-based films, edible coatings | Global market > $1.5 billion (2024) |

| Alternative Materials | Mushroom-based foams, bioplastics | Bioplastics capacity: ~2.7 million metric tons (2023) |

| Smart/Digital Packaging | QR codes, track-and-trace, active packaging | Global market > $40 billion (2024) |

Entrants Threaten

Entering the global packaging industry, particularly at the scale Huhtamaki operates, demands immense capital. We're talking about significant investments in state-of-the-art manufacturing plants, advanced machinery, and cutting-edge technology. For instance, a new, fully automated packaging production line can easily cost millions of dollars, making it a formidable hurdle for potential competitors.

The packaging industry faces a significant threat from new entrants due to the escalating complexity of regulatory compliance and sustainability standards. New players must invest heavily to understand and adhere to evolving environmental laws, waste management directives, and various eco-certifications, creating a substantial barrier to entry. For instance, in 2024, the European Union continued to push for stricter packaging waste reduction targets, with many member states implementing or enhancing Extended Producer Responsibility (EPR) schemes, requiring significant upfront investment from any new company entering the market.

Huhtamaki benefits from deeply entrenched relationships with its suppliers, built over years of consistent business, ensuring reliable access to raw materials. These long-standing partnerships are difficult for newcomers to replicate quickly. For instance, in 2023, Huhtamaki reported a strong supply chain performance, with over 90% of its key raw materials sourced through established, multi-year agreements.

The company also boasts an extensive global distribution network, reaching a vast array of customers across numerous sectors and geographies. Establishing a comparable reach would require significant capital investment and time for new entrants to build trust and logistical capabilities. Huhtamaki’s 2024 strategy continues to focus on optimizing these networks, aiming for a 5% increase in delivery efficiency by year-end.

Brand Loyalty and Customer Relationships

Huhtamaki benefits from significant brand loyalty and deeply entrenched customer relationships, a direct result of its long operating history and consistent delivery of quality products and reliable service. This established trust makes it challenging for new entrants to gain traction.

Newcomers face the considerable hurdle of not only matching Huhtamaki's product offerings but also replicating the strong bonds it has forged with its clientele. Building these relationships requires substantial investment in time, marketing, and customer support, a barrier that can deter potential competitors.

For instance, in the competitive flexible packaging sector, where Huhtamaki is a major player, customer retention rates are often high due to specialized product requirements and integrated supply chain solutions. A new entrant would need to demonstrate superior value or a unique selling proposition to persuade existing Huhtamaki customers to switch, a process that typically takes years and significant financial outlay.

- Brand Loyalty: Huhtamaki's established reputation fosters strong customer loyalty, making it difficult for new entrants to capture market share.

- Customer Relationships: Decades of consistent service and quality have built deep, trust-based relationships that new competitors must painstakingly replicate.

- Barriers to Entry: Overcoming existing brand loyalty and establishing new customer connections represents a significant and costly challenge for potential new entrants in Huhtamaki's markets.

Technological Advancements and Innovation Pace

The packaging industry is a hotbed of innovation, with new materials and technologies constantly emerging, especially in the realm of sustainable solutions. For instance, by early 2024, the global market for bioplastics, a key area of innovation, was projected to reach over $10 billion, indicating significant investment and growth. New companies entering this space need substantial research and development capabilities to not only match but also lead these advancements, offering products that are both environmentally friendly and cost-effective.

This rapid pace of technological change acts as a significant barrier to entry. Companies that cannot invest heavily in R&D risk being left behind by competitors who are quick to adopt or develop cutting-edge packaging solutions. For example, the development of advanced barrier coatings for food packaging, which extend shelf life and reduce waste, requires specialized knowledge and capital investment, making it challenging for less-resourced newcomers to compete effectively.

- High R&D Investment: New entrants require substantial capital for research and development to keep pace with evolving material science and manufacturing processes in packaging.

- Sustainable Innovation Focus: The drive towards eco-friendly packaging, including biodegradable and recyclable materials, necessitates significant investment in novel technologies and supply chains.

- Technological Obsolescence Risk: Companies failing to innovate risk their product offerings becoming outdated quickly, impacting competitiveness and market share.

- Intellectual Property: Patents on new materials or manufacturing techniques can create strong barriers, requiring potential entrants to either license technology or develop their own proprietary solutions.

The threat of new entrants for Huhtamaki remains moderate, primarily due to the substantial capital required for establishing large-scale, technologically advanced packaging operations. Significant investments are needed for manufacturing facilities, machinery, and R&D to compete effectively, especially in areas like sustainable packaging solutions. For instance, the global flexible packaging market, where Huhtamaki is a key player, saw continued investment in new capacity throughout 2023 and early 2024, with major players expanding their footprints.

Furthermore, navigating complex and evolving regulatory landscapes, particularly concerning environmental standards and waste management, presents a considerable barrier. New entrants must invest heavily to comply with directives like Extended Producer Responsibility (EPR) schemes, which were further refined in many regions during 2024. This compliance burden, coupled with the need for specialized knowledge, deters many potential competitors.

Huhtamaki’s deeply entrenched supplier relationships and extensive global distribution network also pose significant challenges for newcomers. Replicating these established ties and logistical capabilities requires considerable time and capital investment, making it difficult for new players to achieve comparable reach and reliability. By the end of 2023, Huhtamaki reported that over 90% of its key raw materials were secured through multi-year agreements, highlighting the strength of these relationships.

| Barrier Type | Description | Example/Data Point (2023-2024) |

|---|---|---|

| Capital Requirements | High initial investment for manufacturing, technology, and R&D. | A new, automated packaging line can cost millions; global bioplastics market projected over $10 billion by early 2024. |

| Regulatory Compliance | Adherence to evolving environmental and waste management laws. | EU's continued push for stricter packaging waste reduction targets and enhanced EPR schemes in 2024. |

| Supplier Relationships | Long-standing, reliable access to raw materials. | Huhtamaki's >90% of key raw materials sourced via multi-year agreements (2023). |

| Distribution Network | Extensive global reach and logistical capabilities. | Huhtamaki's 2024 strategy targets a 5% increase in delivery efficiency. |

| R&D and Innovation | Need for continuous investment in new materials and technologies. | Development of advanced barrier coatings requires specialized knowledge and capital. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Huhtamaki is built upon a foundation of robust data, including Huhtamaki's annual reports, industry-specific market research from firms like Euromonitor and Statista, and relevant regulatory filings. This comprehensive approach ensures a thorough understanding of the competitive landscape.