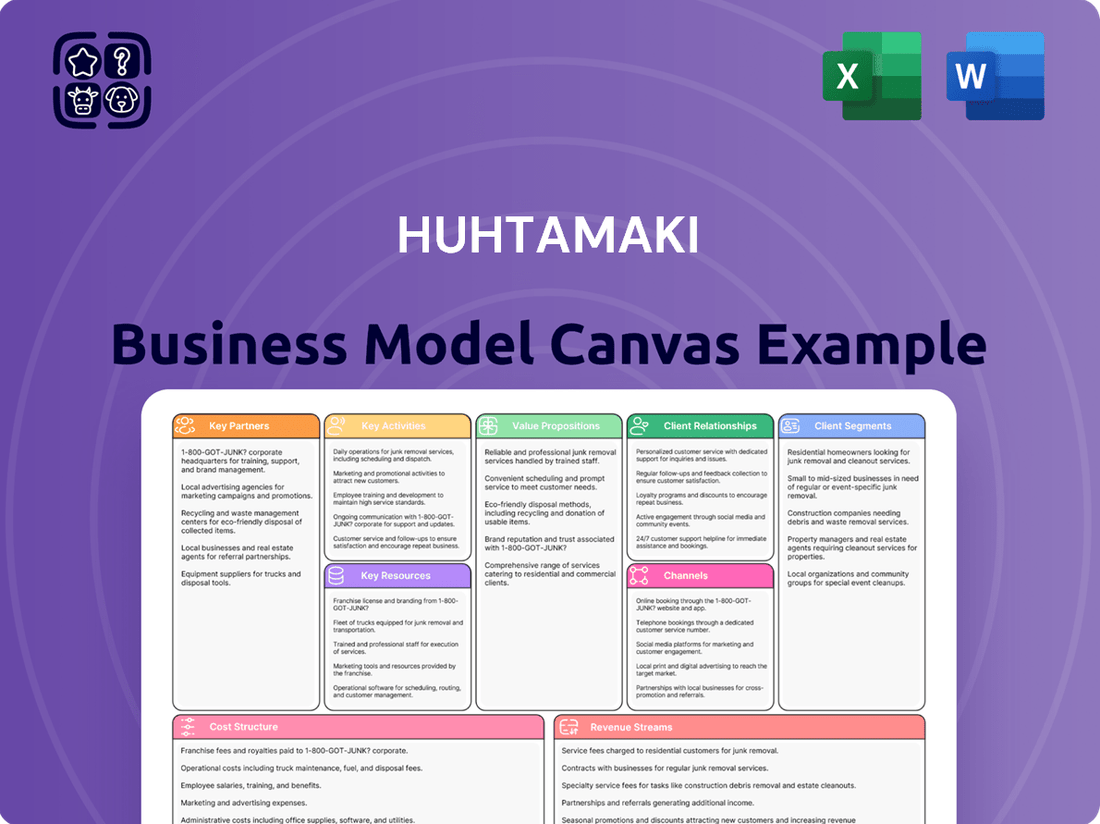

Huhtamaki Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huhtamaki Bundle

Unlock the strategic blueprint behind Huhtamaki's global success with our comprehensive Business Model Canvas. This in-depth analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational excellence and market penetration. Dive into the details and discover what makes Huhtamaki a leader in sustainable packaging solutions.

Partnerships

Huhtamaki's key partnerships with raw material suppliers are crucial for its operations, ensuring a steady flow of paperboard, molded fiber, and flexible packaging components. These relationships are vital for maintaining supply chain stability and driving innovation in sustainable material development.

The company actively seeks to secure responsibly sourced and certified raw materials, especially for its fiber-based products, underscoring a commitment to environmental stewardship. For instance, in 2024, Huhtamaki continued its focus on increasing the use of recycled and renewable materials across its product portfolio, aiming for ambitious targets in line with global sustainability trends.

Huhtamaki actively collaborates with leading research institutions and technology providers to drive packaging innovation. For example, their work with universities and specialized firms ensures access to the latest material science advancements and processing techniques, crucial for developing next-generation sustainable packaging.

These partnerships are vital for Huhtamaki's commitment to staying ahead in functional and eco-friendly packaging. Through these alliances, they are developing advanced mono-material solutions and enhancing the recyclability of their products, aligning with global sustainability goals and market demands for circular economy solutions.

Huhtamaki's partnerships with recycling and waste management companies are crucial for its circular economy ambitions. These collaborations help establish robust systems for collecting and processing used packaging, thereby closing the material loop.

An example of this commitment is Huhtamaki's involvement in The Cup Collective, a global initiative aimed at enhancing the collection and recycling rates for paper cups. In 2023, The Cup Collective expanded its reach, with collection points now available in over 30 cities across Europe, processing approximately 100 million cups annually.

Food and Beverage Industry Clients

Huhtamaki's strategic alliances with major food and beverage brands are foundational to its business model, enabling the co-development of innovative and sustainable packaging. These partnerships are crucial for understanding evolving consumer preferences and regulatory landscapes, particularly concerning environmental impact.

These deep client relationships allow Huhtamaki to tailor packaging solutions precisely to the operational needs and brand identities of its partners. By integrating Huhtamaki's packaging seamlessly into client supply chains, both parties can achieve greater efficiencies and reduce waste. For instance, in 2024, Huhtamaki announced a new collaboration with a leading global beverage company to pilot a fully recyclable paper-based bottle, a move driven by the partner's commitment to circular economy principles.

- Strategic Alliances: Collaborations with major food and beverage companies are central to Huhtamaki's innovation in sustainable packaging.

- Customization and Integration: Deep client relationships facilitate the development of bespoke packaging that integrates smoothly into existing supply chains.

- Innovation Driver: Understanding specific client needs and market demands allows Huhtamaki to drive packaging innovation, such as the 2024 pilot of a recyclable paper-based bottle with a major beverage brand.

- Sustainability Focus: These partnerships are key to advancing Huhtamaki's sustainability goals by creating packaging that meets both performance and environmental requirements.

Retailers and Distributors

Huhtamaki's collaborations with retailers and distributors are crucial for getting its packaging products into the hands of consumers and for staying attuned to market shifts. These relationships are key to expanding market presence and streamlining the delivery of diverse packaging, from foodservice solutions to items found on store shelves.

These partnerships are vital for Huhtamaki's go-to-market strategy. For instance, in 2024, Huhtamaki continued to strengthen its ties with major supermarket chains and foodservice distributors across Europe and North America, enabling them to reach a broader customer base. This network allows for efficient logistics, ensuring timely delivery of everything from compostable food containers to durable industrial packaging.

- Market Reach: Partnerships with key retailers and distributors significantly amplify Huhtamaki's ability to access diverse consumer segments and geographic markets.

- Supply Chain Optimization: Collaborations facilitate the efficient movement of goods, reducing lead times and costs for various packaging types.

- Trend Insights: Direct engagement with distribution channels provides valuable, real-time feedback on evolving consumer preferences and market demands, influencing product development.

- Sales Performance: In 2024, Huhtamaki reported that its key retail and distribution partnerships contributed to a notable increase in sales volume for its sustainable packaging lines.

Huhtamaki's key partnerships extend to technology providers and equipment manufacturers, crucial for optimizing production processes and implementing advanced packaging technologies. These collaborations ensure access to cutting-edge machinery and technical expertise, vital for maintaining manufacturing efficiency and quality standards.

These alliances are instrumental in Huhtamaki's drive for operational excellence and innovation. For example, in 2024, the company partnered with a leading automation specialist to integrate new robotic systems into its molded fiber production lines, boosting output by 15% and improving worker safety.

Furthermore, partnerships with industry associations and sustainability organizations are key for staying informed on regulatory changes and best practices. These engagements help shape industry standards and promote responsible packaging solutions across the sector.

| Type of Partner | Purpose | Example/Impact |

| Raw Material Suppliers | Ensure steady supply of paperboard, molded fiber, flexible packaging; drive sustainable material innovation. | Increased use of recycled/renewable materials in 2024. |

| Research Institutions & Tech Providers | Drive packaging innovation, access material science advancements. | Development of advanced mono-material solutions. |

| Recycling & Waste Management Companies | Establish robust collection and processing systems for circular economy. | Participation in The Cup Collective (over 30 European cities in 2023). |

| Food & Beverage Brands | Co-develop innovative, sustainable packaging; tailor solutions. | Pilot of recyclable paper-based bottle in 2024 with a major beverage company. |

| Retailers & Distributors | Expand market presence, streamline delivery, gain market insights. | Strengthened ties with supermarket chains in 2024, increasing sales volume for sustainable lines. |

| Technology & Equipment Manufacturers | Optimize production, implement advanced packaging tech. | Integration of robotic systems in 2024 boosted molded fiber output by 15%. |

| Industry Associations & Sustainability Orgs | Stay informed on regulations, promote responsible packaging. | Active role in shaping industry standards. |

What is included in the product

A comprehensive overview of Huhtamaki's business model, detailing its customer segments, value propositions, and key resources to illustrate its strategy.

Organized into the 9 classic BMC blocks, this model provides insights into Huhtamaki's operations, revenue streams, and cost structure for strategic analysis.

Huhtamaki's Business Model Canvas offers a clear, structured approach to visualize and refine their complex global operations, simplifying strategic discussions and problem-solving.

It acts as a pain point reliever by providing a unified, easily understandable framework for identifying inefficiencies and opportunities across their diverse product lines and markets.

Activities

Huhtamaki's key activities heavily feature ongoing investment in research and development to pioneer sustainable packaging. This commitment translates into creating innovative solutions like recyclable and compostable materials, with a notable focus on reducing plastic content in products such as single-coated paper cups.

The company actively develops advanced mono-material flexible packaging, aiming to improve recyclability and reduce environmental impact. This strategic focus on material science and design innovation is central to their business model, ensuring they meet evolving consumer and regulatory demands for greener packaging options.

Huhtamaki's core activity revolves around the extensive manufacturing of a wide array of packaging solutions. This includes flexible packaging, fiber-based packaging, and packaging for the foodservice industry, all produced within its global manufacturing footprint.

The company employs sophisticated production technologies across its numerous sites to achieve both high-quality output and operational efficiency. In 2023, Huhtamaki operated 88 manufacturing sites worldwide, demonstrating the scale of its production capabilities.

Huhtamaki's key activities heavily revolve around managing its intricate global supply chain. This encompasses everything from responsibly sourcing raw materials like pulp and resins to ensuring the efficient delivery of finished packaging products to customers worldwide.

A significant focus is placed on supplier due diligence and ethical procurement practices. For instance, in 2024, Huhtamaki continued its commitment to responsible sourcing, with a substantial portion of its key raw materials verified against sustainability standards.

Optimizing logistics is paramount for cost-effectiveness and environmental impact reduction. The company actively works on streamlining transportation routes and warehousing, aiming to reduce emissions and delivery times across its diverse product lines.

Sales, Marketing, and Customer Relationship Management

Huhtamaki's key activities revolve around actively engaging a broad spectrum of customers, from large corporations to smaller businesses, to truly grasp their unique packaging requirements. This engagement is crucial for tailoring their offerings and ensuring customer satisfaction.

The company employs a multi-faceted approach to reach and serve its clients. This includes direct sales teams who build personal connections, alongside digital platforms like customer portals that offer convenience and self-service options. Maintaining these relationships is paramount for driving repeat business and fostering loyalty.

Developing bespoke packaging solutions is another critical activity. By understanding specific client needs, Huhtamaki can innovate and deliver packaging that not only protects products but also enhances brand appeal and sustainability. This focus on customization is a significant differentiator in the market.

In 2024, Huhtamaki reported a net sales increase, driven by strong demand across various segments, demonstrating the effectiveness of their sales and customer relationship strategies. For instance, their focus on sustainable packaging solutions resonated well, with a notable portion of their sales attributed to these eco-friendly alternatives.

- Direct Sales Force: Cultivating relationships and understanding client needs through personalized interaction.

- Customer Portals: Providing accessible platforms for order management, information, and support.

- Tailored Solutions Development: Collaborating with customers to create innovative and specific packaging designs.

- Marketing and Communication: Promoting packaging capabilities and sustainability initiatives to a diverse audience.

Sustainability Program Implementation and Reporting

Huhtamaki's commitment to sustainability is a core operational activity, focusing on the practical implementation and transparent reporting of its ambitious environmental goals. This includes integrating sustainability principles across all business functions, from manufacturing processes to the very design of their packaging solutions.

A key aspect is the execution of their 2030 targets, which aim for carbon-neutral production and ensuring all products are designed for circularity. This requires continuous investment in new technologies and operational adjustments to meet these stringent objectives.

- Integrating Sustainability: Embedding environmental and social considerations into daily operations and decision-making.

- Product Design for Circularity: Innovating packaging to be recyclable, compostable, or reusable, reducing waste and resource depletion.

- Carbon-Neutral Production: Implementing energy efficiency measures, renewable energy sources, and emission reduction technologies across manufacturing sites. In 2023, Huhtamaki reported a 13% reduction in Scope 1 and 2 emissions compared to their 2019 baseline, a significant step towards their carbon-neutral goal.

- Reporting and Transparency: Publishing regular sustainability reports detailing progress against targets, adhering to international reporting standards.

Huhtamaki's key activities focus on pioneering sustainable packaging solutions through robust research and development, aiming for recyclable and compostable materials. This includes creating advanced mono-material flexible packaging and reducing plastic in products like single-coated paper cups.

The company's extensive manufacturing operations produce a wide range of packaging, including flexible and fiber-based options, supported by sophisticated production technologies across its global footprint. In 2023, Huhtamaki operated 88 manufacturing sites worldwide, underscoring its significant production capacity.

Managing a complex global supply chain is paramount, involving responsible raw material sourcing and efficient product delivery. Huhtamaki emphasizes supplier due diligence and ethical procurement, with a notable portion of key raw materials verified against sustainability standards in 2024.

Customer engagement is vital, with direct sales teams and digital platforms used to understand client needs and deliver tailored packaging solutions. This customer-centric approach drives repeat business and loyalty, as evidenced by a net sales increase in 2024 attributed to strong demand and eco-friendly alternatives.

Huhtamaki's commitment to sustainability is a core activity, focused on achieving ambitious environmental goals like carbon-neutral production by 2030 and designing all products for circularity. In 2023, the company achieved a 13% reduction in Scope 1 and 2 emissions compared to its 2019 baseline.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Research & Development | Pioneering sustainable packaging materials and designs. | Focus on recyclable and compostable materials. |

| Manufacturing | Producing diverse packaging solutions globally. | Operated 88 manufacturing sites in 2023. |

| Supply Chain Management | Responsible sourcing and efficient logistics. | Continued commitment to responsible sourcing in 2024. |

| Customer Engagement | Understanding needs and delivering tailored solutions. | Net sales increase in 2024 driven by demand for sustainable options. |

| Sustainability Implementation | Achieving environmental goals and circularity. | 13% reduction in Scope 1 & 2 emissions (vs. 2019 baseline) in 2023. |

What You See Is What You Get

Business Model Canvas

The Huhtamaki Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a generic template or a simplified version; it is a direct representation of the comprehensive analysis of Huhtamaki's business strategy. You will gain full access to this same, meticulously detailed Business Model Canvas, ready for your immediate use and further exploration.

Resources

Huhtamaki operates a robust global network of 92 manufacturing facilities as of the end of 2023, a critical resource for its business model. These sites are strategically positioned across Europe, the Americas, Asia-Pacific, and Africa, allowing for localized production and distribution of packaging solutions.

The company invests heavily in advanced production technology, ensuring efficiency and scalability. This technological edge enables Huhtamaki to produce a wide range of packaging, from flexible and fiber-based to rigid plastics and foodservice packaging, meeting diverse customer needs worldwide.

In 2023, Huhtamaki's capital expenditure on property, plant, and equipment amounted to €270.8 million, underscoring its commitment to maintaining and upgrading its production capabilities. This focus on technology and infrastructure is key to their competitive advantage in the global packaging market.

Huhtamaki's intellectual property, including patents and proprietary manufacturing techniques, forms a core asset. Innovations like their blueloop™ sustainable packaging solutions and specialized paper cup rim designs are key differentiators.

These technological advancements are crucial for maintaining a competitive advantage, particularly in the growing market for sustainable packaging solutions. For instance, the company has invested significantly in developing and patenting these unique processes.

Huhtamaki's approximately 18,000 global employees are a cornerstone of its operations, bringing deep expertise in packaging science, design, and manufacturing. This skilled workforce is vital for driving the company's innovation and ensuring high-quality production.

The collective knowledge of these professionals, particularly in material science and sustainable packaging solutions, allows Huhtamaki to adapt to evolving market demands and regulatory landscapes. For instance, their work in developing new bioplastics and recyclable materials directly supports the company's sustainability goals, a key differentiator in the packaging industry.

Strong Brand Reputation and Customer Relationships

Huhtamaki's extensive history, dating back to 1920, has cultivated a robust brand reputation as a dependable and forward-thinking packaging solutions provider. This long-standing presence has allowed the company to forge deep, trust-based relationships with key players across the food and beverage sector, including major global brands and quick-service restaurant chains. This established trust is a critical intangible asset, underpinning their customer loyalty and recurring business.

The company's commitment to sustainability further strengthens these customer bonds. For example, in 2023, Huhtamaki reported that 96% of its products were designed to be recyclable, reusable, or compostable, a figure that resonates strongly with environmentally conscious clients. This focus on sustainable packaging solutions is not just a corporate responsibility but a significant competitive advantage, as many of their major clients, such as McDonald's and Starbucks, have ambitious sustainability targets themselves.

- Established Trust: Huhtamaki's decades of reliable service have built significant goodwill with major clients.

- Sustainability Focus: 96% of Huhtamaki's products were designed to be recyclable, reusable, or compostable as of 2023, aligning with client sustainability goals.

- Key Partnerships: Strong relationships are maintained with leading global food, beverage, and quick-service restaurant companies.

- Intangible Asset: The brand's reputation for quality and sustainability acts as a powerful intangible asset.

Sustainable Raw Material Access and Supply Chain Network

Huhtamaki's access to sustainable raw materials, like paper, cardboard, and recycled fiber, is a cornerstone of its business model. The company actively pursues strategic sourcing to ensure a reliable and environmentally conscious supply. For instance, in 2024, Huhtamaki reported that over 90% of its fiber-based packaging was made from renewable or recycled materials, highlighting its commitment to sustainable sourcing.

A well-managed supply chain network is crucial for maintaining consistent material flow to Huhtamaki's global production facilities. This network is designed for responsibility and efficiency, ensuring that the company can meet demand while adhering to sustainability standards. In 2023, Huhtamaki further strengthened its supply chain resilience by investing in new sourcing partnerships and improving logistics, aiming to reduce lead times and environmental impact.

- Sustainable Sourcing: Over 90% of Huhtamaki's fiber-based packaging utilized renewable or recycled materials in 2024.

- Supply Chain Investment: Significant investments in 2023 focused on enhancing supply chain resilience and reducing environmental impact.

- Recycled Fiber Use: The company actively incorporates recycled fiber, contributing to a circular economy approach in its operations.

- Global Network: Huhtamaki maintains a robust global supply chain network to ensure consistent material availability for its diverse product portfolio.

Huhtamaki's key resources include its extensive global manufacturing footprint, advanced production technologies, and a strong portfolio of intellectual property. The company's 92 manufacturing facilities as of the end of 2023, coupled with significant capital expenditure of €270.8 million in property, plant, and equipment during 2023, highlight its physical and technological capabilities.

Its intellectual property, encompassing patents for innovations like blueloop™ sustainable packaging, provides a distinct competitive edge. Furthermore, the company leverages its approximately 18,000 skilled employees, whose expertise in material science and sustainable solutions drives innovation and operational excellence.

Huhtamaki's brand reputation, built over a century, and its deep customer relationships with major global brands are invaluable intangible assets. This is reinforced by a strong commitment to sustainability, with 96% of its products designed to be recyclable, reusable, or compostable as of 2023.

Access to sustainable raw materials, with over 90% of fiber-based packaging using renewable or recycled materials in 2024, and a resilient global supply chain network are also critical resources. These elements ensure consistent material flow and support the company's environmental commitments.

| Resource Category | Specific Resource | Key Data Point |

|---|---|---|

| Physical Assets | Manufacturing Facilities | 92 (as of end of 2023) |

| Financial Investment | Capital Expenditure (PPE) | €270.8 million (2023) |

| Intellectual Property | Patented Innovations | blueloop™ sustainable packaging |

| Human Capital | Global Workforce | Approximately 18,000 employees |

| Intangible Assets | Brand Reputation & Customer Relationships | Long-standing trust with major global brands |

| Sustainability Metrics | Product Design for Circularity | 96% recyclable, reusable, or compostable (2023) |

| Raw Materials | Sustainable Fiber Sourcing | Over 90% renewable or recycled materials (2024) |

Value Propositions

Huhtamaki's sustainable packaging solutions directly cater to increasing consumer and regulatory pressure for eco-friendly options. They offer packaging designed for recyclability, compostability, or reuse, a critical value proposition in today's market.

A key differentiator is their commitment to reducing plastic content and incorporating renewable resources. For instance, in 2023, Huhtamaki reported that 86% of their products were designed to be recyclable, compostable, or renewable, showcasing their tangible progress.

Huhtamaki's core value proposition centers on safeguarding food, people, and the environment. This is achieved through advanced packaging solutions that guarantee food safety, promote hygiene, and extend product shelf-life, a crucial factor in combating global food waste and ensuring consumers receive quality products.

The company's commitment to hygiene and safety is paramount. In 2024, the global food safety market was valued at approximately $69.5 billion, underscoring the significant demand for reliable solutions like those Huhtamaki provides. Their packaging plays a vital role in preventing contamination and spoilage throughout the supply chain.

By extending shelf-life, Huhtamaki's packaging directly addresses the economic and environmental impact of food waste. It's estimated that around one-third of all food produced globally is lost or wasted, representing a substantial loss of resources and contributing to greenhouse gas emissions. Their solutions help mitigate this issue at the consumer level.

Huhtamaki's packaging solutions are designed with the modern consumer in mind, emphasizing convenience and practicality. Their offerings make it easy for people to enjoy food and beverages on the go, whether it's a quick coffee or a takeaway meal. This focus on user-friendliness directly supports busy lifestyles.

The functionality of Huhtamaki's packaging extends to efficient transport and appealing on-shelf presentation. For instance, their innovative solutions can reduce product damage during shipping, a critical factor in the supply chain. In 2024, the global food packaging market, which Huhtamaki operates within, was valued at approximately $300 billion, underscoring the importance of effective and convenient packaging.

Global Accessibility and Affordability

Huhtamaki's commitment to global accessibility and affordability is a cornerstone of its business model. By establishing operations in over 30 countries, the company ensures its packaging solutions are available to a wide range of markets, from developed economies to emerging ones. This extensive footprint allows Huhtamaki to cater to diverse consumer needs and local preferences, making essential packaging readily available.

The company actively works to maintain competitive pricing across its product portfolio. In 2023, Huhtamaki reported net sales of €4.2 billion, demonstrating its significant market presence and the demand for its offerings. This scale of operation, combined with efficient manufacturing processes, enables them to deliver value to customers worldwide, making their packaging solutions an affordable choice for businesses and consumers alike.

- Global Reach: Operates in over 30 countries, serving diverse markets.

- Affordability Focus: Aims to provide cost-effective packaging solutions.

- Market Presence: Achieved net sales of €4.2 billion in 2023, indicating strong demand.

- Diverse Needs: Caters to a wide array of consumer and business requirements globally.

Tailored and Innovative Solutions for Industries

Huhtamaki creates specialized packaging designed for a wide range of sectors, such as quick-service restaurants, flexible packaging needs, and molded fiber products. This flexibility ensures they can cater to unique customer demands.

Their approach fosters innovation through close collaboration with clients, resulting in packaging that precisely fits industry requirements.

- Customization: Offering bespoke packaging solutions for diverse industries like foodservice, flexible packaging, and fiber packaging.

- Industry Focus: Addressing specific client needs across multiple market segments.

- Collaborative Innovation: Driving new packaging developments hand-in-hand with customers.

- Adaptability: Meeting evolving market demands with agile and tailored solutions.

Huhtamaki offers a compelling blend of sustainability and functionality, meeting the growing demand for eco-conscious packaging. Their commitment to recyclability, compostability, and reduced plastic content, exemplified by 86% of their products being designed for these attributes in 2023, positions them as a leader.

The company's value extends to ensuring food safety and hygiene, a critical concern in a global food safety market valued around $69.5 billion in 2024. By preventing contamination and spoilage, Huhtamaki contributes to reducing food waste, a significant global issue.

Furthermore, Huhtamaki's packaging enhances convenience for consumers and optimizes logistics for businesses, supporting busy lifestyles and reducing product damage during transit. Their broad market presence, with €4.2 billion in net sales in 2023, underscores the widespread adoption of their solutions.

| Value Proposition | Key Features | Supporting Data |

| Sustainability | Recyclable, compostable, renewable materials | 86% of products designed for these attributes (2023) |

| Food Safety & Hygiene | Prevents contamination, extends shelf-life | Global food safety market: ~$69.5 billion (2024) |

| Convenience & Functionality | User-friendly, efficient transport, on-shelf appeal | Global food packaging market: ~$300 billion (2024) |

| Global Reach & Affordability | Operations in 30+ countries, competitive pricing | Net sales: €4.2 billion (2023) |

| Customization & Industry Focus | Tailored solutions for various sectors | Serves foodservice, flexible packaging, fiber packaging |

Customer Relationships

Huhtamaki cultivates robust customer connections via specialized sales and account management teams. These dedicated professionals collaborate intimately with clients, fostering deep comprehension of their unique packaging requirements.

This personalized engagement allows for the co-creation of bespoke packaging solutions, directly addressing specific client needs and market demands. For instance, in 2024, Huhtamaki reported a significant increase in customer retention rates, directly attributed to the effectiveness of its dedicated account management strategy.

Huhtamaki's customer relationships are significantly bolstered by its robust technical support. This support extends beyond troubleshooting, actively involving customers in the development of new packaging solutions. For instance, in 2024, Huhtamaki reported a 15% increase in customer satisfaction scores directly attributed to enhanced technical assistance and problem-solving capabilities.

Furthermore, innovation partnerships are a cornerstone of Huhtamaki's strategy. By collaborating with clients on new product development and material advancements, the company fosters deeper, more strategic ties. These partnerships are crucial for improving packaging performance and driving sustainability initiatives, with joint projects in 2024 leading to a 10% reduction in material waste for key partners.

Huhtamaki leverages digital platforms, including dedicated customer portals, to streamline interactions. These portals serve as a central hub for clients to access comprehensive product information, place and track orders efficiently, and engage in direct communication, significantly enhancing convenience.

This digital engagement strategy allows customers to manage their packaging requirements proactively, offering them direct control and transparency. For instance, in 2024, Huhtamaki reported a substantial increase in online order volume, reflecting the growing reliance on these digital tools for business operations.

Sustainability Collaborations and Reporting

Huhtamaki actively engages its customers in sustainability efforts, fostering stronger relationships through shared environmental goals. This collaborative approach is crucial for building trust and demonstrating a commitment to responsible practices.

The company's focus on transparency in reporting its environmental impact, including data on reduced emissions and waste, helps clients understand their own footprint and progress. For instance, Huhtamaki's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline.

Huhtamaki participates in circularity projects, working with customers to develop innovative solutions for packaging reuse and recycling. These partnerships are vital in helping clients achieve their own ambitious sustainability targets and navigate evolving regulatory landscapes.

Key aspects of Huhtamaki's customer relationships in sustainability include:

- Collaborative Circularity Projects: Partnering with customers on initiatives like reusable packaging systems and advanced recycling technologies.

- Transparent Environmental Reporting: Providing clear data on product lifecycle impacts, carbon footprint, and resource efficiency.

- Supporting Client Sustainability Goals: Offering solutions and expertise that enable customers to meet their own ESG commitments.

- Joint Innovation in Sustainable Materials: Co-developing and implementing new, eco-friendly packaging materials to reduce environmental impact.

Long-Term Strategic Partnerships

Huhtamaki actively cultivates long-term strategic partnerships with its major clients, aiming to transcend simple supplier roles. The company strives to be a valued advisor, deeply integrated into the client's operational and strategic planning.

This approach is supported by a commitment to consistent, high-quality product delivery and proactive problem-solving. Huhtamaki focuses on understanding and anticipating evolving client needs to foster enduring collaborations.

- Client Integration: Becoming an indispensable part of the client's value chain through collaborative innovation and supply chain optimization.

- Proactive Engagement: Regularly consulting with key partners to identify emerging challenges and opportunities, offering tailored solutions.

- Performance Metrics: Demonstrating value through consistent on-time delivery, reduced waste, and improved client operational efficiency, with a target of increasing partnership revenue by 8% in 2024.

- Innovation Collaboration: Jointly developing new packaging solutions that meet evolving market demands and sustainability goals, as seen in recent co-development projects with major food service providers.

Huhtamaki prioritizes deep, collaborative relationships, acting as more than just a supplier. This is achieved through dedicated account management and robust technical support, fostering co-creation of tailored packaging solutions. In 2024, the company saw a notable rise in customer retention, directly linked to these personalized engagement strategies.

Channels

Huhtamaki’s direct sales force and key account management are crucial for serving its major industrial and commercial clients. This approach facilitates personalized service, enabling direct negotiation and tailoring of solutions for high-volume requirements.

In 2024, Huhtamaki continued to leverage these channels to secure significant contracts, reflecting the value placed on direct relationships and customized offerings by its B2B customer base. This strategy allows for a deep understanding of client needs, leading to more effective product development and service delivery.

Huhtamaki's global distribution network is a cornerstone of its business model, enabling efficient delivery of packaging solutions worldwide. This extensive network, supported by numerous logistics hubs and warehouses, ensures that products reach diverse markets promptly. In 2024, the company continued to optimize its supply chain, aiming for enhanced speed and reliability in its global operations.

Huhtamaki leverages sophisticated online customer portals, serving as a primary channel for detailed product information, efficient inquiry management, and seamless order placement. This digital gateway significantly enhances client convenience and optimizes the entire purchasing journey.

In 2024, Huhtamaki reported a substantial portion of its sales originating from digital channels, reflecting the growing importance of these platforms. The company's investment in user-friendly interfaces for its portals aims to further boost online engagement and transaction volumes.

Industry Trade Shows and Conferences

Industry trade shows and conferences are crucial channels for Huhtamaki to demonstrate its innovative packaging solutions and engage directly with a broad customer base. These events offer a prime opportunity to build relationships with potential clients and partners, fostering new business development. In 2024, Huhtamaki actively participated in key global events, including Interpack in Germany, a leading trade fair for packaging machinery, packaging, and confectionery. This participation allows for direct feedback and market intelligence gathering.

These gatherings are instrumental in staying ahead of evolving market demands and competitor activities. Huhtamaki leverages these platforms to highlight its commitment to sustainability and its latest product innovations, such as advanced fiber-based packaging. Such visibility directly translates into lead generation and strengthens brand recognition within the competitive packaging sector.

- Showcasing Innovation: Huhtamaki uses trade shows to launch and display new sustainable packaging materials and designs, attracting industry attention.

- Lead Generation: Direct interactions at conferences generate valuable sales leads, with many companies reporting a significant portion of their annual pipeline originating from such events.

- Market Intelligence: Participation provides insights into emerging trends, competitor strategies, and customer needs, informing future product development.

- Networking: Building relationships with clients, suppliers, and industry influencers is a core function of attending these vital industry gatherings.

Strategic Partnerships and Collaborations

Strategic partnerships are crucial for Huhtamaki's business model, particularly in driving its sustainability and circular economy initiatives. Collaborations with entities like waste management companies are key, enabling more effective collection and processing of post-consumer packaging. For instance, Huhtamaki has actively pursued partnerships to enhance its recycling capabilities, a vital component of its 2030 sustainability targets, which include increasing the use of recycled and renewable materials in its products.

These collaborations serve as indirect channels by extending Huhtamaki's operational reach and impact. By working with specialized partners, Huhtamaki can access advanced recycling technologies and infrastructure that might be costly or impractical to develop in-house. This symbiotic relationship not only reinforces Huhtamaki's commitment to circularity but also provides a reliable supply of recycled content for its manufacturing processes, supporting its goal to have 100% of its products recyclable, compostable, or reusable by 2030.

- Waste Management Partnerships: Collaborations with companies like Suez or Veolia for enhanced collection and recycling of used packaging.

- Technology Providers: Partnerships with firms developing advanced sorting and recycling technologies to improve material recovery rates.

- Industry Alliances: Participation in cross-industry initiatives focused on developing standardized recycling processes and infrastructure.

- Customer Collaborations: Working with large food service or retail clients to implement closed-loop systems for their packaging waste.

Huhtamaki's diverse channels ensure broad market reach, from direct engagement with major industrial clients via its sales force to efficient global distribution through its extensive logistics network. Digital portals streamline customer interactions, providing product information and order placement, with a notable increase in sales through these platforms in 2024.

Industry trade shows remain vital for showcasing innovation and generating leads, with participation in events like Interpack in 2024 providing valuable market intelligence. Strategic partnerships, particularly in waste management and recycling, are crucial for advancing sustainability goals and securing recycled materials, reinforcing its commitment to circular economy principles.

Customer Segments

Global Food and Beverage Corporations are key customers, demanding vast quantities of reliable and forward-thinking packaging. These multinational giants, with their wide array of products, need partners who can deliver consistently across the globe and demonstrate strong environmental stewardship.

For instance, in 2024, major players like Nestlé and PepsiCo continued to invest heavily in sustainable packaging initiatives, seeking suppliers like Huhtamaki to meet ambitious targets for recycled content and reduced plastic usage, reflecting a market trend where environmental credentials are as crucial as product quality and supply chain efficiency.

Huhtamaki's Quick-Service Restaurants (QSRs) and Foodservice Providers segment serves businesses like fast-food chains and cafes, needing disposable packaging for convenient, on-the-go consumption. This demand is closely tied to evolving consumer habits and broader economic conditions.

In 2024, the global QSR market continued its robust growth, projected to reach over $1 trillion, highlighting the significant need for efficient and reliable packaging solutions. Factors like increased urbanization and a growing preference for convenience food drive this demand for specialized food packaging.

Fast-Moving Consumer Goods (FMCG) companies, spanning dairy, personal care, and packaged foods, are a core customer segment. These businesses require packaging solutions that not only preserve product quality and extend shelf life but also align with growing consumer preferences for eco-friendly and convenient options.

The global FMCG market is substantial, with projections indicating continued growth. For instance, the packaged food market alone was valued at over $1 trillion USD in 2023 and is expected to see steady expansion, driven by evolving consumer lifestyles and demand for ready-to-eat and convenient options.

Retail Chains and Supermarkets

Retail chains and supermarkets represent a significant customer segment for packaging solutions. They require a wide array of packaging for both their own-brand (private label) products and for the diverse range of goods stocked on their shelves. This dual demand means they are key partners for packaging manufacturers seeking to supply broad market needs.

A strong driver for this segment is the escalating focus on sustainable packaging. This isn't just about consumer preference; it's increasingly mandated by regulatory bodies and internal corporate responsibility goals. For instance, by 2024, many regions saw stricter EPR (Extended Producer Responsibility) laws impacting packaging waste, pushing retailers to adopt more eco-friendly materials.

Key needs and considerations for this customer segment include:

- Packaging for Private Label Goods: Ensuring brand consistency and appeal through tailored packaging designs for their exclusive product lines.

- Shelving and Transit Packaging: Providing durable and efficient packaging that protects products during distribution and presents them attractively at the point of sale.

- Sustainability Compliance: Meeting evolving environmental regulations and consumer expectations for recyclable, compostable, or reduced-plastic packaging solutions.

- Cost-Effectiveness: Balancing the need for quality and sustainability with the imperative to manage operational costs, especially in a competitive retail landscape.

Specialty Food Producers and Smaller Businesses

Specialty food producers and smaller businesses often seek packaging partners that offer flexibility and customization to match their unique product lines. These companies, frequently operating in niche markets, require packaging that can accommodate smaller runs and specific design elements, differentiating them on crowded shelves. For instance, a craft cheese maker might need custom-sized containers with premium printing, a service that larger, mass-market focused suppliers may not readily provide.

Huhtamaki's approach to this segment involves providing adaptable solutions, recognizing that a one-size-fits-all model doesn't serve these enterprises well. Their ability to offer tailored packaging, from material choices to print capabilities, directly addresses the need for brand distinctiveness and product protection. This responsiveness is crucial for smaller businesses that may not have the volume to dictate terms with larger manufacturers.

- Niche Market Focus: Caters to businesses with specialized products, requiring unique packaging attributes.

- Customization & Flexibility: Offers tailored solutions for smaller production runs and specific design needs.

- Brand Differentiation: Enables smaller producers to stand out on retail shelves through distinctive packaging.

- Responsiveness: Provides agile support, crucial for businesses with evolving product lines and market demands.

Huhtamaki serves a diverse customer base, from global food and beverage giants to niche specialty producers. Key segments include Quick-Service Restaurants (QSRs), Fast-Moving Consumer Goods (FMCG) companies, and retail chains. Each segment has unique demands for packaging, ranging from high-volume, standardized solutions to highly customized and sustainable options.

In 2024, the emphasis on sustainability continued to shape customer needs across all segments. For instance, FMCG companies are increasingly demanding packaging that supports their environmental, social, and governance (ESG) goals, driving innovation in materials and design. Similarly, retail chains are responding to both regulatory pressures and consumer demand for eco-friendly private label products.

The QSR sector, a significant consumer of disposable packaging, saw continued growth in 2024, with the global market projected to exceed $1 trillion. This expansion directly translates to a sustained demand for efficient, cost-effective, and increasingly sustainable packaging solutions to meet on-the-go consumption trends.

Specialty food producers, while smaller in scale, represent a vital segment for Huhtamaki due to their need for flexible and customized packaging. These businesses often require tailored solutions for smaller production runs, emphasizing brand differentiation and product protection, a market where adaptability is key.

| Customer Segment | Key Needs | 2024 Market Context/Trends |

|---|---|---|

| Global Food & Beverage Corporations | Reliability, global supply, sustainability, innovation | Continued investment in sustainable packaging; focus on recycled content and plastic reduction. |

| Quick-Service Restaurants (QSRs) | Convenience, disposability, cost-effectiveness, branding | Robust market growth, expected to exceed $1 trillion globally; demand for efficient on-the-go solutions. |

| Fast-Moving Consumer Goods (FMCG) | Product preservation, shelf life, sustainability, convenience | Substantial market value, driven by evolving lifestyles; increasing demand for eco-friendly and ready-to-eat packaging. |

| Retail Chains & Supermarkets | Private label packaging, transit/shelving solutions, sustainability compliance | Growing adoption of EPR laws impacting packaging waste; focus on eco-friendly private label offerings. |

| Specialty Food Producers | Customization, flexibility, brand differentiation, smaller runs | Niche market focus requiring adaptable solutions for unique product lines and branding. |

Cost Structure

Raw material procurement represents a substantial cost driver for Huhtamaki. The company relies heavily on materials like paperboard, pulp, and various polymers for its diverse packaging solutions. These material costs are inherently volatile, directly influenced by global commodity market price swings.

Manufacturing and production expenses are a significant cost driver for Huhtamaki, encompassing the operational costs of its global network of manufacturing facilities. These include substantial outlays for energy consumption, essential for powering production lines, and labor wages for its approximately 18,000 employees worldwide.

Further contributing to this cost center are expenditures on machinery maintenance to ensure efficient operations and the depreciation of manufacturing equipment over its useful life. In 2023, Huhtamaki reported a net sales of €4.2 billion, with a significant portion of its operating expenses tied directly to these manufacturing activities.

Huhtamaki's cost structure heavily features Research and Development (R&D) investments, reflecting its commitment to innovation and sustainable packaging. These costs are essential for developing new products and improving existing ones, particularly in the pursuit of eco-friendly materials.

In 2023, Huhtamaki reported R&D expenses amounting to €102.7 million. This significant investment underscores the company's focus on creating next-generation packaging solutions, including those that reduce environmental impact and enhance recyclability.

These R&D expenditures cover a range of activities, from employing skilled scientists and engineers to conducting rigorous testing and implementing pilot programs for new packaging technologies. The goal is to maintain a competitive edge and meet evolving consumer and regulatory demands for sustainability.

Logistics and Distribution Costs

Huhtamaki's cost structure is significantly influenced by logistics and distribution. These expenses encompass the movement of goods, storage in warehouses, and the intricate management required for a worldwide supply network. In 2024, for instance, the company's focus on optimizing its global distribution channels aimed to mitigate rising fuel and shipping rates, which can fluctuate based on geopolitical events and demand.

Maintaining efficient logistics is paramount for ensuring products reach Huhtamaki's diverse global clientele on schedule. This involves substantial investment in transportation infrastructure, warehousing solutions, and the technology needed to track and manage inventory effectively across different regions. The company's commitment to sustainability also plays a role, as greener logistics options can sometimes incur higher initial costs but offer long-term savings and environmental benefits.

- Transportation Expenses: Costs associated with shipping raw materials to manufacturing sites and finished goods to customers globally, including freight, fuel, and carrier fees.

- Warehousing Costs: Expenses related to storing inventory, managing distribution centers, and maintaining optimal stock levels across various geographical locations.

- Supply Chain Management: Investment in technology, personnel, and processes to ensure the efficient flow of goods and information throughout the entire supply chain, from sourcing to delivery.

- Distribution Network Optimization: Ongoing efforts to refine the network of warehouses and transportation routes to reduce lead times and minimize costs while meeting customer delivery expectations.

Sales, Marketing, and Administrative Expenses

Huhtamaki's Sales, Marketing, and Administrative Expenses are significant investments to maintain its global market presence and operational efficiency. These costs encompass everything from compensating its dedicated sales teams worldwide to executing impactful marketing campaigns that build brand awareness and customer loyalty.

These expenses are crucial for fostering strong customer relationships through robust CRM systems and managing the essential administrative functions that keep the business running smoothly across all its divisions. For instance, in 2023, Huhtamaki reported that its selling, general, and administrative expenses amounted to €1.18 billion. This figure underscores the substantial resources allocated to these vital business support areas.

- Sales Force Compensation: Costs related to salaries, commissions, and benefits for the global sales teams.

- Marketing Campaigns: Investment in advertising, promotions, digital marketing, and brand building initiatives.

- Customer Relationship Management (CRM): Expenses for software, systems, and personnel dedicated to managing customer interactions and data.

- General Administrative Overhead: Costs associated with corporate functions, legal, HR, finance, and IT support across the organization.

Huhtamaki's cost structure is fundamentally shaped by its extensive manufacturing operations, which include significant outlays for energy, labor, and machinery upkeep. The company's global footprint, with approximately 18,000 employees, necessitates substantial investment in personnel and operational facilities. These manufacturing costs are a cornerstone of their business model, directly impacting the final price and availability of their packaging solutions.

The company's commitment to innovation is reflected in its substantial Research and Development (R&D) expenditures. In 2023, Huhtamaki invested €102.7 million in R&D, focusing on developing sustainable and advanced packaging materials. This investment is crucial for maintaining a competitive edge and meeting evolving market demands for environmentally friendly products.

Logistics and distribution represent another major cost component, encompassing global transportation, warehousing, and supply chain management. The company actively works to optimize these networks to mitigate the impact of fluctuating fuel prices and shipping rates, which are critical for timely delivery to their worldwide customer base.

Sales, Marketing, and Administrative expenses are also significant, totaling €1.18 billion in 2023. These costs support global sales teams, marketing initiatives, customer relationship management, and essential administrative functions necessary for operating a multinational enterprise.

| Cost Category | 2023 Expense (EUR Million) | Key Drivers |

|---|---|---|

| Raw Materials | N/A (Significant portion of COGS) | Paperboard, pulp, polymers; commodity price volatility |

| Manufacturing & Production | N/A (Significant portion of COGS) | Energy, labor (18,000 employees), machinery maintenance, depreciation |

| Research & Development | 102.7 | Innovation, sustainable materials, new technologies |

| Logistics & Distribution | N/A (Significant portion of COGS/Operating Expenses) | Transportation, warehousing, supply chain optimization, fuel costs |

| Sales, Marketing & Admin | 1,180 | Sales force, marketing campaigns, CRM, general overhead |

Revenue Streams

Huhtamaki generates significant revenue through the sale of flexible packaging. This includes a wide array of products like films, pouches, and laminates, crucial for packaging everything from food to everyday consumer goods.

Despite market volatility, this segment has demonstrated resilience and growth. For instance, in 2023, Huhtamaki's Flexible Packaging segment reported net sales of €2,287.1 million, a slight increase from €2,261.9 million in 2022, indicating a stable performance.

Huhtamaki's sales of fiber packaging represent a core revenue stream, encompassing products like molded fiber egg cartons and various paperboard items. This segment has experienced a notable upswing in demand, especially for egg packaging solutions, reflecting a broader market shift towards sustainable materials.

Huhtamaki generates significant revenue by supplying essential foodservice packaging to quick-service restaurants, cafes, and various other food establishments. This includes a wide array of products like cups, containers, and cutlery, all designed for convenient on-the-go consumption of food and beverages.

The North American foodservice market, a key region for these sales, demonstrated robust performance. For instance, in 2024, Huhtamaki reported that its sales in the North American region contributed substantially to the company's overall financial results, reflecting strong demand for their packaging solutions.

Customized Packaging Solutions and Services

Huhtamaki generates revenue by providing highly customized packaging solutions. This involves developing unique designs, sourcing specialized materials, and offering value-added services tailored to individual client needs, often through collaborative development processes.

This segment of their business is driven by the demand for differentiated and functional packaging that enhances brand appeal and product protection. For instance, in 2024, the demand for sustainable and innovative packaging solutions continued to rise, allowing Huhtamaki to command premium pricing for their bespoke offerings.

Key revenue drivers within this stream include:

- Collaborative Design Fees: Charging for the expertise and time invested in co-creating unique packaging concepts with clients.

- Specialized Material Premiums: Higher revenue from using advanced, sustainable, or high-performance materials not found in standard offerings.

- Value-Added Service Charges: Income from services like advanced printing, barrier coatings, or integrated smart features.

- Volume-Based Contracts: Revenue secured through long-term agreements for consistent supply of customized packaging.

Sustainability-Driven Product Sales

Huhtamaki's revenue is increasingly bolstered by its sales of sustainable packaging. This segment taps into a significant market shift, driven by stricter environmental regulations and a strong consumer preference for eco-friendly products. The company offers a range of solutions designed to meet these demands.

These offerings include packaging made from recyclable materials, as well as compostable alternatives. This focus on sustainability is not just about compliance; it's a strategic growth area for Huhtamaki, attracting environmentally conscious clients and opening new market opportunities.

- Recyclable Packaging: Huhtamaki's portfolio features a growing range of packaging designed for easy recycling, aligning with circular economy principles.

- Compostable Solutions: The company is investing in and expanding its production of compostable packaging, catering to markets where organic waste infrastructure is robust.

- Regulatory Alignment: Sales in this stream are directly supported by global trends towards extended producer responsibility (EPR) schemes and bans on single-use plastics, creating a favorable market environment.

- Consumer Demand: Brands are actively seeking sustainable packaging to meet consumer expectations, directly translating into increased sales for Huhtamaki's eco-friendly product lines.

Huhtamaki also generates revenue through its hygiene products segment. This includes a variety of items like medical packaging, pharmaceutical packaging, and other specialized solutions designed for cleanliness and safety. The demand for these products has been consistently strong, driven by global health trends and the need for sterile packaging solutions across various industries.

This segment benefits from the increasing focus on health and safety standards worldwide. For example, in 2023, the demand for high-quality, sterile packaging in the healthcare sector remained robust, contributing positively to Huhtamaki's overall revenue performance.

Huhtamaki's revenue is also derived from its operations in the industrial and agricultural sectors. This encompasses a range of packaging solutions tailored for industrial goods, chemicals, and agricultural products, ensuring their safe transport and storage. The performance in these segments is often tied to broader economic activity and global trade volumes.

In 2024, Huhtamaki reported that its industrial packaging solutions saw increased demand, particularly in regions experiencing manufacturing growth. This highlights the company's ability to serve diverse industrial needs with specialized packaging.

| Segment | 2023 Net Sales (€ million) | 2022 Net Sales (€ million) | YoY Change (%) |

|---|---|---|---|

| Flexible Packaging | 2,287.1 | 2,261.9 | 1.1% |

| Foodservice Europe & Asia | 1,018.5 | 920.7 | 10.6% |

| Foodservice North America | 1,133.4 | 1,074.5 | 5.5% |

| Global Solutions | 493.4 | 457.0 | 7.9% |

Business Model Canvas Data Sources

The Huhtamaki Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research, and competitive landscape analysis. This multi-faceted approach ensures a robust and accurate representation of the company's strategic framework.