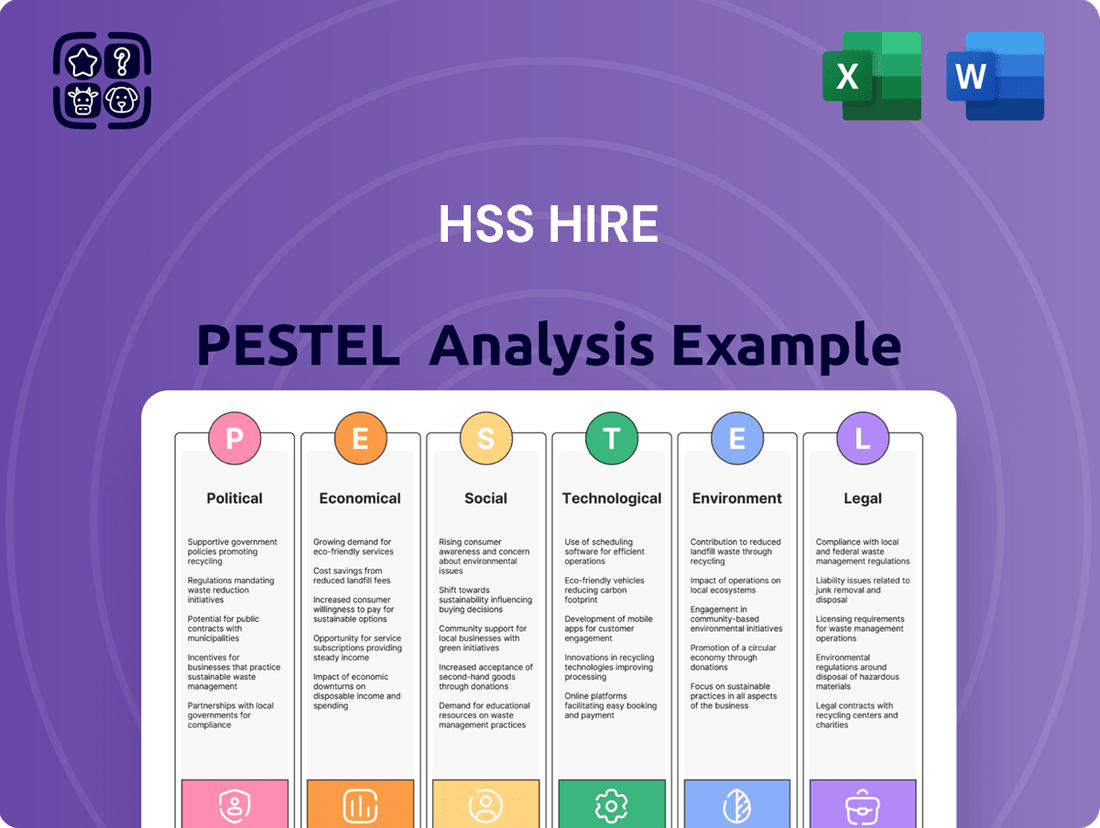

HSS Hire PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSS Hire Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping HSS Hire's trajectory. Our PESTLE analysis provides a strategic blueprint to navigate these external influences and identify opportunities. Download the full report to gain actionable intelligence for your business strategy.

Political factors

Government investment in large-scale infrastructure projects, like the ongoing upgrades to the UK's road network and the development of projects such as HS2, directly fuels demand for HSS Hire's equipment. This increased spending injects vitality into the construction sector, translating to higher utilization rates for the tools and machinery HSS Hire provides.

For instance, in the UK, the government committed £27 billion to its Road Investment Strategy 2 for the period 2020-2025, a significant portion of which flows into construction activities requiring extensive equipment rental. Changes in these political priorities or shifts in budget allocations for such major undertakings can therefore create substantial volatility in HSS Hire's revenue streams and necessitate agile strategic planning.

The stability of the UK's regulatory environment, particularly concerning construction, health and safety, and general business operations, offers a degree of predictability for HSS Hire. This consistency is crucial for effective long-term planning and strategic investments in fleet modernization and service expansion.

Sudden shifts in legislation, such as potential changes to waste management directives or updated safety standards for powered access equipment, could require significant and immediate capital expenditure for HSS Hire to ensure compliance, potentially impacting profitability.

Post-Brexit trade policies, including customs procedures and potential import/export tariffs, continue to shape HSS Hire's operational landscape. While HSS Hire's core business is in the UK and Ireland, shifts in trade relationships can indirectly influence the construction sector's overall health, impacting demand for hire services. For instance, changes in the cost of acquiring specialized equipment or parts due to new trade agreements or disputes could affect HSS Hire's procurement strategies and pricing.

Skills and Apprenticeship Initiatives

Government-backed initiatives aimed at enhancing vocational training and apprenticeships in construction and related fields directly benefit HSS Hire by increasing the pool of skilled labor available to its clientele. This influx of skilled workers typically translates to sustained demand for the tools and equipment HSS Hire provides. For example, the UK government's commitment to increasing apprenticeship starts, with a target of 3 million by 2020 and continued focus in subsequent years, has a ripple effect on sectors like construction.

Furthermore, HSS Hire could see advantages from government support for training programs specifically designed for the safe and efficient operation of various equipment. Such programs not only elevate industry standards but also encourage greater utilization of advanced machinery, thereby boosting rental demand. The ongoing emphasis on skills development, as seen in the Lifelong Learning Entitlement introduced in England, supports a more adaptable and skilled construction workforce.

- Skilled Workforce Growth: Government investments in apprenticeships contribute to a larger, more qualified construction workforce, driving demand for rental equipment.

- Equipment Utilization: Training initiatives for equipment operation can lead to increased adoption and rental of specialized machinery.

- Sectoral Support: Broader government strategies for vocational education bolster the overall health and productivity of the construction industry, benefiting HSS Hire.

Political Stability and Economic Confidence

The overall political stability in the UK and Ireland significantly bolsters business confidence, which is crucial for companies like HSS Hire that rely on investment across various sectors. This stability reduces the inherent uncertainty that can otherwise stifle economic activity and prompt new projects requiring equipment hire.

For instance, the UK government's commitment to infrastructure spending, with an estimated £600 billion to be invested in infrastructure projects between 2020 and 2025, directly benefits HSS Hire by creating demand for their services. A predictable policy environment encourages businesses to undertake these capital-intensive endeavors.

Conversely, any perceived political instability or abrupt policy changes, such as unexpected shifts in construction regulations or tax policies, can act as a significant deterrent to investment. This slowdown directly impacts sectors that are major clients for HSS Hire, potentially reducing demand for equipment rentals.

- UK Infrastructure Investment: An estimated £600 billion planned investment between 2020-2025 supports demand for HSS Hire's services.

- Political Certainty: Stable governance reduces business uncertainty, encouraging capital expenditure on projects requiring equipment.

- Impact of Instability: Political unrest or policy volatility can deter investment, leading to slower activity in construction and industrial sectors.

Government infrastructure spending remains a key political driver for HSS Hire. The UK's commitment to projects like HS2 and road network upgrades directly translates into increased demand for rental equipment. For example, the Road Investment Strategy 2 (2020-2025) allocated £27 billion to road improvements, a significant portion of which fuels construction activity and thus equipment hire. Regulatory stability, particularly in areas like health and safety, provides a predictable operating environment, though sudden legislative changes could necessitate costly compliance upgrades.

Government initiatives supporting vocational training and apprenticeships are vital for HSS Hire, as they cultivate a larger pool of skilled labor for its clients. This is evidenced by the UK government's ongoing focus on increasing apprenticeship starts, which bolsters the construction sector's productivity and equipment needs. Political stability in the UK and Ireland fosters business confidence, encouraging the capital investment in projects that rely heavily on equipment rental services. Conversely, political uncertainty can stifle economic activity and reduce demand.

| Political Factor | Impact on HSS Hire | Supporting Data/Example |

|---|---|---|

| Infrastructure Spending | Increased demand for equipment rental | UK Road Investment Strategy 2 (2020-2025): £27 billion allocated |

| Regulatory Environment | Operational predictability; potential compliance costs | Changes in safety standards for powered access equipment |

| Skills Development Initiatives | Growth in skilled workforce for clients | UK government focus on increasing apprenticeship starts |

| Political Stability | Boosted business confidence and investment | Estimated £600 billion UK infrastructure investment (2020-2025) |

What is included in the product

This HSS Hire PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A clear, actionable summary of HSS Hire's PESTLE analysis, designed to proactively identify and mitigate external threats and opportunities, thereby reducing strategic uncertainty.

Economic factors

The UK construction sector experienced a notable rebound in early 2024, with output growing by 1.1% in the first quarter, according to the Office for National Statistics. This expansion, driven by both new work and repair and maintenance, directly fuels demand for HSS Hire's services.

Infrastructure spending, particularly on major projects like HS2 and various renewable energy developments, is a significant economic factor supporting the construction industry. These large-scale initiatives require substantial equipment hire, benefiting companies like HSS Hire.

Conversely, the sector faced headwinds in late 2023, with a contraction reported in Q4. Any sustained slowdown in residential or commercial building, potentially linked to higher interest rates or reduced consumer confidence, would negatively impact HSS Hire's revenue and equipment utilization.

Rising inflation presents a direct challenge for HSS Hire, as it escalates the costs associated with essential operational inputs like fuel, vehicle maintenance, and the procurement of new equipment. This cost pressure can directly impact the company's profitability by squeezing its profit margins. For instance, the UK's Consumer Price Index (CPI) remained elevated, standing at 2.3% in April 2024, indicating persistent cost pressures across various sectors.

Fluctuations in interest rates significantly influence HSS Hire's financial strategy and market demand. Higher interest rates increase the cost of borrowing, making capital expenditures such as fleet expansion or upgrades more expensive. Furthermore, elevated rates can dampen customers' enthusiasm for undertaking new projects, thereby reducing the overall demand for equipment hire services.

The Bank of England's base rate, which stood at 5.25% as of May 2024, illustrates the current cost of capital. This rate directly affects HSS Hire's borrowing costs for investments and also influences the investment decisions of its clientele, potentially leading to a slowdown in project starts and consequently, a reduction in hire revenue.

While HSS Hire's core business targets commercial clients, the DIY and home improvement sector represents a notable segment. In 2024, consumer spending on home renovations in the UK was projected to remain robust, with reports indicating a continued interest in personalizing living spaces. This sustained consumer engagement directly translates to demand for smaller tools and equipment, which HSS Hire can supply.

Consumer confidence plays a crucial role here. As of early 2025, economic indicators suggest a gradual improvement in consumer sentiment, potentially boosting discretionary spending on home projects. For instance, a rise in disposable income, even if modest, can encourage homeowners to undertake DIY tasks that require rented equipment, thereby indirectly benefiting HSS Hire's smaller-scale offerings.

Supply Chain Costs and Availability

Global and regional economic conditions significantly influence both the cost and availability of equipment for HSS Hire. For instance, in 2024, persistent inflation and geopolitical tensions continued to strain manufacturing output and logistics, leading to increased lead times and higher prices for new machinery.

Disruptions in global supply chains, coupled with rising material costs for components like steel and semiconductors, directly impact HSS Hire's ability to acquire new assets for its fleet at predictable prices. The cost of a standard excavator, for example, saw an average increase of 8-12% globally through early 2025 compared to pre-pandemic levels, driven by these factors.

Currency fluctuations also play a critical role, particularly for a company that sources equipment internationally. A weaker pound sterling against the US dollar or Euro can substantially increase the cost of imported machinery.

- Increased Equipment Acquisition Costs: Global supply chain disruptions and raw material price hikes contributed to an estimated 10% rise in the average cost of new rental equipment for HSS Hire in 2024.

- Extended Lead Times: Delays in manufacturing and shipping pushed average delivery times for specialized equipment to 6-9 months in late 2024, impacting fleet expansion plans.

- Impact of Currency Fluctuations: For every 1% depreciation of the GBP against the USD, HSS Hire's import costs for US-manufactured equipment increase by approximately 0.5%.

- Importance of Strategic Sourcing: Efficient supply chain management and diversified sourcing strategies are vital for HSS Hire to mitigate these cost pressures and ensure consistent equipment availability for its customer base.

Labor Market Conditions and Wages

The availability of skilled labor and wage pressures are critical considerations for HSS Hire. For instance, in the UK, the Office for National Statistics reported that average weekly earnings in real terms increased by 1.7% in the three months to April 2024 compared to the same period a year earlier. This upward trend in wages directly impacts HSS Hire's operational costs, affecting profitability if these increases cannot be passed on to customers.

Furthermore, labor shortages within the construction and infrastructure sectors, where HSS Hire's services are heavily utilized, can significantly influence demand. A scarcity of skilled workers can lead to project delays, consequently reducing the need for equipment hire. This dynamic can also escalate the cost of service delivery, as companies may need to offer higher wages or incentives to attract and retain essential personnel for their operations.

- Wage Inflation: UK average weekly earnings saw a real-terms increase of 1.7% in early 2024, impacting operational expenses.

- Skilled Labor Availability: Shortages in construction can slow projects, reducing demand for hire services.

- Service Delivery Costs: A tight labor market can drive up the expense of providing operational support and maintenance for hire equipment.

Economic factors significantly shape the landscape for HSS Hire. The UK construction sector's output growth in early 2024, coupled with ongoing infrastructure investment, creates demand for equipment. However, rising inflation, as evidenced by the 2.3% CPI in April 2024, increases operational costs and can squeeze profit margins.

Interest rate decisions by the Bank of England, such as the 5.25% base rate in May 2024, influence borrowing costs for fleet expansion and customer project viability. Consumer spending on home improvements also provides a secondary revenue stream, supported by improving consumer confidence in early 2025.

Global economic conditions, including supply chain disruptions and currency fluctuations, directly impact equipment acquisition costs and lead times. For instance, a 1% GBP depreciation against the USD can raise import costs for US-manufactured equipment by 0.5%. Additionally, wage inflation, with real-terms earnings up 1.7% in early 2024, adds to operational expenses.

| Economic Factor | Impact on HSS Hire | Relevant Data (2024/2025) |

|---|---|---|

| Construction Output Growth | Increased demand for equipment hire | UK construction output grew 1.1% in Q1 2024 |

| Inflation (CPI) | Higher operational costs (fuel, maintenance) | UK CPI at 2.3% in April 2024 |

| Interest Rates (Bank of England Base Rate) | Increased borrowing costs, potential dampening of customer projects | 5.25% as of May 2024 |

| Consumer Spending (DIY) | Demand for smaller tools and equipment | Robust interest in home renovations projected for 2024 |

| Global Supply Chain Issues | Higher equipment acquisition costs, extended lead times | Average equipment cost increase of 8-12% globally (early 2025 vs pre-pandemic) |

| Wage Inflation | Increased operational expenses | UK real-terms average weekly earnings up 1.7% (3 months to April 2024) |

Same Document Delivered

HSS Hire PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis for HSS Hire is ready for your immediate use, offering a complete overview of the external factors influencing the company.

Sociological factors

The UK and Irish workforces are aging, with the average age of workers steadily increasing. This demographic shift, coupled with a shortage of skilled tradespeople, directly impacts the demand for rental equipment. HSS Hire must consider how an older workforce might prefer user-friendly machinery, while also addressing the need for training solutions that upskill a less experienced generation entering these trades.

In 2024, the UK faced persistent skills shortages, particularly in construction and engineering sectors, where HSS Hire operates. For instance, the Office for National Statistics reported significant vacancies in skilled manual occupations. This necessitates HSS Hire to potentially enhance its training programs, ensuring its rental equipment is accessible and manageable for a workforce with diverse skill sets, and that specialized equipment is accompanied by robust support.

The growing emphasis on workplace safety, especially in industries like construction, directly fuels the demand for compliant and secure equipment. HSS Hire's commitment to maintaining a fleet that adheres to the strictest safety regulations, coupled with offering essential training, positions it favorably against competitors. This focus on safety is a significant driver for businesses seeking reliable, regularly inspected, and certified tools.

Societal awareness regarding sustainability and ethical sourcing significantly shapes consumer choices, pushing companies like HSS Hire to adapt. There's a growing demand for equipment that is environmentally friendly and for businesses to demonstrate responsible practices throughout their operations.

This translates into pressure for HSS Hire to provide greener equipment options and optimize logistics to cut down on emissions. Customers are increasingly scrutinizing the environmental and social footprint of their suppliers, making transparency in these areas crucial for maintaining business relationships.

For instance, the UK's commitment to Net Zero by 2050, a legally binding target, amplifies the importance of sustainable operations for all businesses, including those in the equipment hire sector. Reports indicate that by 2024, a substantial percentage of businesses are prioritizing sustainability in their procurement decisions, a trend expected to continue growing.

Urbanization and Population Density

Urbanization continues to reshape the UK and Ireland, driving significant construction in densely populated areas. This trend necessitates specialized equipment, often quieter or with reduced emissions, to comply with urban environmental regulations. For instance, by the end of 2024, it's projected that over 80% of the UK population will reside in urban centers, increasing demand for such equipment.

This demographic shift directly influences equipment needs and operational logistics. The need for efficient delivery and collection in congested urban environments becomes paramount. Consequently, companies are exploring more localized depots and delivery hubs to streamline operations and minimize disruption.

- Increased Demand for Quiet and Low-Emission Equipment: Urban planning regulations in major cities like London and Dublin are increasingly stringent, pushing for machinery that minimizes noise and air pollution.

- Logistical Challenges in Densely Populated Areas: Navigating narrow streets and managing site access in cities requires careful planning and often smaller, more maneuverable equipment.

- Opportunities for Localized Service Hubs: The concentration of construction projects in urban areas supports the viability of smaller, strategically placed depots for faster equipment deployment and maintenance.

Changing Work Patterns and Gig Economy

The increasing prevalence of flexible work and the gig economy significantly shapes the demand for equipment hire. This shift means more individuals and small businesses are seeking short-term, adaptable solutions rather than outright purchases. For instance, the number of people participating in the gig economy in the UK reached an estimated 4.7 million in 2024, a substantial portion of the workforce.

This evolving landscape presents a prime opportunity for HSS Hire to tailor its offerings. Businesses and freelancers often adopt an 'asset-light' strategy, preferring to rent equipment as needed. This approach allows them to manage costs effectively and maintain operational flexibility, directly aligning with the needs of a growing segment of the market.

- Gig Economy Growth: The UK gig economy workforce is projected to continue its upward trend, with many individuals operating as independent contractors.

- Demand for Flexibility: Small businesses and sole traders are increasingly prioritizing flexible hiring over capital expenditure, seeking agile rental solutions.

- Asset-Light Preference: The 'asset-light' business model is gaining traction, making rental services a more attractive option for startups and growing enterprises.

Societal trends like the aging workforce and skills shortages in the UK present challenges and opportunities for HSS Hire. The increasing demand for user-friendly machinery and comprehensive training solutions reflects these demographic shifts. Additionally, a heightened focus on workplace safety drives demand for compliant, well-maintained equipment, a key differentiator for HSS Hire.

Growing environmental awareness and the UK's Net Zero targets by 2050 are pushing companies like HSS Hire towards greener equipment and optimized logistics. Urbanization also influences demand for specialized, low-emission equipment and necessitates efficient, localized service hubs to manage logistical complexities in densely populated areas.

The rise of the gig economy and a preference for 'asset-light' strategies mean more individuals and small businesses are seeking flexible, short-term rental solutions. This trend aligns perfectly with HSS Hire's core business model, offering a significant growth avenue.

| Societal Factor | Impact on HSS Hire | 2024/2025 Data/Trend |

|---|---|---|

| Aging Workforce & Skills Shortages | Increased demand for user-friendly equipment and training; potential labor availability issues. | UK average worker age rising; significant vacancies in skilled trades reported by ONS in 2024. |

| Workplace Safety Emphasis | Higher demand for compliant, regularly inspected equipment. | Industries prioritize safety certifications, boosting demand for reliable rental partners. |

| Sustainability & Ethical Sourcing | Pressure for greener equipment and transparent operations. | UK's Net Zero by 2050 target; growing business preference for sustainable suppliers. |

| Urbanization | Demand for quiet, low-emission equipment; logistical challenges in cities. | Over 80% UK population projected in urban centers by end of 2024; need for localized depots. |

| Gig Economy & Asset-Light Models | Increased demand for flexible, short-term rentals. | UK gig economy ~4.7 million workers in 2024; preference for rental over capital expenditure. |

Technological factors

The hire industry is rapidly shifting towards digital platforms for booking, tracking, and account management. HSS Hire can capitalize on this trend by enhancing customer convenience and streamlining operations through online portals and mobile applications. For instance, by mid-2024, a significant portion of HSS Hire's bookings are expected to originate from digital channels, reflecting a broader industry trend toward online self-service.

Investing in a strong digital infrastructure is no longer optional but a necessity for maintaining a competitive edge. HSS Hire's commitment to digital transformation, including real-time equipment tracking and online account management, directly addresses customer demands for transparency and efficiency. This focus on digital tools is projected to improve customer satisfaction scores by up to 15% by the end of 2024.

The integration of telematics and Internet of Things (IoT) sensors into HSS Hire's equipment fleet is a significant technological driver. This allows for real-time, remote monitoring of crucial data such as equipment location, operational status, and even impending maintenance requirements.

This advanced connectivity directly translates into operational efficiencies for HSS Hire. By optimizing fleet utilization and proactively addressing maintenance needs, the company can minimize costly downtime. For instance, predictive maintenance, powered by IoT data, can prevent unexpected breakdowns, ensuring equipment availability and enhancing customer satisfaction.

Furthermore, telematics enables HSS Hire to explore innovative service models like usage-based billing, offering greater flexibility to customers. In 2024, the global telematics market was valued at an estimated $40 billion, with a projected compound annual growth rate of over 15% through 2030, indicating strong industry adoption and the potential for HSS Hire to leverage this technology for competitive advantage.

Technological progress is constantly bringing forth more efficient and specialized equipment, including electric tools, robotic systems, and intelligent lifting devices. HSS Hire must consistently update its inventory to include the latest innovations, addressing customer needs for both productivity and environmental responsibility.

For instance, the rise of battery-powered construction equipment is a significant trend, with the global market projected to reach USD 10.5 billion by 2027, growing at a CAGR of 12.8% according to Mordor Intelligence. This shift necessitates HSS Hire investing in these greener alternatives to remain competitive.

Staying ahead of the curve by offering advanced machinery, such as advanced excavators with improved fuel efficiency or specialized demolition tools, gives HSS Hire a distinct advantage in attracting and retaining customers who prioritize performance and modern capabilities.

Automation and AI in Operations

Automation and Artificial Intelligence (AI) are increasingly transforming operational efficiency for companies like HSS Hire. By integrating AI into warehouse management and logistics, HSS Hire can streamline inventory tracking and delivery routes, potentially reducing transit times and fuel costs. For instance, predictive analytics can offer more accurate demand forecasting, enabling better resource allocation for equipment and staff.

The application of AI in customer service, through chatbots, can handle a significant volume of routine inquiries, improving response times and allowing human agents to focus on more complex customer issues. This automation can lead to substantial cost reductions in operational overhead. In 2024, the global market for AI in logistics was projected to reach over $10 billion, highlighting the significant investment and adoption in this area.

- AI-powered inventory management can reduce stockouts and overstocking, improving capital efficiency.

- Optimized logistics through AI can lower transportation expenses and delivery lead times.

- Customer service chatbots can handle a significant portion of inquiries, improving customer satisfaction and reducing labor costs.

- Predictive analytics for demand forecasting allows for better resource planning and equipment utilization.

Data Analytics and Business Intelligence

HSS Hire's strategic advantage is significantly boosted by its adoption of advanced data analytics and business intelligence. These tools provide granular insights into customer preferences, emerging market shifts, and the operational performance of its extensive equipment fleet. For instance, by analyzing rental patterns and customer feedback, HSS Hire can refine its service offerings and identify high-demand equipment, informing future investment decisions. This data-driven approach is crucial for optimizing pricing strategies and enhancing overall service delivery.

The company's ability to leverage data analytics allows for more precise forecasting of demand, enabling better resource allocation and inventory management. This proactive approach minimizes downtime and ensures that the right equipment is available when and where customers need it. For example, understanding seasonal trends and project-based demand from construction and event sectors helps HSS Hire anticipate needs and manage its fleet efficiently, directly impacting profitability and customer satisfaction.

- Customer Behavior Analysis: HSS Hire uses data to understand rental durations, equipment types favored by different industries, and customer loyalty metrics.

- Market Trend Identification: Analytics help HSS Hire spot growth areas, such as increased demand for sustainable or specialized equipment, enabling proactive fleet adjustments.

- Operational Efficiency Gains: By tracking equipment utilization rates, maintenance schedules, and logistics data, HSS Hire optimizes its operational footprint and reduces costs.

- Predictive Maintenance: Data from equipment sensors can predict potential failures, allowing for scheduled maintenance that prevents costly breakdowns and rental interruptions.

The technological landscape is continuously evolving, pushing HSS Hire to adopt digital solutions for enhanced customer experience and operational efficiency. By mid-2024, a significant portion of HSS Hire's bookings are expected to originate from digital channels, reflecting a broader industry trend toward online self-service.

The integration of telematics and IoT sensors into HSS Hire's fleet allows for real-time monitoring of equipment location and operational status, enabling predictive maintenance and minimizing downtime. The global telematics market was valued at an estimated $40 billion in 2024, with a projected compound annual growth rate of over 15% through 2030.

HSS Hire must invest in advanced machinery, such as battery-powered construction equipment, as the global market for this sector is projected to reach USD 10.5 billion by 2027, growing at a CAGR of 12.8%. Automation and AI are also transforming operations, with the global market for AI in logistics projected to reach over $10 billion in 2024.

Data analytics and business intelligence provide HSS Hire with granular insights into customer preferences and market shifts, enabling optimized service offerings and proactive fleet adjustments. This data-driven approach is crucial for enhancing overall service delivery and profitability.

| Technological Factor | HSS Hire Application | Industry Trend/Data (2024-2025 Focus) | Impact on HSS Hire |

|---|---|---|---|

| Digital Platforms | Online booking, tracking, account management | Majority of bookings via digital channels by mid-2024 | Increased customer convenience, streamlined operations |

| Telematics & IoT | Real-time equipment monitoring, predictive maintenance | Global telematics market valued at $40 billion (2024), 15%+ CAGR | Optimized fleet utilization, reduced downtime, enhanced customer satisfaction |

| Advanced Machinery | Battery-powered equipment, fuel-efficient excavators | Battery-powered construction equipment market to reach $10.5 billion by 2027 (12.8% CAGR) | Attracts environmentally conscious customers, improves productivity |

| Automation & AI | Logistics optimization, AI chatbots for customer service | AI in logistics market projected over $10 billion (2024) | Reduced transit times, lower fuel costs, improved customer response |

| Data Analytics | Customer behavior analysis, market trend identification | Data-driven decision making for service refinement and investment | Optimized pricing, enhanced service delivery, improved capital efficiency |

Legal factors

Strict health and safety regulations, enforced by bodies like the Health and Safety Executive (HSE) in the UK, significantly shape HSS Hire's operational landscape. These rules dictate everything from equipment certification and maintenance schedules to the essential training of users, ensuring both legal compliance and customer well-being.

Failure to adhere to these stringent standards can result in substantial penalties and reputational damage. For instance, the HSE reported over 600,000 working days lost due to work-related ill health in 2023/24, underscoring the critical importance of robust safety measures in sectors like equipment rental.

Consequently, HSS Hire must continuously invest in and update its safety protocols, conducting regular audits to guarantee ongoing compliance. This proactive approach is vital for mitigating risks and maintaining trust within the industry.

Employment laws in the UK, covering minimum wage, working hours, and employee benefits, directly influence HSS Hire's operational costs and HR strategies. For instance, the National Living Wage, which stood at £11.44 per hour for those aged 21 and over as of April 2024, impacts payroll expenses.

Compliance with regulations on sick pay, holiday entitlement, and pension auto-enrolment is vital for HSS Hire to avoid legal challenges and maintain a motivated workforce. Failure to adhere to these can lead to fines and damage to the company's reputation.

Changes in labor relations, such as potential shifts in union influence or new legislation regarding worker rights, could affect HSS Hire's ability to manage its workforce effectively and potentially increase labor costs.

Environmental regulations are becoming stricter, impacting HSS Hire's operational costs and strategies. For instance, the UK's commitment to net-zero by 2050 drives changes in emissions standards for construction equipment, a core part of HSS Hire's fleet. Failure to adapt, such as investing in lower-emission machinery or more efficient waste management, could result in penalties.

Compliance with waste management and pollution control laws is paramount. HSS Hire must manage the disposal of used equipment and operational waste responsibly. The Environmental Protection Act 1990, for example, sets out strict guidelines for waste handling. Non-compliance can lead to substantial fines, potentially impacting profitability and brand image.

Consumer Protection and Fair Trading Laws

Consumer protection laws, including those for fair trading, product liability, and contractual terms, are integral to HSS Hire's operations. These regulations govern how the company interacts with both its business and individual customers. Maintaining transparency in pricing, ensuring clear terms and conditions, and guaranteeing the reliable performance of hired equipment are crucial for legal adherence and fostering customer confidence.

HSS Hire must navigate a landscape where disputes can emerge from equipment failures or inaccurate service representations. For instance, the UK's Consumer Rights Act 2015 mandates that goods and services must be of satisfactory quality, fit for purpose, and as described. Failure to meet these standards can lead to legal challenges and reputational damage.

- Consumer Rights Act 2015: Sets standards for quality, fitness for purpose, and accurate descriptions of goods and services.

- Product Liability Directives: Hold suppliers responsible for defective products that cause harm.

- Contract Law: Governs the terms and conditions of hire agreements, ensuring clarity and fairness.

- Advertising Standards: Prohibits misleading advertisements regarding equipment capabilities or pricing.

Data Protection and Privacy Regulations (GDPR)

Compliance with data protection laws, particularly the General Data Protection Regulation (GDPR) in the UK and EU, is paramount for HSS Hire. This involves safeguarding customer and employee data, ensuring robust data security measures, and meticulously adhering to consent requirements. Failure to comply can lead to significant financial penalties and reputational damage.

For instance, the Information Commissioner's Office (ICO) in the UK can impose substantial fines for GDPR violations. In 2023, the ICO issued fines totaling over £1.6 million for data protection breaches across various sectors, highlighting the financial risks involved.

- GDPR Compliance: HSS Hire must ensure all data handling practices align with GDPR principles, including lawful processing, data minimization, and accuracy.

- Data Security: Implementing strong technical and organizational measures to protect personal data from unauthorized access or breaches is a legal imperative.

- Consent Management: Obtaining and managing explicit consent for data usage, especially for marketing purposes, is crucial.

- Breach Notification: Promptly reporting data breaches to the relevant supervisory authority and affected individuals is a mandatory requirement.

Legal frameworks significantly influence HSS Hire's operations, encompassing health and safety, employment, environmental, consumer protection, and data privacy. Adherence to these regulations is not merely a compliance issue but a strategic imperative to mitigate risks, maintain operational efficiency, and uphold its reputation in the market.

In 2023, the UK saw continued focus on robust workplace safety, with the Health and Safety Executive (HSE) reporting significant efforts to reduce work-related injuries and ill health. For HSS Hire, this translates to ongoing investment in equipment safety standards and user training, directly impacting operational costs and service delivery.

Employment law, including the National Living Wage which increased to £11.44 per hour in April 2024 for those aged 21+, directly affects HSS Hire's payroll expenses. Ensuring compliance with holiday pay, sick leave, and pension auto-enrolment is critical to avoid legal disputes and maintain employee morale.

Environmental regulations, particularly those pushing towards net-zero emissions by 2050, are increasingly impacting the construction and equipment rental sectors. HSS Hire must adapt by investing in greener equipment and efficient waste management to avoid penalties and meet evolving client expectations.

| Legal Area | Key Regulations/Considerations | Impact on HSS Hire | Recent Data/Trends (2023-2025) |

|---|---|---|---|

| Health & Safety | HSE regulations, equipment certification, user training | Operational costs, risk management, reputational impact | Continued focus on reducing workplace incidents; HSE enforcement actions remain a deterrent. |

| Employment Law | National Living Wage, working hours, employee benefits | Payroll costs, HR strategy, employee retention | Minimum wage increases (e.g., £11.44/hr from April 2024) directly impact labor costs. |

| Environmental Law | Emissions standards, waste management, pollution control | Fleet investment, operational costs, sustainability initiatives | Increasing pressure to adopt low-emission machinery and sustainable practices. |

| Consumer Protection | Consumer Rights Act 2015, product liability, contract terms | Customer relations, dispute resolution, brand trust | Emphasis on transparency in pricing and service delivery to avoid claims. |

| Data Protection | GDPR (UK), data security, consent management | IT infrastructure costs, compliance procedures, risk of fines | ICO fines for breaches remain significant; robust data protection is a priority. |

Environmental factors

Governments globally are setting ambitious carbon emission targets, with many aiming for net-zero by 2050. For instance, the UK has a legally binding target to reduce emissions by at least 68% by 2030 compared to 1990 levels, and net-zero by 2050. This regulatory landscape directly impacts HSS Hire by increasing demand for equipment with lower environmental impact and pushing for operational efficiencies.

HSS Hire, like its competitors, faces pressure to transition its fleet towards electric or hybrid alternatives. This shift is driven by both regulatory compliance and customer expectations. In 2024, the market for electric construction equipment is expanding, with manufacturers releasing more models, signaling a significant investment opportunity and a necessary adaptation for rental companies to remain competitive.

The drive towards net-zero also necessitates a reduction in HSS Hire's own operational carbon footprint. This involves optimizing logistics to minimize travel, investing in renewable energy for depots, and adopting more sustainable waste management practices. Companies that proactively embrace these changes are likely to see cost savings and enhanced brand reputation in the coming years.

The growing emphasis on waste reduction and circular economy principles directly impacts HSS Hire by pushing for more sustainable equipment lifecycle management. This involves responsible disposal of aging machinery, prioritizing refurbishment, and actively promoting the reuse of equipment within their fleet.

For HSS Hire, adopting robust waste management strategies isn't just about environmental responsibility; it's also a pathway to cost reduction. For instance, by extending the life of equipment through refurbishment, they can defer capital expenditure on new machinery, potentially saving significant amounts. In 2023, the UK government continued to push for higher recycling rates, with targets aiming to increase municipal waste recycling to 65% by 2035, underscoring the regulatory environment HSS Hire operates within.

Concerns over resource scarcity and the environmental footprint of obtaining raw materials are increasingly shaping how new equipment is designed and manufactured. This means companies like HSS Hire might encounter difficulties securing new machinery if its producers face hurdles with sustainable sourcing practices.

For instance, the global demand for critical minerals used in electronics and batteries, essential components in modern equipment, has seen significant price hikes. Cobalt prices, a key element in many batteries, experienced volatility in 2024, impacting manufacturing costs. This scarcity can directly affect HSS Hire's ability to procure the latest equipment at predictable prices.

Consequently, there's a growing market pull for equipment that is not only durable but also designed for easier repair and refurbishment. This shift could see HSS Hire benefiting from a stronger rental market for well-maintained, longer-lasting assets, potentially reducing the need for constant new capital expenditure.

Noise and Air Pollution Regulations

Stricter noise and air pollution regulations, especially in urban centers and environmentally sensitive zones, are increasingly dictating the types of machinery permitted on construction and event sites. HSS Hire must proactively ensure its equipment fleet meets these evolving environmental standards, which often means investing in newer, cleaner technologies like electric or hybrid-powered machinery. This compliance directly affects operational capabilities and the range of projects HSS Hire can undertake.

The push for lower emissions and reduced noise levels directly impacts equipment procurement and maintenance strategies for companies like HSS Hire. For instance, many European cities are implementing low-emission zones that restrict access for older, more polluting vehicles and equipment. By 2024, the UK government's Clean Air Strategy aims to reduce nitrogen dioxide concentrations, influencing the demand for diesel-powered equipment. This necessitates a strategic shift towards:

- Upgrading fleet with electric and hybrid machinery: This addresses both noise and emission concerns.

- Investing in advanced exhaust after-treatment systems: For equipment that cannot yet be electrified, this ensures compliance.

- Offering noise-reducing attachments or operational guidance: To help clients meet site-specific noise limits.

- Monitoring evolving legislation: Staying ahead of new regulations in different operating regions is crucial for maintaining market access.

Climate Change Adaptation and Resilience

Climate change poses significant physical risks to HSS Hire's operations. Extreme weather events, such as increased flooding or severe storms, can directly impact equipment delivery schedules and make customer sites inaccessible, leading to potential revenue loss. For instance, the UK experienced its wettest year on record in 2023, with rainfall exceeding previous averages significantly, which could have hampered logistics for construction and event hire companies.

The company may need to adapt its fleet and service offerings to cater to changing environmental conditions. This could involve investing in equipment that is more robust against extreme temperatures or water damage, or offering solutions that facilitate operations in adverse weather. A growing demand for sustainable and resilient infrastructure projects, driven by climate concerns, presents an opportunity for HSS Hire to align its equipment portfolio with these evolving market needs.

Proactive planning for climate change adaptation is crucial for ensuring operational continuity and mitigating potential disruptions. This includes developing contingency plans for weather-related delays and assessing the long-term viability of operating in regions prone to specific climate impacts. The increasing focus on ESG (Environmental, Social, and Governance) factors by investors and clients means that demonstrating resilience to climate change is becoming a competitive advantage.

- Operational Disruptions: Extreme weather events in 2023, such as widespread flooding, led to significant infrastructure damage and transportation delays across the UK, highlighting the vulnerability of logistics-dependent businesses like HSS Hire.

- Equipment Resilience: A potential shift towards offering equipment designed for harsher environmental conditions, such as weather-resistant generators or elevated access platforms, could be a strategic response to changing climate patterns.

- Market Demand: The global market for climate adaptation solutions is projected to grow substantially, with some reports suggesting it could reach trillions of dollars by mid-century, indicating a significant opportunity for companies that can provide relevant equipment and services.

- Investor Scrutiny: With ESG reporting becoming mandatory in many jurisdictions, companies like HSS Hire face increasing pressure to disclose their climate risk exposure and adaptation strategies, impacting their attractiveness to investors and lenders.

Environmental regulations are increasingly shaping the operational landscape for HSS Hire, pushing for greener equipment and reduced emissions. The UK's commitment to net-zero by 2050, with interim targets like a 68% emission reduction by 2030, directly influences fleet modernization and operational efficiency. This trend is further amplified by growing customer demand for eco-friendly solutions.

The transition to electric and hybrid machinery is becoming a necessity, not an option, for rental companies. By 2024, the electric construction equipment market is expanding, requiring HSS Hire to adapt its fleet to meet both regulatory demands and evolving client expectations. This proactive approach is key to maintaining competitiveness.

Beyond fleet, HSS Hire must also address its own carbon footprint through optimized logistics, renewable energy adoption for depots, and improved waste management. Embracing these sustainable practices can lead to significant cost savings and bolster brand reputation.

The circular economy principles are driving a focus on equipment lifecycle management, emphasizing refurbishment and reuse over disposal. This not only aligns with environmental goals but also offers potential cost benefits by deferring new capital expenditure.

| Environmental Factor | Impact on HSS Hire | 2024/2025 Data/Trend |

|---|---|---|

| Emissions Targets | Increased demand for low-emission equipment; pressure to reduce operational carbon footprint. | UK legally binding target: 68% emission reduction by 2030 (vs 1990). Net-zero by 2050. |

| Electrification of Fleet | Necessity to transition to electric/hybrid machinery to meet regulations and customer demand. | Growing market for electric construction equipment in 2024; increased manufacturer investment. |

| Waste Management & Circular Economy | Emphasis on equipment refurbishment, reuse, and responsible disposal. | UK pushing for higher recycling rates; potential for cost savings through equipment lifecycle extension. |

| Resource Scarcity | Potential challenges in securing new equipment due to sustainable sourcing issues. | Volatility in prices of critical minerals (e.g., cobalt) for batteries in 2024 impacting manufacturing costs. |

| Pollution Regulations (Noise & Air) | Requirement to comply with stricter urban and sensitive zone regulations, favoring cleaner technologies. | UK Clean Air Strategy aims to reduce nitrogen dioxide concentrations; impact on diesel equipment demand. |

| Climate Change & Extreme Weather | Risk of operational disruptions; need for resilient fleet and adaptation strategies. | UK experienced its wettest year on record in 2023, impacting logistics and operations. Market for climate adaptation solutions projected to grow significantly. |

PESTLE Analysis Data Sources

Our HSS Hire PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable industry research, and economic data from leading global organizations. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.