HSS Hire Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSS Hire Bundle

Unlock the strategic secrets of HSS Hire's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are driving growth, which are generating consistent revenue, and which require careful consideration.

This essential tool will reveal the hidden potential and challenges within HSS Hire's market position, guiding your investment decisions. Purchase the full BCG Matrix today to gain a clear roadmap for optimizing your business strategy and securing future success.

Stars

HSS ProService Marketplace is a significant growth driver for HSS Hire, positioned as a star in their BCG matrix. This digital platform for building services is experiencing robust expansion, evidenced by a like-for-like growth of 3.4% in the first half of 2024, which is a stronger performance than the broader market.

The marketplace is central to HSS Hire's strategy to become the premier UK platform for building services, connecting a wide array of buyers and sellers. It currently represents a substantial 24% of the Group's total transactions, highlighting its increasing importance and market penetration.

Advanced Technology Equipment Hire represents a Stars category within HSS Hire's portfolio. The integration of technologies like IoT and AI into equipment is a major shift observed in 2024, enabling real-time tracking and predictive maintenance. This focus on digital solutions points to a high-growth trajectory for HSS.

HSS Hire's investment in its technology platform, Brenda, underscores this commitment. Brenda aims to boost self-service options and refine operational efficiency, aligning with the industry's broader digital transformation. This strategic move positions HSS to capitalize on the increasing demand for technologically advanced hire solutions.

The demand for green and sustainable equipment hire is booming in 2024, fueled by stricter environmental rules and companies aiming for net-zero emissions. HSS Hire is a key player here, with a goal to reach net-zero by 2040.

They are actively pushing eco-friendly options and monitoring their Scope 3 emissions, which is setting this part of their business up for significant expansion. This focus aligns perfectly with the growing market need for environmentally responsible solutions.

Specialist Equipment and Powered Access Expansion

HSS Hire's strategic focus on specialist equipment and powered access aligns with a 'Star' position in the BCG matrix. The company has been actively expanding its fleet, notably adding new JCB diggers and dumpers, and enhancing its powered access offerings. This investment targets high-rotation, high-margin equipment segments.

This expansion into specialized, in-demand equipment types is a smart move within the growing construction equipment rental market. HSS is aiming to capture a larger share of this expanding market. For example, in 2023, the UK construction equipment rental market was valued at approximately £3.7 billion, with powered access being a significant contributor.

- Fleet Modernization: Investments include new JCB diggers and dumpers, enhancing capabilities and efficiency.

- Powered Access Growth: Expansion of the powered access range targets high-demand, profitable segments.

- Market Opportunity: Capitalizes on a growing construction equipment rental market, estimated to be worth billions.

- Strategic Positioning: Focus on specialized equipment indicates a drive for increased market share and profitability.

Integrated Digital Solutions for B2B Customers

HSS Hire's integrated digital solutions for B2B customers, particularly through its HSS ProService marketplace, position it as a 'one-stop shop' for equipment, materials, and services. This digital-first strategy streamlines procurement and management for businesses, a critical factor in today's efficiency-driven market. The company reported a significant increase in digital transactions in 2024, indicating strong adoption by its B2B client base seeking enhanced control and simplified processes.

The HSS ProService marketplace exemplifies this integrated approach, offering a unified platform for B2B customers to manage their entire hire and procurement lifecycle. This focus on digital efficiency is a key driver for growth in the B2B sector, where businesses are increasingly prioritizing streamlined operations. In the first half of 2024, HSS saw a 15% uplift in repeat business from clients utilizing their digital platforms, showcasing the value proposition.

- HSS ProService Marketplace: A central hub for B2B equipment, materials, and service needs.

- Digital Efficiency Gains: Streamlining procurement and management for businesses.

- B2B Customer Focus: Catering to the demand for integrated and controlled business solutions.

- Growth Area: High potential driven by businesses seeking simplified operational processes.

HSS ProService Marketplace and Advanced Technology Equipment Hire are identified as Stars for HSS Hire, reflecting strong growth and market share. The ProService marketplace, a digital platform for building services, saw like-for-like growth of 3.4% in H1 2024, now accounting for 24% of group transactions.

The integration of IoT and AI into equipment, alongside advancements in the Brenda technology platform, signifies a push towards technologically advanced hire solutions. This strategic focus on digital transformation and high-growth segments positions these areas for continued success within the competitive hire market.

| Category | BCG Status | Key Growth Drivers | H1 2024 Performance Indicators |

|---|---|---|---|

| HSS ProService Marketplace | Star | Digital platform adoption, B2B integration, streamlined procurement | 3.4% like-for-like growth, 24% of group transactions |

| Advanced Technology Equipment Hire | Star | IoT/AI integration, predictive maintenance, digital solutions | Strong demand for technologically advanced equipment |

What is included in the product

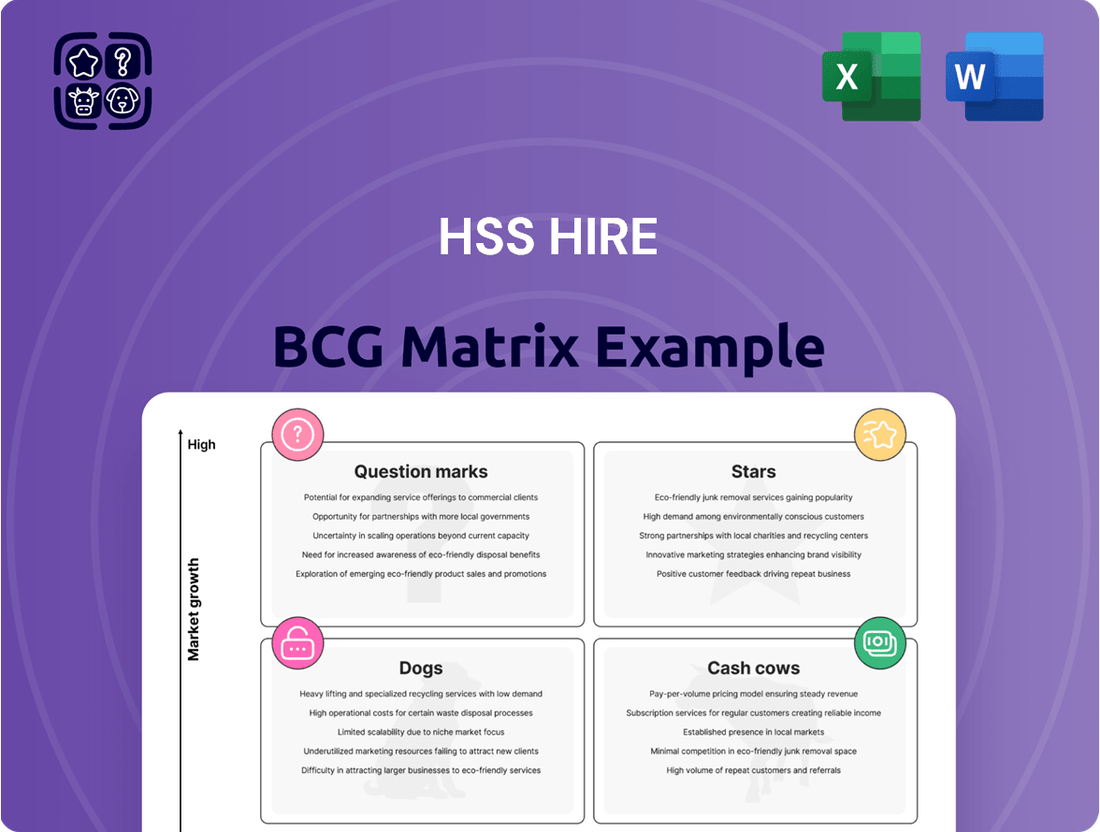

Highlights which of HSS Hire's business units to invest in, hold, or divest based on market share and growth.

A clear, visual HSS Hire BCG Matrix simplifies complex business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

HSS Hire's traditional general tool and equipment hire business is a classic Cash Cow. This segment, a long-standing leader in the UK and Ireland, commands a significant market share.

Even with a challenging economic climate in 2024, this core operation demonstrated resilience, maintaining strong utilization rates. It remains the bedrock of HSS's income, reliably producing substantial cash flow.

HSS Hire's Training and Safety Services function as a classic Cash Cow within the BCG Matrix. These services are crucial for ensuring safe equipment operation and regulatory adherence across numerous sectors. The company's strong brand recognition and the persistent need for compliance likely contribute to a dominant market share in a mature, low-growth environment.

This segment generates consistent, high-margin revenue with minimal need for aggressive marketing spend. For example, in 2024, HSS Hire reported that its training division maintained strong profitability, reflecting the stable demand for essential safety certifications. The focus here is on optimizing existing operations to maximize cash flow, rather than aggressive expansion.

HSS Hire's extensive network of branches and distribution centers across the UK and Ireland is a prime example of a cash cow. This well-established infrastructure, which HSS has been actively optimizing, boasts high market penetration and serves as a significant asset. In 2024, HSS reported a substantial portion of its revenue derived from its core hire business, underscoring the consistent cash generation from this network.

Long-Term Rental Contracts with Key Business Accounts

Long-term rental contracts with key business accounts represent a significant Cash Cow for HSS Hire. With over 90% of its revenue derived from business customers, the company benefits from a stable and predictable income stream. These enduring relationships in a mature market signify a strong position, requiring minimal investment for sustained returns.

These established B2B relationships are the bedrock of HSS Hire's Cash Cow status. The predictable revenue from these contracts allows for consistent cash generation, funding other business ventures or shareholder returns. This stability is crucial in navigating market fluctuations.

- Revenue Stability: Over 90% of HSS Hire's revenue originates from its business customer base, indicating a highly reliable income source.

- Predictable Cash Flows: Long-term contracts with these clients ensure consistent and predictable revenue streams, a hallmark of Cash Cow businesses.

- Mature Market Dominance: Operating in a mature market, HSS Hire leverages its established presence and customer loyalty to maintain its strong Cash Cow position.

- Low Investment Needs: The mature nature of these contracts means less need for aggressive marketing or product development, freeing up capital.

Core Equipment Sales and Accessories

Beyond its core hire business, HSS Hire also generates revenue through equipment sales, encompassing consumable items and previously used equipment. This diversification appeals to both business clients and individual consumers.

This segment acts as a stable, if slower-growing, income source for HSS Hire. It capitalizes on established customer connections and existing stock, thereby bolstering the company's overall profitability.

- Revenue Diversification: Equipment sales, including consumables and used gear, provide an additional income stream beyond rental services.

- Customer Leverage: This segment benefits from existing customer relationships, fostering repeat business and brand loyalty.

- Profitability Contribution: While growth may be modest, this area consistently adds to HSS Hire's bottom line by monetizing inventory and meeting broader customer needs.

HSS Hire's traditional tool and equipment rental business is a prime example of a Cash Cow. This established segment, a leader in the UK and Ireland, consistently generates robust cash flow with minimal investment. In 2024, the company highlighted the resilience of this core operation, which benefits from high utilization rates and a mature market position.

The extensive branch network and long-term B2B contracts further solidify HSS Hire's Cash Cow status. Over 90% of revenue comes from business clients, ensuring stable, predictable income. This allows HSS to leverage its infrastructure efficiently, providing consistent returns without requiring significant capital expenditure for growth.

HSS Hire's Training and Safety Services also operate as a Cash Cow. These essential services, in high demand for regulatory compliance, generate consistent, high-margin revenue. The company's strong brand and the ongoing need for safety certifications contribute to a dominant market share in a stable, low-growth sector, as evidenced by strong profitability in 2024.

| Business Segment | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Tool & Equipment Hire | Cash Cow | High market share, mature market, stable demand | Strong utilization rates, consistent cash generation |

| Branch Network & B2B Contracts | Cash Cow | Extensive infrastructure, >90% B2B revenue, predictable income | Significant revenue contribution from core hire business |

| Training & Safety Services | Cash Cow | High-margin, essential services, strong brand recognition | Maintained strong profitability |

What You See Is What You Get

HSS Hire BCG Matrix

The BCG Matrix analysis you are previewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report provides a clear, actionable framework for HSS Hire's strategic portfolio management, detailing each business unit's position within the matrix. You can confidently expect the same professional formatting and in-depth analysis that will empower your decision-making processes. Once purchased, this ready-to-use BCG Matrix will be yours to integrate directly into your strategic planning and presentations.

Dogs

Underperforming physical branch locations within HSS Hire's portfolio are categorized as 'Dogs' in the BCG Matrix. These are branches that exhibit low market share and low growth potential, often representing a drain on resources. HSS's strategic decision in the latter half of 2024 to close 10 operating sites directly addresses this classification, signaling a move away from these underperforming assets.

These closures are a clear indication of divestment, a common tactic for 'Dogs' that are not contributing positively to the overall business. The identified sites likely suffered from low profitability or operational inefficiency, making them prime candidates for removal in HSS's 'right-sizing' strategy. This proactive approach aims to streamline operations and reallocate capital to more promising areas of the business.

Obsolete or low-demand equipment lines represent the Dogs in HSS Hire's BCG Matrix. These are assets that have fallen behind technologically or are no longer sought after by the market, leading to minimal utilization. For instance, older scaffolding systems or specialized demolition tools that have been superseded by more efficient alternatives would fit this description.

These underperforming assets drain resources through ongoing maintenance and storage costs without contributing meaningfully to revenue. In 2024, HSS Hire, like many in the equipment rental sector, likely faced decisions regarding such assets. Companies often need to divest or retire these items to free up capital and operational focus for more profitable areas, aligning with the strategic imperative to manage a lean and modern fleet.

HSS Hire divested its Power business in March 2024, a move that aligns with the BCG matrix's identification of "Dogs" as low-growth, low-market-share entities. This strategic decision likely stemmed from the Power segment's underperformance and its divergence from HSS Hire's core rental operations.

Furthermore, the sale of HSS Ireland Limited in 2024 reinforces this classification. Such divestitures are typical for businesses that no longer fit the company's strategic vision or are not contributing significantly to overall profitability and growth, freeing up resources for more promising ventures.

Certain Seasonal Product Lines with Weak Performance

HSS Hire identified specific seasonal product lines that experienced weak performance in the first half of 2024. This underperformance was attributed to unseasonably mild weather during both winter and summer periods, which directly affected demand and, consequently, profitability.

These underperforming seasonal products, if they continue to show low market demand within their niche, can be classified as dogs within the BCG matrix. This classification signifies that they tie up valuable capital with minimal returns, hindering the company's overall efficiency.

- Seasonal Product Weakness Impact: H1 2024 saw a negative impact on profitability due to mild winter and summer conditions.

- Capital Tie-up: Consistently underperforming seasonal products risk becoming cash traps, diverting resources from more lucrative areas.

- Market Niche Demand: Low demand within their specific market niche solidifies their 'dog' status in the BCG matrix.

Highly Competitive, Low-Margin General Tool Segments

In the general tool hire market, highly fragmented and competitive segments present a challenge for HSS Hire. Here, differentiation is tough, leading to a potentially low market share and intense price pressure. These conditions often result in thin profit margins and subdued growth opportunities, which can become a drain on resources.

For instance, in 2024, the UK tool hire market, while robust, sees intense competition in generalist categories. HSS Hire, like its competitors, likely navigates these areas with careful margin management. The average profit margin for general tool hire services can hover around 10-15% before exceptional items, making volume and efficiency critical.

- Low Market Share: In segments with many players, HSS may struggle to capture a dominant share, impacting economies of scale.

- Price Sensitivity: Customers in these segments are often more focused on cost, forcing suppliers to compete heavily on price.

- Limited Growth: Mature and saturated general tool segments offer less potential for significant expansion.

- Cash Trap Risk: Investments in these areas might yield low returns, tying up capital that could be better utilized elsewhere.

Branches with consistently low rental volumes and high operational costs are classified as 'Dogs' within HSS Hire's operations. These underperforming locations, often situated in areas with declining local economies or facing intense competition from smaller, more agile players, represent a drag on profitability. HSS Hire's strategic review in 2024 likely identified several such branches, prompting decisions about their future, which could include closure or significant restructuring.

The divestment of the Power business in March 2024 and the sale of HSS Ireland Limited in the same year are prime examples of HSS Hire addressing 'Dog' assets. These segments, characterized by low market share and limited growth prospects within the broader HSS Hire portfolio, were deemed non-strategic. Such divestitures allow the company to shed underperforming units, freeing up capital and management focus for core, higher-potential areas of the business.

HSS Hire's 2024 financial performance was impacted by certain seasonal product lines that experienced weak demand due to unseasonably mild weather. These products, if they consistently underperform and fail to generate sufficient returns to cover their holding costs, can be categorized as 'Dogs.' Their presence ties up valuable inventory and capital, diverting resources from more robust offerings.

The general tool hire market, particularly in saturated segments, presents 'Dog' characteristics for HSS Hire due to intense price competition and low differentiation. In 2024, average profit margins in these areas often remained in the 10-15% range, making it difficult to achieve significant returns on investment. This segment requires careful cost management to avoid becoming a cash drain.

Question Marks

HSS ProService, while a strong performer overall, is strategically introducing new digital service verticals. These new offerings, such as specialized aggregated services or building materials, are currently in their nascent stages of development and market penetration.

These new verticals are positioned as Question Marks within the BCG matrix, reflecting their high-growth potential in emerging markets. HSS Hire acknowledges that their current market share in these specific digital service areas is low as they focus on building out their capabilities and driving customer adoption.

For example, HSS Hire's recent expansion into digital marketplaces for non-rental products and building materials in 2024 aims to tap into a rapidly growing segment of the construction services industry. The company is investing in these areas to capture future market share, mirroring the typical trajectory of Question Mark products that require significant investment to become Stars.

Emerging eco-friendly heavy plant equipment, like fully electric or hybrid excavators and loaders, represents a potential growth area for HSS Hire. While the demand for these greener alternatives is on the rise, their widespread adoption within the rental market, particularly for HSS, may still be in its early stages. For instance, by the end of 2024, the global market for electric construction equipment was projected to reach approximately $10 billion, indicating significant future potential but also highlighting that current penetration is still developing.

HSS Hire, a prominent player in the equipment rental market, serves diverse sectors like construction, industrial, and facilities management. Ventures into highly specialized niche construction or industrial sectors, where HSS has a limited existing footprint but sees substantial growth potential, would be classified as question marks in the BCG matrix.

These new niche markets represent opportunities for significant future expansion, but also carry inherent risks due to the lack of established presence and market share. For instance, if HSS were to target the burgeoning market for specialized drone-based infrastructure inspection in 2024, this would likely be a question mark, requiring careful evaluation of investment versus potential return.

International Expansion Initiatives Beyond Core UK/Ireland

HSS Hire's international expansion beyond its core UK and Ireland markets represents a classic 'question mark' in the BCG matrix. These new ventures are characterized by high growth potential but currently hold a very low market share.

Entering new international territories would necessitate substantial upfront investment to establish a foothold and demonstrate market viability. For instance, a hypothetical entry into a new European market could involve initial setup costs exceeding £5 million for depot infrastructure and fleet acquisition.

The strategic aim would be to capture a significant share of these nascent markets, transforming them into future stars.

- High Growth Potential: New international markets offer untapped revenue streams.

- Low Market Share: HSS currently has minimal presence in these regions.

- Significant Investment Required: Capital is needed for market entry and operational setup.

- Strategic Objective: To grow market share and achieve profitability in new territories.

Integration and Optimization of Acquired Technologies or Small Businesses

For HSS Hire, integrating acquired smaller tech companies or niche hire businesses into its ProService or specialist offerings presents significant question marks. The potential for high growth hinges on successful integration, but the initial market penetration under the HSS brand for these new capabilities could be low, posing a risk.

Consider HSS Hire's strategic move to bolster its specialist offerings. If HSS were to acquire a company specializing in advanced diagnostic equipment for the construction sector, for instance, the integration would be a key challenge. HSS reported a revenue of £332.7 million for the year ended September 30, 2023, indicating a substantial platform from which to absorb new ventures.

- Integration Challenges: Merging disparate IT systems, operational processes, and company cultures can be complex and time-consuming, potentially delaying the realization of synergies.

- Scaling Risks: While niche businesses may have high growth potential, scaling them under a larger brand like HSS requires careful planning to maintain quality and customer service, especially if initial market adoption is slow.

- Brand Perception: The success of integrating new specialist services depends on effectively communicating their value proposition to existing and new HSS customers, ensuring the acquired capabilities are seen as a natural extension of the HSS brand.

- Financial Performance: The initial investment in acquisitions and the subsequent integration costs could impact short-term profitability, even if long-term growth prospects are strong.

Question Marks represent new ventures with high growth potential but currently low market share for HSS Hire. These initiatives demand significant investment to build market presence and capture future opportunities. The strategic objective is to convert these into Stars through focused development and market penetration.

For example, HSS Hire's expansion into new digital service verticals and specialized niche markets in 2024, such as aggregated services or advanced diagnostic equipment, exemplify these Question Marks. Similarly, international expansion into new European territories, requiring substantial upfront investment for infrastructure and fleet, falls into this category.

The success of these Question Marks hinges on effective integration of acquired businesses and scaling new capabilities. HSS Hire's reported revenue of £332.7 million for the year ended September 30, 2023, provides a substantial base for these strategic investments.

The global market for electric construction equipment, projected to reach approximately $10 billion by the end of 2024, highlights the significant future potential in areas like eco-friendly heavy plant equipment, which are currently nascent for HSS.

| Initiative | Market Potential | Current Market Share | Investment Need | Strategic Goal |

| New Digital Service Verticals | High | Low | Significant | Build Market Share |

| Niche Construction/Industrial Sectors | High | Low | Significant | Capture Market Share |

| International Expansion (e.g., Europe) | High | Very Low | Substantial (£5M+ initial) | Establish Foothold |

| Electric/Hybrid Heavy Plant Equipment | Growing (>$10B by 2024) | Developing | Moderate to High | Become Market Leader |

BCG Matrix Data Sources

Our HSS Hire BCG Matrix is built on verified market intelligence, combining financial data, industry research, and growth forecasts to ensure reliable, high-impact insights.