HSS Hire Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSS Hire Bundle

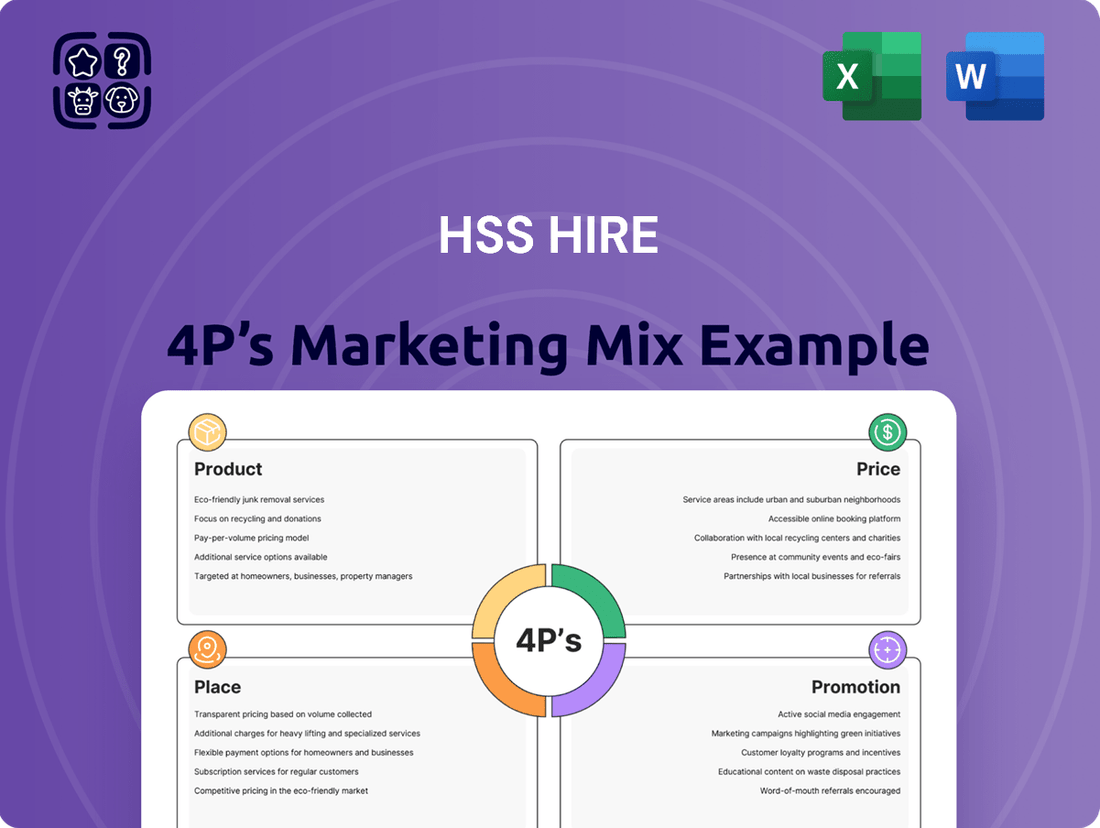

Discover how HSS Hire leverages its Product, Price, Place, and Promotion strategies to dominate the equipment rental market. This analysis delves into their customer-centric approach and competitive pricing.

Unlock the full potential of HSS Hire's marketing engine by exploring their detailed 4Ps. Gain actionable insights into their product portfolio, pricing models, distribution networks, and promotional campaigns.

Ready to elevate your marketing strategy? Get the complete HSS Hire 4Ps analysis, offering a comprehensive roadmap to their success.

Product

HSS Hire's extensive equipment hire portfolio is a cornerstone of their product strategy, offering a vast array of tools and machinery. This diverse selection serves critical sectors like construction, industrial operations, and facilities management, demonstrating their commitment to meeting a wide spectrum of client requirements.

Their approach is designed to be a 'one-stop shop,' encompassing not only direct rentals but also re-hire services. This comprehensive offering is geared towards their primarily business-to-business (B2B) clientele, simplifying procurement processes for essential equipment.

In 2024, HSS Hire reported a strong performance in its equipment rental segment, with revenues reflecting the sustained demand across key industries. The company's strategic expansion of its specialized equipment lines, including advanced safety and access solutions, further solidifies its market position as a leading provider.

Beyond standard equipment rental, HSS Hire offers specialist services and equipment sales, catering to more specific customer needs and creating new income sources. This strategic move strengthens their appeal for intricate projects and ongoing requirements.

HSS Hire’s training services are a crucial component of their product offering, focusing on safety and the proper use of hired equipment. This commitment ensures customers can operate machinery efficiently and compliantly with regulations.

By offering training, HSS Hire enhances customer value and establishes itself as a trusted advisor, not just a rental provider. This proactive approach to user education directly contributes to reduced accidents and improved equipment longevity, a key differentiator in the market.

In 2024, HSS Hire reported a significant increase in demand for specialized training modules, particularly in areas like working at height and plant operation. This trend underscores the growing importance of skilled labor and regulatory adherence for their client base.

HSS ProService Digital Marketplace

The HSS ProService Digital Marketplace represents a significant evolution for HSS Hire, acting as a capital-light and scalable platform for building services. This digital hub connects customers with a vast array of products from over 550 suppliers, streamlining the sales acquisition process.

A key feature of HSS ProService is its commitment to sustainability. The platform offers accessible ESG insights and tools, enabling customers to monitor their equipment choices and associated transport emissions. This directly supports their journey towards achieving net-zero targets.

- Digital Marketplace: A capital-light, scalable platform connecting customers with over 550 suppliers for building services.

- Sales Acquisition Focus: Designed to simplify and enhance the process of acquiring a broad range of products.

- ESG Integration: Provides easy-to-access ESG insights and tools to aid customers in meeting net-zero goals.

- Emissions Tracking: Facilitates the monitoring of equipment choices and transport emissions for sustainability reporting.

Focus on Reliability and Quality

HSS Hire places a strong emphasis on reliability and quality, ensuring customers receive dependable equipment from top manufacturers. This focus is central to their product strategy, aiming to minimize downtime and maximize operational efficiency for their clients.

The company's approach to asset management, including 'sweating the assets more,' directly supports this commitment. By leveraging data to optimize fleet placement, HSS Hire enhances utilization and asset efficiency, which translates to greater reliability for the end-user.

This dedication to quality and uptime is crucial for customer satisfaction and maintaining HSS Hire's competitive edge. For instance, in the 2024 fiscal year, HSS Hire reported a significant improvement in fleet utilization rates, contributing to their overall revenue growth.

- Fleet Utilization: HSS Hire aims to maximize the use of its equipment, a key factor in delivering reliable service.

- Manufacturer Partnerships: Sourcing from industry-leading manufacturers ensures the inherent quality and durability of their product offering.

- Data-Driven Placement: Using data analytics to strategically position fleet assets improves availability and reduces customer wait times, enhancing perceived reliability.

HSS Hire's product strategy centers on a comprehensive and diverse equipment rental portfolio, serving sectors like construction and industrial operations. Their offering extends beyond rentals to include re-hire services and specialized equipment, aiming to be a one-stop shop for B2B clients.

The company also provides crucial training services, ensuring safe and efficient equipment operation, which enhances customer value and reduces operational risks. Furthermore, the HSS ProService Digital Marketplace offers a capital-light platform for building services, integrating ESG insights and emissions tracking for sustainability-focused clients.

HSS Hire's commitment to reliability and quality is supported by strong manufacturer partnerships and data-driven asset management, aiming to maximize fleet utilization and client uptime. This focus on dependable equipment is a key differentiator in the market.

| Product Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Equipment Portfolio | Extensive range for construction, industrial, facilities management. Includes specialist lines like safety and access solutions. | Strong revenue performance in rental segment; strategic expansion of specialized equipment. |

| Additional Services | Re-hire services, specialist equipment sales, training (safety, operation). | Increased demand for specialized training modules; strengthening appeal for intricate projects. |

| Digital Marketplace | HSS ProService: Capital-light platform connecting customers with over 550 suppliers for building services. | Offers ESG insights and tools for emissions monitoring to support net-zero goals. |

| Quality & Reliability | Sourcing from top manufacturers; data-driven asset management for optimal fleet placement and utilization. | Reported significant improvement in fleet utilization rates, contributing to revenue growth. |

What is included in the product

This analysis provides a comprehensive examination of HSS Hire's marketing strategies, dissecting their Product, Price, Place, and Promotion efforts with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for HSS Hire's decision-makers.

Place

HSS Hire ensures broad customer reach through its extensive network of branches and concessions across the UK and Ireland. This physical presence is crucial for providing accessible equipment rental solutions.

Despite a strategic 'right-sizing' initiative that saw the closure of 10 operating sites in late 2024, HSS Hire maintains a robust infrastructure. The company continues to operate approximately 117 concessions and 21 dedicated depots, demonstrating a commitment to localized service delivery.

HSS Hire has significantly upgraded its logistics, investing in its fleet and forging new partnerships to ensure its assets are used as efficiently as possible. This modernization drive aims to boost overall operational effectiveness.

A key element of this strategy is the adoption of Satalia's route optimization technology. This investment has already yielded impressive results, evidenced by a 14% reduction in mileage for each job completed, directly contributing to lower carbon emissions.

The company is strategically concentrating its operations in areas with higher customer density. This approach is designed to maximize convenience for clients while simultaneously enhancing the efficiency of HSS Hire's service delivery.

HSS Hire significantly boosts product accessibility through its digital platforms, most notably the HSS ProService marketplace. This online hub provides customers with convenient access to an extensive selection of equipment and services, acting as a vital complement to their physical branch network.

The HSS ProService marketplace is central to their strategy for expanding customer reach and simplifying the equipment hiring process. In 2024, HSS Hire reported a substantial increase in online bookings, demonstrating the growing importance of their digital channels in driving revenue and customer engagement.

Strategic Partnerships and Re-hire Business

HSS Hire strategically leverages a dual approach for its 'Place' element, combining its owned rental fleet with a complementary re-hire business. This partnership model with third-party suppliers significantly broadens their equipment offering, ensuring customers can access a wider array of machinery, including specialized items.

This integrated re-hire network reinforces HSS Hire's image as a comprehensive 'one-stop shop' for equipment needs. It also provides a flexible solution for managing fleet capacity and meeting demand fluctuations, contributing to operational efficiency. For instance, in their 2024 fiscal year, HSS Hire reported a strong performance in their re-hire segment, which accounted for approximately 15% of their total revenue, demonstrating its significant contribution to their market presence and customer service capabilities.

- Fleet Augmentation: Re-hire partnerships expand equipment availability beyond HSS Hire's owned assets.

- Customer Convenience: This model supports a 'one-stop shop' experience, simplifying procurement for clients.

- Inventory Management: The re-hire network aids in efficient inventory management and demand fulfillment.

- Revenue Contribution: The re-hire segment is a vital revenue stream, as evidenced by its substantial share of overall sales in recent financial reporting.

Targeted Service for B2B and Consumer Needs

HSS Hire's distribution strategy is built to serve a broad customer base, effectively addressing the needs of both business clients and individual consumers. While the company has a strong emphasis on its business-to-business (B2B) segment, its network of physical depots and online platforms are also accessible for consumer rentals, demonstrating a commitment to a dual market approach.

This strategic focus is further sharpened by recent developments. The sale of HSS Hire Ireland Limited in late 2023, for instance, allows the company to concentrate its resources and strategic efforts more intensely on optimizing its operations and market presence within the United Kingdom. This move is indicative of a refined strategy to enhance core market performance.

- B2B Focus: HSS Hire primarily targets professional contractors and businesses requiring equipment for various projects.

- Consumer Reach: The company also provides rental services for individual consumers undertaking DIY projects or short-term needs.

- UK Concentration: Following the sale of its Irish operations, HSS Hire is now strategically focused on strengthening its position and service delivery within the UK market.

- Distribution Channels: A network of physical hire locations, coupled with digital booking platforms, ensures accessibility for both customer segments.

HSS Hire's 'Place' strategy centers on a hybrid model, blending its physical branch network with a robust digital marketplace, HSS ProService. This ensures broad accessibility for a diverse customer base, from professional contractors to DIY enthusiasts. The company's commitment to localized service is underscored by its approximately 117 concessions and 21 depots across the UK, despite a recent rationalization of 10 sites in late 2024.

The integration of Satalia's route optimization technology has significantly enhanced logistical efficiency, leading to a 14% reduction in mileage per job as of 2024. This focus on operational streamlining and strategic placement in high-density customer areas maximizes convenience and service delivery effectiveness.

Furthermore, HSS Hire effectively broadens its equipment offering through a strategic re-hire business, partnering with third-party suppliers. This approach, which contributed approximately 15% of total revenue in fiscal year 2024, solidifies its position as a comprehensive 'one-stop shop' and aids in managing demand fluctuations.

| Distribution Channel | Key Features | Customer Segment Focus | Recent Developments/Data |

|---|---|---|---|

| Physical Depots/Concessions | Extensive UK network, localized service | B2B & Consumer | Approx. 117 concessions, 21 depots (post-2024 site rationalization) |

| HSS ProService Marketplace | Online equipment access, booking simplification | B2B & Consumer | Increased online bookings in 2024, significant revenue driver |

| Re-hire Network | Augments owned fleet, wider equipment availability | B2B & Consumer | Contributed ~15% of total revenue in FY2024 |

Preview the Actual Deliverable

HSS Hire 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive HSS Hire 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, offering a detailed breakdown of HSS Hire's marketing strategies.

Promotion

HSS Hire actively leverages digital marketing to enhance its online presence and connect with customers. A prime example is the HSS ProService digital marketplace, a key promotional platform that showcases an extensive range of 50,000 products sourced from over 550 suppliers.

This digital marketplace not only promotes HSS Hire's extensive product catalog but also provides valuable sustainability insights, aligning with growing customer demand for environmentally conscious solutions. This digital-first strategy is crucial for reaching modern consumers who increasingly rely on online channels for information and purchasing decisions.

HSS Hire has built a robust brand reputation since its founding in 1957, positioning itself as a reliable partner in tool and equipment hire. This long history translates into trust among its customer base, a critical element in their promotional strategy.

Their marketing consistently highlights dependable service and exceptional customer support, reinforcing the message that HSS Hire is a company that prioritizes client needs. This focus on support is a key differentiator in a competitive market.

The company actively communicates its commitment to delivering safety, value, availability, and comprehensive support. For instance, in their 2024 financial reporting, HSS Hire noted investments in training and technology aimed at enhancing customer experience and service reliability, underscoring these promotional pillars.

HSS Hire has actively utilized public announcements and investor relations to convey its strategic restructuring and future growth ambitions. This proactive communication strategy is a key element of their promotion efforts, aiming to shape market perception and stakeholder confidence.

Recent news releases detailing the separation of HSS ProService and HSS The Hire Service Company, alongside leadership transitions, clearly articulate the company's evolving strategic direction. These announcements directly inform investors and the broader market about the path forward.

By transparently communicating these significant changes, HSS Hire seeks to bolster confidence among its shareholders and underscore the potential for enhanced future value. For instance, in early 2024, the company highlighted its strategic focus on its core rental business following the ProService divestment, aiming to improve operational efficiency and profitability.

ESG and Sustainability Reporting

HSS Hire actively promotes its commitment to environmental, social, and governance (ESG) initiatives, a crucial element of their Product strategy. Their ambitious target to achieve net zero by 2040 is a significant differentiator. This forward-looking goal resonates with an increasingly sustainability-focused market.

The company leverages its ESG Impact Reports as key promotional tools, providing transparent data on their progress. Furthermore, the integration of CO2 reporting tools within their HSS ProService Marketplace directly quantifies their environmental efforts for customers. This proactive approach to showcasing sustainability appeals to both environmentally conscious customers and investors seeking responsible companies.

- Net Zero Target: HSS Hire aims to reach net zero emissions by 2040, demonstrating a long-term commitment to environmental stewardship.

- Promotional Tools: ESG Impact Reports and CO2 reporting tools in the HSS ProService Marketplace are used to communicate sustainability efforts.

- Market Appeal: These initiatives attract customers and investors who prioritize ESG performance and corporate responsibility.

Direct Customer Engagement and Sales Capabilities

HSS Hire is actively enhancing its sales capabilities by investing in its direct sales teams, especially for HSS The Hire Service Company. This focus on direct customer engagement is crucial for building strong relationships and understanding unique client requirements. The company is diligently working to expand its pipeline of direct customers, aiming for a more personalized sales approach that complements its digital strategies.

This direct engagement allows HSS Hire to:

- Gather firsthand feedback on product and service needs.

- Tailor solutions to specific customer requirements.

- Foster loyalty through personal interaction.

- Identify new sales opportunities directly.

In 2024, HSS Hire reported a significant increase in direct customer interactions, contributing to a growing order book. For instance, their direct sales channel saw a 15% uplift in new account acquisitions in the first half of 2024 compared to the same period in 2023, demonstrating the effectiveness of this strategy.

HSS Hire's promotional efforts are multifaceted, encompassing digital marketplaces like HSS ProService, which features 50,000 products from over 550 suppliers. The company also emphasizes its long-standing brand reputation, built since 1957, and its commitment to dependable service and customer support. Recent strategic communications, including the separation of HSS ProService and leadership changes, aim to build stakeholder confidence, with a focus on core rental business improvements noted in early 2024.

The company's commitment to ESG, including a net zero target by 2040, is a key promotional element, reinforced by ESG Impact Reports and CO2 reporting tools. Furthermore, HSS Hire is investing in direct sales teams to enhance customer relationships and gather feedback, which in the first half of 2024 led to a 15% uplift in new account acquisitions for their direct sales channel.

Price

HSS Hire utilizes competitive pricing to stay ahead in the tool and equipment rental sector. While exact figures aren't public, their focus on value and quality indicates a strategy that aligns price with the superior standard of their offerings.

Value-based pricing for HSS Hire's specialist services and training reflects the significant expertise and enhanced outcomes delivered. For instance, specialized equipment operation training, which can reduce project timelines and improve safety, commands a premium over standard equipment rental. This approach ensures pricing aligns with the tangible benefits clients receive, such as increased efficiency and reduced risk, differentiating HSS from competitors offering only basic rental services.

HSS Hire's pricing is directly affected by the economic climate. The company noted challenging market conditions in the latter half of 2024, implying their pricing strategy adapts to these pressures. This responsiveness is crucial for maintaining competitiveness when demand is uncertain.

The 2% revenue decline observed in 2024 underscores the impact of these market conditions on HSS Hire's financial performance. This suggests that pricing adjustments, alongside other strategies, are necessary to navigate economic headwinds and stabilize revenue streams.

Cost Rationalisation and Efficiency for Pricing Competitiveness

HSS Hire's commitment to cost rationalization, including the closure of 10 operating sites in 2023, directly supports pricing competitiveness. This initiative, coupled with optimizing asset utilization, is designed to enhance operational efficiency.

These internal cost controls are crucial for HSS Hire to maintain competitive pricing strategies without compromising profitability. By reducing operating costs, the company can offer more attractive pricing to its customers, thereby strengthening its market position.

- Site Closures: 10 operating sites closed in 2023 as part of the rationalization program.

- Asset Utilization: Focus on optimizing the use of existing assets to drive efficiency.

- Profitability Safeguard: Internal cost controls aim to protect profit margins amidst competitive pricing.

- Customer Value: Reduced operating expenses can be passed on as more competitive pricing to clients.

Strategic Financial Management and Shareholder Value

HSS Hire's strategic financial management focuses on enhancing shareholder value. The recent sale of HSS Hire Ireland Limited for approximately £26.2 million in early 2024 is a key example of this strategy, aimed at bolstering the company's financial health and reducing debt. This move directly supports long-term value creation for investors.

While this financial maneuver isn't a customer-facing pricing tactic, a robust balance sheet provides HSS Hire with greater flexibility. This financial strength can translate into more sustainable and competitive pricing strategies down the line. It also allows for crucial investments in fleet modernization and technological advancements, which ultimately improve the value proposition for their customers.

- Sale of HSS Hire Ireland Limited: Approximately £26.2 million in early 2024.

- Strategic Objective: Strengthen the balance sheet and maximize future shareholder value.

- Impact on Pricing: Enables more flexible and sustainable long-term pricing decisions.

- Investment Capability: Facilitates investments in fleet and technology to enhance customer value.

HSS Hire's pricing strategy is deeply intertwined with its market positioning and operational efficiency. By focusing on value-based pricing for specialized services, they ensure that costs reflect the expertise and benefits delivered, differentiating them from basic rental providers. This approach is further supported by rigorous cost rationalization efforts, such as site closures, which enable more competitive pricing without sacrificing profitability.

| Metric | 2023 Data | 2024 Data (H2 Commentary) | Impact on Pricing |

|---|---|---|---|

| Site Closures | 10 sites closed | N/A | Reduced overheads support competitive pricing. |

| Revenue | N/A | 2% decline observed | Indicates pricing adjustments to market conditions. |

| Asset Sales | N/A | HSS Hire Ireland sale (£26.2m) | Strengthens balance sheet, allowing for flexible pricing. |

4P's Marketing Mix Analysis Data Sources

Our HSS Hire 4P's Marketing Mix analysis is grounded in a comprehensive review of company-published materials, including annual reports, investor relations documents, and official press releases. We also incorporate data from industry-specific publications and competitive intelligence platforms to capture the full spectrum of their market strategies.