HSS Hire Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HSS Hire Bundle

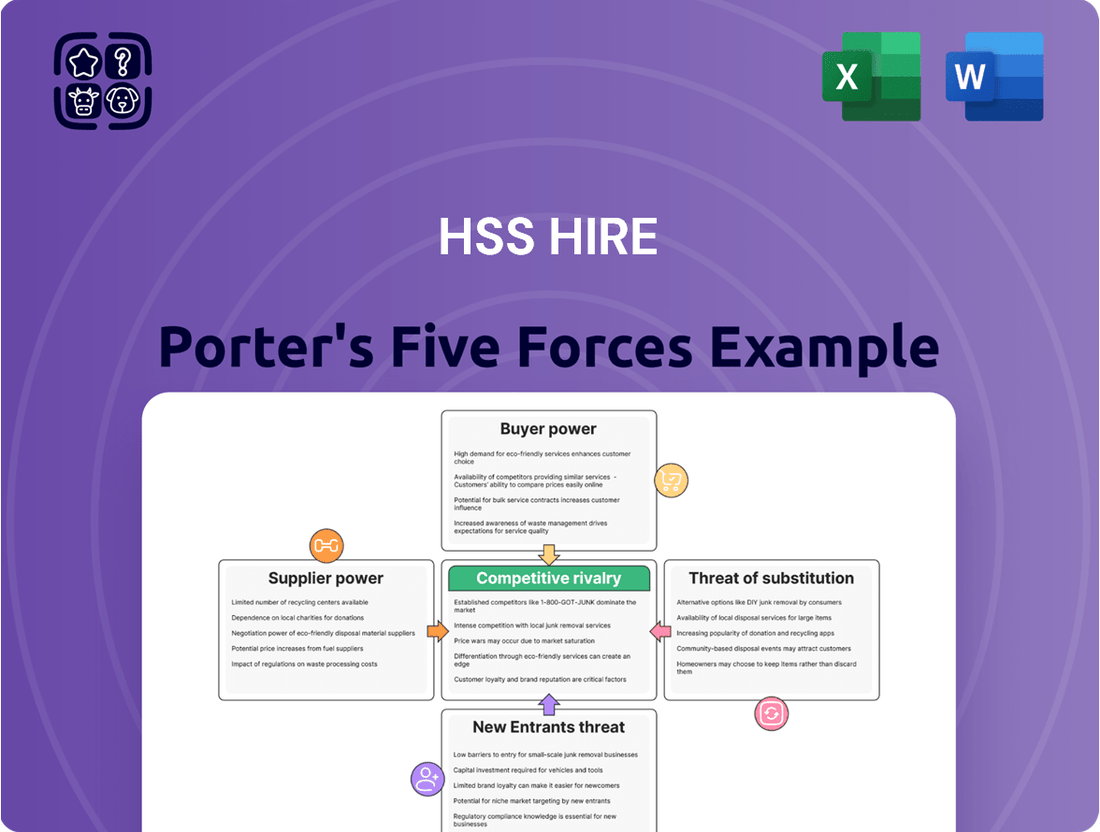

HSS Hire operates in a competitive landscape shaped by several key forces. Understanding the bargaining power of both buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players is crucial for strategic advantage. This brief overview only scratches the surface of these dynamics.

Unlock the full Porter's Five Forces Analysis to explore HSS Hire’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Manufacturers of highly specialized equipment wield considerable bargaining power, particularly when few other providers can supply critical machinery. For HSS Hire, this translates to potential impacts on their operational expenses and the availability of their extensive fleet, as these suppliers dictate pricing and terms.

Technology and software providers are increasingly influential in the equipment rental sector as digitalization accelerates. Companies offering advanced telematics, sophisticated fleet management systems, and digital booking platforms, much like HSS Hire's own 'Brenda' system, can wield significant bargaining power. Their proprietary technologies can introduce switching costs, making it more expensive and complex for HSS to change providers, thus strengthening the suppliers' position.

The ability of these tech suppliers to integrate seamlessly and offer unique functionalities that enhance operational efficiency and customer experience is paramount. For instance, in 2024, the global market for fleet management software was projected to reach over $35 billion, highlighting the significant investment and reliance businesses place on these digital solutions. This reliance grants these technology vendors greater leverage in negotiations with rental companies like HSS.

Fuel and energy providers hold a moderate level of bargaining power for HSS Hire. While traditional fuels like diesel remain prevalent, the increasing demand for sustainable options such as Hydrotreated Vegetable Oil (HVO) and electric machinery is shifting the landscape. Suppliers of these newer, eco-friendly energy sources could see their power grow as the industry transitions, potentially impacting HSS's operational expenses and environmental strategy.

Raw Material and Component Suppliers

The stability of global supply chains for raw materials and components directly influences equipment availability and pricing for hire companies like HSS Hire. While supply chains have shown considerable recovery by 2025, potential disruptions or price fluctuations can still affect HSS's cost-effective acquisition of new fleet assets.

Suppliers of specialized components for construction and industrial equipment can exert significant bargaining power. If there are few alternative suppliers for critical parts, HSS Hire may face higher prices or longer lead times, impacting its operational efficiency and capital expenditure plans.

- Limited Supplier Options: For highly specialized equipment components, the number of manufacturers is often limited, giving those suppliers leverage.

- Supply Chain Vulnerabilities: Despite general stabilization, geopolitical events or natural disasters can still create localized shortages, increasing supplier power.

- Price Volatility: Fluctuations in commodity prices, such as steel or rare earth minerals, can be passed on by suppliers, directly impacting HSS Hire's procurement costs.

Skilled Labor and Maintenance Service Providers

Suppliers of skilled labor, especially for equipment maintenance and specialized repair services, possess a degree of bargaining power. This is largely due to persistent skills shortages within the construction and equipment manufacturing sectors, impacting companies like HSS Hire.

HSS Hire relies heavily on a competent workforce to maintain equipment reliability and provide essential customer support. The availability and cost of these specialized skills directly influence operational efficiency and service quality, making these labor suppliers critical partners.

- Skills Gap Impact: Ongoing shortages in skilled trades, particularly for complex equipment maintenance, grant these labor providers leverage in negotiations.

- Operational Dependence: HSS Hire’s ability to deliver reliable equipment and support is directly tied to the availability of qualified maintenance technicians.

- Cost Implications: Increased demand for skilled labor can drive up wages and service fees, directly impacting HSS Hire's cost structure.

Suppliers of highly specialized equipment and critical components can exert significant bargaining power over HSS Hire, especially when alternative providers are scarce. This leverage can lead to increased costs and potential disruptions in fleet availability. For instance, manufacturers of advanced telematics systems, crucial for fleet management, saw their market grow substantially, with global fleet management software projected to exceed $35 billion in 2024, underscoring their influence.

The bargaining power of suppliers is amplified by factors like limited supplier options for specialized parts and the potential for supply chain vulnerabilities, despite overall stabilization by 2025. Price volatility in raw materials, such as steel, can also be passed on by suppliers, directly impacting HSS Hire's procurement expenses. Furthermore, persistent skills shortages in the construction and equipment maintenance sectors grant skilled labor providers considerable leverage, affecting HSS Hire's operational efficiency and service costs.

| Supplier Type | Bargaining Power Factors | Impact on HSS Hire |

|---|---|---|

| Specialized Equipment Manufacturers | Limited alternative providers, proprietary technology | Higher acquisition costs, potential fleet availability issues |

| Technology & Software Providers | Proprietary systems, integration complexity, switching costs | Increased operational efficiency, but also reliance and potential cost increases |

| Fuel & Energy Suppliers | Shift to sustainable options, demand for eco-friendly fuels | Potential impact on operational expenses and environmental strategy |

| Skilled Labor Providers | Persistent skills shortages, demand for specialized maintenance | Increased labor costs, impact on equipment reliability and service quality |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for HSS Hire, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

HSS Hire's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces, enabling quick and informed strategic decisions to alleviate market pressure.

Customers Bargaining Power

Major construction firms, industrial clients, and facilities management companies are significant customers for HSS Hire, and their substantial rental volumes give them considerable leverage. These large entities can negotiate favorable pricing and service terms due to their potential for long-term commitments and the sheer scale of their business. For instance, in 2024, HSS Hire's focus on securing repeat business from these larger accounts is crucial for revenue stability.

The bargaining power of customers, particularly small-to-medium enterprises (SMEs) and individual consumers, presents a significant dynamic for HSS Hire. While their individual purchase sizes might be modest, their collective influence is substantial. This is largely due to their heightened price sensitivity and the availability of numerous local rental options, meaning they can easily switch providers if pricing or service isn't competitive. For instance, in 2024, the UK SME sector, comprising over 5 million businesses, often prioritizes cost-effectiveness for equipment hire, making transparent and competitive pricing a key decision factor.

HSS Hire actively works to mitigate this customer power by focusing on factors beyond just price. Their extensive network of depots ensures convenience and ease of access, a crucial element for SMEs and consumers who value quick turnaround times. Furthermore, HSS's investment in digital platforms streamlines the rental process, offering transparent pricing and simple booking, which directly addresses customer preferences for ease and clarity. This strategic approach helps retain customers even when faced with competitive pricing from smaller, local providers.

The shift towards renting equipment over buying is a significant factor influencing the bargaining power of HSS Hire Porter's customers. Economic pressures and a strong desire for cost management and operational flexibility are pushing many businesses to opt for rental solutions. This trend, observed across various industries, means customers have more choices and can easily switch between rental providers if their needs aren't met efficiently or cost-effectively.

In 2024, the rental market continues to show robust growth, with companies prioritizing capital preservation and operational agility. For instance, the UK construction equipment rental market alone was valued in the billions of pounds, indicating a substantial customer base actively seeking rental options. This increased demand, coupled with the inherent flexibility of renting, empowers customers to negotiate better terms and demand higher service standards from providers like HSS Hire Porter, as they can readily explore alternatives.

Demand for Digital and Self-Service Solutions

Customers are increasingly demanding digital and self-service options for equipment rental. This shift is driven by a desire for greater convenience and control over the rental process. HSS Hire, for example, has invested significantly in its digital platform, 'Brenda,' to meet this evolving customer need.

The availability of user-friendly digital interfaces that allow for easy booking, management, and tracking of equipment directly impacts customer choice. Companies that provide these seamless digital experiences empower their clients, giving them more transparency and autonomy. This, in turn, strengthens the bargaining power of customers, as they can readily compare and select providers based on their digital capabilities.

- Digital Demand: Customers increasingly expect online portals for booking and managing rentals.

- HSS Investment: HSS Hire has prioritized its 'Brenda' platform to enhance digital offerings.

- Customer Empowerment: Seamless digital experiences give customers more control and transparency.

- Provider Selection: Digital capabilities are becoming a key factor in choosing rental partners.

Emphasis on Sustainability and Modern Fleet

Customers are increasingly demanding suppliers who offer modern, fuel-efficient, and environmentally friendly equipment. This trend is driven by broader sustainable construction practices and a growing awareness of environmental impact. HSS Hire's investment in a greener fleet directly addresses this customer priority.

HSS's commitment to sustainability acts as a significant differentiator, influencing customer choice. For instance, in 2024, a significant portion of construction projects, particularly those funded by public bodies or large corporations, now mandate specific environmental credentials for equipment suppliers. Companies that can demonstrate a lower carbon footprint through their fleet are more likely to win contracts.

- Customer Demand for Green Equipment: In 2024, surveys indicated that over 60% of major construction firms consider a supplier's sustainability credentials when making hiring decisions.

- HSS's Fleet Modernization: HSS Hire has been actively upgrading its fleet, with a stated goal of increasing its proportion of electric and hybrid machinery by 25% by the end of 2025.

- Competitive Advantage: Offering a demonstrably sustainable fleet can reduce price sensitivity among customers who prioritize environmental responsibility, thereby strengthening HSS's bargaining position.

The bargaining power of HSS Hire's customers is substantial, influenced by market concentration and the availability of alternatives. Large construction firms, for example, can leverage their volume to negotiate favorable terms, a critical factor in 2024's competitive landscape. Smaller businesses, while individually less impactful, collectively exert pressure due to price sensitivity and the ease of switching providers, especially with many local rental options available.

HSS Hire counters this by focusing on service differentiation, such as its extensive depot network for convenience and its digital platform, Brenda, for streamlined transactions. In 2024, the demand for greener equipment also empowers customers, with many major construction firms considering sustainability credentials, and HSS actively investing in its electric and hybrid fleet to meet this demand.

| Customer Segment | Leverage Factors | HSS Hire's Mitigation Strategies |

|---|---|---|

| Major Construction Firms | High rental volume, long-term contracts | Focus on repeat business, tailored service agreements |

| SMEs & Individuals | Price sensitivity, numerous local alternatives | Competitive pricing, digital convenience, depot accessibility |

| Environmentally Conscious Clients | Demand for sustainable equipment | Investment in greener fleet (e.g., 25% increase in electric/hybrid by end of 2025) |

Same Document Delivered

HSS Hire Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape for HSS Hire by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

The UK and Ireland equipment rental market is notably fragmented. This means there are many companies, from big names like HSS Hire, Speedy Hire, and Sunbelt Rentals, to smaller, local businesses and those specializing in specific equipment. This wide array of competitors creates a very competitive environment where everyone is fighting to win over customers.

This fragmentation means that HSS Hire faces intense rivalry. With so many players, from national giants to niche providers, the pressure to offer competitive pricing and a broad range of services is constant. For instance, in 2023, the UK construction equipment rental market was valued at approximately £4.5 billion, indicating a substantial market where many companies are seeking to gain a foothold.

The UK construction equipment rental market is expected to see consistent growth, with projections indicating it will reach £5.9 billion by 2024. Ireland's market is also demonstrating stable expansion.

However, prevailing economic uncertainties, including high inflation rates and potential political shifts, can foster a cautious approach among businesses. This 'wait and see' sentiment might temper investment in new equipment and consequently heighten competition for existing rental opportunities.

Customers are increasingly watchful of costs, especially with economic uncertainties. This means rental companies like HSS Hire face pressure to keep prices competitive. For instance, in 2024, many sectors saw a slowdown, making clients more inclined to negotiate on rental rates for equipment, directly impacting HSS Hire's ability to maintain healthy profit margins.

The rental market often experiences volatile rental rates. Companies might resort to aggressive pricing, offering lower rates to win significant contracts, which can indeed put a strain on the industry's overall profitability. This competitive pricing environment is a key factor affecting HSS Hire's financial performance.

Investment in Digital Transformation and Technology

Larger players in the equipment rental sector, including those like HSS Hire, are channeling significant capital into digital transformation. This involves adopting technologies such as the Internet of Things (IoT) for asset tracking and predictive maintenance, artificial intelligence (AI) for optimizing logistics and demand forecasting, and sophisticated fleet management systems. For instance, in 2024, the global equipment rental market saw substantial investment in digital solutions aimed at improving operational efficiency and customer service, with some reports indicating digital spending increasing by over 15% year-on-year.

This technological arms race creates a distinct competitive advantage. Companies that can afford and effectively implement these advanced digital tools can achieve higher levels of operational efficiency, offer superior customer experiences through real-time tracking and personalized services, and gain a deeper understanding of market trends. This often leads to a widening performance gap between market leaders with robust digital capabilities and smaller, less capitalized firms that may struggle to keep pace with these investments.

- Increased Operational Efficiency: Digital transformation enables real-time monitoring and optimization of assets, reducing downtime and improving utilization rates.

- Enhanced Customer Experience: Technologies like IoT and AI allow for better service delivery, including predictive maintenance and personalized rental solutions.

- Competitive Differentiation: Early adopters of advanced digital technologies gain a significant edge in service quality and cost management, potentially leading to market share gains.

- Investment Trends: In 2024, the equipment rental industry's focus on digital integration saw a notable increase in R&D spending on AI and IoT solutions by major industry participants.

Strategic Restructuring and Network Optimization

HSS Hire's strategic restructuring, which involved closing underperforming sites to boost asset utilization and align with current market demand, directly impacts competitive rivalry. This move forces rivals to scrutinize their own operational networks and fleet investments, aiming for similar efficiency gains and enhanced service delivery to remain competitive.

The intense pressure to optimize operations means competitors are constantly evaluating their physical presence and fleet deployment. For instance, in 2024, many rental companies focused on consolidating smaller depots and investing in more efficient, multi-purpose equipment to reduce overheads and respond faster to customer needs.

- Network Optimization: Competitors are actively rationalizing their branch networks, mirroring HSS Hire's approach to improve efficiency.

- Fleet Investment Strategy: Rivals are re-evaluating fleet composition, prioritizing versatile and technologically advanced equipment to meet evolving market demands.

- Cost Management: The drive for efficiency necessitates rigorous cost control across all operational aspects, from site management to fleet maintenance.

- Service Delivery: Ultimately, these strategic adjustments are geared towards improving the speed and quality of service offered to customers, a key differentiator in the competitive landscape.

The UK and Ireland equipment rental market is highly competitive due to its fragmented nature, with numerous players from large national firms to specialized local businesses vying for market share. This intense rivalry pressures companies like HSS Hire to offer competitive pricing and a comprehensive service range. For example, the UK construction equipment rental market was valued at approximately £4.5 billion in 2023, highlighting a substantial arena where competition is fierce.

Economic factors, such as inflation and potential political instability, can further intensify competition by making customers more cost-conscious and leading to aggressive pricing strategies. This environment forces rental companies to focus on operational efficiency and technological adoption to maintain their competitive edge. In 2024, many businesses experienced a slowdown, making clients more inclined to negotiate rental rates.

The ongoing investment in digital transformation, including AI and IoT, by major players creates a technological arms race, widening the gap between leaders and smaller competitors. Companies that effectively implement these advanced digital tools can achieve superior operational efficiency and customer experiences. In 2024, digital spending in the global equipment rental market saw increases of over 15% year-on-year.

Strategic moves like network optimization and fleet rationalization by companies such as HSS Hire compel rivals to adapt. This includes re-evaluating their physical presence and fleet composition to improve efficiency and service delivery, ultimately aiming to meet evolving market demands and manage costs effectively.

| Metric | 2023 (Approx.) | 2024 Projection | Impact on Rivalry |

|---|---|---|---|

| UK Construction Rental Market Value | £4.5 billion | £5.9 billion | Increased market size attracts more competition and investment. |

| Digital Spending Growth (Global Rental Market) | Not specified | >15% year-on-year | Drives a technological arms race, favoring digitally advanced firms. |

| Customer Price Sensitivity | High | Very High | Intensifies price wars and pressure on profit margins. |

| Operational Efficiency Focus | High | Very High | Companies are forced to optimize operations to remain competitive. |

SSubstitutes Threaten

Customers, especially those with substantial and ongoing equipment requirements, such as large construction firms, might opt to buy equipment outright rather than rent it. This is often driven by considerations like capital budgeting, potential tax advantages from depreciation, and the appeal of having complete autonomy over equipment upkeep and operational readiness.

For smaller projects or tasks, customers often consider manual labor or less specialized tools as a viable alternative to renting equipment from companies like HSS Hire. This is especially true for DIY enthusiasts or very small businesses that might not have the budget or need for professional-grade machinery. In 2024, the DIY market continued its robust growth, with reports indicating an increase in consumer spending on home improvement projects, many of which can be completed with basic tools.

While not a significant factor for heavy construction machinery, the growing peer-to-peer sharing economy presents a potential long-term threat. Platforms facilitating the informal rental of tools and smaller equipment could emerge as an alternative for some customers, bypassing traditional rental companies.

Integrated Service Providers

The threat of substitutes for HSS Hire, particularly from integrated service providers, is a significant factor. Larger construction or facilities management firms might choose to build their own equipment fleets and maintenance operations. This internal capability directly substitutes for external hire services, especially for equipment used consistently or considered critical to their core business.

This trend is driven by a desire for greater control over asset utilization and maintenance schedules. For example, a major infrastructure project might justify the capital expenditure for in-house equipment if the projected usage over several years is high. In 2023, the global construction equipment rental market was valued at approximately $115 billion, indicating a substantial market where such strategic decisions can impact rental companies like HSS Hire.

- Internalization of Equipment: Large companies may develop in-house fleets to reduce reliance on external hire.

- Cost-Benefit Analysis: This strategy is often pursued when equipment usage is high and predictable.

- Market Impact: Such moves can reduce the addressable market for equipment rental providers.

Advancements in Modular Construction and Prefabrication

The rise of modular construction and prefabrication presents a significant threat of substitutes for traditional on-site equipment rental companies like HSS Hire. These methods shift manufacturing to controlled factory environments, potentially reducing the reliance on certain heavy machinery typically rented for on-site assembly. For instance, in 2024, the UK modular construction market was valued at approximately £11.4 billion, indicating a substantial and growing alternative to traditional building methods that heavily depend on rented equipment.

This shift means that as more projects adopt off-site manufacturing, the demand for specific types of construction equipment, such as cranes for on-site erection or scaffolding, could see a decline. This substitution effect directly impacts the revenue streams of rental providers whose core business model relies on the traditional construction lifecycle.

- Modular construction reduces on-site labor and equipment needs.

- Prefabrication shifts manufacturing away from traditional job sites.

- The UK modular building market is projected to grow significantly, impacting equipment rental demand.

The threat of substitutes for HSS Hire is multifaceted, encompassing both direct and indirect alternatives. Customers might choose to purchase equipment outright, especially for consistent, long-term needs, or opt for manual labor for smaller tasks. The growing DIY market, which saw increased consumer spending in 2024, exemplifies this, as many projects can be completed with basic tools rather than specialized rentals.

Furthermore, the rise of the peer-to-peer sharing economy presents a potential, albeit currently minor, threat for smaller equipment. More significantly, integrated service providers and the increasing adoption of modular construction methods can reduce the demand for traditional equipment rentals. For example, the UK modular construction market, valued at approximately £11.4 billion in 2024, signifies a shift that could lessen the need for on-site machinery.

| Substitute Type | Description | Impact on HSS Hire | Example/Data Point |

|---|---|---|---|

| Ownership | Customers buying equipment outright | Reduces rental demand for consistent users | Large construction firms budgeting for capital expenditure |

| Manual Labor/Basic Tools | Using human effort or simpler tools | Viable for small projects or DIY tasks | DIY market growth in 2024 |

| Modular Construction | Off-site prefabrication reducing on-site needs | Decreases demand for certain heavy machinery | UK modular construction market value: £11.4 billion (2024) |

| In-house Fleets | Companies owning and maintaining their own equipment | Reduces addressable market for rental services | Major infrastructure projects justifying capital investment |

Entrants Threaten

Entering the equipment hire market, particularly for a business aiming to match HSS Hire's extensive fleet, demands a significant upfront capital outlay. This includes acquiring a wide variety of machinery, from small tools to large construction equipment, and ensuring it's kept in optimal working condition.

The sheer cost of building such a comprehensive inventory acts as a substantial barrier. For instance, a new entrant would need to invest tens of millions of pounds to even begin competing with established players like HSS Hire, which reported capital expenditure of £177.1 million in 2023 to support its fleet and infrastructure.

This high capital requirement effectively deters many potential competitors, as securing the necessary funding and managing the associated financial risks is a considerable challenge. Consequently, the threat of new entrants is somewhat mitigated by this fundamental financial hurdle.

Established brand recognition and customer loyalty represent a significant barrier for new entrants in the UK plant and tool hire market. Companies like HSS Hire have cultivated decades of trust and strong relationships with their customer base across the UK and Ireland. For instance, HSS Hire reported a revenue of £307.6 million in the fiscal year ending March 2023, demonstrating its substantial market presence and the loyalty it commands.

Newcomers must invest heavily in marketing and service to even begin chipping away at this ingrained customer preference. Building a reputation that rivals HSS Hire's, which is synonymous with reliability for many businesses and individuals, is a formidable and costly undertaking, requiring substantial time and resources to overcome ingrained loyalty.

The equipment rental industry faces significant hurdles for new companies due to complex regulatory and safety compliance. For instance, in the UK, companies like HSS Hire must adhere to rigorous Health and Safety Executive (HSE) guidelines for operating machinery, which can involve substantial upfront investment in training and certification. Failure to comply can result in hefty fines and operational shutdowns, acting as a strong deterrent to potential entrants.

Extensive Distribution Network and Logistics

The threat of new entrants for HSS Hire is significantly dampened by its extensive distribution network and logistics capabilities across the UK and Ireland. Establishing a comparable infrastructure, with numerous depots and efficient maintenance operations, represents a formidable barrier. For instance, as of late 2023, HSS Hire operated over 200 locations, a scale that would require immense capital and time for any newcomer to replicate.

This established network allows HSS Hire to offer rapid deployment and maintenance of equipment, a critical service in the rental industry. The sheer cost and complexity involved in building out a nationwide logistics and depot system, including the necessary fleet management and repair facilities, deter potential competitors.

- Extensive Depot Network: HSS Hire's presence across the UK and Ireland, with hundreds of operational depots, provides a significant competitive advantage.

- Logistics Efficiency: The company's established logistics infrastructure ensures timely delivery and collection of equipment, a crucial factor for customer satisfaction.

- High Initial Investment: Replicating this scale of operations would demand substantial upfront capital for real estate, fleet acquisition, and operational setup, making it a major deterrent for new players.

- Maintenance Infrastructure: A robust network of maintenance and repair facilities is essential for equipment reliability, adding another layer of complexity and cost for potential entrants.

Access to Skilled Workforce and Specialized Maintenance

The availability of a skilled workforce is a significant barrier for new entrants into the equipment rental sector, particularly for companies like HSS Hire. Reliable customer support and ensuring equipment is operational hinges on having qualified technicians for maintenance, repairs, and specialized services. A 2024 report indicated a persistent shortage of skilled tradespeople across the UK, exacerbating this challenge.

New companies would struggle to attract and keep these essential personnel, especially when competing with established players who already have established relationships and training programs. This difficulty in securing talent directly impacts a new entrant's ability to offer the same level of service reliability that customers expect.

- Skilled Labor Shortages: Reports from 2024 highlight ongoing deficits in skilled trades, impacting recruitment for maintenance roles.

- Retention Challenges: New entrants face difficulty in retaining skilled workers against established competitors with better benefits and career paths.

- Specialist Service Dependency: The need for specialized maintenance and repair expertise creates a high barrier to entry for firms lacking immediate access to such talent.

The threat of new entrants in the equipment hire market, particularly against a player like HSS Hire, is considerably low due to substantial barriers. High capital requirements for fleet acquisition, estimated in the tens of millions for a comprehensive inventory, present a significant financial hurdle. For example, HSS Hire's 2023 capital expenditure was £177.1 million, illustrating the scale of investment needed.

Established brand loyalty and extensive distribution networks, with HSS Hire operating over 200 locations in late 2023, further deter newcomers. Replicating this scale demands immense capital and time, while regulatory compliance adds another layer of complexity and cost.

The difficulty in attracting and retaining skilled labor, exacerbated by 2024 reports of tradesperson shortages, also limits new entrants' ability to provide reliable service.

| Barrier | Description | Impact on New Entrants | Supporting Data (as of 2023/2024) |

|---|---|---|---|

| Capital Requirements | Acquiring a diverse and well-maintained equipment fleet. | Very High | HSS Hire's 2023 CapEx: £177.1 million |

| Brand Loyalty & Reputation | Building trust and customer relationships. | High | HSS Hire's 2023 Revenue: £307.6 million |

| Distribution Network | Establishing a nationwide presence with numerous depots. | Very High | HSS Hire operated over 200 locations (late 2023) |

| Skilled Workforce | Attracting and retaining qualified technicians. | High | UK skilled tradesperson shortages reported in 2024 |

Porter's Five Forces Analysis Data Sources

Our HSS Hire Porter's Five Forces analysis is built upon comprehensive data from HSS Hire's annual reports, industry-specific market research from sources like IBISWorld, and relevant government regulatory filings. This blend ensures a robust understanding of the competitive landscape.