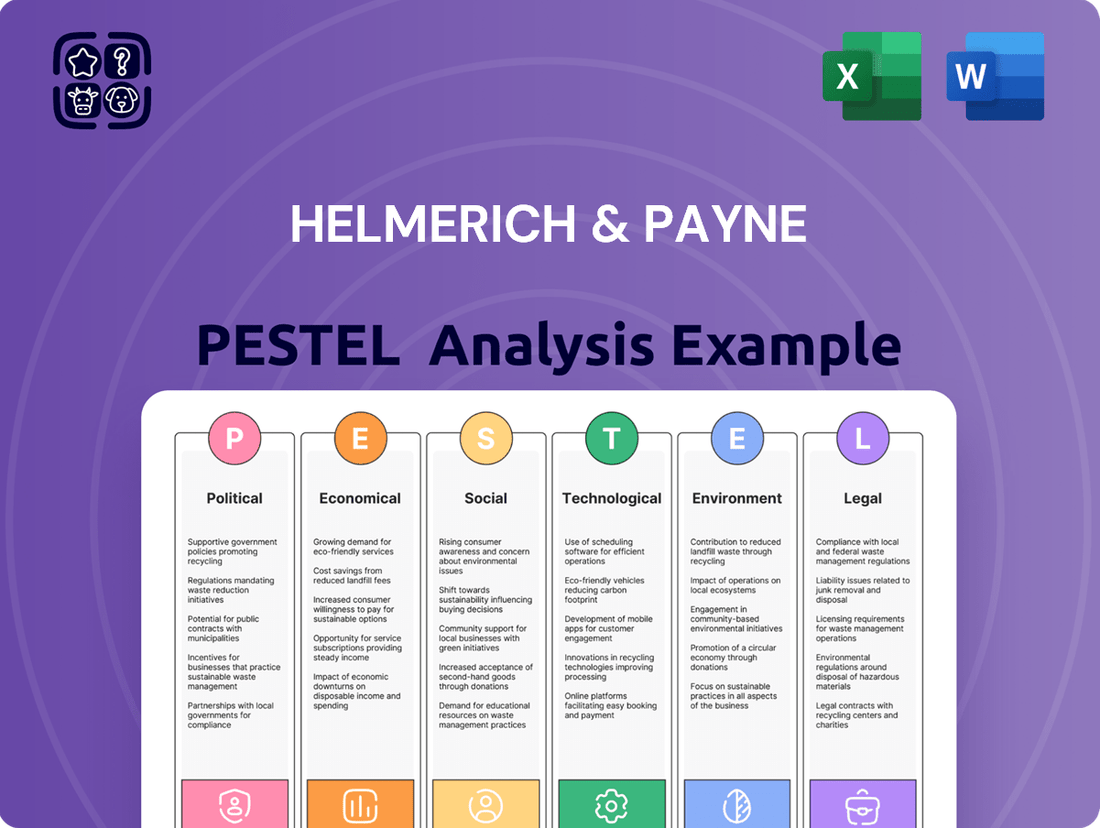

Helmerich & Payne PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

Unlock the strategic advantages Helmerich & Payne holds by understanding the intricate web of political, economic, social, technological, legal, and environmental forces impacting its operations. Our meticulously researched PESTLE analysis dives deep into these external influences, providing you with the critical intelligence needed to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change; lead it. Download the full PESTLE analysis now and gain a decisive edge.

Political factors

Government policies, especially in the U.S., wield considerable power over oil and gas drilling. A shift in federal administration often signals changes in regulations, and a new administration is anticipated to relax some drilling limitations, which could translate into more permits and easier access to land for companies like Helmerich & Payne.

Policies such as Project 2025, for instance, explicitly champion oil and gas operations on public lands and waters. This focus could spur greater drilling activity, though it also raises considerations regarding environmental stewardship and potential impacts.

Geopolitical tensions, including ongoing conflicts and shifts in global alliances, continue to exert significant influence on the energy sector. OPEC+ production decisions, particularly those made in late 2024 and early 2025, directly impact global oil supply and price volatility, creating an uncertain operating environment for drilling contractors like Helmerich & Payne.

Helmerich & Payne's strategic focus on international expansion, including its presence in the Middle East, is a direct response to these geopolitical dynamics. This diversification strategy aims to mitigate risks associated with potential downturns or regulatory changes in the U.S. market, seeking to balance operational exposure across different regions.

The regulatory environment, particularly concerning environmental standards, is a significant factor for Helmerich & Payne. The U.S. Environmental Protection Agency (EPA) has implemented stringent rules to curb methane emissions from oil and gas activities. These regulations mandate the use of advanced leak detection technologies and more rigorous reporting protocols, impacting operational costs.

While these new EPA regulations, like those targeting methane emissions, might increase immediate expenses for companies like Helmerich & Payne, they also pave the way for enhanced environmental stewardship. Adherence to these rules can ultimately lead to a reduction in potential penalties and foster a more sustainable operational footprint.

Trade Policies and Tariffs

Trade policies, particularly tariffs on essential materials like steel and oil country tubular goods (OCTG), directly influence the operational costs for companies like Helmerich & Payne. For instance, in early 2024, ongoing discussions around potential tariffs on imported steel could have added pressure to the already volatile input costs for rig construction and maintenance.

To mitigate these impacts, proactive supply chain management is paramount. Companies are increasingly focusing on diversifying their supplier base, both domestically and internationally, to avoid over-reliance on single sources vulnerable to trade disputes.

- Tariff Impact: Potential tariffs on steel imports in 2024 could increase OCTG costs by an estimated 5-15%.

- Supply Chain Diversification: Helmerich & Payne's strategy includes expanding supplier relationships in Canada and Mexico to reduce reliance on U.S. steel producers facing import pressures.

- Cost Management: Bulk purchasing agreements for materials, negotiated in late 2023 and early 2024, helped lock in prices and cushion the blow of potential tariff increases.

International Relations and Market Access

Helmerich & Payne's global operations are significantly influenced by the political stability and evolving regulatory landscapes of the countries where it conducts business. Fluctuations in international relations can directly impact market access and operational continuity.

Recent events, such as contract suspensions for rigs in Saudi Arabia, underscore the inherent risks in international ventures. These situations necessitate agile strategic planning and the cultivation of robust diplomatic relationships to maintain and secure ongoing market access.

- Geopolitical Risk: Helmerich & Payne's international revenue streams are exposed to geopolitical instability in regions like the Middle East and Latin America, which can lead to project delays or cancellations.

- Regulatory Changes: Shifts in foreign direct investment policies or local content requirements in key markets can affect the cost and feasibility of operations.

- Trade Relations: Evolving trade agreements and sanctions between major economic blocs can create both opportunities and challenges for global energy service providers.

Government policies, particularly those favoring increased domestic oil and gas production, are a significant tailwind for Helmerich & Payne. The anticipated relaxation of drilling limitations, potentially driven by initiatives like Project 2025, suggests a more permissive regulatory environment for exploration and extraction activities in 2024 and 2025.

Geopolitical events and OPEC+ decisions in late 2024 and early 2025 directly influence global oil prices and demand for drilling services. Helmerich & Payne's international expansion, especially in the Middle East, is a strategic move to navigate these global dynamics and diversify revenue streams away from potential U.S. market volatility.

Stricter environmental regulations, such as EPA mandates on methane emissions, are increasing operational costs due to the need for advanced technologies and reporting. While these regulations, effective through 2024 and beyond, present compliance challenges, they also align with growing ESG expectations and can mitigate long-term environmental liabilities.

Trade policies, including potential tariffs on steel and OCTG, directly impact input costs for rig construction and maintenance. For instance, the estimated 5-15% potential increase in OCTG costs due to tariffs in 2024 highlights the importance of supply chain diversification and strategic purchasing agreements to manage these financial pressures.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Helmerich & Payne, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and future growth.

Helmerich & Payne's PESTLE analysis acts as a pain point reliever by providing a clean, summarized version for easy referencing during meetings or presentations, cutting through complex external factors.

Economic factors

Fluctuations in global oil and gas prices are a critical economic factor for Helmerich & Payne, directly influencing the demand for their drilling services. While 2024 experienced relatively stable oil prices, projections for late 2025 anticipate West Texas Intermediate (WTI) crude prices to trade in the high $60s per barrel.

Conversely, natural gas prices faced significant headwinds, with Henry Hub natural gas averaging historic lows throughout 2024. This disparity in price trends creates a mixed economic environment for the energy sector, impacting the profitability and investment decisions of upstream oil and gas companies.

The drilling industry is currently grappling with a challenging environment characterized by declining day rates and low rig utilization. This situation stems from an oversupply of available rigs coupled with subdued demand from exploration and production companies. For instance, in the U.S. Lower 48, the rig count is projected to see minimal change, remaining largely stagnant through 2025.

Despite the current headwinds, there's a glimmer of cautious optimism for an uptick in bid inquiries during the first half of 2025. This suggests that while activity levels may not surge dramatically, operators might begin to re-evaluate their drilling plans and seek out contract opportunities, potentially leading to a gradual improvement in rig utilization and day rates in the near term.

Capital expenditures in the oil and gas sector are on the rise, with oilfield services companies like Helmerich & Payne experiencing robust performance. For instance, Helmerich & Payne reported a significant increase in revenue and profitability through 2023 and into 2024, reflecting this industry-wide upswing.

Companies are strategically focusing on investments that promise high returns and improvements in production efficiency. This approach is crucial for maintaining strong financial results and bolstering investor confidence in a dynamic market environment.

Interest Rates and Economic Growth

Anticipated interest rate cuts in 2025, particularly by major central banks like the U.S. Federal Reserve, are poised to reduce borrowing costs. This could translate into increased capital expenditure by companies, including those in the energy sector, potentially stimulating economic growth.

The International Energy Agency (IEA) projects global oil demand to rise by approximately 1.2 million barrels per day in 2025, reaching 106.4 million barrels per day. This forecast is partly influenced by expectations of monetary easing in key economies, which typically boosts industrial activity and transportation, thereby underpinning drilling demand for companies like Helmerich & Payne.

- Interest Rate Outlook: Many economists anticipate a shift towards lower interest rates in 2025, aiming to counter potential slowdowns and manage inflation.

- Stimulus for Investment: Lower borrowing costs generally encourage businesses to invest in new projects and expand operations, which benefits capital-intensive industries like oil and gas services.

- Global Oil Demand Growth: Forecasts suggest continued demand increases for oil in 2025, driven by economic recovery and monetary policy adjustments in major consuming nations.

- Impact on Drilling: Increased oil demand and potentially lower financing costs create a more favorable environment for drilling contractors to secure new contracts and deploy their fleets.

Market Consolidation and Competition

The oil and gas drilling sector is seeing substantial market consolidation, with major players acquiring smaller competitors. This trend, evident through 2024 and projected into 2025, concentrates rig fleets under fewer, larger operators. For instance, industry reports from late 2024 indicated a significant uptick in M&A activity within the North American land drilling market.

This consolidation offers efficiency advantages for the expanded entities, potentially leading to better cost management and operational synergies. However, it intensifies competition for remaining independent contractors. The market continues to grapple with oversupply of drilling rigs, a factor that keeps pricing pressures high, challenging profitability for all but the most efficient operators.

- Increased M&A Activity: Reports in late 2024 highlighted a surge in mergers and acquisitions within the land drilling sector, particularly in key North American basins.

- Rig Fleet Concentration: The trend is leading to a smaller number of companies controlling a larger percentage of the available drilling rig fleet.

- Efficiency Gains for Larger Players: Consolidated entities can leverage economies of scale, potentially improving their cost structure and competitiveness.

- Challenges for Smaller Contractors: Intense competition and persistent rig oversupply create significant hurdles for smaller, independent drilling service providers.

Economic factors significantly shape Helmerich & Payne's operating landscape, with oil and gas prices being paramount. While 2024 saw relative oil price stability, projections for late 2025 anticipate West Texas Intermediate (WTI) crude trading in the high $60s per barrel, a slight dip from earlier forecasts. Conversely, natural gas prices remained subdued throughout 2024, averaging historic lows, creating a mixed demand environment for drilling services.

The industry faces pressure from declining day rates and low rig utilization due to rig oversupply, with the U.S. Lower 48 rig count expected to remain largely stagnant through 2025. However, cautious optimism exists for an uptick in bid inquiries in early 2025, potentially improving rig utilization and day rates. Anticipated interest rate cuts in 2025 could lower borrowing costs, stimulating capital expenditures and economic growth, further supported by the IEA's projection of global oil demand rising to 106.4 million barrels per day in 2025.

| Economic Factor | 2024 Trend/Projection | 2025 Outlook | Impact on Helmerich & Payne |

|---|---|---|---|

| WTI Crude Oil Price | Relatively stable | High $60s per barrel | Influences demand for drilling services |

| Henry Hub Natural Gas Price | Historic lows | Continued subdued pricing expected | Mixed impact on drilling demand |

| Rig Utilization | Low | Stagnant to slight improvement | Affects day rates and profitability |

| Interest Rates | Stable to slightly decreasing | Anticipated cuts | Lower borrowing costs, potential capex increase |

| Global Oil Demand | Increasing | Projected 1.2 million bpd increase | Supports drilling activity |

Same Document Delivered

Helmerich & Payne PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Helmerich & Payne breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a deep dive into the external forces shaping Helmerich & Payne's operations and strategic decisions.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights for understanding the broader landscape in which Helmerich & Payne operates.

Sociological factors

Public sentiment increasingly favors renewable energy, impacting fossil fuel investments. Surveys in late 2024 indicated a significant majority of consumers preferred companies demonstrating clear environmental commitments, pushing companies like Helmerich & Payne to highlight their sustainability efforts.

The drive for cleaner energy sources means drilling companies must adapt their strategies to align with evolving societal expectations and regulatory pressures. This includes investing in technologies and practices that reduce environmental impact, a trend expected to accelerate through 2025.

Helmerich & Payne's operations, like those of other oil and gas companies, can significantly impact local communities, especially those historically marginalized and with fewer resources. These communities often bear a disproportionate burden from industrial infrastructure, raising concerns about environmental justice.

Proposed expansions or increased drilling activities, potentially influenced by broader economic or political agendas such as those discussed in contexts like Project 2025, could intensify these social impacts. This includes the risk of increased pollution and reduced access to vital natural resources, which can fuel public opposition and necessitate a strong social license to operate.

Maintaining positive community relations is therefore crucial for Helmerich & Payne's long-term viability. For instance, in 2023, the company reported community investment programs totaling over $1.5 million, aiming to foster goodwill and mitigate potential social friction.

Workforce safety is paramount in the oil and gas industry, particularly in the demanding environments of oil drilling. Helmerich & Payne, like its peers, invests heavily in advanced safety protocols and technologies to mitigate risks. For instance, in 2023, the industry continued to see a focus on reducing lost-time injury frequency rates, with companies aiming for rates below 1.0 per 200,000 hours worked.

The availability of a skilled workforce is a significant challenge and a key driver of operational success. The drilling sector requires specialized expertise, and companies like Helmerich & Payne are actively working on recruitment and retention strategies. The U.S. Bureau of Labor Statistics reported in early 2024 that the demand for oil and gas extraction workers remained strong, though the supply of experienced personnel could be a bottleneck.

ESG (Environmental, Social, and Governance) Focus

Helmerich & Payne (HP) demonstrates a strong commitment to ESG principles, actively reporting on its sustainability initiatives. This includes detailed metrics on environmental performance, safety records, talent development, and governance practices, often aligning with recognized frameworks like the Global Reporting Initiative (GRI). For instance, in their 2023 sustainability report, HP highlighted a reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity by 10% compared to their 2021 baseline. This focus not only builds trust but also appeals to the growing segment of investors prioritizing companies with robust ESG credentials, potentially improving access to capital and lowering its cost.

The company's dedication to social factors is evident in its emphasis on employee safety and development. HP reported a Total Recordable Incident Rate (TRIR) of 0.37 in 2023, a figure significantly below the industry average. This commitment to a safe and supportive work environment is crucial for attracting and retaining skilled labor in a competitive market. Furthermore, their governance structure aims for transparency and accountability, which are increasingly scrutinized by stakeholders and regulatory bodies alike.

The increasing demand for ESG-compliant investments is a significant sociological factor influencing companies like Helmerich & Payne. Investors are channeling more capital into companies that demonstrate strong environmental stewardship, social responsibility, and sound governance. This trend suggests that HP's proactive reporting and performance in these areas will likely continue to be a key differentiator, potentially leading to:

- Enhanced investor relations and access to capital from ESG-focused funds.

- Improved brand reputation and stakeholder trust.

- Attraction and retention of top talent who prioritize working for socially responsible companies.

- Mitigation of regulatory and reputational risks associated with poor ESG performance.

Social Responsibility and Local Economic Impact

Helmerich & Payne (HP) operates in an industry where social responsibility and local economic impact are increasingly scrutinized. While offshore drilling can generate significant employment and contribute to national energy security, its operations can also affect coastal communities whose economies depend on tourism and fishing. For instance, concerns about potential environmental damage from spills can directly impact the livelihoods of those in these sectors, creating a social cost that needs to be balanced against economic benefits.

Companies like HP are under growing pressure to not only create jobs but also to actively contribute to the well-being of the local economies where they operate. This includes investing in community development, supporting local businesses, and implementing robust environmental protection measures. For example, in 2023, the oil and gas industry supported approximately 11.3 million jobs in the United States, with a significant portion of these jobs being indirect or induced, benefiting local economies far beyond the direct employment at drilling sites.

The challenge for HP and its peers lies in demonstrating tangible positive local economic contributions while effectively mitigating any negative social or environmental externalities. This often involves transparent communication with stakeholders and a commitment to sustainable practices. A 2024 report indicated that community engagement initiatives by energy companies can significantly improve local perceptions and foster stronger relationships, which is crucial for long-term operational success.

- Job Creation: The industry directly and indirectly supports millions of jobs, boosting local economies through wages and spending.

- Environmental Stewardship: Mitigating environmental risks is crucial to protect coastal economies reliant on fishing and tourism.

- Community Investment: Companies are increasingly expected to invest in local infrastructure and social programs.

- Stakeholder Relations: Transparent communication and engagement with local communities are vital for social license to operate.

Societal expectations are increasingly shaping the energy sector, with a growing emphasis on environmental responsibility and social impact. Public sentiment, as reflected in late 2024 surveys, strongly favors companies with clear sustainability commitments, pushing firms like Helmerich & Payne to highlight their efforts in reducing environmental footprints.

These evolving expectations necessitate adaptation, with drilling companies expected to invest in cleaner technologies and practices, a trend projected to intensify through 2025. Furthermore, the industry's operations can disproportionately affect vulnerable local communities, raising environmental justice concerns and highlighting the need for strong social license to operate.

Maintaining positive community relations is therefore critical for Helmerich & Payne's long-term success, as demonstrated by their over $1.5 million in community investments reported in 2023. This proactive approach aims to foster goodwill and mitigate potential social friction, ensuring continued operational viability.

Workforce safety and the availability of skilled labor remain paramount. Helmerich & Payne invests heavily in advanced safety protocols, evidenced by their low Total Recordable Incident Rate (TRIR) of 0.37 in 2023, well below the industry average. The demand for experienced oil and gas extraction workers remained strong in early 2024, according to the U.S. Bureau of Labor Statistics, underscoring the importance of effective recruitment and retention strategies.

| Sociological Factor | Description | Helmerich & Payne Relevance | Data Point (2023/2024) |

|---|---|---|---|

| Public Environmental Sentiment | Growing preference for sustainable companies. | Drives investment in eco-friendly practices. | 10% reduction in Scope 1 & 2 GHG emissions intensity (2023 report). |

| Community Impact & Relations | Scrutiny of operations' effect on local economies and well-being. | Necessitates investment in community development and transparent communication. | Over $1.5 million in community investments (2023). |

| Workforce Safety & Skills | Importance of safe working environments and skilled labor availability. | Requires investment in safety protocols and talent management. | TRIR of 0.37 (2023); strong demand for skilled workers (early 2024). |

Technological factors

Helmerich & Payne is heavily investing in automation and smart technologies, like robotics and AI, to revolutionize its drilling operations. These systems offer real-time monitoring and predictive maintenance, significantly boosting efficiency and safety.

For instance, their autonomous drilling system, RigSight, has demonstrated improved performance metrics. By reducing human intervention, these technologies minimize errors and enhance precision, leading to faster drilling times and lower operational costs. This focus on technological advancement is crucial for maintaining a competitive edge in the evolving energy sector.

Helmerich & Payne's commitment to innovation is evident in its advanced drilling technologies, particularly its FlexRigs. These super-spec rigs offer superior operational execution and advanced capabilities, setting a new standard in the industry.

The company is strategically shifting from traditional day-rate contracts to performance-based agreements. This move directly capitalizes on the efficiencies gained through technological advancements like FlexRigs, aligning revenue with operational success and client value.

In 2023, Helmerich & Payne reported that its FlexRig fleet continued to drive strong performance, with a significant portion of its revenue generated from these advanced rigs. This technological edge is crucial for maintaining competitiveness in an evolving energy landscape.

Helmerich & Payne is leveraging advanced data analytics and real-time monitoring to optimize drilling operations. The integration of remote operation technologies, coupled with sophisticated data analysis, enables quicker, more informed decisions, which is crucial for managing complex projects, particularly in difficult-to-access areas.

Cloud-based solutions are becoming a cornerstone for managing drill data, offering significant advantages in scalability and the ability to perform real-time analytics. This shift means companies like Helmerich & Payne can process vast amounts of operational data instantaneously, leading to enhanced efficiency and predictive maintenance capabilities.

Eco-Friendly Drilling Innovations

Technological advancements are significantly reshaping the drilling industry towards greater environmental responsibility. Innovations such as low-emission engines, biodegradable lubricants, and advanced waste management systems are becoming standard on drilling rigs. Helmerich & Payne, a key player, has been investing in these eco-friendly technologies, aiming to reduce their operational footprint. For instance, their continued development and deployment of advanced rig technologies, including those designed for reduced emissions, are critical to meeting evolving environmental regulations and client demands. The industry is also seeing a rise in electric and hybrid rigs, which offer substantial reductions in both emissions and noise pollution, a trend H&P is actively participating in.

The drive for sustainability is pushing the adoption of technologies that minimize environmental impact. This includes:

- Low-emission engine technology: Reducing the release of harmful pollutants into the atmosphere.

- Biodegradable lubricants: Minimizing soil and water contamination from operational fluids.

- Advanced waste management systems: Ensuring responsible disposal and recycling of drilling byproducts.

- Electric and hybrid rig utilization: Decreasing reliance on fossil fuels and lowering operational noise.

Digital Integration and Connectivity (IoT)

The Industrial Internet of Things (IIoT) is revolutionizing oil and gas operations, offering real-time monitoring and automation. This digital integration allows for unprecedented insights into field performance.

IoT-enabled drilling equipment, like Helmerich & Payne's advanced rigs, continuously transmit data. This data stream is crucial for improving drilling accuracy and enabling predictive maintenance, which in turn boosts operational efficiency and reduces downtime.

By 2025, the IIoT market in oil and gas is projected to reach significant growth, with companies leveraging connected sensors and analytics. For instance, predictive maintenance powered by IoT data can reduce unplanned downtime by up to 30% in critical infrastructure.

- Real-time data collection from IIoT devices enhances operational visibility.

- Predictive maintenance reduces equipment failures, improving uptime.

- Automation of drilling processes leads to greater efficiency and consistency.

- Enhanced accuracy in drilling operations minimizes costly errors and rework.

Helmerich & Payne's technological advancements are central to its operational strategy, with significant investments in automation and smart technologies like AI and robotics. These innovations, exemplified by their autonomous drilling system RigSight, are designed to enhance efficiency, safety, and precision, leading to faster drilling times and reduced costs. The company's FlexRig fleet, representing a substantial portion of its revenue in 2023, showcases this commitment to superior operational execution and advanced capabilities.

The adoption of cloud-based solutions and advanced data analytics, including remote operation technologies, allows for real-time monitoring and quicker, more informed decision-making, especially in challenging environments. This digital integration is crucial for optimizing operations and enabling predictive maintenance, a key benefit as the Industrial Internet of Things (IIoT) market in oil and gas continues its projected growth towards 2025, with predictive maintenance alone capable of reducing unplanned downtime by up to 30%.

Furthermore, technological progress is driving greater environmental responsibility within the industry. Helmerich & Payne is investing in eco-friendly technologies such as low-emission engines, biodegradable lubricants, and advanced waste management systems. The increasing utilization of electric and hybrid rigs, which significantly reduce emissions and noise pollution, aligns with evolving environmental regulations and client demands, positioning H&P as a participant in this sustainable shift.

| Key Technology Area | Impact on Operations | Example/Data Point |

| Automation & AI | Increased efficiency, safety, precision | RigSight autonomous drilling system |

| Advanced Rigs (FlexRigs) | Superior operational execution, revenue driver | Significant portion of H&P revenue in 2023 |

| Data Analytics & IIoT | Real-time monitoring, predictive maintenance, informed decisions | IIoT market growth projected; predictive maintenance reduces downtime by up to 30% |

| Environmental Technologies | Reduced emissions, waste, noise | Investment in low-emission engines, hybrid rigs |

Legal factors

New U.S. Environmental Protection Agency (EPA) regulations, effective March 2024, impose stringent requirements on oil and gas operations to curb methane emissions. These rules necessitate the deployment of advanced leak detection and repair (LDAR) technologies and demand more rigorous emissions reporting.

Compliance with these evolving environmental mandates is critical for companies like Helmerich & Payne, as failure to adhere can result in significant penalties and reputational damage. The industry is projected to invest billions in upgrading infrastructure and implementing new monitoring systems to meet these standards.

Regulatory shifts concerning permits and land access for drilling operations directly influence Helmerich & Payne's operational efficiency. For instance, the Energy Permitting Reform Act, enacted in late 2023, seeks to expedite the approval timeline for energy infrastructure projects, a move that could potentially reduce project lead times for H&P.

Operating internationally exposes Helmerich & Payne to a complex web of diverse legal frameworks and international treaties. These govern everything from environmental protection standards to labor practices, requiring meticulous adherence. For instance, compliance with varying drilling regulations and safety protocols across different countries, such as those set by the International Maritime Organization for offshore operations, is paramount to avoid penalties and maintain operational integrity.

Health and Safety Regulations

The drilling industry, including companies like Helmerich & Payne (HP), operates under rigorous health and safety regulations designed to manage the inherent risks of high-pressure environments. These regulations are critical for preventing accidents and ensuring the well-being of workers. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) continued to emphasize compliance with standards related to hazardous materials, machinery guarding, and emergency preparedness in industrial settings.

Companies are proactively investing in and implementing advanced safety technologies. A key area of focus is the enhancement of blowout preventer (BOP) systems. These sophisticated pieces of equipment are vital for sealing the wellbore to prevent uncontrolled release of crude oil or natural gas. Helmerich & Payne, for example, has been a leader in deploying advanced rig technologies, which inherently include upgraded safety features and systems to meet and exceed regulatory requirements.

- Regulatory Compliance: Adherence to OSHA and other governmental safety standards is paramount, with ongoing inspections and potential penalties for non-compliance influencing operational costs and strategies.

- Technological Investment: Significant capital is allocated to upgrading safety equipment, such as advanced BOPs and automated drilling controls, to minimize human error and improve incident response.

- Industry Best Practices: Adoption of industry-wide safety protocols, often exceeding minimum regulatory mandates, is driven by a desire to reduce insurance premiums and maintain a strong safety record, crucial for client trust.

Taxation and Fiscal Policies

Changes in tax policies directly affect the oil and gas sector, influencing operational cash flow and the ability to meet shareholder commitments. For instance, shifts in corporate tax rates or the introduction of new excise taxes can alter profitability for companies like Helmerich & Payne.

Potential tax reforms, particularly those associated with new U.S. administrations, could dramatically reshape the industry's financial outlook. For example, a proposed increase in the corporate tax rate from 21% to 28% in the U.S. could reduce net income for oil and gas companies, impacting investment decisions and capital expenditures.

- Impact of Corporate Tax Rate Changes: A hypothetical increase in the U.S. corporate tax rate could reduce Helmerich & Payne's after-tax earnings, potentially affecting dividend payouts or reinvestment in new drilling technologies.

- Depreciation and Depletion Allowances: Modifications to tax deductions for capital investments, such as accelerated depreciation or percentage depletion allowances, can significantly influence the economics of oil and gas exploration and production.

- Environmental Taxes: The potential introduction or adjustment of carbon taxes or other environmental levies could add operational costs, requiring companies to factor these into their pricing and investment strategies.

- International Tax Treaties: For companies operating globally, changes in international tax agreements and transfer pricing regulations can impact the allocation of profits and tax liabilities across different jurisdictions.

Legal factors significantly shape Helmerich & Payne's operational landscape, from environmental compliance to labor laws and tax policies. Evolving regulations, such as the EPA's March 2024 methane emission standards, necessitate substantial investment in new technologies and reporting, with potential penalties for non-compliance. Expedited permitting processes, like those aimed for by late 2023 legislation, could streamline project execution.

Environmental factors

Helmerich & Payne is actively working to shrink its environmental impact, aiming to cut down on greenhouse gas (GHG) emissions. The company achieved a notable 10.7% reduction in normalized GHG emissions in fiscal year 2024, demonstrating progress toward its sustainability objectives.

To achieve these reductions, Helmerich & Payne leverages sophisticated data analytics and software. This technology allows for precise monitoring of energy consumption across its operations, pinpointing areas where efficiency improvements can be made to further lower emissions.

Helmerich & Payne, like other oil and gas companies, faces scrutiny over its water management practices. The industry's significant water consumption for operations, particularly hydraulic fracturing, coupled with the risk of water contamination from produced water and chemicals, makes this a critical environmental factor.

Regulatory landscapes for wastewater in oil and gas extraction are dynamic. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to review and update regulations concerning wastewater discharge from unconventional oil and gas extraction, impacting how companies like Helmerich & Payne must handle and treat their water waste.

Effective waste management systems are therefore paramount for Helmerich & Payne to mitigate environmental impact and ensure compliance. This includes investing in technologies for water recycling and treatment, aiming to reduce reliance on freshwater sources and minimize the discharge of pollutants, a trend likely to intensify through 2025.

Increased oil and gas drilling, especially in sensitive public lands and offshore areas, poses a significant threat to natural habitats and biodiversity. Helmerich & Payne's operations, like those of many in the industry, can contribute to this environmental pressure.

Initiatives like Project 2025, which proposes opening vast tracts of land for leasing and exploration, amplify these concerns. This could lead to increased habitat fragmentation and loss, directly impacting wildlife populations and ecosystem health.

Waste Management and Disposal

Helmerich & Payne, like other oil and gas drilling companies, faces significant environmental considerations regarding waste management and disposal. The drilling process inherently generates a variety of waste streams, including drilling fluids, cuttings, and produced water, all of which necessitate careful handling to prevent soil and water contamination. In 2023, the industry continued to invest in advanced waste treatment technologies and closed-loop systems to minimize their environmental impact.

Responsible waste handling is a key focus for companies aiming to reduce their environmental footprint. This involves implementing comprehensive strategies for waste reduction, recycling, and safe disposal, often exceeding regulatory requirements. For instance, many operators are adopting practices that reuse or reprocess drilling fluids and cuttings, thereby lessening the volume of waste requiring offsite disposal.

- Drilling waste management is a critical operational and environmental challenge for Helmerich & Payne.

- Companies are investing in technologies to reduce, reuse, and recycle drilling byproducts.

- Regulatory compliance and proactive environmental stewardship are paramount in waste disposal strategies.

- The industry is seeing a trend towards more sustainable waste management solutions to minimize contamination risks.

Energy Efficiency and Renewable Energy Integration

Helmerich & Payne is actively pursuing energy efficiency and renewable energy integration as key environmental strategies. The company is implementing eco-friendly innovations such as electric and hybrid rigs, alongside advanced, low-emission engines. These initiatives are designed to significantly reduce emissions and minimize noise pollution from their operations.

Further demonstrating their commitment, Helmerich & Payne is investing in low-carbon technology projects. This strategic move aims to proactively balance the inherent risks associated with traditional oil and gas operations by diversifying into more sustainable energy solutions.

For instance, in 2023, Helmerich & Payne reported a decrease in their Scope 1 and Scope 2 greenhouse gas emissions intensity compared to 2022. While specific figures for 2024 are still emerging, the trend indicates a continued focus on operational improvements in this area.

The company's efforts align with broader industry trends and regulatory pressures to decarbonize the energy sector. Key areas of focus include:

- Development and deployment of advanced rig technologies: Utilizing electric and hybrid systems to reduce reliance on diesel.

- Investment in lower-emission engine technology: Adopting engines that meet or exceed current environmental standards.

- Exploration of carbon capture and utilization (CCU) technologies: Investigating methods to mitigate emissions from existing operations.

- Partnerships in renewable energy projects: Collaborating on initiatives that support the transition to cleaner energy sources.

Helmerich & Payne is actively reducing its environmental footprint, achieving a 10.7% decrease in normalized GHG emissions in fiscal year 2024 through advanced data analytics for energy efficiency. The company is also focusing on responsible water management, a critical area given the industry's water usage and potential contamination risks, especially with evolving EPA wastewater regulations. Furthermore, Helmerich & Payne is investing in eco-friendly technologies like electric and hybrid rigs to lower emissions and noise pollution, demonstrating a commitment to sustainable operations and aligning with broader decarbonization trends in the energy sector.

| Environmental Factor | Helmerich & Payne's Action/Impact | Data/Trend (2023-2025) |

|---|---|---|

| GHG Emissions Reduction | Implementing energy efficiency, electric/hybrid rigs, low-emission engines. | 10.7% reduction in normalized GHG emissions in FY2024. |

| Water Management | Focus on wastewater treatment, recycling, and compliance with evolving regulations. | Continued scrutiny and updates to EPA wastewater discharge regulations in 2024. |

| Waste Management | Investing in advanced waste treatment, closed-loop systems, recycling. | Industry trend towards sustainable waste management to minimize contamination. |

| Habitat Impact | Operations can contribute to habitat fragmentation and loss. | Increased drilling in sensitive areas poses ongoing environmental pressure. |

PESTLE Analysis Data Sources

Our Helmerich & Payne PESTLE Analysis draws from a robust blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the oil and gas sector.