Helmerich & Payne Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

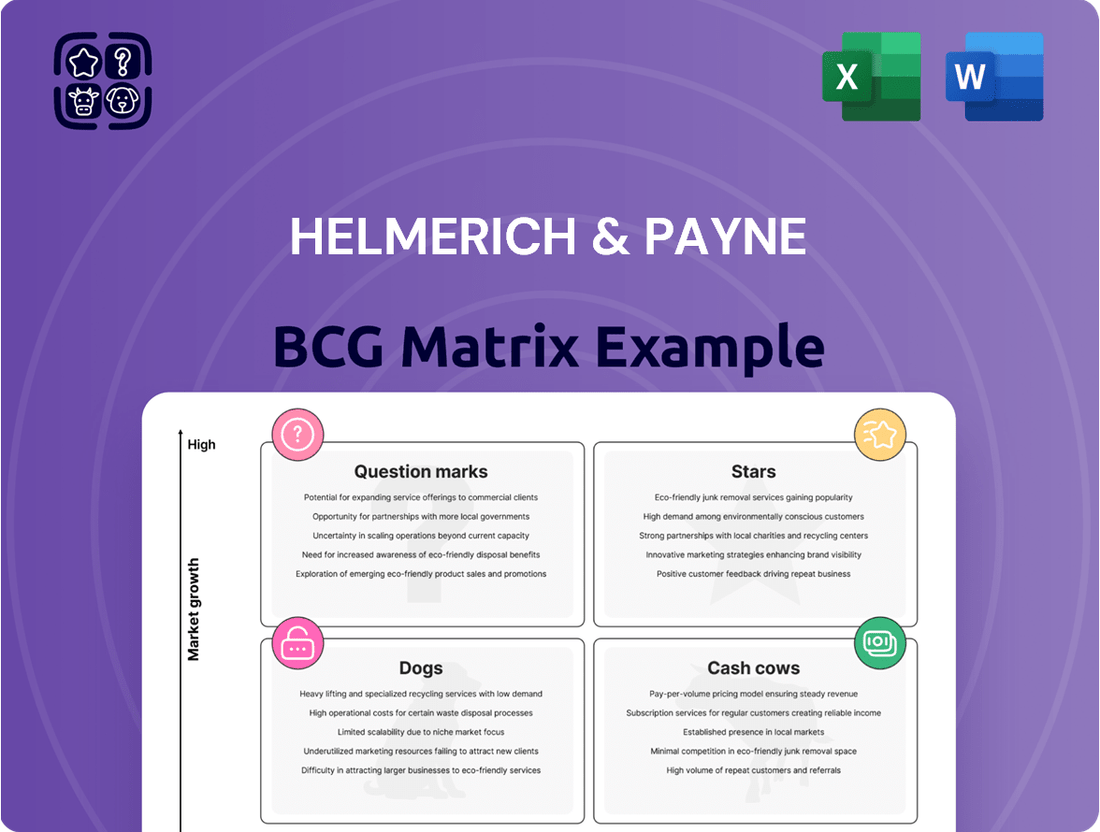

Helmerich & Payne's BCG Matrix offers a crucial snapshot of its business units, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is vital for informed strategic decisions.

This preview highlights the foundational insights; however, to truly unlock the strategic advantage, you need the full BCG Matrix. It provides a comprehensive breakdown, data-driven recommendations, and a clear roadmap for optimizing Helmerich & Payne's portfolio.

Purchase the complete BCG Matrix today and gain the clarity needed to navigate the competitive landscape and drive future growth for Helmerich & Payne.

Stars

Super-Spec FlexRigs represent a significant strength for Helmerich & Payne (H&P) in the U.S. land drilling sector, positioning them as a market leader. H&P commands an estimated 37% share of all active super-spec rigs, a testament to their dominance in this advanced segment.

These sophisticated rigs are crucial for the efficient drilling of complex unconventional wells, a type of operation that remains a primary driver of activity. Even with broader fluctuations in the overall U.S. rig count, the demand for H&P's super-spec capabilities remains robust.

The January 2025 acquisition of KCA Deutag is a game-changer for Helmerich & Payne's international expansion, especially in the Middle East. This region is projected to see robust growth, with an estimated annual increase of 9% through 2026, making it a prime target for H&P's enhanced capabilities.

This strategic integration catapults H&P into a commanding position as a global onshore drilling solutions provider. The combined entity boasts a significantly broadened geographical reach, enabling H&P to leverage KCA Deutag's established presence and operational expertise in key international markets.

Helmerich & Payne's investment in advanced drilling automation and digital solutions, including their Bit Guidance System and Survey Management technologies, places them squarely in a high-growth, innovative segment of the oil and gas sector. These sophisticated tools are designed to significantly boost operational efficiency and minimize downtime, critical factors for today's demanding drilling projects.

The company's commitment to these digital advancements is evident in their ongoing development and deployment, aiming to optimize wellbore placement and reduce non-productive time, which translates directly to cost savings and improved performance for their clients. For example, in 2024, H&P continued to see strong demand for these automated solutions, contributing to their overall market position.

Unconventional Drilling Expertise

Helmerich & Payne's (H&P) expertise in unconventional drilling is a significant strength, particularly evident in their specialized rig offerings designed for complex horizontal shale wells. This focus positions them well in a segment experiencing sustained demand and growth.

The company's technological solutions are engineered to enhance performance and reliability in these demanding unconventional environments, allowing H&P to capture greater market share. For instance, in the first quarter of 2024, H&P reported a substantial increase in their average rig revenue per day for their advanced rigs, reflecting the premium value placed on their specialized capabilities in unconventional plays.

- Specialized Rigs: H&P's fleet includes advanced rigs like the FlexRig® series, specifically engineered for the intricacies of unconventional drilling.

- Technological Solutions: The company integrates cutting-edge technology to optimize drilling efficiency and safety in challenging shale formations.

- Market Position: H&P is strategically positioned to capitalize on the ongoing demand for efficient unconventional well completions, a key driver in the current energy landscape.

- Performance Metrics: In Q1 2024, H&P highlighted that their advanced rigs were operating at higher utilization rates compared to conventional rigs, underscoring the market’s preference for their specialized offerings.

Performance-Based Contracts

Performance-based contracts are a significant differentiator for Helmerich & Payne (H&P). Over 50% of H&P's customers now opt for these agreements, a clear signal of their value. This trend highlights H&P's position as a leader in an evolving industry where clients prioritize tangible results and efficiency.

This customer preference for performance-based contracts positions H&P favorably in a high-growth segment of the market. It demonstrates that H&P is a preferred partner for companies seeking to optimize their drilling operations and achieve superior outcomes.

- Customer Preference: Over 50% of H&P's customer base favors performance-based contracts.

- Industry Trend: This reflects a growing industry demand for efficiency and value-driven drilling services.

- H&P's Position: H&P is a leading provider in this high-growth area, aligning its success with customer achievements.

Helmerich & Payne's (H&P) super-spec FlexRigs represent a significant strength, positioning them as a leader in the U.S. land drilling sector with an estimated 37% share of active super-spec rigs. These advanced rigs are crucial for efficient drilling of complex unconventional wells, a segment that continues to drive activity despite broader market fluctuations. H&P's commitment to technological innovation, including advanced automation and digital solutions, further solidifies their market position by enhancing operational efficiency and reducing downtime for clients.

The company's strategic acquisition of KCA Deutag in January 2025 is a pivotal move for international expansion, particularly targeting the Middle East's projected 9% annual growth through 2026. This integration elevates H&P to a commanding global onshore drilling solutions provider, leveraging KCA Deutag's established international presence and expertise. Furthermore, H&P's focus on performance-based contracts, now favored by over 50% of their customers, highlights a strong industry trend towards efficiency and value-driven services, reinforcing H&P's status as a preferred partner.

| Key Strength | Description | Supporting Data/Facts |

|---|---|---|

| Super-Spec FlexRigs | Market leadership in advanced U.S. land drilling. | Estimated 37% share of active super-spec rigs. Crucial for complex unconventional wells. |

| International Expansion (Post-Acquisition) | Global onshore drilling solutions provider. | January 2025 acquisition of KCA Deutag. Targets Middle East growth (est. 9% annually through 2026). |

| Technological Innovation | Enhanced operational efficiency and reduced downtime. | Investment in advanced drilling automation, Bit Guidance System, Survey Management. Strong demand in 2024. |

| Performance-Based Contracts | Customer preference for efficiency and value. | Over 50% of customers opt for these contracts. Reflects industry trend for optimized drilling. |

What is included in the product

Helmerich & Payne's BCG Matrix offers a strategic framework to analyze its drilling rig portfolio, guiding decisions on investment and resource allocation.

Helmerich & Payne's BCG Matrix provides a clear, one-page overview of business unit performance, easing the pain of strategic uncertainty.

Cash Cows

Helmerich & Payne's established U.S. land drilling operations are a clear Cash Cow within their BCG Matrix. This segment consistently generates robust direct margins, as evidenced by the $265.6 million reported in Q2 fiscal 2025.

Despite the dynamic nature of the U.S. rig count, H&P has successfully defended its market share. This stability in a mature, cash-generating market underscores the strong economic performance and the established, reliable nature of these operations.

The Offshore Solutions segment functions as a Cash Cow for Helmerich & Payne. In Q2 fiscal 2025, this segment delivered a solid operating income of $17.4 million and a direct margin of $26.2 million, underscoring its consistent profitability.

H&P's prominent position as a leading global platform services operator reinforces this segment's Cash Cow status. Operating within a mature, low-growth market, the company's significant market share ensures a reliable and substantial generation of cash.

Helmerich & Payne's (H&P) substantial contract backlog, significantly bolstered by the KCA Deutag acquisition, positions its drilling segment as a strong cash cow. The addition of approximately $5.5 billion in backlog from KCA Deutag provides H&P with highly resilient revenues and enhanced earnings visibility.

This considerable backlog acts as a bedrock for sustained long-term growth and predictable cash flow generation. It underscores the drilling segment's mature and stable market position, a hallmark of a cash cow, capable of delivering consistent financial performance even amidst slower market expansion.

Robust Financial Position and Shareholder Returns

Helmerich & Payne (H&P) demonstrates a robust financial position, consistently generating strong cash flow from operations. This financial strength enables the company to provide reliable shareholder returns via dividends and actively manage its debt obligations.

The company's capacity to produce substantial excess cash, exceeding its operational requirements, clearly marks its drilling services as a cash cow. This surplus capital is strategically deployed to support other business initiatives and reward its investors.

- Strong Operating Cash Flow: In the first quarter of fiscal year 2024, H&P reported operating cash flow of $202 million, underscoring its ability to generate significant liquidity.

- Shareholder Returns: H&P returned approximately $100 million to shareholders through dividends and share repurchases in the same quarter, demonstrating a commitment to rewarding investors.

- Debt Reduction: The company continues to prioritize debt reduction, further strengthening its balance sheet and financial flexibility.

Fleet Modernization and Maintenance

Helmerich & Payne's (H&P) ongoing investment in fleet modernization and maintenance is crucial for sustaining its position as a cash cow. This strategic capital allocation ensures their existing, high-performing rig fleet remains efficient and competitive. By keeping these assets in top condition, H&P solidifies its high market share and operational excellence, particularly in mature markets, which translates to consistent cash generation.

This focus on maintenance directly supports their cash cow status by minimizing downtime and maximizing utilization of their established, revenue-generating assets. For instance, H&P's commitment to advanced technologies, like their automated drilling systems, means their rigs can operate more effectively, commanding premium rates and contributing significantly to the company's financial stability.

- Sustained Operational Efficiency: Modernization investments ensure H&P's rigs operate at peak performance, reducing costs and increasing uptime.

- Market Share Dominance: Maintaining a technologically advanced and reliable fleet allows H&P to retain its leading position in key markets.

- Consistent Cash Flow: The efficiency and market share derived from fleet maintenance directly contribute to stable and predictable cash generation.

- Competitive Advantage: Proactive maintenance and upgrades keep H&P's fleet ahead of competitors, ensuring continued demand for their services.

Helmerich & Payne's (H&P) established U.S. land drilling operations are a prime example of a Cash Cow. This segment consistently generates robust direct margins, with $265.6 million reported in Q2 fiscal 2025, demonstrating its strong profitability. Despite fluctuations in the U.S. rig count, H&P has maintained its market share, highlighting the stability and reliable cash generation from these mature operations.

The Offshore Solutions segment also functions as a Cash Cow, contributing $17.4 million in operating income and $26.2 million in direct margin in Q2 fiscal 2025. H&P's leading position as a global platform services operator in a low-growth market ensures consistent cash generation due to its significant market share.

H&P's substantial contract backlog, significantly boosted by the KCA Deutag acquisition, further solidifies its drilling segment as a cash cow. The approximately $5.5 billion in backlog from KCA Deutag provides resilient revenues and earnings visibility, acting as a bedrock for sustained cash flow generation in a stable market.

The company's strong operating cash flow, exemplified by $202 million in Q1 fiscal 2024, allows for significant shareholder returns, including approximately $100 million in dividends and repurchases in the same quarter. This excess cash generation, exceeding operational needs, clearly marks H&P's drilling services as a cash cow, with surplus capital strategically deployed.

| Segment | Q2 Fiscal 2025 Direct Margin | Q2 Fiscal 2025 Operating Income | Key Characteristic |

| U.S. Land Drilling | $265.6 million | N/A | Mature, stable market, strong market share |

| Offshore Solutions | $26.2 million | $17.4 million | Leading global platform services operator, low-growth market |

| Drilling (with KCA Deutag backlog) | N/A | N/A | Significant backlog ($5.5 billion), resilient revenues |

Delivered as Shown

Helmerich & Payne BCG Matrix

The Helmerich & Payne BCG Matrix preview you're examining is the identical, fully-formatted document you will receive upon purchase, ensuring complete transparency and immediate utility for your strategic planning needs. This means no hidden surprises or altered content; what you see is precisely the comprehensive analysis you'll download, ready for immediate application in your business decision-making processes. You can confidently use this preview to assess the quality and relevance of the Helmerich & Payne BCG Matrix report, knowing the purchased version will be the same professional-grade asset. This ensures you get a complete, actionable report without any watermarks or demo indicators, empowering you to leverage its insights right away.

Dogs

Helmerich & Payne possesses a significant number of idle super-spec rigs in the U.S. These assets present opportunities for export or conversion, suggesting that older, non-super-spec rigs face even more diminished utilization and demand.

These older rigs operate within a low-growth market characterized by declining demand for less advanced technology. Consequently, they are likely to become cash traps, holding a minimal market share and offering little prospect for future growth or profitability.

Underperforming conventional drilling operations within Helmerich & Payne (H&P) would be classified as dogs in a BCG matrix. These are typically segments or regions where demand is flat or declining, and H&P possesses a minimal market share. Think of areas where the need for older, less advanced drilling technology has significantly diminished.

The broader U.S. rig count, a key indicator of drilling activity, has experienced volatility. For instance, throughout 2024, the average U.S. land rig count has hovered significantly below peak levels seen in prior years, influenced by persistently low natural gas prices. This environment particularly challenges conventional rigs that lack the efficiency and versatility of newer, more technologically advanced models.

Customer consolidation also plays a role. As larger energy companies merge, they often streamline their operations, favoring fewer, more capable drilling partners. This trend can further marginalize H&P's conventional offerings in markets where they don't hold a dominant position, pushing these operations into the dog category.

Helmerich & Payne's (H&P) international operations, particularly those in older, less efficient conventional drilling segments within specific niche markets, could be classified as Dogs. These operations often contend with low market share and struggle to achieve competitive returns, potentially draining resources without substantial growth prospects. For instance, while H&P's overall international revenue grew in fiscal year 2023, certain legacy conventional drilling contracts in regions with high operating costs and limited demand may not have met profitability targets.

Non-Strategic Assets Identified for Divestiture

Helmerich & Payne (H&P) might identify certain assets or smaller business units that no longer fit its core strategy of high-performance drilling and global expansion. These would typically be those with limited market share and growth potential, making them prime candidates for divestiture. This move would unlock capital for reinvestment into more strategic and higher-return opportunities.

For instance, H&P could consider divesting older, less efficient rig fleets that don't meet the demands of modern drilling operations. These assets often have low utilization rates and limited future demand, dragging down overall profitability. By selling them, H&P can streamline its operations and focus resources on its advanced FlexRig® technology.

- Divestiture Candidates: Assets with low market share and growth prospects, not aligning with H&P's strategic focus.

- Capital Reallocation: Divestitures free up capital for investment in high-performance drilling and international expansion.

- Operational Efficiency: Selling underperforming assets improves overall fleet utilization and financial performance.

Ancillary Services with Minimal Contribution

Ancillary services with minimal contribution would represent Helmerich & Payne's (H&P) 'dogs' in a BCG matrix. These are services that don't align with their core, high-performance drilling operations, perhaps generating low revenue or incurring significant costs without a clear strategy for growth or market dominance.

For instance, if H&P offered a niche equipment repair service that required substantial investment but yielded negligible returns, it would likely fall into this category. Such services can drain valuable resources—both financial and human—that could otherwise be channeled into their more profitable and strategically important drilling technologies and solutions. In 2024, companies like H&P are increasingly focused on optimizing their portfolios, divesting or minimizing investment in non-core, underperforming segments.

- Low Revenue Generation: Ancillary services that contribute less than 5% to H&P's overall revenue, especially if their operational costs exceed their income.

- Resource Drain: Services requiring significant capital expenditure or operational overhead without a clear return on investment or strategic advantage.

- Lack of Market Leadership: Any non-core offering where H&P does not hold a competitive advantage or have a viable plan to achieve one in the near term.

Helmerich & Payne's 'dogs' are typically its older, less efficient conventional rigs and non-core ancillary services. These segments exhibit low market share and minimal growth potential, often becoming cash traps. For example, the U.S. land rig count in 2024 remained subdued compared to prior years, particularly impacting older rig technologies.

These underperforming assets, like legacy drilling fleets not suited for modern demands, drain resources. Divesting these 'dogs' allows H&P to reallocate capital towards its advanced FlexRig® technology and international expansion, improving overall operational efficiency and financial health.

Ancillary services contributing less than 5% to overall revenue, especially those with high operational costs and no clear path to market leadership, also fall into this category. Such segments represent a drain on capital and human resources that could be better utilized in core, high-growth areas.

The company's focus in 2024 has been on portfolio optimization, which includes divesting or minimizing investment in these non-core, underperforming segments to enhance profitability and strategic alignment.

| H&P Business Segment | BCG Category | Rationale |

|---|---|---|

| Older Conventional Rigs (U.S.) | Dog | Low utilization due to declining demand for older technology; impacted by lower U.S. rig counts in 2024. |

| Niche Ancillary Services | Dog | Low revenue contribution (<5%), high operating costs, lack of competitive advantage. |

| Legacy Conventional Drilling (International Niche Markets) | Dog | Low market share in specific regions; potential for low profitability and resource drain despite overall international growth. |

Question Marks

Helmerich & Payne's (H&P) deployment of FlexRigs in Saudi Arabia for unconventional natural gas presents a classic "Question Mark" scenario within the BCG Matrix. The market itself is experiencing high growth potential, driven by Saudi Arabia's strategic focus on diversifying its energy portfolio beyond oil.

However, these new operations are currently characterized by significant start-up costs and rig suspensions, as reported in Q2 fiscal 2025. This resulted in a substantial decline in net income for H&P's international segment, indicating a current low market share and high cash consumption, typical of a Question Mark needing strategic evaluation.

The initial integration of KCA Deutag's fleet into Helmerich & Payne's portfolio, while promising significant long-term growth, currently positions these assets within the BCG matrix as question marks. This is due to ongoing operational adjustments and the need to overcome specific challenges, such as rig suspensions in Saudi Arabia, which temporarily dampen immediate financial returns. For instance, in early 2024, the market observed the impact of these suspensions on overall fleet utilization for companies operating in that region, highlighting the complexities of integrating large international fleets.

Helmerich & Payne (H&P) is actively developing fully autonomous drilling solutions, aiming to revolutionize the industry. This pioneering effort targets a high-growth, disruptive market segment.

However, this initiative is currently in its nascent stages, characterized by substantial capital requirements and an adoption curve that is still developing. Consequently, it represents a low market share position with uncertain near-term profitability, fitting the profile of a question mark in the BCG matrix.

For instance, H&P's investment in advanced automation and AI for drilling operations is substantial, reflecting the capital-intensive nature of this emerging technology. While the long-term potential is significant, the immediate returns are not yet guaranteed, necessitating continued investment to capture future market share.

Aggressive Market Share Expansion in Select New International Regions

Helmerich & Payne's (H&P) strategy of aggressive market share expansion into select new international regions, beyond the KCA Deutag integration, positions these ventures as question marks within the BCG matrix. These initiatives require substantial upfront capital investment to establish a foothold and capture market share in nascent, high-growth territories. For instance, H&P's recent expansion efforts into regions like Australia, where the onshore drilling market is developing, demand significant capital for new rig deployments and operational setup. This aggressive push, while aiming for future dominance, initially drains cash reserves due to low existing market penetration and substantial initial outlays.

- Aggressive Expansion: H&P's focus on gaining market share in new international territories beyond its established presence.

- High Investment, Low Share: These ventures are characterized by significant capital expenditure and a currently minimal market share in the targeted regions.

- Cash Consumption: Initial stages of these expansions are expected to be cash-intensive, impacting overall cash flow.

- Future Potential: The goal is to transform these question marks into stars by successfully capturing market share in growing international markets.

Exploratory Digital Platforms and Software Tools

New digital platforms and software tools in Helmerich & Payne's (H&P) pipeline, currently in pilot or early commercialization, are classified as question marks in the BCG matrix. These innovations are designed to boost drilling efficiency and performance, areas identified for significant future growth in the energy sector.

H&P is investing heavily in research and development for these emerging technologies. For instance, their focus on AI-driven predictive maintenance for drilling equipment aims to reduce downtime, a critical factor in operational costs. The success of these question mark products hinges on their ability to gain traction and achieve market acceptance, which requires overcoming adoption hurdles and demonstrating clear value propositions to customers in a competitive landscape.

- Digital Drilling Optimization Software: Targeting a projected global market for drilling automation and optimization software estimated to reach $15 billion by 2028, H&P's new platforms aim to capture a share of this expanding segment.

- AI-Powered Performance Analytics: These tools are being developed to provide real-time insights, potentially improving drilling efficiency by up to 15%, according to H&P's internal testing data.

- Cloud-Based Data Management: H&P is exploring cloud solutions to enhance data accessibility and collaboration across drilling operations, a move that aligns with industry trends towards digital transformation.

- Early Commercialization Efforts: While specific revenue figures for these nascent platforms are not yet publicly disclosed, H&P's stated commitment to innovation underscores their strategic importance.

Helmerich & Payne's (H&P) ventures into new international markets, such as Australia, exemplify the 'Question Mark' category in the BCG Matrix. These initiatives are characterized by high growth potential, driven by developing onshore drilling needs, but currently hold a low market share.

Significant upfront capital is required to establish operations and secure market presence, leading to substantial cash consumption during the initial phases. For example, H&P's expansion into Australia involved deploying new rigs, a capital-intensive process that drains cash reserves without immediate, guaranteed returns.

The success of these question marks hinges on H&P's ability to effectively navigate operational challenges and gain market traction, transforming them into future 'Stars' by capturing a significant share of these growing markets.

| Initiative | Market Growth | Market Share (Current) | Cash Flow (Current) | Strategic Outlook |

|---|---|---|---|---|

| Australian Market Expansion | High | Low | Negative (Cash Consumption) | Potential Star (if successful) |

| Autonomous Drilling Solutions | High | Very Low | Negative (High R&D Investment) | Potential Star (disruptive tech) |

| Digital Drilling Platforms | High | Low | Negative (Development Costs) | Potential Star (efficiency gains) |

BCG Matrix Data Sources

Our Helmerich & Payne BCG Matrix leverages comprehensive data from financial filings, industry market share reports, and internal operational performance metrics to accurately position business units.