Helmerich & Payne Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

Helmerich & Payne operates within a dynamic oil and gas drilling sector, where the bargaining power of buyers and the intensity of rivalry significantly shape profitability. Understanding these forces is crucial for navigating the industry's complexities.

The complete report reveals the real forces shaping Helmerich & Payne’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized drilling rigs and advanced drilling technologies wield considerable bargaining power. For instance, companies like Helmerich & Payne rely on proprietary technologies and specialized equipment, the development and maintenance of which are costly and complex. The limited number of providers for such cutting-edge solutions, particularly in areas like automation and AI-driven drilling, creates a less fragmented market, empowering these technology leaders.

The oil and gas sector, including companies like Helmerich & Payne (H&P), experiences a significant demand for specialized talent such as drilling engineers and experienced rig operators. This ongoing need for skilled professionals means that these workers, and the agencies that supply them, possess considerable bargaining power. This can translate into upward pressure on labor costs for H&P as they compete for this essential workforce.

In 2024, the situation remains challenging, with reports indicating continued shortages in critical operational roles within the energy industry. A survey of oilfield service companies in early 2024 revealed that attracting and retaining skilled labor was a top concern, directly impacting operational efficiency and project timelines. This scarcity, exacerbated by a generational shift in workforce demographics and perceptions of the industry, further solidifies the bargaining power of the skilled labor pool and their representatives.

The availability and pricing of critical raw materials and components significantly shape supplier power for companies like Helmerich & Payne. For instance, the cost of steel used in rig construction, specialized drilling fluids, and proppant directly influences operational expenses and profitability.

While certain input costs, such as those for Oil Country Tubular Goods (OCTG) and sand, have experienced reductions, others like drilling mud and cement have maintained stable or even increased pricing. This divergence highlights varying levels of supplier influence across different essential inputs, impacting Helmerich & Payne's bargaining position.

Switching Costs for Drilling Contractors

Switching suppliers for major drilling equipment or comprehensive service packages presents substantial hurdles for drilling contractors. These challenges include ensuring compatibility with existing fleets, the expense of retraining crews on new systems, and the inherent risk of operational downtime during the transition. These factors contribute to a lock-in effect, thereby strengthening the bargaining power of incumbent suppliers.

For instance, a drilling contractor might face millions in costs to integrate a new downhole drilling tool that requires extensive modifications to their rig's control systems and specialized operator training. This significant investment in existing supplier relationships makes it economically unfeasible to switch providers frequently.

- High Capital Investment: The initial outlay for specialized drilling equipment often runs into millions of dollars, making it a substantial commitment for contractors.

- Operational Integration: Integrating new supplier technologies requires compatibility checks, software updates, and potential hardware adjustments, all of which incur costs and lead time.

- Training and Expertise: Personnel need to be trained on new equipment and procedures, adding to the overall cost and complexity of supplier changes.

Supplier's Ability to Forward Integrate

Suppliers of critical components or advanced technologies for the oil and gas drilling industry can enhance their leverage if they possess the capability to integrate forward into providing drilling services themselves. This threat is particularly relevant for technology providers who offer sophisticated, integrated digital solutions. By directly offering these comprehensive services to Exploration and Production (E&P) companies, these suppliers could exert greater influence over the market.

For instance, a company specializing in AI-driven drilling optimization software might also develop the capacity to manage and execute drilling operations using their proprietary technology. This would shift them from a component supplier to a direct competitor or service provider, significantly altering the power dynamic. While physical equipment suppliers are less likely to forward integrate into complex service operations, the trend towards digital integration makes this a growing concern for companies like Helmerich & Payne.

- Forward Integration Threat: Suppliers of specialized drilling technology could potentially offer end-to-end drilling solutions, bypassing traditional rig contractors.

- Digital Solutions Impact: Technology providers with integrated digital platforms are more likely to possess the expertise and capability for forward integration into service provision.

- Increased Supplier Leverage: Successful forward integration by suppliers would directly increase their bargaining power within the drilling services sector.

Suppliers of highly specialized drilling equipment and advanced technologies, particularly those incorporating automation and AI, hold significant bargaining power due to limited providers and high development costs. This power is further amplified by the substantial switching costs for drilling contractors like Helmerich & Payne, which include integration challenges, retraining, and operational downtime risks.

The persistent shortage of skilled labor in the oil and gas sector in 2024 continues to empower suppliers of specialized talent, leading to upward pressure on wages for drilling engineers and rig operators. While some input costs have moderated, others like drilling mud and cement have seen stable or increased pricing, reflecting varied supplier influence across essential materials.

The threat of forward integration by technology providers, who could offer end-to-end drilling solutions using their proprietary digital platforms, represents a growing concern for rig contractors, potentially increasing supplier leverage.

| Input Category | 2024 Trend | Impact on H&P | Supplier Bargaining Power |

|---|---|---|---|

| Specialized Drilling Rigs & Technology | Stable to Increasing Demand | High Dependency | High |

| Skilled Labor (Drilling Engineers, Operators) | Persistent Shortage | Increased Wage Pressure | High |

| Steel (OCTG) | Decreasing Costs | Reduced Input Expenses | Moderate |

| Drilling Fluids & Cement | Stable to Increasing Costs | Increased Operational Expenses | Moderate to High |

| Proppant (Sand) | Decreasing Costs | Reduced Input Expenses | Moderate |

What is included in the product

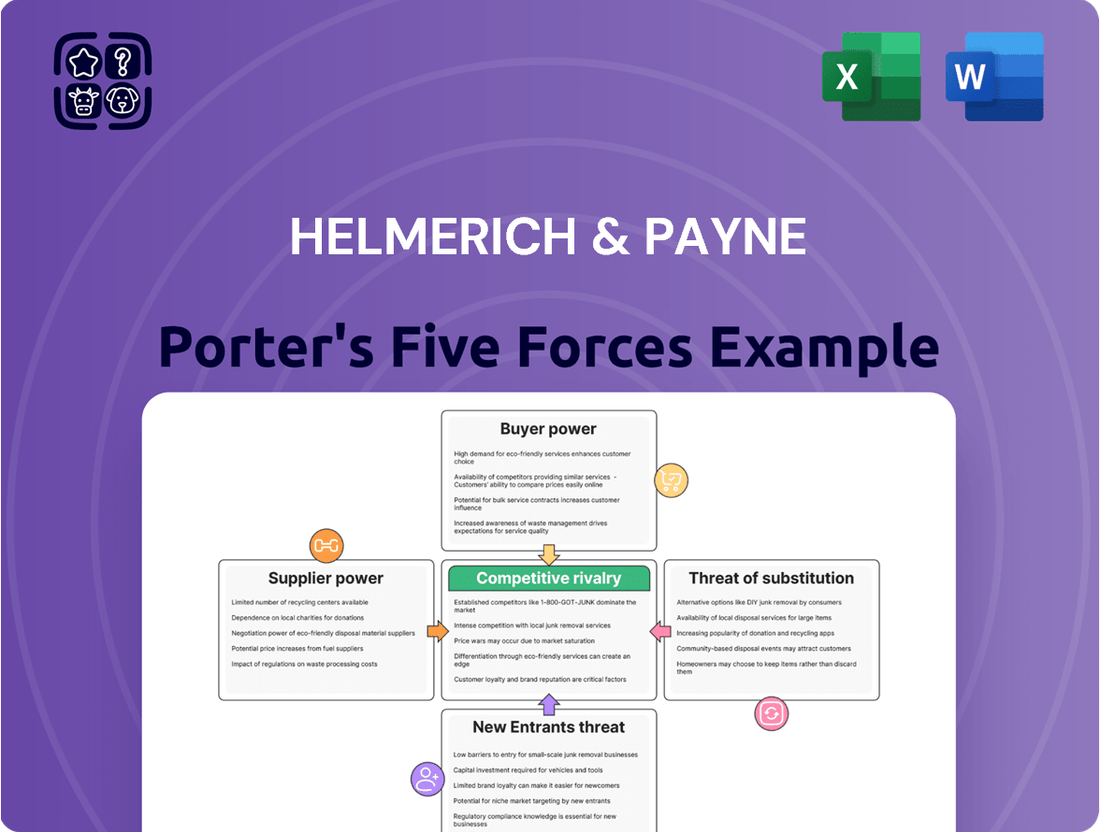

Tailored exclusively for Helmerich & Payne, analyzing its position within its competitive landscape by examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, allowing for rapid identification of strategic threats and opportunities.

Customers Bargaining Power

Consolidation among Exploration & Production (E&P) operators has significantly reshaped the oil and gas landscape. For instance, by the end of 2023, the number of publicly traded oil and gas companies in the U.S. had continued its downward trend, a pattern that has persisted for years, driven by numerous mergers and acquisitions. This trend concentrates drilling rig demand under fewer, larger entities.

These consolidated E&P giants wield increased bargaining power. They can leverage their larger scale and capital to negotiate more favorable terms with drilling contractors like Helmerich & Payne (H&P). This often translates into demands for lower day rates, more efficient rig operations, and greater flexibility in contract terms, directly impacting H&P's pricing power and profitability.

The U.S. composite day rate for drilling rigs has seen a downward trend, a direct consequence of an oversupply of available rigs and fluctuating demand. This excess capacity significantly bolsters the bargaining power of customers.

With more rigs than needed, customers can effectively negotiate for lower day rates. For instance, in early 2024, day rates for premium land rigs hovered around $25,000-$30,000, a notable decrease from peak periods. This pressure forces drilling service providers like Helmerich & Payne to focus on operational efficiency to maintain profitability.

Exploration and Production (E&P) companies are increasingly focused on capital discipline, prioritizing shareholder returns over rapid production expansion. This strategic shift makes them highly attuned to drilling expenses and drives their demand for greater efficiency, accelerated operations, and cutting-edge technologies from drilling service providers. For instance, in 2024, many E&P firms publicly stated their commitment to returning capital to shareholders through dividends and buybacks, signaling a reduced appetite for speculative, high-cost growth projects.

Long-Term Contracts and Performance-Based Agreements

Long-term contracts, while offering revenue predictability for companies like Helmerich & Payne, can also grant customers significant bargaining power. This is because customers can leverage these extended commitments to negotiate more favorable pricing and terms throughout the contract's duration, effectively locking in advantageous conditions.

The increasing prevalence of performance-based agreements further shifts this balance. In these arrangements, a drilling contractor's compensation is directly linked to achieving specific operational targets or outcomes. This structure inherently transfers a portion of the operational risk from the customer to the contractor, thereby enhancing the customer's leverage and bargaining position.

- Customer Leverage: Long-term contracts allow customers to negotiate favorable terms over extended periods, reducing contractor pricing flexibility.

- Risk Transfer: Performance-based contracts shift operational risk to the contractor, empowering customers by tying payment to successful outcomes.

- Industry Trend: The adoption of these contract types by major oil and gas producers directly impacts the bargaining power dynamics within the drilling services sector.

Customer Access to Multiple Drilling Technologies and Service Providers

Customers in the oil and gas industry benefit from a wide array of drilling technologies and a diverse, fragmented market of service providers. This allows them to easily compare offerings and select those that best suit their requirements, whether for conventional, unconventional, onshore, or offshore operations.

This access to multiple options significantly amplifies customer bargaining power, particularly when dealing with services that aren't highly specialized. For instance, in 2024, the oilfield services sector continued to show a high degree of competition, with numerous companies offering similar drilling equipment and support.

- Fragmented Market: The oilfield services sector remains highly fragmented, with many players competing for business.

- Technological Choice: Customers can choose from a broad spectrum of drilling technologies, from conventional rotary drilling to advanced directional and horizontal drilling.

- Price Sensitivity: Increased competition often leads to greater price sensitivity among customers, especially for standardized services.

- Negotiating Leverage: The ability to switch providers easily gives customers considerable negotiating leverage on pricing and contract terms.

The bargaining power of customers is substantial due to industry consolidation, leading to fewer, larger E&P operators with greater leverage. This concentration allows them to demand lower day rates and more favorable contract terms from drilling contractors like Helmerich & Payne.

The market's oversupply of drilling rigs, evident in the downward trend of composite day rates in early 2024, further empowers customers. For example, premium land rig day rates were around $25,000-$30,000 in early 2024, giving customers significant room to negotiate.

Customers also benefit from the increasing adoption of performance-based agreements, which shift operational risk to the contractor, and a fragmented market with numerous service providers offering a wide array of technologies. This competition allows customers to easily compare options and negotiate aggressively on price and terms.

| Factor | Impact on Bargaining Power | Example/Data (2024) |

|---|---|---|

| Customer Consolidation | Increases | Downward trend in U.S. publicly traded E&P companies by end of 2023. |

| Rig Oversupply | Increases | Premium land rig day rates: $25,000-$30,000 (early 2024). |

| Performance-Based Contracts | Increases | Shift operational risk to contractors, tying pay to outcomes. |

| Market Fragmentation | Increases | Highly competitive oilfield services sector with many providers. |

Full Version Awaits

Helmerich & Payne Porter's Five Forces Analysis

This preview showcases the complete Helmerich & Payne Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the oil and gas drilling industry. The document you see here is precisely what you will receive instantly upon purchase, providing a professionally formatted and ready-to-use strategic overview.

Rivalry Among Competitors

The oilfield services sector is characterized by a fragmented structure, yet it’s actively consolidating. Major entities such as Schlumberger and Halliburton are leading the charge in the drilling and well service segments, wielding significant market influence.

This intense competition intensifies rivalry as companies vie for market share. This is particularly true given the projected modest growth in global onshore rig demand for 2025, which is expected to remain relatively flat.

Competitive rivalry in the oil and gas drilling sector is intensely driven by technological advancements. Companies are pouring resources into developing high-performance rigs, incorporating automation, leveraging artificial intelligence, and implementing digital solutions. The primary goals are to boost drilling efficiency, slash operational costs, and significantly improve safety standards.

Helmerich & Payne, for instance, has strategically positioned itself by emphasizing its FlexRigs and a suite of advanced technologies. This commitment to innovation serves as a crucial differentiator, allowing the company to stand out in a crowded market. In 2024, the company continued to highlight its technological edge as a core element of its competitive strategy, aiming to capture market share through superior operational performance and cost-effectiveness.

The oil and gas drilling sector, especially within the U.S. onshore market, is characterized by volatile day rates and utilization rates. This volatility forces companies like Helmerich & Payne to engage in aggressive pricing to win contracts and keep their rigs operational. For instance, in early 2024, average daily rates for land rigs saw significant fluctuations based on rig type and geographic demand, directly impacting profitability.

These pressures on day rates and utilization directly amplify competition. When demand softens or oversupply exists, companies are compelled to lower their prices to secure work, creating a challenging environment where securing contracts often means accepting lower margins. This dynamic is a consistent feature of the industry, requiring constant strategic adaptation.

Global and Regional Market Dynamics

Competitive rivalry in the oil and gas drilling sector is intensifying, with dynamics shifting based on geographical focus. Established markets, such as the U.S. Gulf of Mexico, tend to exhibit a more consolidated landscape with fewer, well-entrenched competitors. Conversely, emerging markets are experiencing a surge in new entrants and increased activity, presenting both opportunities and heightened competition.

Helmerich & Payne's strategic international expansion, exemplified by their operations in Saudi Arabia, underscores the global nature of this rivalry. This move places them directly against other major international drilling contractors vying for lucrative contracts in these developing regions. The company's ability to adapt and compete across diverse regional market conditions is crucial for sustained success.

- Regional Competition Variance: Stable markets like the U.S. Gulf of Mexico feature a limited number of key players, whereas emerging markets, such as India, are experiencing a notable increase in competitive activity.

- Global Reach and Competition: Helmerich & Payne's international ventures, including their presence in Saudi Arabia, demonstrate direct competition on a global scale with other major drilling service providers.

- Market Entry and Consolidation: The oil and gas drilling industry sees varying levels of competition, from consolidated, mature markets to rapidly evolving, emerging markets attracting new participants.

Emphasis on Operational Efficiency and Cost Reduction

Competitive rivalry in the oil and gas drilling sector is intense, largely fueled by a relentless pursuit of operational efficiency and cost reduction. Companies are constantly seeking ways to drill wells more quickly and minimize downtime, directly impacting profitability.

This focus means that firms demonstrating superior speed and reduced non-productive time, along with streamlined supply chains, carve out a significant competitive advantage. Consequently, other players are compelled to invest in similar technological advancements and process improvements to keep pace.

For instance, in 2024, major drilling contractors continued to emphasize automation and advanced rig technologies. Companies like Helmerich & Payne reported advancements in their FlexRig® technology, which aims to reduce rig move times and improve drilling cycles. The industry saw continued investment in digital solutions to optimize operations and reduce costs per well, a trend expected to persist.

- Focus on Speed: Drilling companies compete on the speed at which they can complete wells, a key metric for efficiency.

- Cost Optimization: Reducing the overall cost per well is a primary driver for competitive advantage and market share.

- Technology Investment: Firms are investing heavily in automation, digital tools, and advanced rig designs to enhance performance.

- Supply Chain Efficiency: Optimizing the logistics and supply of materials and services is crucial for cost control and timely operations.

Competitive rivalry within the oilfield services sector remains a dominant force, driven by technological innovation and the pursuit of operational efficiency. Companies are heavily investing in automation, AI, and digital solutions to enhance drilling speed and reduce costs, with Helmerich & Payne's FlexRig technology being a prime example of this trend in 2024. This intense competition, particularly in onshore markets where rig demand is projected to grow modestly, forces companies to adopt aggressive pricing strategies and continuously improve their offerings to secure contracts and maintain market share.

| Metric | 2023 (Approx.) | 2024 Outlook (Approx.) | Key Competitor Actions |

|---|---|---|---|

| U.S. Onshore Rig Demand Growth | Modest | Relatively Flat | Focus on efficiency, cost reduction, technological adoption |

| Average Day Rates (Land Rigs) | Volatile, Fluctuating | Continued Volatility | Aggressive pricing to secure contracts, margin pressure |

| Investment in Automation/AI | High | Increasing | Development of advanced rig technologies, digital solutions |

SSubstitutes Threaten

The global shift towards renewable energy sources like solar and wind presents a significant long-term threat of substitution for traditional oil and gas drilling services. As of 2024, investments in renewable energy continue to surge, with global clean energy spending projected to reach over $2 trillion in 2024, according to the International Energy Agency (IEA). This growing emphasis on decarbonization, driven by government policies and increasing public demand for sustainable solutions, could gradually diminish the reliance on fossil fuels.

Advances in energy efficiency and conservation represent a significant threat of substitutes for Helmerich & Payne's (H&P) core business. As technologies improve, the demand for traditional energy sources like oil and gas can decrease. For instance, in 2024, many nations continued to set ambitious energy efficiency targets, potentially dampening the need for new drilling projects.

This trend directly impacts H&P by reducing the market for their drilling services. When overall energy consumption declines due to better efficiency, the impetus for expanding oil and gas extraction lessens. This can lead to fewer contracts and lower utilization rates for H&P's rig fleet, acting as a direct substitute for the demand they rely on.

The development of alternative hydrocarbon extraction methods presents a potential threat. While not direct replacements for drilling rigs, innovations in enhanced oil recovery (EOR) or less traditional drilling techniques could reduce the need for new drilling rig services. For instance, advancements in technologies like CO2 EOR or steam injection might boost production from existing wells, thereby impacting demand for new rig contracts.

Recycling and Reuse of Produced Water and Waste

The growing emphasis on environmental sustainability and circular economy principles is a significant factor. In the oilfield services sector, this translates to more efficient recycling and reuse of produced water and waste. This trend could potentially decrease the demand for specific drilling services that are currently linked to disposal methods.

For instance, by 2024, many operators are actively seeking ways to minimize their environmental footprint. Initiatives focused on water recycling in hydraulic fracturing operations are becoming more common. A report from the U.S. Energy Information Administration (EIA) in late 2023 highlighted that the percentage of water recycled and reused in fracking operations had seen a steady increase over the past several years, with projections indicating further growth.

- Reduced Need for New Water Sourcing: Increased recycling directly lessens the requirement for fresh water, impacting services related to water acquisition and transportation.

- Lower Disposal Volumes: As more water and waste are reused, the volume requiring traditional disposal methods, such as injection wells, declines.

- Economic Incentives for Reuse: Cost savings associated with recycling versus disposal can drive adoption, making these practices a more attractive substitute for conventional services.

- Regulatory Pressures: Stricter environmental regulations globally are pushing companies towards more sustainable waste management and water usage practices.

Political and Regulatory Shifts Favoring Non-Hydrocarbon Energy

Government policies, subsidies, and regulations that actively promote and incentivize non-hydrocarbon energy sources or disincentivize fossil fuel extraction can significantly accelerate the substitution effect. For instance, carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, make alternative energy more economically viable and attractive compared to traditional hydrocarbons.

These shifts can directly impact Helmerich & Payne's (HP) business by increasing the cost of fossil fuel operations and simultaneously reducing the cost of renewable energy projects. For example, in 2024, many nations continued to implement or strengthen carbon pricing initiatives. The European Union's Emissions Trading System (EU ETS) saw continued activity, with carbon prices fluctuating but remaining a significant factor in energy cost calculations.

The threat of substitutes is amplified when these political and regulatory shifts create a more favorable economic landscape for alternatives.

- Government Incentives: Subsidies for solar, wind, and battery storage projects reduce their upfront costs, making them more competitive.

- Carbon Pricing: Mechanisms like carbon taxes or cap-and-trade systems increase the cost of using fossil fuels, thereby improving the relative economics of alternatives.

- Regulatory Mandates: Renewable portfolio standards or mandates for electric vehicle adoption directly drive demand away from hydrocarbon-based energy.

- International Agreements: Global climate accords encourage national policies that favor cleaner energy sources, accelerating the transition away from fossil fuels.

The increasing adoption of electric vehicles (EVs) presents a substantial substitute threat to the demand for oil and gas, which directly impacts Helmerich & Payne's (H&P) drilling services. As EV technology advances and charging infrastructure expands, consumer preference shifts away from internal combustion engine vehicles. By 2024, global EV sales continued their upward trajectory, with projections indicating that EVs could account for over 20% of new car sales worldwide, a significant increase from previous years.

This transition to electric mobility reduces the overall demand for gasoline and diesel fuel, consequently lowering the need for crude oil extraction. For H&P, this translates to a potential contraction in the market for onshore and offshore drilling operations as the world moves towards cleaner transportation solutions. The economic viability of EVs, coupled with government incentives, further accelerates this substitution.

Furthermore, advancements in battery technology and renewable energy integration for power generation also serve as substitutes. As grid-scale battery storage becomes more efficient and cost-effective, the reliance on fossil fuels for electricity generation can decrease. This broadens the substitution threat beyond just transportation, impacting the entire energy sector.

| Energy Source | 2024 Global Investment (Projected, USD Trillions) | Key Substitution Impact on Drilling |

|---|---|---|

| Renewable Energy (Solar, Wind) | > 2.0 (IEA) | Reduces demand for oil and gas exploration and production. |

| Electric Vehicles (EVs) | Significant growth in sales, >20% of new car sales projected globally | Decreases demand for gasoline and diesel, impacting crude oil extraction needs. |

| Energy Efficiency Improvements | Ongoing national targets and initiatives | Lowers overall energy consumption, reducing the need for new drilling projects. |

Entrants Threaten

The contract drilling industry, particularly for sophisticated, high-performance rigs like those Helmerich & Payne (HP) utilizes, demands immense upfront capital. Acquiring, maintaining, and continuously modernizing these complex assets and their supporting infrastructure represents a significant financial hurdle.

This substantial capital intensity acts as a formidable barrier to entry. New companies looking to compete in this space would need to secure hundreds of millions, if not billions, of dollars just to establish a comparable operational fleet, making it difficult for smaller or less-capitalized players to enter the market.

For instance, a modern land rig can cost upwards of $20 million, and offshore rigs can easily run into the hundreds of millions. HP’s investment in its FlexRig technology, designed for efficiency and advanced capabilities, further elevates this requirement. In 2023, HP reported capital expenditures of $850 million, reflecting ongoing investments in its fleet, a clear indicator of the industry's capital demands.

The sheer technological complexity and the need for specialized expertise present a formidable barrier to new entrants in the oil and gas drilling sector. Operating advanced rigs, especially those leveraging automation and AI for enhanced performance and specific drilling outcomes, requires substantial investment in cutting-edge technology and the development of highly skilled personnel. For instance, companies like Helmerich & Payne (HP) have invested heavily in their FlexRig technology, which incorporates advanced automation and data analytics, making it difficult for newcomers to match this level of sophistication without significant capital and R&D outlays.

Established customer relationships and a strong reputation act as significant barriers to entry for new drilling contractors. Helmerich & Payne (H&P), for instance, boasts decades-long partnerships with major exploration and production (E&P) companies, built on a foundation of reliable operational performance and an unwavering commitment to safety. In 2023, H&P's fleet utilization remained robust, reflecting the trust placed in them by their clientele.

Regulatory and Environmental Compliance

The oil and gas drilling sector faces substantial hurdles for new companies due to rigorous environmental regulations and safety standards. Navigating these complex requirements, including obtaining necessary permits and adhering to strict operational protocols, demands significant capital investment and expertise. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce methane emission regulations, requiring substantial upgrades for drilling operations.

These compliance costs act as a formidable barrier, deterring potential new entrants who may lack the financial resources or established infrastructure to meet these demands. The ongoing evolution of environmental policies, such as those related to carbon capture and storage, further elevates the compliance burden and associated expenses.

- Stringent Environmental Regulations: The industry must comply with regulations like the Clean Air Act and Clean Water Act, impacting drilling practices and waste disposal.

- Safety Standards: Adherence to Occupational Safety and Health Administration (OSHA) standards and industry-specific safety protocols is mandatory, requiring investment in training and equipment.

- Permitting Processes: Obtaining federal, state, and local permits for drilling operations can be time-consuming and costly, often involving environmental impact assessments.

- Compliance Costs: Meeting these regulatory requirements in 2024 often meant significant capital outlays for emissions control technology and safety enhancements.

Access to Skilled Workforce and Supply Chain

Establishing operations in the oil and gas drilling sector, particularly for companies like Helmerich & Payne, necessitates significant access to a skilled workforce and a well-established supply chain. New entrants face a considerable hurdle in attracting experienced personnel, especially in a tight labor market where specialized drilling expertise is in high demand. For instance, the U.S. oil and gas industry, while experiencing fluctuations, consistently requires a specialized talent pool, and in 2024, the competition for experienced rig crews and engineers remained intense.

Furthermore, building reliable supplier networks for essential equipment, parts, and services presents another formidable barrier. New companies may struggle to secure favorable terms or even access critical components from established suppliers who prioritize existing, larger clients. This dependency on specialized suppliers, particularly for advanced drilling technologies and maintenance, can significantly inflate initial capital expenditures and operational costs for newcomers, impacting their ability to compete on price and efficiency.

- Skilled Labor Shortage: In 2024, the demand for experienced oilfield workers, such as roughnecks and directional drillers, often outstripped available supply, driving up wages and training costs for new entrants.

- Supply Chain Dependencies: The oilfield services sector relies on specialized manufacturers for critical components like drill bits and downhole tools; new entrants may face longer lead times and higher prices due to established relationships.

- Capital Intensity: Acquiring and maintaining a fleet of modern drilling rigs and associated equipment requires substantial upfront investment, a barrier exacerbated by the need for specialized aftermarket support and parts.

The threat of new entrants in the contract drilling industry, particularly for sophisticated operations like Helmerich & Payne's, is significantly mitigated by extreme capital intensity. Establishing a competitive fleet requires hundreds of millions, if not billions, in upfront investment for advanced rigs and technology. For example, a modern land rig can cost over $20 million, with offshore units costing far more, making it a substantial barrier for newcomers.

Furthermore, stringent environmental regulations and safety standards, enforced by bodies like the EPA and OSHA, necessitate considerable investment in compliance and specialized equipment. In 2024, adherence to methane emission regulations and advanced safety protocols added to the financial burden for any new player. The need for a highly skilled workforce, coupled with established customer relationships and reputations for reliability, further solidifies the position of incumbents like Helmerich & Payne, making market entry exceptionally challenging.

| Barrier to Entry | Description | Example/Impact |

|---|---|---|

| Capital Intensity | High cost of acquiring and maintaining advanced drilling equipment. | Modern land rigs cost upwards of $20 million; HP's 2023 capex was $850 million. |

| Technological Sophistication | Need for advanced automation, data analytics, and specialized expertise. | HP's FlexRig technology requires significant R&D and skilled personnel. |

| Regulatory Compliance | Adherence to strict environmental and safety standards. | 2024 EPA methane regulations and OSHA standards increase operational costs. |

| Customer Relationships & Reputation | Decades-long partnerships built on performance and safety. | HP's robust fleet utilization in 2023 reflects strong client trust. |

| Skilled Workforce & Supply Chain | Access to experienced personnel and reliable suppliers. | Intense competition for talent in 2024; supply chain dependencies for specialized parts. |

Porter's Five Forces Analysis Data Sources

Our Helmerich & Payne Porter's Five Forces analysis is built upon a foundation of official company filings, including 10-K reports and investor presentations, complemented by industry-specific market research from firms like IHS Markit and Wood Mackenzie.