Helmerich & Payne Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helmerich & Payne Bundle

Helmerich & Payne's marketing mix is a masterclass in aligning product innovation, strategic pricing, efficient distribution, and impactful promotion within the demanding oil and gas sector. Understanding these elements is crucial for anyone seeking to grasp their competitive edge.

Dive deeper into how Helmerich & Payne leverages its advanced drilling technologies (Product), competitive service agreements (Price), global operational reach (Place), and targeted industry engagement (Promotion) to dominate the market. Get the full analysis to unlock these insights.

Save valuable time and gain a significant advantage with our comprehensive, ready-to-use Marketing Mix Analysis for Helmerich & Payne. This editable report provides actionable strategies and expert insights, perfect for business planning or academic research.

Product

Helmerich & Payne's high-performance drilling rigs, notably their FlexRig technology, represent a core component of their product offering. These rigs are engineered for superior efficiency and reliability, featuring advanced AC drive systems and high horsepower to tackle demanding oil and gas extraction projects.

The FlexRig fleet is designed for versatility, supporting complex drilling in both conventional and unconventional resource plays. With substantial hookload ratings and multi-well pad capabilities, H&P's rigs are optimized for modern drilling operations, contributing to improved drilling outcomes and operational cost savings for their clients.

As of early 2024, H&P continues to invest in its rig fleet, focusing on upgrades and technological advancements to maintain its competitive edge. This commitment ensures their rigs remain at the forefront of industry performance, capable of meeting the evolving needs of exploration and production companies.

Helmerich & Payne's product offering centers on cutting-edge drilling technologies and automation, including advanced directional drilling and precise survey management. These innovations significantly boost the accuracy, predictability, and safety of oil and gas extraction. For instance, their FlexFusion® Drilling Automation Technology is designed to minimize downtime and improve the overall efficiency of drilling projects, a critical factor in the current market landscape.

This technological prowess, evident in platforms like FlexFusion®, directly addresses customer needs by reducing non-productive time and enhancing operational reliability. H&P's commitment to software development and automation allows them to offer optimized performance, setting them apart in a crowded sector. Their investment in these areas underscores a strategic focus on delivering superior value and operational excellence.

Helmerich & Payne's (H&P) Comprehensive Drilling Services go far beyond simply providing advanced drilling equipment. They offer end-to-end solutions, managing the entire drilling lifecycle from initial design and fabrication to efficient operation and continuous support for their state-of-the-art rigs. This integrated approach ensures customers receive performance-driven results.

H&P's commitment to delivering superior outcomes is rooted in their deep engineering design capabilities, relentless pursuit of operational efficiency, and an unwavering dedication to safety. For instance, in the first quarter of fiscal year 2024, H&P reported a total revenue of $762 million, with their contract drilling segment, which encompasses these services, being a significant contributor.

Managed Pressure Drilling (MPD) Solutions

Helmerich & Payne (H&P) offers comprehensive Managed Pressure Drilling (MPD) solutions, encompassing everything from the design and manufacturing of specialized MPD packages to the intricate engineering, installation, and integration of control systems directly onto drilling rigs. This integrated approach ensures clients receive a complete, ready-to-deploy service.

These advanced MPD solutions are instrumental in navigating the complexities of modern drilling operations, particularly when encountering challenging geological formations. By precisely managing wellbore pressures, H&P's technology significantly enhances safety and operational efficiency, minimizing risks associated with kicks, losses, and wellbore instability.

For instance, H&P's commitment to innovation in MPD is underscored by their continuous development and deployment of cutting-edge technology. In 2023, H&P reported a significant increase in the utilization of their advanced drilling technologies, including MPD, contributing to a strong performance in their U.S. land contract drilling segment. The company aims to further expand its MPD service offerings in 2024 and 2025, anticipating growing demand from operators seeking to optimize drilling in unconventional resource plays and deepwater environments.

Key aspects of H&P's MPD Product offering include:

- Turnkey MPD Package Design and Manufacturing: Custom-built systems tailored to specific well requirements.

- Rig Engineering and Integration: Seamless incorporation of MPD technology onto existing or new drilling rigs.

- Advanced Control System Integration: Sophisticated software and hardware for real-time pressure management.

- Operational Support and Expertise: Providing skilled personnel and technical guidance for optimal MPD execution.

Support for Conventional and Unconventional Plays

Helmerich & Payne’s (H&P) drilling services are designed to excel in both traditional and more complex oil and gas extraction methods worldwide. This adaptability allows them to serve a broad range of client needs, from established conventional fields to emerging unconventional resource plays.

Their advanced, super-spec rigs are a key differentiator, especially for unconventional drilling. These rigs are engineered to handle the demanding requirements of long horizontal wells, often referred to as extended laterals. By facilitating deeper and more extensive reservoir penetration, H&P’s technology helps operators boost production efficiency and maximize the recovery of hydrocarbons.

In 2023, H&P reported a significant increase in rig utilization, particularly in North America's unconventional basins. This trend highlights the market's demand for the specialized capabilities their rigs offer. For instance, their ability to execute complex well designs directly translates into enhanced economic outcomes for exploration and production companies.

- Advanced Rig Technology: H&P's super-spec rigs are built for the precision and power needed in unconventional drilling, including extended reach laterals.

- Maximizing Reservoir Contact: Their technology enables operators to access more of the underground oil and gas reserves, leading to higher production volumes.

- Global Application: Services support both conventional and unconventional plays, providing flexibility for diverse geological environments and market demands.

- Operational Efficiency: The company's focus on innovation aims to reduce drilling time and costs, improving project economics for their clients.

Helmerich & Payne's product offering is centered on its advanced drilling rig technology, particularly its FlexRig fleet. These rigs are engineered for superior efficiency, reliability, and versatility, supporting complex drilling operations in both conventional and unconventional resource plays. Their commitment to technological advancement ensures their rigs remain at the forefront of industry performance, capable of meeting evolving exploration and production needs.

H&P's product strategy also includes comprehensive drilling services and Managed Pressure Drilling (MPD) solutions. These integrated offerings manage the entire drilling lifecycle, from design and fabrication to operation and support, ensuring performance-driven results. The company's focus on automation and software development, like FlexFusion® Drilling Automation Technology, aims to minimize downtime and enhance operational reliability.

The company's super-spec rigs are a key differentiator, especially for unconventional drilling and extended laterals, enabling deeper reservoir penetration and higher production efficiency. In 2023, H&P saw increased rig utilization in North America's unconventional basins, reflecting market demand for these specialized capabilities.

| Product Aspect | Description | Key Benefits | 2024/2025 Focus |

|---|---|---|---|

| FlexRig Technology | High-performance drilling rigs with advanced AC drive systems and high horsepower | Superior efficiency, reliability, versatility, multi-well pad capabilities | Upgrades and technological advancements for competitive edge |

| Drilling Automation & Software | FlexFusion® Drilling Automation Technology, advanced directional drilling, precise survey management | Minimized downtime, improved accuracy, predictability, and safety | Continued software development and automation deployment |

| Managed Pressure Drilling (MPD) | Turnkey MPD packages, rig integration, advanced control systems, operational support | Enhanced safety and efficiency in complex geological formations, risk minimization | Expansion of MPD service offerings, anticipating growing demand |

What is included in the product

This analysis offers a comprehensive examination of Helmerich & Payne's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding Helmerich & Payne's market positioning.

Provides a clear, concise overview of Helmerich & Payne's 4Ps, easing the burden of detailed analysis for busy executives.

Place

Helmerich & Payne boasts a commanding presence in the North American oil and gas sector, particularly within the U.S. horizontal land rig market. Their extensive operational footprint covers virtually every major producing state, from Texas and Colorado to Pennsylvania and West Virginia.

This deep penetration allows H&P to effectively serve crucial shale plays like the Permian Basin and Eagle Ford Shale, where they hold a significant market share. As of early 2024, H&P consistently operates a substantial portion of its active rig fleet in these high-demand regions, underscoring their established dominance.

Helmerich & Payne (H&P) is significantly broadening its international reach, with established operations already in Argentina, Australia, Bahrain, Colombia, and Saudi Arabia. This expansion is a key part of their strategy to become a premier global onshore drilling services provider.

The company is actively deploying its advanced FlexRig technology to new markets, notably in the Middle East, including Saudi Arabia, where it has recently secured substantial contracts. This strategic move underscores H&P's commitment to global growth and market penetration.

Further bolstering its international diversification, H&P's acquisition of KCA Deutag significantly expands its operational footprint and capabilities across various global regions, enhancing its competitive position in the international drilling sector.

Helmerich & Payne (H&P) maintains a strategic footprint in the Offshore Gulf of Mexico, deploying rigs and services across Louisiana and U.S. federal waters. This offshore segment diversifies H&P's operational portfolio, allowing it to serve a wider spectrum of drilling requirements beyond its substantial land-based activities.

In 2023, H&P's offshore segment contributed to its overall revenue, although specific offshore revenue figures are often consolidated within broader segment reporting. The company's commitment to this market segment underscores its strategy to capture opportunities across various geological and operational environments. For instance, H&P continues to invest in its offshore capabilities, ensuring it can meet the demanding needs of deepwater exploration and production.

Direct Sales and Contractual Engagements

Helmerich & Payne's primary distribution channel is direct sales, forging relationships with major oil companies and significant independent exploration and production firms. This approach allows for tailored service delivery and deep understanding of client needs.

Contractual engagements are the backbone of their sales strategy. These agreements are typically won through competitive bidding processes or direct negotiations, often encompassing extensive multi-well and multi-year projects. This structure provides Helmerich & Payne with a predictable and robust revenue backlog, crucial for long-term planning and investment.

For example, in the first quarter of fiscal year 2024, Helmerich & Payne reported a significant portion of its revenue was derived from long-term contracts. The company's fleet utilization rates, a key indicator of contractual activity, remained strong, reflecting consistent demand from its client base. As of early 2024, the company continued to emphasize securing multi-year contracts to maintain operational stability and capitalize on market opportunities.

- Direct Sales Focus: Engages directly with major and large independent oil and gas companies.

- Contractual Stability: Secures business through competitive bidding and direct negotiations for multi-year projects.

- Revenue Backlog: Contracts ensure a stable and predictable revenue stream.

- Fleet Utilization: High utilization rates in early 2024 indicated strong contractual demand.

Strategic Acquisition for Global Reach

Helmerich & Payne's (H&P) strategic acquisition of KCA Deutag, announced in July 2024, is a pivotal move to enhance its global presence. This deal is set to significantly expand H&P's footprint in crucial international markets, including the Middle East, South America, Europe, and Africa, bolstering its onshore drilling capabilities. The integration is anticipated to solidify H&P's competitive edge in these vital oil and gas territories.

The acquisition is projected to create a more robust global onshore drilling operation for H&P. By combining forces, the company aims to leverage KCA Deutag's established international infrastructure and market access. This strategic alignment is expected to yield significant operational synergies and cost efficiencies, improving overall profitability and market share in the global energy sector.

Key benefits of this strategic acquisition include:

- Expanded Geographic Footprint: Gaining substantial presence in the Middle East, South America, Europe, and Africa.

- Enhanced Onshore Drilling Capabilities: Strengthening H&P's position as a leading global onshore drilling contractor.

- Improved Competitive Standing: Positioning H&P to better compete in key international oil and gas regions.

- Synergistic Opportunities: Realizing operational efficiencies and cost savings through integration.

Helmerich & Payne's (H&P) physical presence is deeply rooted in the U.S. onshore market, particularly in key shale basins like the Permian. Their operational footprint extends internationally, with significant activities in Argentina, Australia, and the Middle East, further strengthened by the July 2024 acquisition of KCA Deutag, which added substantial operations across Europe and Africa.

This global network allows H&P to serve diverse geological environments and client needs, from U.S. unconventional plays to international conventional drilling. The company's strategic deployment of advanced rig technology, like their FlexRig series, across these varied locations is a testament to their commitment to market penetration and service excellence.

H&P's physical infrastructure includes a substantial fleet of land rigs and, to a lesser extent, offshore assets in the Gulf of Mexico. The KCA Deutag acquisition is expected to integrate a significant number of additional rigs and operational bases, enhancing H&P's capacity and reach in key global energy markets.

The company's market reach is defined by its extensive operational bases and the strategic positioning of its rig fleet to meet client demand in high-activity regions. As of early 2024, H&P maintained a robust presence in the U.S. land market, while actively expanding its international footprint.

| Region | Key Markets | Notes |

|---|---|---|

| North America | U.S. Permian Basin, Eagle Ford, Rockies, Mid-Continent | Dominant onshore land rig operator. |

| South America | Argentina, Colombia | Established operations serving local E&P companies. |

| Middle East | Saudi Arabia, Bahrain | Growing presence with advanced rig technology deployment. |

| Australia | Onshore operations | Serving the Australian oil and gas sector. |

| Europe & Africa | (Post-KCA Deutag acquisition) | Significant expansion into new territories. |

| Offshore | Gulf of Mexico | Diversified operations beyond land-based activities. |

Preview the Actual Deliverable

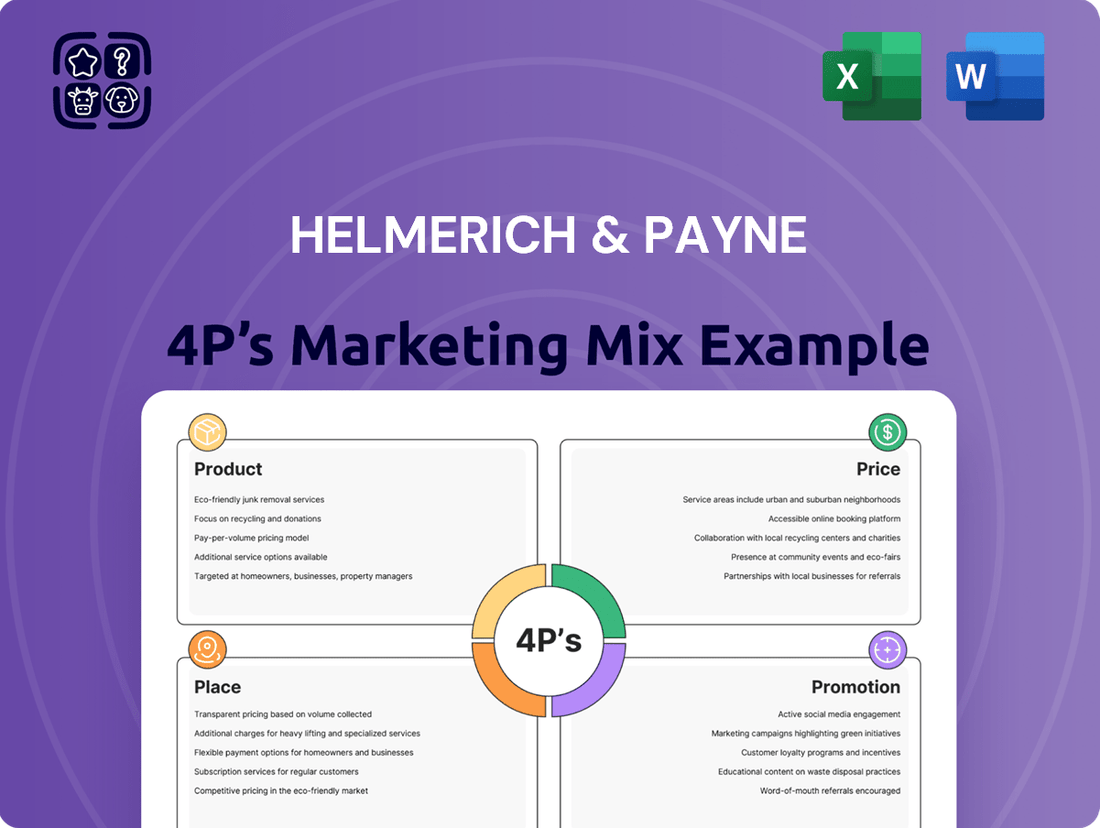

Helmerich & Payne 4P's Marketing Mix Analysis

The preview shown here is the exact Helmerich & Payne 4P's Marketing Mix Analysis you'll receive instantly after purchase. You're viewing the complete, ready-to-use document, ensuring no surprises. This is the final version, fully comprehensive and prepared for immediate application.

Promotion

Helmerich & Payne (H&P) prioritizes investor relations and financial communications as a key element of its marketing mix. The company actively engages with the financial community through regular investor conference calls and webcasts, providing updates on quarterly earnings, financial performance, and strategic direction. For instance, H&P's Q1 2024 earnings call on February 1, 2024, detailed their financial results and outlook.

Transparency is a cornerstone of H&P's communication strategy. They publish comprehensive annual reports and sustainability reports, offering stakeholders detailed financial and operational data. This commitment to open disclosure ensures investors have access to the information needed for informed decision-making, bolstering confidence in the company's long-term prospects.

Helmerich & Payne actively engages in key industry gatherings like the Piper Sandler Energy Conference and the THRIVE Energy Conference. These forums are crucial for showcasing the company's operational progress and strategic direction to a wide array of stakeholders.

Management leverages these presentations to highlight technological innovations and financial results, directly addressing investor interest. For instance, at the Piper Sandler Energy Conference, H&P’s leadership often details their fleet modernization and digital solutions, reinforcing their market position.

Helmerich & Payne's (H&P) promotional activities center on its dedication to providing customers with exceptional outcomes, underpinned by top-tier drilling productivity, unwavering reliability, and a strong safety record. The company actively showcases its advanced technological capabilities and superior operational execution to address and resolve client challenges, setting it apart in the competitive landscape.

For instance, H&P's focus on innovation and efficiency directly impacts customer value. In 2024, the company reported a significant increase in rig utilization, reflecting strong customer demand for its advanced solutions. This operational excellence translates into tangible benefits for clients, such as reduced drilling time and enhanced well performance, directly contributing to their bottom line.

Sustainability Reporting and ESG Initiatives

Helmerich & Payne (H&P) actively communicates its dedication to sustainability through an annual Sustainability Report. This document details their environmental, social, and governance (ESG) initiatives and performance metrics.

H&P's commitment to responsible energy solutions, including specific emissions reduction targets, resonates with a growing investor base prioritizing ESG factors. Their 2023 Sustainability Report, for instance, highlighted progress towards their 2030 greenhouse gas reduction goals. This focus on transparency and actionable ESG strategies is crucial for attracting capital and fostering long-term partnerships.

- Published Annual Sustainability Report: Showcases ESG performance and progress.

- Emissions Reduction Goals: Demonstrates commitment to environmental stewardship.

- Strengthened Governance Practices: Appeals to investors seeking ethical operations.

- Responsible Energy Solutions: Aligns with market demand for sustainable energy.

Strategic Partnerships and Industry Leadership

Helmerich & Payne (H&P) actively cultivates its image as a premier contract driller and a reliable collaborator for prominent oil and gas corporations. This strategic positioning is reinforced through the consistent announcement of substantial contract wins, underscoring their market dominance in sophisticated drilling technologies.

A prime example of this strategy is H&P's multi-rig agreement with Saudi Aramco, a significant deal that not only highlights their operational prowess but also solidifies their leadership in providing advanced drilling solutions. Such public declarations serve to build confidence among existing and potential clients, demonstrating H&P's capacity to execute large-scale, complex projects.

- Market Leadership: H&P emphasizes its standing as a leading contract driller.

- Trusted Partner: The company promotes its role as a dependable partner to major oil and gas firms.

- Contract Wins: Publicizing significant contract awards, like the Saudi Aramco deal, showcases capabilities.

- Advanced Solutions: These announcements reinforce H&P's expertise in cutting-edge drilling technologies.

Helmerich & Payne (H&P) focuses its promotion on demonstrating superior customer outcomes through high drilling productivity, reliability, and safety. The company highlights its advanced technology and operational execution to solve client challenges, differentiating itself in the market.

In 2024, H&P reported strong rig utilization, reflecting robust customer demand for their innovative solutions. This operational excellence directly benefits clients by reducing drilling times and improving well performance, positively impacting their financial results.

H&P's promotional efforts also underscore its commitment to sustainability, detailed in its annual Sustainability Report, which covers ESG initiatives and performance metrics. The company's 2023 report, for example, showed progress toward its 2030 greenhouse gas reduction targets, appealing to investors focused on ESG factors.

The company actively promotes its market leadership and role as a trusted partner by announcing significant contract wins, such as its multi-rig agreement with Saudi Aramco. These announcements showcase H&P's operational expertise and leadership in advanced drilling technologies.

| Metric | 2023 (Approx.) | 2024 (Q1/Guidance) | Significance |

|---|---|---|---|

| Rig Utilization Rate | ~70% | Guidance for ~75-80% | Indicates strong customer demand and operational efficiency. |

| Safety Record (Recordable Incidents per 200,000 Hours) | Below 0.5 | Maintaining industry-leading low rates | Demonstrates commitment to operational excellence and employee well-being. |

| ESG Performance (e.g., GHG Reduction Progress) | Progress towards 2030 goals | Continued reporting and initiatives | Appeals to environmentally conscious investors and stakeholders. |

Price

Helmerich & Payne is increasingly shifting from standard day-rate billing to performance-based contracts. This strategic move aligns their revenue directly with customer success, offering a base rate supplemented by bonuses for exceeding specific performance benchmarks.

This incentivizes H&P to optimize operational efficiency and deliver superior results, ultimately enhancing profitability and customer satisfaction. For instance, in 2023, the company highlighted the success of these contracts in improving rig utilization and overall financial performance.

Helmerich & Payne (H&P) navigates a highly competitive drilling services landscape where pricing is directly tied to rig utilization, fluctuating commodity prices, and broader industry health. For instance, as of early 2024, the North American land rig market saw utilization rates hovering in the mid-60% range, impacting pricing dynamics.

H&P aims to solidify its pricing power by emphasizing its fleet of technologically advanced rigs, such as its FlexRig® models, and a commitment to superior operational efficiency. This focus allows H&P to often secure premium dayrates, even when market conditions are less favorable, reflecting the value proposition of their high-performance solutions.

Helmerich & Payne's pricing is directly tied to its significant capital expenditures, which in 2023 were reported at $480 million, primarily for fleet upgrades and international growth initiatives. This investment strategy necessitates pricing that ensures robust cash flow generation, allowing the company to fund ongoing operations and strategic expansion without compromising financial flexibility.

The company's pricing model is designed to achieve returns that comfortably exceed its cost of capital, estimated to be around 9% in early 2024. This focus on profitability not only covers capital reinvestment but also supports a strong balance sheet, crucial for navigating the cyclical nature of the oil and gas industry and maintaining operational readiness.

Long-Term Contractual Agreements

Long-term contractual agreements are a cornerstone of Helmerich & Payne's (H&P) business strategy, particularly within its North American Solutions segment. A substantial portion of their advanced drilling rig fleet operates under these terms, creating a predictable revenue stream and a robust backlog. For instance, as of Q1 2024, H&P reported a significant backlog of contracted revenue, providing a solid foundation against market volatility.

These contracts offer several key advantages. They insulate H&P from the immediate price swings common in the oil and gas industry, ensuring more stable revenue generation throughout the contract duration. This predictability allows for better financial planning and resource allocation. Moreover, these agreements often include provisions for pricing adjustments, safeguarding margins even during periods of rising operational costs.

- Revenue Stability: Long-term contracts provide a predictable revenue backlog, cushioning against short-term market downturns.

- Pricing Predictability: These agreements help lock in favorable pricing, mitigating the impact of commodity price volatility.

- Operational Efficiency: Contractual commitments allow for better utilization of H&P's technologically advanced rigs, enhancing operational efficiency.

- Customer Relationships: Long-term partnerships foster stronger relationships with key customers, leading to repeat business and strategic alignment.

Value-Driven Pricing for Advanced Solutions

Helmerich & Payne (H&P) employs a value-driven pricing strategy, recognizing that its advanced FlexRigs and automation technologies deliver significant benefits beyond basic drilling services. This approach focuses on the enhanced efficiency, reduced non-productive time (NPT), and superior drilling outcomes that clients achieve, justifying a price point that reflects this superior performance and cost savings. For instance, H&P's commitment to innovation is demonstrated by their ongoing development and deployment of advanced automation and digital solutions, which directly translate into tangible economic advantages for their customers.

This strategy means H&P doesn't just compete on day rates; instead, they price based on the total value delivered. Customers benefit from faster drilling times, fewer operational interruptions, and ultimately, a lower overall cost per barrel. This is crucial in a market where operational excellence and technological superiority directly impact profitability.

H&P's pricing reflects this:

- Value Proposition: Focus on increased efficiency and reduced NPT delivered by FlexRigs and automation.

- Cost Savings for Clients: Pricing is tied to the tangible economic benefits and cost reductions achieved by customers.

- Premium for Performance: Advanced capabilities and improved drilling outcomes command a price that reflects their superior performance compared to traditional methods.

Helmerich & Payne's pricing strategy has evolved, moving from traditional day rates to performance-based contracts, directly linking revenue to customer success. This incentivizes H&P to deliver superior operational efficiency, as seen in their 2023 financial performance improvements driven by these contracts.

The company leverages its technologically advanced FlexRig fleet to command premium day rates, reflecting a value-driven approach. This strategy is supported by significant capital expenditures, such as the $480 million invested in 2023 for fleet upgrades, aiming for returns exceeding their 9% cost of capital.

Long-term contracts, particularly in North America, provide revenue stability and predictable pricing, insulating H&P from market volatility. This focus on value, demonstrated by reduced non-productive time for clients, justifies their premium pricing for advanced drilling solutions.

| Pricing Strategy Element | Description | Supporting Data/Example |

| Performance-Based Contracts | Revenue tied to exceeding performance benchmarks. | Improved rig utilization and financial performance highlighted in 2023. |

| Value-Driven Pricing | Premium rates for advanced technology and efficiency. | FlexRig fleet and automation solutions offer clients reduced NPT and cost savings. |

| Long-Term Contracts | Predictable revenue streams and pricing. | Significant contracted revenue backlog reported as of Q1 2024. |

| Capital Investment Justification | Pricing supports significant CapEx and desired returns. | $480 million CapEx in 2023 for fleet upgrades; target returns > 9% cost of capital. |

4P's Marketing Mix Analysis Data Sources

Our Helmerich & Payne 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, including SEC filings and investor relations materials, alongside comprehensive industry reports and competitive intelligence. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional efforts.