Howmet Aerospace SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Howmet Aerospace, a leader in advanced engineered solutions, boasts significant strengths in its proprietary technologies and strong customer relationships within the aerospace and defense sectors. However, it also navigates challenges like supply chain disruptions and intense competition, making a comprehensive understanding crucial for strategic decision-making.

Want the full story behind Howmet Aerospace's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Howmet Aerospace is a recognized global leader in specialized engineered solutions, especially within the demanding aerospace and defense sectors. This strong market standing is built on its deep expertise in creating high-performance components, including critical airframe and engine parts, as well as advanced fastening systems. For instance, in 2023, Howmet reported approximately $5.7 billion in revenue, with a significant portion driven by these specialized aerospace applications, underscoring its substantial market penetration and competitive edge.

Howmet Aerospace has showcased exceptional financial performance, marked by substantial revenue expansion and record profitability. In 2024, the company achieved a notable 12% revenue increase, reaching approximately $7.4 billion, while its adjusted EBITDA surpassed $1.9 billion, setting a new all-time high.

This robust financial health is further underscored by strong free cash flow generation, enabling significant returns to shareholders. Howmet's commitment to enhancing shareholder value is evident through its active share repurchase programs and consistent increases in dividend payouts.

Howmet Aerospace boasts a highly diversified product range, encompassing engine components, fastening systems, engineered structures, and forged wheels. This broad offering caters to crucial sectors like aerospace, defense, and commercial transportation, demonstrating significant market reach.

These products are not merely components; they are mission-critical, directly contributing to lighter, more fuel-efficient aircraft and vehicles. Their essential role in ensuring safety and peak performance in challenging environments underscores their value.

For instance, in 2023, Howmet Aerospace reported total revenue of $5.7 billion, with its Engine Products segment alone generating $2.8 billion, highlighting the strength of its core offerings. This diversification strategy significantly mitigates risks associated with over-reliance on any single market segment.

Innovation and Technological Expertise

Howmet Aerospace's commitment to innovation and technological prowess is a significant strength. The company consistently invests in research and development, driving advancements in areas like precision casting and additive manufacturing. This focus allows Howmet to create highly specialized components crucial for demanding industries.

Their expertise in these advanced manufacturing techniques translates into tangible benefits for their customers. For instance, Howmet's development of lighter, more durable aerospace components directly supports sustainability goals by improving fuel efficiency and reducing emissions. This technological leadership positions them well for future growth, especially as the aerospace industry increasingly prioritizes these attributes.

- R&D Investment: Howmet Aerospace allocated $524 million to research and development in 2023, underscoring its dedication to technological advancement.

- Additive Manufacturing: The company has expanded its additive manufacturing capabilities, producing complex engine parts and demonstrating its forward-thinking approach to component production.

- Precision Casting: Howmet remains a leader in vacuum casting and other precision casting technologies, essential for creating high-performance aerospace engine parts.

Strong Position in Growing Aerospace and Defense Markets

Howmet Aerospace holds a robust standing within the expanding aerospace and defense industries. The company is strategically placed to capitalize on increasing demand across both commercial aviation and defense segments. This strength is evidenced by their performance, with notable growth in engine spare parts and support for new aircraft production. Furthermore, a significant driver of this segment's success is the elevated defense spending, especially for critical platforms such as the F-35 fighter jet.

Key indicators of this strong market position include:

- Growing Commercial Aerospace Demand: Howmet benefits from the ongoing recovery and expansion in commercial air travel, translating to higher demand for new aircraft components and aftermarket services.

- Increased Defense Spending: The company's involvement in key defense programs like the F-35 provides a stable revenue stream, bolstered by global defense modernization efforts.

- Engine Spares and Aftermarket Services: A substantial portion of Howmet's growth in 2024 and projected into 2025 comes from the robust aftermarket for jet engines, indicating a healthy installed fleet requiring maintenance and parts.

- New Aircraft Production Backlogs: The substantial order backlogs held by major aircraft manufacturers like Boeing and Airbus directly translate into sustained demand for Howmet's specialized components.

Howmet Aerospace's market leadership is a significant strength, particularly in the demanding aerospace and defense sectors. This is built on deep expertise in high-performance components, evidenced by their substantial revenue, with $5.7 billion reported in 2023, and a strong presence in critical airframe and engine parts.

The company's diversified product portfolio, including engine components and fastening systems, caters to essential sectors like aerospace and defense, mitigating single-market risks. This broad offering is crucial, with their Engine Products segment alone generating $2.8 billion in 2023.

Howmet's commitment to innovation, backed by a $524 million R&D investment in 2023, drives advancements in areas like additive manufacturing and precision casting. This technological edge allows them to produce lighter, more efficient components vital for the evolving aerospace industry.

Their strong position in growing aerospace and defense markets is a key advantage, benefiting from increased defense spending and commercial aviation recovery. For instance, demand for engine spares and support for new aircraft production, including platforms like the F-35, fuels their growth.

What is included in the product

Delivers a strategic overview of Howmet Aerospace’s internal and external business factors, highlighting its strengths in advanced manufacturing and market position against potential threats from supply chain disruptions and competition.

Uncovers critical market vulnerabilities and competitive advantages for proactive risk mitigation.

Identifies actionable opportunities and internal weaknesses to optimize resource allocation and strategic focus.

Weaknesses

Howmet Aerospace's Commercial Transportation segment is susceptible to economic slowdowns, as evidenced by recent revenue declines. This sector faced challenging market conditions in 2023, impacting its overall contribution to the company's performance. The volatility in commercial transportation contrasts sharply with the robust growth seen in aerospace, presenting a potential risk if these negative trends persist or worsen.

Howmet Aerospace, like many in the aerospace and defense sector, continues to face significant headwinds from ongoing supply chain disruptions and production constraints. These issues, which have persisted through 2024 and are expected to continue into 2025, manifest as parts shortages and bottlenecks that directly limit output. For instance, the industry-wide shortage of skilled labor and raw materials has directly impacted the ability of manufacturers to scale production to meet the robust demand signaled by substantial order backlogs.

These constraints create a tangible risk for Howmet, potentially delaying customer production timelines and hindering its capacity to fully capitalize on its strong order book. While Howmet reported a substantial backlog in its 2024 financial updates, the inability to secure necessary components or maintain consistent production flow due to these external factors can stifle growth and impact revenue realization, even with high demand.

Howmet Aerospace's deep ties to major aerospace manufacturers like Boeing and Lockheed Martin, supplying critical components, represent a significant concentration risk. This reliance means that shifts in demand or production schedules from these key clients, such as potential impacts on Boeing's 737 MAX output, can directly affect Howmet's revenue streams.

Talent Attraction and Retention Challenges

Howmet Aerospace, like many in the aerospace and defense sector, grapples with attracting and retaining top engineering and manufacturing talent. This is a significant hurdle, especially as the company anticipates revenue growth. For instance, in early 2024, the U.S. Bureau of Labor Statistics reported a continued shortage of skilled manufacturing workers nationwide, a trend impacting specialized fields like aerospace components.

To capitalize on projected revenue increases, Howmet might need to onboard a substantial number of new employees. However, if this expansion isn't met with efficient integration and management, it could strain operational leverage. This means the cost of supporting these additional workers might outpace the revenue they generate, potentially impacting profit margins negatively.

- Persistent industry-wide shortage of skilled aerospace engineers and technicians.

- Increased labor costs associated with attracting and retaining specialized talent.

- Potential for reduced operational leverage if new hires are not productivity-efficient quickly.

- Risk of margin compression due to higher onboarding and training expenses.

Exposure to Geopolitical and Economic Uncertainties

Howmet Aerospace is susceptible to global economic downturns and geopolitical instability. These external forces can lead to fluctuating demand for its aerospace products and services, potentially impacting revenue streams. For instance, heightened trade tensions or unexpected conflicts could disrupt international supply chains, increasing material costs and delivery times, as seen with supply chain disruptions in 2022 impacting various manufacturing sectors.

The company's reliance on a global customer base and manufacturing footprint means it's exposed to currency fluctuations and varying regulatory environments. Tariffs and trade barriers, which have been a recurring theme in global trade discussions, can directly affect the cost of goods sold and the competitiveness of Howmet's offerings in different markets. This necessitates agile strategic planning to navigate these complexities and mitigate potential financial impacts.

- Global Economic Volatility: A slowdown in global GDP growth, projected by the IMF to be around 2.9% in 2024, can dampen airline passenger and cargo demand, directly affecting Howmet's commercial aerospace segment.

- Geopolitical Tensions: Ongoing conflicts or emerging geopolitical flashpoints can disrupt air travel, impact defense spending priorities, and create supply chain vulnerabilities, as evidenced by the impact of the Russia-Ukraine conflict on energy and raw material prices.

- Trade Policy Uncertainty: Shifting trade policies and the potential for new tariffs can increase the cost of imported components and exported finished goods, impacting Howmet's profitability and pricing strategies.

Howmet Aerospace's reliance on a few key customers, such as Boeing and Lockheed Martin, creates a significant concentration risk. A downturn or production issues with these major clients could directly impact Howmet's revenue, as demonstrated by the ongoing challenges faced by Boeing in 2024. This dependency limits Howmet's flexibility and exposes it to the specific market dynamics of its largest partners.

What You See Is What You Get

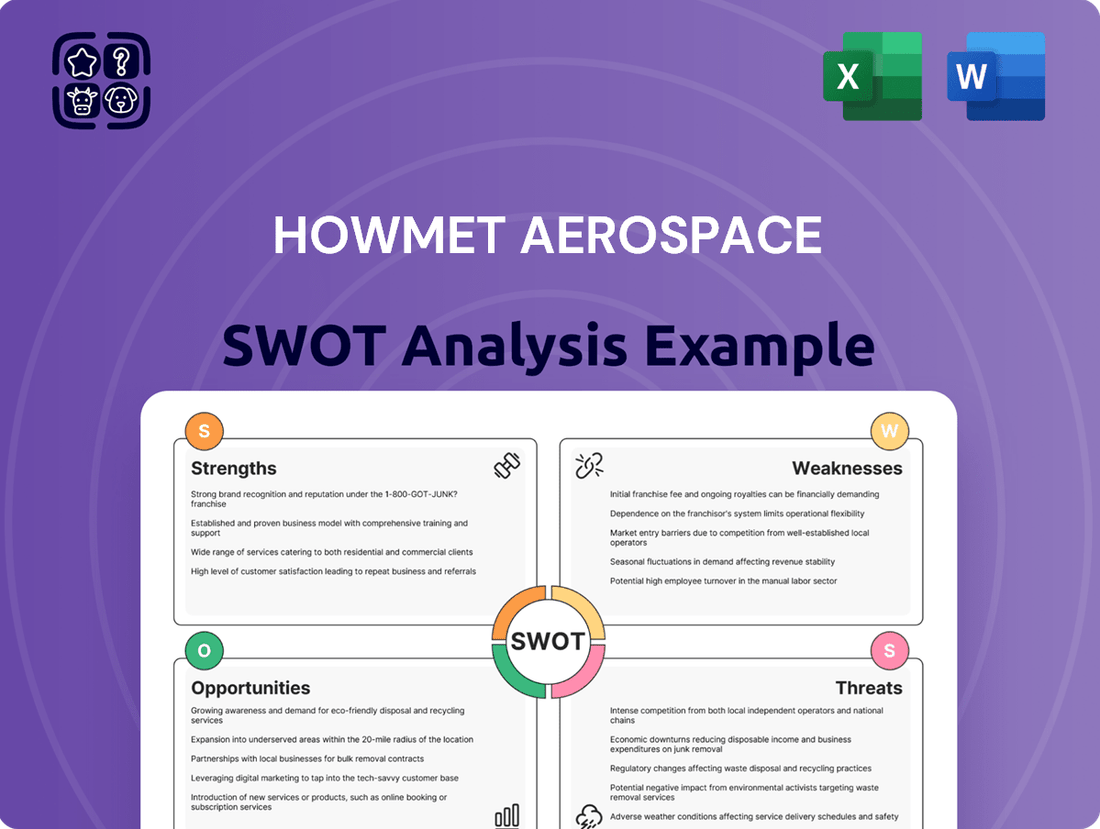

Howmet Aerospace SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Howmet Aerospace's Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to see detailed insights into Howmet Aerospace's competitive landscape and strategic positioning.

Opportunities

The global aviation industry's push for sustainability is fueling a surge in demand for fuel-efficient aircraft. This trend directly benefits manufacturers like Howmet Aerospace, whose advanced components contribute to improved fuel economy. For instance, Boeing's 2024 order backlog includes a significant number of fuel-efficient models like the 737 MAX and 787 Dreamliner, showcasing this market shift.

Beyond new aircraft, the aftermarket for spares and repairs is experiencing robust growth as airlines extend the operational life of their existing fleets. This creates a consistent revenue stream for Howmet, as older aircraft still require maintenance and component replacements. The International Air Transport Association (IATA) projected global air cargo revenue to reach $138 billion in 2024, indicating continued activity and demand for aircraft services.

The ongoing emphasis on defense priorities, bolstered by increasing global defense expenditures, presents a significant avenue for expansion. For instance, in 2023, global military spending reached an estimated $2.4 trillion, a 9% increase from 2022, marking the ninth consecutive year of growth.

Key programs such as the F-35 fighter jet and broader military modernization initiatives are fueling demand for Howmet's specialized defense aerospace components. This sustained government investment directly translates into potential new contract awards and increased order volumes for the company.

Howmet Aerospace is strategically targeting expansion beyond its core aerospace business, with a keen eye on industrial markets. This includes significant anticipated growth in sectors like oil and gas and industrial gas turbines.

A key driver for this industrial expansion is the booming demand for data centers, which require substantial power generation. This presents Howmet with a substantial opportunity to diversify its revenue streams and tap into new, high-growth markets.

For instance, the industrial gas turbine market is projected to see robust growth, with some estimates placing its value in the tens of billions of dollars annually, and a compound annual growth rate (CAGR) in the mid-single digits through the early 2030s. This growth is directly linked to the increasing need for reliable power solutions, especially for energy-intensive operations like data centers.

Leveraging Advanced Manufacturing Technologies and Innovation

Howmet Aerospace can significantly boost its competitive edge by further integrating cutting-edge manufacturing techniques like additive manufacturing and its expertise in advanced materials. This strategic push enables the development of pioneering products that push the boundaries of performance.

The company's commitment to technological advancement directly translates into components that are not only lighter but also contribute to improved fuel efficiency and enhanced sustainability. This aligns perfectly with the increasing demands from customers and the broader aerospace industry for greener and more efficient solutions.

For instance, Howmet's investment in additive manufacturing, also known as 3D printing, has already yielded tangible benefits. In 2023, the company reported that additive manufacturing contributed to a significant reduction in lead times for certain complex parts, with some production cycles shortened by as much as 50%. This technological prowess allows Howmet to respond more agilely to market shifts and customer requirements.

- Additive Manufacturing Integration: Expanding the use of 3D printing for complex engine components, reducing material waste and production time.

- Advanced Materials Development: Continued research and application of novel alloys and composites to create lighter, stronger, and more heat-resistant aerospace parts.

- Sustainability Focus: Developing components that contribute to reduced aircraft emissions and improved fuel economy, aligning with global environmental goals.

- Next-Generation Product Innovation: Leveraging these technologies to secure contracts for future aircraft programs requiring advanced material solutions and intricate designs.

Strategic Investments and Shareholder Value Enhancement

Howmet Aerospace's robust financial health, evidenced by its strong cash flow generation, positions it well for strategic investments. This financial flexibility allows for significant capital expenditures aimed at driving future growth, alongside the potential for opportunistic acquisitions that could expand its market reach or technological capabilities.

The company actively pursues shareholder value enhancement through disciplined capital allocation. This includes ongoing share repurchase programs, which can reduce the number of outstanding shares and increase earnings per share, as well as consistent dividend increases, making the stock more attractive to income-focused investors.

- Financial Strength: Howmet Aerospace reported significant free cash flow in recent periods, enabling reinvestment and shareholder returns. For instance, in the first quarter of 2024, the company generated substantial free cash flow, exceeding analyst expectations.

- Shareholder Returns: The company has a history of returning capital to shareholders, with planned increases in dividend payouts and continued authorization for share buybacks, reflecting confidence in its long-term prospects.

- Strategic Growth: Investments in advanced manufacturing technologies and product development are key priorities, ensuring Howmet remains at the forefront of the aerospace industry.

Howmet Aerospace is well-positioned to capitalize on the increasing demand for fuel-efficient aircraft, a trend driven by the global aviation industry's sustainability push. The company's advanced components directly contribute to improved fuel economy, a key selling point for manufacturers like Boeing, which saw substantial orders for fuel-efficient models in 2024. Furthermore, the aftermarket for aircraft spares and repairs is experiencing robust growth, providing Howmet with a steady revenue stream as airlines extend the operational life of their existing fleets, supported by continued global air cargo activity.

The company's strategic diversification into industrial markets, particularly for power generation solutions like industrial gas turbines, presents a significant growth opportunity. This expansion is fueled by the burgeoning demand for data centers, which require substantial and reliable power. The industrial gas turbine market is projected to grow substantially in the coming years, with estimates suggesting tens of billions in annual value and mid-single-digit CAGR through the early 2030s, directly benefiting Howmet's industrial segment.

Howmet's commitment to integrating advanced manufacturing techniques, such as additive manufacturing, and its expertise in novel materials are key differentiators. This technological focus allows for the creation of lighter, more efficient, and higher-performing components, aligning with industry demands for sustainability and innovation. For instance, Howmet's additive manufacturing capabilities in 2023 led to a notable reduction in lead times for complex parts, with some production cycles cut by up to 50%, showcasing its agile response to market needs.

The company's strong financial health, characterized by robust cash flow generation, enables strategic investments in growth initiatives and potential acquisitions. This financial flexibility supports Howmet's ongoing shareholder value enhancement through share repurchases and consistent dividend increases, reflecting confidence in its long-term prospects and market position.

Threats

The aerospace and defense industry is inherently competitive, with established players and emerging companies constantly vying for market share. Howmet Aerospace faces the ongoing threat of new product introductions and disruptive technologies that could reshape the landscape, as seen with advancements in additive manufacturing and sustainable aviation fuels impacting traditional component designs.

To maintain its position, Howmet must prioritize continuous innovation, investing heavily in research and development to preserve its technological leadership. Failure to do so risks market share erosion as competitors leverage new capabilities, potentially impacting Howmet's revenue streams, which saw approximately $5.7 billion in sales for the fiscal year ending December 31, 2023.

A significant threat to Howmet Aerospace lies in the potential deterioration of global economic conditions, which could directly dampen demand for air travel. Should economic downturns occur, airlines might scale back on new aircraft orders and reduce spending on maintenance and repairs, impacting Howmet's commercial aerospace segment. For instance, the International Air Transport Association (IATA) projected in late 2023 that global airline industry net profits could reach $25.7 billion in 2024, a notable improvement, but this figure remains vulnerable to macroeconomic shocks.

Unexpected declines in air travel demand, perhaps triggered by geopolitical events or health crises, present another substantial risk. While the aerospace market has shown resilience and a strong recovery post-pandemic, a sudden slump in passenger numbers could lead to airlines deferring or canceling aircraft deliveries. This directly affects Howmet's order book and revenue streams, as seen in the volatility experienced during the COVID-19 pandemic, which saw a drastic reduction in global air traffic.

Regulatory shifts, such as evolving trade policies and environmental mandates, present significant compliance challenges for Howmet Aerospace's international footprint. For instance, the United States' renewed focus on supply chain security, particularly concerning critical minerals and advanced manufacturing, could necessitate adjustments to Howmet's sourcing strategies. Failure to adapt to these changes, including new tax laws or sanctions, can lead to operational disruptions and financial penalties.

Navigating the complexities of government contracting regulations remains a critical area of focus. Howmet, as a key supplier to defense and aerospace sectors, must ensure strict adherence to the Federal Acquisition Regulation (FAR) and other defense-specific compliance standards. In 2023, the U.S. Department of Defense continued to emphasize cybersecurity compliance for its contractors, a trend expected to intensify in 2024 and 2025, potentially requiring further investment in IT infrastructure and security protocols.

Supply Chain Vulnerabilities and Cost Increases

Persistent supply chain fragilities continue to pose a significant threat to Howmet Aerospace. Parts shortages and the potential for increased raw material costs are ongoing concerns that can directly impact production efficiency and overall financial performance.

These vulnerabilities can translate into higher manufacturing expenses, potentially delaying crucial delivery schedules for clients. Even with proactive mitigation strategies in place, the unpredictable nature of global supply chains in 2024 and into 2025 means profitability could be squeezed by these external pressures.

- Supply chain disruptions: Continued global economic uncertainty and geopolitical events can exacerbate shortages of critical components.

- Rising input costs: Inflationary pressures on metals, energy, and specialized alloys directly increase Howmet's cost of goods sold.

- Delivery schedule impacts: Delays in receiving necessary materials can cascade into missed customer deadlines, affecting revenue and reputation.

Geopolitical Instabilities and Trade Tensions

Geopolitical instabilities, including ongoing conflicts and escalating trade tensions, present a significant threat to Howmet Aerospace's global supply chain and customer base. Disruptions in key manufacturing regions or trade routes can directly impact production schedules and increase logistics costs.

For instance, the ongoing geopolitical landscape in Eastern Europe and the Middle East, which saw significant military actions and trade sanctions in 2024, highlights the potential for unforeseen impacts on raw material sourcing and the delivery of finished aerospace components. These events can lead to volatile pricing for critical materials like titanium and aluminum, directly affecting Howmet's cost of goods sold.

- Supply Chain Vulnerability: Exposure to regions experiencing political unrest or trade disputes can interrupt the flow of essential raw materials and components.

- Customer Demand Fluctuations: Geopolitical events can dampen global economic sentiment, leading to reduced airline passenger traffic and, consequently, lower demand for new aircraft and aftermarket services, impacting Howmet's order book.

- Increased Operational Costs: Navigating sanctions, tariffs, and security concerns in unstable regions can necessitate higher insurance premiums, security measures, and alternative sourcing strategies, all contributing to elevated operational expenses.

Howmet Aerospace faces intense competition, with rivals introducing innovative products and technologies like additive manufacturing, which could challenge its market position. The company's revenue of approximately $5.7 billion in fiscal year 2023 underscores the need for continuous R&D investment to maintain its edge against competitors leveraging new capabilities.

Economic downturns and geopolitical instability pose significant threats, potentially reducing air travel demand and airline spending on new aircraft and maintenance. For example, while the IATA projected a $25.7 billion net profit for the global airline industry in 2024, this outlook remains sensitive to macroeconomic shocks and sudden shifts in travel patterns.

Regulatory changes, including evolving trade policies and stricter environmental mandates, add compliance burdens and could necessitate costly adjustments to Howmet's global operations and sourcing strategies, particularly concerning supply chain security for critical materials.

SWOT Analysis Data Sources

This Howmet Aerospace SWOT analysis is built upon a foundation of robust data, including audited financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a clear and accurate picture of the company's internal capabilities and external environment.