Howmet Aerospace PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Unlock the strategic forces shaping Howmet Aerospace's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements and environmental regulations, understand the critical external factors impacting its operations and future growth. Gain a competitive advantage by leveraging these actionable insights to refine your market strategy. Download the full PESTLE analysis now for a deeper understanding and to make more informed decisions.

Political factors

Howmet Aerospace, a key supplier to the defense sector, is significantly influenced by global defense budgets and governmental spending priorities. The escalating geopolitical landscape and ongoing military modernization efforts worldwide have spurred a notable increase in defense expenditures throughout 2024, with projections indicating this trend will persist into 2025.

This sustained commitment to defense investment, especially in advanced technologies such as next-generation fighter aircraft, unmanned aerial vehicles, and sophisticated space surveillance systems, directly translates into heightened demand for Howmet's specialized components and integrated solutions.

Changes in international trade policies, particularly the imposition of tariffs, directly impact Howmet Aerospace's global supply chain and operational costs. The aerospace sector relies on intricate, cross-border sourcing for raw materials and specialized components, meaning tariffs on these inputs can inflate manufacturing expenses and squeeze profit margins.

The effects of tariffs announced in early 2025 are still unfolding, but initial analyses suggest they will exacerbate existing challenges in supply chain recovery. For instance, a 10% tariff on titanium, a critical material for aerospace manufacturing, could add millions to Howmet's raw material expenditure in 2025, impacting its competitive pricing and delivery schedules.

The aerospace sector operates under a stringent regulatory framework, making shifts in aviation rules and certification requirements a direct determinant of Howmet Aerospace's product innovation and market entry. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) continually update safety directives, impacting everything from material specifications to manufacturing tolerances.

Emerging aviation technologies present new regulatory hurdles. Stricter safety mandates for Urban Air Mobility (UAM) vehicles and the certification pathways for electric and hybrid propulsion systems, alongside evolving standards for autonomous flight controls, necessitate significant adaptation in Howmet's engineering and production methodologies. This is crucial as the global UAM market is projected to reach $16.7 billion by 2028, according to Statista.

Government Support for Sustainable Aviation

Government support for sustainable aviation is a significant political factor influencing Howmet Aerospace. Initiatives and mandates promoting sustainable aviation fuels (SAFs) and eco-friendly aircraft designs create substantial opportunities for the company. For instance, the EU's Refuel Aviation Regulation and the UK Sustainable Aviation Fuel (SAF) Mandate, effective from January 2025, stipulate increased SAF blending. This regulatory push directly fuels demand for more fuel-efficient components and advanced materials, areas where Howmet Aerospace holds expertise.

These policy shifts are designed to decarbonize the aviation sector, a critical global challenge. By 2030, the EU aims for a minimum SAF blend of 6%, with a further increase to 70% by 2050, creating a predictable market for sustainable solutions. Similarly, the UK's mandate requires at least 10% SAF to be used by 2030. Such government-driven targets translate into tangible business prospects for Howmet, particularly in developing lightweight, high-performance materials that reduce aircraft weight and, consequently, fuel consumption.

- EU Refuel Aviation Regulation: Mandates increasing SAF blending, driving demand for fuel-efficient components.

- UK SAF Mandate (Jan 2025): Requires a minimum 10% SAF blend by 2030, signaling a strong market signal.

- Government Investment in R&D: Many governments are also funding research into new sustainable aviation technologies, potentially benefiting Howmet's innovation pipeline.

Geopolitical Stability and Conflicts

Global geopolitical stability, or the lack thereof, significantly impacts Howmet Aerospace's business, particularly its defense segment. Ongoing conflicts, such as those in Eastern Europe and the Middle East, can spur increased demand for military aircraft components and systems. For instance, in 2023, global military expenditure reached an estimated $2.44 trillion, a 6.8% increase in real terms from 2022, marking the ninth consecutive year of growth, according to the Stockholm International Peace Research Institute (SIPRI). This heightened defense spending environment directly benefits Howmet, a key supplier to major defense contractors.

However, these same conflicts introduce considerable operational risks. Supply chains for critical raw materials like titanium and specialty alloys can be disrupted, leading to price volatility and availability issues. Transportation routes may become less secure or more costly, affecting both inbound logistics for raw materials and outbound delivery of finished goods. Furthermore, market access can be complicated by sanctions, trade restrictions, or shifts in international alliances, creating a complex operating landscape for Howmet.

Howmet's ability to manage these geopolitical uncertainties is paramount. The company's diversified customer base across commercial aerospace and defense, coupled with its robust supply chain management strategies, are vital for maintaining operational stability. For example, Howmet's strong relationships with key aerospace manufacturers like Boeing and Airbus, alongside its significant presence in the defense sector, provide a degree of insulation. Navigating these volatile conditions requires agile strategic planning and a keen understanding of evolving global security dynamics.

- Global military expenditure reached $2.44 trillion in 2023, up 6.8% from 2022, according to SIPRI.

- Geopolitical instability can disrupt supply chains for critical materials like titanium.

- Howmet's diversified customer base in commercial and defense aerospace aids in managing risks.

- Transportation security and market access are directly affected by ongoing global conflicts.

Howmet Aerospace's performance is intricately linked to government defense spending, which saw a 6.8% real increase globally in 2023, reaching $2.44 trillion. This trend is expected to continue into 2024 and 2025, driven by geopolitical tensions and military modernization, directly benefiting Howmet's defense segment.

International trade policies and tariffs pose significant challenges, with potential tariffs on key materials like titanium in 2025 threatening to increase manufacturing costs. Regulatory shifts, particularly in aviation safety and sustainable aviation fuels (SAFs), also shape the market, with mandates like the UK's SAF requirement for 10% blend by 2030 creating opportunities for advanced materials.

Government support for sustainable aviation, including SAF mandates in the EU and UK, is a key driver for Howmet. These policies aim to decarbonize aviation, with the EU targeting a 6% SAF blend by 2030, directly boosting demand for fuel-efficient components and lightweight materials.

Geopolitical instability, while increasing defense demand, also introduces supply chain risks and transportation challenges. Howmet's diversified customer base and robust supply chain management are crucial for navigating these volatile conditions and maintaining operational stability.

| Political Factor | Impact on Howmet Aerospace | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Defense Spending | Increased demand for defense components | Global military expenditure grew 6.8% in 2023 to $2.44 trillion (SIPRI). Expected continued growth in 2024-2025. |

| Trade Policies/Tariffs | Higher manufacturing costs, supply chain disruption | Potential 2025 tariffs on critical materials like titanium could increase raw material expenditure. |

| Aviation Regulations | Demand for sustainable solutions, innovation in safety | EU Refuel Aviation Regulation and UK SAF Mandate (Jan 2025) drive demand for fuel-efficient components. |

| Geopolitical Instability | Increased defense demand but also supply chain risks | Disruptions to titanium and alloy supply chains, transportation security concerns. |

What is included in the product

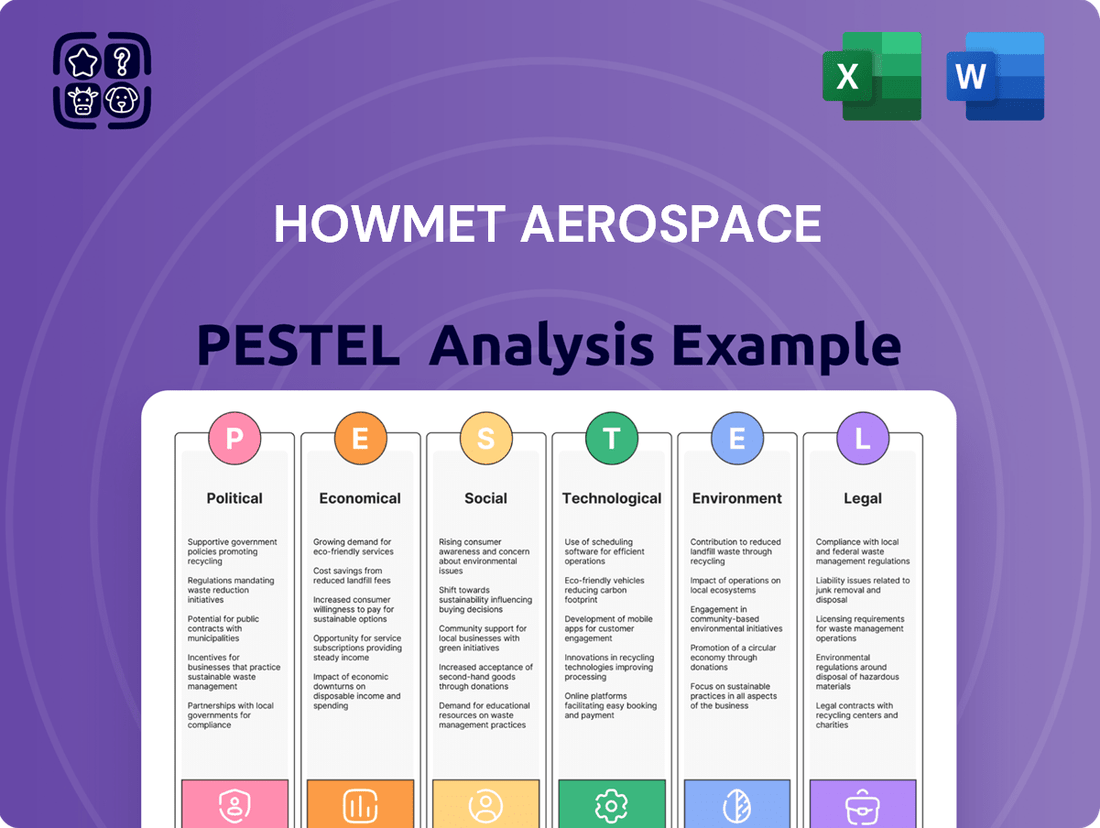

This Howmet Aerospace PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors create both threats and opportunities for the company.

It provides actionable insights for strategic decision-making, enabling proactive adaptation to evolving market and regulatory landscapes.

A Howmet Aerospace PESTLE analysis provides a structured framework to identify and understand external factors impacting the aerospace industry, thereby relieving the pain point of navigating complex market dynamics and enabling more informed strategic decisions.

Economic factors

Howmet Aerospace's commercial aerospace business is intrinsically linked to the health of the global economy and how much people are flying. When economies are strong, travel tends to increase, which is good for aircraft manufacturers and their suppliers like Howmet.

The air travel sector saw a significant recovery in 2024, with passenger traffic in some regions already exceeding 2019 levels. This surge is prompting airlines to ramp up their aircraft orders and expand their fleets, directly benefiting Howmet's demand for critical components.

This robust demand translates into more orders for Howmet's essential parts, including airframe structures, engine components, and fastening systems. For instance, by mid-2024, major aircraft manufacturers reported substantial order backlogs, indicating sustained production growth for the foreseeable future.

Persistent supply chain inefficiencies, such as shortages of critical components and labor disruptions, continue to challenge the aerospace industry. These issues can lead to extended lead times, production delays, and elevated operating costs for Howmet Aerospace. For instance, in 2023, the aerospace sector experienced significant delays in component deliveries, impacting production schedules for major aircraft manufacturers.

These disruptions directly translate to higher operating expenses for Howmet Aerospace, as they navigate increased freight costs and the need for expedited shipping. The company, like its peers, is actively pursuing strategies such as localized sourcing and supply chain diversification to build resilience and mitigate these ongoing risks.

The cost and availability of key raw materials like aluminum and titanium are critical economic considerations for Howmet Aerospace. These materials are fundamental to its manufacturing operations, making the company susceptible to price swings in global commodity markets.

For instance, aluminum prices saw significant volatility in 2024, influenced by factors such as global supply chain disruptions and energy costs. Similarly, titanium prices, while generally more stable, can be impacted by geopolitical events and demand from other high-consumption sectors like defense and medical devices.

These fluctuations directly affect Howmet's production costs and, consequently, its profit margins. While the company may have mechanisms to pass some increased material costs to customers, the overall volatility presents an ongoing economic challenge that requires careful management of procurement and inventory.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Howmet Aerospace's cost of capital and strategic investment choices. For instance, a rising rate environment could make borrowing for new projects, like expanding manufacturing facilities, more expensive. Conversely, favorable market conditions can lower borrowing costs, enabling more aggressive growth strategies.

Howmet's financial health, evidenced by its investment-grade credit rating, positions it well to navigate varying economic climates and secure necessary capital. The company's strategic focus on debt reduction further enhances its flexibility in accessing funds for critical initiatives, such as increasing production capacity to meet growing aerospace demand.

- Debt Management: Howmet Aerospace has been actively working to reduce its outstanding debt, demonstrating a commitment to financial prudence.

- Investment Grade Rating: Maintaining an investment-grade credit rating provides Howmet with favorable access to capital markets and lower borrowing costs.

- Capital Access for Growth: The company's ability to secure capital is crucial for funding expansion projects, technological advancements, and potential acquisitions within the aerospace sector.

- Interest Rate Sensitivity: Changes in benchmark interest rates, such as those set by the Federal Reserve, can directly influence the cost of Howmet's debt financing and the attractiveness of capital investments.

Commercial Transportation Market Performance

Howmet Aerospace's commercial transportation segment, notably its forged wheels business, is sensitive to broader economic conditions impacting the trucking and logistics sectors. These industries often see reduced demand during economic slowdowns, directly affecting Howmet's sales volumes in this area.

In 2024, the commercial transportation market experienced a noticeable downturn in volumes. For instance, North American Class 8 truck orders, a key indicator for this segment, saw significant fluctuations, with some months reporting year-over-year declines. This trend underscores the challenges Howmet faces in managing this part of its business.

- Trucking Industry Demand: Economic slowdowns often lead to reduced freight volumes, impacting new truck purchases and aftermarket demand for components like forged wheels.

- Economic Indicators: Key economic indicators such as GDP growth, inflation rates, and consumer spending directly influence the health of the commercial transportation market.

- Fleet Modernization Cycles: The timing of fleet upgrades and replacements by transportation companies plays a crucial role in demand for new components.

- Supply Chain Disruptions: Lingering supply chain issues can also affect production and delivery, impacting market performance.

The aerospace industry's recovery, particularly in commercial aviation, is a significant economic driver for Howmet Aerospace. Passenger traffic in 2024 saw strong rebounds, with some regions surpassing pre-pandemic levels, leading to increased aircraft orders and a backlog for manufacturers like Boeing and Airbus. This translates directly to higher demand for Howmet's critical components.

However, persistent global supply chain issues, including component shortages and labor availability, continue to pose economic challenges. These disruptions can lead to production delays and increased operational costs for Howmet, as seen with extended lead times for essential parts throughout 2023 and into 2024.

Commodity prices for key materials like aluminum and titanium are also critical economic factors. Volatility in aluminum prices during 2024, influenced by energy costs and supply chain disruptions, directly impacts Howmet's production expenses and profit margins, necessitating careful procurement strategies.

| Economic Factor | Impact on Howmet Aerospace | 2024/2025 Relevance |

| Global Economic Growth & Air Travel Demand | Increased travel boosts aircraft orders and demand for components. | Strong recovery in passenger traffic in 2024 exceeded 2019 levels in some regions, driving order backlogs. |

| Supply Chain Disruptions | Shortages and delays increase costs and production lead times. | Ongoing issues in 2023-2024 led to extended lead times and higher operating expenses for component manufacturers. |

| Commodity Prices (Aluminum, Titanium) | Price fluctuations affect raw material costs and profit margins. | Aluminum prices showed significant volatility in 2024 due to energy costs and supply chain issues. |

| Interest Rates | Affects cost of capital for investments and debt financing. | Rising rates can increase borrowing costs for expansion; stable or falling rates offer more flexibility. |

Same Document Delivered

Howmet Aerospace PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Howmet Aerospace PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a strategic understanding of the external forces shaping its operations and future growth.

Sociological factors

The aerospace and defense sector, including companies like Howmet Aerospace, continues to grapple with a significant skills gap, affecting both production capacity and the pace of innovation. This shortage is particularly acute in specialized areas like advanced manufacturing and engineering. For instance, a 2024 report highlighted that over 60% of aerospace manufacturers identified a lack of skilled labor as a primary challenge.

Howmet Aerospace, a key player in producing complex engineered components for aircraft engines, airframes, and defense systems, fundamentally depends on a highly skilled workforce. The ability to maintain and grow its market position is directly tied to the availability of engineers, machinists, and technicians with expertise in cutting-edge materials and processes.

In response, the industry is actively investing in and expanding vocational training programs and forging stronger partnerships with universities and technical colleges. These initiatives aim to cultivate the next generation of talent, bridging the gap between academic learning and the practical demands of advanced aerospace manufacturing, with a focus on areas like additive manufacturing and digital engineering.

Howmet Aerospace's dedication to employee health, safety, and overall well-being significantly impacts its workforce. A strong focus here boosts morale, enhances productivity, and helps keep talented individuals with the company. This commitment is a critical sociological element for any organization.

The company has established comprehensive health and safety policies to protect its employees. Furthermore, Howmet Aerospace is introducing a Parental Leave program in 2025, a move that directly supports the well-being and work-life balance of its employees, reflecting a growing societal expectation for such benefits.

Societal expectations and regulatory trends are increasingly pushing corporations to prioritize Diversity, Equity, and Inclusion (DEI). Howmet Aerospace's commitment to these principles, as detailed in its 2024 ESG reports, is crucial for its reputation and talent acquisition.

By fostering an environment that values employee differences and supports their career growth, Howmet Aerospace can attract a broader range of skilled individuals. This focus on DEI not only enhances the company's image but also strengthens its ability to innovate and connect with a diverse customer base.

Community Engagement and Social Impact

Howmet Aerospace actively engages with the communities where it has a presence. This engagement often takes the form of employee volunteering initiatives and support through the Howmet Aerospace Foundation. For instance, in 2023, Howmet employees dedicated thousands of hours to community service, supporting various causes. These efforts are crucial for maintaining the company's social license to operate and bolstering its image as a responsible corporate entity.

The company's commitment to social impact extends beyond volunteering. Howmet's foundation plays a vital role in supporting educational programs and local development. In 2024, the foundation allocated over $5 million to STEM education and workforce development projects across its key operating regions, directly impacting thousands of students and communities.

- Community Investment: Howmet Aerospace's foundation contributed $5.3 million to community programs in 2023, focusing on STEM education and local economic development.

- Employee Volunteerism: Over 7,500 Howmet employees participated in community service events in 2023, contributing an estimated 30,000 volunteer hours.

- Reputation Enhancement: Strong community ties and philanthropic activities positively influence Howmet's brand perception, attracting talent and fostering customer loyalty.

Consumer and Public Perception of Aviation

Public perception significantly influences the aviation sector, and by extension, companies like Howmet Aerospace. A strong public trust in air travel's safety and reliability is paramount for sustained demand. For instance, the International Air Transport Association (IATA) reported that global air passenger traffic reached 94.5% of pre-pandemic levels in 2024, indicating a robust recovery and positive public sentiment towards flying.

Environmental concerns are also a growing factor in public perception. As awareness of climate change increases, so does scrutiny of the aviation industry's carbon footprint. This can lead to calls for more sustainable practices and technologies, influencing investment and innovation priorities within the aerospace supply chain, which Howmet is a part of.

The overall health and perception of the aviation industry directly impact Howmet Aerospace. A positive public outlook, bolstered by strong passenger traffic growth and a commitment to environmental responsibility, creates a favorable market for aerospace components. Conversely, negative perceptions regarding safety incidents or environmental impact could dampen demand for new aircraft and, consequently, for Howmet's specialized products.

- Positive Public Outlook: A rebound in air travel, with passenger traffic nearing pre-pandemic levels in 2024, signals public confidence and benefits the entire aerospace supply chain.

- Environmental Scrutiny: Growing public concern over aviation's environmental impact drives demand for sustainable technologies and practices.

- Indirect Demand Driver: While not consumer-facing, Howmet's demand is indirectly linked to public perception of aviation's safety, environmental performance, and reliability.

The aerospace industry, including Howmet Aerospace, faces a persistent skills gap, impacting production and innovation. In 2024, over 60% of aerospace manufacturers cited a lack of skilled labor as a major obstacle.

Howmet Aerospace's success hinges on its highly skilled workforce, making talent acquisition and retention critical. The company is actively investing in training programs and university partnerships to develop future talent, particularly in advanced manufacturing areas.

Societal emphasis on Diversity, Equity, and Inclusion (DEI) is shaping corporate practices. Howmet's 2024 ESG reports highlight its commitment to DEI, which is essential for attracting a diverse talent pool and fostering innovation.

Community engagement is also vital for Howmet's social license to operate. In 2023, Howmet employees contributed over 30,000 volunteer hours, and the Howmet Aerospace Foundation allocated $5.3 million to community programs, primarily focusing on STEM education.

| Sociological Factor | Impact on Howmet Aerospace | 2023-2024 Data/Initiatives |

| Skills Gap | Affects production capacity and innovation; requires investment in workforce development. | 60%+ of manufacturers cited skilled labor shortage in 2024; Howmet invests in training and partnerships. |

| Diversity, Equity, and Inclusion (DEI) | Enhances talent acquisition, innovation, and company reputation. | Commitment detailed in 2024 ESG reports; crucial for attracting diverse talent. |

| Community Engagement & Philanthropy | Builds social license to operate and strengthens brand perception. | 7,500+ employees volunteered 30,000+ hours in 2023; $5.3M foundation contribution to community programs. |

Technological factors

Howmet Aerospace's commitment to advanced manufacturing, including additive manufacturing and automation, is a significant technological factor. These techniques are reshaping the aerospace landscape by boosting production efficiency and enabling the creation of intricate, lighter components. For instance, the aerospace industry saw a significant increase in 3D printed parts, with estimates suggesting the market for 3D printed aerospace components could reach $5.5 billion by 2027.

Howmet Aerospace's focus on high-performance products is significantly driven by advancements in lightweight materials. The ongoing development and application of these materials are crucial for creating more fuel-efficient aircraft, a key technological factor influencing the aerospace sector.

These advanced materials directly contribute to reducing the carbon footprint of aviation, aligning with the industry's increasing emphasis on sustainability. For instance, the push for lighter components in 2024 and 2025 is a direct response to regulatory pressures and customer demand for greener operations.

Howmet Aerospace's future hinges on ongoing innovation in jet engine and airframe components. This means developing advanced materials and cooling technologies that allow engines to operate at higher temperatures and pressures. For instance, advancements in ceramic matrix composites (CMCs) are enabling higher operating temperatures, directly contributing to improved fuel efficiency.

These innovations are crucial for supporting the development of next-generation aircraft, including those powered by electric or hydrogen fuel. By enabling greater efficiency and performance, Howmet's component advancements are essential for meeting the evolving demands of the aerospace industry, aiming for a more sustainable future.

Digitalization and Predictive Maintenance

The aerospace sector is rapidly embracing digitalization, with AI and advanced analytics becoming crucial for optimizing manufacturing processes and component lifecycles. For Howmet Aerospace, this translates into enhanced efficiency and reduced downtime through predictive maintenance.

These technological advancements allow for real-time monitoring of component health, predicting potential failures before they occur. This proactive approach is vital in an industry where safety and reliability are paramount.

- AI-driven predictive maintenance can reduce unscheduled downtime by an estimated 20-30% in complex industrial settings.

- Digital twins are increasingly used to simulate component performance under various conditions, aiding in design and maintenance planning.

- Increased automation in manufacturing, powered by AI, is projected to boost productivity by up to 15% in the coming years.

- Cybersecurity remains a critical consideration as more systems become interconnected and data-driven.

Research and Development (R&D) Investment

Howmet Aerospace's dedication to research and development is paramount for its position as a leader in sophisticated engineered solutions. In 2023, the company reported significant investments in R&D, fueling innovation across its key segments.

This ongoing commitment enables Howmet to pioneer new technologies, enhance the performance of its existing product lines, and proactively meet the dynamic demands of the aerospace industry for enhanced safety, efficiency, and performance. The company's R&D efforts are directly tied to its ability to deliver next-generation components and systems.

- R&D Investment: Howmet Aerospace consistently allocates substantial resources to R&D, a key driver of its competitive advantage.

- Innovation Focus: Investments are directed towards developing advanced materials, additive manufacturing techniques, and sustainable aerospace solutions.

- Product Enhancement: R&D activities lead to improved durability, reduced weight, and increased fuel efficiency in their engineered components.

- Future Technologies: The company is actively researching technologies for future aircraft, including those for electric and hybrid-electric propulsion systems.

Technological advancements are reshaping aerospace, with Howmet Aerospace at the forefront of adopting additive manufacturing and automation. These innovations enhance production efficiency and enable the creation of lighter, more complex parts, a trend supported by the 3D printed aerospace components market projected to reach $5.5 billion by 2027.

The company's focus on lightweight materials is critical for improving aircraft fuel efficiency, directly addressing the industry's push for sustainability and reduced carbon footprints. This drive for lighter components is a key focus for 2024 and 2025, influenced by regulatory demands and customer preferences.

Howmet's investment in R&D fuels innovation in jet engine and airframe components, particularly through advanced materials like ceramic matrix composites (CMCs). These materials allow for higher operating temperatures, boosting fuel efficiency and paving the way for next-generation aircraft, including electric and hydrogen-powered models.

Digitalization, including AI and advanced analytics, is optimizing manufacturing and component lifecycles for Howmet, leading to enhanced efficiency and predictive maintenance. This proactive approach is vital for the industry's paramount focus on safety and reliability, with AI-driven predictive maintenance potentially reducing unscheduled downtime by 20-30%.

| Technological Factor | Description | Impact on Howmet Aerospace | Supporting Data/Trend |

| Additive Manufacturing & Automation | Utilizing 3D printing and automated processes | Increased production efficiency, complex part creation | 3D printed aerospace components market projected at $5.5B by 2027 |

| Advanced Lightweight Materials | Development and application of new materials | Improved fuel efficiency, reduced carbon footprint | Key focus for 2024-2025 due to regulatory/customer demand |

| Next-Gen Engine/Airframe Tech | Innovations in materials and cooling for higher operating temperatures | Enhanced fuel efficiency, enabling future aircraft designs | CMCs enable higher operating temperatures |

| Digitalization (AI, Analytics) | Implementing AI and data analytics for optimization | Enhanced efficiency, predictive maintenance, reduced downtime | AI predictive maintenance can cut downtime by 20-30% |

Legal factors

Howmet Aerospace operates under a web of environmental regulations designed to curb emissions and noise pollution, while also pushing for greater fuel efficiency in aviation. These rules are becoming increasingly rigorous, influencing everything from manufacturing processes to the very design of aircraft components.

International bodies such as the International Civil Aviation Organization (ICAO) are at the forefront of this push, setting ambitious targets for emission reductions. For instance, ICAO's CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) aims to stabilize net carbon dioxide emissions from international aviation. This directly impacts Howmet by necessitating innovation in materials and manufacturing to meet these evolving standards and the growing demand for Sustainable Aviation Fuels (SAF).

Howmet Aerospace, as a key supplier for the aerospace sector, operates under intense scrutiny regarding product liability and safety regulations. Failure to meet these stringent standards can lead to severe legal consequences and damage to its reputation.

The company must ensure its components meet rigorous safety and performance benchmarks, crucial for maintaining customer confidence and the airworthiness of aircraft and spacecraft. For instance, in 2023, the aviation industry saw significant investments in safety technology, with global aerospace safety spending projected to increase, underscoring the importance of compliance for companies like Howmet.

Howmet Aerospace's extensive global manufacturing footprint and supply chains mean it must rigorously adhere to international trade laws, export controls, and sanctions. For instance, in 2024, the aerospace sector continues to be heavily scrutinized for compliance with regulations like those from the Wassenaar Arrangement, impacting the export of dual-use technologies.

Geopolitical shifts in 2024 and 2025 present ongoing risks of changing trade dynamics and potential tariff increases. Navigating these complex and often evolving regulatory environments is critical for Howmet to maintain uninterrupted international business and secure its global supply chain operations, as demonstrated by ongoing trade policy reviews in major markets.

Labor Laws and Employment Regulations

Howmet Aerospace, with its substantial global workforce, navigates a complex web of labor laws and employment regulations. These rules, varying by jurisdiction, dictate everything from minimum wages and working hours to crucial aspects like parental leave policies and stringent non-discrimination mandates. Compliance directly influences HR strategies and the company's overall operational expenses.

The company's adherence to these legal frameworks is critical for maintaining its social license to operate and avoiding costly litigation. For instance, in 2024, many countries continued to strengthen regulations around worker safety and fair compensation, directly impacting manufacturing sectors like aerospace. Howmet's proactive approach to understanding and implementing these evolving labor standards is essential for its human capital management.

- Global Compliance: Howmet must adhere to diverse labor laws across its operational sites, affecting everything from hiring practices to employee benefits.

- Wage and Hour Laws: Regulations concerning minimum wage, overtime pay, and working hours are a constant consideration for cost management.

- Non-Discrimination and Equal Opportunity: Legal frameworks prohibiting discrimination based on age, gender, race, and other protected characteristics are paramount in HR policy development.

- Employee Benefits and Leave: Mandates for benefits such as health insurance, retirement plans, and various forms of paid leave, including parental leave, add to operational costs and policy complexity.

Intellectual Property Rights

Protecting its vast array of patents and proprietary technologies is a critical legal consideration for Howmet Aerospace. These intellectual property rights are fundamental to sustaining its edge in sophisticated engineered solutions and deterring any unauthorized replication of its advancements.

For instance, in 2023, Howmet Aerospace reported significant investment in research and development, a key driver for its patent portfolio. The company's commitment to innovation, underscored by its legal protections, allows it to command premium pricing and secure long-term contracts in specialized aerospace and defense markets.

- Patent Portfolio: Howmet Aerospace actively manages and defends a substantial number of patents covering its advanced materials, manufacturing processes, and product designs.

- Competitive Advantage: Strong IP rights allow Howmet to differentiate its offerings and prevent competitors from directly copying its innovative technologies, thereby safeguarding its market position.

- Licensing and Royalties: The company may also leverage its IP through licensing agreements, generating additional revenue streams and expanding the reach of its technologies.

- Enforcement: Legal strategies to enforce these rights against infringement are vital to maintaining the value and exclusivity of Howmet's technological innovations.

Howmet Aerospace must navigate stringent product liability and safety regulations inherent in the aerospace sector. Failure to meet these rigorous standards can result in significant legal repercussions and reputational damage. For example, in 2023, the global aerospace industry saw continued emphasis on safety, with investments in advanced safety technologies increasing, highlighting the critical need for compliance.

The company's global operations necessitate strict adherence to international trade laws, export controls, and sanctions, which are subject to geopolitical shifts. In 2024, regulations like the Wassenaar Arrangement continue to impact the export of dual-use technologies, requiring Howmet to maintain vigilance in its international business practices and supply chain management.

Intellectual property protection is paramount for Howmet, safeguarding its advanced materials and manufacturing processes. In 2023, Howmet Aerospace reported substantial R&D investments, underscoring the importance of its patent portfolio for maintaining a competitive edge and securing premium pricing in specialized markets.

Environmental factors

The aerospace sector, and by extension Howmet Aerospace, faces significant pressure to curb carbon emissions. This is driven by global climate change concerns and evolving regulations.

Howmet is actively pursuing strategies to lower its operational greenhouse gas (GHG) emissions. Simultaneously, the company is focused on creating products that enhance aircraft fuel efficiency, directly supporting the industry's broader decarbonization goals. For instance, in 2023, Howmet reported a reduction in Scope 1 and Scope 2 GHG emissions intensity compared to its 2019 baseline.

The increasing adoption of Sustainable Aviation Fuel (SAF) is a significant environmental factor for Howmet Aerospace. The company's role in supporting the aviation industry's push for higher SAF usage directly influences its product development, particularly for engine components and materials that must be compatible with these alternative fuels.

This trend is driving innovation in fuel efficiency technologies, a key area for Howmet. For instance, by 2025, the industry aims to significantly increase SAF production, with projections suggesting SAF could account for up to 10% of global jet fuel consumption by 2030, creating a substantial market opportunity for advanced aerospace materials and components.

Howmet Aerospace is actively working to reduce its environmental footprint by focusing on resource efficiency. This includes efforts to lower energy and water usage across its manufacturing operations. For instance, in 2023, the company reported a 7% reduction in energy intensity compared to its 2019 baseline, demonstrating progress in this area.

Eliminating waste from its production processes is another key environmental priority for Howmet. By implementing improved waste management practices, the company aims to minimize landfill contributions and promote recycling and reuse. This commitment aligns with broader sustainability goals and helps to create more environmentally responsible manufacturing.

Noise Pollution Standards

The aerospace sector is facing increasingly stringent noise pollution standards for new aircraft. This directly impacts the design and manufacturing of critical engine components, a core area for Howmet Aerospace. The company must innovate to develop solutions that contribute to quieter engines and aircraft, aligning with these evolving environmental regulations.

Meeting these stricter noise limits requires significant investment in research and development for advanced materials and aerodynamic designs. For instance, the European Union's Aviation Emissions and Noise Standards (ICAO Annex 16) continue to be updated, pushing manufacturers towards quieter operations. Howmet Aerospace's ability to adapt and supply components that enable noise reduction is crucial for its market position.

- Stricter Noise Limits: Regulatory bodies worldwide are imposing lower noise thresholds for new aircraft models, influencing engine design.

- Component Innovation: Howmet Aerospace must develop advanced materials and manufacturing techniques for quieter engine components.

- Market Competitiveness: Suppliers that can effectively address noise reduction requirements will gain a competitive edge in the evolving aerospace market.

- Regulatory Compliance: Adherence to evolving noise standards, such as those influenced by ICAO Annex 16, is essential for market access.

Climate Change and Extreme Weather Events

Climate change and the growing frequency of extreme weather events pose significant risks to Howmet Aerospace's global operations and intricate supply chain. These disruptions can directly impact logistics, potentially delaying shipments of critical components and finished goods. For instance, severe storms or floods in key manufacturing or transportation hubs can halt production and distribution.

The availability of essential raw materials, such as specialized alloys and composites, can also be affected by climate-related events impacting mining or processing facilities. This necessitates a proactive approach to supply chain resilience, including diversifying sourcing and exploring alternative materials to mitigate potential shortages. Howmet Aerospace must invest in more robust operational planning to withstand these environmental challenges.

The financial implications are also substantial. According to the National Oceanic and Atmospheric Administration (NOAA), U.S. billion-dollar weather and climate disasters in 2023 alone caused an estimated $177.1 billion in damages, highlighting the increasing economic impact of such events. This underscores the need for Howmet Aerospace to factor these costs into its risk assessments and capital expenditure planning.

- Increased operational disruptions: Extreme weather can halt production at Howmet's facilities or those of its key suppliers.

- Supply chain vulnerability: Reliance on specific geographic regions for raw materials makes Howmet susceptible to climate-induced supply interruptions.

- Higher insurance and mitigation costs: The company may face escalating premiums and increased investment in climate-resilient infrastructure.

- Logistical challenges: Transportation networks, crucial for moving parts and finished aircraft, are frequently impacted by severe weather.

Howmet Aerospace is navigating a landscape increasingly shaped by environmental regulations and a global push for sustainability. The company is actively working to reduce its greenhouse gas emissions, aiming for greater energy and water efficiency in its operations. For instance, Howmet reported a 7% reduction in energy intensity in 2023 compared to its 2019 baseline, underscoring its commitment to minimizing its environmental footprint.

The rise of Sustainable Aviation Fuel (SAF) presents both challenges and opportunities, requiring Howmet to innovate in materials and components compatible with these alternative fuels. By 2025, the industry anticipates a significant increase in SAF production, potentially reaching 10% of global jet fuel by 2030, creating a market for advanced aerospace solutions.

Furthermore, Howmet must adapt to stricter noise pollution standards for aircraft, investing in R&D for quieter engine components. Compliance with evolving regulations, such as those influenced by ICAO Annex 16, is critical for market competitiveness and access.

The company also faces risks from climate change, including extreme weather events that can disrupt its global supply chain and operations. These disruptions can impact raw material availability and logistics, necessitating robust risk management and investments in climate-resilient infrastructure, as evidenced by the $177.1 billion in damages from U.S. billion-dollar weather and climate disasters in 2023 alone.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Howmet Aerospace is built on a robust foundation of data from official government publications, leading financial institutions like the IMF and World Bank, and comprehensive industry-specific market research reports. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental landscape impacting the aerospace sector.