Howmet Aerospace Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Howmet Aerospace Bundle

Uncover the strategic positioning of Howmet Aerospace's diverse product portfolio with our comprehensive BCG Matrix analysis. See which segments are driving growth and which require careful management.

This preview offers a glimpse into Howmet Aerospace's market dynamics. Purchase the full BCG Matrix report to gain actionable insights, detailed quadrant breakdowns, and a clear roadmap for optimizing your investments and product strategies.

Stars

Howmet Aerospace's commercial aerospace components, crucial for both engines and airframes, are positioned as Stars. This classification stems from the strong rebound and projected growth in global air travel expected through 2024 and into 2025.

The company's performance reflects this trend, with commercial aerospace sales experiencing a healthy 8% increase in the second quarter of 2025. Furthermore, the full-year 2024 saw a substantial 20% surge in this segment, underscoring Howmet's significant market share within a rapidly expanding sector.

Defense Aerospace Components are a significant growth driver for Howmet Aerospace. The sector is booming due to rising global defense budgets and geopolitical instability. Howmet saw its defense aerospace revenue jump 21% in Q2 2025, building on a strong 15% growth for the full year 2024.

Howmet's position in this expanding market is solidified by its production of critical components for key defense platforms, such as the F-35 fighter jet. This demonstrates a strong market foothold in a sector experiencing accelerated expansion.

Aerospace Engine Spares are a strong performer for Howmet Aerospace, fitting the description of a Star in the BCG Matrix. This segment saw its contribution to total revenue climb from 11% in 2019 to an estimated 17% in 2024, reflecting its significant growth trajectory.

The demand for engine spares is robust, fueled by both commercial aviation and defense needs. This growth is further supported by the trend of increasing aircraft utilization and the longer operational life of existing fleets, ensuring a sustained need for these critical components through 2025.

Advanced Turbine Airfoils

Advanced Turbine Airfoils represent a strong Star in Howmet Aerospace's BCG Matrix. Howmet is a global leader in these critical components for aerospace engines and industrial gas turbines, enabling quieter, cleaner, and more fuel-efficient operations.

These high-performance airfoils are vital for next-generation aircraft and power generation, placing them in a high-growth market where Howmet maintains a dominant position. For instance, the aerospace market for engine components is projected to see significant growth, with advanced materials and designs being key differentiators.

- Market Leadership: Howmet is a premier supplier of advanced turbine airfoils.

- Growth Potential: Demand is driven by the push for fuel efficiency and reduced emissions in aviation and power generation.

- Technological Edge: Innovation in materials and manufacturing processes supports its strong market share.

- Strategic Importance: These components are critical for the performance of modern jet engines and industrial turbines.

Engineered Structures for Airframes

Howmet Aerospace's Engineered Structures segment, a key player in producing sophisticated, multi-material components for both aircraft and vehicles, is demonstrating robust growth. This segment’s performance is a significant indicator of its market standing.

The financial results highlight this strength. In the second quarter of 2025, revenue for Engineered Structures climbed by 8%. This follows an even more impressive 21% revenue surge throughout 2024.

The primary drivers behind this upward trend are the expanding commercial and defense aerospace sectors. These markets are increasingly demanding lightweight and fuel-efficient solutions for airframes, a niche where Howmet Aerospace excels.

- Revenue Growth: Q2 2025 saw an 8% increase, building on a substantial 21% rise in 2024.

- Market Demand: Growth is fueled by expanding commercial and defense aerospace sectors.

- Product Relevance: Focus on advanced, multi-material parts for lightweight and fuel-efficient airframes.

Howmet Aerospace's Commercial Aerospace Components, Defense Aerospace Components, Aerospace Engine Spares, Advanced Turbine Airfoils, and Engineered Structures are all positioned as Stars in the BCG Matrix. These segments are experiencing significant growth, driven by strong market demand and Howmet's leading technological capabilities. The company's performance in 2024 and projections for 2025 indicate continued strength in these areas, solidifying their status as key growth drivers.

| Segment | BCG Category | Key Growth Drivers | 2024 Performance | Q2 2025 Performance |

|---|---|---|---|---|

| Commercial Aerospace Components | Star | Rebound in air travel | +20% revenue growth | +8% revenue growth |

| Defense Aerospace Components | Star | Increased defense budgets, geopolitical instability | +15% revenue growth | +21% revenue growth |

| Aerospace Engine Spares | Star | Commercial and defense needs, increased aircraft utilization | Revenue contribution grew to 17% of total | Continued strong demand |

| Advanced Turbine Airfoils | Star | Demand for fuel efficiency and reduced emissions | Dominant market position in high-growth sector | Continued leadership in advanced materials |

| Engineered Structures | Star | Demand for lightweight, fuel-efficient solutions | +21% revenue growth | +8% revenue growth |

What is included in the product

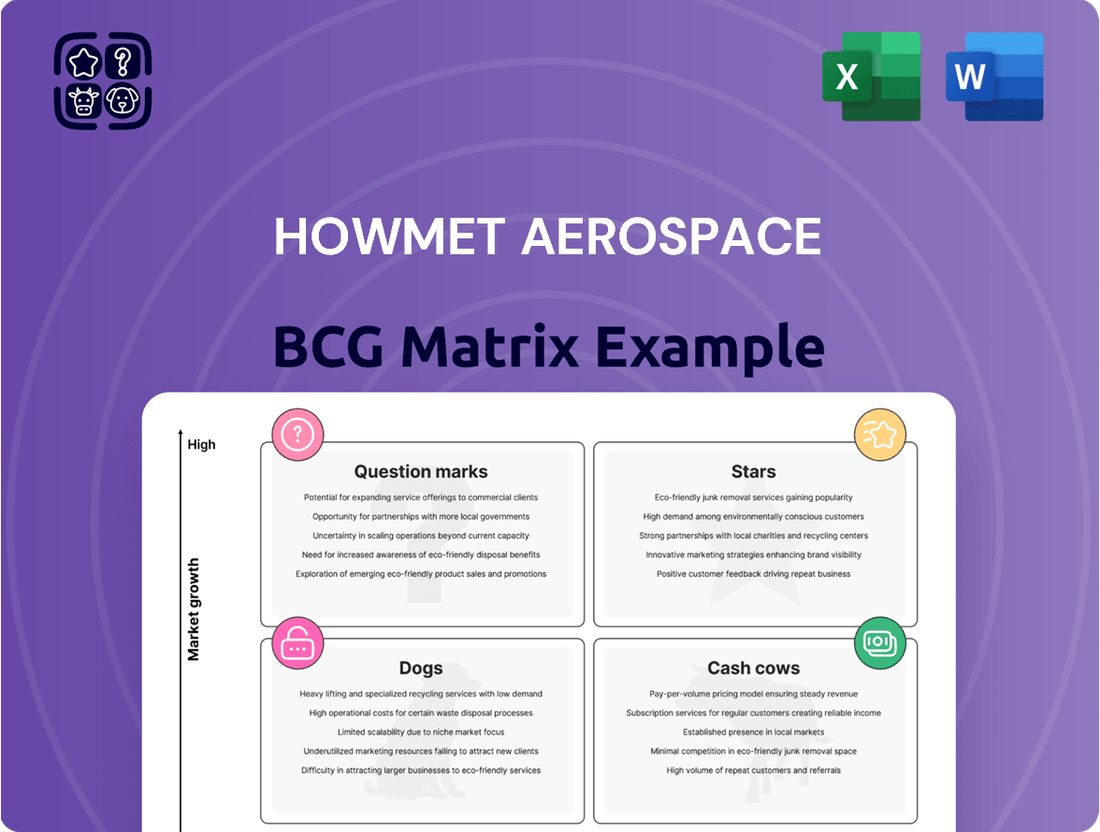

Howmet Aerospace's BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This framework guides strategic decisions on resource allocation, investment, and divestment for each segment.

A clear BCG matrix visualizes Howmet Aerospace's portfolio, easing strategic decision-making.

Cash Cows

Howmet Aerospace's Core Aerospace Fastening Systems segment is a textbook Cash Cow. This division, responsible for producing essential aerospace and industrial fasteners, boasts a dominant market share within a mature industry. Its consistent profitability and strong demand from established aircraft programs are key indicators of its Cash Cow status.

The segment's financial performance in late 2024 and early 2025 underscores its strength. In Q1 2025, Howmet reported record revenue and EBITDA for this segment, building on a similarly strong Q4 2024. This consistent outperformance highlights its ability to generate substantial, stable cash flow, a hallmark of a successful Cash Cow.

Howmet Aerospace's established engine product lines, such as components for legacy jet engines and industrial gas turbines, are prime examples of cash cows. These mature segments consistently deliver strong profit margins and significant cash flow, requiring minimal incremental investment to maintain their market position.

In 2024, Howmet Aerospace reported that its commercial aerospace segment, which includes these established engine components, saw robust performance. The company's focus on operational efficiency within these mature product lines allows them to generate substantial free cash flow, supporting investments in other areas of the business.

The Forged Aluminum Wheels segment for commercial transportation, despite facing a cyclical downturn in 2024 and early 2025, continues to be a robust cash cow for Howmet Aerospace. This division demonstrates a strong market standing and consistently high profitability, evidenced by a notable 27.5% margin reported in the second quarter of 2025.

This segment's ability to generate substantial cash flow exceeding its investment needs solidifies its role as a stable and reliable cash generator for the entire company.

Industrial Gas Turbine (IGT) Components

Howmet Aerospace's Industrial Gas Turbine (IGT) components, particularly turbine blades, represent a strong cash cow. This segment benefits from robust demand driven by the global surge in electricity consumption, notably from the expansion of data centers. In 2024, the IGT market is projected to see continued growth, with key regions like North America and Europe leading the charge in new turbine installations and upgrades.

As a market leader, Howmet leverages its established position in a market characterized by mature but essential technologies. This leadership translates into reliable and consistent cash flow generation. The demand for IGTs is underpinned by the ongoing need for stable and efficient power generation, a trend that is expected to persist well into the future.

- Market Dominance: Howmet holds a significant share in the critical turbine airfoil segment for IGTs.

- Growth Drivers: Increasing electricity demand, especially from data center build-outs, fuels IGT market expansion.

- Cash Flow Generation: The mature technology and established market position ensure consistent, strong cash flow.

- 2024 Outlook: The IGT market continues its upward trajectory, supported by global energy infrastructure needs.

Precision-Engineered Solutions for Demanding Applications

Howmet Aerospace's overall business model is built on providing highly engineered solutions critical for aerospace and defense sectors. These solutions are designed for demanding applications where safety, performance, and efficiency are paramount. This focus allows Howmet to command premium pricing and secure long-term, stable revenue streams, effectively acting as its foundational cash cow.

The company's expertise in complex manufacturing processes and materials science underpins its ability to generate high profit margins. For instance, in 2024, Howmet Aerospace reported strong performance in its Engineered Solutions segment, which includes many of these precision-engineered components. The consistent demand from major aerospace manufacturers for these mission-critical parts ensures a reliable and substantial cash flow.

- High Profit Margins: Due to specialized manufacturing and critical application, Howmet's precision-engineered solutions typically yield robust profit margins.

- Consistent Revenue Streams: Long-term contracts with major aerospace and defense clients provide predictable and stable income.

- Industry Leadership: A reputation for quality and reliability in demanding sectors solidifies its market position and pricing power.

- Foundational Cash Generation: These segments are the bedrock of the company's financial strength, funding other business areas and investments.

Howmet Aerospace's Cash Cows are its mature, high-market-share businesses that generate consistent, strong cash flow with minimal investment. These segments, like Fastening Systems and established engine components, are vital for funding growth initiatives. Their stability is a core strength, as demonstrated by their sustained profitability and operational efficiency.

The company's leadership in segments such as aerospace fasteners and legacy engine components exemplifies its Cash Cow strategy. These divisions benefit from a dominant market position and consistent demand from established programs, ensuring reliable cash generation. This financial strength allows Howmet to reinvest in innovation and other strategic areas.

| Segment | 2024/2025 Performance Highlight | Cash Flow Contribution |

|---|---|---|

| Fastening Systems | Record revenue and EBITDA in Q1 2025 | Strong and stable |

| Engine Components (Legacy) | Robust performance in commercial aerospace | Substantial free cash flow |

| Forged Aluminum Wheels | Notable 27.5% margin in Q2 2025 | Exceeds investment needs |

| Industrial Gas Turbine (IGT) Components | Market leadership in essential turbine airfoils | Consistent and reliable |

Delivered as Shown

Howmet Aerospace BCG Matrix

The Howmet Aerospace BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This means the strategic analysis, including the positioning of Howmet's business units within the matrix, is exactly as it will be delivered, ready for your direct use in business planning or presentations. You can trust that this preview accurately represents the final, professionally formatted report, ensuring no discrepancies and immediate applicability for your decision-making processes.

Dogs

Within Howmet Aerospace's diverse offerings, certain legacy components, characterized by low production volumes and potentially declining market demand, could be classified as dogs. These might be older parts for legacy aircraft or specialized components with niche applications, facing limited growth potential.

These products, while part of the company's history, likely contribute minimally to overall revenue and could consume resources for maintenance or compliance without significant return. For instance, if a specific legacy engine component saw a 5% year-over-year decline in orders in 2024, it would fit this category.

Niche products with limited innovation potential at Howmet Aerospace, despite the company's overall focus on advanced engineered solutions, could be classified as dogs in a BCG matrix. These might be components or systems that, while serving a specific market, do not leverage Howmet's core technological advancements or offer significant avenues for future development. For instance, a legacy aerospace part with a shrinking market and no clear upgrade path would fit this description.

In the context of Howmet Aerospace's BCG Matrix, 'dog' products can often be found in geographically confined or highly specialized, niche markets. These are areas where Howmet might have a small slice of the pie, and the overall market isn't growing much. For instance, a component designed for a very specific, regional aircraft model that has limited production runs would fit this description.

These segments typically don't warrant significant new investment. Instead, Howmet would likely evaluate them for potential divestiture or a strategic scaling back if they begin to consume resources without generating substantial returns. Imagine a situation where a specialized fastener is only used by a handful of smaller, regional aerospace manufacturers whose own order books are shrinking; this would be a prime candidate for such a strategic review.

Outdated Production Technologies

Products still relying on older, less efficient manufacturing processes at Howmet Aerospace could be classified as 'dogs' due to their operational drawbacks. These technologies often result in higher production costs and diminished competitiveness in the market. For instance, legacy machining techniques for certain aerospace components might not match the speed and precision of newer additive manufacturing methods, impacting Howmet's overall cost structure and market agility.

Howmet is actively addressing these inefficiencies by investing significantly in optimizing its manufacturing footprint. This strategic focus aims to phase out outdated technologies and embrace more advanced, cost-effective production methods. By 2024, the company has continued its multi-year investment in advanced manufacturing capabilities, with a notable portion of its capital expenditure directed towards modernizing its plant operations and integrating Industry 4.0 principles.

- Operational Inefficiency: Products manufactured using outdated technologies often incur higher variable costs.

- Competitiveness Gap: Less efficient processes can lead to longer lead times and potentially lower quality compared to competitors using advanced methods.

- Investment Focus: Howmet's capital allocation prioritizes upgrading facilities to improve efficiency and reduce reliance on older equipment.

- Strategic Shift: The company is moving towards leaner, more agile production models to enhance its market position.

Non-Strategic Minor Businesses

Non-strategic minor businesses within Howmet Aerospace, if they exist, would likely represent small, peripheral operations that do not contribute significantly to the company's core aerospace and defense or commercial transportation segments. These units, characterized by both low market share and low market growth, would be classified as dogs in the BCG matrix.

For instance, if Howmet maintained a small division producing, say, specialized industrial fasteners for a niche, non-aerospace market that is experiencing minimal expansion, this would fit the dog profile. Such a business would drain resources without offering substantial growth potential or strategic alignment.

Consider a hypothetical scenario where Howmet has a minor, legacy business in a non-aerospace component manufacturing sector. As of 2024, if this segment reported less than 1% of Howmet's total revenue and operated in a market with projected annual growth below 2%, it would be a prime candidate for the dog category.

- Low Market Share: These businesses typically hold a negligible percentage of their respective markets.

- Low Market Growth: The industries they operate in are not expanding at a significant rate.

- Non-Core Focus: They do not align with Howmet's primary strategic objectives in aerospace and defense or commercial transportation.

- Resource Drain: Such units often consume management attention and capital without generating commensurate returns.

Dogs within Howmet Aerospace's portfolio represent products or business units with low market share in low-growth markets. These are often legacy components or niche offerings that, while perhaps historically significant, now offer limited future potential and may even drain resources. For example, a specific type of legacy fastener used in older aircraft models, with declining demand and no clear path for innovation, would fit this category.

These 'dogs' typically do not warrant significant new investment and might be candidates for divestiture or a strategic wind-down. In 2024, Howmet's focus on advanced manufacturing and new materials means that products not aligning with these strategic priorities, especially if they have minimal market growth, are more likely to be classified as dogs. An example could be a component produced using older, less efficient methods that is being phased out by newer aircraft designs.

The company's strategy involves carefully managing these segments, potentially by optimizing production to minimize costs or by seeking to exit markets where they lack a competitive advantage. If a particular product line saw its market share drop to below 3% in a market growing at less than 2% annually by 2024, it would likely be considered a dog.

Howmet's commitment to innovation and efficiency means that products failing to keep pace with technological advancements or market trends are prime candidates for this classification. These segments require a critical evaluation to ensure capital is allocated to areas with higher growth and return potential.

| Product/Segment Example | Market Share | Market Growth Rate | Strategic Consideration |

| Legacy Aircraft Fasteners | Low (e.g., < 5%) | Declining (e.g., < 1%) | Divestiture or Cost Optimization |

| Niche Industrial Components | Low (e.g., < 3%) | Low (e.g., < 2%) | Strategic Review/Wind-down |

| Older Machining Process Components | Low (e.g., < 4%) | Stagnant (e.g., 0-1%) | Phase-out or Technology Upgrade |

Question Marks

Howmet Aerospace is heavily investing in its Engines business, signaling a strategic move into a Question Mark category within the BCG Matrix. The company reported a substantial 45% year-over-year increase in capital expenditures for Q1 2025, escalating to a 60% increase for H1 2025, with a significant portion earmarked for engine product capacity expansion.

These capital expenditures are aimed at building new production capabilities to meet anticipated future demand. The success of this investment hinges on the market's ability to absorb this increased capacity, making it a classic Question Mark where significant investment is being made in a business with uncertain future growth prospects.

Howmet Aerospace is actively investing in sustainable aviation materials and technologies, focusing on innovations that reduce aircraft carbon footprints. This includes developing advanced materials for lighter, more fuel-efficient airframes and components, directly supporting the industry's push for sustainability. Their strategy also encompasses support for Sustainable Aviation Fuels (SAFs) and next-generation engine technologies, positioning them for future growth in these critical areas.

These initiatives target high-growth markets, but Howmet's precise market share and the ultimate return on these specific new technologies are still in the early stages of development. For instance, the global SAF market is projected to grow significantly, with estimates suggesting it could reach over $15 billion by 2030, highlighting the potential but also the nascent stage of Howmet's specific contributions in this evolving landscape.

Expansion into Advanced Air Mobility (AAM) and space applications represents a potential Stars or Question Marks for Howmet Aerospace within a BCG Matrix framework. These sectors are experiencing significant growth, with the global AAM market projected to reach $20 billion by 2028, according to some industry reports.

While Howmet has a strong presence in traditional aerospace, entering these nascent markets where its current market share is low requires substantial strategic investment and carries inherent risks, fitting the profile of Question Marks. Success in these areas could propel them to Star status, given the high growth potential.

Digital Transformation and AI Integration in Manufacturing

Digital transformation, including AI integration, is a key driver in the aerospace and defense sector. Companies are focusing on concepts like the digital thread and digital twin to enhance performance and streamline supply chains. For instance, by 2024, the global aerospace manufacturing market was projected to reach over $1.1 trillion, with digital technologies playing a significant role in its growth.

Howmet Aerospace's investments in these advanced manufacturing and operational technologies, such as AI-powered predictive maintenance and digital twin simulations, position them for future efficiency gains and market leadership. These initiatives are crucial for optimizing production processes and improving product quality in a highly competitive landscape.

- AI in Manufacturing: By 2024, AI adoption in manufacturing was expected to boost global GDP by $7 trillion, with significant gains in productivity and efficiency.

- Digital Twin Adoption: The digital twin market was anticipated to grow substantially, with estimates suggesting it could reach over $28 billion by 2026, highlighting its increasing importance in complex industries like aerospace.

- Supply Chain Optimization: AI and digital solutions are projected to reduce supply chain costs by up to 20% in various industries, a critical benefit for aerospace manufacturers dealing with intricate global networks.

- Performance Improvement: Companies leveraging digital threads and AI are seeing improvements in operational uptime and reduced defect rates, directly impacting profitability and competitiveness.

New Product Innovations for Enhanced Performance

Howmet Aerospace is pushing the boundaries of aero engine technology through continuous innovation in advanced materials and cooling techniques. These advancements allow engines to operate at higher temperatures and pressures, directly boosting performance and efficiency. For instance, their development of advanced ceramic matrix composites (CMCs) and sophisticated internal cooling channels for turbine blades are key examples.

These cutting-edge product innovations are strategically aimed at high-growth markets within the aerospace sector. However, their position in the BCG matrix would likely be classified as Question Marks. This is because, while the potential is significant, their market adoption and ultimate commercial success are still in the nascent stages of development and validation.

- Advanced Materials: Development of next-generation superalloys and CMCs for lighter, more durable engine components.

- Cooling Technologies: Implementation of intricate internal cooling passages and thermal barrier coatings to manage extreme heat.

- Performance Gains: These innovations enable engines to achieve higher thrust-to-weight ratios and improved fuel efficiency.

- Market Position: Currently considered Question Marks due to early-stage market penetration and unproven long-term success.

Howmet Aerospace's strategic investments in its Engines segment, particularly in capacity expansion and new technologies, firmly place it in the Question Mark category of the BCG Matrix. The company's substantial capital expenditures, showing a 45% year-over-year increase in Q1 2025 and a 60% increase for H1 2025, are directed towards building future production capabilities. This aggressive investment in a sector with uncertain future demand and market adoption, especially concerning sustainable aviation and advanced air mobility, highlights the inherent risks and potential rewards characteristic of Question Marks.

The company's focus on sustainable aviation materials and technologies, alongside expansion into Advanced Air Mobility (AAM) and space applications, represents significant growth opportunities. However, Howmet's current market share in these nascent areas is low, requiring substantial strategic investment. For instance, the AAM market is projected to reach $20 billion by 2028, but Howmet's specific contribution and market penetration remain to be fully established, classifying these ventures as Question Marks.

Digital transformation, including AI integration and the adoption of digital threads and twins, is another area where Howmet is investing heavily. While these technologies are projected to boost global GDP and improve operational efficiency, their ultimate impact on Howmet's market share and profitability in specific product lines is still developing. The digital twin market alone was expected to exceed $28 billion by 2026, underscoring the potential but also the evolving nature of these investments.

| Business Area | BCG Category | Key Investments/Initiatives | Market Potential (Illustrative) | Current Status/Risk |

|---|---|---|---|---|

| Engines Business Expansion | Question Mark | Capacity expansion, new production capabilities | High, driven by future demand | Uncertain market absorption, high capital outlay |

| Sustainable Aviation Technologies | Question Mark | Advanced materials, SAF support, next-gen engines | Projected SAF market over $15 billion by 2030 | Nascent market, unproven long-term commercial success |

| Advanced Air Mobility & Space | Question Mark | Entry into new, high-growth sectors | AAM market projected $20 billion by 2028 | Low current market share, significant strategic investment required |

| Digital Transformation (AI, Digital Twin) | Question Mark | AI in manufacturing, digital thread/twin implementation | AI in manufacturing to boost GDP by $7 trillion | Evolving adoption, impact on specific market share still developing |

BCG Matrix Data Sources

Our Howmet Aerospace BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.