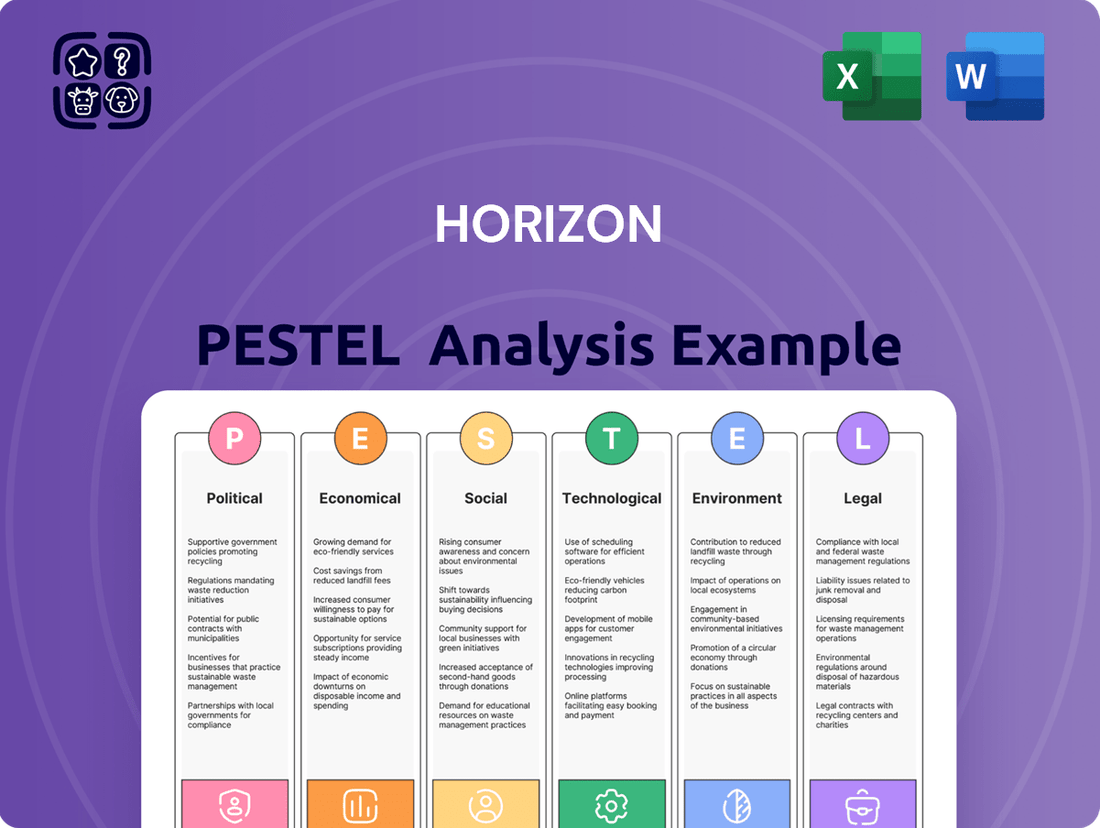

Horizon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Horizon's future. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on opportunities. Download the full report now for actionable intelligence that will empower your decision-making.

Political factors

Government stability and policy changes are crucial for Horizon Oil, which operates in diverse political landscapes. For instance, recent legislative adjustments in Papua New Guinea, including the creation of the National Petroleum Authority and a revised production sharing policy, are designed to boost government revenue and encourage investment, potentially reshaping Horizon Oil's operational framework.

New Zealand's decision to lift its 2018 ban on new petroleum exploration outside of onshore Taranaki indicates a more supportive political climate for the oil and gas sector. This shift could open up new exploration opportunities for Horizon Oil. In 2023, New Zealand's government continued to signal a pragmatic approach to energy security, balancing environmental goals with the need for domestic resource development.

Geopolitical events, especially in the Asia-Pacific, significantly impact oil and gas market stability and business operations. In 2024, the global oil market faced challenges from OPEC+ supply management, fluctuating demand, and economic headwinds. These factors create uncertainty for companies like Horizon Oil, affecting both price and supply chain reliability.

Looking ahead to 2025, continued active management by OPEC+ is anticipated to remain a key driver of oil price movements. This strategic oversight by major oil-producing nations will shape the supply landscape, influencing investment decisions and operational strategies for energy firms.

Governments across the Asia-Pacific are prioritizing energy security, influencing hydrocarbon exploration. New Zealand's recent decision to lift its exploration ban and allocate funds for co-investment in new gas fields highlights a strategic shift towards bolstering domestic production to meet energy needs.

This focus on self-sufficiency is also evident in China's accelerated efforts to boost its domestic oil and natural gas exploration and production. These policy directions signal a significant trend where national energy security objectives directly shape the regulatory and investment landscape for the hydrocarbon sector.

Regulatory Environment and Licensing

Horizon Oil's operations are significantly shaped by the regulatory environment and licensing in its key markets. These frameworks dictate the ease and cost of exploration, development, and production activities. For instance, Papua New Guinea is implementing digital licensing to enhance speed and transparency, alongside a new 0.5% levy on gross sales for petroleum producers and exporters, impacting revenue streams.

Further regulatory shifts are evident in New Zealand, where amendments to the Crown Minerals Act are underway. The goal is to create a more efficient process for allocating petroleum exploration permits, better aligning with investor interest and market dynamics. These changes can influence the attractiveness of exploration opportunities and the overall cost of doing business.

- Digital Licensing: Papua New Guinea's move to digital systems aims to expedite and clarify licensing applications.

- New Levies: A 0.5% levy on gross sales revenue for petroleum producers and exporters has been introduced in Papua New Guinea.

- Streamlined Permitting: New Zealand's Crown Minerals Act is being updated to improve the allocation of petroleum exploration permits.

- Investor Alignment: Regulatory changes are increasingly focused on matching permit allocation processes with investor interest.

Fiscal Regimes and Taxation

Changes in fiscal regimes and taxation policies directly affect Horizon Oil's bottom line. For instance, Papua New Guinea's recent production sharing policy adjustments are designed to boost immediate government revenue from new ventures.

This policy includes a potential reduction in contractor taxes, moving from 30% to a range of 20-25%, a move intended to incentivize investment in the sector.

However, a new 0.5% levy on the gross sales revenue of exported petroleum products from PNG introduces an additional cost for companies like Horizon Oil.

These shifts in fiscal policy create a dynamic environment that requires careful management and strategic adaptation by Horizon Oil to maintain profitability and operational viability.

Government stability and evolving energy policies in the Asia-Pacific region are key political factors influencing Horizon Oil. Papua New Guinea's updated production sharing policy and New Zealand's shift towards supporting domestic exploration, as seen in 2023-2024, signal a dynamic regulatory landscape. Geopolitical events, including OPEC+ management of supply, continue to shape market conditions, impacting oil prices and supply chains throughout 2024 and into 2025.

What is included in the product

The Horizon PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Horizon, providing a comprehensive understanding of its external operating landscape.

The Horizon PESTLE Analysis simplifies complex external factors, alleviating the pain of information overload and enabling clearer strategic decision-making.

Economic factors

Fluctuations in global crude oil and natural gas prices have a direct impact on Horizon Oil's revenue and profitability. The market demonstrated resilience in 2024, with Brent crude oil prices generally trading between US$74 and US$90 per barrel.

However, projections indicate potential downward pressure on prices in 2025 and 2026 due to anticipated builds in global oil inventories.

To navigate this price volatility, Horizon Oil has strategically employed hedging techniques, including securing dated Brent swaps for its future oil liftings, aiming to stabilize financial performance.

Economic expansion across the Asia-Pacific region directly shapes the demand for oil and gas, influencing both sales volumes and the feasibility of new projects. Despite a slowdown in global oil demand growth in 2024, especially from China, the International Energy Agency (IEA) projects a global increase of 1.1 million barrels per day for 2025, with Asian nations, particularly non-OECD countries, expected to be major contributors to this growth.

The outlook for 2025 highlights significant regional activity, with Southeast Asia anticipated to approve a substantial number of oil and gas projects. This surge in project approvals underscores robust underlying demand within the region, signaling continued investment and operational opportunities for the sector.

The investment climate directly impacts Horizon Oil's ability to fund its growth, with the company recently acquiring a 25% stake in the Mereenie oil and gas field, enhancing its production and reserves. This move, alongside securing long-term gas sales agreements for its Thailand operations, demonstrates a positive outlook for capital deployment.

Horizon Oil's financial health, evidenced by strong cash generation and consistent dividend declarations, provides a solid foundation for securing future capital. For instance, in the first half of 2024, the company reported significant operating cash flow, enabling it to pursue strategic acquisitions and development projects.

Operating Costs and Inflation

Managing operating costs and navigating inflation are crucial for sustained profitability. Horizon Oil has demonstrated strong cost discipline, as evidenced by its well-controlled operating expenditures in recent quarterly reports.

The company's approach to funding new field development primarily through existing production cash flow highlights an efficient capital expenditure strategy. This proactive management of expenses is key to offsetting potential inflationary impacts on future operations.

- Controlled Operating Expenditures: Horizon Oil's commitment to cost discipline is a significant advantage in an inflationary environment.

- Internal Funding for Growth: Relying on existing cash flow for new field development minimizes external financing needs, reducing exposure to rising interest rates.

- Inflationary Headwinds: While cost control is strong, the broader economic trend of inflation could still impact input costs for materials and labor in 2024 and 2025.

- Profitability Maintenance: Effective management of these economic factors will be essential for Horizon Oil to maintain its profitability margins.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Horizon Oil, an international entity with operations and sales across various currencies. These shifts directly influence the reported value of revenues and costs when converted to the company's reporting currency, typically USD. For instance, a stronger Australian Dollar (AUD) against the USD could reduce the USD equivalent of AUD-denominated revenues, impacting profitability.

While Horizon Oil's financial reports often detail these exposures, specific currency risk management strategies are not always publicly disclosed. However, the company's financial outlook and performance inherently account for these potential impacts. The dual reporting of financial results in USD and dividends in AUD underscores the critical importance of monitoring and managing the AUD/USD exchange rate.

As of late 2024, the AUD/USD exchange rate has shown volatility, with the Australian dollar trading around 0.66 USD. This means that for every Australian dollar earned by Horizon Oil, it translates to approximately 0.66 US dollars. Fluctuations in this rate can therefore materially affect Horizon Oil's reported earnings and the value of dividend distributions to shareholders.

- Impact on Revenue: A weakening AUD against the USD would increase the USD value of AUD-denominated sales, boosting reported revenue.

- Impact on Costs: Conversely, a strengthening AUD would make USD-denominated costs higher in AUD terms, potentially squeezing margins.

- Dividend Value: Changes in the AUD/USD rate directly affect the USD value of dividends paid in AUD to international investors.

- Reporting Currency Conversion: Horizon Oil's reliance on USD for reporting means that even stable operational performance can appear to change due to currency movements.

Economic growth in key markets directly influences Horizon Oil's demand and project viability. Asia-Pacific, particularly non-OECD countries, is projected to drive global oil demand growth of 1.1 million barrels per day in 2025, with Southeast Asia set to approve numerous new projects.

Oil price volatility remains a key factor, with Brent crude trading between US$74-US$90 per barrel in 2024, though potential inventory builds may pressure prices in 2025-2026. Horizon Oil utilizes hedging strategies, like dated Brent swaps, to mitigate this risk.

The company's financial health, supported by strong cash generation and consistent dividends, enables strategic investments, such as its 25% stake in the Mereenie field, and efficient capital expenditure for new developments, demonstrating resilience against inflation and interest rate shifts.

Currency fluctuations, particularly the AUD/USD exchange rate, impact Horizon Oil's reported revenues and costs. As of late 2024, the AUD traded around 0.66 USD, meaning shifts in this rate directly affect the USD equivalent of the company's AUD-denominated earnings and dividends.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Horizon Oil Strategy | Impact on Horizon Oil |

|---|---|---|---|---|

| Global Oil Prices (Brent Crude) | US$74-US$90/barrel | Potential downward pressure due to inventory builds | Hedging (dated Brent swaps) | Revenue and profitability stabilization |

| Asia-Pacific Demand Growth | Resilient, though China demand slowed | Projected 1.1 mb/d global growth (IEA), driven by Asian non-OECD | Strategic acquisitions, long-term gas sales agreements | Increased sales volumes, project feasibility |

| Inflation and Operating Costs | Strong cost discipline demonstrated | Continued inflationary headwinds possible | Internal funding for growth, cost control | Maintained profitability margins |

| AUD/USD Exchange Rate | Approx. 0.66 USD (late 2024) | Volatile | N/A (inherent in financial reporting) | Affects USD value of AUD revenues and dividends |

Full Version Awaits

Horizon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed Horizon PESTLE Analysis provides a comprehensive overview of the external factors impacting the company.

You'll gain valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Everything displayed here is part of the final product. What you see is what you’ll be working with.

Sociological factors

Horizon Oil's ability to operate smoothly, particularly in Papua New Guinea, China, New Zealand, and Australia, hinges on strong community relations. This social license to operate is built on trust and mutual benefit.

The company actively engages with communities, as evidenced by its support for projects in China and New Zealand, reflecting a commitment to its environmental, social, and governance (ESG) priorities. For example, in 2023, Horizon Oil reported investing in local infrastructure and social programs, though specific figures are often embedded within broader sustainability reporting.

Any future growth or new ventures must meticulously assess and address potential community impacts and ensure tangible benefits are delivered to maintain this crucial local backing. This proactive approach is vital for long-term project viability and stakeholder acceptance.

The availability of a skilled workforce is crucial for the oil and gas sector in the Asia-Pacific, directly influencing how efficiently operations run and how quickly projects can be completed. Horizon Oil, like others in the industry, likely contends with the need for specialized talent in areas like exploration and production.

While specific workforce challenges for Horizon Oil aren't detailed, the broader industry in 2024 and 2025 continues to see high demand for geoscientists, petroleum engineers, and drilling specialists. Reports from industry bodies in late 2023 and early 2024 indicated a persistent skills gap in these critical roles across the region.

Horizon Oil's commitment to its 'Our People and Communities' priority, as highlighted in its sustainability reporting, suggests a proactive approach to managing its human capital. This focus is essential as the company navigates the evolving demands for expertise in both traditional and emerging energy technologies.

Adherence to rigorous health and safety standards is non-negotiable in the oil and gas sector, directly influencing a company's reputation, ensuring uninterrupted operations, and maintaining regulatory compliance. Horizon Oil’s commitment to Health, Safety, and Environment (HSE) is a cornerstone of its ESG strategy, with reported HSE metrics significantly outperforming industry averages. This dedication is vital for the responsible management of hydrocarbon assets and the mitigation of operational hazards.

Public Perception of Fossil Fuels

Public perception of fossil fuels is undergoing a significant shift, directly impacting investor sentiment and regulatory landscapes. As awareness of climate change grows, there's increasing pressure on companies to demonstrate commitment to cleaner energy alternatives. This evolving societal view means that long-term market demand for traditional fossil fuels could be affected, even as some regions continue to rely heavily on them.

The Asia-Pacific region, for instance, shows a complex dynamic. While oil and gas remain crucial energy sources for many nations, there's a concurrent acceleration in clean energy initiatives. Countries are actively pursuing renewable energy projects and exploring technologies like Carbon Capture, Utilization, and Storage (CCUS). Horizon Oil's own sustainability reporting highlights climate change as a key focus, acknowledging this societal imperative.

- Growing investor demand for ESG (Environmental, Social, and Governance) compliant investments, with global ESG assets projected to reach $53 trillion by 2025, according to Bloomberg Intelligence.

- Increased public support for renewable energy, with polls often showing a majority favoring government investment in solar and wind power.

- Regulatory shifts favoring decarbonization, exemplified by policies like the EU's Carbon Border Adjustment Mechanism, which impacts trade based on carbon intensity.

Indigenous and Landowner Rights

Respecting indigenous and landowner rights is a significant sociological consideration, particularly in resource-rich nations like Papua New Guinea. Failure to adequately address these rights can lead to project delays, community opposition, and reputational damage.

The recent legislative changes in Papua New Guinea underscore this. The new production sharing framework mandates that landowners receive a two percent royalty on gross sales, with no deductions. This demonstrates a clear legal recognition of their stake and the need for their consent in resource extraction activities.

- Landowner Royalties: Papua New Guinea's framework sets a 2% royalty for landowners on gross sales.

- Community Engagement: Effective engagement with indigenous groups is crucial for project approval and smooth operations.

- Social License to Operate: Securing community buy-in is as vital as regulatory permits for long-term project sustainability.

Sociological factors significantly shape Horizon Oil's operational landscape, emphasizing the critical need for robust community engagement and respect for local rights. The company's social license to operate, particularly in regions like Papua New Guinea, is directly tied to its ability to foster trust and deliver tangible benefits to local populations.

The evolving global sentiment towards ESG principles is a major driver, with investors increasingly prioritizing companies demonstrating strong social responsibility. This trend is underscored by projections indicating that global ESG assets could reach $53 trillion by 2025, highlighting the financial imperative of positive social impact.

Furthermore, the specific legal frameworks, such as Papua New Guinea's new production sharing model mandating a 2% royalty for landowners on gross sales, directly impact project economics and require meticulous adherence to ensure continued community support and operational continuity.

Technological factors

Advancements in exploration and production technologies are crucial for Horizon Oil, directly impacting efficiency and cost reduction. By leveraging modern techniques, the company can unlock previously inaccessible hydrocarbon resources.

Horizon Oil’s operations, covering the entire lifecycle from exploration to production, necessitate the adoption of cutting-edge technologies. This ensures optimized extraction processes and improved recovery rates from their assets.

The company’s recent activities, like the Mereenie drilling program and infill drilling in Block 22/12, demonstrate the practical application of these evolving technologies. For instance, advancements in seismic imaging and horizontal drilling techniques are key to maximizing output from existing fields.

Digitalization and automation are transforming the oil and gas sector, promising enhanced decision-making, optimized field performance, and improved safety. For Horizon Oil, this trend is evident in regions like Papua New Guinea, where digital licensing systems are being adopted, signaling a move towards more streamlined regulatory processes that could reduce operational friction.

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) are crucial for the oil and gas sector's environmental stewardship and emission targets. Horizon Oil's commitment to reducing field emissions, as evidenced by their Flare Gas Recovery project at Mereenie and planned Vapour Recovery Unit, highlights this trend.

The Asia-Pacific region, including Australia, is actively strengthening policy and regulatory support for CCUS deployment. For instance, the Australian government has identified CCUS as a priority technology, with initiatives aimed at fostering investment and infrastructure development, potentially unlocking significant carbon reduction opportunities by 2030.

Renewable Energy Integration

The energy sector's ongoing transition necessitates considering renewable energy integration, even for traditional oil and gas entities like Horizon Oil. This shift presents opportunities for enhanced operational efficiency through on-site renewable power generation or strategic diversification into new energy markets.

Horizon Oil's strategic investments signal an awareness of this trend. Their reported investment in Re-Vi Group, a developer of biochar projects focused on CO2 sequestration, demonstrates a commitment to exploring broader environmental solutions. This move suggests an understanding that future success may involve technologies that complement or offset traditional hydrocarbon activities.

As of early 2025, global investment in renewable energy continues to surge, with projections indicating significant growth throughout the year. For instance, the International Energy Agency (IEA) reported that renewable energy capacity additions reached record levels in 2023 and is expected to continue this upward trajectory in 2024 and 2025. This macro trend underscores the increasing viability and economic attractiveness of renewable energy solutions for companies across all sectors.

Key considerations for Horizon Oil regarding renewable energy integration include:

- Operational Efficiency: Exploring solar or wind power for their existing facilities to reduce energy costs and carbon footprint.

- Diversification Strategy: Evaluating investments in renewable energy projects or technologies as a means of future revenue generation and risk mitigation.

- Environmental, Social, and Governance (ESG) Alignment: Demonstrating a commitment to sustainability through renewable energy adoption can enhance corporate reputation and investor appeal.

- Technological Advancements: Monitoring innovations in areas like green hydrogen or advanced biofuels, which could offer synergistic opportunities with existing infrastructure.

Data Analytics and AI

Data analytics and AI are becoming crucial for optimizing operations in the oil and gas sector. Horizon Oil can leverage these technologies to enhance reservoir management, ensuring more efficient extraction and resource utilization. For instance, advanced analytics can predict equipment failures, enabling proactive maintenance and reducing costly downtime. In 2024, the global market for AI in oil and gas was estimated to be around $1.5 billion, with significant growth projected through 2030 as companies seek greater operational efficiency and cost savings.

The increasing complexity of oil and gas operations necessitates sophisticated decision-making tools. Horizon Oil's adoption of data analytics and AI is likely to improve its ability to manage assets effectively. This includes better forecasting of production, optimizing drilling plans, and enhancing safety protocols. By analyzing vast datasets, AI algorithms can identify patterns and anomalies that human operators might miss, leading to more informed strategic choices.

The drive for efficiency and cost reduction in the energy industry makes the integration of AI and data analytics a strategic imperative. Horizon Oil would benefit from exploring these applications to gain a competitive edge.

- Enhanced Reservoir Management: AI can analyze geological data and production history to optimize well placement and injection strategies, potentially increasing recovery rates by 5-10% in mature fields.

- Predictive Maintenance: By monitoring sensor data from equipment, AI can predict failures, reducing unplanned downtime and maintenance costs by up to 20%.

- Operational Planning: Advanced analytics can improve logistical planning, supply chain management, and energy consumption across operations.

- Improved Decision-Making: AI-powered insights can support faster and more accurate decisions in areas like exploration, production, and risk management.

Technological advancements are reshaping the oil and gas landscape, directly impacting Horizon Oil's efficiency and cost structures. Innovations in exploration, production, and digital technologies are enabling optimized extraction and improved recovery rates from existing assets.

The company's adoption of cutting-edge techniques, such as advanced seismic imaging and horizontal drilling, as seen in its Mereenie drilling program, maximizes output. Furthermore, the integration of digitalization and AI promises enhanced decision-making and operational performance, with the global AI in oil and gas market projected for significant growth in 2024 and 2025.

Horizon Oil's focus on CCUS technologies and renewable energy integration, evidenced by its investment in Re-Vi Group, reflects a strategic response to industry shifts and ESG imperatives. These technological considerations are crucial for long-term sustainability and competitive advantage in the evolving energy sector.

| Technology Area | Impact on Horizon Oil | Key Data/Projections (2024-2025) |

|---|---|---|

| Exploration & Production Tech | Increased efficiency, cost reduction, access to new resources | Advancements in seismic imaging and horizontal drilling are standard practice. |

| Digitalization & AI | Optimized operations, predictive maintenance, improved decision-making | Global AI in oil & gas market valued at ~$1.5 billion in 2024, with strong growth expected. |

| CCUS Technologies | Emission reduction, environmental stewardship | Australian government prioritizes CCUS, with potential for significant carbon reduction by 2030. |

| Renewable Energy Integration | Operational efficiency, diversification, ESG alignment | Global renewable capacity additions hit record levels in 2023, continuing growth in 2024-2025. |

Legal factors

Horizon Oil's operations are heavily influenced by petroleum and energy legislation, requiring strict adherence to each country's specific regulatory framework. For instance, Papua New Guinea's recent enactment of the National Petroleum Authority Act 2025 and the Oil and Gas (Amendment) Act 2025 introduces a new regulatory body and a production sharing policy for upcoming ventures, impacting potential revenue streams and operational structures.

Similarly, New Zealand's legislative adjustments, including amendments to the Crown Minerals Act, signal a shift by reversing the ban on new petroleum exploration. This change, coupled with modified permit allocation methods, presents new opportunities and competitive dynamics for Horizon Oil in the region, potentially influencing exploration budgets and success rates.

Environmental regulations and the often lengthy permitting processes can significantly impact project schedules and overall expenses for companies like Horizon Oil. These legal frameworks are designed to protect natural resources and public health, but they add layers of complexity to operations.

Horizon Oil's 2024 sustainability report underscores its dedication to environmental responsibility, detailing specific initiatives focused on reducing greenhouse gas emissions. This commitment reflects the critical need to align operational practices with evolving environmental laws in the regions where it conducts business, such as adhering to stricter methane emission standards proposed by the EPA for 2025.

International trade laws and sanctions are critical considerations for Horizon Oil, given the global nature of the energy sector. Changes in trade policies or the imposition of sanctions by major economies can directly affect Horizon's ability to export its products or import essential equipment and services. For instance, the International Energy Agency reported that global energy trade flows are increasingly susceptible to geopolitical shifts, impacting supply chains and market access for companies like Horizon.

Contractual Obligations and Joint Venture Agreements

Horizon Oil's operations are heavily influenced by its joint venture agreements, which are critical legal frameworks. For instance, its partnership with CNOOC Weizhou Operating Company for Block 22/12, OMV New Zealand for the Maari field, and Central Petroleum for the Mereenie project all involve complex contractual obligations.

Adhering to these agreements ensures operational continuity and mitigates legal risks. In 2023, Horizon Oil reported that its share of production from the Maari field was approximately 1.7 million barrels of oil equivalent, highlighting the significance of these partnerships to its overall output and revenue generation.

Failure to meet these contractual duties could lead to disputes, penalties, or even termination of valuable operating licenses, directly impacting the company's financial performance and strategic objectives.

- Contractual Adherence: Horizon Oil's joint venture agreements, such as those with CNOOC for Block 22/12, necessitate strict adherence to all stipulated terms and conditions.

- Operational Stability: Compliance with these legal contracts is paramount for maintaining the stability of its asset operations and ensuring uninterrupted production, as seen in the Maari field.

- Risk Management: Effective management of joint venture agreements is a core component of Horizon Oil's risk mitigation strategy, protecting against potential legal challenges and financial liabilities.

- Partnership Performance: The success and financial contributions of joint ventures, like the Mereenie project with Central Petroleum, are directly tied to the diligent fulfillment of all legal and contractual responsibilities.

Corporate Governance and Reporting Standards

Horizon Oil, as a publicly traded entity, operates under stringent legal mandates requiring strict adherence to corporate governance principles and financial reporting standards. This ensures transparency and accountability to its investors and the broader market. For instance, the company's 2024 Annual Report detailed its compliance with ASX Corporate Governance Council's Principles and Recommendations, a crucial legal framework.

The company's commitment to accurate and timely disclosure is demonstrated through its regular release of financial information. Horizon Oil published its Half-Yearly Financial Report for the period ending December 31, 2024, prepared under the oversight of its Chief Operating Officer, highlighting its dedication to meeting legal reporting obligations.

- ASX Listing Rules Compliance: Horizon Oil must comply with the Australian Securities Exchange (ASX) Listing Rules regarding continuous disclosure and financial reporting.

- Corporations Act 2001 (Cth): The company is bound by the Corporations Act 2001, which governs directors' duties, financial reporting, and corporate conduct in Australia.

- ASIC Regulatory Guides: Horizon Oil's financial statements and disclosures are prepared in accordance with Australian Securities and Investments Commission (ASIC) regulatory guides, ensuring adherence to accounting standards.

- Audited Financial Statements: Annual reports, including statements for the year ended June 30, 2024, undergo independent audits to verify financial accuracy and compliance with legal requirements.

Legal frameworks significantly shape Horizon Oil's operational landscape, from exploration permits to environmental compliance. New legislation in Papua New Guinea, like the National Petroleum Authority Act 2025, and shifts in New Zealand's Crown Minerals Act, directly influence exploration strategies and revenue models. Adherence to international trade laws and sanctions is also critical for global market access and supply chain integrity.

Environmental factors

The intensifying global commitment to climate change mitigation, marked by ambitious national emission targets, presents a significant challenge to the long-term operational models and strategic planning of oil and gas firms. For instance, the International Energy Agency reported in early 2024 that global emissions from energy combustion and industrial processes reached a new record in 2023, underscoring the urgency of policy interventions.

While many Asia-Pacific nations are actively pursuing energy transition strategies, a considerable number also harbor substantial plans for expanding natural gas infrastructure, creating a complex regulatory and market landscape. This dual approach highlights the ongoing debate between decarbonization efforts and the perceived need for transitional fuels.

Horizon Oil explicitly acknowledges climate change as a critical Environmental, Social, and Governance (ESG) priority in its latest sustainability disclosures. The company is actively implementing field emissions reduction programs and has made a strategic investment in a biochar project, aiming to sequester carbon dioxide and mitigate its environmental footprint.

Conducting thorough environmental impact assessments is crucial for Horizon Oil's projects, especially given the increasing global focus on biodiversity. For instance, in 2023, the UN reported that over 1 million species are at risk of extinction, underscoring the need for rigorous mitigation strategies.

The potential for oil and gas exploration to overlap with biodiverse marine areas, particularly in regions like Southeast Asia, demands meticulous environmental planning. Studies in 2024 indicate that marine protected areas in the region are expanding, increasing the likelihood of such overlaps.

Horizon Oil's operations in sensitive environments like Papua New Guinea and New Zealand necessitate robust environmental management plans. These plans must address potential impacts on local ecosystems and comply with evolving international conservation standards, which saw significant updates in late 2024.

Water management is a critical environmental factor for oil and gas companies like Horizon Oil, especially concerning responsible usage and wastewater disposal. In 2024, the industry continues to face scrutiny regarding its water footprint, particularly in regions experiencing water stress. Effective water management is not just about compliance but is increasingly seen as a key aspect of operational sustainability and social license to operate.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for mitigating the environmental impact of oil and gas operations, particularly from drilling and production. Horizon Oil acknowledges this by implementing strategies to minimize contamination and emissions.

Horizon Oil's dedication to environmental stewardship is evident in its initiatives. For instance, the Flare Gas Recovery project at their Mereenie operation is a key pollution control measure designed to reduce flaring and capture valuable gas resources. This project aims to decrease greenhouse gas emissions and improve operational efficiency.

The company's approach to pollution control aligns with broader industry trends and regulatory pressures. In 2023, the Australian oil and gas sector saw continued focus on reducing methane emissions, a significant component of flaring. While specific financial data for Horizon's Flare Gas Recovery project's emissions reduction in 2024/2025 is not yet publicly available, similar projects globally have demonstrated substantial decreases in flared gas volumes, often exceeding 50%.

- Flare Gas Reduction: Horizon Oil's Mereenie project targets a significant reduction in gas flaring, a primary source of air pollution.

- Environmental Stewardship: The company emphasizes its commitment to responsible environmental practices throughout its operations.

- Industry Benchmarking: Efforts to control pollution are crucial for meeting evolving environmental standards and stakeholder expectations in the energy sector.

Transition to Renewable Energy Sources

The global shift towards renewable energy sources is accelerating, creating a complex environment for companies like Horizon Oil, which primarily focuses on hydrocarbon assets. This transition presents significant challenges as demand for fossil fuels may decline in the long term, but also opportunities, particularly if natural gas is viewed as a bridging fuel.

For instance, the International Energy Agency (IEA) reported in 2024 that renewable energy capacity additions reached a record high in 2023, and projections indicate continued strong growth through 2025. This trend necessitates strategic adaptation for traditional energy companies.

- Renewable Capacity Growth: Global renewable electricity capacity is projected to increase by over 240% between 2023 and 2028, reaching nearly 7,700 GW by 2028, according to the IEA.

- Natural Gas as Transition Fuel: In regions like New Zealand, there's ongoing discussion and policy development around the role of natural gas as a transition fuel, potentially offering a near-term market for gas producers.

- Investment Diversification: Companies may need to consider diversifying investments into renewable technologies or carbon capture solutions to remain competitive and relevant in a decarbonizing economy.

- Regulatory Pressures: Increasing government policies and international agreements aimed at reducing carbon emissions will continue to shape the energy landscape, impacting the long-term viability of purely hydrocarbon-focused strategies.

Environmental factors are increasingly shaping the operational landscape for energy companies like Horizon Oil. The global push for decarbonization, evidenced by record renewable energy growth in 2023, necessitates strategic adaptation. Companies must navigate evolving regulations and stakeholder expectations regarding emissions reduction and biodiversity protection.

Horizon Oil is actively addressing these environmental pressures. Their Flare Gas Recovery project at Mereenie aims to significantly cut air pollution by reducing flaring, a common practice in oil and gas production. This initiative aligns with a broader industry trend in 2023 and 2024 to curb methane emissions, which are potent greenhouse gases.

Water management and waste control remain critical environmental considerations. In 2024, the industry faces heightened scrutiny over its water footprint, particularly in water-stressed regions. Horizon Oil's commitment to robust environmental management plans is essential for maintaining its social license to operate and complying with increasingly stringent international conservation standards, which saw notable updates in late 2024.

| Environmental Factor | Impact on Horizon Oil | 2023/2024 Data/Trends |

|---|---|---|

| Climate Change & Emissions | Need for decarbonization strategies, potential impact on long-term demand for hydrocarbons. | Global emissions reached a record high in 2023 (IEA). Renewable capacity additions also hit a record. |

| Biodiversity & Conservation | Risk of operational overlap with sensitive ecosystems, need for rigorous environmental planning. | Over 1 million species at risk of extinction (UN 2023). Marine protected areas are expanding globally. |

| Water Management | Responsible usage and disposal of wastewater, scrutiny in water-stressed areas. | Increased industry focus on water footprint in 2024. |

| Pollution Control (Flaring) | Mitigating air pollution and greenhouse gas emissions. | Flare Gas Recovery project at Mereenie targets significant reduction. Industry focus on methane reduction in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable market research firms, and leading academic journals. We ensure every insight is grounded in current, verifiable data from diverse global and local sources.