Horizon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

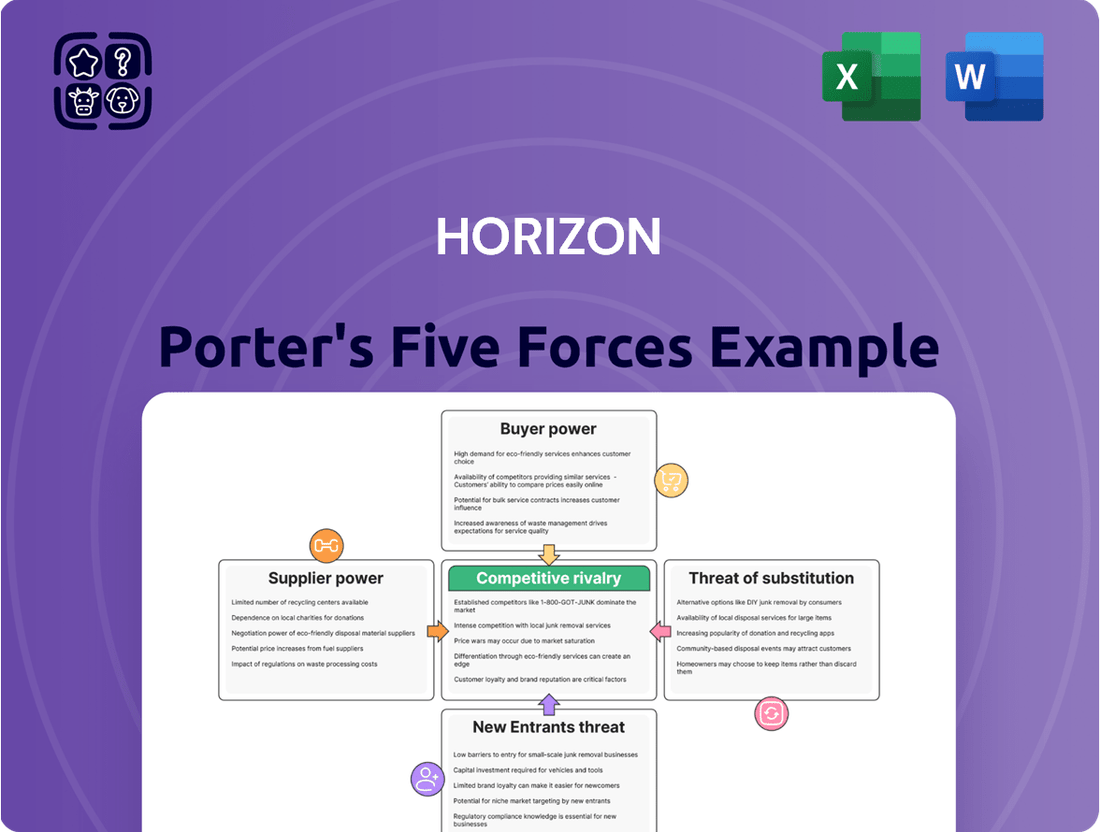

Understanding the competitive landscape is crucial for any business, and Horizon Porter's Five Forces Analysis offers a powerful framework to dissect its industry. By examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, we gain a clearer picture of the forces shaping Horizon's market. This brief overview only scratches the surface of the intricate dynamics at play.

The complete report reveals the real forces shaping Horizon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Horizon Oil's bargaining power. For instance, the oil and gas sector depends heavily on specialized equipment and services like drilling rigs and seismic surveys. A limited number of dominant providers for these essential inputs can wield considerable influence, potentially driving up costs for exploration and production (E&P) companies.

Recent market data from 2024 highlights ongoing consolidation within the drilling services sector. This trend suggests that fewer, larger players are emerging, which could further enhance their pricing power and directly affect the operational expenses for companies like Horizon Oil in securing necessary services.

Switching costs for Horizon Oil are significant, particularly concerning specialized drilling equipment and long-term supply contracts. The oil and gas industry relies on highly integrated systems and requires suppliers to meet stringent safety and operational certifications, making a changeover a complex and expensive undertaking. For instance, in 2024, the average cost for decommissioning and recommissioning offshore drilling platforms due to supplier changes can run into tens of millions of dollars, reflecting the deep integration and specialized nature of these operations.

Suppliers who provide highly specialized or proprietary technology, like unique geological analysis software or advanced directional drilling tools, hold significant bargaining power. Horizon Oil, as an exploration and production company, might rely on these distinct offerings to maintain its competitive edge or ensure efficient operations, which in turn makes it more susceptible to supplier-driven price increases or unfavorable terms.

Threat of Forward Integration by Suppliers

Suppliers possessing the capability and motivation to integrate forward into exploration and production present a significant threat to companies like Horizon Oil. This means suppliers could transition from being partners to direct competitors, potentially limiting Horizon Oil's access to essential services or driving up operational costs. While less common for highly specialized service providers in the upstream oil and gas sector, the potential for this shift cannot be ignored.

The threat of forward integration by suppliers can manifest in several ways:

- Direct Competition: A supplier might acquire existing exploration assets or develop its own, directly competing for resources and market share.

- Increased Input Costs: If suppliers integrate forward, they may prioritize their own operations, leading to higher prices or reduced availability of services for existing clients.

- Control over Technology: Specialized service providers, if they integrate forward, could leverage their proprietary technology to gain a competitive edge, potentially disadvantaging companies that rely on their services.

Importance of Horizon Oil to Suppliers

Horizon Oil's significance to its suppliers directly impacts their bargaining power. If Horizon Oil constitutes a substantial portion of a supplier's annual revenue, that supplier is likely to be more amenable to negotiating favorable pricing and contract terms to retain this key client. For example, if a supplier's business is heavily reliant on Horizon Oil, they might be more willing to offer discounts or flexible delivery schedules.

Conversely, if Horizon Oil is a minor customer for a supplier, the supplier has less incentive to compromise on price or other contractual conditions. In such scenarios, the supplier's focus remains on their larger, more valuable clients, diminishing Horizon Oil's leverage in negotiations. This dynamic means suppliers catering to a broad market may exert more power over smaller clients like Horizon Oil, especially if Horizon Oil represents a small percentage of their overall sales.

For instance, consider a specialized equipment manufacturer. If Horizon Oil accounts for less than 5% of their total sales, they are unlikely to offer significant price reductions. However, if Horizon Oil were to represent 20% or more of that supplier's revenue, negotiations would likely be more favorable for Horizon Oil.

The bargaining power of suppliers for Horizon Oil is shaped by several factors, including supplier concentration and the significance of Horizon Oil as a customer. A concentrated supplier market, where few companies dominate the supply of essential goods or services, grants those suppliers greater leverage. For instance, the oil and gas industry relies on specialized drilling equipment and services, and in 2024, consolidation in the drilling services sector has led to fewer, larger players who can command higher prices.

Switching costs also play a crucial role; high costs associated with changing suppliers, such as for specialized technology or integrated systems, empower existing suppliers. The threat of forward integration by suppliers, where they might become competitors, further strengthens their position. Conversely, if Horizon Oil represents a substantial portion of a supplier's revenue, its bargaining power increases, leading to more favorable terms.

| Factor | Impact on Supplier Bargaining Power | 2024 Example/Data |

|---|---|---|

| Supplier Concentration | High concentration = High power | Consolidation in drilling services sector in 2024 |

| Switching Costs | High switching costs = High power | Tens of millions of dollars for platform decommissioning/recommissioning |

| Supplier Differentiation/Proprietary Tech | Unique offerings = High power | Advanced directional drilling tools, specialized geological software |

| Forward Integration Threat | Potential to become competitor = High power | Suppliers acquiring E&P assets or developing own operations |

| Horizon Oil's Customer Significance | Low significance = High power for supplier | Suppliers with <5% revenue from Horizon Oil unlikely to offer discounts |

What is included in the product

This analysis dissects the five competitive forces shaping Horizon's industry, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Pinpoint and neutralize competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

In the oil and gas sector, Horizon Oil's key customers are usually large entities like refiners, utility companies, and other industrial users. For instance, in 2024, major refining hubs in Asia-Pacific, such as Singapore and South Korea, represent significant customer bases for crude oil producers.

The concentration of these buyers in the Asia-Pacific region means a limited number of major purchasers can significantly influence pricing and contract conditions. If only a handful of these large companies dominate the market for crude oil and natural gas, they gain considerable bargaining power, potentially squeezing Horizon Oil's profit margins.

Large-volume buyers, particularly those with frequent purchasing patterns, wield significant power to negotiate more favorable pricing and contract terms. For Horizon Oil, this means that major industrial clients or national energy distributors who commit to substantial and regular orders of crude oil or natural gas will have a stronger hand in shaping the specifics of their supply agreements.

Customers wield greater bargaining power when readily available substitutes exist. For Horizon Oil, the accelerating global energy transition poses a significant threat. The increasing adoption of renewable energy sources, like solar and wind power, and the surge in electric vehicle (EV) sales directly substitute for traditional hydrocarbon fuels.

In 2024, global EV sales are projected to surpass 17 million units, a substantial increase from previous years, indicating a growing shift away from fossil fuels. This expanding market for alternatives directly diminishes the demand for Horizon Oil's core products, thereby enhancing customer leverage in price negotiations and impacting overall market share.

Customer Switching Costs

Customer switching costs significantly influence their bargaining power. If Horizon Oil's clients, such as refineries or industrial users, can easily switch to alternative crude oil suppliers or different energy sources with minimal expense or disruption, their ability to negotiate favorable terms with Horizon increases. This low switching cost directly erodes Horizon's pricing power.

For instance, a refinery that can readily source crude from multiple global producers or a power plant that has the flexibility to switch between natural gas, coal, or renewables faces fewer constraints. This ease of substitution empowers them to demand lower prices or better contract conditions from Horizon, as they have readily available alternatives.

In 2024, the global oil market is characterized by diverse supply sources. Major producers like Saudi Arabia, Russia, and the United States contribute significantly to global supply, offering refiners multiple options. For example, the US EIA reported that crude oil production in the United States averaged 12.9 million barrels per day in 2023, highlighting the availability of alternative supplies for many buyers.

- Low Switching Costs: If Horizon's customers can easily change suppliers without incurring significant costs (e.g., retraining staff, new equipment, contract penalties), their bargaining power is elevated.

- Availability of Alternatives: The presence of numerous alternative crude oil suppliers or substitute energy sources for Horizon's customers directly strengthens customer bargaining power.

- Price Sensitivity: Customers with readily available and cost-effective alternatives are more price-sensitive, pressuring Horizon to maintain competitive pricing.

- Impact on Pricing Power: High customer bargaining power, driven by low switching costs, limits Horizon Oil's ability to dictate prices and contract terms.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Horizon Oil, particularly in the commodity markets of oil and gas. When products are largely undifferentiated, like crude oil, customers have a stronger inclination to seek the lowest price available. This sensitivity directly influences their purchasing decisions.

In 2024, global oil prices experienced considerable volatility. For instance, Brent crude oil prices fluctuated, trading in a range that saw significant swings due to geopolitical events and supply-demand dynamics. This volatility means Horizon Oil has limited room to set premium prices, as customers can easily switch suppliers if prices are not competitive.

- High Price Sensitivity in Commodities: In markets where products are undifferentiated, such as oil and gas, customers are highly attuned to price.

- Impact of Global Price Fluctuations: Changes in international oil prices directly affect customer willingness to pay, limiting Horizon Oil's pricing power.

- Limited Differentiation: Horizon Oil's inability to significantly differentiate its commodity product means it cannot easily command premium prices compared to competitors.

Customers have significant leverage when they are concentrated, have low switching costs, or when substitutes are readily available, directly impacting Horizon Oil's pricing and contract terms.

In 2024, the global energy market's volatility and the increasing availability of alternative energy sources amplify customer bargaining power, forcing producers like Horizon Oil to remain highly competitive on price.

For Horizon Oil, the presence of many large buyers in key markets like Asia-Pacific, coupled with the ease with which these buyers can source crude from other global producers, substantially limits its ability to dictate terms.

| Factor | Impact on Horizon Oil | 2024 Relevance |

|---|---|---|

| Customer Concentration | High bargaining power for few large buyers | Major refiners in Asia-Pacific |

| Switching Costs | Low costs empower customers to negotiate | Ease of sourcing from multiple global suppliers |

| Availability of Substitutes | Weakens Horizon's pricing power | Growth in renewables and EVs impacting fossil fuel demand |

What You See Is What You Get

Horizon Porter's Five Forces Analysis

This preview showcases the comprehensive Horizon Porter's Five Forces Analysis you will receive immediately upon purchase. You're looking at the actual document, ensuring no surprises or placeholder content, just the complete, professionally formatted analysis ready for your strategic planning. Once your transaction is complete, you'll gain instant access to this exact, ready-to-use file, empowering you with actionable market insights.

Rivalry Among Competitors

The Asia-Pacific oil and gas exploration and production sector is characterized by a diverse landscape of players, including numerous independent firms and national oil companies. This fragmentation, with many entities competing for the same resources, naturally fuels intense rivalry.

A significant number of competitors, particularly those possessing comparable financial strength and operational capabilities, amplify this competitive pressure. These companies are constantly vying for prime exploration blocks, crucial development projects, and ultimately, a larger share of the regional market.

For instance, in 2024, the Asia-Pacific region saw continued participation from major national oil companies like PetroChina and Sinopec, alongside international giants and a growing number of specialized independent producers, all actively bidding in licensing rounds and pursuing joint ventures, thereby heightening the competitive dynamics.

In industries with sluggish or negative growth, competition often intensifies. Companies scramble to capture the shrinking market share, leading to more aggressive pricing and marketing. This dynamic is particularly relevant as the global oil sector navigates a complex future.

While global oil demand saw a modest increase in 2023, reaching approximately 102.1 million barrels per day according to the International Energy Agency (IEA), the long-term trajectory points towards a plateau and eventual decline. This shift is driven by widespread energy transition initiatives aimed at decarbonization.

This projected slowdown in demand growth, coupled with existing overcapacity in some segments, is likely to fuel heightened competitive rivalry among oil and gas companies. They will need to find ways to remain profitable and relevant in an evolving energy landscape.

In the commodity-driven oil and gas sector, products like crude oil and natural gas are largely undifferentiated. This means competition often boils down to who can offer the lowest price, as customers see little difference between one company's oil and another's. Horizon Oil, like its peers, faces this reality.

Horizon Oil's differentiation strategy, therefore, doesn't typically stem from unique product features. Instead, it focuses on operational efficiency and cost management. For example, in 2023, Horizon Oil reported a production cost per barrel of oil equivalent that was competitive within its operating regions, a key factor in its ability to compete on price.

Strategic asset locations also play a crucial role in Horizon Oil's competitive positioning. Access to established infrastructure, proximity to key markets, or ownership of lower-cost reserves can provide an edge. These factors, rather than the inherent nature of the oil or gas itself, are where Horizon Oil seeks to stand out from competitors.

Exit Barriers

High exit barriers, like substantial sunk costs in specialized exploration and production infrastructure, can trap companies in an industry. For instance, in the oil and gas sector, the immense capital invested in offshore platforms and pipelines, often running into billions of dollars, makes exiting difficult even when prices are low. These fixed, unrecoverable costs mean companies are incentivized to continue operating to recoup their investments, thereby prolonging intense competition.

Long-term contractual obligations, such as supply agreements or leases for specialized equipment, also act as significant exit barriers. Companies may be legally bound to continue production or service provision, even at a loss, to avoid penalty clauses. Environmental liabilities, including site remediation and decommissioning costs, can also be substantial, forcing firms to remain operational or face significant future expenses.

- Sunk Costs: Billions invested in oil and gas infrastructure remain unrecoverable, forcing continued operation.

- Contractual Obligations: Long-term supply agreements can mandate production even in unprofitable periods.

- Environmental Liabilities: Decommissioning and remediation costs deter companies from ceasing operations prematurely.

Diversity of Competitors

The competitive landscape in the Asia-Pacific oil and gas sector is notably diverse. This includes major international oil companies (IOCs) such as ExxonMobil and Shell, which possess significant financial muscle and technological capabilities. National oil companies (NOCs), like PetroChina and Petronas, often benefit from government support and preferential access to resources, further intensifying rivalry.

Horizon Oil, as an independent player, navigates this complex environment alongside these larger entities. The presence of such varied competitors means strategies and objectives differ widely, from maximizing national resource extraction by NOCs to global market share pursuit by IOCs. This heterogeneity fuels a dynamic and often fierce competitive rivalry across the region.

For instance, in 2024, the Asia-Pacific region continued to be a key battleground for energy resources. IOCs maintained substantial investment in exploration and production, while NOCs focused on securing domestic supply and expanding downstream operations. This dynamic creates a multifaceted competitive pressure for companies like Horizon Oil.

The varied strategies and objectives among these players contribute to the overall intensity of competition.

- Diverse Competitor Base: The Asia-Pacific market features a mix of IOCs, NOCs, and independent producers, each with distinct strategic priorities and resource endowments.

- Strategic Government Backing: NOCs often leverage government support, providing them with advantages in terms of access to reserves and regulatory favor.

- Resource Allocation: IOCs and NOCs compete for exploration rights and production licenses, influencing market access and potential growth for smaller players.

- Varying Objectives: The differing goals, from profit maximization for IOCs to national energy security for NOCs, create a complex web of competitive interactions.

The Asia-Pacific oil and gas exploration and production sector is characterized by a high degree of competitive rivalry. This intensity stems from a large number of players, including major international oil companies (IOCs), national oil companies (NOCs), and numerous independent producers, all vying for limited resources and market share. The undifferentiated nature of the commodity itself means that competition often centers on cost efficiency and strategic asset positioning rather than product features.

In 2024, companies like PetroChina, Sinopec, ExxonMobil, and Shell continued to be significant players, alongside regional independents, all actively participating in licensing rounds and pursuing joint ventures. This broad participation amplifies the pressure, particularly as the industry faces a future of potentially plateauing demand due to energy transition initiatives. For instance, global oil demand growth is moderating, with the IEA projecting a more subdued outlook compared to previous decades, forcing companies to focus on operational excellence to remain profitable.

High exit barriers, such as substantial sunk costs in infrastructure and long-term contractual obligations, further contribute to sustained competition. Companies are often compelled to continue operations to recoup massive investments, even in challenging market conditions. This dynamic means that even with evolving energy landscapes, the competitive rivalry within the sector remains a defining characteristic.

| Competitor Type | Key Players (Examples) | Competitive Focus |

|---|---|---|

| International Oil Companies (IOCs) | ExxonMobil, Shell | Profit maximization, global market share, technological advancement |

| National Oil Companies (NOCs) | PetroChina, Sinopec, Petronas | National energy security, resource development, downstream integration |

| Independent Producers | Horizon Oil, numerous regional firms | Operational efficiency, cost management, niche market access |

SSubstitutes Threaten

The attractiveness of substitute energy sources, like solar and wind, hinges on their price-performance ratio against oil and gas. As renewables become more cost-effective and efficient, they increasingly threaten Horizon Oil's traditional products, impacting future demand.

In 2024, the levelized cost of electricity for utility-scale solar PV fell to an average of $39 per megawatt-hour, a significant drop from previous years, making it highly competitive with fossil fuels. This cost reduction directly challenges the long-term viability of hydrocarbon-based energy.

Customer willingness to switch to alternative energy sources is a significant threat to Horizon Oil. Factors such as growing environmental consciousness, government mandates promoting renewable energy, and the expanding availability of charging infrastructure for electric vehicles are all pushing consumers towards substitutes. For instance, in 2024, global electric vehicle sales are projected to reach over 17 million units, a substantial increase from previous years, directly impacting gasoline demand.

A heightened propensity to substitute, especially in major markets like China and India where renewable energy adoption is accelerating, directly affects the demand for Horizon Oil's core products. In 2023, China alone saw a significant surge in renewable energy investment, exceeding $140 billion, a trend that is expected to continue and further erode fossil fuel demand.

The expanding availability and accessibility of alternative energy infrastructure directly impacts the threat of substitutes for the oil and gas industry. For instance, the growth of electric vehicle charging networks makes it easier for consumers to transition away from gasoline-powered vehicles. By the end of 2023, the number of public EV charging points in the EU had surpassed 500,000, a significant increase from previous years, indicating growing customer ease in switching.

Similarly, the development of natural gas pipelines for power generation provides a more readily available alternative to oil in certain energy markets. This infrastructure expansion lowers switching costs for businesses and utilities, thereby increasing the competitive pressure on oil and gas producers. The global natural gas market saw substantial growth in 2024, driven by increased demand and infrastructure investments, further solidifying its role as a viable substitute.

Regulatory and Policy Support for Substitutes

Government policies can significantly bolster the appeal of substitute products and services. For instance, in 2024, many nations continued to implement incentives for electric vehicles and renewable energy installations, directly impacting demand for traditional fossil fuels.

In Horizon Oil's key markets, such as China, the government has been a major driver of renewable energy expansion. By 2023, China had already surpassed its 2025 renewable energy targets, demonstrating a strong policy commitment that directly elevates the threat of substitutes in the energy sector.

Similarly, New Zealand's climate change policies, including carbon pricing mechanisms, make fossil fuels less competitive. Papua New Guinea, while still heavily reliant on hydrocarbons, is also exploring diversification, which could be influenced by regional policy trends and international climate agreements.

- Government incentives for renewable energy adoption

- Carbon pricing mechanisms increasing fossil fuel costs

- Stricter emissions standards favoring cleaner alternatives

- International climate agreements influencing national energy policies

Technological Advancements in Substitutes

Technological advancements are rapidly making substitutes for traditional energy sources more competitive. For instance, improvements in solar panel efficiency and battery storage technology are driving down costs, making renewable energy a more attractive option. By the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase from 2022, according to the International Energy Agency (IEA).

These innovations directly challenge the demand for hydrocarbon assets. As energy efficiency technologies also mature, the overall need for fossil fuels could diminish. This trend poses a significant threat to Horizon Oil's established business model, as consumers and industries increasingly adopt cleaner, more cost-effective alternatives.

- Renewable Energy Growth: Global renewable energy capacity additions surged by 50% in 2023, reaching 510 GW.

- Battery Storage Improvements: Advancements in battery technology are lowering costs and increasing the viability of intermittent renewable sources.

- Energy Efficiency Gains: Enhanced efficiency in buildings and transportation reduces overall energy consumption, impacting demand for traditional fuels.

- Cost Competitiveness: The levelized cost of electricity from solar PV and onshore wind has fallen significantly, making them increasingly competitive with fossil fuel power generation.

The threat of substitutes for Horizon Oil is amplified by the increasing cost-competitiveness and widespread adoption of renewable energy sources. As technologies like solar and wind power mature, their price points become more attractive compared to traditional fossil fuels. This shift is further encouraged by government policies and growing consumer environmental awareness.

In 2024, the global energy landscape is witnessing a pronounced shift. The levelized cost of electricity for utility-scale solar PV averaged around $39 per megawatt-hour, a figure that directly challenges the economic viability of oil and gas. Simultaneously, electric vehicle sales are projected to exceed 17 million units in 2024, a clear indicator of consumer preference moving away from gasoline. This growing acceptance of alternatives, supported by expanding charging infrastructure, presents a significant challenge to Horizon Oil's traditional revenue streams.

| Substitute Type | 2024 Cost Metric | Impact on Horizon Oil | Key Driver |

|---|---|---|---|

| Solar PV Electricity | ~$39/MWh (Levelized Cost) | Directly competes with fossil fuel power generation. | Falling technology costs, government incentives. |

| Electric Vehicles (EVs) | Projected >17M units sold in 2024 | Reduces demand for gasoline and diesel. | Consumer preference, charging infrastructure growth. |

| Wind Power | Competitive LCOE | Displaces natural gas and oil in power sector. | Technological advancements, policy support. |

Entrants Threaten

The oil and gas exploration and production sector is notoriously capital-intensive. Horizon Oil, like its peers, faces enormous upfront costs for seismic surveys, drilling, and establishing production facilities. For instance, a single offshore exploration well can cost tens of millions of dollars, and developing a new field can run into billions. This significant financial hurdle inherently limits the number of new companies that can realistically enter the market, thereby reducing the threat of new entrants for Horizon.

New companies looking to enter the oil and gas sector, like Horizon Oil, often struggle to gain access to crucial distribution channels. These include pipelines, refineries, and export terminals, which are frequently controlled by established companies or even national governments. This control creates a significant barrier, making it tough for newcomers to get their products to market efficiently.

Horizon Oil, with its existing infrastructure and long-standing relationships, has a distinct advantage in this area. This established access makes it considerably harder for new entrants to compete on a level playing field, as they would need to invest heavily in building their own distribution networks or negotiate costly access agreements.

The oil and gas sector faces significant barriers to entry due to extensive regulatory and licensing requirements. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict emissions standards, requiring substantial investment in pollution control technology for any new facility. Obtaining the necessary permits for exploration, drilling, and production can involve lengthy environmental impact assessments and public consultations, often taking years and costing millions of dollars, effectively deterring smaller or less capitalized new players.

Proprietary Technology and Expertise

The threat of new entrants is significantly mitigated by the proprietary technology and specialized expertise that established players like Horizon Oil have cultivated. Developing or acquiring the necessary geological data, advanced exploration techniques, and deep operational know-how represents a substantial barrier to entry. For instance, the cost of seismic data acquisition and interpretation alone can run into millions, a considerable investment for a newcomer.

New companies would face the daunting task of replicating the decades of accumulated experience and the unique technological advantages that existing firms possess. This includes specialized drilling equipment, advanced reservoir modeling software, and established safety protocols honed through years of practical application. In 2024, the capital expenditure for a single offshore exploration well can easily exceed $100 million, underscoring the immense financial commitment required.

- Proprietary Technology: Horizon Oil's investment in advanced seismic imaging and data analytics provides a competitive edge, making it difficult for new entrants to match their discovery success rates.

- Operational Expertise: Years of experience in managing complex extraction processes and navigating regulatory environments in diverse geological settings are invaluable assets that new firms lack.

- High Capital Requirements: The significant upfront investment in exploration, drilling, and infrastructure, often in the hundreds of millions of dollars, deters many potential new entrants.

- Data Advantage: Access to and interpretation of vast geological databases, often proprietary and costly to replicate, gives incumbent firms a crucial advantage in identifying viable prospects.

Brand Loyalty and Switching Costs for Customers

While oil and gas are often viewed as commodities, established players like Horizon Oil benefit from long-term supply relationships and a history of reliability, fostering a degree of customer inertia that acts as a barrier to new entrants. For instance, in 2023, major integrated oil companies often secured the majority of their crude oil supply through existing, long-standing contracts, demonstrating the stickiness of these relationships.

New competitors would need to present significant advantages, such as demonstrably lower pricing or a more consistent and secure supply chain, to persuade customers to switch from trusted, established providers. The cost and effort involved in re-negotiating contracts and verifying the reliability of a new supplier can be substantial deterrents.

- Customer Inertia: Existing relationships and trust create a natural resistance to switching suppliers.

- Switching Costs: The effort and expense associated with changing suppliers act as a barrier.

- Competitive Advantage Required: New entrants must offer substantial benefits like lower prices or superior reliability to overcome inertia.

The threat of new entrants in the oil and gas exploration and production sector is significantly dampened by the immense capital requirements, with a single offshore exploration well costing upwards of $100 million in 2024. Established companies like Horizon Oil also benefit from proprietary technology and deep operational expertise, making it difficult for newcomers to replicate their success. Furthermore, access to critical distribution channels and long-standing customer relationships create substantial barriers, requiring new players to offer compelling advantages to overcome existing inertia.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Intensity | High upfront costs for exploration, drilling, and infrastructure. | Deters smaller or less capitalized firms. | Offshore exploration well cost: ~$100 million+ |

| Distribution Channels | Control of pipelines, refineries, and export terminals by incumbents. | Limits market access for new players. | Negotiating pipeline access can involve lengthy, costly agreements. |

| Technology & Expertise | Proprietary data, advanced techniques, and operational know-how. | Creates a significant competitive disadvantage for new firms. | Seismic data acquisition and interpretation costs: Millions of dollars. |

| Customer Relationships | Long-term supply contracts and established trust. | Leads to customer inertia and switching costs. | Major oil companies secure majority of supply via existing contracts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and government economic databases to provide a comprehensive view of competitive pressures.