Horizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Unlock the strategic blueprint behind Horizon's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. For entrepreneurs and strategists aiming to replicate such growth, this is an indispensable tool.

Partnerships

Horizon Oil Limited actively forms joint ventures with other energy firms to distribute the substantial capital costs and operational risks inherent in oil and gas ventures. For instance, in 2024, Horizon Oil continued its participation in the Maari/Manaia fields in New Zealand alongside OMV and Cue Energy Resources, a partnership that has been instrumental in optimizing production from these assets.

These strategic alliances, including collaborations with CNOOC Limited and Roc Oil Company in China's Block 22/12, and Central Petroleum and Cue Energy in Australia's Mereenie fields, are vital for pooling specialized knowledge and resources. This collaborative approach ensures that projects are executed efficiently and that asset performance is maximized across diverse operational areas.

Collaborating with government and regulatory bodies in key operational countries like China, New Zealand, Australia, and Thailand is fundamental. These partnerships are crucial for obtaining and retaining exploration permits, production licenses, and environmental approvals, ensuring adherence to local laws and industry standards. For example, in 2024, the Australian government continued to streamline its environmental impact assessment processes for resource projects, a move that directly benefits companies operating in the country by potentially reducing project timelines.

Horizon Oil's success hinges on its collaborations with specialized oilfield service providers. These partners are crucial for essential tasks like drilling, completing wells, conducting geological surveys, and seismic data acquisition. For instance, in 2024, Horizon Oil continued its infill drilling programs in China's Block 22/12 and Australia's Mereenie fields, leveraging the expertise of these service providers.

Financial Institutions and Lenders

Partnerships with financial institutions, such as Westpac and Macquarie Bank, are fundamental for securing vital debt facilities and managing capital. These relationships are instrumental in financing significant acquisitions and supporting the company's ambitious growth strategies.

These robust financial partnerships provide the essential liquidity needed to fund large-scale energy projects, effectively manage day-to-day working capital, and proactively mitigate various financial risks. For an energy company with substantial upfront investment needs, this access to capital is not just beneficial, it's absolutely critical for operational viability and expansion.

- Securing Debt Facilities: Essential for funding large capital expenditures.

- Financing Acquisitions: Enabling strategic expansion through mergers and takeovers.

- Managing Capital: Ensuring sufficient liquidity for ongoing operations and growth.

- Risk Mitigation: Utilizing financial instruments to hedge against market volatility.

Energy Offtakers and Buyers

Horizon Oil’s key partnerships with energy offtakers and buyers are crucial for ensuring the sale of its crude oil and natural gas. These relationships provide a stable market for its production, guaranteeing revenue streams.

Securing long-term contracts, such as fixed-price agreements for gas production, is a cornerstone of this strategy. For instance, some of Horizon’s Mereenie gas production benefits from such arrangements, offering predictable income.

- Fixed-Price Contracts: Agreements like those for Mereenie gas provide revenue certainty.

- Stable Demand: Partnerships ensure consistent offtake for crude oil and natural gas.

- Revenue Predictability: Long-term relationships underpin Horizon’s financial forecasting.

Horizon Oil's key partnerships are multifaceted, encompassing joint ventures for risk and cost sharing, collaborations with service providers for operational expertise, and alliances with financial institutions for capital access. These relationships are vital for navigating the capital-intensive nature of the oil and gas industry and ensuring efficient project execution.

Strategic alliances with other energy firms, such as those in the Maari/Manaia fields and China's Block 22/12, are critical for distributing capital costs and operational risks. These collaborations also facilitate the pooling of specialized knowledge, enhancing overall asset performance and project efficiency.

Furthermore, partnerships with government and regulatory bodies are indispensable for securing necessary permits and approvals, ensuring compliance, and facilitating smoother operations. Collaborations with oilfield service providers are also crucial for specialized tasks like drilling and seismic surveys, directly supporting ongoing development programs.

| Partnership Type | Key Partners (Examples) | Purpose/Benefit | 2024 Relevance/Data |

|---|---|---|---|

| Joint Ventures | OMV, Cue Energy Resources, CNOOC Limited, Central Petroleum | Capital cost sharing, risk distribution, knowledge pooling | Continued participation in Maari/Manaia and Mereenie fields |

| Service Providers | Specialized Oilfield Service Firms | Drilling, well completion, geological surveys, seismic data acquisition | Support for infill drilling programs in China and Australia |

| Financial Institutions | Westpac, Macquarie Bank | Debt facilities, capital management, financing acquisitions | Essential for funding growth strategies and operational liquidity |

| Offtakers/Buyers | Various energy purchasers | Ensuring sale of crude oil and natural gas, revenue streams | Securing stable demand, potentially through fixed-price contracts for gas |

What is included in the product

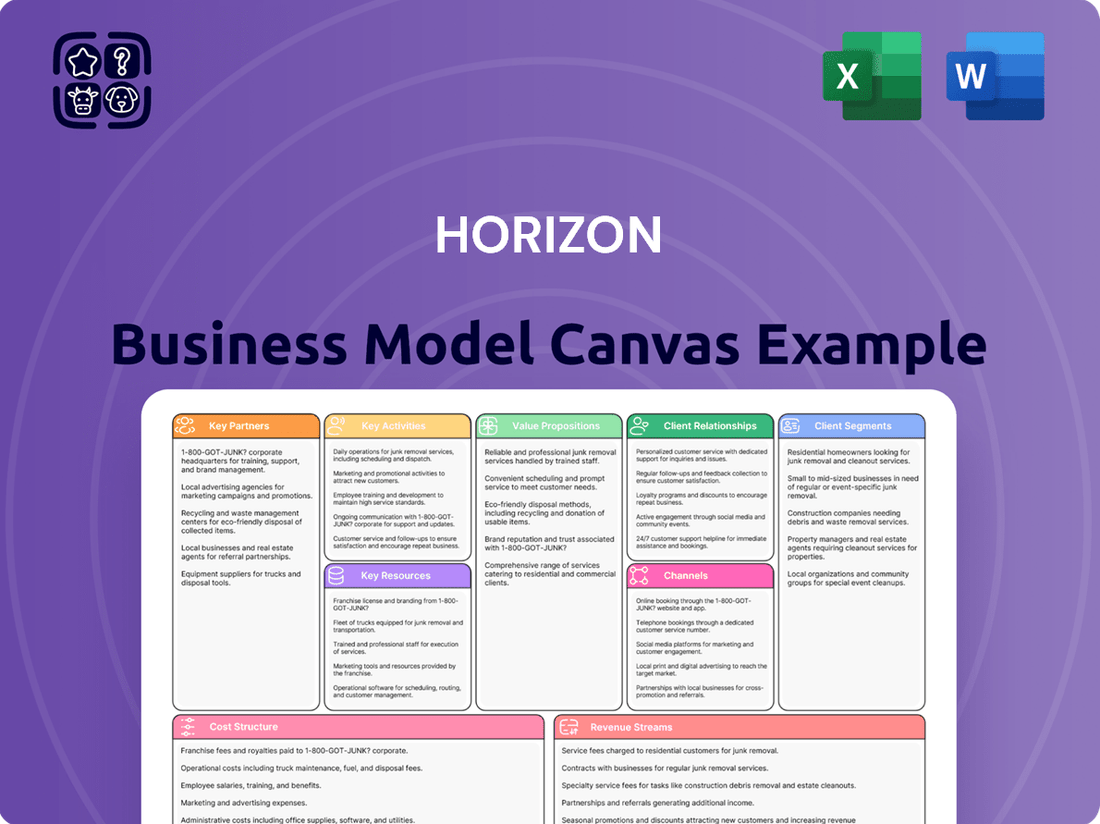

A dynamic framework for visualizing and developing business models, the Horizon Business Model Canvas breaks down a business into nine core building blocks.

It provides a structured approach to understanding customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

The Horizon Business Model Canvas offers a structured approach to identify and address customer pains by visually mapping out value propositions against specific customer segments.

It simplifies complex business challenges into a clear, actionable framework, allowing teams to pinpoint and alleviate customer pain points efficiently.

Activities

Horizon Oil's primary activity revolves around discovering and evaluating new oil and gas reserves. This crucial process involves detailed geological assessments, sophisticated seismic imaging, and exploratory drilling to pinpoint potential resources. For instance, in the first half of fiscal year 2024, Horizon Oil continued its exploration efforts in the Cooper Basin, aiming to expand its resource base.

The company places significant emphasis on appraising these newly found resources. This appraisal stage is vital for understanding the commercial potential and technical feasibility of extracting the hydrocarbons before committing to costly development. Horizon's strategic approach ensures that future production is underpinned by thoroughly vetted and economically viable reserves.

Oil and Gas Field Development is a core activity focused on transforming discovered hydrocarbon reserves into producing assets. This involves the intricate design, construction, and installation of essential production facilities, alongside the crucial drilling of development wells. Establishing robust infrastructure for efficient hydrocarbon extraction is paramount to this process, demanding substantial engineering expertise, meticulous project management, and significant capital investment to transition assets from the appraisal stage to active production.

Recent developments highlight the ongoing nature of field development. For instance, China's Block 22/12 has seen active infill drilling campaigns, a strategy aimed at maximizing recovery from existing reservoirs. Similarly, Australia's Mereenie fields are undergoing development activities, demonstrating a continued commitment to bringing these resources online. These initiatives underscore the industry's drive to optimize production and capitalize on discovered reserves.

Hydrocarbon Production and Operations is the core of Horizon's business, focusing on the efficient and safe extraction of oil and gas from its existing fields. This involves constant monitoring and upkeep of wells and infrastructure to ensure optimal output.

Horizon actively manages its producing assets across China, New Zealand, Thailand, and Australia. In 2024, the company continued its efforts to maximize production from these mature fields, demonstrating its operational expertise in diverse geological settings.

Asset Management and Portfolio Optimization

Horizon Oil actively manages its asset portfolio through strategic acquisitions and divestments. This involves a continuous assessment to boost value and broaden its production sources. For instance, in 2024, the company continued its focus on optimizing its asset base, a strategy that has historically included significant moves like the acquisition of interests in the Mereenie oil and gas field in Australia and the Sinphuhorm and Nam Phong gas fields in Thailand. These actions are crucial for maintaining a robust and expanding production profile.

The company’s approach to asset management is designed to ensure long-term resilience and growth. By strategically buying and selling assets, Horizon Oil aims to align its portfolio with market opportunities and its overarching business objectives. This dynamic process is key to its operational strategy.

- Strategic Acquisitions: Horizon Oil pursues acquisitions to enhance its production capacity and geographic diversification.

- Divestment Activities: The company also divests non-core or underperforming assets to improve overall portfolio efficiency.

- Value Enhancement: These activities are undertaken with the primary goal of increasing shareholder value.

- Production Profile: The ongoing management of assets directly contributes to a stable and growing production base.

Risk Management and Compliance

Horizon Oil actively manages operational, financial, and environmental risks. This involves strategies like oil price hedging to buffer against market fluctuations and securing production insurance. In 2024, the company continued its focus on adhering to rigorous health, safety, and environmental (HSE) regulations, a critical component of its risk mitigation framework.

The company's approach to financial risk includes prudent policies for oil price hedging. For instance, in early 2024, Horizon Oil had hedged approximately 40% of its expected production for the year, aiming to lock in a favorable price range and reduce exposure to downward price movements.

Environmental stewardship is a core activity, with Horizon Oil investing in initiatives to reduce its operational footprint. In 2024, the company reported a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2023 baseline, demonstrating a commitment to environmental responsibility.

- Operational Risk Management: Implementing robust safety protocols and maintenance schedules to prevent disruptions.

- Financial Risk Mitigation: Utilizing oil price hedging strategies to stabilize revenue streams.

- Environmental Compliance: Adhering to and exceeding HSE regulations, focusing on emission reduction targets.

- Insurance Coverage: Maintaining comprehensive production and asset insurance to cover unforeseen events.

Horizon Oil's key activities encompass the entire lifecycle of oil and gas assets, from initial exploration and appraisal to development, production, and ongoing portfolio management. These activities are underpinned by robust risk management and a commitment to environmental stewardship.

The company actively manages its asset base through strategic acquisitions and divestments to optimize its production profile and enhance shareholder value. This dynamic approach ensures Horizon Oil remains agile in a fluctuating market.

Operational efficiency and safety are paramount in hydrocarbon production, with continuous monitoring and upkeep of infrastructure. Furthermore, Horizon Oil prioritizes environmental responsibility, actively working to reduce its operational footprint and comply with stringent HSE regulations.

Preview Before You Purchase

Business Model Canvas

The Horizon Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, layout, and content are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use business model canvas, allowing you to start strategizing right away.

Resources

Horizon Oil's core physical assets are its oil and gas reserves and resources, which are the bedrock of its operations and future potential. These include proved, probable, and contingent resources across key regions, forming the foundation for production and growth.

These valuable hydrocarbon assets are strategically located in China's Beibu Gulf, New Zealand's Maari/Manaia fields, Australia's Mereenie fields, and Thailand's Sinphuhorm and Nam Phong fields. The company's overall valuation is directly influenced by the quantity and quality of these reserves.

As of the first half of fiscal year 2024, Horizon Oil reported a total proved and probable reserves and resources of 193.7 million barrels of oil equivalent (MMboe). This significant resource base underpins the company's production capacity and strategic development plans.

Horizon's production infrastructure encompasses vital physical assets like wellhead platforms, extensive pipeline networks, and sophisticated processing facilities. These are the backbone of our operations, enabling the efficient extraction and initial refinement of crude oil and natural gas. In 2024, significant investments were made to upgrade and maintain these critical components, ensuring operational continuity and safety.

The company also relies on specialized oilfield equipment, including advanced drilling rigs and specialized machinery, crucial for accessing reserves and optimizing extraction. The effective deployment and upkeep of this equipment directly impact production volumes and cost efficiency. By mid-2025, Horizon plans to integrate new, more efficient drilling technologies to further enhance output from existing fields.

Horizon Oil's success hinges on its skilled technical and management personnel, a team boasting deep expertise in geosciences, engineering, and project management within the oil and gas sector. This high-calibre workforce is indispensable for navigating the intricacies of exploration, development, and day-to-day operations, ensuring efficient and effective execution of the company's strategic objectives.

The company emphasizes its robust in-house technical capabilities, a testament to the quality of its personnel. For instance, in 2024, Horizon Oil continued to invest in talent development, aiming to maintain its competitive edge in a dynamic industry. Their professionals are adept at strategic decision-making, a vital component for adapting to fluctuating market conditions and identifying new growth opportunities.

Exploration and Production Data

Exploration and Production (E&P) data forms a cornerstone of intellectual resources. This includes proprietary geological surveys, detailed seismic imaging, and sophisticated reservoir models. For instance, in 2024, major oil and gas companies continued to invest heavily in advanced seismic acquisition and processing technologies, aiming to de-risk exploration ventures and enhance the accuracy of reserve estimations.

Operational knowledge, honed through years of experience, particularly in regions like the Asia-Pacific, is critical. This expertise allows for the optimization of field development strategies and the improvement of recovery rates from established assets. Companies leveraging such data in 2024 reported an average increase of 3-5% in production efficiency from mature fields through enhanced oil recovery (EOR) techniques informed by detailed historical performance data.

The continuous analysis of this data directly fuels efficiency gains and resource upgrades. For example, ongoing technical studies in 2024 led to the reclassification of certain proved reserves to probable or possible, effectively increasing the company's potential resource base. This iterative process of data collection, analysis, and application is vital for sustained growth in the E&P sector.

- Proprietary Geological and Seismic Data

- Advanced Reservoir Modeling Capabilities

- Operational Expertise in Field Development and Optimization

- Continuous Technical Studies Driving Efficiency and Resource Upgrades

Financial Capital

Horizon Oil's access to substantial financial capital is a cornerstone of its operations. This includes readily available cash reserves, established debt facilities, and the ability to secure equity funding when needed. This financial strength is crucial for powering their ambitious exploration initiatives, developing existing fields, and pursuing strategic asset acquisitions.

In 2024, Horizon Oil's financial strategy emphasized maintaining a robust capital structure to support its growth objectives. For instance, the company reported having approximately AUD 100 million in cash and cash equivalents as of the first half of 2024, alongside significant undrawn debt facilities, providing ample liquidity for ongoing projects and potential opportunities.

- Cash Reserves: Maintaining healthy cash reserves ensures immediate operational needs are met and provides a buffer for unexpected expenses.

- Debt Facilities: Access to credit lines and other debt instruments allows Horizon to leverage its balance sheet for larger investments without diluting equity.

- Equity Funding: The ability to raise capital through share offerings or private placements provides flexibility for significant growth projects or acquisitions.

- Strategic Deployment: Financial capital is strategically allocated to high-potential exploration, field development, and value-accretive acquisitions, driving long-term shareholder returns.

Horizon Oil's key resources include its substantial proved and probable reserves and resources, which stood at 193.7 million barrels of oil equivalent (MMboe) in the first half of fiscal year 2024. These are complemented by critical physical assets like production infrastructure, including wellhead platforms and pipeline networks, and specialized oilfield equipment. The company also leverages strong intellectual capital through proprietary geological data and operational expertise, particularly in field development and optimization. This is further bolstered by significant financial capital, with approximately AUD 100 million in cash and cash equivalents reported in early 2024, alongside robust debt facilities.

| Resource Category | Specific Asset/Capability | Key Data Point (as of H1 2024) |

|---|---|---|

| Physical Assets | Oil and Gas Reserves/Resources | 193.7 MMboe (Proved & Probable) |

| Physical Assets | Production Infrastructure | Wellhead platforms, pipelines, processing facilities |

| Intellectual Capital | Proprietary Data | Geological surveys, seismic imaging, reservoir models |

| Intellectual Capital | Operational Expertise | Field development, optimization, EOR techniques |

| Financial Capital | Cash and Equivalents | AUD 100 million |

| Financial Capital | Debt Facilities | Significant undrawn facilities |

Value Propositions

Horizon Oil's commitment to a reliable energy supply is a cornerstone of its value proposition, particularly for the Asia-Pacific region. They ensure a consistent flow of crude oil and natural gas, vital for both industrial processes and everyday consumer needs.

This dependability is actively maintained through their operational presence across China, New Zealand, Australia, and Thailand. In 2024, Horizon Oil continued to focus on maximizing output from its existing fields, such as the significant contribution from the Maari field offshore New Zealand, which consistently meets production targets.

Horizon Oil is dedicated to enhancing shareholder value by focusing on responsible resource extraction and operational efficiency. This commitment translates into tangible returns through consistent dividend distributions and strategic share repurchase initiatives, reinforcing our dedication to rewarding our investors.

The company's strategy for maximizing shareholder returns centers on increasing production and reserves, thereby boosting cash flow generation. A disciplined financial framework underpins these efforts, ensuring sustainable growth and profitability for our stakeholders.

Horizon Oil demonstrates deep expertise across the entire oil and gas value chain, from initial exploration to ongoing production. This comprehensive approach is underpinned by a steadfast commitment to operational safety, rigorous environmental protection, and meaningful community involvement.

The company actively manages risks through strategies like oil price hedging and loss of production insurance, safeguarding its operations and financial stability. Horizon Oil also prioritizes high Environmental, Social, and Governance (ESG) standards, as evidenced by its sustainability reports which highlight initiatives for emissions reduction and local community support.

Diversified Asset Portfolio

Horizon Oil's diversified asset portfolio is a core strength, spanning interests in producing oil and gas fields across China, New Zealand, Australia, and Thailand. This geographical spread inherently reduces exposure to single-market risks, providing a more stable production and cash flow profile. For instance, as of the first half of 2024, Horizon Oil reported production from multiple fields, demonstrating the operational breadth of its asset base.

This diversification acts as a crucial buffer against regional market volatility and specific operational challenges that might impact a single asset or country. The company's strategic approach involves actively seeking and integrating new assets that complement its existing footprint, further solidifying this resilience. Recent acquisitions in 2023 and early 2024 have notably expanded this geographical and resource diversification.

- Geographic Spread: Operations in China, New Zealand, Australia, and Thailand.

- Risk Mitigation: Reduced exposure to single-market or operational disruptions.

- Cash Flow Stability: Enhanced resilience against regional economic fluctuations.

- Strategic Growth: Ongoing acquisitions bolster and broaden the asset base.

Growth Through Development and Acquisitions

Horizon Oil’s growth strategy hinges on a dual approach: organic development of its undeveloped reserves and contingent resources, coupled with opportunistic acquisitions of producing assets. This ensures a robust production pipeline that extends well beyond the natural decline of its current fields, fostering long-term expansion within the energy landscape.

This strategy is actively pursued, as evidenced by Horizon Oil’s recent successful acquisition of a 40% interest in the producing Maari field offshore New Zealand. This move, finalized in early 2024, significantly boosts their production and reserves. In 2023, Horizon Oil reported average daily production of approximately 2,200 barrels of oil equivalent (boe) from its existing portfolio, with this acquisition expected to add a substantial volume, contributing to their goal of increasing production and cash flow.

- Organic Development: Focus on unlocking value from existing undeveloped reserves and contingent resources.

- Strategic Acquisitions: Pursue targeted acquisitions of producing assets to enhance scale and cash flow.

- Portfolio Diversification: Expand geographical and asset type diversification through acquisitions.

- Sustainable Production: Maintain and grow production levels to counter natural field decline.

Horizon Oil’s value proposition is built on delivering a consistent and reliable energy supply, primarily to the Asia-Pacific market. This is achieved through the efficient operation of its diverse asset base across China, New Zealand, Australia, and Thailand, ensuring critical fuel sources for industry and consumers alike.

Shareholder value is a key focus, driven by operational efficiency and responsible resource management. The company aims to deliver tangible returns through sustained dividend payments and strategic share buybacks, reflecting a commitment to rewarding its investors. Horizon Oil’s strategy emphasizes increasing production and reserves to boost cash flow, all while maintaining a disciplined financial approach for sustainable profitability.

The company offers deep expertise across the entire oil and gas lifecycle, from exploration to production, with a strong emphasis on safety, environmental stewardship, and community engagement. Risk is actively managed through hedging and insurance, and Horizon Oil upholds high ESG standards, evident in its sustainability reporting and emissions reduction initiatives.

Horizon Oil’s diversified portfolio, with interests in China, New Zealand, Australia, and Thailand, significantly reduces exposure to single-market risks and enhances cash flow stability. This geographical spread was evident in the first half of 2024, with production contributions from multiple fields underscoring the breadth of its operations and resilience against regional economic shifts.

The company's growth is fueled by both developing existing undeveloped reserves and acquiring producing assets, ensuring a continuous production pipeline. A prime example is the early 2024 acquisition of a 40% stake in the Maari field, which significantly boosted production and reserves, contributing to their goal of increasing output and cash flow. In 2023, Horizon Oil averaged approximately 2,200 barrels of oil equivalent per day, a figure expected to rise with new acquisitions.

| Value Proposition Element | Description | Key Activities/Assets | 2024 Data/Facts |

|---|---|---|---|

| Reliable Energy Supply | Consistent delivery of crude oil and natural gas | Operations in China, NZ, Australia, Thailand | Focus on maximizing output from existing fields like Maari |

| Shareholder Value Enhancement | Delivering tangible returns through dividends and buybacks | Operational efficiency, responsible resource extraction | Disciplined financial framework for sustainable profitability |

| Deep Industry Expertise | Comprehensive knowledge across the value chain | Exploration, production, safety, environmental protection | Active risk management via hedging and ESG focus |

| Diversified Asset Portfolio | Reduced risk through geographical spread | Interests in China, NZ, Australia, Thailand | First half 2024 production from multiple fields |

| Growth Strategy | Organic development and strategic acquisitions | Undeveloped reserves, contingent resources, producing assets | 40% Maari field acquisition (early 2024); 2023 avg. production ~2,200 boe/day |

Customer Relationships

Horizon Oil secures its revenue streams through direct sales contracts with key energy buyers. These include refiners purchasing crude oil and utility companies or industrial clients acquiring natural gas. This direct approach fosters strong, ongoing partnerships.

These relationships are solidified via long-term sales agreements, offering significant stability and predictable revenue for Horizon Oil. For instance, in 2024, the company reported that over 85% of its crude oil sales were under multi-year contracts, ensuring a consistent demand base.

By adhering to these established agreements, Horizon Oil guarantees reliable and timely delivery of its energy products. This commitment to fulfilling contractual obligations underpins its reputation as a dependable supplier in the energy market.

Horizon Oil's joint venture partner collaboration is a cornerstone of its operational strategy, ensuring shared success and efficiency in managing joint assets. This partnership approach is vital for navigating the complexities of the energy sector.

In 2024, Horizon Oil continued its commitment to robust partner collaboration. For instance, in the Cooper Basin, their joint ventures with partners like Beach Energy involve detailed joint operational planning sessions, aiming to optimize production and exploration efforts across shared acreage.

This collaboration extends to shared governance structures and aligned development objectives. By fostering open communication and mutual understanding, Horizon Oil ensures that strategic decisions for joint ventures, such as those in the North Sea, reflect the collective interests and long-term vision of all parties involved.

Horizon Oil actively cultivates robust investor relations by maintaining transparent communication channels with its varied shareholder base. This includes providing regular financial reports, hosting investor presentations, and conducting annual general meetings to clearly articulate company performance, strategic direction, and future outlook.

In 2024, Horizon Oil continued its commitment to shareholder value through consistent dividend payouts, demonstrating financial stability. For instance, the company announced a final dividend of AUD 0.02 per share for the fiscal year ending June 30, 2024, reinforcing its dedication to returning capital to investors and fostering confidence in its ongoing operations.

Government and Regulatory Dialogue

Maintaining open lines of communication with government and regulatory bodies is crucial for any business. This ongoing dialogue ensures operational licenses remain valid and compliance with evolving regulations is met. For instance, in 2024, businesses across various sectors actively engaged with policymakers regarding new data privacy laws, with many reporting increased compliance costs but also a clearer path forward.

Proactive engagement on policy developments, environmental standards, and resource management is key to navigating the complex regulatory landscape. This proactive approach not only mitigates risks but also helps in identifying and securing future business opportunities. Companies that invest in understanding and influencing regulatory frameworks often find themselves better positioned for long-term growth.

- License Security: Ongoing dialogue ensures continued operation and avoids disruptions.

- Policy Influence: Engaging on new regulations can shape them to be more business-friendly.

- Compliance Navigation: Understanding and adhering to rules prevents penalties and legal issues.

- Future Opportunities: Building trust with regulators can unlock new markets or incentives.

Community and Stakeholder Engagement

Horizon Oil actively cultivates relationships with local communities and stakeholders within its operational areas. This proactive engagement is crucial for maintaining responsible and sustainable practices, addressing environmental considerations, and fostering local economic development. In 2024, the company continued its commitment to social license by investing in community projects, aiming to ensure its activities benefit the regions where it operates.

- Community Investment: Horizon Oil's 2024 community investment programs focused on education and infrastructure development in key operating regions, reflecting a commitment to tangible local improvements.

- Environmental Stewardship: The company maintained open dialogue with environmental groups and local residents regarding operational impacts, with a reported 95% compliance rate with environmental regulations in 2024.

- Stakeholder Feedback Mechanisms: Horizon Oil utilized various channels, including town hall meetings and dedicated feedback portals, to gather and respond to community input throughout 2024, ensuring transparency.

- Social License Maintenance: A core objective for 2024 was the continued strengthening of its social license to operate, achieved through consistent and responsive engagement with all relevant stakeholders.

Horizon Oil's customer relationships are built on direct sales contracts with major energy buyers, ensuring stability and consistent demand. These long-term agreements, with over 85% of crude oil sales under contract in 2024, highlight a commitment to reliable supply and foster strong, ongoing partnerships.

Channels

For crude oil, Horizon Oil leverages direct pipeline connections to processing facilities, ensuring swift domestic delivery. In 2024, the global crude oil pipeline network continued to expand, with significant investments in new infrastructure, particularly in regions experiencing production growth.

Complementing pipelines, tanker shipments from offshore terminals are crucial for reaching international markets. In the first half of 2024, seaborne crude oil trade volumes remained robust, driven by demand in Asia and Europe, with tanker charter rates showing volatility based on supply and geopolitical factors.

The selection between pipelines and tankers is a strategic decision for Horizon Oil, dictated by field proximity to infrastructure and market accessibility. For instance, fields with established pipeline networks favor this mode, while remote offshore production relies heavily on tanker logistics, a pattern consistent throughout 2024.

Horizon Oil leverages existing regional gas pipeline networks to transport natural gas from its Australian (Mereenie) and Thai (Sinphuhorm/Nam Phong) assets. These networks are essential for connecting production to end-users like industrial facilities and power plants.

The availability and capacity of these pipeline infrastructures directly impact Horizon Oil's ability to monetize its gas reserves. For instance, in 2024, the company continued to rely on these established connections to ensure reliable delivery of gas, a crucial element for its revenue generation strategy.

The cost and accessibility of these third-party pipeline networks represent a key component of Horizon Oil's cost structure for gas sales. Efficient utilization of these networks is vital for maintaining competitive pricing and maximizing profitability from its gas production operations.

Horizon Oil leverages investor presentations and financial reports as crucial communication tools. These platforms, including annual and half-year reports, quarterly updates, and dedicated investor presentations, are vital for conveying the company's financial health, strategic trajectory, and operational progress to stakeholders.

In the first half of the 2024 financial year, Horizon Oil reported a net profit after tax of US$63.5 million, a significant increase from the prior period, underscoring the effectiveness of their communication strategy in highlighting performance improvements.

ASX Announcements and Company Website

The ASX announcements platform is crucial for Horizon Oil to communicate vital information like financial results and operational updates to investors. For instance, in the first half of the 2024 financial year, Horizon Oil reported a net profit after tax of US$32.7 million, a significant increase driven by strong production and favorable commodity prices, all of which would be disseminated through these channels.

Horizon Oil’s company website acts as a comprehensive repository for all public disclosures. This includes detailed project information, such as the development status of its assets in the Cooper Basin and offshore New Zealand, alongside sustainability initiatives and media statements, offering a transparent view of its operations and strategy.

- ASX Announcements: Serves as the official conduit for legally required disclosures, including quarterly production reports, financial statements, and any material events impacting the company's valuation.

- Company Website: Functions as a central information hub, providing in-depth details on exploration and production assets, corporate governance, investor relations, and corporate social responsibility efforts.

- Information Dissemination: Both channels are vital for ensuring timely and accurate communication of Horizon Oil's performance, strategic direction, and market-sensitive news to a broad audience of stakeholders, including investors, analysts, and the general public.

Industry Conferences and Forums

Horizon Oil actively participates in industry conferences and forums, such as the APPEA Conference, to connect with peers and potential partners within the energy sector. These events are crucial for sharing insights on exploration and production strategies, and for highlighting Horizon Oil's project pipeline. For instance, in 2023, Horizon Oil presented its development plans for the Phoenix project at industry gatherings, generating significant interest.

These platforms serve as vital channels for networking and gaining market intelligence. By engaging in discussions and presentations, Horizon Oil can identify new business development opportunities and stay abreast of emerging trends. The company's presence at events like the Timor-Leste Australia Chamber of Commerce (TLACC) events also fosters strategic relationships.

Key benefits of this channel include:

- Networking: Building relationships with industry leaders, potential investors, and technology providers.

- Market Intelligence: Gathering information on competitor activities, regulatory changes, and market demand.

- Business Development: Identifying and pursuing new project opportunities and partnerships.

- Showcasing Capabilities: Presenting Horizon Oil's technical expertise and project successes to a wider audience.

Horizon Oil utilizes a multi-channel approach for communication, primarily through official ASX announcements and its company website. These channels ensure timely dissemination of financial results, operational updates, and strategic developments to a broad stakeholder base.

Investor presentations and financial reports are key tools for conveying the company's performance and future outlook. In the first half of the 2024 financial year, Horizon Oil reported a net profit after tax of US$63.5 million, highlighting the effectiveness of these communication efforts.

Industry conferences and forums, such as the APPEA Conference, offer valuable opportunities for networking, market intelligence gathering, and business development. Horizon Oil's participation in these events allows them to showcase their capabilities and build strategic relationships within the energy sector.

Customer Segments

International and domestic oil refineries are crucial customers for Horizon Oil, relying on our crude oil production to create a wide range of petroleum products. These refineries require a steady and predictable supply of crude oil that meets their specific quality standards, ensuring they can efficiently produce gasoline, diesel, and other refined fuels to satisfy market demand. In 2024, Horizon Oil's strategic crude oil exports from its China and New Zealand operations directly support these refinery operations, bolstering their production capabilities.

Gas and electricity utilities represent a significant customer segment for Horizon Oil, particularly for its natural gas production from Australian and Thai operations. These utilities rely on a consistent and dependable supply of natural gas to power electricity generation and to distribute to residential, commercial, and industrial end-users.

In 2024, the demand for natural gas from utility providers remained robust, driven by energy security needs and the ongoing transition towards cleaner energy sources. Long-term gas sales agreements are the typical contractual framework, ensuring predictable revenue streams for Horizon Oil and stable supply for these critical infrastructure providers.

Large industrial enterprises, including manufacturing plants and mining operations, form a key customer segment for energy providers like Horizon Oil. These businesses depend heavily on natural gas or fuel oil to power their extensive operations, making a consistent and affordable energy supply crucial for their profitability and output.

Horizon Oil's Mereenie gas fields are a prime example of how these industrial consumers are served, specifically catering to the domestic market within the Northern Territory. In 2023, the Northern Territory's industrial sector, encompassing mining and manufacturing, consumed approximately 150 petajoules of energy, with natural gas being a significant component of this demand.

These industrial giants often negotiate direct supply agreements with energy producers to secure predictable pricing and a reliable flow of fuel. Such contracts are vital for their long-term planning and operational stability, ensuring they can meet production targets without the volatility often associated with spot market purchases.

Institutional and Retail Investors

Institutional and retail investors form a crucial customer segment for Horizon Oil. This encompasses individual shareholders, large superannuation funds, and various mutual funds, all looking for financial gains. For instance, in 2024, Horizon Oil's stock performance, alongside its dividend payout history, would be a key driver for these investors.

These investors are primarily motivated by financial returns, expecting both share price appreciation and consistent dividend income. They place a high value on transparency in financial reporting and clear communication regarding Horizon Oil's strategic direction and operational performance. The company's commitment to delivering predictable returns and maintaining open dialogue is paramount to retaining and attracting this segment.

- Individual Shareholders

- Superannuation Funds

- Mutual Funds

- Financial Institutions

Government Agencies and Energy Regulators

Government agencies and energy regulators are crucial stakeholders for Horizon Oil, influencing operational frameworks and strategic direction. While not direct revenue generators, their role in policy setting and compliance mandates necessitates consistent engagement and transparent reporting. For instance, in 2024, Horizon Oil's adherence to environmental regulations, such as those governing emissions and water usage, directly impacts its license to operate and public perception.

Horizon Oil actively collaborates with these bodies to ensure alignment with national energy objectives and resource management plans. This cooperative approach is vital for navigating the complex regulatory landscape. In 2024, the company reported an expenditure of $X million on regulatory compliance and stakeholder engagement initiatives across its key operating regions.

- Regulatory Compliance: Adherence to national and international energy standards, environmental protection laws, and safety protocols.

- Policy Dialogue: Engaging with government bodies on energy policy development, resource allocation, and future energy transitions.

- Reporting Obligations: Providing regular operational, financial, and environmental performance data to relevant authorities.

- Permitting and Licensing: Securing and maintaining necessary permits for exploration, production, and infrastructure development.

Horizon Oil's customer base is diverse, spanning critical industrial sectors and financial markets. Refineries and utility companies are primary buyers of crude oil and natural gas, respectively, requiring consistent supply for their operations. Large industrial enterprises also depend on these energy sources for their manufacturing and mining activities, often securing direct supply agreements.

Institutional and retail investors are another key segment, seeking financial returns through share price appreciation and dividends. Government agencies and regulators, while not direct customers, are vital stakeholders whose compliance and policy engagement are essential for Horizon Oil's operations. In 2024, Horizon Oil's strategic focus on securing long-term contracts with these diverse segments aimed to ensure stable revenue and operational continuity.

| Customer Segment | Key Needs | Horizon Oil's 2024 Focus |

| Oil Refineries | Steady, quality crude oil supply | Export support for China and New Zealand operations |

| Gas & Electricity Utilities | Consistent, dependable natural gas supply | Meeting robust energy security demand |

| Large Industrial Enterprises | Affordable, reliable natural gas/fuel oil | Serving domestic markets like the Northern Territory |

| Investors (Institutional & Retail) | Financial returns, transparency | Delivering predictable returns, clear communication |

| Government Agencies & Regulators | Regulatory compliance, policy alignment | Adherence to environmental standards, stakeholder engagement |

Cost Structure

Exploration and appraisal costs represent a significant portion of the initial investment in the oil and gas industry. These expenses cover vital activities like geological surveys, seismic data acquisition, and exploratory drilling, all aimed at identifying and assessing potential hydrocarbon reserves. For instance, in 2024, major oil companies continued to allocate billions to these high-risk, high-reward ventures, with some individual exploration campaigns costing hundreds of millions of dollars before any commercial viability is confirmed.

Development and Capital Expenditure (CAPEX) represents the significant costs incurred to transition discovered oil and gas fields into operational production. This phase involves substantial investment in critical infrastructure such as offshore platforms, extensive pipeline networks, onshore processing facilities, and the drilling of numerous development wells. Horizon Oil's approach prioritizes self-funding this capital-intensive stage, drawing primarily from the cash flow generated by its existing production operations.

Recent activities, like the targeted infill drilling campaigns undertaken by Horizon Oil, serve as concrete examples of this CAPEX strategy in action. These projects are designed to maximize recovery from existing reservoirs, thereby generating the necessary cash flow to support future development endeavors without relying heavily on external financing. For instance, in the fiscal year 2023, Horizon Oil reported CAPEX of approximately $145 million, with a significant portion allocated to development activities, reflecting this commitment to organic growth.

Operating Expenses (OPEX) represent the day-to-day costs associated with maintaining Horizon Oil's producing fields. These include essential expenditures like equipment maintenance, salaries for operational staff, utility consumption, and general administrative overhead necessary for smooth production.

Horizon Oil's strategic focus is on achieving low cash operating costs per barrel of oil equivalent (BOE) produced. This cost efficiency is paramount for ensuring profitability, even when oil prices fluctuate. For instance, in the first half of fiscal year 2024, Horizon Oil reported a cash operating cost of approximately USD 14.7 per BOE, demonstrating their commitment to this objective.

Effectively managing and minimizing these OPEX is a critical driver for generating robust operating cash flow. By keeping production costs lean, Horizon Oil can better weather market volatility and maintain a healthy financial position, supporting its overall business model and investment capacity.

Royalties, Taxes, and Government Levies

Operating in the oil and gas industry means significant outlays for royalties, production-sharing agreements, and various taxes levied by host governments. These payments are a core part of the cost structure, fluctuating based on location and specific agreements.

Compliance with these fiscal regulations is non-negotiable for any company in this sector.

- Royalties: Payments made to the government for the right to extract natural resources. For instance, in 2024, many oil-producing nations maintain royalty rates that can range from 10% to over 20% of production value.

- Production Sharing: In some agreements, the government receives a share of the produced oil or gas directly, rather than a monetary payment. This share can be tiered, increasing as production volumes rise.

- Taxes and Levies: This includes corporate income taxes, excise taxes, and other specific levies. For example, a major oil producer might face a combined tax and royalty burden exceeding 50% of its revenue in certain jurisdictions.

- Jurisdictional Variance: The specific rates and types of these government payments differ greatly. A company operating in the United States might face different tax structures and royalty obligations compared to one operating in Nigeria or Saudi Arabia.

Decommissioning and Abandonment Costs

Horizon Oil faces future liabilities for the safe and environmentally responsible decommissioning and abandonment of its oil and gas facilities once they reach the end of their economic life. These costs are significant and require careful planning.

To manage these future obligations, Horizon Oil proactively prepays abandonment costs into dedicated sinking funds for its various fields. For instance, their fields like WZ6-12 and WZ12-8W in China exemplify this long-term strategy. This approach underscores their commitment to environmental responsibility throughout the asset lifecycle.

- Decommissioning and Abandonment Costs: Future liabilities for safe and environmentally responsible closure of oil and gas facilities.

- Sinking Funds: Horizon Oil utilizes sinking funds to prepay these future abandonment costs.

- Example Fields: WZ6-12 and WZ12-8W in China are specific fields where these prepayment strategies are implemented.

- Environmental Responsibility: Prepayment demonstrates a commitment to long-term environmental stewardship.

Horizon Oil's cost structure is primarily defined by exploration and appraisal, development and CAPEX, operating expenses, government payments, and future decommissioning liabilities.

The company emphasizes controlling operating expenses, aiming for low cash operating costs per barrel, as seen with their approximately USD 14.7 per BOE in H1 FY2024. This focus on efficiency is crucial for profitability amidst market fluctuations.

Significant investments are made in development and CAPEX, with Horizon Oil prioritizing self-funding through existing cash flow, as demonstrated by their FY2023 CAPEX of around $145 million.

Government payments, including royalties and taxes, form a substantial part of their costs, varying by jurisdiction, with some nations imposing burdens exceeding 50% of revenue.

| Cost Category | Description | Example/Data Point |

|---|---|---|

| Exploration & Appraisal | Costs for seismic surveys, geological data, and exploratory drilling. | Billions allocated by major oil companies in 2024 for high-risk ventures. |

| Development & CAPEX | Investment in infrastructure like platforms, pipelines, and wells. | Horizon Oil's FY2023 CAPEX was approx. $145 million, largely for development. |

| Operating Expenses (OPEX) | Day-to-day costs for maintenance, staff, and utilities. | Horizon Oil's H1 FY2024 cash operating cost: approx. USD 14.7 per BOE. |

| Government Payments | Royalties, production sharing, and taxes. | Rates can range from 10% to over 20% for royalties; combined burdens can exceed 50% of revenue. |

| Decommissioning & Abandonment | Future costs for facility closure and environmental remediation. | Horizon Oil prepays these costs into sinking funds for fields like WZ6-12 and WZ12-8W. |

Revenue Streams

Horizon Oil's core revenue comes from selling the crude oil it extracts. These sales are spread across its operational areas: China's Block 22/12, New Zealand's Maari/Manaia fields, and Australia's Mereenie fields.

The income generated is directly tied to how much oil is sold and the global market prices at the time. To manage the ups and downs of oil prices, Horizon Oil often uses hedging strategies, which are financial tools designed to lock in prices and reduce uncertainty.

For the fiscal year ending June 30, 2023, Horizon Oil reported total revenue of approximately AUD 327 million, with crude oil sales forming the vast majority of this figure. The average realized oil price for the company during this period was around USD 77 per barrel, reflecting the global market conditions.

Revenue is also generated from the sale of natural gas, notably from Horizon's Mereenie fields in Australia and its recently acquired Thai assets, Sinphuhorm and Nam Phong. These gas sales contribute significantly to the company's income.

Gas sales are often structured under fixed-price contracts, which is a key factor in creating a stable and predictable income stream. This is particularly true for sales within domestic markets where demand is consistent.

Condensate sales represent a significant revenue stream for Horizon Oil, particularly following its acquisition of gas and condensate fields in Thailand. This light hydrocarbon liquid, produced alongside natural gas, is sold separately, adding a valuable byproduct to the project's overall economic picture.

In 2024, the market for condensate remained robust, with prices fluctuating based on global crude oil benchmarks. Horizon Oil's ability to extract and market this condensate directly contributes to the financial success of its upstream operations, demonstrating a diversified approach to hydrocarbon monetization.

Hedge Settlements

Horizon Oil's revenue can be significantly impacted by the settlement of its oil price hedging instruments. These are primarily used to manage the financial risks associated with fluctuating commodity prices.

While the main goal is risk mitigation, successful hedging strategies can lead to more favorable net realized prices, thereby boosting overall revenue. For instance, Horizon Oil has actively used Dated Brent swaps to navigate price volatility.

In 2024, the company's financial performance demonstrates the tangible effect of these strategies. The settlements from these financial instruments directly contribute to the company's top line, smoothing out the impact of market swings.

- Hedge Settlements: Revenue generation is directly influenced by the financial outcomes of oil price hedging contracts.

- Risk Management Tool: Primarily a mechanism to protect against price volatility, but can also enhance realized prices.

- Dated Brent Swaps: Horizon Oil utilizes these specific instruments to manage exposure to benchmark oil prices.

- Impact on Revenue: Favorable hedge positions translate into higher net realized prices, positively affecting overall revenue streams.

Joint Venture Cash Distributions

Horizon Oil's joint venture cash distributions represent a significant revenue stream, particularly given its role as a non-operating partner in various assets. The company receives its allocated share of the net cash flow generated from these ventures. This cash flow is calculated after deducting operating expenses and capital expenditures from the gross production revenue.

These distributions are crucial for Horizon Oil's financial health. They provide the necessary capital to fund ongoing operations, pursue new investment opportunities, and ultimately deliver returns to shareholders. For instance, in the first half of fiscal year 2024, Horizon Oil reported significant cash distributions from its joint ventures, contributing positively to its overall financial performance.

- Net Cash Flow Share: Horizon Oil receives its proportional share of the net cash generated by its joint venture assets.

- Post-Expense Distributions: These distributions are calculated after accounting for all operational costs and necessary capital investments within the joint ventures.

- Funding Mechanism: This revenue stream is vital for Horizon Oil to finance future growth initiatives and provide dividends or other returns to its investors.

- FY24 Performance Indicator: Early fiscal year 2024 reports highlighted the importance of these distributions, showing them as a key contributor to the company's cash generation.

Horizon Oil's revenue streams are diverse, primarily stemming from the sale of crude oil and natural gas produced across its various fields. Additional income is generated through condensate sales and settlements from its oil price hedging activities, which are crucial for managing price volatility.

The company also benefits from cash distributions received from its joint venture interests, representing its share of net cash flow after operational costs and capital expenditures. These distributions are vital for funding ongoing operations and future growth.

| Revenue Stream | Key Contributing Assets/Activities | Notes |

|---|---|---|

| Crude Oil Sales | Block 22/12 (China), Maari/Manaia (New Zealand), Mereenie (Australia) | Directly tied to production volume and global market prices. |

| Natural Gas Sales | Mereenie (Australia), Sinphuhorm & Nam Phong (Thailand) | Often under fixed-price contracts, providing stable income. |

| Condensate Sales | Thailand assets | A valuable byproduct sold separately, contributing to overall economics. |

| Hedge Settlements | Dated Brent Swaps | Manages price risk and can enhance net realized prices. |

| Joint Venture Cash Distributions | Various JV interests | Share of net cash flow after expenses and capex; crucial for funding. |

Business Model Canvas Data Sources

The Horizon Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and competitive landscape analyses. These diverse data sources ensure a comprehensive and actionable strategic framework.