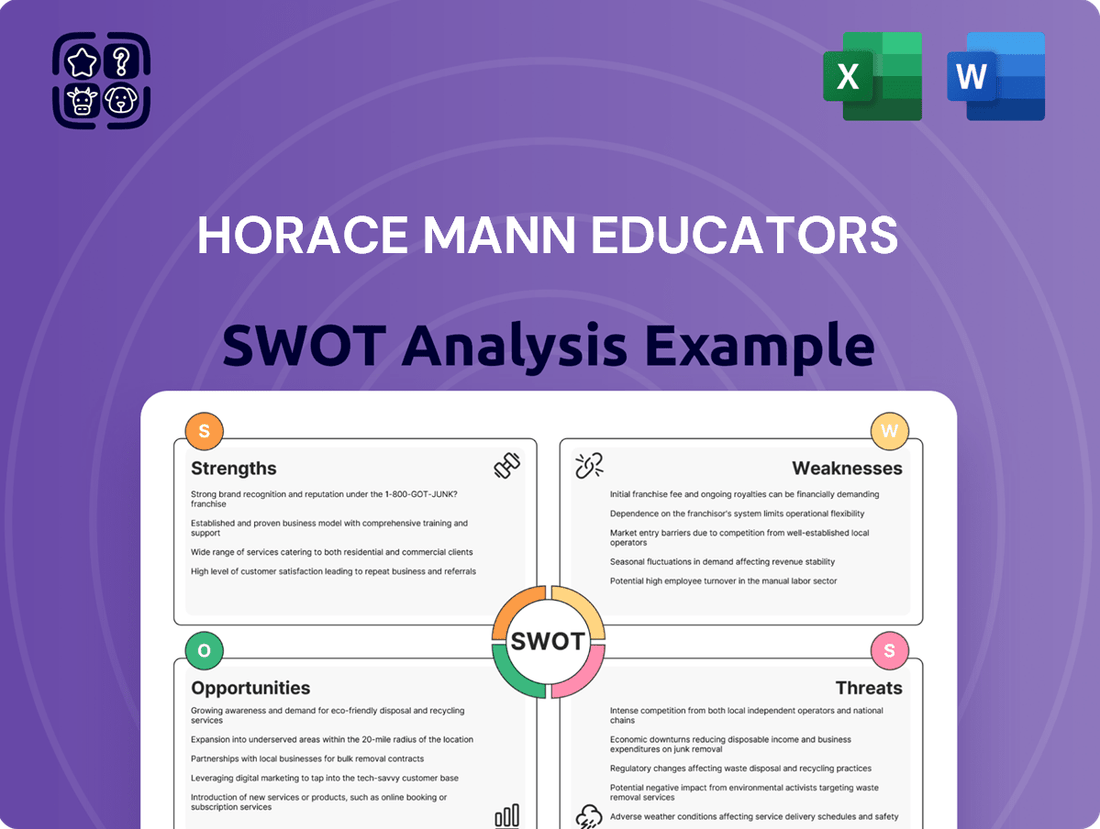

Horace Mann Educators SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horace Mann Educators Bundle

Horace Mann Educators leverages its strong brand recognition and deep understanding of the education sector to serve a loyal customer base. However, it faces increasing competition from diversified financial institutions and must adapt to evolving customer needs and technological advancements.

Want the full story behind Horace Mann Educators' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Horace Mann's core strength is its dedicated focus on serving the education sector, offering specialized insurance and financial products designed for teachers and school administrators. This niche approach has cultivated significant brand recognition and deep loyalty within this professional group.

By concentrating on educators, Horace Mann has developed a profound understanding of their unique financial needs and life stages. This allows them to craft highly relevant and customized solutions, fostering a strong connection and trust with their customer base. For instance, in the first quarter of 2024, Horace Mann reported that its education segment continued to be a significant driver of its business, demonstrating the ongoing success of this specialized strategy.

Horace Mann Educators boasts a comprehensive product suite, encompassing auto, home, and life insurance, alongside retirement annuities and financial planning services. This broad offering caters to the diverse financial needs of educators, fostering deeper customer relationships and enhancing cross-selling potential.

In 2023, Horace Mann reported total revenue of $1.02 billion, with its insurance segment contributing significantly to this figure. The diversification across various financial products provides a buffer against downturns in any single market, contributing to a more resilient business model.

Horace Mann has shown robust financial performance, reporting an increase in net income and core earnings in Q1 2025. This consistent financial strength underpins the company's operational health and market position.

The company is strategically focused on enhancing shareholder value, evidenced by its commitment to achieving a double-digit return on equity by 2025. Additionally, Horace Mann has actively engaged in share repurchase programs, directly returning capital to its investors.

Customer-Centric Programs and Agent Network

Horace Mann stands out with its dedicated customer-centric programs tailored for educators. The Educator Advantage program, for instance, offers unique benefits such as special coverages and waived deductibles, directly addressing the needs of its core demographic. This focus on educators extends to investments in student loan solutions and financial wellness workshops, building loyalty and trust within this specific market segment.

The company's distribution strategy, relying on an exclusive network of agents, many of whom possess direct experience in education, is a significant strength. This personal connection fosters stronger customer relationships and enhances satisfaction, as agents can better understand and address the unique financial concerns of educators. This specialized approach differentiates Horace Mann in a competitive insurance landscape.

- Educator Advantage Program: Provides specialized insurance coverages and waived deductibles for educators.

- Financial Wellness Initiatives: Offers programs like student loan solutions and financial education workshops.

- Exclusive Agent Network: Leverages agents with education backgrounds to build strong, understanding customer relationships.

Strategic Digital and Partnership Initiatives

Horace Mann Educators is making significant strides in its digital transformation, aiming to provide educators with a more streamlined and accessible experience for their financial needs. This focus on modernization is crucial for meeting the evolving expectations of their core customer base.

Strategic partnerships are a key component of their growth strategy. Recent collaborations, including those with Crayola and TransUnion, signal an intent to broaden appeal and enhance service offerings. Furthermore, the company’s expansion into new markets, such as New Jersey, underscores its commitment to increasing its geographic footprint and customer acquisition.

- Digital Enhancement: Simplifying access to financial services for educators through improved online platforms.

- Strategic Partnerships: Collaborations like the one with Crayola aim to enhance brand engagement and reach.

- Market Expansion: Entry into states like New Jersey broadens the potential customer base and revenue streams.

- Modernization Drive: These initiatives collectively work to update operations and attract a new generation of educators.

Horace Mann's primary strength lies in its deep specialization within the education sector, fostering significant brand loyalty and a nuanced understanding of educators' unique financial needs. This focused approach allows for the development of highly relevant products and services, as demonstrated by their Q1 2024 performance where the education segment remained a key business driver.

The company offers a comprehensive suite of products, from insurance to retirement planning, which enhances customer relationships and cross-selling opportunities. In 2023, Horace Mann generated $1.02 billion in revenue, with its diversified insurance offerings contributing substantially, providing a stable business model.

Horace Mann's commitment to shareholder value is evident in its pursuit of a double-digit return on equity by 2025 and active share repurchase programs, reflecting strong financial health and a focus on investor returns. Their Q1 2025 results showed increased net income and core earnings, underscoring this financial resilience.

Customer-centric initiatives, such as the Educator Advantage program and financial wellness workshops, build strong trust and loyalty within their niche market. This is further amplified by their exclusive agent network, many of whom have educational backgrounds, enabling personalized service and deeper client understanding.

| Strength Category | Specific Initiative | Impact/Data Point |

|---|---|---|

| Niche Market Focus | Serving Educators | Q1 2024: Education segment a significant business driver. |

| Product Diversification | Insurance, Retirement, Financial Planning | 2023 Revenue: $1.02 billion, with insurance as a major contributor. |

| Financial Performance | Shareholder Value Focus | Q1 2025: Increased net income and core earnings; Target: Double-digit ROE by 2025. |

| Customer Engagement | Educator Advantage Program | Offers specialized coverages and waived deductibles for educators. |

What is included in the product

Analyzes Horace Mann Educators’s competitive position through key internal and external factors, highlighting its strengths in serving educators and potential threats from market shifts.

Offers a clear, actionable framework to identify and address critical challenges within Horace Mann Educators' operations.

Weaknesses

Horace Mann's financial results are susceptible to investment losses, a risk highlighted by their Q1 2025 report which detailed net investment losses. This exposure means market downturns can directly affect their profitability, particularly within the Life & Retirement segment. For instance, a significant portion of their revenue is tied to investment returns, making them vulnerable to economic volatility.

Horace Mann Educators' significant reliance on the education market, while a specialized strength, inherently creates a vulnerability. This narrow focus limits their potential customer base, making them susceptible to downturns within this specific sector.

Negative trends affecting educators, such as budget constraints in schools or shifts in teacher employment, can have a magnified impact on Horace Mann's financial performance. For instance, if state education budgets tighten, leading to fewer new teachers or reduced benefits, Horace Mann's sales could be directly curtailed.

This concentration exposes Horace Mann to considerable market risk. Any substantial negative shifts within the education sector, such as declining teacher retention rates or demographic changes, could disproportionately impact the company's revenue streams and overall business health.

Horace Mann's Property & Casualty (P&C) segment grapples with significant headwinds. A notable challenge stems from an uptick in both how often and how badly weather events impact claims. This trend, observed across the industry, directly affects underwriting results.

Furthermore, the auto insurance line specifically is seeing claims become more expensive. This rise in severity is attributed to broader economic shifts and social inflation, meaning the cost to repair vehicles and settle claims is escalating. These factors put pressure on the segment's ability to maintain strong underwriting profitability.

Litigation Risks from Legacy Policies

Horace Mann Educators faces significant litigation risks stemming from its legacy commercial liability policies. These older policies have already led to substantial after-tax costs, impacting the company's financial performance in 2024. This persistent liability from past underwriting practices necessitates ongoing attention and potential adjustments to financial reserves to manage these unexpected expenses.

The company's exposure to these legacy policies presents a clear weakness:

- Ongoing Litigation Costs: Significant after-tax costs were incurred in 2024 due to litigation tied to legacy commercial liability policies, highlighting a direct financial drain.

- Financial Uncertainty: The continued liability from these older policies introduces an element of unpredictability into financial results, making forecasting more challenging.

- Reserve Management: Effective management of financial reserves is crucial to absorb potential future expenses arising from these legacy claims, requiring careful actuarial assessment.

Potential for Slower Revenue Growth in Certain Segments

While Horace Mann Educators has demonstrated overall revenue growth, certain segments may face headwinds. For instance, the Life & Retirement sector, a key area for the company, experienced a dip in net income during the first quarter of 2025. This was partly attributed to elevated mortality costs, indicating potential challenges in maintaining consistent growth across all product lines.

This differential growth rate across segments presents a weakness. The company must navigate the complexities of managing diverse offerings, where some, like the Life & Retirement segment, might lag behind others. This can impact the overall pace of revenue expansion.

- Segmental Growth Disparities: Not all business lines are expected to grow at the same rate, potentially creating uneven financial performance.

- Impact of Mortality Costs: Higher-than-anticipated mortality expenses in the Life & Retirement segment can directly affect profitability and growth in that area, as seen in Q1 2025.

- Challenge of Diversification: Managing a broad portfolio of financial products and services means that challenges in one area can disproportionately affect overall growth metrics.

Horace Mann's reliance on the education sector makes it vulnerable to specific industry downturns. For example, a decline in teacher retention or school funding could directly impact their customer base and revenue. This narrow focus, while a strength in specialization, inherently limits their market reach.

The Property & Casualty segment faces rising claims costs, particularly in auto insurance, due to increased repair expenses and social inflation. Additionally, the frequency and severity of weather-related claims are impacting underwriting results negatively. These pressures challenge the segment's profitability.

Legacy commercial liability policies continue to pose a financial burden, with significant after-tax costs incurred in 2024 due to ongoing litigation. This persistent financial drain introduces uncertainty into future earnings and requires careful reserve management.

The Life & Retirement segment experienced a dip in net income in Q1 2025, partly due to elevated mortality costs. This highlights a weakness in achieving consistent growth across all product lines, as some segments may lag due to specific challenges.

| Weakness | Description | Impact |

| Sector Concentration | Heavy reliance on the education market. | Vulnerability to education sector downturns, limiting customer base. |

| P&C Claims Costs | Rising auto repair expenses and weather-related claims. | Pressure on underwriting profitability in the P&C segment. |

| Legacy Litigation | Ongoing legal costs from past commercial liability policies. | Significant after-tax costs in 2024, creating financial uncertainty. |

| Segmental Growth Disparities | Elevated mortality costs impacting Life & Retirement segment. | Uneven financial performance and challenges in overall growth metrics. |

Full Version Awaits

Horace Mann Educators SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Horace Mann Educators has a prime opportunity to grow by offering more financial products specifically designed for teachers. This means building on their current offerings like student loan assistance and retirement planning, and creating new tools to help educators manage common financial challenges.

For instance, with the average student loan debt for teachers often exceeding $30,000, expanding student loan refinancing and repayment programs could attract a significant segment of this market. Furthermore, financial wellness programs addressing issues like budgeting and saving for a down payment on a home could resonate deeply with educators, given that many report feeling stressed about their finances.

Horace Mann can significantly boost efficiency and customer satisfaction by investing more in advanced analytics and artificial intelligence. These technologies can streamline everything from operations to how they handle customer interactions, and importantly, make the processes for underwriting and claims much smoother.

By continuing to build out their digital platforms and tools, Horace Mann can make their services much easier for educators to access and use. This not only improves customer satisfaction but also helps to lower operational costs, a key benefit in today's competitive market.

Horace Mann's strategic partnership with Plymouth Rock Assurance, announced in late 2023, exemplifies an opportunity to expand its insurance offerings. This move allows Horace Mann to tap into a broader customer base beyond educators, potentially reaching other community-serving professionals and diversifying its revenue streams.

By leveraging such alliances, Horace Mann can reduce its dependence on the educator market, which has shown fluctuating enrollment trends. This diversification strategy is crucial for long-term stability and growth, opening up new avenues for financial performance.

Growth in Employee Benefits and Group Offerings

Horace Mann has a significant opportunity to expand its reach within the education sector by offering enhanced employee benefits and group insurance solutions directly to school districts. This strategic focus can tap into the consistent demand for attractive compensation packages, which are crucial for teacher recruitment and retention in an environment where these professionals are highly valued.

By strengthening its employer-sponsored benefits and group offerings, Horace Mann can solidify its position as a key partner for educational institutions. This approach promises a reliable and expanding revenue stream, directly addressing the collective needs of school districts seeking to provide comprehensive benefits to their staff. For example, in 2024, the demand for robust benefits packages in education is projected to remain high, driven by ongoing efforts to bolster the teaching profession.

- Expand offerings to meet evolving teacher needs, potentially including specialized health, retirement, and wellness programs.

- Leverage existing relationships with school districts to introduce new and improved group benefit solutions.

- Target districts experiencing teacher shortages, highlighting benefits as a competitive advantage for recruitment.

- Develop flexible benefit plans that can be customized to the specific requirements of different school districts and their employees.

Geographic Expansion and Increased Market Share

Horace Mann's geographic expansion offers a significant avenue for growth by targeting new states and deepening penetration in existing ones. This strategy aims to capture a broader segment of the educator market nationwide. For instance, their recent entry into New Jersey demonstrates a commitment to reaching educators in previously untapped regions with specialized financial solutions.

Expanding market share within current operational states is also a key opportunity. By increasing brand visibility and tailoring product offerings to specific state needs, Horace Mann can solidify its position and attract more educators. This focused approach can lead to a more robust customer base and increased revenue streams.

Key opportunities include:

- Entering new states: Targeting underserved educator communities in states where Horace Mann currently has a limited presence.

- Increasing penetration in existing states: Enhancing market share within states where the company already operates by offering more comprehensive product suites.

- Tailored product offerings: Developing and marketing financial products specifically designed to meet the unique needs of educators in different geographic regions.

- Leveraging brand recognition: Building on the established reputation within the education sector to gain traction in new markets.

Horace Mann Educators can capitalize on the growing demand for specialized financial products tailored to educators, such as student loan management and retirement planning, to expand its customer base. For example, with teacher salaries often lagging behind other professions, offering enhanced financial wellness programs and accessible digital tools can significantly attract and retain educators. The company can also leverage strategic partnerships, like the one with Plymouth Rock Assurance, to broaden its insurance offerings beyond the education sector, thereby diversifying revenue streams and mitigating risks associated with market fluctuations. This diversification is crucial as educational sector enrollment trends can be unpredictable.

Expanding its geographic footprint into new states and increasing market share in existing ones presents a substantial growth opportunity. By tailoring product offerings to specific regional needs and leveraging its strong brand recognition within the education community, Horace Mann can attract a larger segment of the educator market. For instance, their recent expansion into New Jersey highlights a strategic move to tap into previously underserved educator populations, aiming to replicate this success in other states.

| Opportunity Area | Description | Potential Impact | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Product Expansion for Educators | Developing specialized financial products (e.g., student loan refinancing, enhanced retirement plans) for teachers. | Increased customer acquisition and retention within the core market. | Average teacher student loan debt remains a significant concern, with many seeking debt management solutions. |

| Digital Platform Enhancement | Investing in advanced analytics and AI to streamline operations and improve customer experience. | Higher operational efficiency, improved customer satisfaction, and reduced costs. | Digital adoption for financial services continues to rise, with customers expecting seamless online interactions. |

| Strategic Partnerships | Collaborating with other financial institutions or insurance providers to broaden service offerings. | Diversified revenue streams and access to new customer segments beyond education. | The Plymouth Rock Assurance partnership (late 2023) signals a move to reach broader community-serving professionals. |

| Geographic Expansion | Entering new states and increasing penetration in existing markets. | Broader market reach, increased brand visibility, and larger customer base. | Entry into states like New Jersey in 2024 indicates a proactive strategy to capture new educator markets. |

Threats

The insurance sector is a crowded arena, with many companies aggressively pursuing market share. Horace Mann faces the challenge of staying ahead by constantly innovating and making its products stand out from competitors, including larger, more diversified insurance giants and niche specialists. For instance, in the first quarter of 2024, the U.S. property and casualty insurance market saw a combined ratio of 100.1%, indicating a highly competitive pricing environment.

Rising inflation, especially in labor and material expenses, is significantly increasing the cost of property and casualty claims for Horace Mann. For instance, the U.S. Bureau of Labor Statistics reported a 5.5% increase in the Consumer Price Index for All Urban Consumers (CPI-U) for the twelve months ending April 2024, with specific categories like motor vehicle repair experiencing even higher surges.

This economic pressure directly translates to higher loss costs, potentially eroding underwriting profitability. Horace Mann must continually adapt its pricing and underwriting strategies to account for these escalating claim severities, ensuring premiums adequately reflect the increased risk and cost of settling claims.

Shifts in education policy, such as changes to tenure or retirement benefits, could directly impact educators' financial planning needs, potentially reducing demand for Horace Mann's offerings. For instance, a 2024 report indicated that teacher turnover rates in some states reached 20%, creating a less stable customer base.

Demographic changes, like a shrinking pool of new teachers entering the profession due to burnout or lower pay, could also affect Horace Mann's growth potential. With fewer educators entering the workforce, the overall market size for financial and insurance products tailored to this group may contract.

Furthermore, increased financial strain on educators, perhaps from rising healthcare costs or stagnant salary growth, could limit their disposable income for insurance premiums and investment products. Data from late 2024 shows that the average teacher salary has only increased by 2.5% year-over-year, lagging behind inflation.

Market Risk Benefits Adjustments and Investment Volatility

Horace Mann Educators' Life & Retirement segment faces significant threats from market risk benefit adjustments, particularly sensitive to shifts in interest rates and equity market performance. For instance, a sustained period of low interest rates, as seen in recent years, can compress net investment income, directly impacting profitability. The company's exposure to equity markets means that downturns, like the volatility experienced in early 2024, could lead to substantial investment losses.

Continued investment losses or severe market downturns pose a direct risk to the financial health of this core segment. For example, if equity markets were to experience a significant decline in late 2024 or early 2025, Horace Mann could see its investment portfolio value diminish, negatively affecting its capital position and earnings. This volatility directly translates to uncertainty in the company's overall financial performance.

- Interest Rate Sensitivity: Fluctuations in interest rates directly impact the valuation of fixed-income securities held by the Life & Retirement segment.

- Equity Market Exposure: The segment's performance is tied to the broader equity markets, meaning downturns can lead to realized investment losses.

- Profitability Impact: Adverse market movements can erode investment income and capital, thereby reducing the segment's profitability.

- 2024 Market Volatility: The market's unpredictable nature in 2024 highlights the inherent risk of investment losses impacting the company's financial stability.

Regulatory Changes and Compliance Burden

Horace Mann Educators operates within a highly regulated insurance and financial services sector, where evolving compliance requirements pose a significant threat. For instance, the NAIC's ongoing efforts to modernize regulations, particularly around data privacy and cybersecurity, can necessitate substantial investments in new systems and processes. These changes can increase operational costs and potentially constrain the flexibility of product development, impacting profitability.

The burden of adapting to new regulations, such as those stemming from the SEC's enhanced focus on fiduciary duty for investment advisors, can divert resources. For example, increased reporting requirements or capital adequacy adjustments could directly affect a company's bottom line. Failure to stay ahead of these shifts, like the potential for new state-level data breach notification laws in 2024-2025, could result in fines and reputational damage.

- Increased Operational Costs: Implementing new compliance protocols can lead to higher spending on technology and personnel.

- Systemic Overhauls: Regulatory shifts may necessitate costly upgrades or replacements of existing IT infrastructure.

- Product Offering Limitations: Stricter rules could restrict the types of financial products or services Horace Mann can offer.

- Potential Profitability Impact: Higher compliance costs and product restrictions can directly squeeze profit margins.

Horace Mann faces intense competition from both large, diversified insurers and specialized firms, making it challenging to differentiate its offerings. The first quarter of 2024 saw the U.S. property and casualty insurance market with a combined ratio of 100.1%, highlighting a highly competitive pricing environment. Rising inflation, with the CPI-U at 5.5% for the twelve months ending April 2024, increases claim costs, particularly in areas like auto repair, directly impacting underwriting profitability and necessitating constant strategy adaptation.

Shifts in education policy and demographics, such as declining teacher retention rates (around 20% in some states in 2024) and fewer new educators entering the field, could shrink Horace Mann's customer base and demand for its products. Furthermore, financial pressures on educators, evidenced by a modest 2.5% average salary increase in late 2024 that lags inflation, limit their disposable income for insurance and investments.

The Life & Retirement segment is vulnerable to market risks, including interest rate fluctuations and equity market downturns, which can compress net investment income and lead to realized losses, as seen with early 2024 market volatility. Increased regulatory compliance, especially concerning data privacy and cybersecurity, can also drive up operational costs and potentially restrict product offerings, as exemplified by evolving state data breach notification laws.

| Threat Category | Specific Threat | Impact on Horace Mann | Supporting Data/Example |

|---|---|---|---|

| Competition | Intense market competition | Pressure on pricing and market share | Q1 2024 P&C combined ratio: 100.1% |

| Economic Factors | Rising inflation and claim costs | Erosion of underwriting profitability | CPI-U (12 months ending April 2024): 5.5% |

| Industry Trends | Shifting education landscape | Reduced customer base and demand | Teacher turnover rates ~20% (2024) |

| Market Risk | Interest rate and equity market volatility | Reduced investment income and potential losses | Early 2024 equity market volatility |

| Regulatory Environment | Evolving compliance requirements | Increased operational costs and product limitations | Potential new state data breach laws (2024-2025) |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of verified financial reports, comprehensive market research, and expert commentary from industry professionals. These dependable sources ensure an accurate and insightful assessment of Horace Mann Educators' current standing and future potential.