Horace Mann Educators Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horace Mann Educators Bundle

Horace Mann Educators operates in a dynamic market shaped by intense competition and evolving customer needs. Understanding the underlying forces of rivalry, buyer power, supplier influence, threat of new entrants, and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Horace Mann Educators’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The insurance sector, including companies like Horace Mann Educators, depends on a range of suppliers such as reinsurers, data analytics firms, and technology providers. A market where a small number of these suppliers hold substantial sway can significantly impact Horace Mann's operational costs and strategic flexibility. For instance, in 2024, the global reinsurance market saw major players continuing to consolidate, potentially increasing their leverage over primary insurers by influencing treaty terms and pricing.

Horace Mann Educators' reliance on specialized inputs significantly shapes supplier bargaining power. For instance, unique actuarial software or proprietary educator demographic data sets are not readily available elsewhere, granting those suppliers considerable leverage. This is particularly true if these inputs are critical for accurate risk assessment and product development.

The absence of easy substitutes for certain crucial resources amplifies supplier influence. If Horace Mann cannot easily switch to alternative data providers or software vendors without incurring substantial costs or operational disruptions, suppliers of these specialized inputs hold a stronger negotiating position. This can translate into higher prices or less favorable contract terms for Horace Mann.

Horace Mann Educators faces significant bargaining power from its suppliers due to high switching costs. For instance, migrating core systems like policy administration or claims processing can incur substantial expenses, lead to operational disruptions, and necessitate extensive employee retraining. These factors make Horace Mann hesitant to change providers, thereby strengthening the suppliers' position.

Threat of Forward Integration by Suppliers

Suppliers could potentially move into the educator market themselves, offering insurance or financial planning directly. This would turn them into rivals, potentially disrupting Horace Mann's established customer relationships.

While direct forward integration by traditional reinsurance providers is uncommon, technology and service vendors might offer more comprehensive, end-to-end solutions. This could diminish Horace Mann's reliance on their specialized offerings, effectively competing with parts of their business model.

- Potential for Disruption: Suppliers entering Horace Mann's direct market could fragment customer acquisition and increase competitive intensity.

- Technological Advancements: Technology providers offering integrated financial wellness platforms might bypass traditional insurance intermediaries, impacting Horace Mann's service delivery.

- Strategic Partnerships: Horace Mann's ability to maintain strong partnerships and demonstrate unique value will be crucial in mitigating this threat.

Uniqueness of Supplier Offerings

The uniqueness of Horace Mann Educators' supplier offerings significantly influences supplier bargaining power. When suppliers provide highly specialized or proprietary products and services, their leverage increases. For example, a cybersecurity firm offering advanced, tailored protection against threats specific to the education sector would command more power than a generalist IT support company.

Consider the scenario where a key software provider for Horace Mann Educators develops unique algorithms for personalized financial planning for teachers. This differentiation means Horace Mann Educators has fewer alternatives, strengthening the supplier's position. In 2024, companies specializing in niche educational technology solutions often reported higher profit margins due to this very factor.

- Proprietary Technology: Suppliers with patented or exclusive technology, like a unique data analytics platform for educator demographics, gain considerable bargaining power.

- Specialized Expertise: Firms offering deep, sector-specific knowledge, such as consultants understanding the intricacies of K-12 benefits administration, can negotiate more favorable terms.

- Limited Substitutes: The fewer readily available alternatives for a critical input, the stronger the supplier's position.

- High Switching Costs: If transitioning to a different supplier involves significant investment in new systems or retraining, existing suppliers benefit from increased bargaining power.

Horace Mann Educators faces considerable supplier bargaining power due to the specialized nature of inputs and high switching costs. For instance, critical actuarial software or unique educator demographic data sets are not easily replaceable, granting those suppliers significant leverage. In 2024, the consolidation within the global reinsurance market also amplified the bargaining power of major reinsurers, impacting treaty terms and pricing for primary insurers like Horace Mann.

| Supplier Type | Bargaining Power Factor | Impact on Horace Mann Educators | 2024 Data Point/Trend |

|---|---|---|---|

| Reinsurers | Market Concentration | Increased pricing power, potentially higher reinsurance costs. | Major reinsurers continued consolidation, strengthening their negotiating position. |

| Data Analytics Firms | Uniqueness of Data/Algorithms | Higher costs for specialized educator demographic data; reliance on proprietary insights. | Niche educational technology solution providers reported higher profit margins due to unique offerings. |

| Technology Providers (Software) | High Switching Costs | Hesitation to change providers for core systems (e.g., policy administration) due to expense and disruption. | Significant investment required for system migration and retraining remains a deterrent. |

What is included in the product

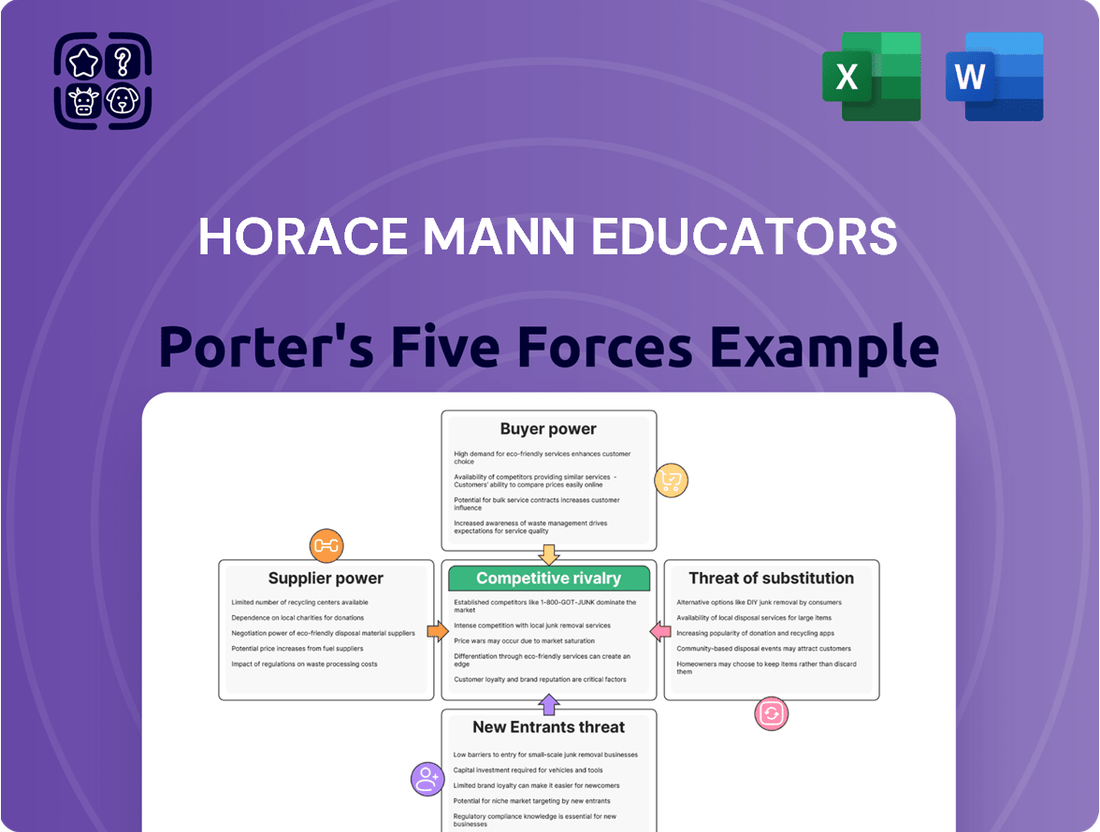

This analysis of Horace Mann Educators leverages Porter's Five Forces to dissect the competitive intensity within the education sector, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall industry rivalry.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

While the broader insurance market features a highly fragmented customer base, Horace Mann Educators operates within a more defined niche: educators. This specialization, while potentially limiting overall market reach, also shapes the bargaining power of its customers.

The bargaining power of individual educators as customers is typically low. This is primarily because each educator, in isolation, represents a relatively small volume of business for Horace Mann. For instance, in 2023, the average premium per policy for Horace Mann was a fraction of a larger corporate or group insurance contract, underscoring the limited individual leverage.

Educators today have a wealth of choices when it comes to insurance and financial services, significantly impacting Horace Mann's bargaining power. They can easily compare offerings from major national insurance companies, specialized providers catering to educators, and even direct-to-consumer online platforms. This broad accessibility means educators are not reliant on a single provider and can actively seek out the best value.

Educators, much like other consumers, are keenly aware of the cost of insurance and financial services. In 2024, persistent inflation and economic uncertainty mean that premiums and fees are scrutinized more closely than ever. This heightened price sensitivity directly translates into increased bargaining power for customers.

Horace Mann must therefore prioritize competitive pricing strategies to retain its customer base. Failure to do so could see educators seeking more affordable alternatives, particularly as the cost of living continues to impact household budgets across the nation.

Low Switching Costs for Customers

For many insurance and financial products tailored to educators, the cost and effort involved in switching providers are minimal. This low barrier to entry means customers can readily explore and move to competitors offering more appealing products or superior service. For instance, in 2024, the average customer acquisition cost in the financial services sector can be significantly impacted by the ease with which clients can shift their business, making customer retention a critical focus.

This ease of switching directly translates into increased bargaining power for customers. They are not locked into a provider by substantial exit fees or complex integration processes, allowing them to leverage competitive offers. In fact, recent surveys indicate that over 60% of consumers in the financial sector consider switching providers if they find a better deal, underscoring the sensitivity to price and value.

- Low Switching Costs: Educators can easily move between financial and insurance providers without incurring significant penalties or complex procedures.

- Competitive Pressure: This ease of movement forces providers like Horace Mann Educators to continuously offer competitive pricing and enhanced service to retain their client base.

- Customer Empowerment: Customers are empowered to seek out better value, leading to a more dynamic and responsive market environment.

Customer Information and Transparency

Educators, like many consumers today, benefit from a significant increase in information availability. Comparison websites and readily accessible financial literacy resources empower them to scrutinize pricing, features, and service quality across various providers. This heightened transparency directly translates to stronger bargaining power.

This trend is particularly evident in the education sector, where educators are increasingly savvy about their financial choices. For instance, in 2024, a significant portion of educators actively researched and compared insurance and financial products online before making a purchase. This proactive approach allows them to negotiate better terms and secure more favorable offerings.

- Informed Decision-Making: Access to detailed product comparisons and independent reviews allows educators to identify the best value propositions.

- Price Sensitivity: With clear visibility into pricing structures, educators are more likely to seek out competitive offers, driving down costs for providers.

- Demand for Value: Educators are increasingly demanding not just products, but comprehensive solutions that align with their specific needs and financial goals.

- Shifting Market Dynamics: Providers must adapt by offering transparent pricing and demonstrating clear value to attract and retain this informed customer base.

The bargaining power of Horace Mann Educators' customers, primarily educators, is significant due to low switching costs and widespread access to competitive alternatives. In 2024, with inflation impacting household budgets, educators are more price-sensitive than ever, actively seeking better value. This empowers them to demand competitive pricing and superior service, forcing providers like Horace Mann to remain agile and customer-focused to ensure retention.

| Factor | Impact on Horace Mann | 2024 Context |

|---|---|---|

| Switching Costs | Low | Educators can easily move to competitors with minimal effort or cost. |

| Information Availability | High | Online comparison tools and financial literacy resources empower informed choices. |

| Price Sensitivity | High | Inflation and economic uncertainty drive demand for cost-effective solutions. |

| Competitive Landscape | Intense | Numerous providers offer similar products, increasing customer leverage. |

Same Document Delivered

Horace Mann Educators Porter's Five Forces Analysis

This preview showcases the complete Horace Mann Educators Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the education sector. You're viewing the exact, professionally formatted document that will be yours to download and utilize immediately upon purchase, ensuring transparency and immediate value.

Rivalry Among Competitors

The insurance and financial services landscape is intensely competitive, featuring a wide array of providers from major national entities to niche specialists. Horace Mann encounters rivals offering comparable products to a broad customer base, alongside those focusing on specific market segments.

In 2024, the U.S. life insurance industry alone saw over 600 companies actively competing, according to industry reports. This sheer volume underscores the crowded nature of the market, forcing companies like Horace Mann to differentiate themselves effectively.

The industry growth rate significantly shapes competitive rivalry within the insurance and financial services sectors. When markets expand briskly, companies can often grow by simply capturing a larger piece of the expanding pie. However, in slower-growth segments, the competition for existing market share intensifies considerably, forcing companies to innovate and differentiate more aggressively.

Horace Mann Educators' performance, for instance, reflects the dynamics of an active market. The company reported a robust 7% increase in total net written premiums and contract deposits in the first quarter of 2025. This positive growth suggests that while competition exists, there are also opportunities for companies like Horace Mann to gain traction and expand their reach.

Horace Mann's competitive edge hinges on its educator-focused niche, yet many of its core insurance and financial products are quite similar to those offered by competitors, making them somewhat commoditized. The company's success relies on effectively communicating its specialized services, deep understanding of educators' unique financial needs, and product customization to differentiate itself in a crowded market.

Exit Barriers

Horace Mann Educators faces considerable competitive rivalry due to high exit barriers within the insurance industry. Significant investments in specialized fixed assets, such as actuarial software and extensive agent networks, make it costly for companies to leave the market. For instance, many insurers maintain long-term policyholder contracts that necessitate continued service even when unprofitable, effectively locking them into ongoing operations and intensifying the competitive landscape.

Regulatory obligations further cement these exit barriers. Insurers must adhere to strict solvency requirements and consumer protection laws, which can involve substantial costs and complex procedures for winding down operations. In 2024, the insurance sector continued to grapple with evolving capital adequacy frameworks, adding another layer of difficulty for firms considering exiting the market. This regulatory environment ensures that even struggling entities remain active competitors, contributing to sustained rivalry.

- High Fixed Asset Investment: Insurers often possess substantial investments in IT infrastructure, physical branches, and specialized actuarial systems, creating significant sunk costs.

- Regulatory Compliance Costs: Meeting ongoing compliance requirements, such as those mandated by state insurance departments, represents a considerable financial commitment.

- Policyholder Commitments: Long-term insurance contracts and the ethical obligation to policyholders prevent rapid divestment, even in periods of low profitability.

- Brand Reputation and Market Presence: The effort and investment required to build a recognizable brand and market presence make a sudden exit detrimental to a company's overall valuation.

Strategic Alliances and Acquisitions

The competitive environment for Horace Mann Educators is significantly influenced by strategic alliances and acquisitions. Companies within the education sector frequently merge with or acquire rivals to boost market share or acquire specialized expertise. For instance, in 2024, the insurance and retirement services sector saw ongoing consolidation. Horace Mann itself, in its strategic financial planning, authorized a new share repurchase program in early 2024, demonstrating a commitment to shareholder value and potentially signaling a focus on internal efficiencies or future strategic moves.

These strategic maneuvers, including partnerships and buyouts, allow firms to broaden their geographical reach or enhance their product and service portfolios. This dynamic landscape means that competitive intensity can shift rapidly as new combinations of resources and capabilities emerge. Such activities directly impact the strategic positioning and operational choices available to all players in the market, including Horace Mann.

- Mergers and Acquisitions: Companies acquire others to gain market share or specialized capabilities.

- Strategic Alliances: Partnerships are formed to expand reach or product offerings.

- Share Repurchases: Horace Mann authorized a new share repurchase program in 2024, indicating strategic financial management.

- Industry Consolidation: The education sector, including insurance and retirement services for educators, experiences ongoing consolidation.

The competitive rivalry for Horace Mann Educators is heightened by the sheer volume of players in the insurance and financial services sector, with over 600 companies active in the U.S. life insurance market in 2024. This crowded field necessitates strong differentiation, as many core products are commoditized, making effective communication of specialized services crucial for success.

High exit barriers, stemming from substantial fixed asset investments and stringent regulatory compliance costs, keep even struggling entities in the market, intensifying ongoing rivalry. For instance, the need to maintain long-term policyholder commitments and navigate evolving capital adequacy frameworks in 2024 locks companies into operations, contributing to sustained competition.

Strategic maneuvers like mergers, acquisitions, and alliances further shape the competitive intensity, allowing firms to expand reach and capabilities. Horace Mann's 2024 share repurchase program also signals strategic financial management amidst this dynamic landscape of industry consolidation.

| Metric | 2024 Data Point | Implication for Rivalry |

|---|---|---|

| Number of U.S. Life Insurers | Over 600 | Intense competition due to market saturation. |

| Horace Mann Q1 2025 Premium Growth | 7% increase | Indicates ability to gain market share despite competition. |

| Exit Barrier Factor | High Fixed Asset Investment | Keeps competitors active, increasing rivalry. |

| Strategic Activity | Horace Mann Share Repurchase Program (2024) | Focus on internal efficiencies or strategic positioning in a competitive market. |

SSubstitutes Threaten

Educators may opt for alternative risk management strategies instead of traditional insurance for certain exposures. This can involve self-insuring for smaller risks, participating in community-based risk pools, or even accepting minor financial losses. For instance, the National Association of Insurance Commissioners reported that in 2023, captive insurance companies, a form of self-insurance, continued to grow, managing billions in risk for their parent organizations.

Government-sponsored programs or robust employee benefit packages offered by school districts can indeed serve as substitutes for some of Horace Mann's individual insurance and retirement products. For instance, many states offer comprehensive retirement plans that may reduce the perceived need for private annuities or life insurance policies for educators. In 2023, the average public-sector pension contribution rate in the US was around 8%, a significant benefit that can offset the appeal of individual retirement savings plans.

The widespread availability and perceived value of these employer-provided benefits can significantly diminish the demand for Horace Mann's standalone offerings. If a school district provides a generous life insurance policy or a strong disability income plan, an educator might see less urgency to purchase a similar policy from Horace Mann. This is particularly true when these benefits are perceived as secure and cost-effective.

Horace Mann's strategy acknowledges this competitive landscape by focusing on helping employers, like school districts, attract and retain talent through enhanced and comprehensive benefit solutions. By partnering with districts to offer tailored benefit packages, Horace Mann aims to integrate its products into the employer framework, rather than solely competing with it. This approach can be seen in their efforts to provide supplemental retirement options or specialized insurance products that complement, rather than directly substitute, core employer benefits.

For retirement and financial planning, individuals have numerous direct investment and savings alternatives that can serve as substitutes for Horace Mann's offerings. These include investing directly in mutual funds, exchange-traded funds (ETFs), real estate, or other savings vehicles outside of traditional insurance channels.

The trend toward direct investment is significant, with active ETFs, for instance, seeing substantial growth. In 2024, the ETF market continued its expansion, with assets under management reaching new heights, indicating a strong preference among investors for accessible and diversified investment options.

Furthermore, the increasing allocation of capital by retail investors into private markets, such as private equity and venture capital, presents another potent substitute. This shift demonstrates a growing appetite for alternative investments that may offer different risk-return profiles compared to traditional insurance products.

Emerging Fintech and Insurtech Solutions

The burgeoning fintech and insurtech sectors present a significant threat of substitutes for Horace Mann Educators. These digital innovators are fundamentally changing how consumers access financial services and insurance, often sidestepping traditional intermediaries. For instance, by mid-2024, digital-only banks and investment platforms continued to gain traction, with some reporting double-digit percentage increases in customer acquisition year-over-year, attracting users with their convenience and often lower fees.

These agile, tech-driven companies are disrupting the market by offering streamlined, user-friendly digital experiences and competitive pricing structures. Many have focused on niche markets or specific customer needs, providing specialized solutions that traditional providers may not easily replicate. This can lead to a migration of customers seeking more efficient and cost-effective alternatives.

Key aspects of this threat include:

- Digital-First Platforms: Fintech and insurtech companies are built on modern technology stacks, enabling rapid innovation and scalability.

- Competitive Pricing: Lower overheads allow these new entrants to offer more attractive rates and fees, directly challenging established players.

- Enhanced Customer Experience: Intuitive interfaces and personalized digital journeys are drawing in consumers, particularly younger demographics.

- Specialized Offerings: Many new entrants focus on specific financial needs, such as micro-investing, peer-to-peer lending, or specialized insurance policies, creating tailored alternatives.

Changing Educator Needs and Preferences

Educators' evolving needs present a significant threat of substitutes. As preferences shift towards more flexible and personalized financial solutions, alternative providers offering on-demand digital platforms or specialized advisory services could draw educators away from traditional offerings like those from Horace Mann. This trend is amplified by the increasing digital savviness of the workforce.

For instance, a growing number of educators are seeking financial planning tools that integrate seamlessly with their personal budgeting apps or offer micro-consultations tailored to specific career stages. This demand for hyper-personalization and accessibility can be met by fintech companies and independent financial advisors who may not be burdened by the legacy structures of established players. The market for financial wellness programs specifically targeting educators is also expanding, offering a direct substitute for Horace Mann's core services.

- Shift to Digital Platforms: A significant portion of the workforce, including educators, now prefers digital-first financial management tools.

- Demand for Personalization: Educators are increasingly looking for financial advice and products that cater to their unique career paths and life stages.

- Emergence of FinTech Solutions: New financial technology companies are offering innovative, often more agile, alternatives to traditional financial services.

- Growth of Independent Advisory: A rise in independent financial advisors provides educators with specialized, often more flexible, planning options.

The threat of substitutes for Horace Mann Educators is substantial, driven by a growing array of alternative financial and insurance solutions. Educators can opt for self-insurance, community risk pools, or even accept minor losses, as evidenced by the growth in captive insurance companies managing billions in risk by 2023. Furthermore, government-sponsored programs and robust employer-provided benefits, such as public-sector pensions with average contribution rates around 8% in 2023, can reduce the perceived need for Horace Mann's individual retirement and insurance products.

Direct investment avenues like mutual funds, ETFs, and real estate also pose a significant threat, with the ETF market continuing its expansion and reaching new asset management heights in 2024. The rise of fintech and insurtech companies offering streamlined, user-friendly digital experiences and competitive pricing further intensifies this threat, attracting customers with convenience and lower fees.

Entrants Threaten

The insurance and financial services sectors, including Horace Mann Educators, demand substantial capital. For instance, in 2024, property and casualty insurers often need hundreds of millions of dollars in capital to underwrite risks and comply with stringent state and federal regulations. This considerable financial hurdle acts as a significant deterrent for many aspiring new companies.

New entrants into the education sector, particularly those seeking to offer financial services to educators like Horace Mann Educators, encounter substantial regulatory hurdles. These include obtaining licenses in multiple states, adhering to stringent financial solvency requirements, and complying with a complex web of consumer protection laws. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continues to emphasize robust capital requirements for insurance providers, a key area for financial service firms targeting educators.

Established players like Horace Mann Educators benefit significantly from strong brand recognition and trust, cultivated over decades of dedicated service to educators. This deep-seated credibility is a formidable barrier for newcomers. For instance, Horace Mann has been a trusted partner for educators since 1945, a testament to its enduring commitment and established reputation.

New entrants face a considerable challenge in replicating this level of trust and visibility. They would need to invest heavily in marketing and dedicate substantial time to build comparable credibility, particularly within a sensitive sector like financial security where reliability is paramount. This makes the threat of new entrants, at least in the short to medium term, relatively low.

Distribution Channels and Access to Customers

Horace Mann Educators benefits from its deeply entrenched distribution channels specifically designed to serve the educational community. These established networks provide direct access to educators, a segment that can be difficult for newcomers to penetrate effectively.

New entrants face a significant hurdle in replicating Horace Mann's access to customers. Building trust and establishing the necessary relationships to reach educators requires substantial investment in specialized sales forces and marketing efforts, often proving to be a costly and time-consuming endeavor.

For instance, in 2024, the insurance industry saw continued consolidation, making it harder for smaller, less established players to gain market share. Horace Mann's long-standing presence within school districts and its tailored product offerings give it a distinct advantage in customer acquisition and retention compared to potential new entrants.

- Established Relationships: Horace Mann leverages decades of engagement with educational institutions.

- Specialized Sales Force: The company employs agents with expertise in understanding educators' unique needs.

- Cost of Entry: New entrants must invest heavily in building similar outreach capabilities.

- Customer Loyalty: Existing channels foster loyalty, making it challenging for competitors to attract Horace Mann's customer base.

Economies of Scale and Experience Curve

Existing insurers like Horace Mann Educators leverage significant economies of scale. This translates to lower per-unit costs in critical functions such as claims processing, underwriting, and investment management. For instance, a larger operational footprint allows for more efficient technology adoption and bulk purchasing of services.

New entrants face a substantial hurdle in matching these cost efficiencies. Without an established, large customer base, they cannot spread fixed costs as thinly. This initial disadvantage can make it difficult for newcomers to compete on price against incumbents who benefit from years of operational experience and accumulated scale.

- Economies of Scale: Horace Mann Educators, like other established insurers, benefits from lower per-unit costs due to its large operational size.

- Experience Curve: Over time, insurers refine processes, leading to further cost reductions and improved efficiency, a benefit new entrants lack.

- Competitive Disadvantage: New entrants struggle to achieve similar cost structures, impacting their ability to offer competitive pricing.

- Barriers to Entry: The need for substantial upfront investment to reach competitive scale acts as a significant barrier.

The threat of new entrants for Horace Mann Educators is moderated by significant capital requirements and regulatory complexity. In 2024, insurers must maintain substantial reserves, often in the hundreds of millions, to meet solvency standards, a substantial barrier for startups. This, combined with the intricate licensing and compliance landscape, deters many potential competitors.

Horace Mann's established brand trust and decades of service to educators present a formidable challenge for newcomers. Building equivalent credibility and visibility in the financial services sector, particularly where trust is paramount, requires immense time and investment. This deep-seated reputation is a key factor limiting the immediate impact of new entrants.

The company's entrenched distribution channels and specialized sales force, honed over years of serving educators, create another significant barrier. New entrants would need considerable investment to replicate this direct access and build the necessary relationships within the educational community, making market penetration difficult.

Economies of scale enjoyed by Horace Mann translate to lower operational costs in areas like claims and underwriting. New entrants struggle to match these efficiencies without a large, established customer base, impacting their ability to compete on price and creating a cost disadvantage.

| Barrier Type | Description | Impact on New Entrants | Horace Mann Advantage |

|---|---|---|---|

| Capital Requirements | Substantial capital needed for solvency and regulatory compliance. | High initial investment required. | Established financial strength. |

| Regulatory Hurdles | Licensing, compliance with consumer protection laws. | Complex and costly to navigate. | Expertise in navigating regulations. |

| Brand Reputation | Decades of trust and recognition among educators. | Difficult to build comparable credibility. | Strong, long-standing brand loyalty. |

| Distribution Channels | Existing networks and specialized sales force. | Challenging to penetrate and replicate access. | Direct and efficient customer reach. |

| Economies of Scale | Lower per-unit costs due to large operational size. | Inability to match cost efficiencies. | Competitive pricing and operational leverage. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Horace Mann Educators is built upon a robust foundation of data, including their annual reports, investor relations materials, and filings with the SEC. We also incorporate insights from industry-specific publications and reputable financial news outlets to provide a comprehensive view of the competitive landscape.