Horace Mann Educators Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horace Mann Educators Bundle

Horace Mann Educators' BCG Matrix offers a strategic lens to understand their product portfolio's market share and growth potential. This preview highlights key areas, but for a truly actionable understanding of their Stars, Cash Cows, Dogs, and Question Marks, you need the full report.

Unlock the complete BCG Matrix to gain detailed quadrant placements and data-driven recommendations for Horace Mann Educators. This comprehensive analysis will equip you to make informed investment and product decisions, guiding your strategy for optimal resource allocation and market positioning.

Don't miss out on the complete strategic picture. Purchase the full BCG Matrix for Horace Mann Educators and receive a detailed Word report along with a high-level Excel summary, empowering you to evaluate, present, and strategize with complete confidence.

Stars

Horace Mann's Property & Casualty (P&C) segment is a standout performer, demonstrating robust growth and profitability. In the first quarter of 2025, core earnings within this segment impressively doubled, a significant leap driven by a favorable claims environment, particularly reduced property losses.

This strong performance is further evidenced by a reported combined ratio of 89.4%. This figure signifies excellent operational efficiency, meaning the company is paying out less in claims and expenses relative to the premiums it earns, directly contributing to a healthier bottom line.

The P&C segment is clearly a powerhouse for Horace Mann, acting as a primary engine for generating profits. Management anticipates this segment will continue to be a major contributor to the company's financial success in the coming periods, bolstered by strategic rate adjustments and ongoing claims management improvements.

Horace Mann Educators' deliberate focus on educators and community service professionals provides a significant competitive edge, establishing it as a dominant player within this specialized market. This strategic niche allows the company to sidestep the fierce competition prevalent in the general insurance industry, fostering consistent growth and a substantial market share among its target audience.

Horace Mann's strategic partnership with SimpliSafe, unveiled in late 2023, aims to boost client loyalty by offering educators discounted home security solutions. This collaboration is designed to enhance customer retention and unlock cross-selling avenues, positioning Horace Mann as a holistic financial partner for its core demographic.

Consistent Profitability and Earnings Growth

Horace Mann Educators shows a solid track record of consistent profitability and earnings growth, a key indicator for a potential Star in the BCG Matrix. This financial strength is underpinned by impressive revenue performance.

The company's financial health is further evidenced by its revenue trajectory. Specifically, Horace Mann Educators experienced a 6.67% revenue increase in the twelve months leading up to Q4 2024. This momentum carried into the new year, with a notable 8% year-over-year revenue growth reported in Q1 2025.

- Revenue Growth: 6.67% (TTM ending Q4 2024) and 8% (YoY Q1 2025).

- Profitability: Consistent profitability demonstrated through revenue increases.

- Earnings Performance: Exceeded earnings expectations, signaling financial robustness.

- Market Position: Strong financial foundation suggests potential for continued market leadership.

Strong Shareholder Returns and Buyback Program

Horace Mann has consistently prioritized shareholder returns, demonstrating a strong commitment to rewarding its investors. This dedication is evident in its robust dividend history and active share repurchase program. Since 2011, the company has returned over $130.9 million to shareholders, underscoring its focus on capital allocation.

Further solidifying this commitment, Horace Mann authorized an additional $50 million for share buybacks in 2025. This proactive approach to returning capital, coupled with an anticipated double-digit return on equity for 2025, paints a compelling picture for potential investors seeking value and consistent returns.

- Shareholder Returns: Over $130.9 million returned since 2011.

- 2025 Buyback Authorization: An additional $50 million approved.

- Projected 2025 ROE: Expected to be in the double digits.

- Investor Appeal: Strong commitment to value creation enhances attractiveness.

The Property & Casualty segment is a clear Star for Horace Mann Educators, exhibiting exceptional growth and profitability. This segment's strong performance, marked by a doubled core earnings in Q1 2025 and a favorable combined ratio of 89.4%, positions it as a key profit driver. Its strategic niche targeting educators and a partnership with SimpliSafe further solidify its market dominance and potential for sustained high growth.

| Metric | Value | Period |

| P&C Core Earnings Growth | Doubled | Q1 2025 |

| P&C Combined Ratio | 89.4% | Q1 2025 |

| Revenue Growth | 8% | YoY Q1 2025 |

| Shareholder Returns | $130.9 million+ | Since 2011 |

| 2025 Share Buyback Authorization | $50 million | 2025 |

What is included in the product

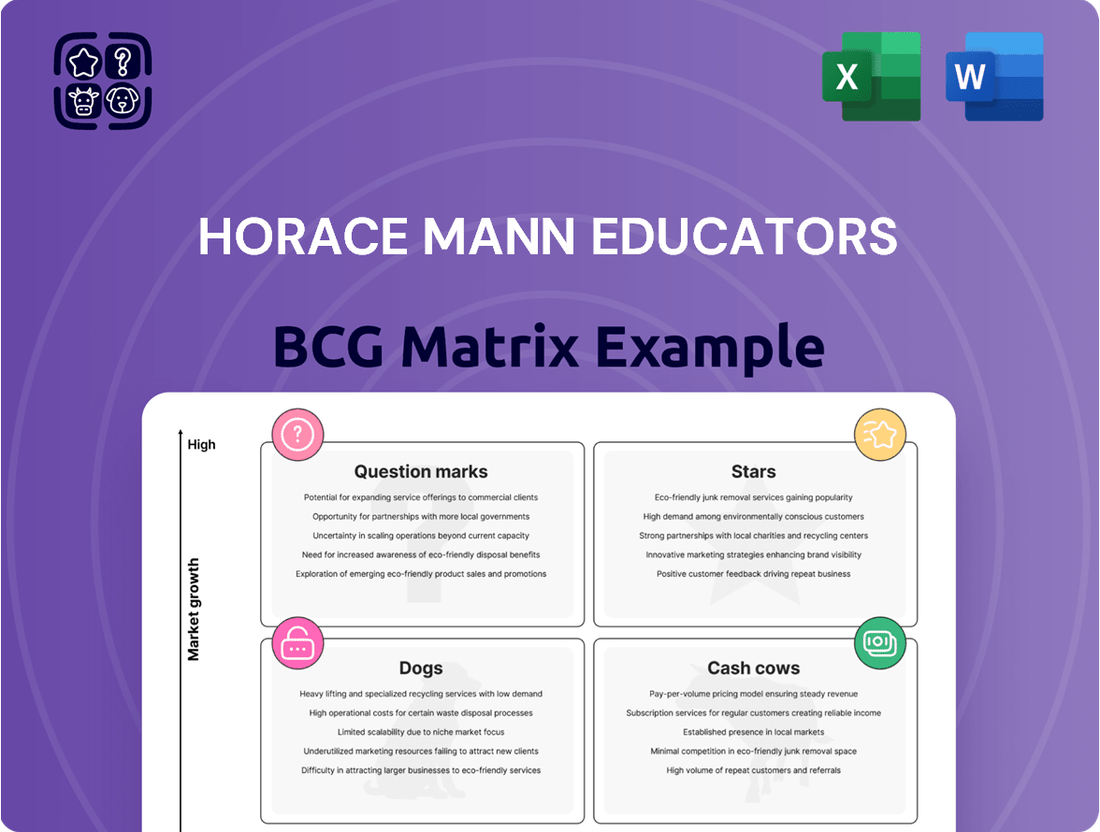

This BCG Matrix analysis identifies Horace Mann Educators' product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic recommendations on investment, holding, or divestment for each category.

Clear visualization of Horace Mann Educators' business units, identifying Stars, Cash Cows, Question Marks, and Dogs for strategic focus.

Cash Cows

Horace Mann's retirement annuities and financial planning services for educators are firmly positioned as Cash Cows. This segment benefits from a mature market where Horace Mann holds a significant share, indicating strong customer loyalty and a well-established presence.

These offerings likely produce reliable cash flow, a direct result of the long-term commitment inherent in retirement planning and the dedicated educator demographic. For instance, in 2024, Horace Mann reported substantial assets under management in their retirement segment, underscoring the stability and consistent revenue generation from these products.

Horace Mann's auto and home insurance offerings represent established cash cows within their portfolio. These mature product lines have a significant market presence, particularly within the educator demographic, thanks to the company's deep-rooted relationships in this community.

These offerings consistently generate steady revenue and robust cash flow, a testament to their enduring market position. The successful profitability restoration efforts in the Property & Casualty (P&C) segment during 2024 have further bolstered their capacity to generate substantial cash.

Horace Mann Educators' long-standing relationships with educators, spanning 73 years, are a cornerstone of its business. This deep connection, driven by its 'Educators for Educators®' mission, fosters exceptional customer loyalty. This loyalty directly contributes to high retention rates, securing a stable and predictable revenue stream from its insurance and financial services offerings, effectively making these relationships a valuable cash-generating asset.

Disciplined Capital Allocation and Dividend Stability

Horace Mann Educators demonstrates a disciplined approach to capital allocation, evident in its consistent quarterly dividend of $0.35 per share. This stability underscores robust cash flow generation from its core operations and a firm commitment to returning value to shareholders.

The company's ability to maintain this dividend payout, totaling $1.40 annually per share, suggests that its established business segments are reliably generating surplus cash. This financial strength allows for continued investment in growth opportunities while simultaneously supporting shareholder distributions and preserving overall financial health.

- Consistent Dividend: Horace Mann Educators has maintained a quarterly dividend of $0.35 per share, indicating stable earnings.

- Shareholder Value: This consistent payout reflects a commitment to rewarding investors and signals financial stability.

- Cash Flow Strength: The ability to sustain dividend payments points to strong cash generation from its core business lines.

Large Multiline Financial Services Provider for Educators

Horace Mann Educators, as a leading multiline financial services provider specifically catering to educators, operates as a strong Cash Cow within the BCG Matrix framework. Its extensive suite of offerings, encompassing insurance, retirement solutions, and financial planning, allows for significant cross-selling opportunities.

This strategic advantage enables Horace Mann to maximize client lifetime value, fostering robust cash generation. For instance, in 2024, the company reported continued strength in its core insurance segments, which are known for their stable and predictable cash flows, reflecting the maturity and market dominance of these offerings.

- Market Dominance: Horace Mann holds a significant market share among educators, a demographic with consistent financial needs.

- Cross-Selling Synergy: The ability to bundle diverse financial products enhances revenue per customer and operational efficiency.

- Stable Cash Flows: Mature product lines, like life insurance and annuities, provide a reliable source of cash to fund other business ventures.

- Profitability: High customer retention and economies of scale contribute to strong profitability margins.

Horace Mann's retirement annuities and financial planning services are prime examples of Cash Cows. These offerings benefit from a mature market where Horace Mann has a substantial share, indicating deep customer loyalty and a well-established presence. In 2024, the company's retirement segment demonstrated strong assets under management, highlighting the stability and consistent revenue these products generate.

The company's auto and home insurance lines also function as Cash Cows. These are mature products with a significant footprint in the educator market, bolstered by Horace Mann's long-standing relationships. The successful profitability restoration in the Property & Casualty segment during 2024 further solidified their ability to generate substantial cash flow.

Horace Mann's ability to maintain its quarterly dividend of $0.35 per share, totaling $1.40 annually, is a direct indicator of its Cash Cow status. This consistent payout reflects strong, reliable cash generation from its core operations, allowing for shareholder returns and reinvestment.

The company's market dominance within the educator demographic, coupled with its strong customer retention and cross-selling capabilities, ensures stable and predictable cash flows from its insurance and financial services. This financial strength is further evidenced by the consistent profitability observed in its core segments throughout 2024.

| Segment | BCG Category | Key Characteristics | 2024 Financial Indicator |

|---|---|---|---|

| Retirement Solutions | Cash Cow | Mature market, high share, stable revenue | Strong Assets Under Management |

| Auto & Home Insurance | Cash Cow | Established products, deep customer loyalty | Restored P&C Profitability |

| Overall Financial Health | Cash Cow | Consistent dividend payout, reliable cash generation | $0.35 Quarterly Dividend |

Delivered as Shown

Horace Mann Educators BCG Matrix

The BCG Matrix preview you are currently viewing is the exact, unedited document you will receive upon purchase. This comprehensive analysis of Horace Mann Educators' product portfolio is fully formatted and ready for immediate strategic application, containing no watermarks or placeholder content.

Dogs

Horace Mann Educators' legacy commercial liability policies are a clear example of a 'Dog' in the BCG Matrix. These older policies, some dating back to the 1960s, are a declining segment that no longer contribute significantly to the company's growth or market share.

In the fourth quarter of 2024, Horace Mann recorded $15.7 million in after-tax costs associated with these non-core legacy policies. This highlights the financial drag these assets represent, tying up capital and resources without generating new value for the business.

Within Horace Mann's portfolio, specific niche products that fail to resonate with educators or become technologically irrelevant are categorized as Dogs. These products, while serving a niche, drain valuable resources without generating substantial revenue or market share. For instance, a legacy insurance product designed for a fading educational trend might represent such a category.

Horace Mann's early 2024 digital engagement launch, aimed at simplifying educator interactions, faces the risk of becoming a 'Dog' in the BCG matrix if it doesn't demonstrably boost customer acquisition or retention. An underperforming digital platform signifies an investment yielding minimal returns, potentially impacting future growth. For instance, if customer onboarding through the new platform sees less than a 10% improvement compared to previous methods, it would signal inefficiency.

Products with Declining Educator Demand

Products experiencing a sustained drop in educator demand, possibly due to shifting economic landscapes or evolving financial needs, could be categorized as 'Dogs' within Horace Mann Educators' BCG Matrix. These offerings would likely exhibit both a low market share and minimal growth potential within the education sector.

Consider, for example, certain types of annuity products that were popular a decade ago but are now seeing reduced uptake among educators. This decline could be attributed to factors like historically low interest rates in recent years, making them less attractive compared to other investment vehicles, or a greater preference for more flexible, digital-first financial solutions.

- Declining Annuity Sales: While specific 2024 data for Horace Mann Educators' annuity products is not yet fully available, broader industry trends from late 2023 indicated a slowdown in fixed annuity sales compared to previous periods, often linked to interest rate environments.

- Shifting Investment Preferences: Educators, like many demographics, are increasingly seeking investments that offer potential for higher growth, even with associated risks, moving away from traditionally conservative products.

- Low Market Share & Growth: Products that fail to adapt to these changing preferences risk becoming 'Dogs,' characterized by a shrinking customer base and limited new business generation within the educator market.

Segments with Persistent Low Profitability

Within the Horace Mann Educators portfolio, segments consistently exhibiting low profit margins or failing to meet profitability targets would be classified as 'Dogs.' These underperforming areas demand significant resources without yielding commensurate returns, potentially hindering overall financial health.

For instance, if a particular insurance product line, despite market presence, consistently operates with net profit margins below 3% compared to industry averages in the low-to-mid single digits, it might be flagged. This is especially true if remediation efforts, such as marketing adjustments or product enhancements, have not improved its financial performance over the past few fiscal years, including 2023 and projected 2024 performance indicators.

- Persistent low profit margins: Segments with net profit margins consistently below the company's target or industry benchmarks.

- High resource allocation, low return: Areas that consume substantial operational or capital resources but generate minimal financial gains.

- Lack of competitive advantage: Segments that struggle to differentiate themselves or compete effectively in their respective markets.

- Stagnant or declining revenue: Businesses or product lines that are not growing or are experiencing a downward trend in sales.

Dogs within Horace Mann Educators' portfolio represent products or services with low market share and low growth potential, often requiring significant resource allocation without generating substantial returns. These are typically mature or declining offerings that have not kept pace with market evolution or competitive pressures.

For example, legacy commercial liability policies, some originating from the 1960s, exemplify this category. In Q4 2024, Horace Mann incurred $15.7 million in after-tax costs related to these non-core legacy policies, underscoring their financial drain.

Similarly, niche educational products that have become technologically irrelevant or no longer align with educator needs also fall into the Dog quadrant, consuming resources without contributing meaningfully to growth or market share.

The company's performance in 2024, particularly the ongoing costs associated with legacy products, highlights the need to strategically manage these 'Dog' assets, potentially through divestiture or managed decline, to free up capital for more promising growth opportunities.

Question Marks

Horace Mann's new digital experience, launched in February 2024, is a significant technology investment designed to streamline how educators access insurance and financial products. This initiative reflects a strategic push to enhance customer engagement and simplify the user journey.

The platform's performance in achieving widespread market adoption and growing Horace Mann's digital market share will be the key determinant of its classification within the BCG matrix. If it captures substantial new customer segments and demonstrates high growth, it could emerge as a Star.

Horace Mann is strategically investing in its Worksite products, aiming to extend its reach beyond the traditional K-12 educator base into the wider municipal market. This move signifies a deliberate effort to tap into a new, potentially lucrative growth avenue.

This expansion positions Horace Mann's Worksite products as a 'Question Mark' within the BCG framework. While the broader municipal market represents a significant opportunity with high growth potential, Horace Mann currently holds a low market share in this segment, reflecting the inherent risks and uncertainties associated with entering a new territory.

The success of this expansion hinges on Horace Mann's ability to effectively leverage its investments in distribution and infrastructure. If these initiatives gain traction and capture a meaningful share of the municipal market, these Worksite products could transition into 'Stars,' generating substantial returns for the company.

Horace Mann is actively tackling educator financial wellness through targeted initiatives. They conduct regular surveys to understand specific challenges, offering solutions like student loan management programs and comprehensive financial wellness workshops. For instance, in 2023, Horace Mann reported that over 90% of educators surveyed expressed concerns about retirement planning, a key area addressed in their workshops.

Furthermore, Horace Mann supports educators in securing classroom resources, notably through their partnership with DonorsChoose. This initiative not only aids teachers but also strengthens Horace Mann's brand as a dedicated partner to the education community. The success of these programs in client acquisition and retention is crucial for their continued development and market impact.

Strategic Initiatives for 'Outsized Growth' in Individual Supplemental & Group Benefits

Horace Mann Educators is focusing on achieving significant growth in its Individual Supplemental and Group Benefits segments. While Q1 2025 saw a notable increase in sales for these areas, they remain classified as 'Question Marks' within the company's strategic portfolio.

This classification indicates that while there's potential for high growth, the long-term market share and sustained success are not yet firmly established. Strategic initiatives are therefore crucial to solidify their position and capitalize on the observed sales momentum.

- Targeted Product Development: Introduce innovative supplemental products that address evolving customer needs, potentially leveraging data analytics to identify underserved niches within the educator market.

- Enhanced Distribution Channels: Expand reach through digital platforms and partnerships, ensuring seamless access for educators seeking supplemental coverage.

- Customer Engagement Strategies: Implement proactive communication and educational campaigns to increase awareness and understanding of the value proposition of these benefits.

- Competitive Analysis: Continuously monitor competitor offerings and market trends to ensure Horace Mann remains a leading provider in the supplemental and group benefits space for educators.

New or Enhanced Product Offerings to Meet Evolving Educator Needs

Horace Mann Educators is committed to evolving its product suite to meet the dynamic needs of educators. New or enhanced offerings that directly address current challenges, such as managing increased student-to-teacher ratios or adapting to new educational technologies, are crucial for capturing market share.

These innovative solutions, designed to simplify educators' workloads and improve student outcomes, are positioned as potential Stars within the BCG Matrix. For instance, in 2024, Horace Mann launched a new digital platform offering personalized professional development modules, a response to the growing demand for flexible, career-advancing training. This initiative taps into a segment of the education market experiencing significant growth, driven by ongoing policy shifts and the need for continuous skill enhancement among educators.

- Focus on Digital Tools: Development of AI-powered grading assistants and classroom management software to alleviate teacher workload.

- Personalized Learning Support: Introduction of adaptive learning platforms that cater to diverse student needs, addressing challenges in differentiated instruction.

- Financial Wellness Programs: Enhanced offerings focused on educators' financial planning, including retirement readiness and student loan management solutions, reflecting increased financial pressures on the profession.

- Professional Development Integration: Bundling of new product offerings with accredited professional development courses to increase educator engagement and retention.

Horace Mann's Worksite products targeting the broader municipal market are currently classified as Question Marks. This means they operate in a high-growth sector but have a low market share, presenting both opportunity and risk.

The success of these Worksite products hinges on Horace Mann's ability to effectively penetrate this new market. If they can gain significant traction and increase their market share, these offerings could evolve into Stars, generating substantial returns.

Similarly, the Individual Supplemental and Group Benefits segments are also categorized as Question Marks. Despite recent sales increases in Q1 2025, their long-term market share and sustained success are still uncertain, requiring strategic focus to solidify their position.

The company's new digital experience, launched in February 2024, is a key investment aimed at improving customer engagement and simplifying access to products. Its future classification will depend on its ability to drive market adoption and grow digital market share.

BCG Matrix Data Sources

Our Horace Mann Educators BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.