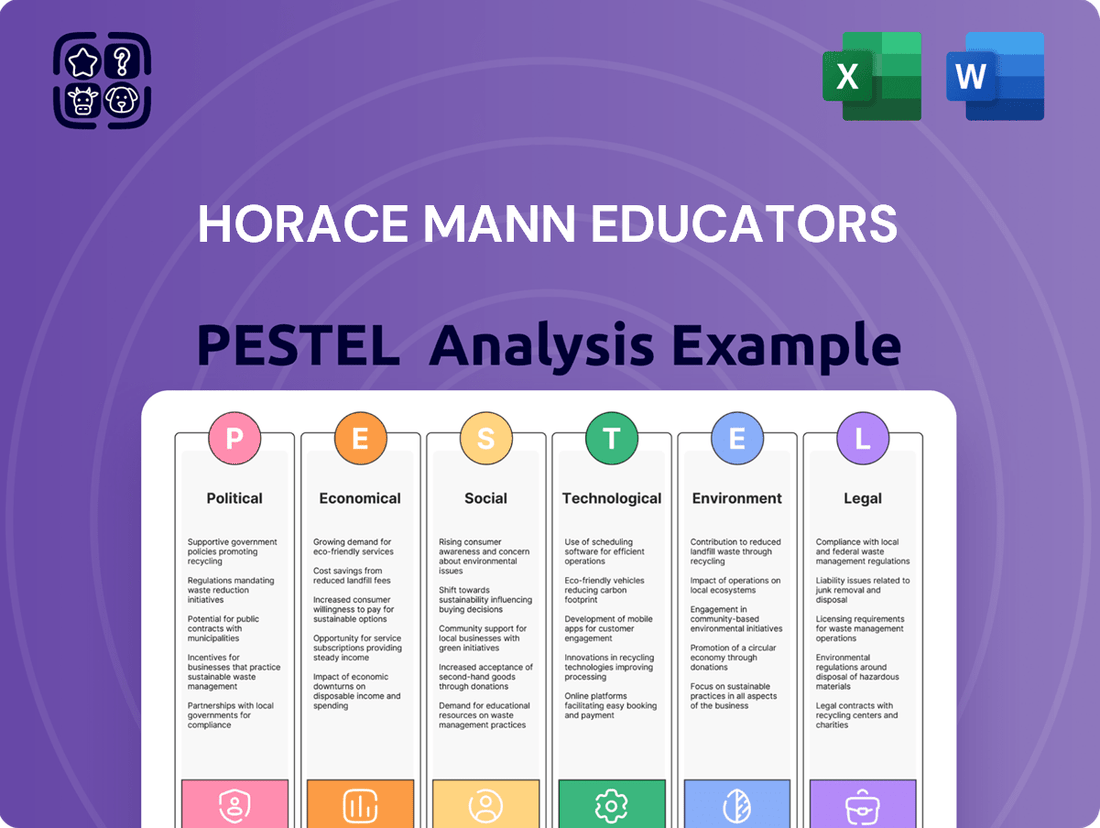

Horace Mann Educators PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horace Mann Educators Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Horace Mann Educators's strategic landscape. Our expertly crafted PESTLE analysis provides actionable insights to navigate market complexities and identify growth opportunities. Download the full version to gain a competitive advantage and make informed decisions.

Political factors

Government policies on education funding significantly shape the financial landscape for Horace Mann's core demographic. For instance, the U.S. Department of Education reported that total federal, state, and local revenue for public elementary and secondary schools reached $799 billion in the 2021-2022 school year, a slight decrease from the previous year when adjusted for inflation.

A contraction in these budgets, as seen in some states during economic downturns, can directly affect educators' compensation and benefits. This, in turn, can dampen demand for Horace Mann's insurance and financial planning services, as educators may have less disposable income or face greater financial uncertainty.

Conversely, policy shifts towards increased education investment, such as proposed federal initiatives to boost teacher salaries or expand school resources, could create a more favorable market. For example, if a state legislature approves a 5% increase in per-pupil spending in 2025, this could translate to better salaries and benefits for teachers in that region, potentially increasing their capacity and willingness to invest in financial products.

The insurance sector operates under a dense regulatory framework, with oversight from both state and federal authorities in the United States. Horace Mann must diligently adhere to these rules, which dictate everything from the types of products they can offer and how they price them, to safeguarding consumers and managing sensitive data. For instance, the National Association of Insurance Commissioners (NAIC) continually updates model laws, such as those pertaining to cybersecurity and data privacy, which states then adopt, creating a dynamic compliance environment.

Upcoming or recently implemented regulatory shifts can significantly influence Horace Mann's operations and strategic planning. For example, increased emphasis on climate-related risk disclosures, as seen in various state initiatives and potential federal guidance, could necessitate substantial investments in data analytics and reporting infrastructure, impacting operational expenditures and potentially reshaping product portfolios to account for emerging risks.

The political climate significantly impacts Horace Mann Educators, as sentiment towards public sector employees, especially teachers, directly shapes policies on compensation and benefits. A supportive political environment can translate into better financial stability for educators, potentially boosting their ability to invest in financial products and services offered by Horace Mann.

For instance, in 2024, several states saw renewed legislative efforts to increase teacher salaries and improve benefits packages, reflecting a growing political recognition of the value of educators. This trend, if sustained into 2025, could lead to increased disposable income among Horace Mann's target demographic, fostering greater engagement with their investment and insurance solutions.

Taxation Policies

Changes in tax laws, such as adjustments to corporate tax rates or taxes on investment income, directly impact Horace Mann's bottom line and the appeal of its financial offerings to educators. For example, alterations to 403(b) tax-qualified plans can significantly influence the sales of retirement annuities.

The Tax Cuts and Jobs Act of 2017, for instance, lowered the corporate tax rate, which could have provided a boost to companies like Horace Mann by increasing retained earnings. However, future legislative changes, particularly those affecting retirement savings vehicles prevalent among educators, remain a key consideration.

For 2024 and beyond, potential shifts in tax policy could include changes to the deductibility of certain retirement contributions or modifications to capital gains taxes, both of which would directly affect the financial planning landscape for Horace Mann's target demographic.

- Corporate Tax Rate Impact: A stable or decreasing corporate tax rate generally benefits Horace Mann by allowing for greater retained earnings.

- Retirement Savings Taxation: Changes to the tax treatment of 403(b)s and other retirement plans are critical, as these are core products for Horace Mann.

- Investment Income Taxes: Fluctuations in capital gains and dividend taxes can affect the attractiveness of investment-linked insurance products.

Trade and International Relations

While Horace Mann Educators is primarily focused on the U.S. market, global trade policies and international relations can still have an indirect impact. For instance, significant shifts in international trade agreements or escalating trade tensions can influence overall U.S. economic stability. This, in turn, affects the financial well-being of its citizens, including educators who are Horace Mann's core customer base.

Economic disruptions stemming from global events, such as supply chain issues exacerbated by geopolitical instability, can contribute to inflation. In 2024 and early 2025, persistent inflation, partly influenced by global factors, has been a concern, potentially impacting the purchasing power of educators and the investment returns Horace Mann generates for its clients.

- Global Trade Dynamics: Changes in U.S. trade policies, such as tariffs or new trade agreements, could indirectly affect the national economy and the financial security of educators.

- Geopolitical Risks: International conflicts or political instability can create market volatility, influencing investment performance and potentially impacting Horace Mann's asset management.

- Inflationary Pressures: Global economic factors, including energy prices and supply chain disruptions, can contribute to inflation in the U.S., affecting the real value of savings and investments for educators.

Political factors significantly influence Horace Mann Educators through government funding for education, which directly impacts educators' financial stability and their capacity to utilize financial services. For example, legislative efforts in 2024 aimed at increasing teacher salaries in several states could improve the disposable income of Horace Mann's target demographic, potentially boosting engagement with their offerings into 2025.

What is included in the product

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Horace Mann Educators, providing a comprehensive understanding of the external landscape.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats for the organization.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Horace Mann Educators.

Helps support discussions on external risk and market positioning during planning sessions, by highlighting key political, economic, social, technological, environmental, and legal influences.

Economic factors

High inflation in 2024 and early 2025 directly increases Horace Mann's costs, particularly for property and casualty insurance claims. For instance, the rising cost of auto parts and labor significantly impacts the expense of repairing vehicles, a core component of their insurance business. This puts pressure on underwriting profitability if premiums don't keep pace.

Simultaneously, the Federal Reserve's interest rate policy, which saw rates remain elevated through 2024, presents a dual effect. While higher rates boost the investment income Horace Mann earns on its substantial bond portfolio, potentially offsetting some claim cost increases, they also dampen demand. Higher rates make it more expensive for educators to borrow for major purchases or to finance retirement savings plans, potentially reducing enrollment in Horace Mann's annuity and life insurance products.

The financial health of schools and educational institutions is a critical economic factor impacting educators' employment and income. For instance, in the 2023-2024 school year, many districts faced budget constraints, with some reporting deficits, which can lead to hiring freezes or layoffs. This directly affects the stability of Horace Mann's target market.

Enrollment trends also play a significant role. Declining enrollment in certain regions, as seen in some K-12 public schools which experienced a dip in attendance post-pandemic, can lead to reduced funding and fewer teaching positions. Conversely, areas with growing student populations might offer more opportunities, benefiting educators and Horace Mann's potential client base.

Budget allocations within the education sector are paramount. In 2024, federal and state education budgets are under scrutiny, with debates around increased funding for special education and teacher salaries. A positive trend in budget allocations means more resources for schools, potentially leading to higher educator incomes and greater demand for financial services.

Consumer spending, particularly among educators, is a key economic factor. In 2024, personal consumption expenditures in the U.S. are projected to grow, but inflation and interest rate environments can impact discretionary income available for financial services like insurance and retirement planning. Educators, like many households, may adjust their spending habits based on these economic conditions.

Savings behavior is also critical. As of early 2024, savings rates have seen fluctuations. If economic uncertainty persists or worsens, educators might prioritize building emergency funds or paying down debt, potentially reducing immediate contributions to long-term financial planning or opting for more basic insurance plans.

Competition in the Financial Services Industry

Horace Mann Educators operates within a highly competitive financial services sector, facing rivals ranging from established insurance giants to agile fintech startups. This intense competition necessitates continuous innovation and strategic pricing to maintain market share. For instance, the U.S. property and casualty insurance market, a key segment for Horace Mann, saw a competitive landscape where direct-to-consumer models and digital-first insurers gained traction in 2024, challenging traditional distribution channels.

Market dynamics, including ongoing consolidation among larger players and the emergence of new, technology-driven entrants, directly influence Horace Mann's operational environment. Competitors employing aggressive pricing strategies or offering novel product bundles can exert significant pressure on profit margins and customer retention. In 2024, the trend of insurers leveraging AI for underwriting and claims processing intensified, creating a competitive advantage for those adopting such technologies.

- Intensified Competition: The financial services industry, particularly insurance and wealth management, is characterized by a crowded marketplace with numerous providers vying for customer attention.

- Market Consolidation: Ongoing mergers and acquisitions within the insurance sector can lead to fewer, larger competitors with greater market power, potentially impacting pricing and product offerings.

- New Entrants and Disruptors: Fintech companies and insurtech startups are introducing innovative business models and technologies, forcing traditional players like Horace Mann to adapt or risk losing market share.

- Aggressive Pricing Strategies: Competitors may engage in price wars or offer promotional rates to attract new customers, putting pressure on Horace Mann's profitability and pricing structures.

Investment Market Performance

Horace Mann Educators' financial health is closely linked to how its investment portfolios perform, especially concerning its retirement annuities and life insurance products. Market swings, whether up or down, directly affect the income generated from these investments, influencing the company's overall profitability. For instance, during 2023, the S&P 500 saw a substantial increase of over 24%, a trend that would generally benefit investment income for companies like Horace Mann, assuming a significant allocation to equities. However, the performance of fixed-income markets, crucial for annuity products, can be more nuanced, with interest rate changes playing a significant role.

The company's reliance on investment income means that periods of market volatility or economic downturns can present challenges. A significant drop in asset values can lead to reduced investment returns, potentially impacting the company's ability to meet its obligations and generate profits. For example, if Horace Mann holds a substantial portion of its assets in bonds that decline in value due to rising interest rates, this can directly reduce its reported investment income and capital. The economic outlook for 2024 and 2025, with ongoing discussions around inflation and interest rate policy, will continue to be a critical factor in evaluating Horace Mann's investment market performance.

Key considerations for Horace Mann's investment market performance include:

- Equity Market Performance: The company's exposure to stock markets directly impacts returns on its investment portfolio. Strong equity performance in 2023, like the aforementioned S&P 500 gains, generally boosts investment income.

- Fixed Income Market Conditions: Fluctuations in bond yields and prices are critical, especially for annuity products. Changes in interest rates can affect the valuation of bond holdings and the income generated.

- Economic Uncertainty: Broader economic factors such as inflation, recession risks, and geopolitical events can create market volatility, impacting investment returns and potentially requiring adjustments to investment strategies.

- Regulatory Environment: Changes in financial regulations can also influence investment strategies and the types of assets Horace Mann can hold, indirectly affecting market performance.

Economic factors significantly shape Horace Mann Educators' operating landscape. High inflation in 2024-2025 increases claims costs, particularly for auto insurance, while elevated interest rates boost investment income but can dampen demand for financial products. The financial health of educational institutions, influenced by budget allocations and enrollment trends, directly impacts the income and stability of Horace Mann's target market.

Consumer spending and savings behavior among educators are also key. In 2024, while overall spending may grow, inflation and interest rates could reduce discretionary income for financial services. Persistent economic uncertainty might lead educators to prioritize savings or debt reduction, potentially impacting contributions to retirement plans or the purchase of comprehensive insurance.

The competitive environment is intense, with traditional insurers and fintech startups vying for market share. Aggressive pricing and technological adoption, such as AI in underwriting, are key competitive drivers. Market consolidation and new entrants continually reshape the industry, compelling Horace Mann to innovate and adapt its strategies.

Horace Mann's investment performance is crucial, influenced by equity and fixed-income market conditions. Economic uncertainty and interest rate changes directly affect returns on annuities and insurance products. For example, while the S&P 500 saw strong gains in 2023, fixed-income performance can be more volatile, impacting overall profitability.

Preview the Actual Deliverable

Horace Mann Educators PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Horace Mann Educators delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. Gain valuable insights into the strategic landscape they operate within.

Sociological factors

The demographics of the educator workforce significantly shape the market for insurance and financial products. As of 2024, the average US teacher is a white woman in her 40s. This profile suggests a substantial segment of the workforce is likely focused on mid-career financial planning and potentially supporting families.

An aging educator population, a trend observed in recent years, naturally drives a higher demand for retirement planning services and products like annuities. Conversely, a younger, diversifying workforce might prioritize different offerings, such as student loan repayment strategies, affordable life insurance, or starter home insurance.

Teacher shortages, a persistent issue, directly affect Horace Mann's market stability. For instance, in the 2023-2024 school year, a survey by the National Education Association indicated that 55% of educators reported considering leaving the profession, a significant concern for a company serving this demographic.

Factors like compensation and benefits heavily influence teacher retention, impacting Horace Mann's client acquisition and loyalty. In 2024, the average teacher salary in the U.S. was approximately $62,000, a figure many educators find insufficient, highlighting the importance of attractive benefit packages that Horace Mann offers.

Public perception of educators significantly impacts policy and funding for education. In 2024, surveys indicated that a majority of Americans believe teachers are undervalued, with 62% expressing concern about teacher pay and resources. This sentiment can translate into greater support for initiatives that benefit educators, a key demographic for Horace Mann.

A positive societal view of teachers can foster a more stable and expanding client base for Horace Mann. As of early 2025, teacher satisfaction surveys show a slight uptick in morale compared to previous years, potentially indicating a more optimistic outlook among educators, which could benefit financial service providers catering to them.

Financial Literacy and Planning Among Educators

The financial literacy and retirement planning awareness among educators directly impact their receptiveness to Horace Mann's offerings. A higher level of financial understanding can lead to greater engagement with retirement savings products and financial advisory services.

Horace Mann's market expansion could be significantly boosted through educational initiatives focused on improving financial literacy among educators. For instance, a 2024 survey indicated that only 45% of teachers feel confident in their retirement planning, presenting a clear opportunity.

- Educator Financial Confidence: A 2024 survey revealed that 55% of educators lack confidence in their retirement planning.

- Market Opportunity: Partnerships for financial literacy programs could tap into a significant unmet need among educators.

- Product Adoption: Improved financial awareness is likely to correlate with increased adoption of Horace Mann's retirement and investment products.

Workplace Benefits and Employee Expectations

Educators' expectations for workplace benefits are evolving significantly. They are increasingly seeking more than just basic health coverage, looking towards robust retirement plans and a wider array of supplemental insurance options, such as disability and life insurance. This shift directly influences the market for Horace Mann's group and individual offerings.

The demand for flexible financial solutions is a key driver in product development. As educators prioritize personalized financial well-being, Horace Mann must adapt its product portfolio to meet these diverse needs. For instance, in 2024, the average employer contribution to 401(k) plans for new hires reached 4.5% of salary, indicating a growing emphasis on retirement security that educational institutions and their providers need to match.

- Increased Demand for Comprehensive Health Coverage: Educators are prioritizing health benefits that offer broader networks and lower out-of-pocket costs.

- Focus on Retirement Security: There's a heightened expectation for strong retirement plans, with many educators looking for employer-sponsored plans that offer competitive matching contributions.

- Interest in Supplemental Insurance: Benefits like long-term disability, critical illness, and life insurance are becoming more sought after to provide a financial safety net.

- Desire for Financial Wellness Programs: Beyond traditional benefits, educators are showing interest in resources that support their overall financial literacy and planning.

Societal views on education and educators directly impact Horace Mann's operating environment. A positive public perception can lead to increased funding and support for educational institutions, benefiting the educator workforce and, by extension, Horace Mann's client base.

Teacher retention is closely tied to compensation and benefits, with many educators feeling undervalued. In 2024, the average U.S. teacher salary was around $62,000, underscoring the importance of robust benefits packages that Horace Mann provides to attract and retain clients.

Financial literacy levels among educators present both challenges and opportunities. With 55% of teachers in 2024 reporting low confidence in retirement planning, there's a clear market for financial education and tailored products.

The demographic profile of educators, predominantly middle-aged women, suggests a strong demand for mid-career financial planning and retirement solutions.

| Sociological Factor | 2024/2025 Data Point | Implication for Horace Mann |

|---|---|---|

| Educator Demographics | Average US teacher is a white woman in her 40s (2024) | Focus on mid-career financial planning and retirement products. |

| Teacher Retention Concerns | 55% of educators considered leaving profession (NEA, 2023-2024) | Highlights need for attractive benefits and financial support. |

| Public Perception of Teachers | 62% concerned about teacher pay/resources (2024 survey) | Potential for increased support for educator-focused initiatives. |

| Educator Financial Literacy | 45% of teachers confident in retirement planning (2024 survey) | Significant opportunity for financial education and planning services. |

Technological factors

The insurance industry is undergoing a significant digital transformation, with platforms for policy management, claims, and customer service becoming increasingly vital. Horace Mann's strategic imperative is to invest in these digital capabilities to deliver smooth online experiences and boost operational efficiency.

By embracing digital tools, Horace Mann can better meet the evolving expectations of its customers, who increasingly demand convenient and accessible digital interactions. This shift is crucial for maintaining competitiveness in the 2024-2025 landscape, where digital-first approaches are becoming the norm.

Artificial Intelligence and Machine Learning are fundamentally reshaping the insurance landscape. Horace Mann can harness these advancements to refine underwriting accuracy, streamline claims processing, and detect fraudulent activities more effectively. For instance, the global AI in insurance market was projected to reach $10.2 billion in 2023 and is expected to grow significantly, indicating substantial opportunities for efficiency gains and improved risk management.

Advanced data analytics are transforming the insurance landscape for educators. Insurers like Horace Mann can now leverage sophisticated tools to dissect vast datasets, uncovering intricate patterns in educator behavior, evolving market dynamics, and nuanced risk factors specific to this demographic. This allows for a more granular understanding than ever before.

Predictive modeling, powered by these analytics, is a game-changer. For instance, by analyzing historical claims data and demographic trends among educators, Horace Mann can refine its pricing strategies to be more competitive and accurate. In 2024, insurers leveraging AI for underwriting reported a 15% reduction in claims processing time, a benefit that can translate to better customer service and more efficient operations.

Furthermore, these capabilities enable the development of highly tailored product offerings. By understanding the unique financial needs and life stages of educators, such as retirement planning or student loan management, Horace Mann can create specialized insurance and financial products that resonate deeply, fostering stronger customer loyalty and market penetration within this key sector.

Cybersecurity and Data Security

As financial services increasingly move online, cybersecurity threats are a major concern for Horace Mann Educators. The company must invest significantly in protecting sensitive customer information from cyberattacks and data breaches. This is crucial for maintaining customer trust and complying with stringent data privacy laws, particularly within the insurance industry.

The financial services sector experienced a notable increase in cyber threats during 2023 and early 2024. For instance, IBM's 2023 Cost of a Data Breach Report indicated that the global average cost of a data breach reached $4.45 million, a 15% increase over three years. For financial institutions, this average cost was even higher, at $5.90 million.

- Increased Sophistication of Cyberattacks: Threat actors are employing more advanced methods, including AI-powered attacks, to breach financial systems.

- Regulatory Scrutiny: Compliance with regulations like GDPR and CCPA necessitates robust data protection, with significant penalties for breaches.

- Reputational Risk: A major data breach can severely damage customer confidence and brand reputation, impacting long-term business viability.

- Investment in Advanced Security: Horace Mann needs to allocate substantial resources to cutting-edge security technologies and continuous employee training to mitigate these risks.

Mobile Technology and Telematics

The widespread adoption of mobile devices and the advancement of telematics are fundamentally reshaping how businesses interact with customers and manage risk. In 2024, smartphone penetration continues to climb, with global figures expected to surpass 6.8 billion users. This ubiquity creates fertile ground for direct customer engagement strategies. Telematics, particularly in auto insurance, is a prime example, enabling usage-based insurance (UBI) models that reward safe driving behavior.

Horace Mann Educators can leverage these technological shifts to its advantage. By integrating telematics data, the company can develop more personalized insurance products, tailoring premiums and coverage to individual driving habits. This not only enhances customer satisfaction through fairer pricing but also improves risk management by providing granular insights into policyholder behavior. For instance, UBI programs have shown the potential to reduce accident frequency by up to 10% in some markets.

- Mobile Device Penetration: Over 6.8 billion global smartphone users in 2024, offering a vast channel for direct customer interaction.

- Telematics in Auto Insurance: Usage-based insurance (UBI) models are gaining traction, rewarding safe driving and improving risk assessment.

- Personalized Product Development: Opportunities exist for Horace Mann to create tailored auto and home insurance offerings based on real-time data.

- Enhanced Risk Management: Telematics data can provide deeper insights into policyholder behavior, leading to more accurate underwriting and claims processing.

Technological advancements, particularly in AI and data analytics, are revolutionizing the insurance sector. Horace Mann Educators can leverage these tools for more accurate underwriting and efficient claims processing, as seen by the projected significant growth in the AI in insurance market. This allows for a more granular understanding of educator-specific risks and behaviors, enabling personalized product development and competitive pricing strategies.

Legal factors

Horace Mann Educators navigates a dense web of state and federal insurance regulations. These cover everything from initial licensing to ongoing solvency and reserve requirements, ensuring policyholder protection. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize robust capital adequacy standards across the industry.

Failure to adhere to these stringent rules can result in significant financial penalties and reputational damage. Maintaining compliance is therefore a critical operational imperative for Horace Mann, directly impacting its ability to conduct business and maintain trust with its customers and regulators.

The growing emphasis on data privacy, highlighted by regulations such as the NAIC Insurance Data Security Model Law and emerging state-specific privacy laws, significantly shapes how Horace Mann handles customer data. This includes the collection, storage, processing, and sharing of sensitive information, demanding robust compliance measures.

Failure to adhere to these evolving data privacy mandates can result in substantial financial penalties and considerable damage to Horace Mann's reputation. For instance, California's CCPA (California Consumer Privacy Act) and its successor, the CPRA (California Privacy Rights Act), have set a precedent for consumer data rights, with potential fines reaching thousands of dollars per violation.

Consumer protection laws are vital for Horace Mann Educators, safeguarding policyholders from deceptive marketing and unfair pricing practices. Adherence to regulations like the Unfair and Deceptive Acts and Practices (UDAP) statutes ensures fair treatment in sales and claims. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on financial services, issuing warnings and fines for misleading advertising, underscoring the need for robust compliance.

Employment and Labor Laws

Horace Mann Educators operates under a complex web of employment and labor laws that govern everything from recruitment and pay to employee benefits and workplace safety. For instance, the Fair Labor Standards Act (FLSA) sets minimum wage and overtime pay standards, directly impacting payroll expenses. Recent shifts in how independent contractor versus employee status is determined, as seen in various state-level legislative efforts throughout 2024, can significantly alter a company's cost structure and HR compliance requirements.

Changes in legislation, such as updates to the Occupational Safety and Health Administration (OSHA) regulations or new mandates concerning paid family leave, can increase operational costs and necessitate adjustments in human resource management strategies. For example, a federal push for expanded paid sick leave, which gained traction in discussions during late 2024 and early 2025, could add substantial new benefit costs for employers like Horace Mann.

The company must remain vigilant regarding evolving regulations concerning employee benefits, including healthcare under the Affordable Care Act (ACA) and retirement plans. As of 2024, the average employer contribution to employee health insurance premiums remained a significant cost, and any legislative changes affecting these contributions or introducing new benefit mandates would require careful financial planning.

- Compliance Burden: Adhering to federal and state employment laws requires ongoing investment in legal counsel and HR expertise.

- Wage and Hour Laws: Minimum wage increases and overtime regulations directly influence labor costs.

- Workplace Safety: OSHA standards and potential penalties for non-compliance necessitate safety investments.

- Benefit Mandates: New requirements for paid leave or healthcare contributions can impact overall compensation expenses.

Contract Law and Policy Wording

The legal enforceability of insurance contracts and the clarity of policy wording are paramount for Horace Mann Educators. Ambiguous policy language can lead to costly disputes and damage the company's reputation. In 2023, the U.S. insurance industry saw a notable increase in litigation related to policy interpretation, highlighting the importance of precise contractual language.

Horace Mann must ensure its policy documents are not only legally sound but also transparent, clearly outlining coverage, exclusions, and obligations. This commitment to clarity helps prevent misunderstandings and upholds the company's promises to its policyholders. For instance, regulatory bodies frequently scrutinize policy wording for compliance with consumer protection laws.

Key considerations for Horace Mann include:

- Contractual Clarity: Ensuring all policy terms and conditions are unambiguous and easily understood by policyholders.

- Regulatory Compliance: Adhering to all state and federal insurance regulations regarding contract drafting and disclosure.

- Dispute Resolution: Implementing clear processes for handling policyholder claims and grievances to minimize legal challenges.

Horace Mann Educators operates under a stringent regulatory environment, requiring constant adaptation to evolving insurance laws and consumer protection mandates. For instance, in 2024, the NAIC continued to push for stronger capital adequacy, impacting solvency requirements.

Data privacy laws, such as California's CCPA/CPRA, impose significant obligations on how Horace Mann handles sensitive customer information, with potential fines for non-compliance. The company must also ensure its contracts are clear and legally sound to prevent costly disputes, a trend observed with increased litigation in the insurance sector in 2023.

Environmental factors

The escalating frequency and intensity of climate-driven events like wildfires, hurricanes, and floods pose a significant threat to Horace Mann's property and casualty insurance offerings. These occurrences translate directly into a surge in insurance claims and elevate the costs associated with rebuilding damaged properties. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported 28 separate billion-dollar weather and climate disasters in the United States during 2023, a record-breaking number that underscores the growing financial strain on insurers.

These escalating risks also influence the very availability and cost of insurance, particularly in regions identified as high-risk for natural disasters. Insurers may face challenges in maintaining affordable coverage options for policyholders in these vulnerable areas, potentially leading to market disruptions and increased uninsured losses.

Horace Mann, like all financial institutions, faces increasing regulatory scrutiny and stakeholder pressure concerning environmental, social, and governance (ESG) factors. This trend is particularly pronounced in the insurance sector, where companies are expected to disclose their climate risk exposure and embed climate considerations into their underwriting processes. For instance, by the end of 2024, many jurisdictions are implementing stricter disclosure requirements for financial institutions regarding their carbon footprints and climate-related financial risks, impacting how Horace Mann manages its investment portfolio and operational footprint.

Resource scarcity, while not as immediately visible as climate change, poses a significant indirect threat to property and casualty insurers like Horace Mann Educators. Concerns over the availability of essential building materials, such as lumber and specialized components needed for repairs after events like fires or floods, can drive up costs. For instance, in 2024, supply chain issues for key construction materials have seen price increases of 5-10% compared to the previous year, directly impacting the cost of claims settlements.

These rising material costs, coupled with potential labor shortages in skilled trades exacerbated by broader environmental pressures, can strain underwriting profitability. Insurers must account for these escalating expenses when setting premiums. A report from the Bureau of Labor Statistics in late 2024 indicated a persistent shortage of skilled construction workers, contributing to higher labor rates, which in turn increases the overall expense of property restoration and thus, insurance claims.

Public Awareness of Environmental Risks

Growing public concern over climate change and its potential impacts is directly influencing consumer behavior and corporate responsibility. This heightened awareness means Horace Mann Educators might see increased demand for insurance products that cover environmental risks, such as flood or wildfire damage. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental practices when making purchasing decisions.

This trend can also shape investment strategies, with a greater focus on Environmental, Social, and Governance (ESG) factors. Companies demonstrating strong environmental stewardship may attract more capital and enjoy improved brand loyalty.

Horace Mann Educators should consider how this public sentiment translates into tangible market opportunities and potential risks.

- Increased demand for environmental risk coverage

- Influence on consumer purchasing decisions

- Impact on brand perception and reputation

- Potential for ESG-focused investment strategies

Geographical Risk Concentration

Horace Mann Educators' exposure to environmental risks is significantly influenced by the geographical distribution of its policyholders. A substantial concentration of customers in regions susceptible to particular natural disasters, such as hurricanes or wildfires, could result in considerable financial strain following severe weather occurrences.

For instance, if a large portion of Horace Mann's property and casualty insurance policies are concentrated in coastal Florida, the company faces heightened risk from hurricane activity. In 2023, Florida experienced numerous named storms, leading to significant insured losses nationwide, underscoring the financial impact of such geographical concentrations. This concentration necessitates robust risk management strategies and potentially higher reinsurance costs to mitigate potential payouts.

- Geographical Concentration: Horace Mann's policyholder base is a key factor in its environmental risk profile.

- Natural Disaster Susceptibility: Areas with a high density of policyholders prone to specific natural disasters present a greater financial exposure.

- Financial Impact: Extreme weather events in concentrated geographical areas can lead to substantial financial losses for the insurer.

The increasing frequency of climate-related disasters, such as the 28 billion-dollar weather events recorded in the U.S. in 2023 by NOAA, directly impacts Horace Mann's claims and operational costs. This trend is pushing insurers to reassess underwriting in high-risk zones, potentially affecting coverage affordability and availability for policyholders. Furthermore, heightened consumer awareness of environmental issues, with over 60% of consumers considering a company's environmental practices in 2024 purchasing decisions, influences brand perception and demand for eco-conscious products.

| Environmental Factor | Impact on Horace Mann Educators | Supporting Data (2023-2024) |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims, higher rebuilding costs, potential for market disruption in high-risk areas. | 28 billion-dollar weather/climate disasters in the U.S. in 2023 (NOAA). |

| Resource Scarcity & Supply Chain | Elevated costs for repairs due to material shortages and price increases. | 5-10% price increase for key construction materials in 2024 due to supply chain issues. |

| Consumer & Stakeholder Pressure | Demand for ESG disclosures, potential shift in investment strategies, influence on purchasing decisions. | Over 60% of consumers consider environmental practices in purchasing (2024 survey). Stricter ESG disclosure requirements by end of 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Horace Mann Educators is built upon a robust foundation of data, drawing from official government publications, reputable financial news outlets, and industry-specific research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the education sector.