Holcim PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

Navigate the complex external forces shaping Holcim's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the construction materials giant. Gain a strategic advantage by leveraging these expert insights to inform your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government investment in infrastructure projects like roads, bridges, and public buildings is a significant driver for Holcim's core products. Increased government spending directly translates to higher demand for cement, aggregates, and ready-mix concrete, which are Holcim's bread and butter. For instance, the Infrastructure Investment and Jobs Act in the United States, enacted in late 2021, is projected to inject billions into infrastructure upgrades through 2025, creating substantial opportunities for companies like Holcim.

Global and regional climate policies, such as carbon pricing mechanisms and emissions reduction targets, directly shape Holcim's operational costs and strategic direction. For instance, the European Union's Emissions Trading System (EU ETS) impacts carbon costs for cement production, pushing Holcim to invest in decarbonization technologies. The company is also subject to mandates promoting low-carbon building materials in various markets, influencing its product innovation and sales strategies.

Holcim actively engages with governments worldwide, advocating for policies that support the widespread adoption of lower-carbon building materials and carbon capture technologies. This advocacy aligns with Holcim's ambitious net-zero targets, aiming to reduce its Scope 1, 2, and 3 emissions. For example, in 2023, Holcim announced a partnership to develop a large-scale carbon capture facility at its Obourg plant in Belgium, demonstrating its commitment to policy-driven decarbonization efforts.

Holcim's global operations are significantly shaped by international trade policies and tariffs. For instance, changes in import/export regulations in key markets like the United States or the European Union can directly impact the cost of essential raw materials such as clinker and cement, as well as the profitability of finished goods. The ongoing trade tensions and potential for new tariffs, particularly between major economic blocs, create uncertainty for supply chains and pricing strategies.

Geopolitical Stability and Conflicts

Geopolitical instability and conflicts present significant challenges for Holcim, potentially disrupting its extensive supply chains and increasing operational risks in key markets. For instance, ongoing conflicts in Eastern Europe and the Middle East have already impacted global trade routes and material availability, directly affecting construction project timelines and costs. Holcim's strategy of maintaining a diversified global presence, operating in over 70 countries as of 2024, is crucial in buffering these localized shocks.

The company's ability to navigate these turbulent environments is underscored by its financial resilience. Despite regional challenges, Holcim reported robust performance in 2024, with net sales reaching CHF 20.9 billion for the first nine months, demonstrating its capacity to absorb localized disruptions. This global footprint allows for the reallocation of resources and mitigation of risks associated with specific conflict zones.

- Supply Chain Vulnerability: Conflicts can halt or delay the transport of raw materials and finished goods, impacting production schedules and increasing logistics costs.

- Operational Risk: Instability can lead to increased security costs, potential damage to assets, and challenges in maintaining workforce safety in affected regions.

- Construction Activity Impact: Geopolitical tensions often dampen investor confidence and economic activity, leading to reduced demand for construction materials and services.

- Diversification as Mitigation: Holcim's widespread operations across continents help to spread risk, ensuring that challenges in one region do not cripple the entire business.

Spin-off of North American Business

Holcim's strategic decision to spin off its North American business into a new entity, Amrize, by mid-2025 represents a significant political maneuver. This move is driven by the aim to unlock shareholder value and allow Amrize to strategically target the robust U.S. infrastructure market. The separation enables Holcim to sharpen its focus on global growth and its ambitious sustainability agenda.

This political restructuring is designed to create two more agile and focused companies. Amrize will be positioned to capitalize on the substantial opportunities within the U.S. construction and infrastructure sectors, potentially benefiting from government infrastructure spending initiatives. Holcim, meanwhile, can pursue its global diversification and sustainability goals without the operational complexities of its North American assets.

- Strategic Separation: Holcim plans to spin off its North American business as Amrize by mid-2025.

- Market Focus: Amrize will concentrate on the U.S. infrastructure market, a sector projected for significant growth.

- Global Strategy: Holcim will redirect its efforts towards global expansion and sustainability initiatives.

- Value Unlocking: The spin-off aims to create distinct value propositions for both entities.

Government policies heavily influence Holcim's demand through infrastructure spending and building regulations. For instance, the U.S. Infrastructure Investment and Jobs Act, with billions allocated through 2025, directly boosts demand for Holcim's products. Conversely, climate policies like carbon pricing in the EU increase operational costs, pushing Holcim towards decarbonization investments and low-carbon material mandates.

Holcim actively engages with governments to promote policies favoring sustainable building materials and carbon capture. This advocacy supports their net-zero targets, exemplified by a 2023 partnership for a large-scale carbon capture facility in Belgium. International trade policies and tariffs also pose risks, impacting raw material costs and profitability, as seen with ongoing trade tensions between major economic blocs.

Geopolitical instability can disrupt Holcim's supply chains and operations, though its diversified presence in over 70 countries (as of 2024) mitigates localized shocks. The company's robust financial performance, with net sales of CHF 20.9 billion in the first nine months of 2024, demonstrates resilience against such challenges.

Holcim's strategic spin-off of its North American business into Amrize by mid-2025 is a significant political and financial maneuver. This aims to unlock shareholder value, allowing Amrize to target the U.S. infrastructure market while Holcim focuses on global growth and sustainability.

What is included in the product

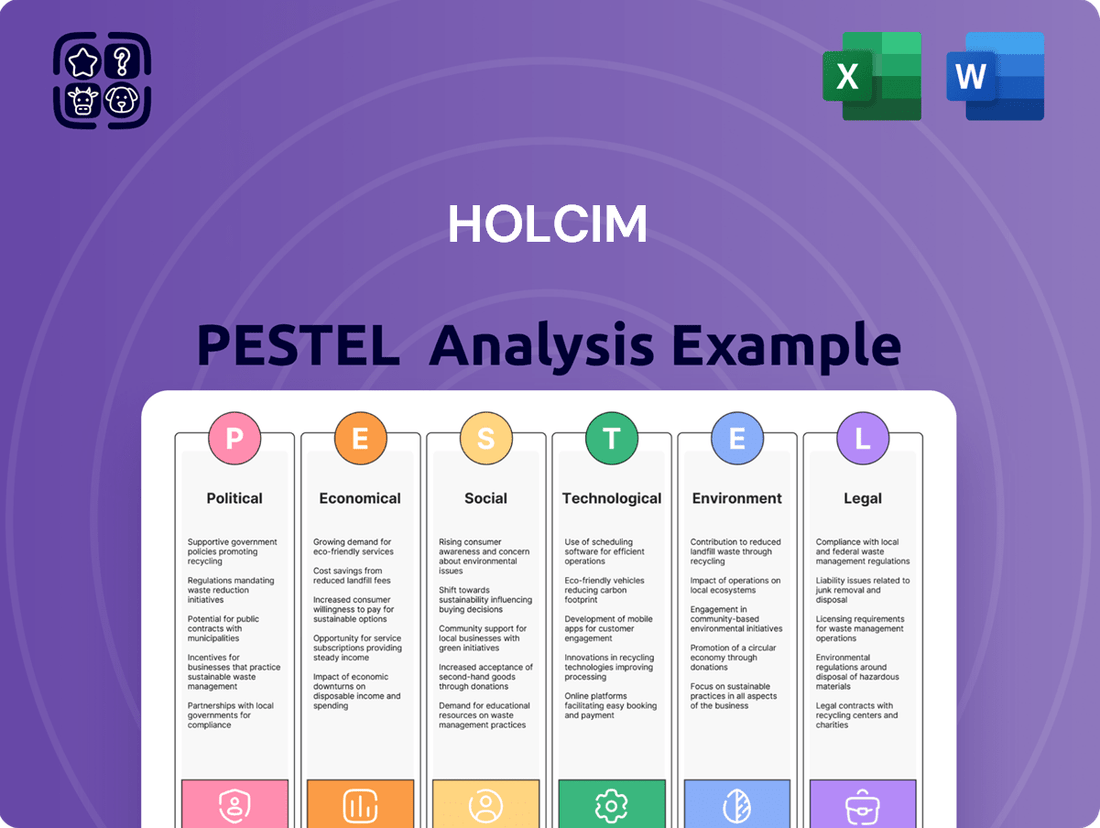

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Holcim, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying critical trends and potential impacts on Holcim's operations and market position.

Provides a concise version of Holcim's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risks and market positioning for Holcim by offering a clear, summarized view of the PESTLE landscape during planning sessions.

Economic factors

The global construction market's overall health is a primary driver for Holcim. Residential, commercial, and infrastructure projects directly translate into demand for Holcim's materials. For instance, Q1 2025 net sales remained stable, demonstrating resilience even with adverse weather in North America.

This stability was bolstered by robust performance in key regions. Latin America and Europe showed particularly strong results, helping to counterbalance any regional headwinds. This geographic diversification is crucial for maintaining consistent sales figures in a fluctuating global market.

Fluctuations in the cost of essential raw materials like limestone, clay, and sand, along with energy prices, significantly influence Holcim's production expenses and overall profitability. For instance, the global average price of thermal coal, a key energy source for cement production, saw considerable volatility throughout 2024, impacting operational costs.

Holcim's strategic initiatives, such as the increased use of alternative fuels and a strong emphasis on circular economy principles, are designed to buffer against these volatile input costs. By sourcing recycled materials and exploring lower-carbon energy alternatives, the company aims to enhance cost resilience and mitigate the direct impact of traditional commodity price swings.

Interest rates significantly shape the construction sector by affecting borrowing costs for developers and potential homeowners. For instance, as of early 2024, central banks in major economies like the US and Eurozone have maintained elevated interest rates, making large-scale construction financing more expensive. This directly impacts Holcim's sales volume as fewer projects become economically viable.

A supportive lending environment, characterized by accessible credit and competitive loan terms, can invigorate demand for building materials. Conversely, tighter credit conditions, often seen when interest rates are high, can dampen consumer spending on renovations and new builds. In 2023, for example, some regions experienced a slowdown in mortgage approvals due to higher rates, which in turn reduced demand for residential construction inputs supplied by Holcim.

Inflation and Economic Growth

Inflation directly impacts Holcim's profitability by increasing the cost of raw materials, energy, and transportation. For instance, rising energy prices in 2024 and early 2025 have presented a challenge, necessitating careful cost management.

Conversely, robust economic growth fuels demand for construction projects, benefiting Holcim's core business. As economies expand, so does the need for new infrastructure, residential buildings, and commercial spaces, all of which require Holcim's products and services.

Holcim is strategically positioned to capitalize on these trends, targeting mid-single-digit net sales growth in local currency for 2025. This growth objective is underpinned by a commitment to profitable expansion, adapting to inflationary pressures while leveraging opportunities presented by economic upswings.

- Inflationary pressures: Increased operational costs for raw materials and energy.

- Economic growth drivers: Higher demand for construction from infrastructure and building projects.

- Holcim's 2025 target: Mid-single-digit net sales growth in local currency.

- Strategic focus: Balancing cost management with capitalizing on market demand.

Currency Exchange Rates

As a global leader in building materials and solutions, Holcim's financial performance is significantly influenced by currency exchange rate volatility. Fluctuations in the value of currencies where Holcim operates, relative to its reporting currency (Swiss Francs, CHF), can materially impact its reported sales and earnings. For instance, a stronger Swiss Franc can reduce the value of foreign earnings when translated back, while a weaker Franc can have the opposite effect.

The company's exposure to currency risk is substantial given its widespread international operations. For example, in 2023, Holcim reported that a 1% adverse movement in exchange rates against its reporting currency could have impacted its recurring EBITDA by approximately CHF 40 million. This highlights the critical need for robust hedging strategies and careful management of foreign currency exposures.

- Impact on Sales: Currency fluctuations directly affect the reported revenue from international subsidiaries. A stronger USD against the CHF, for example, would boost reported USD sales when converted to CHF.

- Impact on Earnings: Beyond sales, exchange rate changes also influence the translation of foreign subsidiaries' profits and losses into Holcim's consolidated financial statements.

- Hedging Strategies: Holcim employs financial instruments to mitigate currency risks, aiming to stabilize its financial results against adverse currency movements.

- Operational Hedging: The company also utilizes operational hedging, such as matching revenues and costs in the same currency, to reduce its net currency exposure.

Economic factors like inflation and interest rates directly impact Holcim's cost of operations and demand for its products. For example, persistent inflation in 2024 increased raw material and energy costs, while elevated interest rates in major economies made construction financing more expensive, slowing project development.

Despite these challenges, Holcim aims for mid-single-digit net sales growth in local currency for 2025, indicating a strategic focus on managing costs and capitalizing on economic opportunities. This growth is supported by strong performance in regions like Latin America and Europe, which helped offset headwinds in other markets during Q1 2025.

Currency exchange rate volatility also presents a significant risk, as demonstrated by the potential impact of a 1% adverse currency movement on Holcim's recurring EBITDA. The company actively employs hedging strategies to mitigate these financial risks and stabilize its reported earnings.

Preview Before You Purchase

Holcim PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Holcim PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed strategic overview for informed decision-making.

Sociological factors

The world's population is growing, and more people are moving to cities. This trend is a major driver for Holcim, as it means a constant need for new homes, roads, and other structures. By 2030, the United Nations projects that 3 billion people will still need access to safe and affordable housing, highlighting the vast market potential for building materials.

This increasing urbanization directly translates into higher demand for cement, aggregates, and concrete – Holcim's core products. As cities expand, so does the need for sustainable construction solutions to manage this growth effectively. Holcim is actively engaged in developing and supplying these materials, positioning itself to benefit from this ongoing societal shift.

Societal awareness of climate change is a powerful driver, fueling a growing preference for sustainable and green building practices. This shift in consciousness directly translates into increased demand for materials that minimize environmental impact.

Holcim is capitalizing on this trend with its innovative ECOPact and ECOPlanet product lines. These offerings are specifically designed to lower CO2 emissions throughout the construction lifecycle, and they are indeed capturing significant market share, reflecting the market's embrace of greener alternatives.

For instance, in 2024, Holcim reported that its low-carbon concrete solutions, like ECOPact, saw substantial growth, contributing to a notable portion of its overall sales volume. This indicates a clear market validation of their sustainable product strategy.

Holcim actively works to build stronger communities through its social impact programs. These efforts focus on critical areas like affordable housing, essential infrastructure, education, and vocational training, aiming to uplift local populations. In 2024 alone, the company dedicated over CHF 24.2 million to these vital social initiatives, demonstrating a significant commitment to positive change.

Workforce Demographics and Skills

Holcim's operational success hinges on a skilled workforce, and the company actively addresses evolving demographic trends. In 2023, Holcim employed approximately 72,000 people globally, reflecting a diverse talent pool essential for its operations. The company's strategy emphasizes empowering its employees and cultivating a decentralized leadership model to foster agility and innovation.

Adapting to changing workforce demographics is crucial for Holcim's long-term sustainability and competitive edge. This involves attracting and retaining talent across different age groups and skill sets. Holcim's commitment to people development is evident in its ongoing training and development programs designed to enhance employee capabilities and ensure the availability of specialized skills needed in the construction materials sector.

- Global Workforce: Holcim employed around 72,000 individuals worldwide in 2023, highlighting its significant human capital.

- Skills Gap Mitigation: The company prioritizes upskilling and reskilling its workforce to meet the demands of evolving industry technologies and sustainability goals.

- Leadership Development: Holcim fosters an environment of empowered, decentralized leadership, encouraging initiative and problem-solving at all levels.

Health and Safety Standards

Societal expectations and increasing regulatory pressures are driving construction companies, including Holcim, to adopt stringent health and safety standards. This focus is critical for worker well-being and maintaining a positive corporate reputation.

Holcim actively promotes a culture of zero harm, emphasizing a robust Health, Safety, and Environment (HSE) framework across its operations. This commitment is reflected in their continuous efforts to minimize workplace incidents and environmental impact.

In 2023, Holcim reported a Lost Time Injury Frequency Rate (LTIFR) of 0.78, demonstrating a tangible commitment to reducing workplace accidents. This figure is a key indicator of their success in implementing and adhering to high safety protocols.

- Zero Harm Culture: Holcim's organizational ethos is centered on achieving zero harm to employees, contractors, and the communities in which it operates.

- Regulatory Compliance: Adherence to and often exceeding local and international health and safety regulations is a core operational principle.

- Continuous Improvement: The company consistently invests in training, technology, and process enhancements to further elevate its HSE performance.

- Stakeholder Expectations: Meeting the evolving expectations of employees, customers, and investors regarding workplace safety is a key driver for Holcim's HSE strategy.

Holcim's commitment to community well-being is demonstrated through its social impact initiatives. These programs focus on affordable housing, infrastructure, education, and vocational training, aiming to uplift local populations. In 2024, the company invested over CHF 24.2 million in these vital social programs, underscoring a significant dedication to positive societal contributions.

Technological factors

Holcim is channeling a significant portion of its resources into developing groundbreaking low-carbon cement and concrete. This includes advancements like calcined clay-based cement and materials incorporating recycled construction debris. A substantial 80% of Holcim's annual research and development budget is specifically dedicated to carbon emission reduction initiatives.

Advancements in Carbon Capture, Utilization, and Storage (CCUS) are pivotal for Holcim's journey toward net-zero emissions. These technologies are essential for decarbonizing cement production, a historically carbon-intensive industry.

Holcim is actively investing in CCUS, with seven large-scale projects underway in Europe. The company's ambitious goal is to produce 8 million tons of net-zero cement annually by 2030, directly leveraging these CCUS initiatives.

Holcim is actively integrating digitalization and artificial intelligence (AI) across its operations to boost efficiency and sustainability. For instance, their 'Plants of Tomorrow' initiative employs AI for predictive maintenance, reducing downtime, and fine-tuning cement formulations for optimal performance and reduced environmental impact.

This technological push is yielding tangible results. By 2024, Holcim reported that digitalization efforts contributed to a significant reduction in CO2 emissions per ton of cement produced, a key metric in their sustainability drive. AI-powered analytics are also enabling better resource allocation and energy management within their manufacturing facilities.

Automation and Robotics in Manufacturing

Holcim is increasingly leveraging automation and robotics to boost efficiency and cut costs across its manufacturing operations. This technological shift is also a significant factor in enhancing workplace safety. For instance, by 2024, the company was exploring wider deployment of AI-powered quality control systems, aiming to reduce defects by up to 15%.

The integration of advanced robotics is streamlining material handling and production line processes. Furthermore, Holcim is actively using drones for site inspections and surveying, which has demonstrably improved data accuracy and reduced the time required for these tasks by an estimated 20% compared to traditional methods.

- Enhanced Efficiency: Automation and robotics streamline production, leading to faster output and better resource utilization.

- Cost Reduction: Reduced labor needs and minimized errors contribute to lower operational expenses.

- Improved Safety: Automating hazardous tasks significantly lowers the risk of workplace accidents.

- Data-Driven Insights: Drones and automated systems provide valuable data for process optimization and predictive maintenance.

Circular Economy Technologies

Holcim is heavily investing in circular economy technologies, specifically targeting the construction and demolition waste (CDW) sector. Their ECOCycle® technology platform is central to this strategy, enabling the transformation of waste materials into valuable new building products.

This initiative is crucial for reducing landfill reliance and conserving natural resources. Holcim's commitment is underscored by a target to process 20 million tons of CDW annually through its ECOCycle® platform.

- Recycling Focus Holcim is developing and implementing technologies to recycle construction and demolition waste (CDW) into new building materials.

- ECOCycle® Platform The company's ECOCycle® technology platform is key to its circular economy strategy, processing CDW.

- Volume Target Holcim aims to process 20 million tons of CDW annually using its ECOCycle® technology.

Holcim is heavily investing in digitalization and AI to optimize operations, with AI-powered predictive maintenance reducing downtime and improving cement formulations. By 2024, these digital efforts significantly lowered CO2 emissions per ton of cement. Automation and robotics are also enhancing production efficiency and safety, with a goal to reduce defects by up to 15% through AI quality control systems by 2024.

| Technology Focus | Key Initiative/Application | Impact/Target |

| Low-Carbon Materials | Calcined clay cement, recycled debris concrete | 80% of R&D budget dedicated to carbon reduction |

| Carbon Capture | CCUS technologies for cement production | 7 large-scale projects in Europe; 8M tons net-zero cement by 2030 |

| Digitalization & AI | 'Plants of Tomorrow', predictive maintenance, AI quality control | Reduced CO2 emissions per ton (by 2024); 15% defect reduction target |

| Automation & Robotics | Streamlined material handling, drone inspections | 20% reduction in inspection time; enhanced safety |

| Circular Economy | ECOCycle® platform for CDW processing | Target of 20M tons of CDW processed annually |

Legal factors

Holcim faces stringent environmental regulations globally, impacting everything from CO2 emissions to waste disposal and quarrying practices. For instance, in 2023, the European Union's Carbon Border Adjustment Mechanism (CBAM) began phasing in, directly affecting cement producers like Holcim by imposing costs on carbon-intensive imports, incentivizing lower-carbon production methods.

Compliance with these evolving rules, such as the increasing pressure for circular economy principles and reduced landfill waste, requires significant investment in new technologies and operational adjustments. Holcim's commitment to decarbonization, aiming for net-zero operations, is directly tied to navigating and exceeding these legal requirements.

Legal and industry standards for building materials, covering performance, safety, and sustainability certifications such as BREEAM and LEED, significantly shape product development and market acceptance. These regulations directly impact how Holcim designs and markets its offerings.

Holcim's commitment to sustainable solutions is strategically aligned with these evolving standards. For instance, their ECOPact concrete range is designed to meet stringent environmental criteria, contributing to projects aiming for high LEED or BREEAM ratings, which are increasingly mandated in major construction markets.

The company actively monitors and adapts to regulatory changes impacting embodied carbon in construction materials, a key focus in 2024 and projected for 2025. This proactive approach ensures their product portfolio remains competitive and compliant with global green building initiatives.

Labor laws significantly shape Holcim's operations, impacting everything from worker safety protocols to wage structures and the right to unionize. These regulations directly influence human resource management strategies and contribute to overall operational expenses across Holcim's diverse global footprint. For instance, in 2024, Holcim continued its commitment to upholding international human rights standards, a framework that necessitates adherence to varied labor laws in each operating country, ensuring fair treatment and safe working conditions.

Holcim's dedication to promoting social impact is intrinsically linked to its compliance with these labor regulations. The company's approach to employment is guided by principles that foster a positive work environment and contribute to community well-being. This includes robust health and safety programs, which in 2024 saw continued investment in training and equipment to meet and exceed evolving safety standards, a critical component of labor law compliance.

Antitrust and Competition Laws

Antitrust and competition laws are significant considerations for Holcim, particularly affecting its strategic mergers and acquisitions. These regulations can influence the company's ability to consolidate market share or enter new markets through acquisitions. For example, in 2023, Holcim completed the acquisition of Firestone Building Products, a move that likely underwent scrutiny from competition authorities in relevant jurisdictions to ensure it did not create anti-competitive market conditions.

Holcim's stated strategy includes pursuing value-accretive M&A to expand its presence in attractive markets. However, the enforcement of antitrust laws by bodies like the European Commission or the U.S. Federal Trade Commission can impose conditions on these deals, such as divestitures of certain assets, or even block them entirely if they are deemed to harm competition. This regulatory landscape necessitates careful planning and legal review for all potential transactions.

- Regulatory Scrutiny: Holcim's M&A activities are subject to review by competition authorities globally, impacting deal structuring and completion.

- Market Share Impact: Antitrust laws can limit Holcim's ability to achieve dominant market positions through acquisitions, influencing its growth strategies.

- Compliance Costs: Navigating complex antitrust regulations requires significant legal and financial resources, adding to the cost of M&A.

- Strategic Flexibility: The threat of regulatory intervention can reduce Holcim's strategic flexibility in pursuing certain acquisition targets.

Land Use and Permitting Regulations

Holcim's operations, from quarrying to manufacturing and construction, are heavily influenced by land use, zoning, and permitting regulations. These legal frameworks dictate where and how the company can establish and expand its facilities, directly impacting project timelines and costs. For instance, securing permits for new quarry sites or cement plants can be a lengthy and complex process, often involving environmental impact assessments and public consultations. In 2024, the European Union continued to emphasize stricter environmental permitting for industrial activities, potentially increasing compliance burdens for Holcim's European operations.

Navigating these diverse legal landscapes is crucial for maintaining business continuity and enabling strategic growth. Delays or denials in obtaining necessary permits can halt expansion plans and affect production capacity. Holcim's ability to adapt to evolving land use policies, such as those promoting brownfield redevelopment or restricting greenfield development, will be key to its long-term success. As of early 2025, several regions are implementing updated zoning laws to encourage sustainable urban development, which may present both challenges and opportunities for Holcim's construction materials businesses.

Key regulatory considerations for Holcim include:

- Zoning ordinances: Restrictions on industrial activities in residential or environmentally sensitive areas.

- Environmental permits: Requirements for air and water quality, waste management, and biodiversity protection.

- Building codes and standards: Regulations governing the safety and performance of construction materials and projects.

- Land reclamation obligations: Legal requirements for restoring quarry sites after extraction.

Holcim's legal landscape is dominated by environmental regulations, particularly concerning carbon emissions and waste management. The EU's Carbon Border Adjustment Mechanism (CBAM), implemented in 2023, directly impacts cement producers by adding costs to carbon-intensive imports, pushing companies like Holcim towards lower-carbon production methods. This regulatory pressure is a significant driver for Holcim's decarbonization goals, aiming for net-zero operations by 2050.

Compliance with evolving building codes and sustainability certifications, such as LEED and BREEAM, is also critical. Holcim's ECOPact concrete range, for example, is designed to meet these stringent environmental criteria, supporting projects that aim for high sustainability ratings, which are increasingly becoming market requirements. The company actively monitors embodied carbon regulations, a key focus for 2024 and 2025, to ensure its product portfolio remains competitive and compliant.

Antitrust and competition laws significantly influence Holcim's M&A strategy. For instance, the acquisition of Firestone Building Products in 2023 underwent scrutiny from competition authorities. These regulations can impose conditions on deals, such as asset divestitures, or even block transactions, thereby affecting Holcim's strategic flexibility and growth plans.

Environmental factors

The construction sector is a major player in global greenhouse gas emissions, making climate change a critical environmental factor. Holcim is actively addressing this by setting ambitious net-zero targets for 2030 and 2050, which have been validated by the Science Based Targets initiative (SBTi).

Specifically, Holcim aims to slash its Scope 1 and 2 GHG emissions by 26.2% per ton of cementitious materials by the year 2030, using 2018 as its baseline. This commitment reflects a proactive approach to mitigating its environmental footprint in response to growing climate concerns and regulatory pressures.

The construction industry's reliance on finite resources like aggregates presents a significant environmental challenge. Holcim is actively addressing this by prioritizing circular economy principles, aiming to reduce its environmental footprint.

A key strategy involves increasing the utilization of recycled construction and demolition materials. In 2024, Holcim reported a substantial 20% increase in the use of these materials, reaching 10.2 million tons, demonstrating a tangible commitment to resource efficiency.

Water scarcity is a significant environmental challenge for industries like cement production, where water is essential for various processes. Holcim recognizes this risk and has set an ambitious target to decrease its freshwater withdrawal by 33% compared to 2020 levels. This initiative is a key part of their strategy to foster a nature-positive future, demonstrating a commitment to sustainable resource management.

Biodiversity and Land Use Impact

Holcim's extensive operations, especially its quarrying activities, inherently pose a risk to local biodiversity and land use. These operations can alter natural habitats, impacting plant and animal life within those ecosystems.

Recognizing this, Holcim is actively implementing its Nature Strategy. This strategy is designed to mitigate the environmental footprint of its activities and promote biodiversity conservation.

Holcim's commitment to nature is further underscored by its pioneering efforts in setting science-based targets for nature. It stands as one of the initial three companies globally to establish such ambitious and scientifically validated goals, aiming to improve its impact on the natural world by 2030.

- Biodiversity Risk: Quarrying operations can lead to habitat fragmentation and loss, affecting species populations.

- Nature Strategy: Holcim is committed to enhancing biodiversity at its sites, with a focus on restoration and conservation.

- Science-Based Targets: Holcim is among the first three companies worldwide to set science-based targets for nature, demonstrating a commitment to measurable environmental improvement.

Waste Management and Pollution

Holcim actively addresses waste management, viewing it as a resource. The company prioritizes the use of waste materials as alternative fuels and raw materials in its production processes, aiming to reduce landfill dependency and lower carbon emissions. In 2023, Holcim reported a significant increase in the use of waste and secondary materials, reaching 27% of its fuel and raw material mix, up from 24% in 2022.

Controlling air and water pollution is also a critical focus. Holcim invests in technologies to minimize emissions from its cement plants and quarries. For instance, the company is implementing advanced dust suppression systems and stricter effluent control measures across its global operations to meet and exceed environmental regulations.

- Waste Diversion: Holcim aims to divert 10 million tonnes of waste annually by 2025, utilizing it in its circular economy solutions.

- Emissions Reduction: The company is committed to reducing its Scope 1 and 2 CO2 emissions, with targets aligned with the Paris Agreement, impacting pollution control strategies.

- Water Stewardship: Holcim focuses on responsible water management, implementing water recycling and conservation programs at its sites, particularly in water-stressed regions.

Holcim is actively tackling climate change, a significant environmental factor for the construction industry, by pursuing net-zero targets validated by the SBTi. The company aims to reduce its Scope 1 and 2 GHG emissions by 26.2% per ton of cementitious materials by 2030, based on 2018 levels.

Resource depletion is another key concern, which Holcim addresses through circular economy principles, notably increasing recycled construction material usage. In 2024, Holcim reported a 20% rise in recycled material use, amounting to 10.2 million tons.

Water scarcity is managed through a target to decrease freshwater withdrawal by 33% from 2020 levels, supporting a nature-positive future. Holcim is also a pioneer in setting science-based targets for nature, aiming for measurable improvements by 2030.

| Environmental Factor | Holcim's Target/Action | Data/Progress |

|---|---|---|

| Climate Change | Net-zero targets; Scope 1 & 2 GHG reduction | 26.2% reduction per ton by 2030 (vs. 2018) |

| Resource Depletion | Circular economy; Use of recycled materials | 10.2 million tons of recycled materials used in 2024 (+20% YoY) |

| Water Scarcity | Freshwater withdrawal reduction | 33% reduction target (vs. 2020) |

| Biodiversity | Nature Strategy; Science-based targets for nature | Among first 3 companies globally with nature SBTs |

| Waste Management | Waste as resource; Alternative fuels/raw materials | 27% of fuel/raw material mix from waste/secondary materials (2023) |

PESTLE Analysis Data Sources

Our Holcim PESTLE Analysis is built on a robust foundation of data from international financial institutions, government statistical agencies, and leading market research firms. We incorporate insights from environmental regulatory bodies, technological innovation reports, and socio-economic trend analyses to ensure comprehensive coverage.