Holcim Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

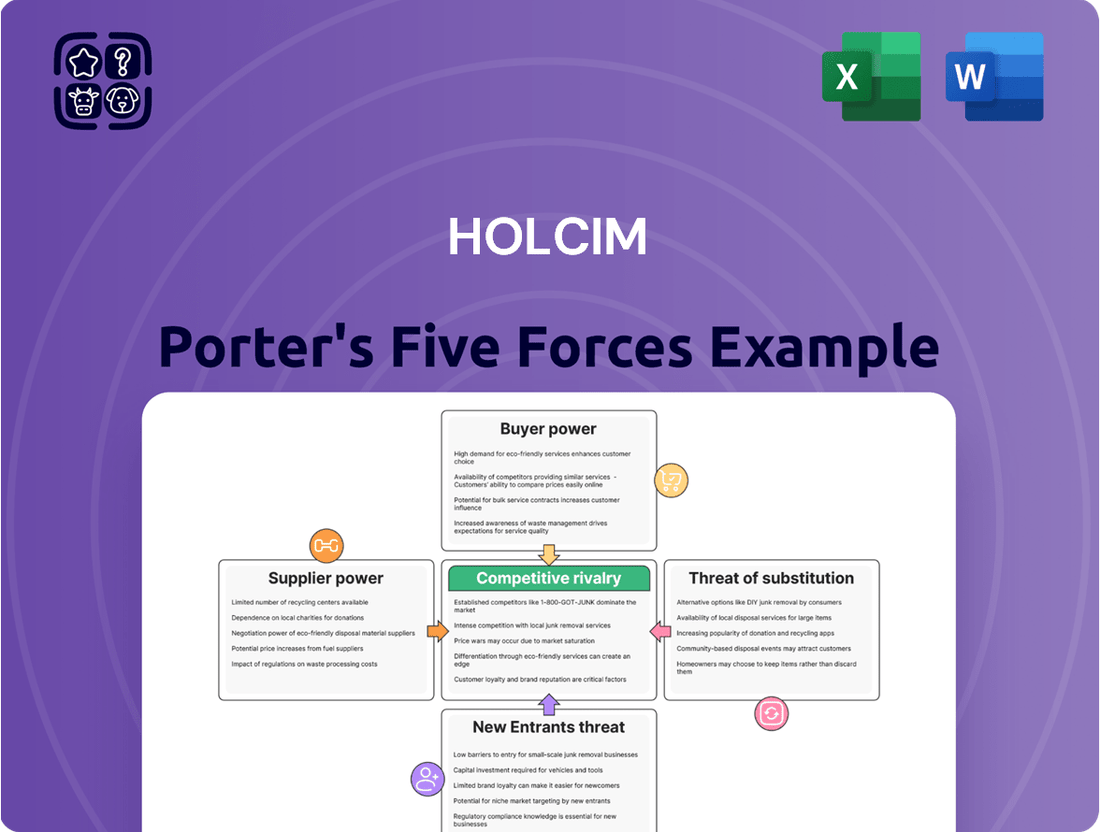

Holcim operates in a competitive landscape shaped by significant buyer power and the constant threat of new entrants, particularly in emerging markets. Understanding these forces is crucial for navigating the construction materials industry.

The complete report reveals the real forces shaping Holcim’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Holcim's dependence on raw materials such as limestone, clay, and sand means suppliers of these essential inputs hold a degree of bargaining power. While these resources are generally abundant globally, securing the necessary extraction rights and permits creates localized dependencies. This can empower regional suppliers, especially when alternative sources are limited or transportation expenses are prohibitive, impacting Holcim's cost structure and operational continuity.

Energy costs, encompassing coal, natural gas, and electricity, represent a substantial input for cement production, a key factor in Holcim's operational expenses. In 2023, global energy prices experienced significant volatility, with natural gas prices in Europe, for example, fluctuating considerably throughout the year. This volatility gives energy suppliers considerable leverage.

When energy prices surge, as they did in certain periods of 2023, it directly squeezes Holcim's profit margins. The company's ability to pass these increased costs onto customers is often limited by market competition. Consequently, managing this energy cost volatility through effective hedging strategies is crucial for maintaining profitability and financial stability.

Holcim's reliance on specialized equipment providers for critical machinery like kilns and crushers grants these suppliers significant leverage. The limited global pool of manufacturers for such high-tech, heavy-duty equipment means Holcim often faces a concentrated supplier base.

This concentration is particularly impactful for ongoing maintenance and the procurement of essential spare parts, where switching suppliers can be prohibitively expensive and time-consuming. For instance, the cost of a new cement kiln can easily run into tens of millions of dollars, making supplier relationships crucial for operational continuity.

Logistics and Transportation Services

Holcim's reliance on logistics and transportation services significantly impacts its operational costs and efficiency. The ability to move raw materials like cement and aggregates, as well as finished products, relies heavily on a robust and cost-effective transport network.

The bargaining power of logistics suppliers can be substantial for Holcim. Factors such as fluctuating fuel prices, which saw global average diesel prices rise by approximately 15% between early 2023 and mid-2024, directly influence shipping costs. Additionally, persistent labor shortages in the trucking and maritime sectors, a trend noted throughout 2023 and continuing into 2024, can limit carrier availability and drive up rates.

- Fuel Price Volatility: Global oil prices, a key driver of transportation costs, experienced significant fluctuations in 2024, impacting Holcim's freight expenses.

- Labor Shortages: A scarcity of qualified drivers and maritime personnel in key regions in 2023 and 2024 gave logistics providers more leverage in negotiating rates.

- Carrier Capacity: Limited availability of shipping containers and trucking capacity, particularly during peak seasons in 2023-2024, allowed transport companies to command higher prices.

- Regulatory Changes: Evolving environmental regulations impacting emissions standards for transport fleets can necessitate costly upgrades, potentially increasing supplier power.

Sustainable Input Suppliers

As Holcim intensifies its commitment to circular economy principles and sustainable building materials, suppliers of alternative fuels, recycled aggregates, and advanced low-carbon technologies are becoming increasingly influential. These specialized suppliers, often operating in emerging markets with unique expertise, can wield considerable bargaining power due to the strategic necessity of their offerings for Holcim's sustainability goals.

The strategic value of these sustainable input suppliers is amplified by their ability to provide critical components for Holcim's decarbonization efforts. For instance, the growing demand for low-carbon cement alternatives, like those incorporating calcined clay or supplementary cementitious materials, creates a stronger negotiating position for suppliers of these raw materials.

- Increased Demand for Sustainable Inputs: Holcim's 2023 sustainability report highlighted a target to increase the use of low-carbon binders by 20% by 2030, driving demand for specialized suppliers.

- Limited Supplier Base: The market for certain advanced recycled materials and low-carbon technologies is still developing, leading to fewer suppliers and thus greater supplier leverage.

- Technological Dependence: Suppliers of proprietary low-carbon technologies essential for Holcim's product innovation possess significant bargaining power due to their unique intellectual property and expertise.

- Regulatory Tailwinds: Government incentives and regulations promoting circularity and carbon reduction further enhance the strategic importance and bargaining power of suppliers aligned with these trends.

The bargaining power of suppliers for Holcim is influenced by raw material availability, energy costs, specialized equipment, and logistics. Suppliers of essential raw materials like limestone and clay have localized power due to extraction rights and transportation costs. Energy suppliers, particularly for coal and natural gas, wield significant influence due to price volatility, as seen with European natural gas prices in 2023. Specialized equipment manufacturers for kilns and crushers also hold leverage due to a concentrated global market and high switching costs.

Logistics providers gain power from fuel price fluctuations, with diesel prices rising approximately 15% between early 2023 and mid-2024, and labor shortages in the transport sector continuing into 2024. Suppliers of alternative fuels and recycled materials are increasingly important as Holcim pursues sustainability goals, with the company targeting a 20% increase in low-carbon binder use by 2030.

| Supplier Category | Factors Influencing Power | Impact on Holcim |

|---|---|---|

| Raw Materials (Limestone, Clay) | Extraction rights, local availability, transportation costs | Cost of goods, operational continuity |

| Energy (Coal, Natural Gas) | Global price volatility, hedging effectiveness | Profit margins, operational expenses |

| Specialized Equipment (Kilns, Crushers) | Limited manufacturers, high switching costs, spare parts availability | Capital expenditure, maintenance costs, downtime |

| Logistics & Transportation | Fuel prices, labor availability, carrier capacity | Freight costs, supply chain efficiency |

| Sustainable Inputs (Recycled Materials, Alternative Fuels) | Strategic necessity for sustainability goals, limited supplier base | Product innovation, decarbonization efforts |

What is included in the product

This analysis delves into the competitive forces shaping Holcim's cement and building materials industry, examining the threat of new entrants, buyer and supplier power, the intensity of rivalry, and the availability of substitutes.

Instantly visualize competitive intensity across the industry, empowering Holcim to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Holcim's major customers, such as large construction firms, government bodies, and real estate developers, frequently procure building materials in massive volumes for substantial infrastructure and development projects. This considerable purchasing power allows these clients significant leverage to negotiate favorable pricing and contract terms, especially for widely used, standardized products.

For fundamental building materials like cement and aggregates, which are largely seen as commodities, customers exhibit significant price sensitivity. This means that even small price differences can heavily influence purchasing decisions.

The limited differentiation in these basic products allows buyers to readily switch between suppliers if a better price is offered. This ease of switching directly amplifies competitive pressures on companies like Holcim, forcing them to remain highly competitive on cost.

In 2024, the global construction market, while showing resilience, continued to experience price volatility for raw materials. For instance, cement prices in many regions saw fluctuations driven by energy costs and supply chain dynamics, underscoring the critical role of price in customer acquisition and retention for Holcim's core offerings.

The bargaining power of customers in the construction materials sector, like Holcim, is heavily shaped by regional market dynamics. In areas where there are numerous local suppliers competing, customers gain more leverage to negotiate prices and terms. For instance, a region with a high density of cement producers will likely see customers able to demand lower prices.

Conversely, in more remote or less developed regions where Holcim might be one of the few major suppliers, customer bargaining power is naturally diminished. This localized competition intensity directly impacts how much price pressure customers can exert, with highly competitive markets empowering buyers more than those with limited supplier options.

Switching Costs and Relationships

While direct switching costs for basic materials like cement might appear minimal, Holcim benefits from established supply chain relationships. These long-standing partnerships, coupled with integrated logistics and a reputation for consistent product quality, can create a degree of customer loyalty. This "stickiness" means that simply finding a lower price elsewhere might not be enough for a customer to switch, as they also value the reliability and ease of doing business with Holcim.

However, for many large-scale buyers in the construction industry, price remains a dominant factor. The sheer volume of materials purchased means that even small price differences can translate into significant cost savings. This puts pressure on Holcim, as customers are often willing to explore alternative suppliers if the price is sufficiently attractive, thereby limiting the company's bargaining power in these instances. For example, in 2024, the global cement market experienced significant price volatility, with regional price differences sometimes exceeding 20% for bulk purchases, highlighting the sensitivity of large buyers to cost.

- Established Relationships: Holcim's long-term supply chain connections and integrated logistics offer some customer retention.

- Quality Consistency: A track record of reliable product quality further encourages repeat business.

- Price Sensitivity: For large volume buyers, price remains a primary driver, often outweighing relationship benefits.

- Market Dynamics: Significant price variations in the 2024 global cement market underscore customer focus on cost savings.

Demand Fluctuations from Construction Cycles

Customer demand for building materials like those Holcim produces is directly linked to the ups and downs of the construction industry, which in turn is heavily influenced by the overall economy. This cyclical nature means demand isn't constant. For instance, in 2023, global construction output saw varied performance across regions, with some markets experiencing slowdowns impacting material demand.

When the economy slows and construction projects decrease, the bargaining power of customers increases significantly. Holcim and its competitors find themselves competing for a smaller pool of available work. This intensified competition often forces them to offer price reductions or more favorable terms to secure contracts, directly impacting Holcim's pricing power.

- Construction activity is a key driver of demand for building materials.

- Economic downturns lead to reduced construction and amplified customer bargaining power.

- Intensified competition during slowdowns results in price concessions for Holcim.

- In 2023, global construction growth varied, with some regions experiencing contraction, impacting demand for materials.

The bargaining power of Holcim's customers is substantial, particularly for large construction firms and developers who purchase materials in bulk. These buyers often exhibit high price sensitivity for standardized products like cement and aggregates, readily switching suppliers if better pricing is available. For example, in 2024, regional cement price variations could exceed 20% for bulk orders, emphasizing customer focus on cost. While Holcim benefits from established relationships and consistent quality, price remains a dominant factor for these high-volume purchasers, limiting Holcim's pricing leverage.

| Factor | Impact on Holcim | 2024 Data/Trend |

|---|---|---|

| Customer Volume | High volume buyers exert significant price pressure. | Large infrastructure projects continue to drive bulk material demand. |

| Product Standardization | Low differentiation increases customer ability to switch. | Basic materials like cement are largely viewed as commodities. |

| Price Sensitivity | Customers prioritize cost savings on large orders. | Regional price disparities in cement in 2024 highlighted this sensitivity. |

| Switching Costs | Generally low for basic materials, but relationships offer some stickiness. | Established logistics and quality can mitigate some switching. |

Same Document Delivered

Holcim Porter's Five Forces Analysis

This preview showcases the comprehensive Holcim Porter's Five Forces Analysis, detailing the competitive landscape of the cement industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering no surprises or placeholders. You're looking at the actual, ready-to-use analysis, which will be available for download the moment you complete your transaction.

Rivalry Among Competitors

The building materials sector is characterized by the significant presence of global industry giants. Companies like Holcim, Heidelberg Materials, Cemex, and CRH command substantial market share worldwide.

This concentration of powerful players fuels intense competitive rivalry. These giants frequently engage in aggressive strategies to capture or maintain market share across diverse geographical regions and product categories, impacting pricing and innovation.

For instance, in 2023, Holcim reported net sales of CHF 29.1 billion, demonstrating its considerable scale. Heidelberg Materials achieved net sales of €22.3 billion in the same year, highlighting the financial muscle of these key competitors.

The cement and aggregates industry is notoriously capital-intensive. Building and maintaining cement plants and quarries requires massive upfront investment, leading to substantial fixed costs for all players. For instance, a modern cement plant can cost hundreds of millions of dollars to construct.

These high fixed costs create a strong incentive for companies to run their facilities at or near full capacity. Operating below optimal levels means spreading those fixed costs over fewer units, significantly increasing the cost per ton. This pressure to maximize capacity utilization often drives aggressive pricing tactics, especially when demand falters.

When multiple companies in a region are all striving for high capacity utilization, it can easily lead to oversupply. This oversupply intensifies competitive rivalry as firms try to capture market share through lower prices, impacting profitability across the board. In 2023, for example, certain European markets experienced periods of overcapacity, leading to price pressures.

While Holcim champions innovative and sustainable building materials, its fundamental products such as standard cement and aggregates face significant commoditization. This lack of distinctiveness in core offerings means that competition often hinges on factors like price, speed of delivery, and the quality of customer interactions, rather than unique product features. For instance, in 2024, the global cement market continued to see intense price competition, with regional price variations often dictated by local supply-demand dynamics and energy costs, rather than inherent product superiority.

Industry Consolidation and M&A Activity

The building materials industry has a long history of consolidation through mergers and acquisitions (M&A). This ongoing activity has significantly reduced the number of independent players over time.

While consolidation can seem to lessen direct competition, it frequently leads to the emergence of larger, more dominant companies. These consolidated entities often possess expanded geographical coverage and more entrenched market positions, intensifying rivalry among the remaining major players.

- Holcim's Strategic Acquisitions: Holcim itself has been a key participant in this consolidation. For instance, its acquisition of Firestone Building Products in 2021 for $3.4 billion significantly boosted its presence in the North American roofing market, demonstrating a strategic move to gain scale and market share.

- Industry Trends: Global M&A deal volume in the construction and building materials sector remained robust through 2023, with a particular focus on sustainability and digitalization driving strategic acquisitions.

- Impact on Rivalry: The creation of larger, more integrated companies means that competition is often based on broader capabilities, such as supply chain efficiency, technological innovation, and sustainability offerings, rather than solely on price.

Sustainability and Innovation as New Battlegrounds

Competitive rivalry within the building materials sector is increasingly focused on sustainability and innovation. Companies are no longer just competing on cost and market share but are actively differentiating themselves through the development of low-carbon products and the adoption of circular economy principles. This shift is driven by escalating regulatory pressures and growing customer demand for environmentally responsible construction practices.

- Holcim's Commitment: Holcim, a major player, has been investing heavily in sustainable solutions. In 2023, the company reported that 39% of its net sales came from low-carbon products, a significant increase from previous years, demonstrating a clear strategic pivot.

- Innovation in Action: Competitors are vying to introduce novel materials and processes that reduce embodied carbon. For instance, advancements in geopolymer cements and recycled aggregate technologies are becoming key competitive differentiators.

- Market Response: The market is rewarding companies that demonstrate a strong environmental, social, and governance (ESG) profile. As of mid-2024, ESG-focused funds saw continued inflows, indicating investor preference for sustainable businesses.

- Regulatory Impact: Evolving building codes and carbon pricing mechanisms are forcing companies to innovate or risk losing market access. The EU's Green Deal, for example, sets ambitious targets for the construction sector, intensifying the race for greener alternatives.

The building materials sector is dominated by a few large global players, leading to intense competition. This rivalry is amplified by high fixed costs and the drive for capacity utilization, often resulting in aggressive pricing strategies and periods of oversupply. While core products like cement are commoditized, competition is increasingly shifting towards sustainability and innovation.

Holcim and its peers, such as Heidelberg Materials, face a market where price, delivery, and customer service are crucial, but the long-term battleground is increasingly defined by low-carbon products and circular economy principles. For example, in 2023, Holcim's net sales reached CHF 29.1 billion, while Heidelberg Materials reported €22.3 billion, underscoring the scale of competition.

Mergers and acquisitions continue to reshape the landscape, creating larger entities with broader capabilities. This consolidation intensifies rivalry among the remaining giants, who now compete on factors beyond price, including supply chain efficiency and technological advancements. The push for sustainability, driven by regulations and customer demand, is a key differentiator, with companies like Holcim reporting 39% of net sales from low-carbon products in 2023.

| Competitor | 2023 Net Sales (Approx.) | Key Competitive Focus |

|---|---|---|

| Holcim | CHF 29.1 billion | Sustainability, low-carbon products, digital solutions |

| Heidelberg Materials | €22.3 billion | Decarbonization, circular economy, digital services |

| Cemex | USD 15.3 billion | Sustainable products, operational efficiency, digital transformation |

| CRH | USD 32.3 billion | Value-added solutions, sustainability, digital integration |

SSubstitutes Threaten

Steel and timber are viable substitutes for concrete in certain construction projects, presenting a competitive challenge to Holcim. For instance, in 2024, the global steel market was valued at approximately $900 billion, with ongoing innovation in lightweight yet strong steel alloys potentially increasing its appeal as a concrete alternative for structural elements.

While concrete's versatility and cost-effectiveness keep it dominant, evolving building codes and a growing emphasis on sustainability could favor timber construction in specific applications. The global engineered wood market, projected to reach over $30 billion by 2025, reflects this trend, indicating a growing acceptance of wood as a primary structural material.

The growing emphasis on circular economy practices is boosting the adoption of recycled concrete aggregates and other secondary materials in construction projects. This trend, while aligning with sustainability goals, presents a threat as external suppliers of these alternatives can diminish the demand for Holcim's traditional virgin aggregates, potentially affecting established revenue streams.

For instance, the European Union's Circular Economy Action Plan, with ambitious targets for resource efficiency, encourages the use of secondary raw materials. In 2023, the construction sector in Europe was a significant focus for these initiatives, with directives aimed at increasing the use of recycled materials in infrastructure. This external push for alternatives directly challenges the market share of virgin aggregate producers like Holcim.

The development of innovative low-carbon binders, like geopolymers and cements with reduced clinker content, poses a significant long-term threat to traditional Portland cement. Research and development in this area is accelerating, driven by the urgent need to lower the construction industry's substantial carbon footprint. These alternatives offer a compelling substitute for conventional cementitious materials.

As of 2024, the global market for green cement, which includes these innovative binders, is experiencing robust growth, with projections indicating a compound annual growth rate of over 10% through the end of the decade. This expansion is fueled by increasing regulatory pressure and growing customer demand for sustainable building solutions, directly impacting the market share potential for traditional cement producers.

Modular and Prefabricated Construction

The increasing adoption of modular and prefabricated construction presents a significant threat of substitution for Holcim. These methods, which often involve off-site manufacturing and assembly, can reduce the reliance on traditional on-site ready-mix concrete and aggregates. For instance, by 2024, the global modular construction market was projected to reach over $100 billion, indicating a substantial shift in building practices.

This trend challenges Holcim's established supply chain and product portfolio, as alternative materials and construction processes gain traction. The efficiency and speed offered by prefabrication can make it a more attractive option for developers, potentially diverting demand away from Holcim's core offerings.

- Growing Market Share: The modular construction sector is experiencing robust growth, with some estimates suggesting it could account for 20-30% of all new construction in developed markets by the late 2020s.

- Material Innovation: Innovations in materials used for prefabricated components, such as advanced composites and engineered wood, offer alternatives to traditional concrete.

- Cost and Time Savings: Prefabricated solutions often promise significant cost and time savings, making them appealing to developers seeking to reduce project overheads.

- Environmental Benefits: Off-site construction can lead to reduced waste and a smaller environmental footprint, aligning with increasing sustainability demands in the construction industry.

Green Building Standards and Regulations

The increasing stringency of green building standards, such as LEED and BREEAM, presents a significant threat. For instance, by the end of 2024, many regions are expected to have updated their building codes to mandate higher percentages of recycled content or lower embodied carbon in construction materials. If Holcim's cement and concrete offerings, which are core to its business, fall short of these evolving requirements or if alternative, more sustainable materials like mass timber or advanced recycled composites gain widespread adoption and become cost-competitive, Holcim could see its market share erode.

The availability of cost-effective, environmentally superior substitutes directly impacts Holcim’s competitive position. For example, in 2024, the cost of certain bio-based building materials has seen a reduction due to technological advancements and increased production scale, making them more attractive alternatives to traditional concrete in specific applications. This trend forces Holcim to innovate and adapt its product portfolio to meet market demands for sustainability without compromising on price or performance.

- Evolving Green Building Codes: Many jurisdictions are tightening regulations, requiring lower embodied carbon and higher recycled content in construction materials by 2024-2025.

- Rise of Sustainable Substitutes: Materials like mass timber and advanced recycled composites are becoming more viable and cost-competitive alternatives to traditional cementitious products.

- Market Share Erosion Risk: If Holcim's products do not align with these new standards or if substitutes offer comparable performance at a better environmental profile and price point, its market position is threatened.

The threat of substitutes for Holcim is significant, driven by advancements in alternative construction materials and methods. Steel and engineered wood offer competitive advantages in specific applications, with the global steel market valued around $900 billion in 2024 and the engineered wood market projected to exceed $30 billion by 2025. Furthermore, the push for circular economy principles is promoting recycled materials, potentially reducing demand for virgin aggregates. Innovative low-carbon binders, like geopolymers, are also gaining traction, with the green cement market showing over 10% annual growth as of 2024.

| Substitute Material/Method | 2024 Market Value/Projection | Key Advantages | Holcim Impact |

| Steel | ~$900 billion | Lightweight, high strength alloys | Competition for structural elements |

| Engineered Wood | >$30 billion (by 2025) | Sustainability, growing acceptance | Alternative for specific construction types |

| Recycled Aggregates | Growing adoption (EU focus) | Circular economy alignment | Reduced demand for virgin materials |

| Low-Carbon Binders/Green Cement | >10% CAGR (as of 2024) | Reduced carbon footprint | Long-term threat to traditional cement |

| Modular Construction | >$100 billion (projected 2024) | Speed, cost savings, reduced waste | Challenges traditional supply chains |

Entrants Threaten

Establishing a new cement or aggregates production facility demands substantial capital, often running into hundreds of millions of dollars for land, construction, and advanced machinery. This immense financial hurdle significantly discourages potential new competitors from entering the market, effectively protecting established companies like Holcim.

The building materials sector faces significant barriers to entry due to its complex regulatory landscape. Environmental regulations, land use restrictions, and resource extraction permits are particularly stringent, requiring extensive compliance efforts. For instance, in 2024, obtaining a new quarry permit in many jurisdictions can take several years and involve millions in upfront costs for environmental impact assessments and legal fees, deterring potential new players.

Existing players in the cement industry, such as Holcim, benefit immensely from economies of scale. This means they can produce and distribute their products at a lower cost per unit due to their large operational size. For instance, Holcim's global presence allows for bulk purchasing of raw materials, optimizing logistics, and spreading fixed costs over a larger output.

New entrants would face a significant hurdle in matching these cost efficiencies. Without the substantial initial volume to justify massive investments in plant and equipment, a newcomer would struggle to achieve comparable per-unit production costs. This makes it challenging to compete on price in a market where cement is often viewed as a commodity, where price is a primary differentiator.

Established Distribution Networks and Logistics

Holcim's formidable distribution networks, encompassing quarries, cement plants, ready-mix facilities, and a vast transportation fleet, present a significant barrier to new entrants. Establishing a similar logistical infrastructure requires immense capital investment and considerable time, making it difficult for newcomers to compete effectively on scale and efficiency.

The sheer density and optimization of Holcim's existing supply chain, developed over decades, create substantial cost advantages. New companies would struggle to replicate this reach and operational efficiency without facing prohibitively high startup costs.

- Significant Capital Outlay: Building a new, comprehensive distribution network comparable to Holcim's would likely require billions of dollars in investment for land acquisition, plant construction, and fleet acquisition.

- Time to Market: Establishing such an extensive network can take many years, allowing incumbents like Holcim to further solidify their market position and customer relationships.

- Operational Expertise: Beyond physical assets, Holcim possesses deep operational expertise in managing its supply chain, a factor that is difficult for new entrants to quickly acquire.

Brand Recognition and Customer Relationships

While basic building materials can be seen as commodities, established companies like Holcim have cultivated significant brand recognition and forged deep, long-standing relationships with major contractors and developers. This makes it difficult for newcomers to gain traction.

New entrants would struggle to build the necessary trust and market acceptance to compete effectively against these entrenched incumbents. For instance, Holcim's extensive network and reputation, built over decades, represent a substantial barrier.

- Brand Loyalty: Holcim's established brand equity fosters customer loyalty, making it harder for new players to attract and retain clients.

- Contractor Relationships: Long-term partnerships with key industry players provide Holcim with a consistent customer base and market insights.

- Market Trust: Decades of reliable service and product quality have built a reservoir of trust that new entrants must painstakingly replicate.

The threat of new entrants into the cement and building materials industry remains moderate for Holcim. Significant capital requirements for plant construction and regulatory hurdles, particularly concerning environmental permits and land use, act as substantial deterrents. For example, securing a new quarry in 2024 can involve millions in upfront costs and years of waiting, a considerable barrier for any new player.

Established players like Holcim benefit from strong economies of scale, which translate into lower per-unit production costs. This cost advantage, coupled with extensive distribution networks and established customer relationships built over decades, makes it challenging for newcomers to compete on price and market penetration. Holcim's global operational scale allows for optimized raw material purchasing and logistics, further solidifying its competitive position.

| Barrier Type | Description | Estimated Cost/Timeframe (Illustrative) |

|---|---|---|

| Capital Investment | Establishing a new cement plant and distribution network | Hundreds of millions to billions of USD |

| Regulatory Compliance | Obtaining environmental permits, land use rights | Millions of USD and several years |

| Economies of Scale | Achieving cost efficiencies through large-scale production | Requires significant initial production volume |

| Distribution Network | Building a comparable logistics infrastructure | Billions of USD and many years |

| Brand & Relationships | Developing market trust and contractor partnerships | Decades of consistent performance |

Porter's Five Forces Analysis Data Sources

Our Holcim Porter's Five Forces analysis is built upon a foundation of robust data, including Holcim's annual reports, investor presentations, and industry-specific market research from firms like GlobalData and Fitch Ratings. We also leverage data from building material trade associations and macroeconomic indicators to capture the broader industry landscape.