Holcim Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Holcim Bundle

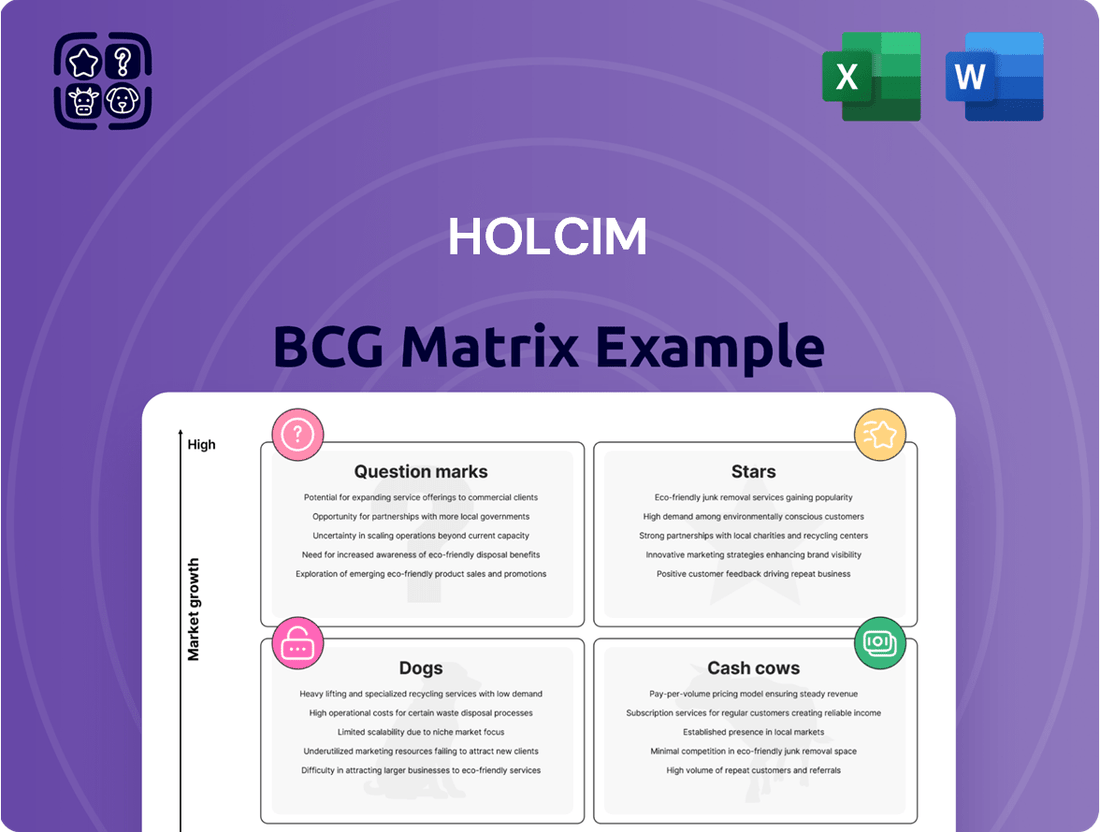

Curious about Holcim's strategic product portfolio? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock the potential of this analysis and gain a comprehensive understanding of their market position, purchase the full version for detailed insights and actionable strategies.

Stars

Holcim's ECOPact green concrete is a standout performer in the sustainable building materials market. It offers a significantly reduced CO2 footprint, a critical factor as the construction industry increasingly prioritizes decarbonization. This product line has seen remarkable adoption, quickly becoming a leader in its category.

In 2024, ECOPact's impact was clearly demonstrated as it accounted for 29% of Holcim's ready-mix concrete net sales. This figure not only highlights its substantial market share but also surpasses the company's initial 2025 target, underscoring its rapid growth and market acceptance.

ECOPlanet Green Cement, much like Holcim's ECOPact concrete, represents a significant advancement in sustainable building materials, boasting a considerably lower carbon footprint. This innovative product line has seen impressive market acceptance, achieving 26% of Holcim's total cement net sales in 2024.

The rapid and widespread adoption of ECOPlanet highlights its strong market positioning and its crucial role in driving profitable growth for Holcim. This success firmly establishes ECOPlanet as a frontrunner in the rapidly expanding market for low-carbon cement solutions.

Holcim is strategically prioritizing the expansion of its Solutions & Products business, focusing on high-value offerings such as advanced roofing systems under its Elevate brand. This segment has demonstrated robust growth, with advanced branded solutions accounting for 36% of total net sales in 2024. This signifies Holcim's commitment to a high-growth market where it is actively building a leading position.

Carbon Capture, Utilization, and Storage (CCUS) Projects

Holcim is heavily investing in Carbon Capture, Utilization, and Storage (CCUS) projects, aiming for near-zero cement production by 2030. These efforts, including the significant OLYMPUS project, are vital for the company's decarbonization strategy and place it in a rapidly expanding, disruptive market. This focus on CCUS demonstrates Holcim's ambition for future market dominance.

- Strategic Investment: Holcim's commitment to CCUS is a cornerstone of its sustainability roadmap, targeting substantial emissions reductions in cement manufacturing.

- Market Potential: The CCUS sector is projected for significant growth as global efforts to combat climate change intensify, creating a high-potential market for innovative solutions.

- Project Examples: Holcim's OLYMPUS project is a prime example of its large-scale CCUS initiatives, showcasing its dedication to technological advancement and market leadership.

Circular Construction Initiatives

Holcim's commitment to circular construction, especially through recycling construction and demolition waste, positions it as a leader in a rapidly growing market driven by sustainability. This focus aligns perfectly with global efforts to reduce environmental impact and conserve resources.

The company's proactive approach is evident in its achievement of its 2025 recycling target ahead of schedule. In 2024, Holcim successfully recycled 10 million tons of construction and demolition waste, underscoring its robust operational capabilities and significant market presence in this expanding sector.

- Circular Economy Leadership: Holcim is a frontrunner in integrating circular economy principles into construction.

- Waste Recycling Milestone: Achieved a 2024 recycling volume of 10 million tons of construction and demolition waste, surpassing its 2025 goal.

- Market Growth Alignment: This initiative taps into the high-growth potential of sustainable building materials and practices.

- Sustainability Focus: Demonstrates a strong commitment to environmental responsibility by repurposing waste materials.

Holcim's ECOPact and ECOPlanet product lines, along with its Elevate roofing systems, are clear examples of its "Stars" in the BCG matrix. ECOPact accounted for 29% of ready-mix concrete sales in 2024, exceeding its 2025 target. ECOPlanet achieved 26% of cement sales in the same year. The Elevate brand contributed 36% to total net sales in 2024, showcasing strong performance in high-growth segments.

| Product/Segment | 2024 Net Sales Contribution | Market Position |

|---|---|---|

| ECOPact (Green Concrete) | 29% of Ready-Mix Concrete | Market Leader, Exceeding Targets |

| ECOPlanet (Green Cement) | 26% of Cement Sales | Strong Market Acceptance |

| Elevate (Advanced Roofing) | 36% of Total Net Sales | Leader in High-Growth Segment |

What is included in the product

The Holcim BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Holcim BCG Matrix offers a clear, visual way to identify underperforming business units, simplifying strategic decisions and resource allocation.

Cash Cows

Holcim's traditional cement production, a cornerstone of its operations in mature markets, functions as a classic cash cow. The company's dominant market share in this segment ensures a steady and substantial generation of cash flow, providing the financial muscle to fund innovation and expansion into emerging sectors. For instance, in 2024, Holcim reported robust net sales figures for its cement business, highlighting its enduring strength and foundational role in the company's financial performance.

Holcim's aggregates business, a cornerstone of its operations, includes essential materials like crushed stone, sand, and gravel. This segment thrives in established markets where Holcim commands a significant market share, underscoring its strong competitive position.

This business is a classic cash cow. It generates a consistent and dependable income stream because aggregates are fundamental to all construction projects. While the growth rate in these mature markets is modest, the profitability is high, leading to substantial and reliable cash generation for the company.

In 2024, Holcim reported that its Aggregates segment contributed significantly to its overall performance, demonstrating the segment's stable cash-generating capabilities even amidst varying economic conditions. The demand for aggregates remains robust, driven by ongoing infrastructure development and building activities globally.

Holcim's traditional ready-mix concrete segment remains a substantial contributor to its financial performance, even as the company diversizes into greener building materials. This established business line enjoys consistent demand across a broad spectrum of conventional construction activities, underpinning its role as a significant cash generator for the company.

In 2024, Holcim's ready-mix concrete business continued to benefit from ongoing infrastructure development and housing construction globally. While specific segment revenue figures for traditional concrete are often integrated within broader reporting, the company’s overall net sales for 2023 reached CHF 30.3 billion, with Europe and North America being key markets where ready-mix concrete demand is robust.

Established European Operations

Holcim's established European operations represent a significant cash cow within its business portfolio. In 2024, this mature market demonstrated robust performance, with recurring EBIT growth and notable margin expansion. This success is a testament to Holcim's strong market share and operational efficiency in the region.

These consistent financial contributions from Europe are crucial, providing a stable source of cash. This allows Holcim to strategically allocate resources to fuel growth in other business segments or to invest in new ventures and innovation.

- Strong Recurring EBIT Growth: European operations consistently delivered positive EBIT growth throughout 2024.

- Margin Expansion: The region saw an increase in operating margins, reflecting improved profitability.

- Market Share Dominance: Holcim's strong position in mature European markets underpins its cash-generating capability.

- Strategic Funding Source: Profits generated here are vital for financing other growth initiatives across the company.

Profitable Latin American Operations

Holcim's Latin American operations are a prime example of a Cash Cow within its BCG Matrix. This segment has demonstrated exceptional financial health, recording record net sales and recurring EBIT in the first quarter of 2024. This robust performance is further underscored by significant margin expansion, indicating strong pricing power and efficient cost management.

The region benefits from Holcim's substantial market share, allowing it to command a leading position in a market characterized by stable construction demand. While not experiencing explosive growth, the consistent demand provides a reliable revenue stream, a hallmark of a Cash Cow. This stability allows Holcim to generate substantial cash flow with relatively low investment requirements.

- Record Net Sales in Q1 2024

- Strong Recurring EBIT Performance in Q1 2024

- Significant Margin Expansion in the Region

- High Market Share in a Stable Demand Environment

Holcim's aggregates business, a cornerstone of its operations, includes essential materials like crushed stone, sand, and gravel. This segment thrives in established markets where Holcim commands a significant market share, underscoring its strong competitive position. It generates a consistent and dependable income stream because aggregates are fundamental to all construction projects. While the growth rate in these mature markets is modest, the profitability is high, leading to substantial and reliable cash generation for the company. In 2024, Holcim's Aggregates segment contributed significantly to its overall performance, demonstrating the segment's stable cash-generating capabilities even amidst varying economic conditions.

| Holcim Business Segment | BCG Matrix Category | Key Characteristics | 2024 Performance Indicator |

| Aggregates | Cash Cow | Mature markets, high market share, stable demand, high profitability | Significant contribution to overall performance |

| Traditional Cement Production | Cash Cow | Dominant market share in mature markets, steady cash flow | Robust net sales |

| Ready-Mix Concrete | Cash Cow | Consistent demand in conventional construction, significant cash generator | Continued benefit from global infrastructure development |

What You’re Viewing Is Included

Holcim BCG Matrix

The Holcim BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after your purchase. This comprehensive analysis, designed to illuminate Holcim's strategic positioning, is ready for immediate application in your business planning and decision-making processes. You'll gain access to the exact same professionally formatted report, offering actionable insights into Holcim's product portfolio and market share. This is not a demo or a sample, but the final, ready-to-use strategic tool.

Dogs

Holcim's underperforming legacy assets represent older, less efficient production facilities or operational sites that struggle to meet current profitability or environmental standards. These assets often carry high operating costs and hold a low market share within competitive sub-segments, making them prime candidates for divestment. For instance, in 2024, Holcim continued its strategic review of its portfolio, aiming to divest non-core or underperforming assets to streamline operations and enhance overall efficiency.

In 2024, Holcim strategically divested its operations in four markets. These moves signify the company's proactive management of its portfolio, shedding businesses that were likely underperforming or no longer aligned with its core strategic objectives.

These divested units can be viewed as past 'dogs' within the BCG matrix framework. By removing them, Holcim aims to enhance its overall performance and reallocate resources towards areas with greater growth potential and strategic fit.

Holcim may have niche product lines, perhaps in specialized construction chemicals or historical building materials, that are seeing reduced interest. For instance, if a particular type of cement additive, once popular, is now superseded by more efficient alternatives, its demand would naturally shrink. These segments, characterized by low market share and negligible growth, represent potential divestment opportunities if they no longer align with Holcim's strategic focus.

Operations in Structurally Declining Markets

Holcim’s operations in structurally declining markets, often characterized by economic stagnation or reduced infrastructure investment, would be classified as Dogs in the BCG Matrix. These segments typically exhibit low market share and limited growth potential, making profitability a significant hurdle.

For instance, certain mature European markets or specific sub-segments of the construction materials industry that have seen a long-term downturn in demand due to demographic shifts or policy changes could represent these Dog units. In 2023, for example, while Holcim reported strong overall performance, some of its more established, slower-growing markets in regions with limited new construction activity would fit this profile.

- Low Market Share: Units operating in regions with shrinking construction volumes and intense competition would struggle to gain significant market share.

- Limited Growth Prospects: Structural declines mean these markets are unlikely to rebound, offering minimal opportunities for revenue expansion.

- Challenging Profitability: Sustaining profitability in these segments often requires aggressive cost management and a focus on niche, high-margin products or services, if available.

- Potential Divestment or Restructuring: Companies often consider divesting or significantly restructuring Dog units to reallocate capital to more promising areas of the business.

Outdated Conventional Building Systems

Outdated conventional building systems, while perhaps historically significant for Holcim, would likely fall into the 'dog' category of the BCG matrix. These are products or systems with low market share and low growth potential, often facing obsolescence as newer, more sustainable technologies emerge. For instance, traditional concrete formulations that lack advanced admixtures for improved durability or reduced carbon footprint could be seen as lagging behind market demands for greener construction.

The demand for such conventional systems is expected to decline as regulations and consumer preferences shift towards environmentally friendly and high-performance materials. By 2024, the global construction market saw a significant push towards green building, with reports indicating that sustainable building materials could capture a substantial portion of the market share, leaving less room for older technologies. Holcim's focus on innovation, such as its ECOPlanet range of low-carbon cement, directly addresses this shift, implicitly categorizing less advanced offerings as dogs.

- Declining Demand: Conventional building systems face reduced demand as sustainability becomes a primary driver in construction choices.

- Low Market Share: Products that do not align with modern environmental standards are likely to see their market share erode.

- Technological Obsolescence: The rapid advancement of building technologies renders many traditional systems outdated and less competitive.

- Struggling Relevance: Without significant investment in modernization, these systems risk losing market relevance and profitability.

Holcim's 'Dog' category represents business units or product lines with low market share and low growth potential. These are often legacy assets or operations in mature, declining markets where profitability is challenging. For example, in 2024, Holcim continued its strategic portfolio review, which included divesting non-core assets, many of which would have previously fit the 'Dog' profile due to underperformance.

These units typically face shrinking demand and intense competition, making it difficult to achieve significant revenue growth or maintain healthy profit margins. The company's focus on divesting such segments, as seen in its 2024 market exits, aims to free up capital and management attention for more promising ventures.

Holcim's strategy to divest operations in certain markets in 2024 highlights the active management of its portfolio, shedding businesses that likely represent 'Dogs' due to their low market share and limited growth prospects. This proactive approach allows for resource reallocation towards areas with higher strategic value and potential for future returns.

The company's emphasis on innovation, such as its ECOPlanet range of low-carbon cement, implicitly categorizes older, less sustainable product lines as 'Dogs'. These traditional offerings face declining demand as the market shifts towards greener building solutions, a trend that accelerated in 2024 with increased regulatory and consumer focus on sustainability.

| BCG Category | Holcim Examples | Market Characteristics | Financial Implications |

|---|---|---|---|

| Dogs | Underperforming legacy assets, operations in structurally declining markets, outdated conventional building systems | Low Market Share, Low Growth Potential, Declining Demand | Challenging Profitability, Potential Divestment/Restructuring |

Question Marks

Holcim's commitment to early-stage carbon capture and utilization (CCUS) research positions these initiatives as potential stars or question marks within a BCG matrix framework. These ventures, though currently small in market share, represent high-risk, high-reward opportunities, demanding significant research and development funding to unlock future market potential.

In 2024, the global CCUS market was valued at approximately $3.5 billion, with projections indicating substantial growth. Holcim's investment in experimental CCUS technologies, such as direct air capture or novel utilization pathways for CO2, aligns with this trend, aiming to develop proprietary solutions that could offer a competitive edge.

Advanced Digital Construction Solutions, like Holcim's investments in AI-driven optimization and robotics, fall into the question mark category of the BCG matrix. These are high-growth potential areas, but currently hold a small market share. Significant investment is needed to develop these nascent digital platforms and gain user adoption.

Holcim's strategic pushes into new, developing markets, like certain parts of Sub-Saharan Africa or Southeast Asia, would be classified as question marks. These regions present substantial growth opportunities, but Holcim's current footprint is minimal, meaning they need considerable investment to build market share.

For instance, in 2024, many emerging economies in Africa continued to show robust GDP growth, with some projected to expand by over 5% annually. However, Holcim's market penetration in these specific countries remained under 10%, necessitating significant capital expenditure for plant construction, distribution networks, and brand building to compete effectively.

Experimental Sustainable Material Innovations

Holcim's commitment to sustainability extends to experimental materials, potentially beyond their established ECOPact and ECOPlanet lines. These advanced, niche products, while currently representing a small fraction of sales, hold the potential for significant future market disruption. For instance, research into advanced geopolymer cements or novel bio-based binders could redefine low-carbon construction practices.

These experimental innovations are crucial for Holcim's long-term growth and market leadership, positioning them as pioneers in a rapidly evolving construction landscape. While precise figures for these nascent materials are proprietary, Holcim's overall investment in R&D for sustainable solutions reached CHF 234 million in 2023, signaling a strong focus on future-proofing their portfolio.

- Development of Carbon Capture Materials: Holcim is actively exploring materials that actively sequester CO2 during their lifecycle, moving beyond just reducing emissions.

- Bio-Aggregate Integration: Research into using agricultural waste or recycled organic materials as aggregates in concrete formulations is ongoing.

- Advanced Recycled Content: Innovations in processing and utilizing higher percentages of construction and demolition waste into new building products are a key focus.

- Self-Healing Concrete Technologies: Experimental formulations incorporating bacteria or microcapsules to enable concrete to repair its own cracks are being investigated.

Strategic Venture Capital Investments in ConTech Startups

Holcim’s strategic venture capital investments in ConTech startups align with a ‘Question Mark’ position in the BCG Matrix. These investments target companies with high growth potential in the rapidly evolving construction technology sector, but they often operate in nascent markets with low current market share. For instance, Holcim has been actively investing in areas like modular construction, digital platforms for project management, and advanced building materials. These ventures represent a significant opportunity for future market leadership if the startups successfully scale their innovative solutions.

These ConTech investments are characterized by their inherent risk. Startups in this space frequently require substantial capital to develop and commercialize their technologies, and their market penetration can be slow initially. However, the potential rewards are substantial, promising to revolutionize construction processes, improve efficiency, and enhance sustainability. Holcim's engagement in this segment reflects a forward-looking strategy to capture emerging trends and build competitive advantages in the future construction landscape.

- High Growth Potential: ConTech startups often aim to disrupt traditional construction methods, offering solutions that promise significant efficiency gains and cost reductions.

- High Risk: Early-stage ConTech ventures face challenges in market adoption, regulatory hurdles, and securing follow-on funding, making them inherently risky investments.

- Low Market Share: Until their technology gains widespread acceptance and scales, these startups typically hold a small share of the overall construction market.

- Strategic Importance: Holcim's investments signal a commitment to innovation and a belief in the transformative power of technology to shape the future of the building industry.

Holcim's investments in emerging low-carbon cement technologies, such as novel binder chemistries or advanced supplementary cementitious materials, are prime examples of Question Marks. These innovations hold significant promise for reducing the environmental impact of construction but currently represent a small market share and require substantial R&D investment to scale and gain market acceptance.

In 2024, the global market for green building materials continued its upward trajectory, with a particular focus on low-carbon concrete solutions. Holcim's exploration into these nascent technologies positions them to capture future market share, but the initial investment and market penetration remain modest, characteristic of a Question Mark.

Holcim’s strategic focus on developing and integrating advanced digital solutions for its operations, such as AI-powered supply chain optimization and predictive maintenance for its plants, also falls into the Question Mark category. These high-growth potential areas require significant upfront investment to mature and achieve widespread adoption within the industry.

The company's exploration into advanced recycling technologies for construction and demolition waste, aiming to create higher-value building materials, represents another significant Question Mark. While the demand for circular economy solutions is growing, the technological hurdles and market acceptance for these advanced recycled products are still developing.

BCG Matrix Data Sources

Our Holcim BCG Matrix is constructed using a blend of internal financial statements, global construction market reports, and sustainability performance data to accurately reflect business unit positioning.