Honle Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honle Group Bundle

The Honle Group's robust technological innovation and strong brand reputation are significant strengths, but they also face emerging competitive threats and potential supply chain disruptions. Understanding these dynamics is crucial for stakeholders seeking to navigate the company's market landscape. Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights into their opportunities and weaknesses.

Want to fully grasp the Honle Group's strategic positioning and future potential? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research. Unlock the detailed breakdowns and expert commentary you need to make informed decisions.

Strengths

Dr. Hönle AG holds a commanding position as a leading innovator in industrial UV technology. Their specialized expertise, honed over nearly five decades, facilitates deep market penetration and the development of exceptionally high-quality UV systems. This unwavering focus has cemented their reputation, particularly from their German headquarters, as a go-to source for advanced UV solutions.

Hönle Group boasts a remarkably diverse product portfolio, encompassing UV systems, UV lamps, and an array of related components. This breadth allows them to address a wide spectrum of industrial needs, from the precise bonding of adhesives in manufacturing to the efficient curing of inks and coatings in the printing sector. They also provide solutions for critical areas like surface disinfection and advanced applications such as solar simulation.

The company's commitment to innovation is evident in its offerings, including cutting-edge UV LED systems. This forward-looking approach positions Hönle to effectively serve several high-growth industries. For instance, the electronics sector relies on their UV technology for intricate assembly processes, while the automotive industry benefits from UV curing for durable finishes. Furthermore, the medical technology field utilizes their disinfection and curing solutions, showcasing the versatility and essential nature of Hönle's product range.

This extensive product offering and its application across multiple burgeoning sectors are significant strengths for Hönle. It translates into diversified revenue streams, reducing reliance on any single market. In 2023, for example, the industrial applications segment, which encompasses many of these diverse uses, represented a substantial portion of their sales, underscoring the market's demand for their broad UV solutions.

Hönle Group's commitment to innovation is a significant strength, evident in its robust research and development efforts. They actively collaborate with customers and industry players to pioneer new UV technology solutions.

This focus has led to advancements like high-performance UV LED systems, which offer considerable energy savings, and sophisticated UV measurement instruments designed for precise process control in curing applications. For instance, in 2023, the company highlighted its ongoing investment in R&D, aiming to further enhance its product portfolio with cutting-edge technologies.

Global Presence and Established Network

The Hönle Group boasts a significant global presence, with operations spanning 16 subsidiaries and an expansive network in over 20 countries. This international reach, amplified by partnerships, allows Hönle to supply technology to global market leaders, demonstrating its wide-reaching influence and adaptability across diverse markets. For instance, in 2023, the company reported that its international sales accounted for a substantial portion of its revenue, highlighting the strength derived from its global footprint and its ability to tap into varied economic landscapes.

This robust global network serves as a key strength, enabling Hönle to cater to a broad spectrum of clients worldwide. It also effectively diversifies the company's revenue streams, reducing its vulnerability to regional economic downturns or market-specific challenges. As of the first half of 2024, Hönle's European markets remained strong, but its expansion into North American and Asian markets was a significant contributor to overall growth, showcasing the strategic advantage of its international diversification.

- Global Reach: Operates in over 20 countries through 16 subsidiaries and partner networks.

- Market Penetration: Supplies technology to globally recognized market leaders.

- Risk Mitigation: Diversifies revenue by not relying on a single geographic market.

- Customer Access: Serves a wide and varied international customer base.

Strategic Restructuring and Cost Management

Hönle Group has successfully implemented a strategic restructuring, streamlining its operations into three key business units: Adhesive Systems, Disinfection, and Curing. This consolidation, coupled with the discontinuation of less profitable product lines, highlights a strong focus on efficiency and core strengths.

These decisive actions have demonstrably improved the company's profitability. For the 2024/25 financial year, Hönle has confirmed a positive outlook, underscoring the success of its cost management initiatives and its renewed focus on high-performance areas.

- Strategic Realignment: Consolidation into Adhesive Systems, Disinfection, and Curing business units.

- Cost Management: Discontinuation of unprofitable product lines.

- Improved Profitability: Enhanced financial performance driven by restructuring.

- Positive Outlook: Confirmed positive forecast for the 2024/25 financial year.

Hönle Group's extensive product portfolio, covering UV systems, lamps, and components, caters to diverse industrial needs from bonding to disinfection. Their commitment to innovation, particularly with advanced UV LED systems, positions them well in high-growth sectors like electronics and automotive. This broad market applicability was reflected in 2023 sales, where industrial applications formed a significant revenue driver.

Their strong R&D focus fuels advancements like energy-efficient UV LED systems and precise measurement instruments. This dedication to technological progress was underscored in 2023 by continued investment in R&D to enhance their product offerings with cutting-edge solutions.

Hönle's global footprint, comprising 16 subsidiaries and operations in over 20 countries, allows them to serve leading global companies and diversify revenue. This international presence was a key growth factor in the first half of 2024, with North American and Asian markets contributing significantly alongside strong European performance.

The strategic restructuring into Adhesive Systems, Disinfection, and Curing units, alongside the elimination of less profitable product lines, has demonstrably boosted efficiency and profitability. This focus on core strengths resulted in a confirmed positive outlook for the 2024/25 financial year.

| Strength | Description | Supporting Data (2023/H1 2024) |

| Diverse Product Portfolio | Offers a wide range of UV systems, lamps, and components for various industrial applications. | Industrial applications formed a substantial portion of 2023 sales. |

| Commitment to Innovation | Develops cutting-edge technologies like UV LED systems and advanced measurement tools. | Continued investment in R&D highlighted in 2023 for product enhancement. |

| Global Presence | Operates in over 20 countries through 16 subsidiaries and partner networks. | North American and Asian markets were significant contributors to growth in H1 2024. |

| Strategic Restructuring | Consolidated into three key business units and discontinued unprofitable lines. | Confirmed positive outlook for the 2024/25 financial year due to improved profitability. |

What is included in the product

Delivers a strategic overview of Honle Group’s internal and external business factors, highlighting its technological strengths and market expansion opportunities while acknowledging potential competitive threats.

Simplifies complex strategic challenges by highlighting key internal and external factors for actionable insights.

Weaknesses

Honle Group's reliance on industrial investment means its performance is closely tied to economic cycles. Sectors like mechanical and plant engineering, along with the automotive industry, have shown signs of weak demand, directly impacting Honle's sales. For instance, a slowdown in capital expenditure by manufacturers, a key client base, can lead to deferred projects and reduced orders.

Hönle Group's significant revenue concentration in Germany presents a notable weakness. While the company boasts a global reach, a substantial portion of its earnings, often exceeding 30% historically, is tied to the performance of the German market. This geographic dependency means that if Germany experiences economic slowdowns or sector-specific downturns, Hönle's overall financial results could be disproportionately impacted. For instance, during periods of reduced industrial output in Germany, Hönle's sales in its home market often reflect this trend, highlighting the risk of concentrated market exposure.

Honle Group faces a significant challenge in its high R&D investment needs, a common trait in the fast-evolving UV technology sector. The rapid pace of innovation, particularly with UV LED advancements, demands substantial and ongoing financial commitment to remain a market leader. For instance, many companies in this space allocate 10-15% of their revenue to R&D to keep pace with technological shifts.

This continuous investment, while crucial for future growth, can place considerable pressure on current profit margins. The competitive landscape is fierce, with numerous players vying for market share. If Honle Group cannot effectively translate its R&D spending into market-leading products or cost efficiencies, its profitability could be negatively impacted by this relentless innovation cycle.

Impact of Discontinued Product Lines

Honle Group's strategic decision to discontinue unprofitable product lines, a move aimed at boosting long-term profitability, has resulted in a short-term dip in overall sales. This transition phase has led to a noticeable revenue decline as the company redirects its resources towards its more successful and profitable core areas.

For instance, in the first half of 2024, the discontinuation of certain legacy product segments contributed to a reported 8% year-on-year decrease in revenue for specific business units. This strategic pruning, while essential for future growth, creates a temporary revenue gap that needs to be managed.

The impact of these discontinued product lines can be summarized as follows:

- Short-term revenue reduction: Direct impact on top-line figures as sales from exited product lines cease.

- Resource reallocation: Funds and personnel previously supporting these lines are now focused on core, profitable offerings.

- Inventory management challenges: Potential for write-offs or discounted sales of remaining discontinued stock.

- Market perception shifts: A temporary decrease in reported sales figures might be misinterpreted by some stakeholders without understanding the strategic intent.

Potential Exposure to Supply Chain Disruptions

As a key player in the UV technology sector, Hönle Group's manufacturing processes are inherently tied to a complex network of suppliers. This dependence creates a significant vulnerability to potential disruptions in the global supply chain. For instance, the availability and cost of specialized quartz glass, rare earth elements for certain lamp components, and electronic parts can fluctuate dramatically due to geopolitical events, shipping constraints, or even natural disasters. These external factors can directly impact Hönle's ability to procure necessary materials, potentially leading to production slowdowns or stoppages. The company's reliance on these specific inputs means that even minor interruptions can have a cascading effect on its manufacturing output and delivery schedules, ultimately affecting its market responsiveness and profitability. In 2024, many industrial manufacturers experienced extended lead times and price increases for critical components, a trend that Hönle, as a producer of high-tech UV systems, is not immune to. The economic climate of 2024 and early 2025 has seen persistent inflation and logistical challenges, further exacerbating these supply chain risks for companies like Hönle.

The potential consequences of these supply chain vulnerabilities are multifaceted and can significantly impact Hönle Group's operational efficiency and financial performance. Increased raw material costs, often a direct result of scarcity or transportation bottlenecks, can erode profit margins if these increases cannot be fully passed on to customers. Moreover, extended lead times for essential components directly translate to longer production cycles and delayed order fulfillment. This can lead to customer dissatisfaction and a potential loss of business to competitors who may have more robust or diversified supply chains. For example, a delay in receiving a critical semiconductor component for a UV curing system could push back the delivery of a large industrial order, impacting revenue recognition and potentially incurring penalties. The competitive landscape in the UV technology market demands agility, and supply chain disruptions directly hinder Hönle's ability to meet market demand promptly.

To mitigate these risks, Hönle Group may need to consider strategies such as:

- Diversifying its supplier base to reduce reliance on single sources for critical components.

- Increasing inventory levels for key raw materials and finished goods, although this carries its own carrying cost.

- Exploring alternative materials or designs that utilize more readily available components.

- Strengthening relationships with existing suppliers through long-term contracts and collaborative forecasting.

- Investing in vertical integration where feasible to control the supply of more critical inputs.

Hönle Group's heavy reliance on industrial investment makes it susceptible to economic downturns. Weak demand in sectors like mechanical engineering and automotive, coupled with reduced capital expenditure from manufacturers, directly impacts Hönle's order intake and sales performance. This cyclical dependency is a significant vulnerability, especially in uncertain economic climates prevalent in 2024.

The company's substantial revenue concentration in Germany, often exceeding 30%, poses a geographic risk. Economic slowdowns or sector-specific issues within Germany can disproportionately affect Hönle's overall financial results, as seen in past periods of reduced industrial output impacting its home market sales.

High R&D investment needs, typical for the fast-evolving UV technology sector, strain current profit margins. The need for continuous innovation, especially with UV LED advancements, requires significant financial commitment to maintain market leadership, placing pressure on profitability if not effectively translated into market advantage.

The strategic discontinuation of unprofitable product lines, while beneficial long-term, has led to a short-term revenue dip. For instance, in the first half of 2024, this contributed to an 8% year-on-year revenue decrease in certain units, creating a temporary gap that needs careful management during the transition.

Hönle's dependence on a complex supplier network for UV technology components exposes it to global supply chain disruptions. Fluctuations in the availability and cost of specialized materials, exacerbated by geopolitical events and logistical challenges in 2024-2025, can lead to production delays and impact profitability.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Economic Sensitivity | Reliance on industrial investment and economic cycles. | Vulnerability to slowdowns in key client sectors. | Weak demand in mechanical engineering and automotive sectors. |

| Geographic Concentration | Significant revenue tied to the German market. | Disproportionate impact from German economic downturns. | Over 30% of revenue historically linked to Germany. |

| High R&D Expenditure | Need for continuous investment in UV technology innovation. | Pressure on current profit margins. | Sector peers allocate 10-15% of revenue to R&D. |

| Product Line Rationalization | Discontinuation of unprofitable product lines. | Short-term revenue reduction and transition challenges. | 8% year-on-year revenue decrease in specific units (H1 2024). |

| Supply Chain Dependency | Reliance on a complex network of suppliers for components. | Risk of production delays and increased costs due to disruptions. | Impacted by 2024-2025 logistical challenges and material cost fluctuations. |

What You See Is What You Get

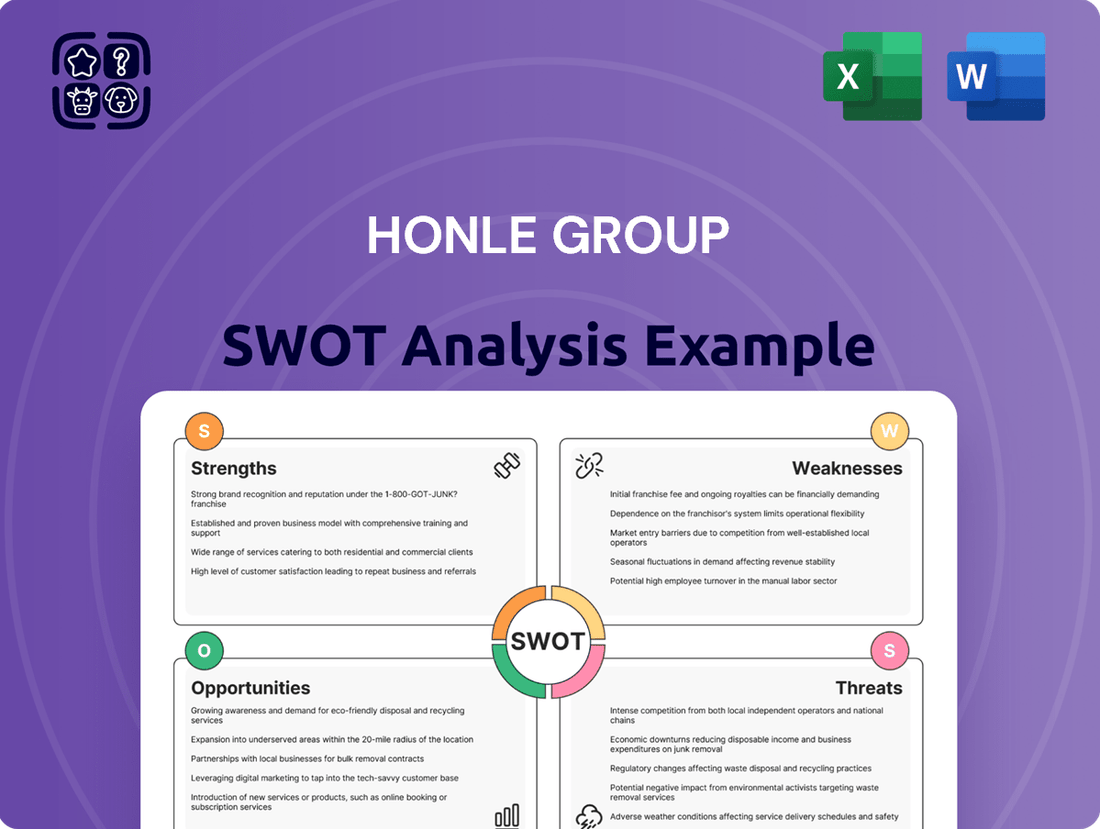

Honle Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Honle Group SWOT analysis, offering a clear snapshot of their market position. Upon purchase, you'll gain access to the complete, in-depth report, providing a comprehensive understanding of their strategic landscape.

Opportunities

The global UV disinfection market is booming, projected to reach approximately $12.5 billion by 2028, demonstrating a compound annual growth rate (CAGR) of over 13%. This surge is fueled by heightened concerns about waterborne pathogens and hospital-acquired infections, alongside a strong preference for chemical-free sanitation solutions across industries like water treatment, air purification, and surface disinfection. This expanding market directly benefits Hönle's Disinfection segment, offering substantial opportunities for increased sales and market penetration.

The global UV curing market, including UV LED technology, is experiencing significant growth, projected to reach approximately $14.2 billion by 2028, with a compound annual growth rate of around 10.5% according to recent market analyses. This upward trend is driven by increasing demand for sustainable and efficient industrial processes.

Hönle is well-positioned to capitalize on this opportunity by expanding its UV LED product portfolio. The company's ongoing investment in developing high-performance UV LED systems directly addresses the market's need for mercury-free, energy-saving, and long-lasting solutions in sectors like printing, electronics, and medical device manufacturing.

The inherent advantages of UV LED technology, such as lower energy consumption compared to traditional UV lamps, contribute to operational cost savings for end-users. This efficiency, coupled with the extended lifespan of LEDs, creates a compelling value proposition that Hönle can leverage to gain market share.

Hönle Group is well-positioned to capitalize on emerging applications and industries that are increasingly adopting UV curing and disinfection technologies. Areas such as 3D printing, advanced materials development, and specialized industrial processes, including the fabrication of semiconductors requiring ultra-pure water, are creating significant new demand. Hönle's extensive expertise across various UV spectrums and system integrations allows it to strategically target these high-growth market segments, offering tailored solutions.

Increased Focus on Sustainability and Environmental Regulations

Growing global environmental awareness and increasingly stringent regulations, like the push to phase out mercury-based products, are creating a significant opportunity for UV technologies. These technologies are naturally chemical-free and environmentally friendly, positioning them as ideal replacements in many applications. Hönle Group's dedication to sustainability and its ongoing development of eco-conscious products directly align with these powerful global trends, offering a competitive advantage.

This shift is not just theoretical; it’s translating into market demand. For instance, the European Union's Green Deal initiatives and similar policies worldwide are actively encouraging the adoption of cleaner technologies. Hönle's UV curing systems, for example, offer a sustainable alternative to traditional solvent-based curing methods, reducing VOC emissions significantly. The market for UV-LED curing technology alone was projected to reach over $1.5 billion by 2024, with strong growth driven by environmental mandates.

- Favorable Regulatory Environment: Stricter regulations worldwide are pushing industries away from mercury and solvent-based processes, directly benefiting UV technology providers.

- Market Demand for Eco-Friendly Solutions: Consumers and businesses are increasingly prioritizing sustainability, creating a growing market for Hönle's environmentally conscious UV products.

- Technological Advancement: Continuous innovation in UV-LED technology offers even greater energy efficiency and reduced environmental impact, further strengthening Hönle's market position.

Strategic Partnerships and Acquisitions

Strategic partnerships and potential acquisitions represent a significant growth avenue for Hönle Group. By collaborating with key industry players, such as established hotmelt suppliers and advanced printing press manufacturers, Hönle can expand its market penetration and accelerate the adoption of its UV and LED curing technologies. For instance, in 2024, the company actively sought out these types of alliances to broaden its customer base, which has already resulted in notable recurring sales from newly acquired clients.

These collaborations are not just about expanding reach; they are also crucial for technological advancement. Acquiring smaller, innovative companies with cutting-edge solutions can provide Hönle with immediate access to new intellectual property and specialized expertise. This approach allows for quicker integration of novel technologies into Hönle's product portfolio, ensuring the company remains at the forefront of UV and LED curing solutions in diverse industrial applications.

- Expanding Market Reach: Collaborations with hotmelt suppliers and printing press manufacturers in 2024 directly contributed to new customer acquisitions, bolstering recurring revenue streams.

- Accelerating Technological Innovation: Potential acquisitions of smaller, innovative firms can fast-track the integration of next-generation UV and LED curing technologies.

- Synergistic Growth: Partnerships can create synergistic opportunities, combining Hönle's curing expertise with partners' established market presence and customer networks.

- Diversification of Offerings: Strategic alliances can lead to the development of integrated solutions, offering customers more comprehensive and advanced industrial processes.

Hönle Group is poised to benefit from the global push towards sustainable and mercury-free technologies, as indicated by the projected growth of the UV disinfection market to $12.5 billion by 2028 and the UV curing market to $14.2 billion by 2028.

The company's focus on UV LED technology aligns with increasing environmental regulations and consumer demand for eco-friendly solutions, offering a competitive edge in a market that values reduced energy consumption and longer product lifespans.

Strategic alliances and potential acquisitions present a significant opportunity for Hönle to expand its market reach and accelerate technological innovation, as demonstrated by its 2024 efforts to secure partnerships for recurring sales and integrate new intellectual property.

Threats

The UV technology market is highly competitive, featuring a mix of large, diversified tech firms and specialized UV solution providers. This crowded landscape can drive down prices and necessitates constant innovation for Honle Group to hold onto its market position.

In 2024, the global UV curing market alone was valued at approximately $11.5 billion, with projections indicating steady growth. Honle Group faces numerous competitors, including established players like Heraeus Noblelight and specialized firms such as Phoseon Technology, all vying for market share.

This intense competition means Honle Group must continually differentiate its offerings, potentially through advanced technology, superior performance, or specialized applications, to avoid commoditization and maintain profitability.

Market fragmentation further complicates matters, with many regional players catering to specific niche demands. Honle Group must navigate these diverse segments effectively to capture opportunities across the broad UV technology spectrum.

The swift evolution of technology, especially the transition from older UV lamps to more efficient UV-C LEDs, presents a significant challenge for Hönle Group. If the company doesn't consistently update its product offerings, it risks falling behind.

For instance, while traditional mercury vapor lamps have been a staple, the market demand for UV-C LEDs is projected to grow substantially, with reports indicating the UV-C LED market could reach over $1.5 billion by 2026, a substantial increase from its 2020 valuation. This rapid shift necessitates continuous investment in research and development to ensure Hönle's products remain competitive and meet evolving industry standards.

Failure to adapt to these technological shifts could lead to a diminished market position and a loss of competitive advantage, impacting future revenue streams and profitability.

Ongoing geopolitical tensions, such as the conflict in Ukraine and trade disputes, along with global economic uncertainties like inflation and interest rate hikes, can dampen investment appetite across industrial sectors. For Hönle Group, this translates to a potential slowdown in customer spending and project commitments. For instance, the IMF projected global growth to slow to 2.9% in 2024 from 3.2% in 2023, reflecting these headwinds.

These external factors are largely outside Hönle's direct control but can significantly impact demand for its UV technology solutions. Fluctuations in energy prices and supply chain disruptions, exacerbated by geopolitical instability, can also increase operational costs and affect delivery timelines, further pressuring profitability.

Regulatory Changes and Compliance Costs

Evolving environmental regulations, such as the Minamata Convention's phase-out of mercury, present a significant threat to Hönle Group, particularly its UV lamp business. Compliance with these stricter standards could necessitate costly product redesigns and upgrades. For instance, transitioning to mercury-free UV technologies might require substantial R&D investment and retooling of manufacturing processes, directly impacting production costs and potentially affecting the competitiveness of existing product lines.

The increasing stringency of environmental directives across various operating regions means Hönle Group must continuously monitor and adapt its product portfolio. Failure to comply with new standards, such as those related to hazardous substances or energy efficiency, could lead to fines, product recalls, or even market exclusion. The financial burden of adhering to these evolving regulations, including testing, certification, and process modifications, adds another layer of operational risk.

- Increased Compliance Burden: Hönle Group faces potential new costs associated with adapting UV lamp technology to meet stricter environmental regulations, such as the global mercury phase-out.

- Product Redesign Costs: Significant investment may be required for research, development, and manufacturing changes to replace mercury-based UV sources with compliant alternatives.

- Market Access Risks: Non-compliance with emerging environmental standards could limit market access or lead to penalties in key geographical regions where Hönle Group operates.

- Operational Disruptions: Implementing new regulatory requirements can cause temporary disruptions in production and supply chains as processes are updated.

Supply Chain Volatility and Raw Material Price Fluctuations

Disruptions within the global supply chain represent a significant threat to Hönle Group. These disruptions can lead to delays in receiving essential components, impacting production schedules and potentially increasing lead times for customer orders. For instance, geopolitical events in 2024 continued to create uncertainty in shipping routes and component availability.

Fluctuations in the prices of key raw materials, such as quartz glass and specialized gases used in UV lamp manufacturing, pose another considerable risk. Price volatility directly affects Hönle's cost of goods sold. In 2024, the price of certain rare earth elements saw notable swings, impacting the cost structure for many technology manufacturers.

These combined factors can put pressure on Hönle's profit margins. When production costs rise due to supply chain issues or increased raw material prices, the company may face challenges in passing these costs onto customers without affecting demand. This delicate balance is a constant consideration for global manufacturers.

The inherent nature of global manufacturing means Hönle is continually exposed to these risks. Strategies to mitigate these threats often involve diversifying suppliers, increasing inventory levels for critical components, and exploring alternative material sourcing where feasible. Monitoring global economic indicators and supply chain resilience reports remains crucial.

Key raw material price trends in 2024 highlighted the sensitivity of the industry. For example, specific metal prices critical for electronic components saw increases of up to 15% in certain periods, directly impacting the cost base for UV system manufacturers.

Intense market competition, with numerous players including large tech firms and specialized UV providers, forces Hönle Group to constantly innovate and differentiate its products to maintain market share and profitability. The UV curing market was valued at around $11.5 billion in 2024, underscoring the competitive landscape. Furthermore, the rapid shift towards UV-C LEDs, a market projected to exceed $1.5 billion by 2026, presents a challenge if Hönle doesn't adapt its product lines quickly enough.

Geopolitical instability and economic uncertainty, as evidenced by the IMF's projected global growth slowdown to 2.9% in 2024, can reduce customer spending and delay project commitments for Hönle. Supply chain disruptions and fluctuating raw material costs, such as increases of up to 15% in certain metal prices in 2024, also threaten profit margins by raising operational expenses. Stricter environmental regulations, like the global mercury phase-out, necessitate costly product redesigns and could restrict market access if not met.

SWOT Analysis Data Sources

This SWOT analysis for Honle Group is constructed using a robust blend of financial statements, comprehensive market research, and insights from industry experts to provide a well-rounded and accurate strategic overview.