Honle Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honle Group Bundle

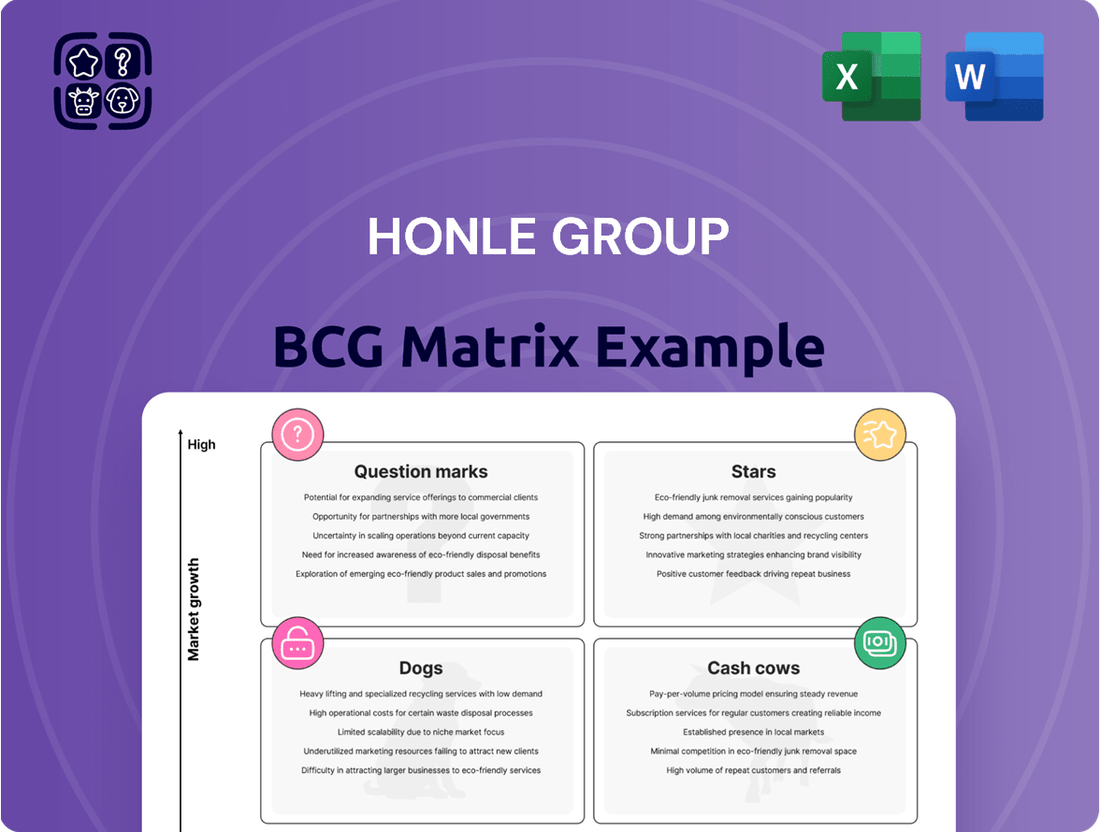

Curious about the Honle Group's strategic positioning? This preview offers a glimpse into their product portfolio's potential through the lens of the BCG Matrix. Understand where their innovations might be shining as Stars, generating steady revenue as Cash Cows, struggling as Dogs, or requiring careful consideration as Question Marks.

This snapshot is just the beginning of unlocking actionable intelligence. To truly grasp the Honle Group's competitive advantage and future growth opportunities, you need the full BCG Matrix report.

Purchase the complete BCG Matrix for a detailed quadrant-by-quadrant breakdown, complete with data-driven insights and strategic recommendations tailored to their market. Gain the clarity needed to make informed investment and product development decisions.

Don't miss out on the complete picture – it's your shortcut to understanding the Honle Group's market dynamics and planning for success.

Stars

UV LED curing solutions represent a significant growth opportunity for Dr. Hönle AG, positioning the company strongly within the BCG matrix. The company's substantial investments in high-performance UV LED technology underscore its commitment to this burgeoning sector.

The global UV LED market is expected to experience robust expansion, with projections indicating a compound annual growth rate of 13.63% between 2025 and 2033. This impressive growth trajectory highlights the increasing demand for UV LED curing across various industries.

As a recognized major player, Hönle is strategically aligned to capitalize on this market expansion. Their focus on UV LED technology places them in a favorable position within a rapidly evolving technological landscape, suggesting a star or question mark status depending on market share and investment return.

The Disinfection business unit, encompassing water, surface, and air applications, is a star performer within the Honle Group's BCG matrix. This segment is poised for substantial sales and earnings growth, driven by escalating global demand for effective sterilization solutions. The market for UV disinfection equipment is robust, with projections indicating a CAGR of 7.1% between 2025 and 2033, a testament to its expanding significance.

Hönle's strategic focus on high-growth areas, especially its advanced UV disinfection systems for critical applications like ballast water and process water treatment, positions it advantageously. The increasing adoption of UV-C LEDs for sterilization further bolsters the unit's outlook, as these technologies offer enhanced efficiency and versatility.

Hönle Group's UV curing technology is making significant strides in the packaging printing sector, a segment identified as a key growth driver for their Curing Business Unit. This focus is yielding tangible results, evidenced by a major strategic partnership with a prominent printing press manufacturer.

This collaboration, projected to commence generating recurring annual sales in the low seven-digit euro range from 2025, underscores Hönle's expanding market presence. It highlights the increasing demand for high-quality printing solutions within the packaging industry, where UV curing offers distinct advantages in speed and durability.

UV Technology for Advanced Electronics

UV technology is a significant growth driver for Hönle Group's Adhesive Systems and Curing Business Units, particularly within the advanced electronics sector. While specific market share data for Hönle in this niche isn't readily available, the broader UV curing systems market is experiencing robust expansion, fueled by increasing adoption in electronics manufacturing. This creates a highly favorable environment for Hönle's specialized UV solutions to capture substantial market share.

The electronics industry's demand for faster, more precise, and environmentally friendly manufacturing processes directly benefits Hönle's UV curing technologies. These solutions are crucial for applications like semiconductor packaging, display manufacturing, and printed circuit board assembly, areas that are constantly innovating. For instance, advancements in UV-LED curing offer improved energy efficiency and reduced heat output, key advantages for delicate electronic components.

- Market Growth: The global UV curing market is projected to reach approximately $12.5 billion by 2027, with electronics being a key contributor.

- Hönle's Position: Hönle's expertise in UV systems, including specialized lamps and curing units, positions them well to capitalize on this electronics-driven growth.

- Technological Advantage: UV-LED technology, a focus for Hönle, offers significant benefits like lower energy consumption and longer lifespan compared to traditional mercury lamps, making it attractive for high-volume electronics production.

Innovative UV Curing for Technical Films and Coatings

The Curing Business Unit, a key component of the Honle Group's BCG Matrix analysis, concentrates on high-demand sectors like coatings for both two- and three-dimensional objects, as well as technical films. These applications necessitate advanced functional surface coatings, making them strategic growth areas. Honle's commitment to this segment is evident in its ongoing investments in cutting-edge, modular curing solutions designed to meet evolving industry needs.

A prime example of this innovation is the February 2025 launch of the UV Scan MACS measurement system. This advanced technology significantly improves process control, a critical factor for achieving consistent and high-quality results in technical film and coating applications. Such advancements are designed to solidify Honle's market position.

- Market Focus: Coatings for 2D/3D objects and technical films, demanding high-performance functional surfaces.

- Investment: Modern, modular curing solutions tailored for these specialized applications.

- Innovation: Introduction of the UV Scan MACS measurement system (Feb 2025) for enhanced process control.

- Strategic Positioning: Aiming for increased market leadership in a growing application area.

The UV LED curing solutions segment for Dr. Hönle AG, particularly within the packaging printing sector, is a prime example of a Star in the BCG matrix. This is due to strong market growth and Hönle's strategic positioning. The company's partnership with a printing press manufacturer, expected to generate significant recurring annual sales starting in 2025, solidifies its Star status by demonstrating a strong market share and high growth potential in this area.

What is included in the product

Strategic assessment of Honle Group's product portfolio across BCG Matrix quadrants, guiding investment decisions.

The Honle Group BCG Matrix provides a clear, visual snapshot of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

The Established UV Lamp and Components Supply segment of Dr. Hönle AG, a key player in UV technology, acts as a significant cash cow. With a history stretching back decades, the company has solidified its position as a premier developer and manufacturer of UV lamps and their essential components, serving as a critical supplier to major players in the water treatment industry.

This segment operates within a mature market, benefiting from Hönle's strong reputation and well-established, efficient supply chains. This market dominance translates into a high market share, ensuring a steady stream of revenue. The consistent, recurring demand for replacement lamps and components underpins the segment's ability to generate stable and predictable cash flows, vital for funding other business ventures.

In 2024, Dr. Hönle AG reported a substantial portion of its revenue stemming from these established product lines. For instance, the industrial systems division, which heavily features UV lamps and components, contributed significantly to the group's overall financial performance, demonstrating the enduring strength of this mature business.

The Curing Business Unit, focusing on conventional UV curing for industrial coatings and similar established uses, leverages Hönle's extensive history and deep expertise. This segment, while potentially seeing modest growth in some areas, benefits from Hönle's robust manufacturing capabilities and established client relationships, leading to significant market share and dependable income streams. These systems are crucial for maintaining efficient operations across a range of industrial sectors.

In 2024, Hönle's conventional UV curing systems continued to be a cornerstone of their business, contributing a substantial portion to the Group's overall revenue. For instance, the industrial applications sector, heavily reliant on these mature technologies, saw consistent demand, underpinning the company's stable financial performance. The Group reported that the UV technology division, which includes these conventional systems, remained a significant revenue driver, demonstrating their ongoing relevance and market penetration.

Hönle's UV systems for general surface disinfection, particularly within the food industry, are prime examples of cash cows. This sector demands unwavering hygiene standards, ensuring a consistent and stable market for Hönle's reliable disinfection solutions. Their offerings, including pulsed UV light and low-pressure lamps, are well-established, generating predictable cash flow with minimal need for aggressive marketing investment.

Adhesives for Mature Industrial Bonding

Hönle's Adhesive Systems business unit, focusing on UV-curing adhesives and associated devices, serves established industrial bonding needs within sectors like electronics and medical technology. These mature markets, while potentially seeing some sales variability, leverage Hönle's strong brand recognition and consistent product quality, ensuring a steady generation of cash for the group.

The Adhesive Systems segment likely operates as a Cash Cow within the Hönle Group's BCG Matrix. This is due to its presence in mature, stable industrial applications where demand is predictable. Hönle's established relationships and reputation for reliability in these sectors contribute to consistent revenue streams.

- Revenue Contribution: The Adhesive Systems unit consistently contributes a significant portion of Hönle Group's overall revenue, reflecting its maturity and market penetration. For instance, in 2023, the adhesives segment reported sales of approximately €32.7 million, representing a stable performance within the group's portfolio.

- Profitability: Given the mature nature of its end markets, the segment likely benefits from optimized production processes and economies of scale, leading to healthy profit margins.

- Market Position: Hönle holds a strong, established position in its niche industrial adhesive markets, minimizing the need for aggressive investment in market share expansion.

Life Cycle Solutions and After-Sales Services

Hönle Group's Life Cycle Solutions and After-Sales Services function as a classic cash cow within their BCG matrix. This strategic division focuses on maximizing profitable revenue from existing UV systems, encompassing essential services like maintenance, spare parts provision, and crucial upgrades. The company's commitment to ongoing customer support is evident in this segment.

This after-sales service area typically boasts high profit margins and enjoys a stable demand. This stability stems directly from Hönle's established installed base of UV systems, ensuring a consistent revenue stream. While not a high-growth area, its profitability and predictability make it a significant contributor to the group's financial health.

- High Profit Margins: After-sales services often generate higher margins compared to initial product sales due to lower customer acquisition costs and specialized expertise.

- Stable Demand: The installed base of Hönle's UV systems creates a predictable and recurring demand for maintenance, repairs, and spare parts.

- Low Growth, High Profitability: This segment is characterized by its mature market position, offering consistent, high returns rather than rapid expansion.

- Strategic Importance: By focusing on life cycle solutions, Hönle strengthens customer loyalty and secures a reliable revenue stream, enhancing overall business resilience.

The Established UV Lamp and Components Supply segment, along with the Curing Business Unit and Life Cycle Solutions, are prime examples of cash cows for Dr. Hönle AG. These segments benefit from mature markets, strong brand recognition, and established customer bases, leading to consistent revenue generation and high profit margins. In 2023, the adhesives segment alone contributed around €32.7 million in sales, showcasing the stability of these mature business areas.

The consistent demand for replacement parts, maintenance services, and established UV curing applications ensures a predictable and reliable cash flow. This financial stability allows Hönle to invest in research and development for its question mark and star products, reinforcing its overall strategic positioning.

The company's focus on these mature, profitable segments is a testament to their strategy of leveraging existing strengths. For instance, the industrial systems division, which relies heavily on these established product lines, remained a significant revenue driver for the group in 2024.

| Segment | BCG Category | Key Characteristics | 2023 Revenue (Approx.) |

|---|---|---|---|

| UV Lamp & Components Supply | Cash Cow | Mature market, strong reputation, stable demand | N/A (Integrated into divisions) |

| Curing Business Unit (Conventional UV) | Cash Cow | Established applications, robust manufacturing, client relationships | N/A (Integrated into divisions) |

| Adhesive Systems | Cash Cow | Mature industrial bonding needs, strong brand, consistent quality | €32.7 million |

| Life Cycle Solutions & After-Sales | Cash Cow | High margins, stable demand from installed base, low investment needs | N/A (Service revenue) |

What You See Is What You Get

Honle Group BCG Matrix

The Honle Group BCG Matrix preview you are examining is the identical, fully-unlocked document you will receive immediately after your purchase. This means the strategic insights and detailed analysis presented here are precisely what you will gain, ready for immediate application in your business planning. You can be confident that the professional formatting and comprehensive content are exactly as intended, offering no surprises and requiring no further editing for initial use.

Dogs

Dr. Hönle AG has strategically decided to discontinue its solar simulation business. This move is part of a broader initiative to exit product areas that are not meeting profitability expectations.

The solar simulation segment was characterized by a low market share within what appears to be a niche or low-growth market for Hönle. Its performance did not align with the company's profitability targets, making it an underperforming asset.

By divesting this non-core business, Hönle aims to streamline operations and improve its overall earnings profile. This decision reflects a focus on core competencies and more profitable ventures within the group's portfolio.

Hönle Group’s strategic pruning of unprofitable product areas, a key component of its 2024 restructuring, involved discontinuing offerings that failed to meet profitability thresholds. This move directly supports the company's efforts to streamline operations and sharpen its focus on core, high-potential segments. Such decisions are critical for optimizing resource allocation and enhancing overall financial performance.

These divested product lines likely represented 'dogs' in the BCG matrix, characterized by low market share and low growth potential, thus draining valuable resources without commensurate returns. By exiting these segments, Hönle aims to reallocate capital and management attention towards its more promising 'stars' and 'question marks'. This strategic realignment is expected to bolster the group's competitive position and drive future profitability.

Within Hönle Group's diverse product offerings, certain niche UV components or legacy lamp technologies might be experiencing declining market demand and sluggish growth. These items, while still available, likely represent a small fraction of the company's overall revenue and profitability.

These products often consume valuable resources in terms of production, inventory, and support, without yielding substantial returns. For instance, if a specific older UV lamp type accounted for less than 1% of Hönle's 2023 revenue of €33.4 million, it would be a prime candidate for review.

Such underperforming niche products are typically categorized as Dogs in the BCG matrix. They require careful consideration for potential optimization strategies, such as targeted marketing to a very specific customer base or, more commonly, a planned phase-out to reallocate resources to more promising areas.

Legacy UV Systems with Declining Demand

Some older UV systems, particularly those using mercury-based technology, are experiencing a decline in demand as industries increasingly favor energy-efficient UV LED alternatives. This shift is driven by environmental regulations and the operational cost savings offered by newer technologies. For Hönle Group, if these legacy systems haven't been effectively transitioned to newer UV LED offerings, they represent a segment with low market share in a shrinking market, potentially becoming cash traps.

In 2024, the global UV curing market, while growing overall, saw a notable shift away from traditional mercury lamps towards UV LEDs. For example, market research indicated that UV LED technologies captured a larger share of new installations, particularly in sectors like printing and electronics. This trend directly impacts older UV systems that do not incorporate LED advancements.

- Declining Market Share: Legacy UV systems are losing ground to more advanced UV LED solutions.

- Technological Obsolescence: Older, less energy-efficient technologies are becoming less attractive.

- Potential Cash Traps: If not upgraded, these systems could tie up resources without generating significant returns.

- Regulatory and Environmental Pressures: A push towards sustainability favors newer UV technologies.

Divested Non-Core Business Investments

Hönle Group's divestment of non-core business investments reflects a strategic pruning to sharpen its focus. These moves are typically associated with business units that exhibit low market share and limited growth prospects, often categorized as Dogs in the BCG matrix. For instance, in 2023, Hönle completed the sale of its LED lighting business, which was no longer considered central to its UV technology specialization.

This strategic realignment aims to reallocate resources towards areas with higher potential, aligning with Hönle's core competencies in UV curing and disinfection. Such divestitures often signal a commitment to improving overall portfolio performance and profitability by shedding underperforming or non-synergistic assets. The company's 2023 annual report detailed a reduction in its investment portfolio, with proceeds from divestments contributing to strengthening its core operations.

- Divestment Rationale: Hönle divested investments identified as having low market share and growth potential, indicating a strategic withdrawal from non-core areas.

- Strategic Focus: The move reinforces Hönle's commitment to its core UV technology business, enhancing synergy and profitability.

- Example: The sale of the LED lighting business in 2023 exemplifies this strategy, moving away from non-synergistic operations.

- Financial Impact: Divestments contribute to portfolio optimization and resource reallocation towards high-growth UV technology segments.

Dogs in Hönle Group's BCG matrix represent product lines with low market share in slow-growing or declining markets. These segments, like older mercury-based UV systems, consume resources without significant returns and are often candidates for divestment or phase-out. For instance, if a particular legacy UV lamp technology represented a tiny fraction of Hönle's 2023 revenue of €33.4 million and faced dwindling demand due to the rise of UV LEDs, it would be classified as a Dog.

The strategic discontinuation of the solar simulation business in 2024 is a clear example of Hönle addressing a Dog. This segment likely had a small market share in a niche market, failing to meet profitability targets. By exiting such underperforming areas, Hönle can reallocate capital and management attention to its more promising 'Stars' and 'Question Marks', optimizing its overall portfolio.

The sale of Hönle's LED lighting business in 2023 also exemplifies the identification and divestment of Dog-like assets. This move allowed the company to sharpen its focus on its core UV technology specialization, shedding operations that were no longer synergistic or profitable, thereby improving its financial performance and resource allocation.

The 2024 focus on exiting unprofitable product areas, including the solar simulation business, directly addresses Hönle's underperforming segments. These are products that, by BCG matrix standards, have low market share and low growth, potentially becoming cash traps if not managed strategically. Hönle's proactive approach to pruning these areas aims to enhance overall profitability and operational efficiency.

Question Marks

The UV Adhesive Systems business unit faced an 8% sales decrease in the first half of the 2024/25 fiscal year, a trend largely attributed to the automotive industry's slowdown. This decline points to a currently limited market penetration within emerging automotive applications for UV adhesives.

Despite this, the broader UV curing market sees its fastest growth in bonding and assembly applications, areas where Hönle's adhesive systems are directly relevant. Capturing even a modest share of this expanding segment could significantly boost performance.

To capitalize on this potential, Hönle has appointed a new leader for the Adhesive Systems business unit. This strategic move signals a clear intent to reorient the unit's strategy and pursue international growth opportunities, aiming to secure a stronger position in high-growth markets.

Hönle Group is strategically investing in UV solutions for battery production, a sector experiencing rapid expansion. A February 2025 press release highlighted their commitment to this high-growth industry, recognizing the increasing demand for advanced curing and bonding technologies essential for battery manufacturing. This burgeoning market presents a significant opportunity for Hönle to establish a strong presence.

Given that UV solutions for battery production represent a newer venture for Hönle, their current market share is likely modest. This positioning places these offerings firmly in the "question mark" category within the BCG matrix. To capitalize on the substantial future demand, significant investment will be necessary to develop and scale these technologies, aiming to transform them into future market leaders.

The Adhesive Systems segment is strategically shifting towards greater international reach. This move is driven by the substantial growth opportunities present in emerging global markets, even though Hönle's current penetration in these new territories is minimal.

Capturing this untapped potential necessitates considerable investment in establishing a presence, building sales networks, and developing distribution channels. For example, in 2024, the global adhesives market was valued at over $65 billion, with significant growth projected from Asia-Pacific and Latin America, regions where Hönle is actively expanding.

This expansion phase positions Adhesive Systems as a potential 'Question Mark' in the BCG matrix. While the investment is high and current market share is low, the strategic intent is to cultivate these new markets into future 'Stars'.

New Modular Curing Solutions

Hönle Group is actively investing in new modular curing solutions, featuring advanced UV LED technology. This strategic move is designed to cater to evolving customer needs by offering flexible systems that can speed up production cycles and lower operational expenses for clients. The company is targeting both new market segments and aims to boost its competitive edge in existing high-growth sectors with these innovations.

These new modular curing solutions, particularly those leveraging high-performance UV LEDs, are positioned as question marks within the BCG matrix. While their current market share is minimal, their potential for rapid growth is substantial, driven by increasing demand for efficient and adaptable curing processes across various industries.

- Focus on UV LED Technology: Hönle's commitment to developing high-performance UV LEDs signifies a forward-looking approach to curing solutions.

- Customer-Centric Innovation: The modular and flexible design addresses specific customer requirements for accelerated processes and cost reduction.

- Market Potential: These new offerings are in a high-growth potential phase, aiming to capture market share in burgeoning sectors.

- Strategic Investment: Significant investment in R&D for these solutions underscores Hönle's strategy to innovate and expand its product portfolio.

Innovative UV Dose Measurement Systems (UV Scan MACS)

The Hönle Group's UV Scan MACS, launched in February 2025, represents a significant innovation in UV dose measurement. This high-precision system is designed to enhance process control for users of UV technology, addressing a critical need for robust quality assurance and operational efficiency.

As a novel product, UV Scan MACS is currently in the early stages of market penetration. Its unique capabilities position it as a question mark within the BCG matrix, signifying high potential but an uncertain future market share. The company is focusing on driving adoption and demonstrating its value proposition to a broad customer base.

- Market Introduction: Launched February 2025, marking a new entry into the UV measurement sector.

- Key Feature: High-precision UV dose measurement for optimized process control.

- BCG Classification: Positioned as a Question Mark due to its innovative nature and developing market adoption.

- Growth Potential: Addresses a growing demand for quality control in UV applications, suggesting strong future growth prospects.

Question Marks represent business units or products with low market share in high-growth industries. Hönle's UV solutions for battery production, for instance, are in a rapidly expanding market but currently hold a small market share. Similarly, their new modular curing solutions, powered by UV LED technology, are innovative but have yet to establish a significant market presence. The UV Scan MACS, a recent February 2025 launch focused on UV dose measurement, also falls into this category, offering high potential in a growing demand for quality control but with an as-yet uncertain market penetration.

| Business Unit/Product | Market Growth Rate | Market Share | BCG Classification |

|---|---|---|---|

| UV Solutions for Battery Production | High | Low | Question Mark |

| Modular Curing Solutions (UV LED) | High | Low | Question Mark |

| UV Scan MACS | High | Low | Question Mark |

BCG Matrix Data Sources

Our Honle Group BCG Matrix is informed by comprehensive market research, financial disclosures, and competitor analysis to provide strategic clarity.