Hochtief Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Discover how Hochtief leverages its Product, Price, Place, and Promotion strategies to dominate the global construction market. This analysis reveals their approach to complex project delivery, competitive bidding, international presence, and strategic communication.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Hochtief. Ideal for business professionals, students, and consultants looking for strategic insights into the construction industry.

Explore how this brand’s product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success in large-scale infrastructure and building projects. Get the full analysis in an editable, presentation-ready format.

Product

Hochtief's Integrated Infrastructure Solutions represent their Product strategy, offering a complete spectrum of services from initial development and design through construction, operation, and ongoing maintenance. This end-to-end capability provides clients with a unified point of contact for major infrastructure projects, streamlining complex undertakings and ensuring continuous support. For instance, in 2024, Hochtief secured significant contracts for large-scale transport and energy infrastructure projects, highlighting their capacity to manage the entire lifecycle.

Hochtief’s specialized infrastructure focus is a key element of its marketing mix. The company concentrates on major transportation, energy, and urban infrastructure projects, building deep expertise in these vital areas. This specialization allows Hochtief to cater to sectors experiencing robust global investment, including data centers, renewable energy, and high-tech facilities, positioning them for growth.

Hochtief's advanced technology and digital infrastructure focus is evident in its growing portfolio of high-tech construction projects. This includes significant work in data centers, semiconductor manufacturing facilities, and electric vehicle battery plants, sectors demanding cutting-edge precision and digital integration.

To support these complex projects, Hochtief is heavily investing in digital tools. Building Information Modeling (BIM) is a cornerstone, enabling detailed digital representations of projects from conception to completion. This is complemented by real-time monitoring systems and AI-driven project management solutions, aimed at boosting efficiency and ensuring the successful delivery of technologically advanced infrastructure.

Sustainable and Resilient Infrastructure

Hochtief's product portfolio heavily emphasizes sustainable and resilient infrastructure, a core component of their market offering. This commitment is underscored by their ambitious target of achieving climate neutrality by 2045, supported by interim goals for reducing greenhouse gas emissions and implementing circular economy principles. For instance, in 2023, Hochtief reported a 15% reduction in Scope 1 and 2 emissions compared to their 2019 baseline, demonstrating tangible progress towards their climate goals.

Their focus on sustainable projects is evident in the development of advanced data centers. These facilities are designed with a strong emphasis on integrating renewable energy sources and employing innovative liquid cooling systems. This approach not only aligns with global decarbonization efforts but also positions Hochtief to capitalize on the growing demand for green infrastructure, attracting investment from dedicated green infrastructure funds. The company's pipeline for 2024-2025 includes several significant data center projects with a projected renewable energy mix exceeding 70%.

- Climate Neutrality Target: Hochtief aims for climate neutrality by 2045.

- Emission Reduction: Achieved a 15% reduction in Scope 1 and 2 emissions by 2023 (vs. 2019 baseline).

- Project Focus: Prioritizes renewable energy and liquid cooling in data center projects.

- Market Opportunity: Taps into the growing green infrastructure investment sector.

Public-Private Partnerships (PPPs)

Hochtief’s engagement in Public-Private Partnerships (PPPs) represents a strategic evolution, moving beyond traditional construction to encompass ownership and operation of critical infrastructure. This approach is evident in their involvement with assets like data centers, where they secure long-term, stable revenue streams.

This PPP model allows Hochtief to capitalize on its established expertise in project execution and engineering, translating this into sustained growth. The company is particularly focused on sectors identified as having high strategic importance, leveraging these partnerships for ongoing development and market penetration.

- Revenue Diversification: PPPs provide Hochtief with predictable, long-term income streams, reducing reliance on cyclical construction cycles.

- Leveraging Expertise: The company’s deep engineering and project management capabilities are directly applied to the operational phase of PPP projects, enhancing efficiency and profitability.

- Strategic Sector Focus: Hochtief prioritizes PPPs in growth areas such as digital infrastructure (data centers) and sustainable energy solutions, aligning with global trends.

- Risk Mitigation: By sharing project risks with public sector partners, Hochtief can undertake larger, more complex projects with a more manageable risk profile.

Hochtief's product strategy centers on delivering integrated, sustainable, and digitally enabled infrastructure solutions. They manage projects from conception through operation, focusing on key sectors like transportation, energy, and advanced technology facilities. Their commitment to sustainability is backed by a 2045 climate neutrality target and demonstrated emission reductions, as seen with a 15% decrease in Scope 1 and 2 emissions by 2023 compared to 2019.

| Product Offering | Key Features | 2023/2024 Data Points |

|---|---|---|

| Integrated Infrastructure Solutions | End-to-end project lifecycle management (design, build, operate, maintain) | Secured significant transport and energy infrastructure contracts in 2024. |

| Specialized Infrastructure Focus | Expertise in transportation, energy, urban infrastructure, data centers, renewable energy, EV battery plants | Focus on sectors with robust global investment. |

| Digital & Technology Integration | Advanced digital tools (BIM), real-time monitoring, AI-driven project management | Growing portfolio of high-tech construction projects. |

| Sustainable & Resilient Infrastructure | Climate neutrality by 2045, circular economy principles, renewable energy integration, advanced cooling systems in data centers | 15% reduction in Scope 1 & 2 emissions (vs. 2019) by 2023; Data center projects in 2024-2025 pipeline with >70% renewable energy mix. |

What is included in the product

This analysis offers a comprehensive examination of Hochtief's marketing strategies, delving into its Product, Price, Place, and Promotion tactics with real-world examples and strategic insights.

Simplifies complex marketing strategies into actionable 4Ps, alleviating the pain of overwhelming data for informed decision-making.

Provides a clear, concise overview of Hochtief's marketing approach, resolving confusion and streamlining strategic alignment.

Place

Hochtief boasts a significant global reach, strategically concentrating its operations in North America, Australia, and Europe. This international presence is managed through its key operating companies, including Turner in the US, CIMIC in Australia and Asia, and Hochtief Europe, enabling the company to tap into diverse economic cycles and project pipelines.

In 2023, the Americas region, largely driven by Turner, contributed approximately €15.1 billion to Hochtief's total revenue. Australia, through CIMIC, generated around €11.4 billion, while Europe accounted for roughly €7.8 billion, showcasing the substantial impact of these core geographical markets on the group's overall performance.

HOCHTIEF strategically concentrates its efforts on markets exhibiting robust growth, evidenced by its significant involvement in data center construction across Germany, the United States, and the Asia Pacific region. This targeted approach allows the company to capitalize on escalating demand for digital infrastructure.

Further demonstrating this focus, HOCHTIEF is actively pursuing renewable energy projects, particularly in Australia, where government initiatives and private investment are driving substantial expansion in this sector. These strategic selections ensure resource allocation aligns with high-demand areas, bolstering their ability to secure substantial contracts.

Hochtief's direct client engagement strategy is central to its success in securing and executing large-scale, complex infrastructure and building projects. This approach fosters deep partnerships with both public sector entities and private developers, enabling the company to offer highly customized solutions that precisely meet client needs.

By working directly, Hochtief maintains control over the entire project lifecycle, from the initial conceptualization and development phases through to construction and ongoing operations and maintenance. This integrated involvement allows for greater efficiency and a more holistic understanding of project requirements. For instance, in 2023, Hochtief reported a strong order backlog, with a significant portion stemming from these direct client relationships, underscoring the effectiveness of this engagement model in securing future revenue streams.

Integrated Project Delivery Model

Hochtief's 'place' strategy hinges on its Integrated Project Delivery (IPD) model, which encompasses development, financing, design, construction, and often operations. This holistic approach simplifies the process for clients by offering a single point of responsibility. For example, Hochtief's involvement in major infrastructure projects, such as the ongoing expansion of the Sydney Metro in Australia, showcases this integrated capability, managing complex timelines and stakeholder requirements from inception to completion.

This comprehensive service delivery allows Hochtief to maintain tighter control over project execution, ensuring quality and efficiency throughout the lifecycle. By internalizing or closely managing various project phases, they can optimize resource allocation and mitigate risks more effectively. This strategy was evident in their successful delivery of the new Brisbane Airport International Terminal, a project that demanded seamless coordination across multiple disciplines.

The IPD model positions Hochtief as a value-added partner rather than just a contractor. This strategic placement in the value chain enables them to capture greater value and build stronger, long-term client relationships. In 2024, Hochtief reported a significant portion of its order backlog stemming from these complex, integrated projects, underscoring the model's commercial success.

- Integrated Service Offering: Development, financing, design, construction, and operations management.

- Client Simplification: Reduces complexity for clients by providing a single point of contact and accountability.

- Enhanced Control: Greater oversight over project execution, quality, and risk management.

- Value Capture: Positions Hochtief higher in the project value chain, leading to increased profitability and client loyalty.

Leveraging Subsidiaries and Joint Ventures

Leveraging its extensive network of subsidiaries and strategic joint ventures is a core element of HOCHTIEF's market strategy, enabling significant project execution and market penetration. These collaborations are crucial for accessing specialized expertise and financial capacity for complex, large-scale endeavors.

The FlatironDragados joint venture in North America exemplifies this approach, demonstrating HOCHTIEF's ability to form powerful partnerships for major infrastructure projects. This strategy allows for the pooling of resources and risk-sharing, which is particularly beneficial in the current economic climate where large capital investments are required.

- Market Reach Expansion: Subsidiaries and JVs allow HOCHTIEF to enter new geographic markets and secure a broader range of projects, as seen with its significant presence in the North American infrastructure sector.

- Expertise Pooling: Collaborations enable the integration of diverse technical skills and knowledge, essential for tackling highly specialized construction challenges.

- Risk Mitigation: Joint ventures distribute financial and operational risks across multiple partners, making ambitious projects more feasible and manageable.

- Project Scale: This model is vital for undertaking mega-projects that might exceed the capacity or risk appetite of a single entity.

HOCHTIEF's strategic placement emphasizes its global operational footprint and its focus on key growth markets. The company's presence in North America, Australia, and Europe, managed through subsidiaries like Turner and CIMIC, allows it to capitalize on diverse economic cycles and project pipelines. By concentrating on areas like data center construction and renewable energy projects, particularly in Australia, HOCHTIEF aligns its resources with high-demand sectors.

The company's Integrated Project Delivery (IPD) model is a cornerstone of its market strategy, offering clients a comprehensive solution from development to operations. This single point of accountability simplifies complex projects for clients and allows HOCHTIEF greater control over execution, quality, and risk. For instance, its involvement in the Sydney Metro expansion highlights this integrated capability, managing intricate timelines and stakeholder needs. In 2023, a substantial portion of HOCHTIEF's order backlog was attributed to these complex, integrated projects, demonstrating the model's commercial viability.

HOCHTIEF further leverages its market reach through strategic joint ventures, such as the FlatironDragados venture in North America, which enables participation in major infrastructure projects. These collaborations are crucial for accessing specialized expertise and financial capacity, essential for large-scale endeavors. This approach is vital for undertaking mega-projects that might otherwise exceed the capacity or risk appetite of a single entity.

| Region | 2023 Revenue (approx. € billion) | Key Subsidiaries | Strategic Focus Areas |

|---|---|---|---|

| Americas | 15.1 | Turner | Infrastructure, Data Centers |

| Australia | 11.4 | CIMIC | Infrastructure, Renewable Energy |

| Europe | 7.8 | Hochtief Europe | Infrastructure, Data Centers |

What You Preview Is What You Download

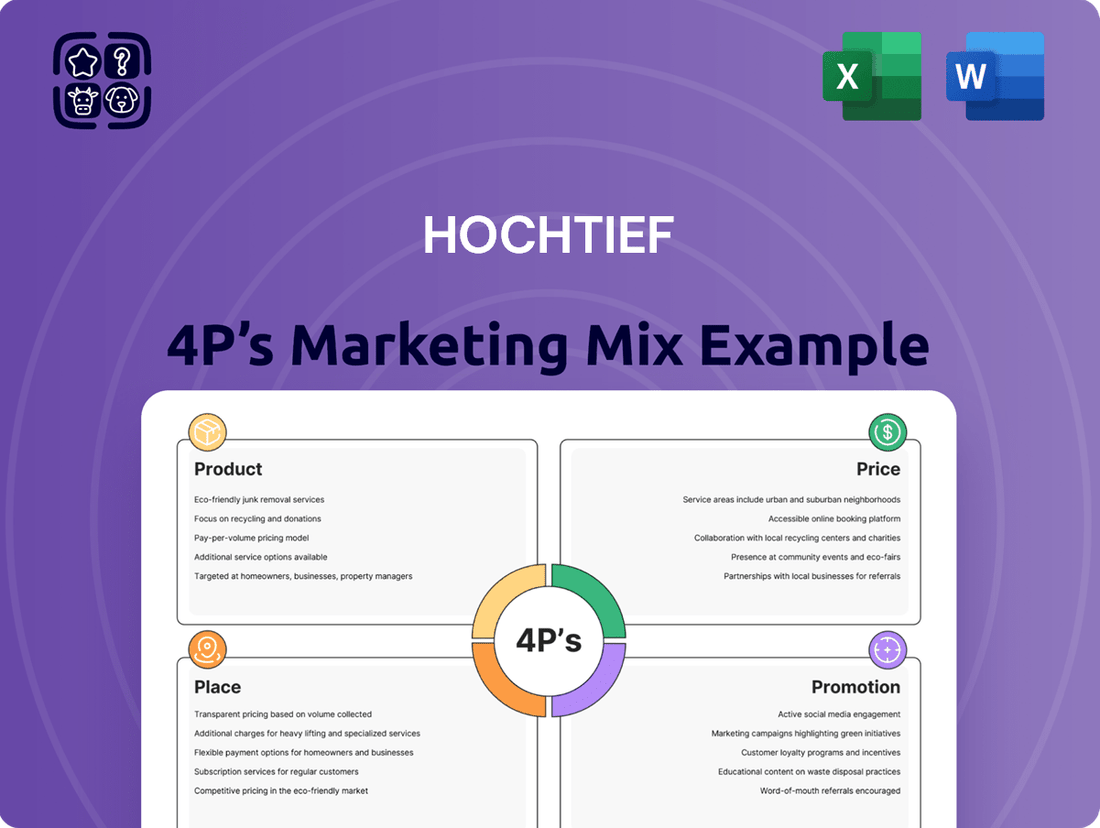

Hochtief 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hochtief 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You can confidently acquire the exact same detailed report that outlines Hochtief's strategic approach to product, price, place, and promotion.

Promotion

Hochtief's deep roots, stretching back to its founding in 1873, have cultivated a formidable global reputation. This long-standing history is a powerful promotional tool, underscoring its expertise in handling complex infrastructure and construction projects. This established credibility consistently attracts significant international clients and major project wins, as evidenced by its consistent performance in securing large-scale contracts.

Hochtief consistently showcases its prowess through a diverse portfolio of completed high-profile projects. This includes significant undertakings in transportation, energy, and urban development, demonstrating their broad expertise.

For instance, their involvement in major data center campuses and critical airport modernizations, such as the expansion of Sydney Airport which saw significant progress in 2024, serves as tangible proof of their capabilities. These completed projects act as powerful endorsements of their delivery capacity and technical skill.

Hochtief's promotion heavily emphasizes investor relations, a crucial element for financial stakeholders. This includes detailed annual and half-year reports, alongside presentations that highlight robust financial performance, significant contract acquisitions, and clear future growth trajectories. For instance, in 2023, Hochtief reported a net profit of €372 million, demonstrating its consistent financial strength and strategic execution.

This commitment to transparency is designed to cultivate trust and confidence among investors and financial analysts. By clearly communicating its achievements, such as securing major projects like the Sydney Metro West project, Hochtief reinforces its market position and its ability to deliver on its strategic objectives, thereby attracting and retaining capital.

Sustainability and ESG Reporting

Hochtief actively champions its dedication to sustainability and robust Environmental, Social, and Governance (ESG) performance, as detailed in its Sustainability Plan 2025. This strategic focus is crucial for attracting clients and investors increasingly prioritizing environmental stewardship and responsible corporate practices.

The company's sustainability initiatives are designed to resonate with a market that values long-term resilience and ethical operations. By showcasing progress in areas like climate neutrality and circular economy principles, Hochtief positions itself as a forward-thinking leader in the construction sector.

- Climate Neutrality Goals: Hochtief aims for climate neutrality by 2045, with significant interim targets for emissions reduction.

- Circular Economy Focus: The company is committed to increasing the use of recycled materials and reducing waste in its projects.

- Social Responsibility: This includes a strong emphasis on health and safety for its workforce and engagement with local communities.

- ESG Reporting Transparency: Hochtief provides detailed ESG reports, allowing stakeholders to track its performance against sustainability objectives.

Participation in Industry Events and Thought Leadership

Hochtief actively cultivates its industry presence through participation in key events and by fostering thought leadership. This strategic approach aims to highlight the company's innovative capabilities and forward-thinking strategies within the global construction and infrastructure landscape.

By engaging in prominent industry conferences and contributing to specialized publications, Hochtief reinforces its position as a leader. This visibility is crucial for showcasing technological advancements and shaping market perceptions, thereby attracting new business opportunities and partnerships.

- Industry Conferences: Hochtief likely participates in major global construction and infrastructure forums, such as the World Economic Forum's infrastructure initiatives or regional construction expos, to present its projects and insights.

- Thought Leadership: The company probably publishes white papers, case studies, and articles in leading industry journals, demonstrating expertise in areas like sustainable construction and digital transformation in infrastructure.

- Technological Showcases: Events provide a platform to exhibit cutting-edge technologies and methodologies employed by Hochtief, such as advanced BIM (Building Information Modeling) or prefabrication techniques, which are increasingly important in project delivery efficiency.

- Market Perception: Consistent engagement in these activities helps to build and maintain a strong brand reputation, positioning Hochtief as a reliable and innovative partner for complex infrastructure development.

Hochtief's promotional efforts are multifaceted, leveraging its long history, project successes, and financial transparency. Its robust investor relations, including detailed reports highlighting achievements like the €372 million net profit in 2023, build confidence. Furthermore, a strong emphasis on sustainability, with goals for climate neutrality by 2045 and circular economy practices, appeals to a growing market segment. Active participation in industry events and thought leadership initiatives solidify its image as an innovative and reliable global player.

Price

Hochtief's approach to pricing its large-scale, complex infrastructure projects is strongly rooted in value-based principles. This means their pricing reflects the significant specialized expertise, the seamless integration of diverse services, and the enduring value delivered to clients, rather than just the cost of materials and labor.

This strategy allows Hochtief to secure competitive pricing that aligns with the substantial benefits and long-term advantages their comprehensive solutions offer. For instance, in 2024, the global infrastructure spending forecast remained robust, with projections suggesting continued growth, underscoring the demand for high-value construction services.

Hochtief actively engages in competitive bidding for both public and private tenders. In these processes, pricing is a fundamental element, weighed alongside the company's technical expertise and proven history of successful project completion.

The company's success in securing substantial contracts, even amidst demanding market conditions, underscores its competitive pricing strategies. For instance, in 2024, Hochtief secured a significant contract for the development of a new high-speed rail line in Germany, a project valued at over €2 billion, demonstrating their ability to offer compelling bids in highly contested tenders.

In Public-Private Partnership (PPP) models, pricing structures for Hochtief go beyond upfront construction. They encompass long-term operational and maintenance fees, creating predictable, recurring revenue. This approach reflects the total lifecycle cost and value of the asset, offering financial stability.

For instance, in 2024, PPP projects often feature availability payments or shadow tolls, where Hochtief receives payments based on the asset's availability and performance rather than direct user fees. This shifts risk and ensures consistent income streams, a key advantage in long-term contracts.

Risk-Adjusted Pricing

Hochtief's strategic move towards lower-risk projects, now representing over 85% of its order backlog, indicates a pricing approach that actively accounts for risk. This focus on stability and profitability, even amidst market fluctuations, is a key element of their risk-adjusted pricing strategy.

This strategy likely involves more sophisticated risk assessment and mitigation techniques, translating into contract terms that better reflect potential uncertainties. For instance, by securing a significant portion of revenue from less volatile, fixed-price or cost-plus contracts, Hochtief can better predict and manage project costs and profitability.

- Reduced Exposure to Volatility: Over 85% of Hochtief's order book consists of lower-risk contracts, minimizing exposure to unforeseen project cost escalations.

- Enhanced Profitability Safeguards: Pricing models are adjusted to incorporate risk premiums, ensuring stable margins even in challenging economic environments.

- Strategic Contract Selection: A deliberate focus on contracts with clearer scope and payment terms allows for more accurate cost forecasting and pricing.

Market Demand and Economic Conditions Influence

Hochtief's pricing strategies are significantly shaped by market demand, particularly in high-growth sectors such as data centers and renewable energy. The robust demand in these areas allows for the implementation of premium pricing models, reflecting the specialized nature and critical infrastructure these projects represent. For instance, the global data center construction market was projected to reach over $200 billion by 2025, indicating substantial pricing potential.

Furthermore, broader economic conditions and government infrastructure stimulus packages play a crucial role in determining Hochtief's pricing power and the overall viability of its projects. Favorable economic climates and active infrastructure spending, such as the EU's €800 billion NextGenerationEU recovery plan, can bolster demand and create opportunities for more advantageous project pricing.

- Data Center Growth: Global data center construction market expected to exceed $200 billion by 2025, supporting premium pricing.

- Renewable Energy Demand: Increasing global investment in renewable energy infrastructure, estimated to reach trillions by 2030, drives demand for specialized construction services.

- Infrastructure Stimulus: Programs like NextGenerationEU provide significant funding for infrastructure development, enhancing project viability and pricing.

- Economic Sensitivity: Pricing power is directly influenced by overall economic health and government spending on infrastructure projects.

Hochtief's pricing for its extensive project portfolio is a sophisticated blend of value-based assessment and competitive market positioning. The company leverages its deep expertise and integrated service offerings to justify premium pricing, particularly in high-demand sectors like data centers and renewable energy.

This strategy is evident in their successful bidding for major projects, such as the over €2 billion high-speed rail line contract secured in 2024. Their pricing reflects not just immediate costs but also the long-term value and risk management embedded in their solutions, especially within PPP frameworks where lifecycle costs and availability payments are key.

The company's focus on lower-risk contracts, comprising over 85% of its backlog as of early 2025, further demonstrates a pricing approach that prioritizes stability and predictable profitability by incorporating risk premiums.

| Metric | Value | Year | Source/Context |

|---|---|---|---|

| High-Speed Rail Contract Value | €2 billion+ | 2024 | Hochtief Secured Contract |

| Data Center Market Growth Projection | >$200 billion | 2025 | Global Market Forecast |

| Low-Risk Contracts in Backlog | >85% | Early 2025 | Company Reporting |

4P's Marketing Mix Analysis Data Sources

Our Hochtief 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, project portfolios, and public financial disclosures. We also leverage industry-specific market research and competitor analysis to provide a robust understanding of their strategies.