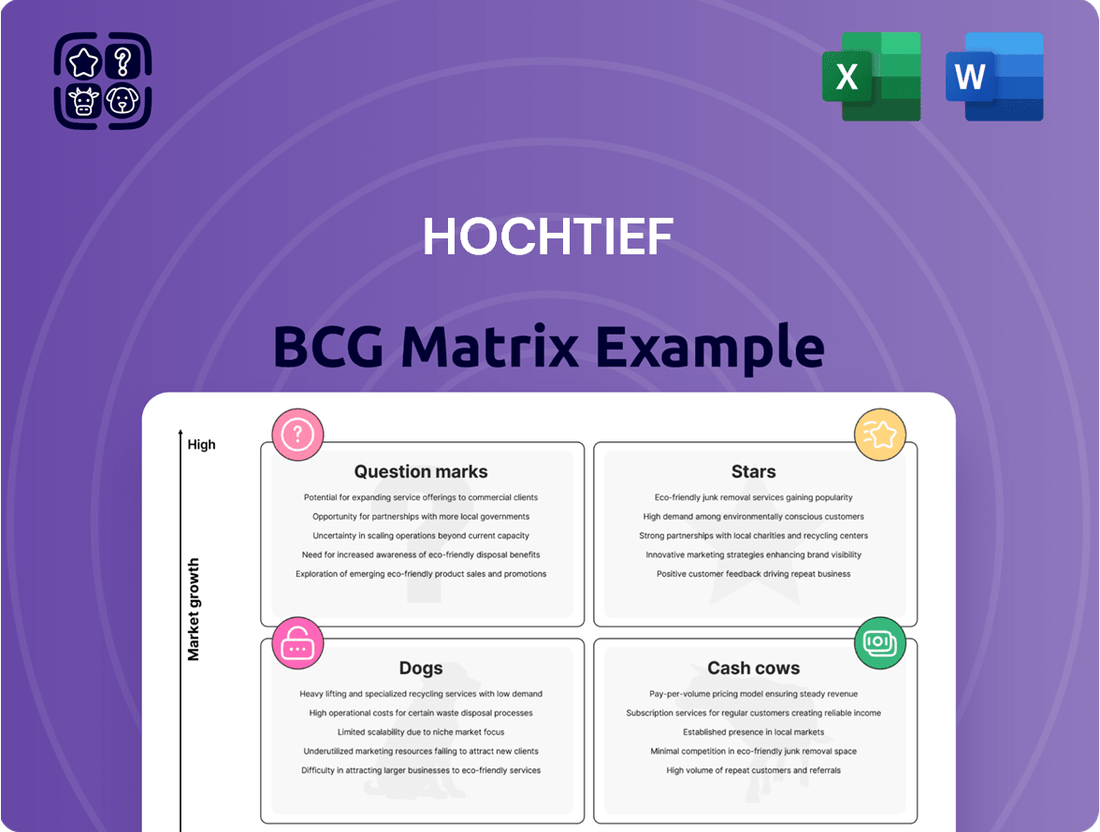

Hochtief Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Curious about where Hochtief's diverse portfolio of construction projects and services truly shines? Our preview of the Hochtief BCG Matrix offers a glimpse into its strategic positioning, highlighting potential Stars and Cash Cows. Don't miss out on the full picture; purchase the complete report to unlock detailed quadrant analysis, identify resource-draining Dogs, and pinpoint promising Question Marks for future investment and growth.

Stars

HOCHTIEF is making significant strides in the high-tech infrastructure sector, focusing on data centers and semiconductor fabrication plants. This strategic push aligns with the booming demand fueled by digitalization and artificial intelligence. The company is actively securing large-scale projects, demonstrating its commitment to this lucrative market segment.

Recent contract wins highlight HOCHTIEF's growing influence, including a substantial data center campus in Louisiana and various projects across Asia and Europe. For instance, their subsidiary CIMIC is involved in major infrastructure developments. This expansion is critical as global demand for digital infrastructure continues to surge, with data center construction alone projected for significant growth through 2025 and beyond.

The global energy transition is a significant growth area for Hochtief, with the company actively securing projects in renewable energy infrastructure. This includes substantial investments in solar farms and large-scale battery storage systems, crucial components for grid stability. By 2024, the renewable energy sector saw continued robust investment, with global clean energy investment reaching an estimated $1.7 trillion, according to the International Energy Agency (IEA), highlighting the market's potential.

Global infrastructure stimulus packages are fueling significant growth in new mobility concepts, particularly advanced rail and electric vehicle (EV) infrastructure. Hochtief is strategically positioned to capitalize on this trend, having secured substantial rail contracts in North America and Germany. For instance, in 2023, Hochtief secured a major contract for the California High-Speed Rail project, valued at over $1 billion.

The company is also actively involved in the burgeoning EV sector, including the construction of EV battery production facilities. This diversification into critical future transportation and energy sectors highlights Hochtief's expanding market share. In 2024, Hochtief announced its involvement in building a new gigafactory for a major automotive manufacturer in Europe, further solidifying its presence in the EV supply chain.

Complex Transport Infrastructure

Hochtief's Complex Transport Infrastructure segment is a clear star in its BCG matrix. The company consistently secures and successfully executes large-scale projects like the Sydney Metro City & Southwest project, a testament to their expertise in intricate rail networks. This segment benefits from ongoing global investment in transportation upgrades, ensuring sustained demand for Hochtief's specialized capabilities. Their significant order backlog, often exceeding €10 billion in this area, underscores their leading market share and strong future revenue potential.

- Strong Market Position: Hochtief excels in complex transport infrastructure, including major bridges and tunnels.

- Sustained Demand: Global investment in transportation networks drives consistent demand for these high-value projects.

- Robust Order Backlog: A substantial order book in this segment reinforces its star status and future revenue.

Defense and Social Infrastructure

Defense and Social Infrastructure are key growth areas for Hochtief, capitalizing on rising global defense budgets and the persistent need for healthcare and education facilities.

Hochtief's strategic focus on these sectors is paying off, with a robust defense order book and continued success in securing healthcare and education projects. For instance, in 2023, Hochtief’s order intake in the infrastructure segment, which includes defense and social infrastructure, demonstrated strong performance, contributing significantly to the group's overall revenue.

Subsidiaries like Turner are instrumental in this expansion, actively winning contracts in the healthcare and education space. This highlights Hochtief's capability to deliver complex projects that meet critical societal needs, further solidifying its market position.

- Growing Defense Market: Global defense spending is projected to continue its upward trend, driven by geopolitical shifts and national security priorities.

- Social Infrastructure Demand: The need for modern healthcare facilities and improved educational infrastructure remains a constant, offering sustained opportunities.

- Hochtief's Strong Pipeline: The company has a substantial order backlog in defense and is actively securing new projects in healthcare and education.

- Subsidiary Contributions: Turner, a key Hochtief subsidiary, plays a vital role in winning and executing projects within the social infrastructure domain.

HOCHTIEF's Complex Transport Infrastructure segment is a clear star in its BCG matrix. The company consistently secures and successfully executes large-scale projects like the Sydney Metro City & Southwest project, a testament to their expertise in intricate rail networks. This segment benefits from ongoing global investment in transportation upgrades, ensuring sustained demand for HOCHTIEF's specialized capabilities. Their significant order backlog, often exceeding €10 billion in this area, underscores their leading market share and strong future revenue potential.

HOCHTIEF's commitment to the high-tech infrastructure sector, particularly data centers and semiconductor fabrication plants, positions it strongly for future growth. This focus aligns with the accelerating demand driven by digitalization and artificial intelligence. The company's recent contract wins, including a major data center campus in Louisiana and projects across Asia and Europe, highlight its expanding influence in this critical market.

The global energy transition represents another significant growth area for HOCHTIEF, with substantial investments in renewable energy infrastructure like solar farms and battery storage systems. By 2024, global clean energy investment was projected to reach approximately $1.7 trillion, underscoring the immense market potential HOCHTIEF is tapping into.

HOCHTIEF is strategically capitalizing on global infrastructure stimulus packages, particularly in new mobility concepts like advanced rail and electric vehicle (EV) infrastructure. Their success in securing major rail contracts, such as the California High-Speed Rail project, and involvement in building EV gigafactories in Europe demonstrates their forward-looking approach.

| Segment | BCG Category | Key Drivers | 2024 Data/Outlook |

|---|---|---|---|

| Complex Transport Infrastructure | Star | Global infrastructure investment, urbanization | Order backlog > €10bn; Sydney Metro project success |

| High-Tech Infrastructure (Data Centers, Semiconductor Plants) | Star | Digitalization, AI, cloud computing growth | Securing large-scale data center projects globally |

| Renewable Energy Infrastructure | Star | Energy transition, climate initiatives | Investments in solar, battery storage; global clean energy investment ~$1.7 trillion (IEA) |

| Defense and Social Infrastructure | Question Mark/Potential Star | Geopolitical shifts, increased defense spending, societal needs | Robust defense order book; strong pipeline in healthcare/education |

What is included in the product

The Hochtief BCG Matrix analyzes its business units by market share and growth, guiding investment decisions.

A clear visual representation of Hochtief's business units, simplifying strategic resource allocation.

Cash Cows

Hochtief's traditional civil engineering operations, encompassing roads, bridges, and general infrastructure, represent a bedrock of its business. This segment leverages decades of experience, offering a reliable and mature revenue stream that is less susceptible to the fluctuations often seen in newer or more volatile markets.

These core activities are characterized by established processes, strong client relationships, and a proven track record of successful project delivery, all of which contribute to consistent cash flow generation. For instance, in 2023, Hochtief's infrastructure segment, which heavily features traditional civil engineering, reported a significant contribution to the group's overall performance, demonstrating its stability.

This segment typically demands lower investment for growth compared to more dynamic business areas, yet it maintains a high market share due to its expertise and established reputation. This allows Hochtief to generate substantial cash, which can then be strategically allocated to other parts of the business, such as its growth-oriented segments.

Hochtief's commercial and general building segment, particularly in mature markets, functions as a robust cash cow. This sector, encompassing large-scale commercial structures, airports, and sports arenas, benefits from Hochtief's established market position and strong reputation, leading to consistent profitability and cash flow. For instance, in 2023, Hochtief's net profit attributable to shareholders was €341 million, with a significant portion stemming from these stable, mature operations.

Hochtief's 20% ownership in Abertis, a major global toll road operator, positions this investment as a classic Cash Cow within its portfolio. This stake is a mature asset, consistently delivering stable and predictable earnings to Hochtief.

Toll road concessions, like those operated by Abertis, are generally long-term ventures with limited growth prospects. However, they are renowned for generating substantial and consistent cash flows, requiring minimal additional capital investment from Hochtief. For instance, Abertis's robust performance in 2023 saw significant revenue growth driven by traffic recovery and toll adjustments across its extensive network.

This reliable income stream from Abertis serves as a crucial and dependable source of funding for Hochtief's broader strategic initiatives and operations, underpinning its financial stability.

Long-term Operations & Maintenance Contracts

Hochtief's long-term operations and maintenance contracts are a significant contributor to its stable cash flow. These agreements, often spanning many years, leverage the company's expertise in managing complex infrastructure post-construction, ensuring consistent revenue streams with typically high profit margins.

These contracts are classic Cash Cows within the BCG matrix, characterized by high market share in a low-growth sector. Hochtief's ability to offer full lifecycle services, from initial build to ongoing upkeep, solidifies its position and reduces the inherent risks associated with individual projects. For instance, in 2024, the infrastructure services segment, which includes O&M, continued to be a bedrock of the company's financial stability, demonstrating the enduring value of these long-term commitments.

- Recurring Revenue: O&M contracts provide a predictable income stream, unlike the more cyclical nature of pure construction projects.

- High Profitability: Established operational efficiencies and specialized knowledge allow for strong profit margins on these services.

- Reduced Risk: Long-term agreements mitigate the volatility and project-specific risks often seen in the construction phase.

- Market Dominance: Hochtief's integrated approach to infrastructure development and maintenance fosters a dominant market share in this segment.

Established Public-Private Partnerships (PPPs)

Established Public-Private Partnership (PPP) projects represent a significant Cash Cow for Hochtief. These mature ventures, often in the operational phase, are characterized by long-term concession agreements that generate consistent, albeit low-growth, revenue streams. Hochtief's extensive history in developing and managing these complex projects ensures predictable, high-margin cash flows, reinforcing its stable market position.

Hochtief's portfolio includes numerous operational PPPs, such as highway concessions and infrastructure management contracts, which are crucial for its steady income. For instance, in 2024, the company continued to benefit from its stake in the A1 motorway concession in Germany, a project with decades of operational life remaining. These projects typically offer stable returns, often exceeding 10% EBITDA margins, due to their low risk profile and essential service nature.

- Mature PPPs provide predictable, stable income.

- Long-term concession agreements ensure low-growth, high-margin cash flows.

- Hochtief's extensive experience in PPPs solidifies its market leadership and revenue stability.

- Operational PPPs in 2024 continued to be a core driver of Hochtief's profitability.

Hochtief's established infrastructure projects, particularly those in mature markets like roads and bridges, function as key Cash Cows. These operations benefit from high market share due to decades of expertise and strong client relationships, generating consistent and predictable revenue streams. For example, in 2023, the company's infrastructure segment demonstrated resilience, contributing significantly to overall group performance.

These mature segments require relatively low capital investment for growth, allowing Hochtief to extract substantial cash. This reliable cash flow is vital for funding investments in higher-growth areas of the business. The stability of these operations is further evidenced by their consistent profitability, often supported by long-term contracts and established operational efficiencies.

Hochtief's stake in Abertis, a major toll road operator, exemplifies a classic Cash Cow. This mature investment provides stable, predictable earnings with minimal need for further capital infusion. In 2023, Abertis reported strong revenue growth, underscoring the consistent cash generation from its extensive network of toll roads, which directly benefits Hochtief.

The company's long-term operations and maintenance (O&M) contracts are also significant Cash Cows. These agreements leverage Hochtief's specialized knowledge in managing infrastructure post-construction, ensuring high-margin, recurring revenue. In 2024, the infrastructure services segment, including O&M, continued to be a bedrock of financial stability for the company.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Traditional Civil Engineering | Cash Cow | Mature market, high market share, low growth, stable cash flow | Significant contribution to group performance in 2023 |

| Abertis (Toll Road Concessions) | Cash Cow | Mature asset, predictable earnings, low capital requirement | Strong revenue growth in 2023 |

| Operations & Maintenance (O&M) Contracts | Cash Cow | High market share in low-growth sector, recurring revenue, high profitability | Bedrock of financial stability in 2024 |

What You See Is What You Get

Hochtief BCG Matrix

The preview you are currently viewing is the identical, fully completed Hochtief BCG Matrix report that you will receive immediately after your purchase. This comprehensive analysis, meticulously crafted for strategic decision-making, contains no watermarks or placeholder content. You can be assured that the document you see is precisely the professional-grade resource you will download, ready for immediate integration into your business planning and presentations.

Dogs

Fragmented, small-scale local construction projects represent a segment where Hochtief, a global infrastructure giant, would likely have minimal involvement. These endeavors, characterized by low market share and limited growth prospects, are typically characterized by intense competition and tight profit margins.

For a company of Hochtief's caliber, these types of projects are generally unattractive due to their scale and strategic fit. In 2024, the global construction market continues to see consolidation, with larger players focusing on mega-projects and specialized services, leaving smaller, localized work to regional firms.

Hochtief's non-strategic, low-margin building ventures are those that don't fit its core focus on advanced sectors like energy transition or complex infrastructure. These ventures, often in standard commercial or residential building, typically yield lower profits and offer little room for growth. For instance, a project in 2024 involving a standard office building with a projected net margin of only 2% would likely be categorized here.

Segments of Hochtief that still rely on outdated construction technologies or methods are considered Dogs. These areas are characterized by inefficiency, higher costs, and a lack of innovation, directly contrasting with Hochtief's strategic focus.

Hochtief's commitment to digitalization and sustainable practices means business lines heavily dependent on traditional, less efficient approaches without substantial market adoption are likely to be phased out or significantly minimized. For instance, if a division is still heavily using manual labor for tasks that modern robotics can perform more efficiently, it would fall into this category.

The company actively invests in modernizing its processes, aiming to shed any operations that do not align with future-forward construction. This strategic divestment or restructuring of 'Dog' segments allows Hochtief to reallocate capital and resources towards more promising and innovative ventures within its portfolio.

Geographical Markets with Limited Growth and Market Share

Within the Hochtief BCG Matrix, smaller geographical markets where the company holds a low market share and faces limited prospects for substantial infrastructure investment or growth are classified as Dogs. These regions are unlikely to attract significant strategic investment from Hochtief, and the company might consider reducing its presence or exiting these markets altogether. Hochtief strategically prioritizes its focus on key developed markets offering greater potential for profitable operations and expansion.

For instance, while Hochtief's primary markets are robust, a hypothetical scenario could involve a smaller nation with a nascent infrastructure sector and minimal government spending allocated to large-scale projects. In such a market, Hochtief's market share might be negligible, perhaps less than 5%, and the projected annual growth rate for infrastructure development could be as low as 1-2% over the next five years, significantly below the company's global average growth targets.

- Low Market Share: In these Dog markets, Hochtief's share of the total infrastructure spending might be under 5%.

- Limited Growth Prospects: Projected annual growth rates for infrastructure in these regions could be as low as 1-2%.

- Strategic Re-evaluation: Hochtief would likely not allocate new capital expenditure to these markets.

- Focus on Core Markets: The company concentrates resources on developed economies with higher infrastructure investment potential.

Legacy Projects with High Risk and Low Profitability

Legacy Projects with High Risk and Low Profitability, often termed Dogs in the BCG matrix, represent older ventures that have become financial burdens. These projects are characterized by unforeseen complications, significant cost overruns, or unfavorable contract terms, making them incapable of yielding acceptable returns. For instance, during 2024, Hochtief has been actively divesting from or restructuring such legacy contracts that were draining resources without promising future growth or profitability.

These "Dogs" can significantly impact a company's overall financial health by tying up capital and management attention. Hochtief's strategic shift in its order book towards lower-risk contracts is a direct response to mitigate the negative effects of these legacy projects. This proactive approach aims to streamline operations and improve the company's risk-adjusted returns by minimizing exposure to unpredictable outcomes.

- Cash Traps: Legacy projects often become cash traps due to escalating costs and stagnant revenues.

- Unfavorable Terms: Contractual issues can lock companies into unprofitable long-term commitments.

- Strategic Divestment: Companies like Hochtief are actively moving away from high-risk, low-return legacy projects.

- Order Book Shift: A focus on lower-risk contracts is a key strategy to improve future profitability and stability.

Dogs in Hochtief's BCG Matrix represent business segments with low market share and low growth potential. These are often fragmented, small-scale local construction projects or legacy ventures with high risk and low profitability. For instance, a project in 2024 with a projected net margin of only 2% would likely be categorized here.

These segments are characterized by inefficiency, outdated technologies, and unfavorable contract terms, tying up capital and management attention. Hochtief is actively divesting from or restructuring such legacy contracts to improve risk-adjusted returns.

In 2024, the global construction market sees consolidation, with larger players like Hochtief focusing on mega-projects, leaving smaller, localized work to regional firms. Hochtief strategically prioritizes focus on key developed markets offering greater potential for profitable operations and expansion.

Segments of Hochtief that still rely on outdated construction technologies or methods are considered Dogs. These areas are characterized by inefficiency, higher costs, and a lack of innovation, directly contrasting with Hochtief's strategic focus on digitalization and sustainable practices.

| BCG Category | Market Share | Market Growth | Hochtief Example | 2024 Relevance |

|---|---|---|---|---|

| Dogs | Low (<5%) | Low (1-2%) | Small-scale local projects, legacy contracts | Divestment/restructuring of low-margin, high-risk ventures |

Question Marks

Hochtief's early-stage digital construction solutions, such as BIM and AI-driven project management, are prime examples of potential Stars in the BCG matrix. While these internal innovations hold significant promise for the future of the construction industry, their commercialization as standalone revenue streams is still developing. This means they have high growth potential but currently contribute a relatively small portion to Hochtief's overall external revenue.

Hochtief is likely evaluating new geographical markets for its high-growth strategic segments, such as data centers and renewable energy infrastructure, where its current presence is minimal. These ventures represent potential "question marks" in the BCG matrix, characterized by high market growth but low current market share.

Entering these new regions demands significant upfront investment for establishing operations, building brand recognition, and securing initial projects. For instance, in the burgeoning renewable energy sector, a new market entry might require substantial capital for developing solar or wind farms, mirroring the high investment needs of question mark businesses.

The inherent risk and uncertainty associated with these new geographical market entries are considerable. However, successful navigation could transition these segments into stars, driving future revenue and profitability for Hochtief. The global renewable energy market alone was projected to reach over $1.9 trillion by 2023, highlighting the vast potential for those willing to invest and innovate in new territories.

Investing in niche, emerging infrastructure technologies, like highly specialized smart city solutions or advanced material science applications, places these areas firmly in the question mark quadrant of the BCG matrix for Hochtief. These segments, while holding significant future growth potential, currently represent a small market share for the company. For instance, the global smart cities market was projected to reach over $2.5 trillion by 2026, but Hochtief's current penetration in highly specialized sub-segments is likely minimal.

Significant research and development (R&D) and dedicated market development efforts are essential for these emerging technologies to gain traction and increase their market share. Hochtief's commitment to innovation in areas like sustainable construction materials, which saw global investment in green building technologies exceed $150 billion in 2023, could be a key driver for these question mark assets.

Early-Stage Critical Metals Extraction Infrastructure

Hochtief's engagement in early-stage critical metals extraction infrastructure, exemplified by its work with rare earths in Australia, aligns with global megatrends like electrification and renewable energy. This sector is experiencing significant growth, projected to reach hundreds of billions globally by the end of the decade, driven by demand for materials essential in batteries, wind turbines, and advanced electronics. However, as a relatively new entrant, Hochtief's market share in this specialized niche is likely still developing, necessitating substantial capital investment and strategic partnerships to achieve significant scale and competitive positioning.

- Market Growth: The global critical minerals market is anticipated to see robust expansion, with some estimates suggesting a doubling in value by 2030, driven by clean energy transitions.

- Hochtief's Position: While Hochtief possesses strong engineering and construction capabilities, its specific market share in early-stage critical metals extraction infrastructure is likely nascent, requiring strategic development.

- Investment Needs: Scaling operations in this capital-intensive sector demands significant upfront investment in exploration, processing technology, and supply chain development to capture market opportunities.

Pilot Projects in Untapped Value Chain Segments

Hochtief is likely exploring pilot projects in emerging construction segments, such as specialized off-site prefabrication or innovative modular building solutions for sectors like data centers or advanced medical facilities. These ventures represent potential high-growth areas where Hochtief currently has a limited market presence.

These initiatives are characterized by substantial upfront investment and a steep learning curve, typical of 'Question Marks' in a BCG matrix. Success in these pilot projects could lead to significant market share gains in the future, but the inherent risks are also considerable.

- Focus on niche prefabrication techniques: Exploring advanced concrete casting or timber frame systems for high-rise residential or sustainable commercial projects.

- Modular construction for new asset classes: Piloting modular solutions for temporary healthcare facilities or specialized industrial units, aiming for faster deployment and cost efficiencies.

- Investment in R&D for new materials: Testing and integrating novel building materials, like advanced composites or self-healing concrete, in small-scale projects to assess performance and scalability.

- Digital integration in new segments: Implementing BIM and AI-driven project management in pilot projects for infrastructure components or urban regeneration schemes to capture early-mover advantages.

Hochtief's ventures into new geographical markets for high-growth sectors like data centers and renewable energy infrastructure are classic examples of Question Marks. These areas offer substantial growth potential, but Hochtief's current market share is minimal, requiring significant investment to establish a foothold.

The company is likely investing heavily in R&D and market development for specialized off-site prefabrication and modular building solutions. These emerging segments, while promising, demand considerable upfront capital and present a steep learning curve, characteristic of Question Marks.

Hochtief's exploration of pilot projects in advanced construction technologies, such as niche prefabrication or modular units for data centers, positions these as Question Marks. These initiatives require substantial investment and offer high growth potential but currently hold a small market share.

Hochtief's engagement in early-stage critical metals extraction infrastructure, while aligned with global trends, represents a Question Mark due to its nascent market share and substantial capital needs for scaling.

| Category | Market Growth Potential | Hochtief's Current Market Share | Investment Required | Strategic Focus |

| New Geographic Markets (Data Centers, Renewables) | High | Low | High | Market Entry, Brand Building |

| Niche Infrastructure Tech (Smart Cities, Advanced Materials) | High | Low | High (R&D, Market Dev.) | Innovation, Market Penetration |

| Critical Metals Extraction Infrastructure | High | Low (Nascent) | Very High | Scaling, Partnerships |

| Pilot Projects (Prefabrication, Modular) | High | Low | High | Learning Curve, Market Share Gain |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, market share analysis, and industry growth projections to accurately position each business unit.