Hochtief Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Hochtief operates in a landscape shaped by intense competition, fluctuating buyer power, and the constant threat of new entrants. Understanding these pressures is crucial for navigating the construction sector.

The full Porter's Five Forces Analysis delves into the intricate details of each force impacting Hochtief, offering a comprehensive strategic overview. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for specialized materials, advanced technology, and skilled labor is a key factor in their bargaining power. If only a few companies offer essential sustainable building materials or cutting-edge construction software, they can often set higher prices and stricter terms for HOCHTIEF. For example, in 2024, the global market for advanced BIM (Building Information Modeling) software, crucial for complex projects, is dominated by a handful of major players, giving them considerable leverage.

Suppliers who provide specialized or proprietary inputs, like advanced sustainable building materials or innovative digital twin technologies, wield significant influence. For HOCHTIEF, if these inputs are vital for securing a competitive edge in delivering unique or environmentally conscious projects, these suppliers are in a strong position to negotiate higher prices.

The bargaining power of suppliers for HOCHTIEF is influenced by switching costs. If it's expensive or time-consuming for HOCHTIEF to change suppliers for key materials or equipment, those suppliers gain leverage. Imagine needing to retrain your entire team on new construction software or recertify all your building materials; these are real costs that make switching less appealing.

For HOCHTIEF, a company heavily reliant on specialized equipment and vast quantities of construction materials, these switching costs can be substantial. For example, a long-term contract for a unique type of steel or a specialized tunneling machine might come with significant penalties or require extensive logistical overhauls if HOCHTIEF decides to switch providers. This dependence strengthens the supplier's position.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they could begin offering construction services themselves, directly impacts their bargaining power. While less likely for basic material providers, specialized technology or equipment suppliers might consider this to capture more value. For instance, a firm providing advanced tunneling equipment could potentially offer the entire tunneling service, bypassing general contractors.

This forward integration capability is a significant lever for suppliers, allowing them to dictate terms or even compete directly with companies like Hochtief. However, the immense capital requirements, specialized expertise, and complex project management involved in large-scale construction projects often serve as substantial deterrents to suppliers seeking to move into this space. The sheer scale of projects, such as the €1.5 billion expansion of the A1 motorway in Germany, requires a breadth of capabilities that most suppliers do not possess.

- Supplier Forward Integration: Suppliers may possess the capability and incentive to perform construction services themselves, thereby increasing their bargaining power.

- Specialized Technology Providers: This threat is more pronounced for suppliers of specialized technologies or integrated solutions, who could potentially offer these directly to end clients.

- Barriers to Integration: The complexity and capital intensity of large-scale infrastructure projects, such as those undertaken by Hochtief, typically act as significant barriers preventing most suppliers from successfully integrating forward.

Importance of the Supplier's Input to HOCHTIEF's Cost or Quality

The criticality of a supplier's input for HOCHTIEF significantly influences its cost structure and the quality of its final projects. For essential materials like specialized concrete mixes or high-performance steel, or crucial services such as advanced geotechnical surveys, even minor price hikes or quality deviations from a dominant supplier can have a disproportionate impact on HOCHTIEF's bottom line and project success.

For instance, in 2024, the global construction industry faced continued volatility in raw material prices. Steel prices, a key input for many HOCHTIEF projects, saw fluctuations. In early 2024, benchmark steel prices were around $750-$800 per metric ton, a level that, if increased by a powerful supplier, could directly escalate HOCHTIEF's project costs.

- Impact on Cost: HOCHTIEF's reliance on specific, high-quality materials means suppliers of these inputs hold considerable leverage.

- Quality Dependence: The quality of specialized components or services directly affects the durability and safety of HOCHTIEF's finished structures.

- Profitability Squeeze: Even a small percentage increase in the cost of a critical input, if passed on by a supplier, can significantly reduce HOCHTIEF's profit margins on fixed-price contracts.

- Reputational Risk: Substandard materials or delayed deliveries from key suppliers can jeopardize project timelines and HOCHTIEF's reputation for reliability.

The bargaining power of suppliers is a significant factor for HOCHTIEF, particularly concerning specialized materials and advanced technologies. When few suppliers can provide critical inputs, their ability to dictate terms and prices increases substantially. For example, the market for advanced construction software, essential for modern project management, is highly concentrated, giving dominant players considerable leverage in 2024.

Switching costs also empower suppliers. If it is difficult or expensive for HOCHTIEF to change providers for key components or equipment, existing suppliers gain leverage. This includes costs associated with retraining staff or re-qualifying materials, making suppliers of specialized tunneling machines or unique steel types particularly influential due to the high switching costs involved.

The criticality of a supplier's input directly impacts HOCHTIEF's cost structure and project quality. Even minor price increases on essential materials like high-performance steel, which saw prices around $750-$800 per metric ton in early 2024, can significantly squeeze profit margins on fixed-price contracts.

| Factor | Impact on HOCHTIEF | Example (2024 Data) |

| Supplier Concentration | Higher prices and stricter terms | Dominant BIM software providers |

| Switching Costs | Reduced flexibility, increased supplier leverage | Specialized tunneling equipment contracts |

| Criticality of Input | Direct impact on profitability and project success | Steel prices ($750-$800/ton) affecting project costs |

What is included in the product

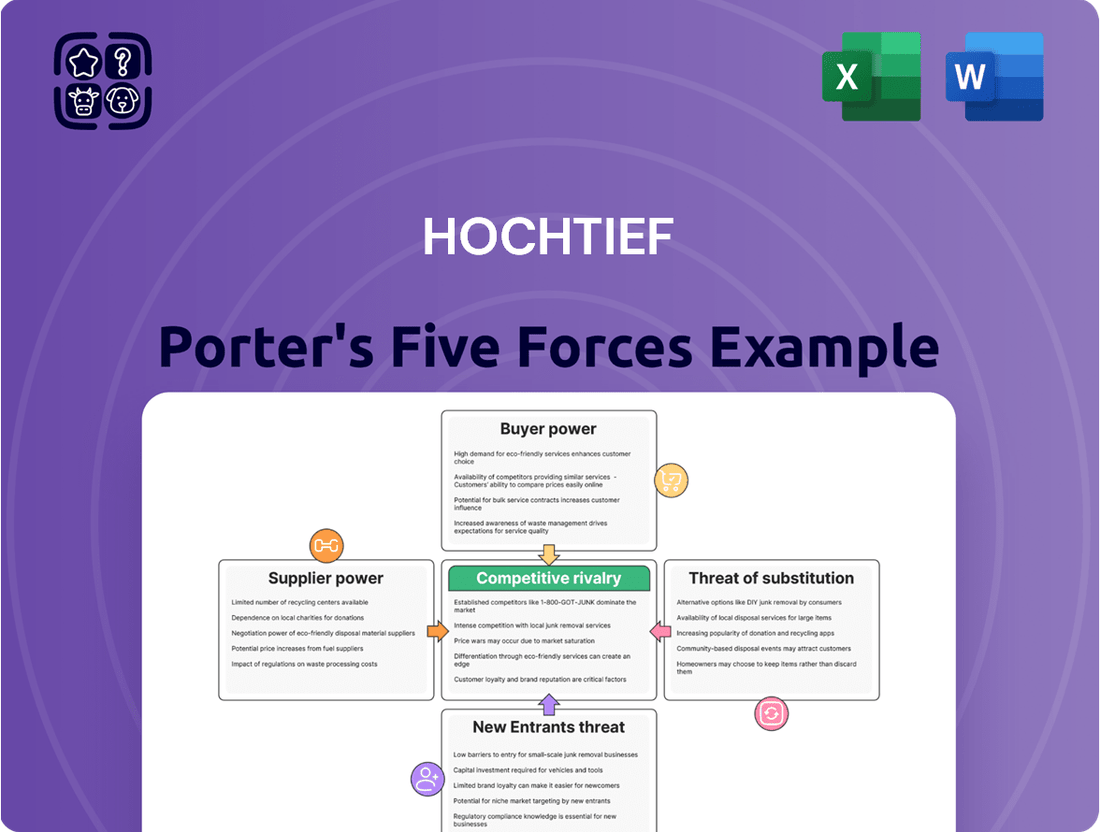

This analysis of Hochtief's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Instantly assess competitive pressures with a visual representation of each of Porter's Five Forces, enabling rapid identification of strategic vulnerabilities and opportunities for Hochtief.

Customers Bargaining Power

HOCHTIEF's customer base is broad, encompassing both public sector entities like governments for infrastructure projects and private developers for urban construction. In 2024, for instance, a significant portion of HOCHTIEF's revenue often stems from large, long-term government contracts for transportation and energy networks, highlighting the importance of these public clients.

Should a few of these major public sector clients, or a handful of dominant private developers, represent a disproportionately large share of HOCHTIEF's business, their ability to negotiate favorable terms and pricing would be considerably amplified. This concentration would grant them substantial bargaining power.

For large, complex infrastructure projects, the switching costs for clients are extremely high once a project is underway. Changing a main contractor like HOCHTIEF mid-project would involve immense delays, cost overruns, and significant contractual complexities, thereby diminishing the customer's bargaining power during the project execution phase.

Customers can threaten Hochtief by undertaking construction projects themselves, a move known as backward integration. While some public sector clients possess in-house engineering capabilities, the sheer size and specialized nature of projects like data centers or energy infrastructure typically make complete backward integration by most clients impractical.

Price Sensitivity of Customers

Customers, particularly those in the public sector, exhibit significant price sensitivity. This is often driven by strict budget allocations and the need for transparency, making competitive bidding a common practice. For instance, many government infrastructure projects are awarded through tenders where price is a major determining factor.

Even private sector clients, while prioritizing quality and project completion, are increasingly focused on cost-effectiveness. The current economic landscape, marked by rising inflation and fluctuating interest rates as of mid-2024, further amplifies this price consciousness across all client segments. This means that companies like Hochtief must carefully balance their pricing strategies to remain competitive.

- Public Sector Price Sensitivity: Government clients are often bound by public funds and scrutiny, leading to a strong emphasis on competitive pricing in contract awards.

- Private Sector Cost Focus: While private clients value quality and delivery, they also actively seek the most cost-efficient solutions available in the market.

- Economic Influence on Sensitivity: Macroeconomic factors such as inflation rates and borrowing costs directly impact how sensitive customers are to price increases.

Information Availability to Customers

Customers who are well-informed about market prices, competitor offerings, and emerging technologies gain a significant advantage when negotiating with companies like HOCHTIEF. This increased information access allows them to benchmark HOCHTIEF's proposals against alternatives, driving down prices and demanding better terms.

HOCHTIEF's commitment to transparent financial reporting and showcasing its extensive project portfolio, combined with readily available industry data, further amplifies customer bargaining power. For instance, in 2024, the global construction market saw increased transparency initiatives, with many project owners publicly sharing tender results and cost breakdowns, making it easier for potential clients to assess fair pricing.

- Informed Negotiations: Customers armed with data on competitor bids and industry cost benchmarks can more effectively challenge HOCHTIEF's pricing.

- Benchmarking Capabilities: Access to project performance data allows clients to compare HOCHTIEF's proposed methodologies and outcomes against industry standards.

- Technological Awareness: Knowledge of advancements in construction technology empowers customers to request more efficient and cost-effective solutions.

- HOCHTIEF's Transparency: Clear financial disclosures and detailed project histories strengthen the customer's position by providing a basis for comparison.

HOCHTIEF's bargaining power with customers is influenced by several factors, including price sensitivity and the availability of information. Public sector clients, often bound by strict budgets, demonstrate high price sensitivity, with government infrastructure projects frequently awarded through competitive tenders where price is a key determinant.

Private sector clients, while valuing quality, are also increasingly cost-conscious, a trend amplified by mid-2024 economic conditions like inflation and fluctuating interest rates. Well-informed customers, aware of market prices and competitor offerings, can leverage this knowledge to negotiate better terms, especially as industry transparency initiatives in 2024 made pricing benchmarks more accessible.

The bargaining power of HOCHTIEF's customers is moderate. While switching costs for large, ongoing projects are high, reducing customer leverage during execution, a broad client base with varying price sensitivities and increasing access to market information allows for effective negotiation. Key factors include public sector price sensitivity driven by budget constraints and private sector focus on cost-efficiency, both heightened by 2024 economic conditions.

Preview the Actual Deliverable

Hochtief Porter's Five Forces Analysis

This preview shows the exact Hochtief Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the construction industry. This fully formatted document is ready for your immediate use, offering a detailed strategic overview.

Rivalry Among Competitors

The global construction market for complex infrastructure projects is characterized by a relatively concentrated group of major international players. HOCHTIEF contends with other diversified construction and engineering giants, fostering intense rivalry. This competition is especially fierce for high-value projects that demand specialized expertise and substantial resources, a domain where only a select few firms operate.

The global construction market is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2028, reaching an estimated $15.5 trillion by 2028. This steady expansion, fueled by significant investments in infrastructure, particularly in emerging economies and renewable energy projects, creates a dynamic environment. For instance, the U.S. infrastructure bill, passed in 2021, allocates substantial funding towards transportation and energy grid upgrades, stimulating demand.

This moderate industry growth rate, while positive, directly translates into heightened competitive rivalry. As more opportunities arise from government spending and private sector development, construction firms actively compete for these projects. Companies like Vinci, Bouygues, and Skanska are all vying for lucrative contracts, leading to price pressures and a need for greater efficiency and innovation to secure market share.

HOCHTIEF distinguishes itself by focusing on complex infrastructure, sustainable building, and cutting-edge technology like data centers and digital twins. This specialization moves beyond basic construction, which is often a price-driven market.

By offering these advanced capabilities, HOCHTIEF reduces direct competition based solely on price for highly specialized projects. Clients face significant risks and costs if they switch to less experienced or technologically advanced competitors for critical infrastructure development.

Exit Barriers

High fixed costs are a major factor contributing to significant exit barriers in the construction sector. For instance, the substantial investment required for heavy machinery, specialized equipment, and large project sites means that shutting down operations before recouping these costs is often financially unviable. This can trap companies in the market even when profitability is low.

Specialized assets further solidify these exit barriers. Many construction firms invest in unique or highly specific machinery and technology tailored to particular types of projects, such as tunneling or bridge building. These assets have limited resale value or alternative uses outside the construction industry, making it difficult for companies to divest them without incurring substantial losses.

Long-term contractual obligations also play a crucial role. Construction companies often enter into multi-year contracts for major infrastructure projects. Fulfilling these commitments, even during periods of market downturn, prevents a swift exit. For example, a company might be obligated to complete a large public works project for several more years, tying up resources and personnel, and thus limiting their ability to withdraw.

Consequently, these combined factors lead to sustained competitive rivalry. Even when market conditions are unfavorable, the reluctance to exit due to high sunk costs and contractual duties means that competitors remain active, potentially leading to price wars or reduced margins as firms fight for remaining business. In 2023, the global construction market faced challenges, yet many firms continued operations due to these inherent exit barriers.

Diversity of Competitors

HOCHTIEF encounters a broad spectrum of competitors, ranging from large, globally operating construction firms to more specialized regional players. This diversity means competitive pressures can arise from various angles, with different entities possessing distinct strengths and market approaches.

The competitive landscape includes not only publicly traded construction giants but also state-owned enterprises, particularly in certain geographic markets. These varied origins often translate into differing cost structures, access to capital, and strategic priorities, creating a complex competitive environment for HOCHTIEF.

For instance, in 2024, major global competitors like Vinci and Bouygues reported significant revenue figures, highlighting the scale of established players. Vinci, for example, announced revenues exceeding €65 billion for 2023, indicating the substantial resources and market reach of key rivals HOCHTIEF must contend with.

- Global Diversified Competitors: Large, multinational construction and engineering firms with broad service offerings and international project portfolios.

- Regional Specialists: Companies focusing on specific geographic areas or niche construction sectors, often with deep local market knowledge and established relationships.

- State-Owned Enterprises: Government-backed construction entities, particularly prevalent in certain emerging markets, which may benefit from direct state support and preferential treatment.

The competitive rivalry within the global construction market, particularly for complex infrastructure, is intense due to a concentrated group of major international players. HOCHTIEF faces formidable competition from diversified construction and engineering giants, especially for high-value projects requiring specialized expertise and significant resources. This competition is further amplified by moderate industry growth, encouraging firms to actively pursue lucrative contracts, leading to price pressures and a drive for greater efficiency.

HOCHTIEF's strategy of focusing on specialized areas like complex infrastructure, sustainable building, and advanced technologies such as data centers helps mitigate direct price competition. By offering unique capabilities, HOCHTIEF reduces the incentive for clients to switch to less experienced competitors, given the high risks and costs associated with critical infrastructure development. This differentiation is crucial in a market where many firms remain active due to high exit barriers, including substantial investments in specialized assets and long-term contractual obligations.

The competitive landscape is diverse, featuring large global firms, regional specialists with deep local knowledge, and state-owned enterprises that may possess different cost structures and strategic priorities. For instance, in 2023, Vinci reported revenues exceeding €65 billion, illustrating the scale and resources of key rivals HOCHTIEF must contend with.

| Competitor Type | Key Characteristics | Example |

| Global Diversified | Broad service offerings, international project portfolios | Vinci, Bouygues, Skanska |

| Regional Specialists | Focus on specific geographies or niche sectors, local expertise | (Varies by region) |

| State-Owned Enterprises | Government backing, potentially different cost structures | (Varies by market, e.g., China Communications Construction Company) |

SSubstitutes Threaten

While traditional on-site construction remains the norm, alternative project delivery methods are emerging as viable substitutes. Modular construction and prefabrication, for instance, offer significant advantages in terms of speed, cost predictability, and reduced environmental impact. The global modular construction market was valued at approximately USD 120 billion in 2023 and is projected to grow substantially, indicating a growing acceptance of these alternatives.

These innovative approaches can directly replace traditional methods for certain project types, especially those where speed and standardization are key. For example, the healthcare sector increasingly utilizes modular building for clinics and hospitals. If HOCHTIEF, a major player in traditional construction, fails to integrate or offer these alternative solutions, it risks losing market share to competitors who do.

The threat of substitutes for construction services is growing as alternative solutions emerge for core client needs. For instance, advancements in digital communication and remote work technologies, accelerated by the pandemic, could significantly curb the demand for new office spaces. In 2024, the global flexible workspace market was valued at approximately $15 billion and is projected to grow substantially, indicating a shift in how businesses approach office infrastructure.

Similarly, innovations in urban planning and public transportation could lessen the reliance on extensive new road construction. Investments in smart city initiatives and integrated public transit systems, like the expansion of metro networks in cities such as London and Delhi, aim to optimize existing infrastructure and reduce the need for new road projects. This trend directly impacts the demand for road construction, a significant segment for companies like HOCHTIEF.

Advanced technologies are increasingly making existing infrastructure more efficient, potentially acting as a substitute for new construction. For instance, the adoption of digital twins and predictive maintenance can significantly extend the lifespan and optimize the performance of current assets. This means that if existing buildings and infrastructure can be upgraded to meet evolving demands, the pressure to undertake entirely new, costly builds could decrease.

DIY or In-House Capabilities of Clients

While some clients might consider handling smaller, less complex projects internally, this isn't a significant threat for HOCHTIEF's core business. For instance, a homeowner might manage a small renovation themselves, but this doesn't translate to building a major highway or a large-scale industrial facility.

The sheer scale, technical demands, and capital investment required for HOCHTIEF's typical projects make in-house execution by clients highly impractical. Imagine a client needing to construct a new airport terminal; sourcing specialized equipment, managing thousands of workers, and navigating complex regulatory frameworks are not feasible for most organizations to do independently.

The threat of clients developing their own in-house capabilities is minimal for large infrastructure projects. For example, in 2024, the average cost of a major infrastructure project, such as a new bridge or tunnel, can easily run into hundreds of millions or even billions of dollars, far exceeding the typical operational budget or expertise of most client organizations outside of specialized government agencies or very large industrial firms.

- Limited In-House Feasibility: Clients typically lack the specialized expertise, equipment, and capital to undertake large-scale, complex construction projects independently.

- Scale Disparity: The threat is confined to very small, non-core projects, not the major infrastructure and construction HOCHTIEF specializes in.

- High Capital Requirements: The multi-million or billion-dollar price tags of HOCHTIEF's projects make self-execution by clients economically unviable.

Shift in Public or Private Investment Priorities

A significant shift in investment priorities away from traditional infrastructure and towards digital or social initiatives could present a substitute threat to HOCHTIEF. For instance, if governments redirect substantial funds from road or rail projects to cybersecurity or public health programs that don't require extensive physical construction, it could reduce demand for HOCHTIEF's core services.

However, global trends indicate a sustained need for infrastructure development. As of early 2024, the Infrastructure Investment and Jobs Act in the United States continues to inject billions into transportation and energy projects, underscoring ongoing investment in physical assets. Similarly, the European Union's Green Deal emphasizes massive investments in sustainable infrastructure, including renewable energy and modernized transport networks, which directly benefit construction firms like HOCHTIEF.

- Infrastructure spending remains robust globally, driven by modernization needs and climate initiatives.

- Digital and social programs, while important, often complement rather than entirely substitute physical infrastructure.

- HOCHTIEF's diversified business model, encompassing construction, mining, and concessions, mitigates the impact of shifts in any single investment area.

The threat of substitutes for HOCHTIEF's services is multifaceted, encompassing alternative construction methods, evolving client needs driven by technology, and shifts in investment priorities. Modular construction and prefabrication offer faster, more predictable, and often greener alternatives to traditional building, with the global modular construction market projected for substantial growth from its estimated USD 120 billion valuation in 2023.

Furthermore, advancements in digital infrastructure and remote work capabilities are reducing the demand for new physical office spaces, as evidenced by the projected growth in the global flexible workspace market, valued at approximately $15 billion in 2024. Innovations in urban planning and public transportation also aim to optimize existing infrastructure, potentially lessening the need for new road construction, a key sector for firms like HOCHTIEF.

While clients handling smaller projects internally is not a significant threat due to the scale and complexity of HOCHTIEF's core business, shifts in global investment priorities away from traditional infrastructure towards digital or social initiatives could pose a challenge. However, ongoing global investment in infrastructure, such as the US Infrastructure Investment and Jobs Act and the EU's Green Deal, continues to drive demand for construction services.

| Substitute Threat | Description | Impact on HOCHTIEF | Supporting Data (2023-2024) |

|---|---|---|---|

| Alternative Construction Methods | Modular construction, prefabrication | Potential loss of market share if not adopted; cost and speed advantages | Global modular construction market valued at ~USD 120 billion in 2023; strong growth projected. |

| Technological Shifts (Remote Work) | Reduced need for new office spaces | Decreased demand for commercial construction projects | Global flexible workspace market valued at ~$15 billion in 2024; projected substantial growth. |

| Urban Planning & Public Transport | Optimizing existing infrastructure, reducing new road construction | Lower demand for road and highway projects | Significant investments in smart city initiatives and metro network expansions globally. |

| Investment Priority Shifts | Redirecting funds from physical infrastructure to digital/social initiatives | Reduced demand for traditional construction services | Counterbalanced by continued robust global infrastructure spending (e.g., US Infrastructure Investment and Jobs Act, EU Green Deal). |

Entrants Threaten

The construction industry, particularly for large-scale infrastructure, demands immense capital. Think about the sheer cost of specialized heavy machinery, advanced digital modeling software, and securing a highly skilled workforce. These upfront investments can easily run into hundreds of millions, if not billions, of dollars, creating a significant hurdle for any newcomer looking to challenge established giants like HOCHTIEF.

For instance, a single major tunnel boring machine can cost upwards of $50 million, and a fleet for a large project would multiply that considerably. Furthermore, securing performance bonds and insurance for these massive undertakings adds another layer of financial commitment, often requiring proven financial stability and a track record of successful project completion, which new entrants simply lack.

Established players like HOCHTIEF leverage significant economies of scale in global procurement and project management, giving them a cost advantage. For instance, in 2023, HOCHTIEF reported a revenue of €30.05 billion, reflecting its operational size and capacity to absorb overheads across a vast number of projects.

New entrants struggle to match this scale, facing higher per-unit costs for materials, equipment, and skilled labor. HOCHTIEF's decades of experience in complex infrastructure and construction projects also translate into superior risk management and operational efficiency, a difficult advantage for newcomers to replicate quickly.

Securing significant infrastructure projects, both public and private, heavily depends on cultivating strong, established relationships and demonstrating a history of successful delivery. New companies face a considerable hurdle in quickly building the trust and pre-qualification status necessary to even bid on these high-value tenders.

Proprietary Technology and Expertise

HOCHTIEF's substantial investment in cutting-edge technologies such as Building Information Modeling (BIM), digital twins, and AI-powered project management significantly raises the bar for potential new competitors. This technological advantage, coupled with deep expertise in specialized engineering fields like data center construction and renewable energy infrastructure, creates a formidable barrier to entry. New players would face immense capital requirements and a steep learning curve to replicate HOCHTIEF's advanced capabilities. In 2024, HOCHTIEF continued to emphasize digital transformation, with significant R&D allocation towards these areas, aiming to further solidify its technological lead.

The threat of new entrants is mitigated by HOCHTIEF's proprietary technology and specialized expertise, which demand considerable upfront investment and time to develop. For instance, the company's advanced digital tools streamline complex project lifecycles, offering efficiency gains that are difficult for newcomers to match without comparable development.

- Significant R&D Investment: HOCHTIEF's commitment to innovation is evident in its continuous investment in digital technologies, fostering a competitive edge.

- High Barrier to Entry: The cost and complexity of replicating HOCHTIEF's technological infrastructure and specialized engineering knowledge deter new market participants.

- Expertise in Niche Markets: HOCHTIEF's established proficiency in high-demand sectors like data centers and sustainable energy provides a unique advantage that new entrants would struggle to acquire quickly.

Regulatory and Legal Barriers

The construction sector, particularly for substantial infrastructure undertakings, operates within intricate regulatory landscapes. These include stringent environmental impact assessments, obtaining various permits, and adhering to licensing mandates. For instance, in 2024, projects like the expansion of the UK's High Speed 2 railway faced ongoing scrutiny and adjustments related to environmental regulations, highlighting the complexity new firms must navigate.

These legal and bureaucratic obstacles present a substantial barrier to entry. New companies often lack the established relationships and expertise to efficiently manage these processes. In 2023, the European Union continued to emphasize stricter environmental compliance for construction projects, adding another layer of complexity for potential market entrants seeking to operate across member states.

- Regulatory Complexity: Navigating a web of national and international construction regulations can be daunting for new firms.

- Environmental Approvals: Securing necessary environmental permits, which are increasingly rigorous, requires significant time and resources.

- Licensing Requirements: Obtaining and maintaining the appropriate licenses for specialized construction work can be a substantial hurdle.

- Bureaucratic Hurdles: The sheer volume of paperwork and administrative processes involved in large projects deters many potential new entrants.

The threat of new entrants for HOCHTIEF is generally low due to substantial capital requirements for specialized equipment and a highly skilled workforce, as evidenced by the tens of millions needed for a single major piece of machinery. Furthermore, HOCHTIEF's established economies of scale, demonstrated by its €30.05 billion revenue in 2023, provide significant cost advantages that newcomers struggle to match. Building the necessary trust and pre-qualification for large infrastructure tenders is also a considerable barrier for emerging companies.

HOCHTIEF's investment in advanced digital technologies like BIM and AI in 2024, coupled with deep expertise in niche areas such as data centers, creates a formidable technological moat. Navigating complex and evolving regulatory landscapes, including stringent environmental approvals that intensified in the EU in 2023, further deters new entrants who lack the established processes and relationships to manage these hurdles efficiently.

| Barrier Type | Description | Example Data Point |

| Capital Requirements | High upfront investment for machinery and workforce. | Single tunnel boring machine cost: >$50 million. |

| Economies of Scale | Cost advantages from large-scale operations. | HOCHTIEF 2023 Revenue: €30.05 billion. |

| Technological Advancement | Proprietary digital tools and specialized engineering knowledge. | HOCHTIEF's 2024 R&D focus on digital transformation. |

| Regulatory Complexity | Navigating environmental, licensing, and bureaucratic processes. | Increased environmental compliance emphasis in EU (2023). |

Porter's Five Forces Analysis Data Sources

Our Hochtief Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Hochtief's official annual reports, investor presentations, and public disclosures. We supplement this with insights from reputable industry analysis firms and construction sector-specific market research databases.