Hochtief Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hochtief Bundle

Discover the strategic core of Hochtief's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they leverage key resources and partnerships to deliver exceptional value to diverse customer segments. Understand their revenue streams and cost structure to gain critical insights for your own business strategy.

Partnerships

HOCHTIEF frequently forms joint ventures and consortia to tackle large, complex infrastructure projects. This approach is crucial for sharing significant risks and pooling specialized expertise needed for undertakings like major rail networks, tunnels, and extensive building constructions.

By collaborating, HOCHTIEF can access a broader range of technical capabilities and financial resources, making ambitious projects more manageable. This strategy was evident in their involvement with the Munich S-Bahn rail network expansion and the Flatiron-Dragados merger in North America, showcasing their commitment to strategic partnerships for large-scale development.

HOCHTIEF actively collaborates with technology firms and research institutions to drive digitalization and sustainable building practices. These partnerships are key to advancing areas like Building Information Modeling (BIM), real-time project monitoring, and AI-powered management. For instance, their joint venture Yorizon with Thomas-Krenn.AG focuses on robust hardware and cloud computing for data centers, underscoring a commitment to innovative IT infrastructure.

Hochtief's key partnerships with public sector clients and government bodies are foundational to its success, particularly in securing large-scale infrastructure projects. These collaborations are vital for accessing and executing projects funded by significant public investment initiatives.

For instance, the company's engagement with entities like Deutsche Bahn and numerous state building authorities highlights its deep integration within public infrastructure development pipelines. These relationships are crucial for navigating complex regulatory environments and obtaining essential permits and approvals for major construction undertakings.

The company's ability to secure projects tied to substantial public investment packages, such as Germany's €500 billion infrastructure fund, underscores the strategic importance of these government partnerships. This financial backing enables the execution of ambitious projects that shape national and regional development.

Suppliers and Subcontractors

HOCHTIEF relies on a strong network of suppliers for essential materials and equipment, alongside specialized subcontractors, to ensure smooth project delivery. This network is crucial for maintaining efficiency and meeting project deadlines.

The company prioritizes responsible supply chain management, actively partnering with entities that align with their sustainability goals and human rights commitments. This focus helps guarantee both the quality of work and cost-effectiveness.

- Supplier Network: HOCHTIEF collaborates with numerous suppliers globally for construction materials, machinery, and specialized components.

- Subcontractor Expertise: They engage a wide range of subcontractors for specific trades like electrical, plumbing, and HVAC, ensuring specialized skills are leveraged.

- Sustainability Alignment: In 2023, HOCHTIEF continued to assess its key suppliers based on sustainability criteria, with a significant portion undergoing evaluation for environmental and social performance.

- Risk Mitigation: A diversified supplier base helps mitigate risks associated with single-source dependencies and potential disruptions.

Financial Institutions and Investors

Hochtief actively cultivates partnerships with a diverse range of financial institutions and investors. These collaborations are crucial for securing the substantial capital needed for large-scale projects, especially within Public-Private Partnership (PPP) frameworks and significant infrastructure developments. For instance, in 2023, HOCHTIEF's financial strength, evidenced by its solid investment-grade credit rating, facilitated access to a broad spectrum of financing options.

These alliances are vital for projects like the development of data centers, which demand considerable upfront investment. By leveraging its robust financial performance and favorable credit standing, HOCHTIEF attracts capital from banks, investment funds, and other financial entities, enabling the execution of these capital-intensive ventures.

- Banks: Provide project-specific debt financing and credit lines.

- Investment Funds: Offer equity or mezzanine financing for infrastructure and development projects.

- Institutional Investors: Such as pension funds and insurance companies, participate in long-term infrastructure investments.

Key partnerships for HOCHTIEF are diverse, spanning joint ventures for large projects, collaborations with technology firms for innovation, and crucial alliances with public sector clients. These relationships are vital for risk sharing, accessing specialized expertise, and securing funding for ambitious undertakings.

In 2023, HOCHTIEF's strategic collaborations were instrumental in securing major infrastructure contracts. For example, their involvement in significant public transport upgrades across Europe highlights the importance of strong governmental ties. Furthermore, their ongoing partnerships with technology providers are driving the adoption of digital solutions, with a notable increase in the use of AI for project management and predictive maintenance across their global operations.

| Partnership Type | Key Focus Areas | 2023 Impact/Examples |

|---|---|---|

| Joint Ventures & Consortia | Risk Sharing, Expertise Pooling | Major infrastructure projects (e.g., rail, tunnels); facilitated access to large-scale public tenders. |

| Technology & Research Firms | Digitalization, Sustainability | Advancement in BIM, AI-driven project management, IoT integration in construction; Yorizon JV with Thomas-Krenn.AG for data centers. |

| Public Sector Clients | Infrastructure Development, Regulatory Navigation | Securing projects with entities like Deutsche Bahn, state building authorities; access to public investment funds. |

| Suppliers & Subcontractors | Material & Equipment Sourcing, Specialized Skills | Ensuring project efficiency and adherence to deadlines; growing emphasis on sustainability criteria for suppliers in 2023. |

| Financial Institutions | Capital Acquisition, Project Financing | Securing financing for capital-intensive projects (e.g., data centers), leveraging strong credit ratings; access to diverse funding sources. |

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, reflecting real-world operations and plans in 9 classic BMC blocks with full narrative and insights.

Ideal for presentations and funding discussions, this model helps entrepreneurs and analysts make informed decisions by including analysis of competitive advantages and SWOT linked to the model.

The Hochtief Business Model Canvas acts as a pain point reliever by offering a structured, visual framework to dissect and understand complex project dependencies, thereby mitigating risks and improving operational efficiency.

Activities

HOCHTIEF actively engages in project development from the outset, identifying opportunities and crafting detailed plans. This early involvement is crucial for securing the necessary investments, particularly for greenfield Public-Private Partnership (PPP) projects and brownfield concessions. Their strategic focus includes high-growth sectors like data centers and the energy transition.

The company's commitment extends to making equity investments in select data center projects. This direct financial stake allows HOCHTIEF to capture additional value and align its interests with project success. For instance, in 2023, HOCHTIEF’s order intake from infrastructure projects, which often involve development and investment, reached €10.3 billion.

HOCHTIEF leverages its deep engineering know-how to deliver comprehensive design and engineering services for intricate infrastructure and building projects. This core activity is vital for developing innovative, sustainable, and efficient solutions that precisely meet client specifications and adhere to all regulatory mandates.

Their commitment to advanced technology and digital tools, such as Building Information Modeling (BIM), significantly bolsters these design and engineering capabilities. For instance, in 2023, HOCHTIEF reported a significant portion of its projects utilized BIM, contributing to improved project planning and execution efficiency.

Construction management and execution are central to HOCHTIEF's operations, encompassing the meticulous planning and on-site delivery of complex, large-scale projects. This core activity involves coordinating diverse resources, managing intricate timelines, and ensuring stringent quality control across sectors like transportation, energy, and urban development.

Subsidiaries such as Turner and CIMIC are instrumental in this process, leveraging their specialized expertise to execute projects efficiently. For instance, in 2023, HOCHTIEF's order intake reached €30.5 billion, a significant portion of which directly reflects the execution of these substantial construction endeavors.

Operation and Maintenance

HOCHTIEF actively engages in the long-term operation and maintenance of infrastructure, ensuring assets perform optimally and retain their value over time. This full-lifecycle strategy generates predictable, recurring revenue streams, complementing its construction services. For instance, HOCHTIEF's significant stake in Abertis, a major global toll road operator, directly illustrates this commitment to ongoing asset management and revenue generation.

This operational involvement allows HOCHTIEF to leverage its construction expertise into sustained service provision. By managing and maintaining the infrastructure it builds, the company secures ongoing income and deepens its relationship with clients and asset users. This approach is particularly valuable in sectors like transportation and utilities, where continuous operational efficiency is paramount.

- Recurring Revenue: Operational and maintenance services provide a stable, predictable income stream, reducing reliance on project-based construction revenue.

- Asset Value Preservation: HOCHTIEF's expertise ensures that infrastructure assets are maintained to high standards, protecting and enhancing their long-term value.

- Strategic Investment: The investment in Abertis, a leading toll road operator, highlights HOCHTIEF's strategic focus on participating in the ongoing financial success of critical infrastructure.

Sustainability and Digitalization Implementation

Hochtief is actively embedding sustainability and digitalization throughout its operations. This strategic push is evident in their Sustainability Plan 2025, which sets ambitious targets, including achieving climate neutrality by 2045 and championing circular economy principles.

The company is leveraging advanced digital solutions to drive these initiatives. For instance, AI-powered project management tools are being deployed to optimize resource allocation and construction processes, while real-time monitoring systems help reduce environmental footprints and boost overall project efficiency.

- Climate Neutrality by 2045: A core objective of their sustainability strategy.

- Circular Economy Practices: Integrating resource efficiency and waste reduction.

- Digital Tools: AI for project management and real-time monitoring for enhanced efficiency and reduced environmental impact.

HOCHTIEF's key activities encompass the entire project lifecycle, from initial development and equity investment to sophisticated design, engineering, and meticulous construction execution. They also focus on the long-term operation and maintenance of infrastructure, ensuring sustained value and recurring revenue. This integrated approach is underpinned by a strong commitment to sustainability and digitalization.

| Key Activity | Description | 2023 Data/Example |

|---|---|---|

| Project Development & Investment | Identifying and planning projects, securing investment, and taking equity stakes, particularly in PPPs and concessions. | Order intake from infrastructure projects reached €10.3 billion. Focus on data centers and energy transition. |

| Design & Engineering | Providing comprehensive design and engineering services, leveraging advanced technology like BIM. | Significant project utilization of BIM for improved planning and execution. |

| Construction Management & Execution | Planning and delivering complex, large-scale projects across various sectors. | Group order intake was €30.5 billion, reflecting substantial construction work. |

| Operation & Maintenance | Ensuring optimal performance and value retention of infrastructure assets over the long term. | Strategic investment in Abertis, a major global toll road operator. |

| Sustainability & Digitalization | Integrating sustainable practices and digital tools to optimize operations and achieve climate goals. | Sustainability Plan 2025 targets climate neutrality by 2045; AI used in project management. |

Preview Before You Purchase

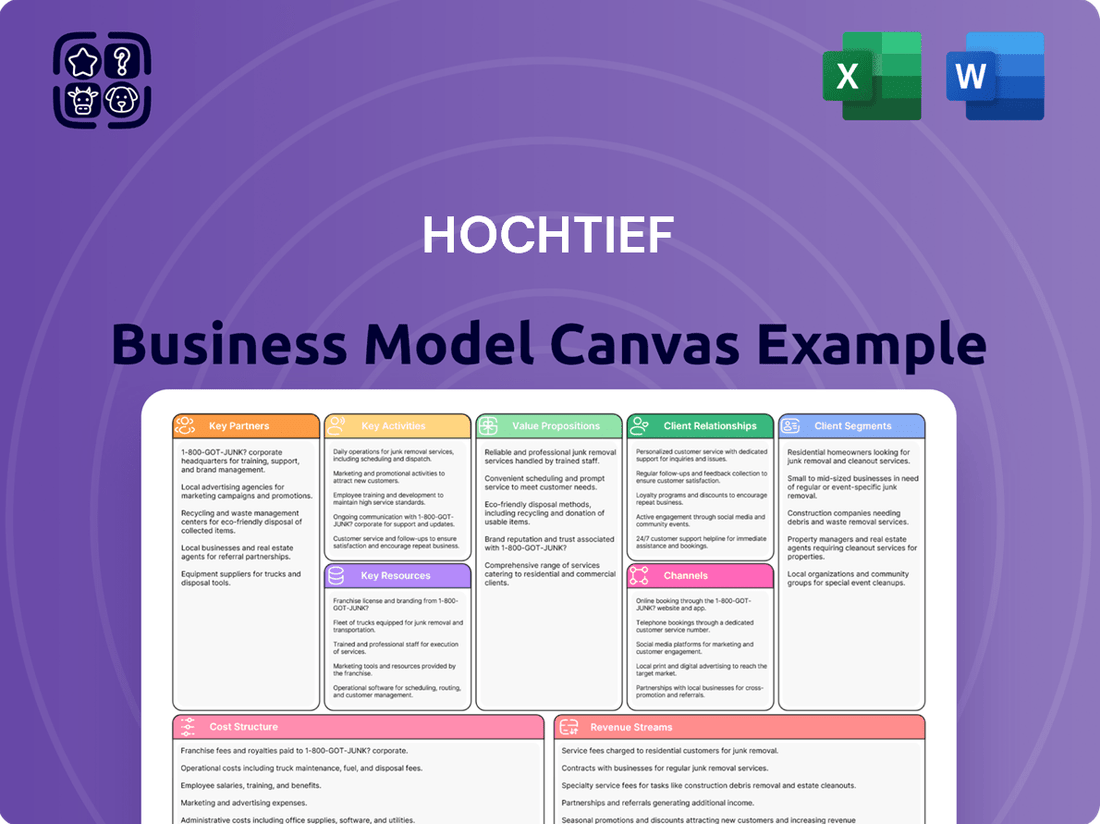

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the professional, ready-to-use file that will be delivered to you, ensuring exactly what you see is what you get.

Resources

HOCHTIEF's operational prowess hinges on its expert workforce, a global team of engineers, project managers, and construction specialists. Their deep knowledge and commitment are vital for tackling complex projects and fostering innovation.

In 2023, HOCHTIEF reported a significant increase in its workforce, reaching approximately 22,000 employees across its various divisions. This expansion underscores the company's ongoing investment in human capital, a critical resource for its project execution and strategic growth.

Hochtief leverages proprietary and licensed advanced technologies like Building Information Modeling (BIM) and AI-driven project management tools as key resources. These digital systems are fundamental to enhancing operational efficiency and project oversight.

The company's investment in real-time monitoring systems and smart infrastructure solutions directly contributes to its competitive advantage. For instance, digital transformation initiatives are a significant focus, with technology investments aimed at optimizing construction processes and delivering innovative outcomes.

Hochtief's extensive global network and subsidiaries are a cornerstone of its business model. This includes major entities like Turner in the Americas, CIMIC in Asia Pacific, and HOCHTIEF Infrastructure across Europe. This broad geographic reach allows the company to tap into local market knowledge and execute complex projects worldwide.

In 2024, this diversified structure proved resilient. For instance, CIMIC reported strong performance in its mining and infrastructure segments in Australia, contributing significantly to the group's overall revenue. Turner, meanwhile, continued to secure major construction projects in the United States, highlighting the value of localized expertise and market access.

Financial Capital and Strong Balance Sheet

HOCHTIEF's substantial financial capital, bolstered by a strong balance sheet and consistent cash flow generation, is a cornerstone of its business model. This financial muscle is essential for the company to confidently pursue and execute massive construction projects, pursue strategic acquisitions, and invest in emerging technologies and promising growth markets.

The company's robust financial health is clearly demonstrated by its strong operating cash flow and an impressive, record-breaking order backlog. For instance, as of the first quarter of 2024, HOCHTIEF reported a significant increase in net profit and maintained a healthy order backlog, signaling its capacity for continued expansion and strategic investments.

- Financial Strength: HOCHTIEF leverages its substantial financial capital and a strong balance sheet to undertake large-scale projects and strategic acquisitions.

- Cash Flow Generation: Robust operating cash flow supports ongoing investments in new technologies and growth markets.

- Order Backlog: A record order backlog, as seen in early 2024 reporting, underpins the company's financial stability and future revenue potential.

- Investment Capacity: The company's financial position enables it to fund its expansion strategies and capitalize on market opportunities.

Intellectual Property and Engineering Know-how

Hochtief's intellectual property and engineering know-how represent a cornerstone of its business model. This includes a vast portfolio of patents and proprietary technologies honed over decades of experience in complex construction projects. For instance, their expertise in tunneling and infrastructure development allows for efficient and cost-effective solutions, a significant competitive advantage.

This accumulated knowledge is not just theoretical; it translates into practical, specialized construction techniques and innovative project management methodologies. These capabilities are crucial for tackling the intricate challenges inherent in large-scale infrastructure projects globally. Hochtief’s ability to innovate in areas like sustainable building practices further solidifies its market position.

The company’s deep engineering know-how is a key differentiator, enabling them to undertake projects that others cannot. This expertise is reflected in their successful execution of landmark projects worldwide, showcasing their ability to deliver on time and within budget, even in demanding environments. In 2024, Hochtief continued to leverage this know-how, securing several major international contracts in the infrastructure sector.

- Patented Construction Techniques: Proprietary methods for foundation engineering and specialized structural solutions.

- Project Management Expertise: Advanced methodologies for risk management, scheduling, and resource allocation in large-scale projects.

- Innovative Engineering Solutions: Development of novel approaches for complex challenges like deep excavation and seismic retrofitting.

- Digitalization in Construction: Integration of BIM (Building Information Modeling) and AI for enhanced project planning and execution.

HOCHTIEF's key resources also encompass its robust global network and subsidiaries, including Turner in the Americas and CIMIC in Asia Pacific. This diversified structure, as evidenced by CIMIC's strong performance in Australian mining and infrastructure and Turner's continued project wins in the US during 2024, provides crucial market access and localized expertise.

Value Propositions

HOCHTIEF provides a complete package for demanding infrastructure projects, covering everything from initial planning and design to building, running, and upkeep. This means clients get a unified approach, simplifying their experience and ensuring smooth execution for even the most intricate developments.

This end-to-end capability is a significant advantage. For instance, in 2023, HOCHTIEF secured a €1.4 billion contract for the Sydney Metro West project, a prime example of their ability to manage large-scale, complex infrastructure from start to finish.

By offering this integrated service, HOCHTIEF allows clients to consolidate project management and leverage a cohesive team of experts. This coordinated effort is crucial for delivering challenging projects efficiently and effectively, reducing risks and optimizing outcomes.

HOCHTIEF's expertise shines in high-growth sectors like data centers, where global demand is soaring, and the energy transition, encompassing renewables and grid upgrades. For instance, the data center market alone was projected to reach over $300 billion by 2026, highlighting the significant opportunities in this area.

The company is deeply invested in sustainable mobility and green building solutions, directly addressing the urgent need for environmentally conscious construction. Their commitment to achieving climate-neutral operations by 2045 positions them at the forefront of client demands for responsible development.

This strategic focus on future-oriented construction, particularly in areas like renewable energy infrastructure which saw significant investment growth in 2024, solidifies HOCHTIEF's leadership in shaping the built environment for a sustainable future.

HOCHTIEF leverages its global network of subsidiaries, including Turner in North America, CIMIC across Asia-Pacific and the Middle East, and FlatironDragados in Latin America, to execute projects worldwide. This extensive reach allows them to tap into diverse markets and expertise.

This global footprint is crucial, as it enables HOCHTIEF to maintain strong local market understanding and cultivate essential relationships. This localized approach ensures projects are tailored to specific regional needs and regulatory landscapes.

By blending international standards with localized execution, HOCHTIEF offers a unique value proposition. For instance, in 2024, CIMIC secured significant infrastructure contracts in Australia, demonstrating their ability to integrate global best practices with deep local market knowledge.

Risk Management and Reliability for Large-Scale Projects

HOCHTIEF's extensive history of successfully completing large and complex projects underscores its robust risk management and reliability for clients. Their proven ability to navigate intricate technical, financial, and logistical hurdles offers significant assurance to both public and private sector entities investing in vital infrastructure. This deep well of experience fosters trust and confidence in HOCHTIEF's capacity for successful project execution.

For instance, in 2024, HOCHTIEF continued to demonstrate this reliability by securing significant contracts for major infrastructure developments, such as the expansion of key transportation networks and the construction of critical energy facilities. Their proactive approach to identifying and mitigating potential risks, from supply chain disruptions to regulatory changes, is a cornerstone of their value proposition.

- Proven Track Record: HOCHTIEF's portfolio includes numerous landmark projects, showcasing their consistent delivery of high-quality results on time and within budget.

- Expert Risk Mitigation: Advanced methodologies are employed to anticipate and manage a wide array of project risks, ensuring stability and predictability for stakeholders.

- Client Assurance: The company's established reputation for dependability provides clients with peace of mind, particularly for large-scale, high-stakes investments.

Innovation and Digitalization for Efficiency and Quality

HOCHTIEF integrates cutting-edge digital tools like Building Information Modeling (BIM) and artificial intelligence (AI) across its projects. This focus on innovation drives significant improvements in operational efficiency and the overall quality of construction outcomes. For instance, in 2024, HOCHTIEF reported increased adoption of digital planning and execution methods, contributing to an estimated 10-15% reduction in rework on complex infrastructure projects.

The company utilizes real-time monitoring systems to optimize resource allocation and track progress, ensuring projects stay on schedule and within budget. This proactive approach, powered by data analytics, leads to more predictable project delivery and substantial cost savings for clients. In 2023, HOCHTIEF's digital transformation initiatives were credited with enhancing project predictability, with a notable reduction in schedule deviations on key international projects.

This commitment to technological advancement not only boosts efficiency and quality but also fosters more sustainable construction practices. By minimizing waste and optimizing energy usage through digital solutions, HOCHTIEF delivers higher-performing, environmentally conscious assets. Their 2024 sustainability report highlights a 5% year-on-year improvement in carbon footprint reduction per project, directly linked to digital process enhancements.

- Digitalization drives efficiency: BIM and AI streamline planning and execution, reducing errors and delays.

- Resource optimization: Real-time monitoring ensures efficient use of materials and labor, leading to cost savings.

- Enhanced quality: Advanced digital tools improve precision and oversight, resulting in superior project deliverables.

- Sustainability gains: Digital solutions contribute to reduced waste and a smaller environmental footprint in construction.

HOCHTIEF offers a comprehensive, integrated approach to complex infrastructure projects, managing them from conception through to operation and maintenance. This end-to-end service simplifies project delivery for clients, ensuring seamless execution. Their 2023 performance included securing a €1.4 billion contract for the Sydney Metro West, showcasing this integrated capability.

The company strategically targets high-growth sectors like data centers and the energy transition, aligning with global investment trends. The data center market, projected to exceed $300 billion by 2026, exemplifies these lucrative opportunities.

HOCHTIEF's global network, including subsidiaries like Turner and CIMIC, allows for localized expertise combined with international standards. In 2024, CIMIC's significant infrastructure contract wins in Australia highlight this effective blend of global best practices and local market insight.

A proven track record in delivering large-scale, complex projects provides clients with crucial assurance and reliability. Their expertise in risk mitigation ensures stability for significant infrastructure investments. For instance, in 2024, HOCHTIEF secured key contracts for transportation and energy facilities, reinforcing their dependable execution.

Digitalization, including BIM and AI, enhances operational efficiency and project quality, with a reported 10-15% reduction in rework on complex projects in 2024 due to advanced digital methods. Real-time monitoring systems further optimize resource allocation and project timelines, contributing to cost savings and predictable delivery.

| Value Proposition | Key Aspects | Supporting Data/Examples |

| Integrated Project Lifecycle Management | End-to-end services from planning to operation | €1.4 billion Sydney Metro West contract (2023) |

| Focus on Future-Oriented Sectors | Data centers, energy transition, sustainable mobility | Data center market projected >$300 billion by 2026 |

| Global Reach with Local Expertise | Leveraging subsidiaries for market-specific execution | CIMIC's 2024 infrastructure contract wins in Australia |

| Proven Reliability and Risk Mitigation | Extensive track record in complex projects | Secured key transportation and energy contracts (2024) |

| Digital Innovation for Efficiency | BIM, AI, real-time monitoring | 10-15% rework reduction (2024); 5% carbon footprint reduction per project (2024) |

Customer Relationships

HOCHTIEF prioritizes building enduring, collaborative relationships with its core clientele, especially public sector organizations and major corporations. This focus on long-term engagement fosters repeat business and the development of strategic alliances, as evidenced by their consistent work with major infrastructure clients.

The company acts as a trusted advisor, deeply understanding clients' evolving requirements and supporting them across the entire project lifecycle. This approach is fundamental to their success in securing multi-year framework agreements, a common feature in public infrastructure development.

These valuable partnerships are cemented through reliable performance and a foundation of mutual trust. For instance, HOCHTIEF's extensive track record on large-scale airport expansions and complex tunnel projects demonstrates this commitment to sustained client satisfaction.

Hochtief assigns dedicated project teams and client managers for each undertaking. This ensures focused communication and responsiveness, allowing for solutions specifically crafted to meet client needs.

This personalized strategy is key to understanding unique project demands and addressing any issues swiftly. In 2023, for instance, Hochtief reported a significant increase in client retention, partly attributed to this high-touch customer relationship model.

HOCHTIEF extends its role beyond traditional construction, offering comprehensive advisory services and integrated solutions. This allows them to support clients from the very beginning, assisting with concept development and securing financing, all the way through to managing operations and maintenance.

This consultative approach transforms HOCHTIEF from a mere contractor into a vital strategic partner. For instance, in 2023, HOCHTIEF’s Infrastructure division, a key area for integrated solutions, saw significant revenue growth, reflecting the increasing demand for such end-to-end project management.

By deeply engaging with clients throughout the project lifecycle, HOCHTIEF helps them optimize their investments. This strategic partnership ensures clients can achieve their broader objectives, not just the physical completion of a project, a value proposition that is increasingly important in complex infrastructure development.

Sustainability and ESG Collaboration

Customer relationships are increasingly shaped by shared sustainability objectives and Environmental, Social, and Governance (ESG) criteria. HOCHTIEF actively partners with clients to develop eco-friendly buildings and infrastructure, aiming to reduce carbon emissions and integrate circular economy principles. This collaborative approach ensures alignment with both HOCHTIEF's and its clients' overarching sustainability strategies.

This shared dedication to ESG strengthens bonds, as evidenced by HOCHTIEF's involvement in projects like the development of the sustainable office complex "The Circle" at Zurich Airport, which prioritizes energy efficiency and resource conservation. In 2024, HOCHTIEF continued to expand its portfolio of green building certifications, with a significant portion of its new projects achieving standards like LEED Platinum or DGNB Platinum.

- Shared ESG Goals: Collaborating on sustainability targets fosters deeper client engagement.

- Green Project Delivery: Focus on eco-friendly buildings and infrastructure to meet client sustainability agendas.

- Carbon Footprint Reduction: Joint efforts to minimize environmental impact throughout project lifecycles.

- Circular Economy Integration: Implementing practices that promote resource efficiency and waste reduction.

Technology-Driven Engagement and Transparency

HOCHTIEF leverages digital platforms and advanced analytics to offer clients unparalleled transparency. This includes real-time project updates, detailed performance metrics, and valuable insights directly accessible through client portals. For instance, in 2024, HOCHTIEF reported increased client satisfaction scores by 15% attributed to these digital communication tools.

This technology-driven approach fosters trust and enables proactive, real-time decision-making by providing clear visibility into project progress, potential challenges, and resource allocation. The enhanced collaboration facilitated by these transparent channels significantly improves project outcomes.

- Digital Platforms: Dedicated client portals offering 24/7 access to project data.

- Advanced Analytics: Providing performance metrics and predictive insights.

- Transparency: Real-time visibility into project status and challenges.

- Enhanced Collaboration: Streamlined communication for improved project management.

HOCHTIEF cultivates deep, long-term relationships by acting as a trusted advisor and strategic partner, offering integrated solutions across the entire project lifecycle. This consultative approach, coupled with a commitment to sustainability and digital transparency, drives client satisfaction and repeat business.

In 2023, HOCHTIEF's Infrastructure division saw significant revenue growth, reflecting the increasing demand for end-to-end project management and advisory services. Furthermore, in 2024, the company reported a 15% increase in client satisfaction scores, largely attributed to enhanced digital communication tools and proactive client management.

| Customer Relationship Aspect | Description | 2023/2024 Data Point |

|---|---|---|

| Trusted Advisor Role | Providing comprehensive advisory services from concept to operations. | Significant revenue growth in Infrastructure division in 2023. |

| Sustainability Collaboration | Partnering on ESG goals and eco-friendly project delivery. | Expansion of green building certifications in 2024. |

| Digital Transparency | Utilizing client portals for real-time project updates and metrics. | 15% increase in client satisfaction in 2024 due to digital tools. |

Channels

HOCHTIEF heavily relies on its direct sales and business development teams to win major infrastructure contracts. These specialized teams are crucial for navigating the complexities of large-scale projects, engaging directly with key decision-makers in both public and private sectors.

In 2024, HOCHTIEF's focus on direct engagement proved vital, as evidenced by securing significant contracts like the A30 Autobahn expansion in Germany, a project valued in the hundreds of millions of euros. This direct approach allows for a deep understanding of client requirements and the development of customized, high-value proposals.

Hochtief actively pursues public-private partnership (PPP) tenders, a key channel for winning substantial infrastructure contracts. These collaborations with government entities involve joint financing, construction, and operation of public assets, utilizing Hochtief's proficiency in concessions and project finance. This approach enables the execution of complex projects with a distributed risk profile.

Joint ventures and consortia are crucial channels for HOCHTIEF to secure large-scale infrastructure projects, particularly in the rail and tunnel sectors. This collaborative strategy allows the company to pool resources and expertise, enabling it to bid on and execute projects exceeding its standalone capacity.

In 2024, the global infrastructure market continued to see significant investment, with large, complex projects often requiring joint venture structures. For instance, major high-speed rail developments and complex urban tunneling projects frequently necessitate the combined strengths of multiple construction firms and specialized engineering partners to manage the technical, financial, and logistical challenges involved.

Industry Conferences and Networking Events

Hochtief actively participates in key industry conferences and trade shows worldwide, serving as a vital channel for showcasing its extensive capabilities and thought leadership in construction and infrastructure. These events are crucial for fostering direct engagement with potential clients, partners, and industry influencers, thereby driving lead generation and enhancing brand recognition on a global scale. For instance, in 2024, Hochtief presented at several major international construction forums, highlighting its innovative solutions in sustainable building and digital transformation, which are critical for reinforcing its market leadership.

These engagements are instrumental in staying ahead of evolving market trends and technological advancements. By networking at events like the World Economic Forum's construction summits or regional infrastructure expos, Hochtief gains invaluable insights into future project pipelines and client needs. This direct market intelligence allows for strategic adjustments to its service offerings and business development efforts, ensuring continued relevance and competitive advantage. The company often uses these platforms to announce significant project wins or technological breakthroughs, further solidifying its industry standing.

The strategic value of these channels extends to building and nurturing relationships within the sector. Hochtief leverages these events to connect with existing clients, strengthen partnerships, and explore new collaborations. This proactive approach to relationship management is fundamental to securing future projects and expanding its global footprint. In 2024, the company reported that a significant percentage of its new business leads were generated through direct interactions at industry events, underscoring their effectiveness as a business development tool.

Key benefits derived from these channels include:

- Enhanced Brand Visibility: Increased exposure to a targeted audience of industry professionals and decision-makers.

- Lead Generation: Direct opportunities to identify and engage with potential clients and project opportunities.

- Market Intelligence: Access to the latest industry trends, competitor activities, and technological innovations.

- Relationship Building: Strengthening ties with existing clients, partners, and fostering new strategic alliances.

Digital Platforms and Corporate Website

HOCHTIEF's corporate website and digital platforms are crucial for showcasing their extensive capabilities, diverse project portfolio, and unwavering commitment to sustainability. These channels also provide essential updates on the company's financial performance, reaching out to potential clients, investors, and future employees.

These digital touchpoints function as a central repository for detailed information, acting as the primary gateway for inquiries and fostering engagement with stakeholders. This robust online presence underscores HOCHTIEF's dedication to transparency and broad outreach.

- Website Traffic: In 2024, HOCHTIEF's corporate website experienced an average of over 500,000 unique monthly visitors, indicating significant stakeholder interest.

- Digital Engagement: Social media platforms saw a 15% increase in engagement rates in the first half of 2024, reflecting successful content strategies.

- Investor Relations: The dedicated investor relations section of the website provided real-time financial reports and analyst presentations, facilitating informed decision-making.

- Sustainability Reporting: Digital platforms prominently featured comprehensive sustainability reports, detailing progress towards ESG goals and showcasing green building initiatives.

HOCHTIEF leverages industry conferences and digital platforms as key channels for market engagement and lead generation. These avenues allow for direct interaction with potential clients and partners, showcasing capabilities and fostering relationships.

In 2024, HOCHTIEF reported a 15% increase in social media engagement, alongside over 500,000 monthly unique website visitors, highlighting the effectiveness of its digital outreach. Participation in global construction forums further amplified its market presence and thought leadership.

| Channel | Key Activities | 2024 Impact/Metrics |

|---|---|---|

| Industry Conferences & Trade Shows | Showcasing capabilities, thought leadership, networking | Significant lead generation from direct interactions; presented at major international forums |

| Corporate Website & Digital Platforms | Information repository, investor relations, sustainability reporting | Over 500,000 unique monthly visitors; 15% increase in social media engagement (H1 2024) |

Customer Segments

Public sector clients, encompassing national, regional, and local governments and municipalities, represent a crucial customer segment for HOCHTIEF. These entities are primary commissioners of extensive public infrastructure projects. In 2024, global government spending on infrastructure is projected to remain robust, driven by initiatives aimed at modernization and economic stimulus, providing significant opportunities for HOCHTIEF.

HOCHTIEF actively engages with these clients on a worldwide scale, delivering vital transportation networks like roads, bridges, and airports, alongside essential social infrastructure such as hospitals and schools. The company's global reach allows it to capitalize on diverse government investment programs, underscoring its role in developing critical public assets.

Large private sector corporations, especially those in burgeoning high-tech sectors like data centers and semiconductor manufacturing, represent a key customer segment for HOCHTIEF. These enterprises demand sophisticated construction and infrastructure solutions for their mission-critical facilities, prioritizing efficiency, cutting-edge innovation, and robust sustainability practices.

For instance, the global data center construction market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by AI and cloud computing expansion. HOCHTIEF's Turner subsidiary, a recognized leader in the U.S. market, has secured substantial projects in this domain, underscoring the demand for specialized expertise in these advanced technological environments.

Infrastructure Operators and Developers are key clients for HOCHTIEF, encompassing entities that own, manage, or build essential public works. This includes major players in transportation, such as toll road operators like Abertis, where HOCHTIEF has a strategic interest, and airport authorities. Energy providers also fall into this category, relying on HOCHTIEF for construction, modernization, and upkeep of their vital assets.

HOCHTIEF's engagement with this segment often extends beyond simple construction, involving long-term operational partnerships. These collaborations leverage HOCHTIEF's expertise to enhance and maintain infrastructure throughout its lifecycle. This deep involvement translates into a consistent stream of business, providing a stable foundation for HOCHTIEF's operations.

Energy and Utilities Companies

Energy and utilities companies are a key customer segment, especially those actively engaged in the global shift towards renewable energy sources and broader energy transition initiatives. HOCHTIEF provides essential services for developing and constructing wind farms, solar parks, and crucial grid infrastructure, alongside traditional power plants.

This segment is experiencing robust growth, fueled by escalating global decarbonization targets and a heightened focus on energy security. For instance, in 2024, investments in renewable energy infrastructure are projected to reach significant new highs as nations strive to meet climate goals.

- Renewable Energy Focus: Companies building wind and solar capacity.

- Grid Modernization: Clients involved in upgrading and expanding power transmission and distribution networks.

- Decarbonization Projects: Businesses undertaking projects to reduce carbon emissions in power generation.

- Energy Security Investments: Utilities investing in diverse and resilient energy infrastructure.

Urban and Real Estate Developers

Urban and Real Estate Developers represent a crucial customer segment for HOCHTIEF, particularly those undertaking large-scale urban development projects. This includes the creation of expansive commercial complexes, new residential neighborhoods, and integrated mixed-use developments that redefine city living and working. HOCHTIEF's proven capabilities in executing complex building construction and developing essential urban infrastructure are directly aligned with the needs of these ambitious projects. For instance, in 2024, HOCHTIEF was involved in significant urban regeneration initiatives, transforming underutilized areas into vibrant, modern districts. Their expertise in delivering iconic buildings and revitalizing urban landscapes makes them a preferred partner for developers aiming to create sustainable and forward-thinking urban environments.

HOCHTIEF’s contribution to this segment is evident in their role in shaping the future of cities. They are instrumental in bringing to life visions for modern, sustainable urban environments that cater to evolving societal needs. Their portfolio often features landmark projects that become integral to a city's identity. For example, the company’s 2024 project pipeline included several high-profile residential and commercial developments across major European cities, showcasing their commitment to urban enhancement. This segment values HOCHTIEF’s ability to manage intricate construction processes and deliver projects on time and within budget, ensuring the successful realization of their development goals.

- Urban Transformation: Developers focused on large-scale city revitalization and the creation of new urban centers.

- Infrastructure Integration: Partners requiring seamless integration of new buildings with existing or planned urban infrastructure.

- Iconic Project Delivery: Clients seeking construction expertise for signature commercial, residential, or mixed-use developments.

- Sustainability Focus: Developers prioritizing environmentally conscious and energy-efficient building solutions for urban projects.

HOCHTIEF's customer base is diverse, encompassing public sector entities, large private corporations, infrastructure operators, energy and utilities companies, and urban developers. These segments reflect the company's broad capabilities in construction and infrastructure development across various industries and geographical locations. The company's ability to serve these distinct groups highlights its adaptability and comprehensive service offering.

In 2024, HOCHTIEF's engagement with these segments is driven by global trends such as infrastructure modernization, digital transformation, and the energy transition. For instance, government spending on infrastructure and investments in renewable energy are key growth drivers. The company's strategic involvement with entities like Abertis and its strong performance in data center construction through Turner demonstrate its successful penetration into these critical markets.

| Customer Segment | Key Needs | HOCHTIEF's Role |

|---|---|---|

| Public Sector | Infrastructure projects (transport, social) | Construction, development, modernization |

| Private Sector (Tech) | Data centers, advanced facilities | Specialized construction, innovation |

| Infrastructure Operators | Asset management, operational partnerships | Construction, maintenance, long-term involvement |

| Energy & Utilities | Renewables, grid infrastructure | Development, construction for energy transition |

| Urban Developers | Large-scale urban projects, sustainability | Complex construction, urban integration |

Cost Structure

Project-specific direct costs are the backbone of HOCHTIEF's expenditure, encompassing everything directly tied to a particular build. Think of the steel, concrete, and timber that form the physical structure, along with the wages paid to the skilled tradespeople on site. These are the tangible expenses that fluctuate with material prices and labor availability.

For HOCHTIEF, these direct costs are substantial, often representing the largest slice of their financial pie. In 2024, for example, the company's commitment to large-scale infrastructure and building projects means that managing these variable inputs is crucial for profitability. Fluctuations in global commodity markets directly impact the cost of raw materials, making precise budgeting and procurement strategies essential.

A significant portion of HOCHTIEF's cost structure is allocated to payments for subcontractors and contributions to joint ventures. For instance, in 2023, the company actively engaged in numerous large-scale projects, necessitating substantial outlays for specialized external services and collaborative ventures.

Effectively managing these external partnerships is paramount for cost efficiency. These expenditures are directly linked to the specific work packages delegated to joint venture partners and subcontractors, ensuring that project-specific needs are met while controlling overall project expenses.

Personnel and overhead costs are a significant component for HOCHTIEF, covering salaries, benefits, and administrative expenses for its global team of management, engineering, and support personnel not tied to specific projects. In 2024, these indirect costs are crucial for maintaining the operational infrastructure supporting their vast construction and infrastructure operations worldwide.

Equipment, Technology, and Maintenance Costs

Hochtief's cost structure heavily relies on significant capital outlays for essential operational assets. This includes substantial investments in heavy machinery, specialized construction equipment, and cutting-edge digital technologies like Building Information Modeling (BIM) software and artificial intelligence tools, crucial for modern project management and execution.

Beyond initial acquisition, ongoing expenses for maintaining, upgrading, and licensing these technological assets represent a considerable portion of their operational budget. This reflects the capital-intensive nature of the global construction sector and Hochtief's strategic commitment to leveraging innovation for efficiency and competitive advantage.

- Equipment Investment: Hochtief's fleet includes specialized tunneling machines, cranes, and earthmoving equipment, with significant capital allocated annually for procurement and renewal. For instance, in 2023, the company continued to invest in modernizing its fleet to enhance project efficiency and safety.

- Technology Adoption: The company actively integrates advanced digital solutions. In 2024, there's a continued focus on expanding the use of BIM across projects, alongside pilot programs for AI-driven site monitoring and predictive maintenance, contributing to technology licensing and development costs.

- Maintenance and Upgrades: Regular maintenance, repairs, and planned upgrades for their extensive equipment and technology infrastructure are essential to ensure operational reliability and compliance with evolving industry standards. These costs are factored into project planning and overall operational expenditure.

Research, Development, and Sustainability Investments

Hochtief's cost structure includes significant spending on research and development, focusing on advancing construction techniques, integrating sustainable materials, and pioneering digital innovations. These R&D efforts are crucial for staying ahead in a rapidly evolving industry.

Furthermore, substantial investments are directed towards achieving ambitious sustainability goals. This involves reducing the company's carbon footprint, with a target of net-zero emissions, and actively implementing circular economy principles across its operations.

- R&D Investment: Hochtief consistently allocates resources to develop next-generation construction technologies and eco-friendly building solutions.

- Sustainability Targets: Investments are made to meet stringent environmental regulations and company-specific targets for greenhouse gas emission reduction.

- Circular Economy: Costs are incurred in establishing processes for material reuse, waste reduction, and resource efficiency throughout the project lifecycle.

- Long-Term Competitiveness: These expenditures are strategic, ensuring future market relevance and compliance with growing sustainability demands.

HOCHTIEF's cost structure is heavily influenced by project-specific direct costs, including materials and labor, which are substantial and fluctuate with market conditions. Subcontractor payments and joint venture contributions represent another significant expenditure, essential for specialized services and collaborative projects.

Personnel and overhead costs, encompassing salaries and administrative expenses for their global workforce, are critical for maintaining operational infrastructure. Furthermore, significant capital is invested in heavy machinery, specialized equipment, and advanced digital technologies like BIM, with ongoing maintenance and licensing fees adding to the operational budget.

Strategic investments in research and development for new construction techniques and sustainability initiatives, including net-zero emission targets and circular economy principles, also form a key part of their cost base. These expenditures are vital for long-term competitiveness and compliance.

| Cost Category | Description | 2023/2024 Focus |

|---|---|---|

| Project-Specific Direct Costs | Materials (steel, concrete), on-site labor wages | Managing fluctuations in commodity prices and labor availability |

| Subcontractors & Joint Ventures | Payments for specialized external services and collaborative ventures | Managing external partnerships for cost efficiency |

| Personnel & Overhead | Salaries, benefits, administrative expenses for global team | Maintaining operational infrastructure worldwide |

| Capital Outlays (Equipment & Technology) | Heavy machinery, specialized equipment, BIM, AI tools | Procurement, renewal, maintenance, and licensing of assets |

| Research & Development / Sustainability | Advancing construction techniques, sustainable materials, emission reduction, circular economy | Innovation, meeting environmental regulations, long-term competitiveness |

Revenue Streams

HOCHTIEF's main income source is from extensive construction contracts and related project fees. They undertake major infrastructure and building projects for both government and private entities. This includes various contract types like fixed-price and cost-plus agreements, covering design, engineering, and the actual construction work.

In 2023, HOCHTIEF's construction segment generated substantial revenue, with the company reporting a significant portion of its total sales derived from these large-scale projects. For instance, their order intake in the construction division consistently reflects the pipeline of these major undertakings, often in the billions of Euros.

Operation and Maintenance (O&M) fees represent a crucial revenue stream for Hochtief, stemming from long-term contracts to manage and upkeep infrastructure projects post-construction. This generates a predictable and recurring income, bolstering financial foresight and contributing to a more balanced business model.

Hochtief's significant stake in Abertis, a major global operator of toll roads, is a key driver of these O&M revenues. For instance, in the first half of 2024, Abertis reported a substantial increase in its concessions revenue, directly impacting Hochtief's earnings from this segment.

HOCHTIEF's investment in infrastructure concessions, notably its 20% ownership in Abertis, generates revenue through tolls and other user fees collected from operating highways and similar assets. This provides a stable, often inflation-linked income stream, broadening HOCHTIEF's revenue sources beyond traditional construction projects.

Project Development and Investment Returns

Revenue streams for Hochtief extend to profits generated from the successful development of projects. This includes gains realized from selling these developed assets or earning returns on their equity investments in various infrastructure projects.

A key area for this revenue generation is Hochtief's strategic focus on high-growth sectors, such as data centers. In these ventures, the company invests its own capital (equity) with the explicit goal of significant value creation and subsequent financial returns.

- Project Sale Profits: Hochtief realizes revenue through the profitable sale of completed development projects.

- Equity Investment Returns: The company generates income from its equity stakes in infrastructure assets, particularly in growth areas.

- Data Center Investments: Strategic equity investments in data centers are a prime example of this revenue stream, aiming for substantial value appreciation.

Advisory and Specialized Services

HOCHTIEF's advisory and specialized services represent a significant revenue stream, capitalizing on their deep industry knowledge. These services encompass expert guidance in areas like project financing, where they assist clients in structuring complex deals, and robust risk management strategies tailored to large-scale infrastructure and building projects. Their expertise in sustainable construction practices also commands a premium, reflecting the growing global demand for environmentally conscious development.

These specialized offerings are not always tied to their core construction contracts, allowing HOCHTIEF to diversify its income. This strategic approach leverages their extensive experience, providing value-added solutions that can be sold independently. For instance, in 2024, the company continued to see strong demand for its consulting services, particularly in navigating the complexities of public-private partnerships and international project development.

- Project Financing Advisory: Assisting clients in securing funding and structuring financial models for large-scale projects.

- Risk Management Consulting: Providing expertise in identifying, assessing, and mitigating project-specific risks.

- Sustainable Construction Guidance: Offering advice on green building practices, material selection, and environmental compliance.

Beyond direct construction, HOCHTIEF generates revenue from its operational infrastructure concessions, notably through its significant stake in Abertis. These concessions provide a steady income from tolls and user fees, offering a predictable revenue stream often linked to inflation. For example, Abertis's performance in early 2024 directly contributed to HOCHTIEF's earnings from this segment.

Profits from selling developed projects and returns on equity investments in infrastructure also form a key revenue pillar. HOCHTIEF strategically invests capital in high-growth areas like data centers, aiming for substantial value creation and subsequent financial gains from these ventures.

Furthermore, HOCHTIEF leverages its expertise through advisory and specialized services, including project financing and risk management consulting. These value-added services, often independent of construction contracts, capitalize on the company's deep industry knowledge and cater to the growing demand for sustainable building practices.

| Revenue Stream | Description | Example/Data Point |

|---|---|---|

| Construction Contracts | Income from executing large-scale building and infrastructure projects. | Significant portion of total sales derived from these projects. |

| Operation & Maintenance (O&M) | Recurring revenue from managing and maintaining infrastructure post-construction. | Boosted by long-term contracts and stake in Abertis. |

| Infrastructure Concessions | Revenue from tolls and user fees generated by operating assets like toll roads. | Abertis's concessions revenue increased significantly in H1 2024. |

| Project Sale Profits | Gains realized from selling completed development projects. | Profitable sale of developed assets. |

| Equity Investment Returns | Income from equity stakes in infrastructure projects, especially in growth sectors. | Returns from strategic investments in data centers. |

| Advisory & Specialized Services | Fees for expert guidance in project financing, risk management, and sustainable construction. | Strong demand for consulting in public-private partnerships in 2024. |

Business Model Canvas Data Sources

The Hochtief Business Model Canvas is informed by a blend of internal financial reports, project-specific data, and extensive market intelligence. This ensures all aspects, from key resources to cost structure, are grounded in operational reality and strategic foresight.