Hilton Food Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Food Group Bundle

Gain a critical understanding of the external forces shaping Hilton Food Group's future with our comprehensive PESTLE analysis. Discover how political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting their operations and strategic direction. Equip yourself with actionable intelligence to navigate this complex landscape. Download the full PESTLE analysis now and unlock the insights needed to make informed decisions and secure your competitive advantage.

Political factors

Governments globally enforce rigorous food safety and hygiene standards, a critical aspect for food processors like Hilton Food Group. These regulations, covering everything from sourcing to packaging, directly influence operational procedures and compliance costs.

In 2024, for instance, the European Union continued to emphasize traceability and allergen management within its food safety frameworks, requiring significant investment in data systems and quality control for companies operating within or exporting to the bloc. Failure to comply can lead to hefty fines, product recalls, and severe damage to brand reputation, impacting market access and consumer confidence.

Hilton Food Group's international operations mean it's significantly impacted by global trade policies. For instance, the UK's post-Brexit trade deals, or the EU's Common Agricultural Policy, directly influence sourcing costs and market access. Fluctuations in tariffs, like those potentially seen in ongoing trade disputes between major economies, could increase the price of imported raw materials or finished goods, affecting profit margins and pricing strategies for Hilton's diverse product range.

Government policies directly impact the agricultural sector, which is a crucial supply chain component for Hilton Food Group. Subsidies for livestock or crop production, for instance, can significantly alter the availability and pricing of raw materials. For example, in the UK, the Agriculture Act 2020 aims to transition away from EU-based subsidies, focusing on environmental land management schemes. This shift could influence the cost and sourcing of meat products, a core business for Hilton.

Labor Laws and Employment Regulations

Changes in labor laws, like minimum wage hikes or new worker protections, can significantly impact Hilton Food Group's operating expenses and how they manage their staff across different countries. For instance, a 2024 report indicated that the average minimum wage in the UK, a key market for Hilton, saw an increase, directly affecting labor costs for entry-level positions.

Staying compliant with evolving employment regulations, such as those concerning working hours or the right to unionize, is crucial for maintaining smooth business operations and avoiding potential legal issues. In 2025, several European nations are expected to introduce stricter regulations on temporary worker contracts, which could influence Hilton's flexible staffing models.

- Minimum Wage Impact: A 5% increase in the national minimum wage in a major operating region could add an estimated £5 million to Hilton Food Group's annual labor costs.

- Working Hour Regulations: New legislation limiting weekly working hours could necessitate hiring additional staff, increasing overall payroll expenses by up to 3%.

- Unionization Trends: A rise in union membership in the food processing sector could lead to increased collective bargaining power, potentially driving up wages and benefits beyond statutory requirements.

- Compliance Costs: Investing in updated HR systems and training to meet new labor law requirements is projected to cost Hilton Food Group approximately £1 million in 2025.

Political Stability in Operating Regions

Political stability in the regions where Hilton Food Group operates is a critical factor. Instability, conflicts, or sudden policy changes in countries with their processing plants or major retail partners can significantly disrupt their supply chains. For instance, geopolitical tensions in Eastern Europe, a key sourcing region for some food products, could impact raw material availability and logistics.

Such disruptions can directly affect consumer demand for Hilton's products and create considerable risks for their existing investments and overall business continuity. The company's reliance on a global network means that localized political unrest can have far-reaching consequences.

- Geopolitical Risk: Hilton Food Group's global footprint exposes it to varying levels of political stability across its operating regions.

- Supply Chain Vulnerability: Political instability can lead to supply chain disruptions, impacting the availability and cost of raw materials.

- Investment Risk: Significant policy shifts or conflicts can jeopardize the company's investments in processing facilities and market presence.

- Operational Impact: Business continuity is threatened by events that impede production, transportation, or market access.

Government regulations on food safety, such as those enforced by the EU in 2024 regarding traceability and allergen management, necessitate significant investment in data systems and quality control for Hilton Food Group. Trade policies, including post-Brexit agreements and agricultural subsidies, directly influence sourcing costs and market access, with potential tariff fluctuations impacting profit margins. Changes in labor laws, like minimum wage increases seen in the UK in 2024, directly affect operating expenses, while evolving employment regulations in 2025 concerning temporary workers could influence staffing models.

| Political Factor | Impact on Hilton Food Group | 2024/2025 Data/Trend |

|---|---|---|

| Food Safety Regulations | Increased compliance costs, potential fines, brand reputation risk | EU's continued emphasis on traceability and allergen management |

| Trade Policies & Tariffs | Fluctuations in raw material costs, market access changes | Impact of post-Brexit trade deals, potential tariffs in global trade disputes |

| Labor Laws & Minimum Wage | Higher operating expenses, potential need for increased staffing | UK minimum wage increases in 2024, projected stricter regulations on temporary workers in Europe by 2025 |

| Political Stability | Supply chain disruptions, investment risks, business continuity threats | Geopolitical tensions in Eastern Europe impacting sourcing and logistics |

What is included in the product

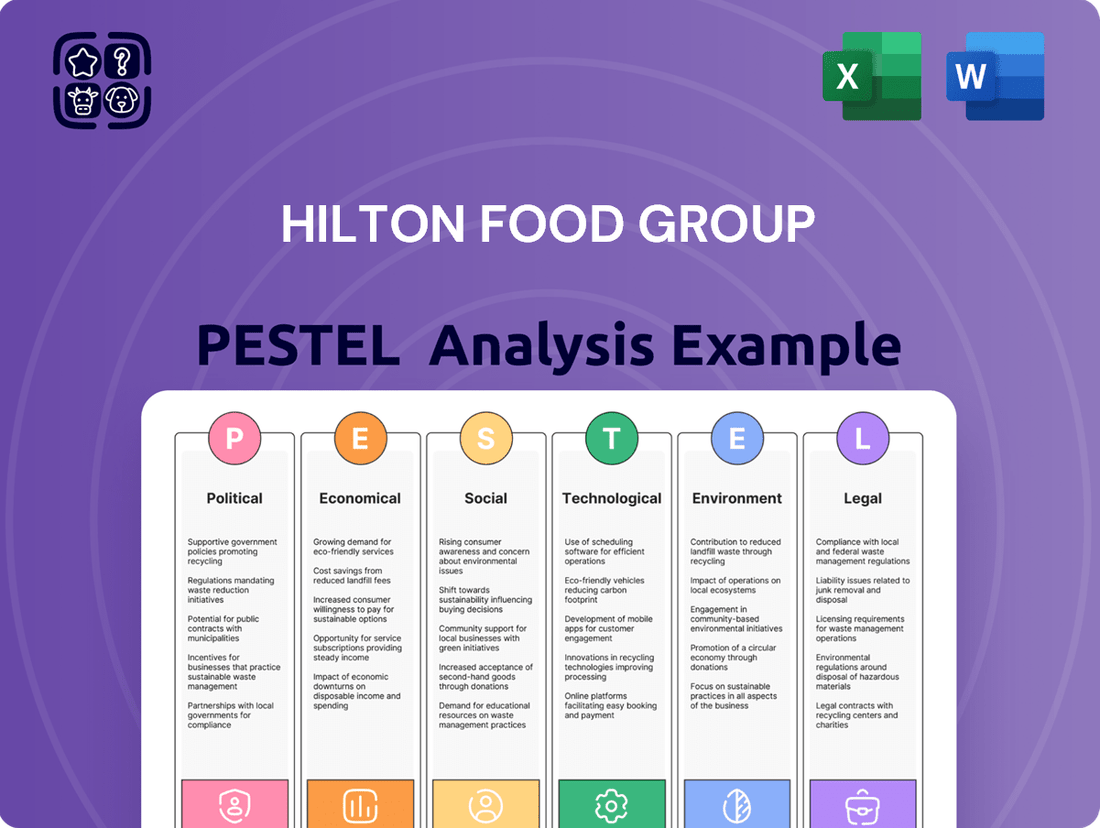

This PESTLE analysis examines the external macro-environmental factors impacting Hilton Food Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces create both threats and opportunities for the company's strategic planning and market positioning.

The Hilton Food Group PESTLE analysis provides a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of information overload.

Economic factors

Inflation significantly impacts Hilton Food Group by increasing the cost of essential raw materials such as meat, seafood, and packaging. For instance, in early 2024, global food commodity prices, while showing some moderation from previous peaks, remained elevated due to ongoing geopolitical tensions and supply chain disruptions, directly affecting Hilton's input costs.

This rise in raw material expenses puts pressure on Hilton's profit margins. If the company cannot fully pass these increased costs onto its retail partners and ultimately consumers, its profitability will be squeezed. Hilton's ability to manage these costs efficiently through strategic sourcing and operational improvements is therefore crucial for maintaining financial health.

Consumer disposable income is a key driver for grocery spending. In the UK, for instance, real household disposable income saw a slight increase in early 2024, but persistent inflation has continued to pressure household budgets. This means consumers are increasingly scrutinizing their spending, potentially favouring value options over premium products.

Hilton Food Group's strategy of offering a diverse product range, from premium to value-oriented lines, is well-positioned to address these evolving consumer habits. As economic conditions fluctuate, the group's ability to cater to different price sensitivities will be crucial for maintaining sales volumes and market share.

Hilton Food Group's international operations mean it's directly impacted by exchange rate shifts. A weaker pound, for instance, could increase the cost of sourcing meat from abroad, while a stronger pound might make its products more expensive for international buyers, potentially impacting sales volume.

For example, in the first half of 2024, Hilton Food Group reported that currency headwinds had a notable impact on its reported profits, underscoring the need for robust risk management. The company actively uses hedging strategies to lock in exchange rates for a portion of its foreign currency exposures, aiming to stabilize costs and revenues.

Economic Growth and Market Demand

Overall economic growth in key markets significantly impacts consumer confidence and, consequently, the demand for food products, especially convenience and value-added items. As economies expand, disposable incomes tend to rise, leading to increased spending on such products.

Strong economic conditions are a direct driver for boosting sales volumes for companies like Hilton Food Group. This increased revenue can then be reinvested to support expansion strategies, whether it's introducing new product lines or entering new geographical markets. For instance, in 2023, the UK economy saw a modest growth of 0.1% in Q4, contributing to a stable consumer spending environment for food retailers and suppliers.

- Economic Growth Impact: Countries with robust GDP growth, like the United States which projected a 2.3% GDP growth for 2024 by the IMF in April 2024, generally exhibit higher consumer spending on food.

- Consumer Confidence: Rising consumer confidence, often correlated with economic stability, encourages purchases of premium and convenience food items, directly benefiting food processing and distribution businesses.

- Market Demand: Hilton Food Group's demand is closely tied to the economic health of its operating regions, with strong economic periods typically translating to higher sales volumes for its meat and meal solutions.

Energy Costs and Supply Chain Logistics

Fluctuations in energy prices, particularly for fuel and electricity, significantly influence Hilton Food Group's operating expenses. For instance, the average price of Brent crude oil, a key global benchmark, experienced considerable volatility in late 2023 and early 2024, impacting transportation costs.

Efficient energy management and the optimization of supply chain logistics are therefore paramount for Hilton Food Group to navigate these economic pressures effectively. This involves strategies like route optimization for its delivery fleet and investments in energy-efficient processing facilities.

- Energy Price Volatility: Global energy prices, including diesel and electricity, directly affect transportation and processing costs for food manufacturers like Hilton Food Group.

- Supply Chain Efficiency: Optimizing logistics, from sourcing raw materials to final delivery, is crucial for mitigating the impact of rising energy expenses.

- Operational Costs: Higher energy bills translate to increased operational expenditures, potentially impacting profit margins if not managed proactively.

- Mitigation Strategies: Investments in fuel-efficient vehicles and renewable energy sources for facilities can help offset these economic challenges.

Economic growth directly fuels consumer spending on food, benefiting Hilton Food Group. For example, the IMF projected 2.3% GDP growth for the US in 2024, indicating a supportive market. Higher consumer confidence, often linked to economic stability, encourages purchases of premium and convenience food items, a key segment for Hilton.

Inflationary pressures, however, continue to impact raw material costs and consumer disposable income. While some commodity prices moderated in early 2024, they remained elevated. This necessitates Hilton's focus on efficient sourcing and cost management to protect profit margins amidst potentially tighter household budgets.

Currency fluctuations also present a challenge, as seen with the impact of currency headwinds on Hilton's reported profits in early 2024. The group's international operations require robust risk management, including hedging strategies, to mitigate the effects of exchange rate volatility on its financial performance.

| Economic Factor | Impact on Hilton Food Group | Supporting Data/Example (2024/2025) |

| Economic Growth | Boosts consumer spending and demand for food products. | IMF projected 2.3% US GDP growth for 2024. |

| Inflation | Increases raw material costs and pressures consumer disposable income. | Global food commodity prices remained elevated in early 2024 due to supply chain issues. |

| Exchange Rates | Affects costs of imported materials and competitiveness of exports. | Hilton reported notable impact from currency headwinds in H1 2024. |

| Energy Prices | Increases transportation and processing operational costs. | Brent crude oil experienced volatility in late 2023/early 2024, impacting logistics. |

What You See Is What You Get

Hilton Food Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for the Hilton Food Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the intricate landscape shaping the company's strategic decisions.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a significant rise in demand for plant-based and flexitarian options. This shift is evident in the global plant-based food market, which was valued at approximately $29.7 billion in 2023 and is projected to reach $169.9 billion by 2030, growing at a CAGR of 28.1%.

Hilton Food Group is strategically responding to these evolving dietary preferences by expanding its product portfolio to include a wider range of vegetarian, vegan, and sustainable seafood offerings. This diversification allows the company to capture a larger share of the growing market segment focused on ethical sourcing and reduced meat consumption.

Modern lifestyles are increasingly prioritizing convenience, driving a significant demand for ready meals and pre-packaged food solutions. This trend is particularly pronounced among busy professionals and families seeking time-saving options for their daily meals.

Hilton Food Group's strategic focus on retail packing and ready-to-cook meal kits directly capitalizes on this societal shift, positioning the company to meet the evolving needs of consumers. For instance, the UK ready meal market alone was valued at over £3 billion in 2023, with continued growth projected.

Consumers are increasingly vocal about the ethical treatment of animals throughout the food supply chain, a trend that significantly impacts companies like Hilton Food Group. This growing awareness extends to the environmental footprint of food production, pushing for greater transparency and accountability. For instance, a 2024 report indicated that over 60% of consumers consider ethical sourcing a key factor in their purchasing decisions for meat products.

Hilton Food Group must actively showcase its commitment to robust animal welfare standards and demonstrably sustainable sourcing practices. This is not merely a matter of compliance but a crucial element for maintaining consumer trust and safeguarding its brand reputation in a market where ethical considerations are paramount. Failure to do so could lead to reputational damage and a decline in market share, as seen with competitors facing public backlash over animal welfare issues in recent years.

Demographic Shifts and Household Structures

Demographic shifts significantly impact food consumption patterns, directly affecting companies like Hilton Food Group. For instance, in the UK, the average household size has been on a downward trend. Data from the Office for National Statistics (ONS) indicated that in 2023, the average household size was around 2.3 people, a decrease from previous decades. This trend, coupled with an aging population and an increasing number of single-person households, necessitates a re-evaluation of product sizing and packaging strategies to meet evolving consumer demands for smaller, more convenient portions.

These changes directly influence purchasing habits and the demand for specific portion sizes. Hilton Food Group needs to be agile in adapting its product portfolio. This might involve offering a wider range of single-serving or smaller family packs to cater to smaller households and individuals.

- Decreasing Household Size: Average UK household size around 2.3 people (ONS, 2023).

- Aging Population: A growing segment with potentially different dietary needs and preferences.

- Single-Person Households: Increasing prevalence drives demand for smaller, individual meal solutions.

- Packaging Innovation: Need for multi-pack options and single-serve formats to align with demographic trends.

Food Culture and Global Cuisine Influence

The growing interconnectedness of the world means people are more exposed than ever to different food cultures. This trend is fueling a desire for a wider range of tastes and ingredients, moving beyond traditional offerings. For instance, the global ethnic food market was valued at over $140 billion in 2023, showcasing this significant consumer shift.

Hilton Food Group has a prime opportunity to tap into this evolving palate. By developing innovative product lines that incorporate international flavors and unique culinary profiles, the company can attract a much larger and more diverse customer base. This strategic move aligns with consumer demand for novelty and authenticity in their food choices.

- Global Food Market Growth: The worldwide food and beverage market is projected to reach $9.15 trillion by 2027, indicating substantial opportunities for companies adapting to changing tastes.

- Consumer Interest in International Flavors: Surveys in 2024 showed that over 60% of consumers are actively seeking out new and international food experiences.

- Product Innovation Potential: Hilton Food Group can leverage this by introducing ready-to-eat meals or meal kits featuring popular cuisines like Korean, Thai, or Mediterranean, reflecting current consumer preferences.

Societal attitudes towards health and sustainability are profoundly shaping food choices. Consumers are increasingly seeking out plant-based, ethically sourced, and environmentally friendly products. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is expected to surge to $169.9 billion by 2030, reflecting a strong CAGR of 28.1%.

Hilton Food Group is adapting by expanding its offerings to include more vegetarian, vegan, and sustainably produced options, directly addressing these consumer priorities and capturing a growing market segment.

Modern lifestyles, characterized by busy schedules, are driving a significant demand for convenience. Ready meals and pre-prepared food solutions are becoming essential for time-pressed consumers. The UK ready meal market alone was valued at over £3 billion in 2023, underscoring this trend.

Hilton Food Group's focus on retail packing and meal kits directly caters to this need for convenience, positioning the company to meet the evolving demands of today's consumers.

Consumer awareness regarding animal welfare and the environmental impact of food production is at an all-time high. A 2024 report highlighted that over 60% of consumers consider ethical sourcing when purchasing meat. Hilton Food Group must therefore emphasize its commitment to robust animal welfare standards and transparent, sustainable sourcing to maintain consumer trust and brand reputation.

Demographic shifts, such as decreasing household sizes and an aging population, are altering food consumption patterns. The average UK household size was around 2.3 people in 2023, according to the ONS. This necessitates a strategic adjustment in product sizing and packaging to cater to smaller households and individuals seeking convenient, single-serve options.

The increasing global interconnectedness exposes consumers to diverse food cultures, fueling a demand for varied tastes and ingredients. The global ethnic food market was valued at over $140 billion in 2023, illustrating this significant shift in consumer preferences.

Hilton Food Group can capitalize on this by developing innovative product lines featuring international flavors, thereby attracting a broader and more diverse customer base seeking novel culinary experiences.

| Sociological Factor | Trend | Impact on Hilton Food Group | Market Data/Example |

|---|---|---|---|

| Health & Wellness | Rising demand for plant-based and sustainable foods | Portfolio expansion into vegetarian, vegan, and sustainable options | Plant-based food market valued at ~$29.7 billion in 2023, projected to reach $169.9 billion by 2030 (28.1% CAGR) |

| Lifestyle | Increased demand for convenience and ready-to-eat meals | Focus on retail packing and meal kits | UK ready meal market exceeded £3 billion in 2023 |

| Ethics & Sustainability | Growing consumer concern for animal welfare and environmental impact | Emphasis on transparent sourcing and animal welfare standards | Over 60% of consumers consider ethical sourcing in purchasing decisions (2024 report) |

| Demographics | Decreasing household size, aging population | Need for smaller portion sizes and single-serve packaging | Average UK household size ~2.3 people (ONS, 2023) |

| Cultural Exposure | Appetite for diverse international flavors | Opportunity for product innovation with global cuisines | Global ethnic food market valued at over $140 billion in 2023 |

Technological factors

Advanced automation is revolutionizing food processing, boosting efficiency and cutting labor expenses. For Hilton Food Group, this means better product consistency and heightened safety standards. Their investments in state-of-the-art facilities highlight a strategic push for operational excellence through technology.

Hilton Food Group is increasingly leveraging digital technologies like blockchain and the Internet of Things (IoT) to enhance its supply chain. This push for digitalization, a key technological factor, aims to provide unparalleled transparency and traceability from the initial sourcing of products right through to the consumer. For instance, by implementing robust tracking systems, Hilton can pinpoint the origin of every item, ensuring quality and safety standards are met at every stage.

The benefits of this technological adoption are significant. Greater traceability allows Hilton Food Group to effectively manage inventory, minimizing spoilage and waste, a crucial aspect in the food industry where freshness is paramount. In 2023, the company reported a focus on operational efficiency, with digital tools playing a central role in achieving this. This also enables a more agile response to potential disruptions, such as unexpected weather events or transportation issues, ensuring continuity of supply.

Technological leaps in food packaging and preservation are significantly extending product shelf life and reducing spoilage. For instance, advancements in modified atmosphere packaging (MAP) and active packaging are becoming more sophisticated, offering tailored environments to maintain freshness. Hilton Food Group can capitalize on these innovations to not only improve the quality and safety of its products but also to bolster its sustainability credentials by minimizing waste throughout the supply chain.

These innovations directly impact distribution efficiency by allowing for longer transit times and wider market reach without compromising product integrity. For example, research in 2024 highlighted that certain bio-based barrier films can extend the shelf life of fresh produce by up to 30% compared to traditional materials. By integrating such technologies, Hilton Food Group can optimize logistics and reduce the environmental footprint associated with food transportation.

Data Analytics and AI for Demand Forecasting

Hilton Food Group is increasingly leveraging big data analytics and artificial intelligence to refine its demand forecasting. This allows for more precise predictions of consumer needs, which in turn optimizes production schedules and enables the personalization of product offerings to specific markets. This data-driven strategy significantly boosts operational efficiency and the company's ability to react swiftly to market changes.

The impact of these technological advancements is evident in improved inventory management and reduced waste. For instance, by analyzing vast datasets encompassing sales trends, seasonal variations, and promotional impacts, Hilton Food Group can better align its supply chain with actual demand. This was particularly crucial in 2024 as consumer purchasing habits continued to evolve rapidly post-pandemic.

- Enhanced Demand Accuracy: AI algorithms can process complex variables far beyond traditional forecasting methods, leading to more precise predictions.

- Optimized Production: Better forecasting directly translates to more efficient use of manufacturing resources and reduced lead times.

- Personalized Offerings: Data analytics allows for tailored product assortments based on regional preferences and purchasing patterns.

- Supply Chain Agility: The ability to anticipate demand fluctuations improves the responsiveness of the entire supply chain.

E-commerce and Direct-to-Consumer Capabilities

The increasing preference for online grocery shopping and direct-to-consumer (DTC) channels demands sophisticated e-commerce infrastructure and streamlined last-mile delivery. Hilton Food Group’s investments in advanced packing technologies and automation solutions are designed to equip its retail partners with the capabilities needed to thrive in this evolving digital marketplace.

By enhancing these digital commerce capabilities, Hilton Food Group is directly addressing a key technological shift. For instance, the global online grocery market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, with DTC models playing an increasingly vital role. Hilton's ability to support partners in this transition is crucial for their continued relevance and growth.

- E-commerce Growth: Online grocery sales are a rapidly expanding segment of the retail industry.

- DTC Importance: Direct-to-consumer models offer enhanced customer relationships and data insights.

- Automation Investment: Hilton's focus on automation supports efficiency in online order fulfillment.

- Last-Mile Delivery: Effective logistics are paramount for meeting consumer expectations in online grocery.

Technological advancements are central to Hilton Food Group's strategy, driving efficiency and innovation across its operations. Investments in automation and digital tools are key, as seen in their 2023 focus on operational excellence through technology. The company is also embracing data analytics and AI for more accurate demand forecasting, a critical factor in the dynamic food market of 2024.

Legal factors

Hilton Food Group navigates a complex web of food labeling and advertising laws, crucial for maintaining consumer trust and avoiding legal repercussions. These regulations dictate the precise presentation of nutritional data, allergen warnings, product origin, and even sustainability claims. For instance, in the UK, the Food Information Regulations 2014 mandate specific allergen information, a standard Hilton adheres to across its operations. Failure to comply can result in significant fines and damage to brand reputation, as seen in past cases involving mislabeled products in the wider food industry.

Hilton Food Group operates in highly competitive food retail and processing sectors, necessitating strict adherence to competition and anti-trust laws. These regulations are designed to prevent market dominance and ensure fair play, safeguarding against monopolistic practices. Failure to comply can result in significant fines and legal scrutiny, impacting operational freedom and market access.

Hilton Food Group must adhere to a complex web of employment laws, ensuring fair wages, safe working conditions, and non-discriminatory practices across its operations. For instance, in the UK, the National Living Wage, which stood at £11.44 per hour for those aged 21 and over as of April 2024, sets a baseline for employee compensation. Failure to comply can lead to significant penalties and reputational damage.

The food processing industry is particularly scrutinized for health and safety. Hilton Food Group's commitment to complying with regulations like the UK's Health and Safety at Work etc. Act 1974 is paramount. This includes implementing robust procedures to prevent accidents and foodborne illnesses, which could result in hefty fines and operational disruptions, impacting their 2024 financial performance.

International Trade and Customs Regulations

Hilton Food Group's global operations mean it must contend with a patchwork of international trade and customs regulations. These rules govern everything from import duties on raw materials to export compliance for finished goods, directly impacting cost structures and market access. For instance, changes in tariffs or the implementation of new trade agreements can significantly alter the profitability of sourcing and distribution channels.

Navigating these legal complexities is crucial for maintaining an efficient and reliable supply chain. In 2024, the World Trade Organization (WTO) reported ongoing discussions and potential adjustments to customs valuation methods in several key markets, which could affect how companies like Hilton Food Group declare the value of their goods. Staying abreast of these evolving legal landscapes is paramount for avoiding penalties and ensuring smooth cross-border movement of products.

- Tariff Variations: Different countries impose varying import duties on meat products, impacting sourcing costs. For example, EU tariffs on certain imported meats can differ significantly from those in Asian markets.

- Customs Compliance: Adhering to specific documentation and inspection requirements for food products in each country is essential to prevent delays and potential product seizures.

- Trade Agreements: Hilton Food Group benefits from or is challenged by free trade agreements (FTAs) and trade blocs. The UK's post-Brexit trade relationships, for example, continue to shape its import and export dynamics.

- Sanitary and Phytosanitary (SPS) Measures: International regulations concerning food safety, animal health, and plant health are critical. Non-compliance with SPS measures can lead to market exclusion.

Data Protection and Privacy Laws

Hilton Food Group operates in an environment increasingly shaped by data protection and privacy laws. With growing digitalization and direct interactions with both partners and consumers, adherence to regulations like the General Data Protection Regulation (GDPR) or comparable legislation globally is paramount.

Failure to safeguard sensitive customer and partner data can severely damage Hilton Food Group's reputation and lead to substantial financial penalties. For instance, GDPR violations can incur fines up to 4% of global annual turnover or €20 million, whichever is higher. This underscores the critical importance of robust data management practices.

- GDPR Compliance: Hilton Food Group must ensure all data processing activities align with GDPR principles, including consent, transparency, and data minimization.

- Data Breach Response: Proactive measures and clear protocols for handling data breaches are essential to mitigate damage and comply with notification requirements.

- Cross-border Data Transfer: Navigating international data transfer regulations is crucial given Hilton's global operations and supply chains.

- Consumer Trust: Demonstrating a commitment to data privacy is vital for maintaining consumer trust and brand loyalty in the competitive food retail sector.

Hilton Food Group's operations are significantly influenced by food safety regulations, with compliance being non-negotiable. In the UK, the Food Safety Act 1990 sets out the primary legal framework, requiring businesses to ensure food sold is of satisfactory quality, fit for purpose, and not injurious to health. Penalties for breaches can include substantial fines and imprisonment, impacting operational continuity and financial stability.

Environmental factors

Hilton Food Group is actively addressing its carbon footprint, driven by increasing stakeholder pressure to curb greenhouse gas emissions throughout its supply chain. In 2023, the company continued to invest in energy-efficient technologies within its processing facilities, aiming to reduce operational energy consumption.

Optimizing logistics remains a core strategy, with efforts focused on route planning and fleet efficiency to lower emissions from transportation. Hilton Food Group has set ambitious targets, aligning with broader industry trends and regulatory frameworks that mandate significant emission reductions by 2030.

The increasing consumer and retailer demand for sustainably sourced meat and seafood presents a significant environmental factor for Hilton Food Group. Meeting these expectations requires robust supply chain management that prioritizes responsible farming and fishing practices, directly impacting the company's environmental footprint.

In 2024, for instance, a significant portion of consumers globally expressed a preference for products with clear sustainability certifications. Hilton Food Group's commitment to these practices is crucial for maintaining market share and aligning with corporate social responsibility goals, especially as regulatory bodies increasingly scrutinize supply chain transparency.

Hilton Food Group faces increasing pressure to minimize food waste, a significant environmental concern. In 2023, the UK food industry alone generated an estimated 4.7 million tonnes of food waste, with a substantial portion occurring at the retail and processing stages. Hilton's efforts to reduce this waste, alongside optimizing packaging materials and expanding recycling initiatives, directly impact its environmental footprint and operational efficiency.

Embracing circular economy principles offers Hilton Food Group a pathway to cost reduction and improved environmental performance. By focusing on resource efficiency, such as reusing or recycling packaging and finding value in by-products, the company can mitigate waste disposal costs and potentially create new revenue streams. This strategic shift aligns with growing consumer and regulatory demands for sustainable business practices.

Water Usage and Conservation

Water is a critical input for food processing, and Hilton Food Group, like others in the sector, faces scrutiny over its water footprint. Efficient management is paramount for environmental sustainability and operational resilience. In 2024, the food and beverage industry globally is increasingly focused on reducing water intensity, with many companies setting ambitious targets for water reduction and responsible wastewater discharge.

Hilton Food Group must actively implement strategies to minimize water consumption across its operations, from cleaning to production processes. This includes investing in water-efficient technologies and exploring water recycling opportunities. Responsible wastewater treatment is also key to mitigating environmental impact and complying with evolving regulations.

Specific initiatives could include:

- Implementing advanced water metering and monitoring systems to identify areas of high usage.

- Investing in water-saving equipment, such as high-pressure, low-volume cleaning systems.

- Exploring closed-loop water systems where feasible to reuse treated process water.

- Ensuring all wastewater meets or exceeds local discharge standards through robust treatment processes.

Biodiversity Protection and Land Use

The increasing global focus on biodiversity protection and sustainable land use directly impacts Hilton Food Group's supply chain. Agricultural practices, especially those related to meat production, can significantly affect land degradation and habitat loss. Hilton's commitment to responsible sourcing means actively evaluating how its ingredient suppliers manage land and protect ecosystems.

Hilton Food Group's sourcing policies must address the environmental footprint of its suppliers. This includes scrutinizing practices that could lead to deforestation or soil erosion, particularly for key ingredients like beef and poultry. By prioritizing suppliers who engage in regenerative agriculture or adhere to strict land management standards, Hilton can mitigate its environmental impact.

Consideration of land use is critical for both animal welfare and the sourcing of plant-based alternatives. For instance, the expansion of land for soy cultivation, often used in animal feed and plant-based products, can have biodiversity implications. Hilton's 2024 sustainability reports indicate a growing emphasis on traceability and supplier audits related to land use practices. In the UK, for example, the government's Environment Act 2021 aims to halt species decline by 2030, creating a regulatory push for companies like Hilton to demonstrate robust biodiversity strategies.

Key considerations for Hilton Food Group include:

- Supplier Audits: Implementing rigorous audits to assess suppliers' land management practices and biodiversity impact assessments.

- Sustainable Sourcing Guidelines: Developing and enforcing clear guidelines for sourcing meat and plant-based ingredients that promote ecosystem health.

- Traceability: Enhancing supply chain traceability to understand the origin of ingredients and their associated land use impacts.

- Partnerships: Collaborating with conservation organizations and industry bodies to promote best practices in biodiversity protection and sustainable agriculture.

Hilton Food Group faces growing pressure to reduce its environmental impact, particularly concerning carbon emissions and waste. The company is investing in energy-efficient technologies and optimizing logistics to lower its carbon footprint, aligning with 2030 reduction targets. Consumer demand for sustainably sourced products is a key driver, requiring robust supply chain management and transparency.

Food waste reduction is a critical environmental factor, with the UK food industry generating millions of tonnes annually. Hilton's efforts in waste minimization, packaging optimization, and recycling directly influence its environmental performance and operational costs. Embracing circular economy principles offers opportunities for cost savings and new revenue streams.

Water management is paramount, with the food industry globally focusing on reducing water intensity. Hilton must implement strategies for water conservation, invest in water-saving technologies, and ensure responsible wastewater treatment to meet environmental standards and operational resilience.

Biodiversity protection and sustainable land use are increasingly important, impacting Hilton's supply chain. The company must scrutinize suppliers' land management practices, promote regenerative agriculture, and enhance traceability to mitigate environmental impacts, especially in light of regulations like the UK's Environment Act 2021.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hilton Food Group is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are current and credible.