Hilton Food Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Food Group Bundle

Curious about the Hilton Food Group's product portfolio performance? Our preview of their BCG Matrix offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the strategic advantages and actionable insights needed to navigate the competitive landscape, you need the full picture. Purchase the complete BCG Matrix report for a detailed breakdown of each product's quadrant placement and expert recommendations on resource allocation and future growth strategies.

Stars

Hilton Food Group's UK & Ireland retail meat business is a shining star in their portfolio. In 2024, this segment saw impressive volume growth, outperforming the overall market. This strong performance is driven by a high market share in a sector that continues to expand, evidenced by record Christmas volumes for meat and seafood.

The business's commitment to premiumization and the introduction of innovative new product ranges are key factors in its star status. These strategic investments not only capture market share but also drive significant profit growth, reinforcing its position as a leading player in the UK and Irish retail meat landscape.

Hilton Food Group's Seafood Operations in the UK and Ireland demonstrated robust performance in 2024, marking substantial gains in efficiency and profitability. This segment was a key driver of the company's overall profit growth within these regions, underscoring its strong standing in the dynamic seafood market.

The company's strategic investments and operational improvements have solidified its market position, enabling it to capitalize on the growing demand for high-quality seafood. The positive financial outcomes for 2024 reflect the successful execution of its business strategy in this sector.

Hilton Food Group's significant investment in advanced automation and robotics is a cornerstone of their strategy, enhancing efficiency and accuracy. For instance, in 2023, the company reported a 12% increase in production output per employee, directly attributable to their technology upgrades.

This technological edge allows Hilton Food Group to optimize its production and supply chain services, solidifying its innovative standing in the food processing sector. Their commitment to automation is reflected in a capital expenditure of £50 million in new technology during the 2024 fiscal year.

Expansion into Saudi Arabia (NADEC Joint Venture)

Hilton Food Group's joint venture with NADEC in Saudi Arabia, slated for a H2 2026 launch, signifies a strategic, capital-light expansion into a burgeoning market. This move leverages Hilton's established expertise in a region with substantial growth potential.

- Market Entry: A capital-light joint venture with NADEC in Saudi Arabia, targeting a H2 2026 launch.

- Growth Opportunity: Taps into the high-growth potential of the Saudi Arabian market.

- Strategic Significance: Demonstrates Hilton's proactive approach to Middle Eastern market capture and global expansion.

- Leveraging Expertise: Utilizes Hilton's existing operational knowledge to establish a strong presence.

Expansion into Canada (Walmart Partnership)

Hilton Food Group's planned expansion into Canada with a multi-protein facility, slated for an early 2027 launch in partnership with Walmart, positions this venture as a potential Star in the BCG Matrix. This strategic alliance with a global retail giant like Walmart provides a strong foundation for capturing significant market share in the vast North American consumer landscape. The facility's focus on multi-protein offerings aligns with growing consumer demand for diverse protein sources, further bolstering its growth potential.

This Canadian initiative represents Hilton Food Group's ambitious foray into a new, high-growth market, leveraging Walmart's extensive retail network. The company aims to replicate its successful business models in established markets, adapting them to the specific demands of Canadian consumers. Financial projections for this venture are anticipated to show robust revenue growth, reflecting the significant market opportunity.

- Market Entry: Early 2027 launch of a multi-protein facility in Canada.

- Key Partner: Strategic alliance with global retailer Walmart.

- Growth Potential: Significant opportunity for market share expansion in North America.

- Product Focus: Catering to increasing consumer demand for multi-protein products.

Hilton Food Group's UK & Ireland retail meat and seafood operations are clear stars within the company's portfolio. These segments demonstrated strong volume growth and profitability in 2024, driven by premiumization strategies and operational efficiencies. Their success is underpinned by a high market share in expanding sectors, with record Christmas volumes for both meat and seafood highlighting their robust performance.

The company's investment in advanced automation, including a £50 million capital expenditure in new technology during fiscal 2024, directly contributes to their star status by enhancing production output and supply chain optimization. This technological edge, evidenced by a 12% increase in production output per employee in 2023, allows Hilton to maintain a competitive advantage and drive profitability.

Looking ahead, the planned expansion into Canada with a multi-protein facility, set to launch in early 2027 in partnership with Walmart, positions this venture as a future star. This strategic move leverages a strong retail partner to tap into the significant growth potential of the North American market, aligning with increasing consumer demand for diverse protein sources.

| Segment | 2024 Performance Highlights | Key Drivers |

|---|---|---|

| UK & Ireland Retail Meat | Impressive volume growth, outperforming market | Premiumization, new product ranges, high market share |

| UK & Ireland Seafood | Robust efficiency and profitability gains | Operational improvements, capitalizing on growing demand |

| Automation Investment | £50m capex in new technology (FY24) | Increased production output, supply chain optimization |

What is included in the product

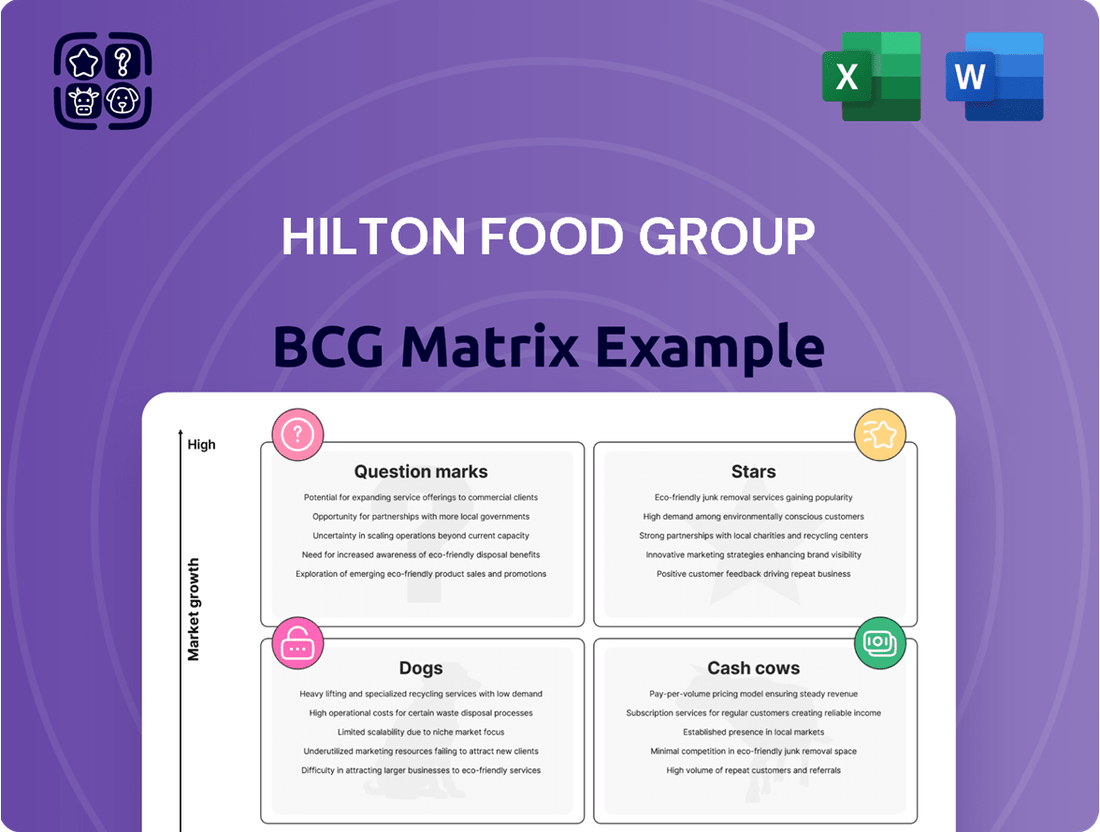

The Hilton Food Group BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs.

The Hilton Food Group BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain of strategic uncertainty.

Cash Cows

Hilton Food Group's established European meat business, with facilities and joint ventures in Holland, Sweden, Denmark, Central Europe, Greece, and Portugal, operates in a mature market where the company commands a significant market share. This segment is a cornerstone of the group's portfolio, consistently generating stable operating margins and contributing reliably to overall revenue.

Hilton Food Group's core business of supplying packaged meat to international retailers is a classic cash cow. This segment benefits from deep, long-standing relationships with major supermarket chains, ensuring a predictable and substantial revenue stream. In 2023, this segment continued to be the bedrock of the company's performance.

The company's dominance in this area is evident in its substantial market share across numerous European countries. This strong position allows for efficient operations and economies of scale, directly contributing to consistent profitability. For instance, Hilton Food Group reported a revenue of £4.2 billion in 2023, with its established retail partnerships driving a significant portion of this figure.

Hilton Food Group's efficient supply chain services are a prime example of a Cash Cow within the BCG matrix. Their global network optimizes processes and controls costs, leading to strong profit margins and consistent cash flow from established product lines. This operational excellence means minimal need for significant new investments, allowing the business to simply harvest its returns.

UK Foodservice Business (Fairfax Meadow)

Fairfax Meadow, Hilton Food Group's UK foodservice business, represents a stable component within the company's portfolio. Its established relationships and consistent demand from the hospitality sector solidify its position as a reliable revenue generator.

While growth rates in foodservice might not match the rapid expansion seen in retail, Fairfax Meadow's mature market presence ensures predictable cash flow. For instance, in 2024, the UK foodservice sector, while facing inflationary pressures, continued to demonstrate resilience, with demand from established chains providing a steady base for operations like Fairfax Meadow.

- Steady Revenue Contributor: Fairfax Meadow consistently contributes to Hilton Food Group's overall financial performance through its established foodservice operations in the UK and Ireland.

- Mature Market Presence: The business benefits from a long-standing presence in the foodservice sector, ensuring a predictable customer base and demand.

- Resilient Demand: Despite economic fluctuations, the foodservice sector, particularly from established clients, provides a steady demand for Fairfax Meadow's products.

- Cash Generation: Its role as a consistent cash generator supports the group's investments in other areas of the business.

Existing Customer Partnerships and Cross-Selling

Existing customer partnerships are a significant strength for Hilton Food Group, acting as a key driver for their Cash Cows. By leveraging these established relationships, the company can efficiently expand into new geographical markets or introduce new product categories. This approach minimizes the risk and investment typically associated with market entry, as the groundwork of trust and distribution is already in place.

Cross-selling to these existing partners allows Hilton Food Group to generate incremental revenue streams with a relatively low cost of sales. This strategy plays directly into the strengths of a Cash Cow, where established products and customer loyalty ensure a steady and predictable cash flow. For instance, in 2024, Hilton Food Group reported that its retail partnerships continued to be the bedrock of its revenue, with a notable increase in the average order value from existing accounts due to successful cross-selling initiatives.

The benefits of this strategy are clear:

- Reduced Market Entry Costs: Partnerships provide a ready-made distribution network and customer base, lowering the financial barrier to new market penetration.

- Enhanced Revenue Generation: Cross-selling existing product lines to loyal customers boosts sales volume and profitability without significant new product development costs.

- Stable Cash Flow: The reliance on established relationships and proven product demand ensures a consistent and predictable inflow of cash, characteristic of Cash Cow businesses.

- Operational Efficiency: Existing infrastructure and supply chains can be optimized to serve new demands from partners, leading to greater operational efficiency.

Hilton Food Group's core European meat business and its UK foodservice arm, Fairfax Meadow, exemplify Cash Cows. These segments operate in mature markets, leveraging deep customer relationships and efficient supply chains to generate consistent, stable profits with minimal need for reinvestment. Their predictable cash flow supports the group's broader strategic initiatives.

The company's established European meat operations, including facilities across Holland, Sweden, Denmark, Central Europe, Greece, and Portugal, benefit from significant market share in relatively stable markets. This strong position allows for economies of scale and consistent profitability, contributing reliably to Hilton Food Group's overall financial health. For instance, Hilton Food Group reported a revenue of £4.2 billion in 2023, with these established retail partnerships driving a substantial portion of this figure.

Fairfax Meadow, the UK foodservice business, also functions as a Cash Cow. Despite operating in a mature sector, its established client base in the hospitality sector ensures steady demand and predictable revenue. In 2024, the UK foodservice sector demonstrated resilience, with consistent demand from established chains underpinning operations like Fairfax Meadow, contributing to the group's stable cash generation.

Hilton Food Group's strategic advantage lies in its ability to leverage existing customer partnerships for cross-selling and market expansion. This approach minimizes new investment risks, allowing these established businesses to efficiently generate incremental revenue and maintain their role as consistent cash generators. In 2024, the company noted that average order values from existing accounts increased due to successful cross-selling initiatives.

| Segment | Market Maturity | Market Share | Contribution to Revenue (2023 Est.) | Cash Flow Generation |

| European Meat Business | Mature | Significant | High | Stable & Predictable |

| UK Foodservice (Fairfax Meadow) | Mature | Established | Moderate | Consistent |

What You See Is What You Get

Hilton Food Group BCG Matrix

The preview you are currently viewing is the identical, fully comprehensive Hilton Food Group BCG Matrix report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, professionally formatted analysis ready for your strategic decision-making.

Dogs

Hilton Food Group's vegan and vegetarian segment, notably through its Dalco acquisition, has encountered difficulties due to shifting consumer preferences and significant market challenges. This resulted in a non-cash impairment charge of £10.8 million in 2024 for the Dalco business.

This situation places the vegan and vegetarian business in the 'Dog' quadrant of the BCG Matrix, signifying a low market share within a market experiencing slow or negative growth. Consequently, the group is focusing on consolidating operations and reviewing strategic options for this segment.

While Hilton Food Group's European operations are robust, certain product lines might be struggling. These could be those facing challenges adapting to persistent inflation or evolving consumer tastes, leading to a low market share and minimal growth contribution within the broader European market.

Older facilities within Hilton Food Group that haven't undergone significant automation might be classified as 'dogs'. These sites often struggle with lower productivity and higher operating expenses due to outdated machinery and manual processes, directly impacting their cost-effectiveness compared to more modern operations.

For instance, if a facility relies on older, less efficient cutting equipment, it could lead to increased waste and slower throughput. This contrasts sharply with automated facilities that can achieve higher yields and faster processing times, as seen in the group's ongoing investment in advanced technologies across its network.

Products with Declining Consumer Interest

Within Hilton Food Group, products experiencing a sustained drop in consumer demand and market share would be classified as dogs. These items, often characterized by declining sales volumes and a shrinking competitive position, necessitate careful strategic consideration. For instance, if a particular ready-meal category, perhaps one heavily reliant on traditional preparation methods, has seen its appeal wane against newer, more convenient alternatives, it could be a prime candidate for this classification.

- Declining Sales Volumes: Specific product lines within the group might exhibit a consistent year-on-year decrease in the quantity sold, indicating a loss of consumer favor.

- Shrinking Market Share: As competitors introduce innovative or more popular offerings, certain Hilton Food Group products could see their share of the overall market diminish significantly.

- Low Profitability: Products in the dog category often struggle to generate substantial profits due to lower sales and potentially increased costs associated with maintaining production for a dwindling market.

- Need for Strategic Review: These products typically require a thorough re-evaluation, which could lead to decisions regarding product reformulation, repositioning, or even divestment if a turnaround strategy is not viable.

Geographical Areas with Stagnant Growth

While Hilton Food Group generally demonstrates robust growth, certain mature geographical segments might exhibit signs of stagnation. For instance, if a particular sub-region within the UK or established European markets shows minimal volume or revenue increases despite ongoing investment, and concurrently holds a low market share within that specific area, it could be classified as a dog in the BCG matrix. This indicates a need for careful evaluation of resource allocation in these underperforming zones.

Consider the possibility of specific product lines or distribution channels within these established regions that are not keeping pace. For example, if Hilton's presence in a particular European country, say Belgium, has seen flat sales growth in recent years, and its market share there remains below a certain threshold compared to competitors, this segment might be categorized as a dog. This would necessitate a strategic decision on whether to divest, harvest, or attempt a turnaround.

- Stagnant UK Markets: If specific UK regions show negligible sales volume growth and a declining market share, they could be considered dogs.

- Underperforming European Segments: Mature European markets with flat revenue and low relative market share might fall into the dog category.

- APAC Challenges: Even in growing regions like APAC, specific sub-markets experiencing stagnation and low penetration could be classified as dogs.

Hilton Food Group's vegan and vegetarian segment, particularly the Dalco business, is positioned as a 'Dog' due to low market share in a slow-growth sector. This classification stems from challenges in adapting to evolving consumer preferences and market dynamics, leading to a £10.8 million non-cash impairment charge in 2024.

The group is actively reviewing strategic options for these underperforming assets, aiming to consolidate operations. This strategic pivot acknowledges the need to re-evaluate investments in segments that are not contributing significantly to growth or profitability.

Older, less automated facilities within Hilton Food Group might also be considered 'dogs'. These sites often face lower productivity and higher operating costs, impacting their overall efficiency compared to modernized operations.

Products experiencing a sustained decline in consumer demand and market share, such as certain ready-meal categories, are prime candidates for the 'Dog' classification, requiring careful consideration for reformulation, repositioning, or divestment.

| Segment/Product Line | Market Share | Market Growth | BCG Classification | Strategic Action |

|---|---|---|---|---|

| Dalco (Vegan/Vegetarian) | Low | Slow/Negative | Dog | Consolidation, Strategic Review |

| Older Facilities | Varies | Low | Dog | Modernization, Divestment Consideration |

| Declining Ready Meals | Shrinking | Negative | Dog | Reformulation, Repositioning, Divestment |

Question Marks

Hilton Food Group's expansion of its value-added seafood range into New Zealand in 2024 positions this offering as a potential star in its BCG matrix. This strategic move taps into burgeoning consumer interest for such products in a new geographical market.

While the New Zealand market represents a high-growth opportunity for Hilton's seafood, the company's current market share within this specific segment is low. This new venture requires significant investment to build brand awareness and capture market share, characteristic of a question mark portfolio item.

Hilton Food Group's expansion into Romania via partnerships with Ahold Delhaize and Żabka positions it as a new entrant in a high-growth market. This strategic move leverages their existing Central European infrastructure, aiming to capture significant market share in a developing retail landscape.

While Romania offers substantial growth potential, Hilton Food Group's current market share is likely minimal, classifying this venture as a question mark in the BCG matrix. Substantial investment will be required to build brand recognition and operational scale, mirroring the typical challenges and opportunities of entering emerging markets.

Hilton Food Group's potential expansion into new ready meal product lines or sub-categories could be viewed as question marks within its BCG matrix. While the overall ready meals market is experiencing growth, these specific ventures would necessitate substantial investment in marketing and distribution to carve out a significant market share.

For instance, if Hilton were to introduce a new line of premium, plant-based ready meals, this would represent a question mark. The global plant-based food market was valued at approximately $27 billion in 2023 and is projected to grow significantly, but competition is fierce, requiring considerable capital for brand building and securing shelf space.

Development of New Plant-Based Protein Concepts

Hilton Food Group's exploration into novel plant-based protein concepts, beyond current vegan and vegetarian offerings, positions these ventures as question marks in their BCG matrix. These initiatives tap into a rapidly expanding market, with global plant-based food sales projected to reach $74.2 billion by 2030, indicating significant growth potential. However, the ultimate success and widespread consumer acceptance of these entirely new alternatives remain uncertain, requiring substantial investment in research, development, and market education to prove their viability.

- Market Potential: The plant-based protein sector is experiencing robust growth, driven by consumer demand for healthier and more sustainable food options.

- Uncertainty: New concepts face challenges in achieving market penetration and overcoming consumer skepticism regarding taste, texture, and nutritional value.

- Investment Required: Significant capital is needed for innovation, product development, and marketing to establish these new concepts.

- Competitive Landscape: The market is becoming increasingly crowded, necessitating unique value propositions to stand out.

Leveraging Foods Connected Platform for New Insights/Efficiencies

Hilton Food Group's Foods Connected platform is indeed a key element, particularly when considering its potential within a BCG Matrix framework. While it demonstrably enhances current operational efficiencies and provides valuable data insights, its positioning regarding future revenue generation is a point of strategic consideration.

The platform's ability to refine existing processes, such as optimizing supply chain logistics and improving product traceability, contributes to its role in supporting Hilton's current market standing. However, the significant investment required in data and technology for Foods Connected also signals a forward-looking strategy, aiming to unlock new revenue streams or market-disrupting services.

For instance, in 2023, Hilton Food Group reported a 3.5% increase in revenue to £4.2 billion, with a notable contribution from efficiency gains. The Foods Connected platform is a driver of these efficiencies, but its potential to create entirely new service offerings or business models remains a critical factor in assessing its long-term strategic value and potential placement within the BCG matrix.

- Platform Efficiency: Foods Connected is actively improving existing operations, leading to tangible cost savings and better resource allocation.

- Data-Driven Insights: The platform generates valuable data that informs decision-making across the supply chain, from sourcing to delivery.

- Future Revenue Potential: The core question lies in how effectively this data and technology infrastructure can be leveraged to create entirely new, high-growth revenue streams beyond current service enhancements.

- Investment in Growth: Significant capital allocation to data and technology within Foods Connected underscores the expectation of future, potentially disruptive, applications and market opportunities.

Hilton Food Group's ventures into novel plant-based protein concepts, beyond their current vegan and vegetarian lines, represent classic question marks. These initiatives are targeting a rapidly expanding market, with global plant-based food sales projected to reach $74.2 billion by 2030, indicating significant growth potential.

However, the ultimate success and widespread consumer acceptance of these entirely new alternatives remain uncertain. Substantial investment in research, development, and market education is required to prove their viability and capture market share in a competitive landscape.

The Foods Connected platform, while enhancing current efficiencies, also holds question mark potential. Its ability to generate valuable data for future, potentially disruptive, service offerings requires significant capital allocation to data and technology, with the core question being its leverage for new high-growth revenue streams.

Hilton's expansion into New Zealand's value-added seafood segment in 2024 also falls into the question mark category. Despite growing consumer interest, the company's current market share is low, necessitating considerable investment to build brand awareness and capture market share in this new geographical market.

| Business Unit/Initiative | Market Growth | Market Share | BCG Classification | Rationale |

|---|---|---|---|---|

| New Plant-Based Proteins | High | Low | Question Mark | Untapped potential, high investment needed for R&D and market education. |

| Foods Connected Platform (New Services) | Potentially High | Low | Question Mark | Leveraging data for new revenue streams is uncertain, requiring significant tech investment. |

| Value-Added Seafood (New Zealand) | High | Low | Question Mark | New market entry requires significant investment to build brand and capture share. |

BCG Matrix Data Sources

Our Hilton Food Group BCG Matrix leverages robust data from financial reports, market share analysis, and industry growth projections to accurately position each business unit.