Hilton Food Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Food Group Bundle

Hilton Food Group operates in a dynamic market shaped by powerful forces. Understanding the intensity of buyer bargaining power and the threat of substitutes is crucial for navigating this landscape effectively. This brief overview only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Hilton Food Group’s competitive dynamics, market pressures, and strategic advantages in detail, revealing the real forces shaping its industry and providing actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hilton Food Group sources essential raw materials such as meat and seafood from a diverse supplier base. However, if a significant portion of these critical inputs comes from a small number of dominant suppliers, their collective bargaining power escalates. This concentration means Hilton has fewer viable alternatives, potentially leading to increased costs or less favorable contractual conditions.

Switching suppliers in the food processing sector, particularly for a company like Hilton Food Group, can incur substantial expenses. These costs often include the need for re-certifications of new suppliers to meet stringent food safety standards, modifications to existing production lines and equipment to accommodate different product specifications, and the inherent risk of supply chain disruptions during the transition period. These factors can make it challenging and costly to change providers.

For Hilton Food Group, high switching costs would significantly enhance the bargaining power of its suppliers. If it becomes difficult and expensive for Hilton to change suppliers, even when facing unfavorable terms or pricing, suppliers can leverage this situation. This means suppliers can potentially dictate more demanding contract conditions, knowing that Hilton has limited viable alternatives without incurring significant financial penalties and operational setbacks.

Supplier differentiation significantly impacts the bargaining power of suppliers for Hilton Food Group. If suppliers provide highly specialized ingredients, unique processing techniques, or proprietary livestock breeds, their leverage increases. For instance, a supplier of a unique, high-welfare, antibiotic-free pork breed could command premium pricing if Hilton Food Group's product lines heavily depend on it, as direct substitutes would be scarce.

Threat of Forward Integration

The threat of suppliers integrating forward into food processing and directly supplying retailers significantly amplifies their bargaining power. This means suppliers could potentially bypass Hilton Food Group, creating direct competition. For instance, if a major protein supplier in 2024 decided to invest in processing facilities and distribution networks, they could offer their products directly to supermarkets, potentially at competitive prices.

This looming possibility forces Hilton Food Group to be more accommodating in negotiations, as losing a key supplier to direct competition could be detrimental. Hilton Food Group's reliance on these suppliers for raw materials means they are vulnerable to demands for better terms if suppliers perceive an opportunity to capture more of the value chain. In 2023, the global food processing market was valued at approximately $3.1 trillion, indicating the substantial revenue streams available if suppliers were to integrate forward.

- Increased Supplier Leverage: Suppliers can demand higher prices or more favorable contract terms if they can credibly threaten to enter Hilton Food Group's market.

- Potential for Disintermediation: Retailers might be tempted to source directly from integrated suppliers, cutting out the intermediary role of Hilton Food Group.

- Impact on Margins: This threat can squeeze Hilton Food Group's profit margins as they face pressure from both their suppliers and potential new competitors.

Importance of Supplier's Input to Hilton Food Group's Cost Structure

The bargaining power of suppliers is a critical factor for Hilton Food Group, directly influencing its cost structure. When suppliers provide essential inputs that represent a significant portion of the cost of goods sold, their leverage increases substantially. This means Hilton Food Group is more susceptible to price increases or supply disruptions from these key suppliers.

The sensitivity to supplier costs is evident in market dynamics. For instance, significant raw material price deflation observed in the APAC region during 2024 had a notable impact on revenues across various industries, underscoring how fluctuations in input costs can directly affect a company's financial performance. Hilton Food Group, like many in the food processing sector, relies on a consistent and cost-effective supply of raw materials.

- Cost of Goods Sold Impact: The proportion of a specific raw material or input in Hilton Food Group's total cost of goods sold directly correlates with a supplier's bargaining power.

- 2024 APAC Deflation: Significant price deflation in raw materials within the APAC region in 2024 highlighted the sensitivity of revenues to input cost volatility.

- Supplier Dependence: High dependence on a limited number of suppliers for critical components amplifies their ability to dictate terms.

- Input Price Volatility: Fluctuations in the prices of key inputs, such as meat or packaging materials, can significantly affect Hilton Food Group's profitability and operational stability.

The bargaining power of suppliers for Hilton Food Group is moderated by the availability of alternative suppliers and the importance of their products to Hilton's operations. While Hilton sources from many, a concentration of critical inputs from a few dominant players increases supplier leverage, potentially leading to higher costs.

High switching costs for Hilton, including re-certification and equipment adjustments, empower suppliers by making it difficult and expensive to change providers. This financial and operational barrier allows suppliers to dictate more demanding terms, knowing Hilton is locked in.

Supplier differentiation, such as unique breeds or processing techniques, further strengthens their position. If Hilton's product lines heavily rely on these specialized inputs, suppliers can command premium pricing due to a lack of direct substitutes.

The threat of suppliers integrating forward into food processing and supplying retailers directly significantly amplifies their bargaining power. This potential disintermediation forces Hilton to be more accommodating, as losing a key supplier to direct competition could be detrimental.

| Factor | Impact on Hilton Food Group | 2024 Data/Context |

| Supplier Concentration | Increased leverage for dominant suppliers | N/A (Specific concentration data not publicly available for HFG) |

| Switching Costs | High costs empower suppliers | Includes re-certification, equipment modification, transition risks |

| Supplier Differentiation | Premium pricing for specialized inputs | Example: Unique, high-welfare livestock breeds |

| Forward Integration Threat | Potential for disintermediation | Suppliers could bypass Hilton to supply retailers directly |

What is included in the product

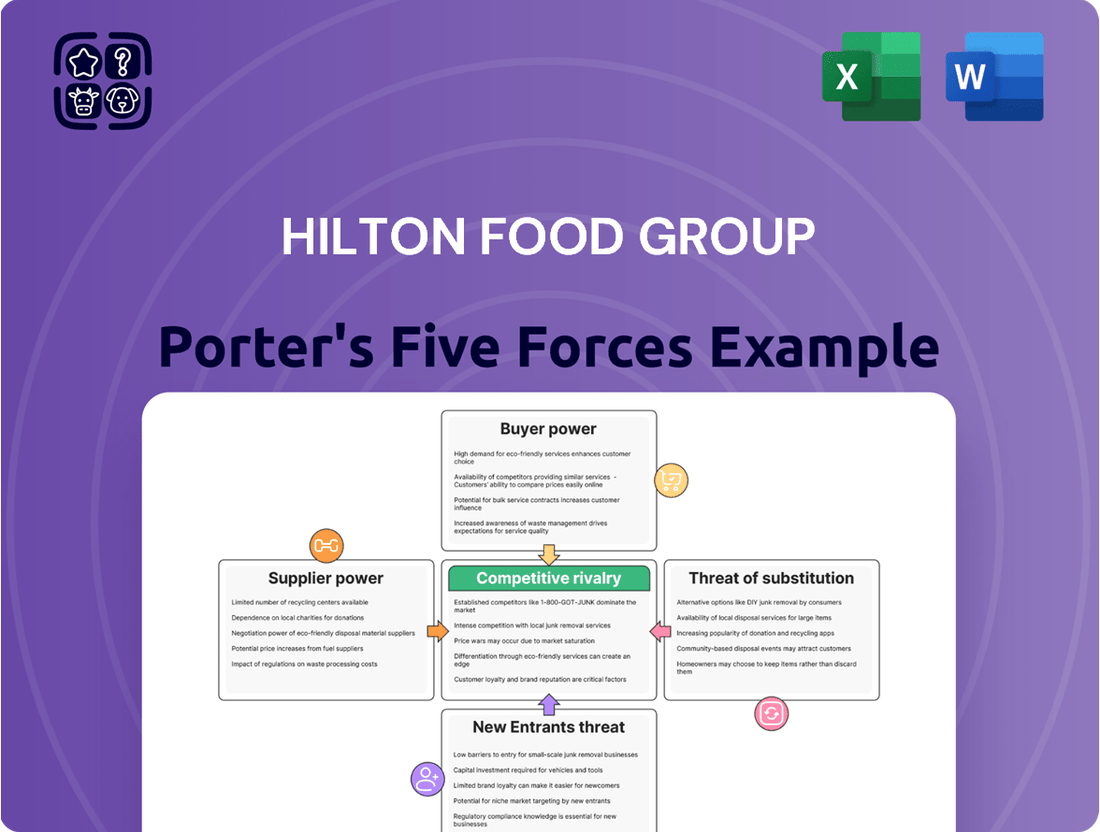

This Porter's Five Forces analysis unpacks the competitive intensity and profitability drivers for Hilton Food Group by examining industry rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, allowing Hilton Food Group to pinpoint and address market pressures effectively.

Customers Bargaining Power

Customer concentration significantly impacts bargaining power. Hilton Food Group's reliance on a few major international retailers means these large clients can leverage their purchase volume to negotiate more favorable pricing and terms.

For instance, if a single retail giant accounts for over 10% of Hilton's revenue, its ability to switch suppliers or reduce orders gives it considerable leverage. This concentration can pressure Hilton's profit margins and operational flexibility.

Switching from one packaged food supplier to another presents retailers with significant logistical hurdles, including adjustments to supply chain management and potential disruptions to established shelf space and consumer recognition. These complexities create a degree of stickiness for existing supplier relationships.

Despite these switching costs, the retail landscape is characterized by a multitude of suppliers offering comparable products, which inherently dilutes the bargaining power of any single supplier like Hilton Food Group. For instance, in the UK, the packaged food market is highly competitive, with numerous players vying for supermarket shelf space, meaning retailers can often source similar items from alternative providers if terms become unfavorable.

Large retailers, like major supermarket chains, possess a significant ability to produce their own private-label food products, effectively integrating backward into processing and packaging. This capability acts as a powerful lever in their negotiations with suppliers like Hilton Food Group.

The credible threat of retailers bringing production in-house means Hilton must remain competitive. For instance, in 2024, private-label brands continued to gain market share across major grocery sectors, with some analyses suggesting they accounted for over 20% of sales in certain categories. This trend underscores the leverage customers hold.

Hilton Food Group's strategy must consider this customer power. By offering efficient, high-quality, and cost-effective solutions, Hilton mitigates the incentive for its major retail partners to develop their own internal meat processing and packaging operations, thereby preserving its customer relationships and market position.

Price Sensitivity of Customers

Retailers, particularly those in crowded markets, exhibit significant price sensitivity. They are driven to offer consumers the most competitive prices possible, a strategy that directly influences their purchasing decisions from suppliers.

This intense focus on competitive pricing by retailers creates substantial pressure on their suppliers, including companies like Hilton Food Group. Consequently, Hilton faces demands for favorable pricing, which can directly impact its profit margins.

- Retailer Price Sensitivity: Supermarkets and grocery chains are under constant pressure to maintain low prices to attract and retain shoppers.

- Supplier Pricing Demands: This retailer pressure forces them to negotiate harder on prices with their suppliers, seeking cost reductions.

- Margin Impact: For suppliers like Hilton Food Group, meeting these aggressive pricing demands can squeeze profit margins, especially in a high-volume, low-margin sector like food production.

Information Availability to Customers

Customers, particularly large retailers, possess significant market data, consumer insights, and competitive intelligence. This information advantage allows them to better understand market conditions and the availability of alternative suppliers, thereby increasing their bargaining power when dealing with Hilton Food Group.

For instance, in 2024, major supermarket chains often leverage sophisticated data analytics to track consumer purchasing habits and price sensitivities. This detailed knowledge enables them to negotiate more effectively on price and product specifications with their suppliers, including Hilton Food Group.

- Retailers' Data Advantage: Large retailers have access to vast amounts of sales data, customer feedback, and competitor pricing information.

- Informed Negotiations: This data empowers retailers to make informed decisions during price and contract negotiations with food producers like Hilton Food Group.

- Shifting Power Dynamics: Increased transparency and readily available market information reduce information asymmetry, strengthening the customer's position.

The bargaining power of Hilton Food Group's customers, primarily large international retailers, is substantial due to their significant purchase volumes and the competitive nature of the grocery market. These retailers can leverage their size to demand lower prices and more favorable terms, directly impacting Hilton's profitability.

The threat of backward integration, where retailers might consider producing their own private-label products, further strengthens their negotiating position. For instance, the continued growth of private-label brands in 2024, capturing over 20% of sales in some grocery categories, highlights this customer leverage.

Retailers also benefit from a wealth of market data and consumer insights, enabling them to negotiate from a position of informed advantage. This data-driven approach allows them to identify the most competitive pricing and product specifications, putting pressure on suppliers like Hilton.

| Customer Factor | Impact on Hilton Food Group | Supporting Data/Trend (2024) |

|---|---|---|

| Customer Concentration | High leverage for major clients | Reliance on a few large international retailers |

| Price Sensitivity | Pressure for lower pricing | Retailers' drive to offer competitive consumer prices |

| Backward Integration Threat | Incentive for Hilton to remain cost-competitive | Growing market share of private-label brands (e.g., >20% in some categories) |

| Information Advantage | Stronger negotiation position for retailers | Use of sophisticated data analytics for consumer insights and competitor pricing |

What You See Is What You Get

Hilton Food Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Hilton Food Group, offering a detailed examination of industry competitiveness. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase. You can confidently expect to download this exact file, providing actionable insights into the competitive landscape of Hilton Food Group's operations without any alterations or placeholders.

Rivalry Among Competitors

The packaged food sector, especially for meat, seafood, vegetarian options, and ready-to-eat meals, is a fiercely competitive arena. Hilton Food Group faces a multitude of both local and global competitors vying for consumer attention and market share.

This intense rivalry is further amplified by the sheer diversity in product portfolios and the varied geographical footprints of these competing entities. For instance, in 2024, the global packaged food market was valued at over $1.1 trillion, with a significant portion driven by these specific categories, highlighting the crowded nature of Hilton's operating space.

Hilton Food Group demonstrated robust volume growth in its core retail meat operations during 2024, exceeding general market performance. However, the broader industry growth rate significantly shapes the competitive landscape. A decelerating industry pace typically intensifies rivalry as companies fight harder for a larger slice of a smaller pie.

Hilton Food Group actively differentiates its offerings through a strong focus on innovation and sustainability. This includes developing value-added seafood products and introducing new product ranges designed to appeal to evolving consumer preferences. For instance, the company's commitment to sourcing and processing high-quality products allows it to command a premium and build brand loyalty.

By emphasizing unique selling propositions and premiumization strategies, Hilton Food Group can effectively reduce the intensity of direct price competition. This product differentiation is crucial in a market where competitors may offer similar goods, allowing Hilton to carve out a distinct market position and protect its profit margins.

Exit Barriers

High exit barriers within the food manufacturing sector, particularly for companies like Hilton Food Group, can trap underperforming competitors in the market. These barriers often stem from significant investments in specialized, technologically advanced food processing facilities. These assets, while crucial for efficient operation, are not easily repurposed or sold, effectively locking companies into the industry even when facing losses.

The consequence of these high exit barriers is a potential for persistent overcapacity. When unprofitable firms cannot easily exit, they continue to operate, contributing to a surplus of production capacity. This situation naturally intensifies price competition as these firms strive to maintain market share and cover their fixed costs, putting downward pressure on profit margins for all players in the sector.

Long-term contracts with major retailers also act as a significant exit barrier. Once secured, these agreements obligate manufacturers to supply products for extended periods. Breaking these contracts can incur substantial penalties, further discouraging less successful competitors from leaving the market, even if their operational performance is weak. For example, in 2024, the UK food manufacturing sector faced ongoing challenges with retailer contract negotiations, highlighting the sticky nature of these relationships.

- Specialized Assets: Technologically advanced food processing plants represent substantial capital expenditure with limited alternative uses, increasing the cost and difficulty of exiting the market.

- Long-Term Contracts: Agreements with major supermarkets can span several years, creating financial penalties for early termination and keeping companies committed to operations.

- Brand Reputation: Established brands built over time are difficult to divest or transition, encouraging companies to persist rather than risk losing brand equity.

- Workforce Skills: A highly skilled and specialized workforce in food production and processing is not easily transferable to other industries, adding another layer to exit challenges.

Strategic Commitments of Competitors

Competitors are making substantial investments, mirroring Hilton Food Group's own strategic moves. For instance, significant capital outlays in advanced automation, the introduction of innovative product lines, and ambitious international expansion plans are common. These commitments signal a fierce determination to either defend existing market share or aggressively expand their reach.

These deep-seated strategic commitments often translate into intensified competitive actions. Companies are willing to engage in price wars, increase marketing spend, or accelerate product innovation cycles to gain an edge. For example, in the European meat processing sector, several key players announced substantial investments in new, highly automated facilities in late 2023 and early 2024, aiming to boost efficiency and capacity.

- Significant Investment in Automation: Competitors are channeling funds into advanced robotics and AI-driven processing to lower costs and improve quality.

- New Product Development: A focus on developing value-added products, such as ready-to-eat meals and plant-based alternatives, is a key strategy.

- International Expansion: Companies are actively seeking growth in new geographic markets, much like Hilton's ventures into Saudi Arabia and Canada.

- Aggressive Market Tactics: These investments often precede or accompany more aggressive pricing strategies and promotional activities to capture market share.

The competitive rivalry within the packaged food sector, particularly for meat, seafood, and ready-to-eat meals, is intense, with Hilton Food Group facing numerous global and local rivals. The sheer breadth of product offerings and geographical reach of competitors, within a market valued at over $1.1 trillion in 2024, underscores this crowded landscape. While Hilton's volume growth in 2024 surpassed market averages, a slowing industry growth rate can heighten competition as firms fight for a larger share of a less expansive market.

Hilton Food Group actively differentiates itself through innovation and sustainability, focusing on value-added products and appealing to evolving consumer tastes. This strategy helps mitigate direct price competition by building brand loyalty and commanding a premium. For example, the company's commitment to high-quality sourcing allows for distinct market positioning.

High exit barriers, such as specialized processing facilities and long-term retailer contracts, can keep less successful competitors operating, leading to persistent overcapacity and intensified price competition. These factors, coupled with strategic investments in automation and new product lines by rivals, create a dynamic environment where companies are willing to employ aggressive market tactics to gain or maintain market share.

SSubstitutes Threaten

Consumers have a wide array of alternatives to Hilton Food Group's core offerings. Beyond their packaged meat, seafood, vegetarian, and ready meals, individuals can opt for fresh ingredients to prepare meals at home, dine out at restaurants, or choose from other convenient prepared food options. For instance, the UK's grocery market saw a significant shift, with online grocery sales accounting for approximately 12% of total grocery sales in early 2024, indicating a growing preference for convenience and variety in food sourcing.

The threat of substitutes for Hilton Food Group's products hinges significantly on their relative price and performance. If alternative protein sources, like plant-based meats or other meat processors, offer comparable quality and convenience at a more attractive price point, or even superior attributes for a similar cost, consumers will be more inclined to shift their purchasing habits. For instance, in 2024, the retail price of many plant-based meat alternatives remained a key consideration for mainstream adoption, often being 20-50% more expensive per pound than conventional meat products, thus limiting their immediate threat to price-sensitive consumers.

Consumer trends are a significant factor in the threat of substitutes. For instance, a growing preference for plant-based diets, as observed with the increasing popularity of vegan and vegetarian options, directly impacts traditional meat consumption. Hilton Food Group recognized this shift and has strategically expanded its product lines to include a variety of vegetarian and vegan offerings, aiming to capture a segment of this growing market.

Switching Costs for Buyers to Substitutes

For consumers, the switching costs to alternative protein sources or prepared meals are typically quite low. This often involves little more than a shift in grocery shopping routines or a minor adjustment to meal preparation habits.

This ease of switching directly amplifies the threat of substitutes for Hilton Food Group. Consumers can readily choose plant-based alternatives, other meat producers, or even ready-to-eat meals without significant financial or practical barriers.

- Low Switching Costs: Consumers face minimal hurdles when moving from Hilton's products to alternatives.

- Ease of Adoption: Changing purchasing habits for protein sources is straightforward for the average consumer.

- Market Responsiveness: This low barrier means consumer preferences can shift rapidly towards substitutes, impacting demand for Hilton's offerings.

Innovation in Substitute Industries

Innovation in substitute industries poses a significant threat to Hilton Food Group. Emerging technologies like cultured meat and advanced plant-based protein alternatives are gaining traction, offering consumers new choices that could divert demand from traditional meat products. For instance, the global plant-based meat market was valued at approximately USD 8.1 billion in 2023 and is projected to grow substantially, indicating a rising competitive landscape.

Hilton Food Group must actively monitor these innovations to understand their impact on consumer preferences and market share. The increasing sophistication and palatability of these substitutes, coupled with growing consumer interest in sustainability and health, can accelerate their adoption. This necessitates a proactive approach to product development and marketing to ensure Hilton remains competitive.

The company's strategy needs to include adapting to these evolving trends. This might involve diversifying its product portfolio to include or partner with producers of these novel protein sources, or enhancing the appeal and value proposition of its core meat offerings. For example, focusing on ethical sourcing, premium quality, and convenience can help differentiate Hilton's products in a market where substitutes are becoming more appealing.

The threat is amplified by the rapid pace of innovation in these sectors. Companies developing these alternatives are often well-funded and agile, capable of quickly bringing improved products to market. Hilton Food Group's ability to respond effectively to these advancements will be crucial for maintaining its market position and profitability.

The threat of substitutes for Hilton Food Group is substantial due to the wide availability of alternatives, from preparing meals at home with fresh ingredients to dining out. The low switching costs mean consumers can easily shift their preferences. For instance, the UK's online grocery sales reached about 12% of total sales in early 2024, highlighting a growing consumer inclination towards diverse and convenient food sourcing options.

Price and performance are key determinants in the threat of substitutes. If alternatives like plant-based meats offer comparable quality and convenience at a better price, consumers will likely switch. In 2024, many plant-based meat alternatives were still 20-50% more expensive per pound than conventional meats, a factor limiting their immediate impact on price-sensitive shoppers.

Consumer trends, particularly the rise of plant-based diets, directly challenge traditional meat consumption. Hilton Food Group has responded by expanding its vegetarian and vegan product lines to cater to this growing market segment, acknowledging the evolving dietary landscape.

Innovation in substitute industries, such as cultured meat and advanced plant-based proteins, presents a significant future threat. The global plant-based meat market, valued at approximately USD 8.1 billion in 2023, is projected for substantial growth, indicating an increasingly competitive environment for traditional protein providers.

| Substitute Category | Key Differentiators | Potential Impact on Hilton | 2024 Market Insight |

|---|---|---|---|

| Home-cooked Meals (Fresh Ingredients) | Cost control, customization, perceived freshness | Reduced demand for pre-packaged convenience | Continued strong presence in grocery sector |

| Restaurant Dining | Convenience, variety, dining experience | Shift in discretionary spending away from home | Post-pandemic recovery in dining out |

| Plant-Based Alternatives | Health, environmental concerns, novelty | Market share erosion for meat products | Market growth projected, price parity a key factor for wider adoption |

| Cultured Meat | Ethical sourcing, potential environmental benefits | Disruptive potential, long-term threat | Still in early stages of development and regulatory approval |

Entrants Threaten

The food processing sector, particularly for companies like Hilton Food Group utilizing advanced technology, demands immense capital for state-of-the-art facilities and equipment. For instance, establishing a modern meat processing plant can easily run into tens of millions of pounds, a significant hurdle for newcomers.

This substantial upfront investment acts as a powerful deterrent, effectively limiting the number of new players that can realistically enter the market and compete with established firms. The sheer scale of financial commitment required to match existing operational efficiencies and quality standards is a primary barrier.

Hilton Food Group leverages significant economies of scale, a direct result of its extensive international operations and substantial production capacities. This scale allows the company to spread fixed costs over a larger output, driving down per-unit production costs.

For instance, in 2023, Hilton Food Group reported revenue of £4.2 billion, indicating a substantial operational footprint. New entrants would find it incredibly challenging to match these cost efficiencies, as building comparable infrastructure and achieving similar production volumes would require immense capital investment, effectively creating a high barrier to entry.

New entrants face significant hurdles in securing shelf space and distribution agreements with major international retailers, the very customers Hilton Food Group serves. These established relationships, built over years, represent a substantial barrier to entry.

Hilton Food Group's existing, long-standing partnerships with key retailers, such as a significant portion of the UK's top supermarkets, create a formidable moat. For instance, in 2024, Hilton continued its extensive supply agreements with major players, making it difficult for newcomers to replicate this level of access and trust.

Brand Loyalty and Differentiation

Hilton Food Group's strong relationships with major retailers, built on consistent quality and innovation, create a significant barrier for new entrants. These partnerships are not just transactional; they involve co-development of unique product lines and sustainable sourcing practices, fostering deep loyalty. For example, Hilton's commitment to reducing plastic packaging, a key focus in 2024 for many food retailers, strengthens its position. New competitors would struggle to replicate this level of integrated trust and differentiation within the supply chain.

The threat of new entrants is mitigated by Hilton's established brand equity with its retail partners, which translates into a form of B2B brand loyalty. This loyalty is cultivated through:

- Collaborative Product Development: Working closely with retailers to create exclusive and innovative food offerings.

- Quality Assurance and Sustainability: Consistently delivering high-quality products and meeting evolving sustainability targets, such as those related to carbon footprint reduction which gained prominence in 2024.

- Supply Chain Reliability: Providing dependable and efficient supply chain solutions that retailers rely on.

Government Policy and Regulations

Government policy and regulations present a substantial barrier to new entrants in the food industry, including for companies like Hilton Food Group. Compliance with stringent food safety, hygiene, labeling, and environmental standards across diverse international markets requires significant investment and expertise. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) mandates traceability throughout the food chain, adding complexity for newcomers.

Navigating these intricate regulatory landscapes can deter potential competitors due to the increased time and cost associated with market entry. In 2024, the global food and beverage industry continued to grapple with evolving regulations, from stricter allergen labeling requirements in the UK to new sustainability reporting mandates in various regions. These factors collectively elevate the threat of new entrants by making it more challenging and expensive to establish a compliant and competitive operation.

- Regulatory Compliance Costs: New entrants must invest heavily in understanding and adhering to a complex web of international food safety and labeling laws.

- Time to Market: Obtaining necessary certifications and approvals can significantly prolong the time it takes for a new business to launch.

- International Variations: Differing regulations across countries create additional hurdles for companies aiming for global reach.

- Environmental Standards: Increasing focus on sustainability means new players must also meet evolving environmental protection requirements.

The threat of new entrants for Hilton Food Group is generally low due to significant capital requirements for modern food processing facilities, which can easily cost tens of millions of pounds. This substantial financial barrier deters many potential competitors from entering the market and matching existing operational efficiencies.

Furthermore, Hilton's established economies of scale, evidenced by its £4.2 billion revenue in 2023, allow for cost efficiencies that newcomers would struggle to replicate without immense investment. This scale creates a significant cost advantage, making it difficult for new players to compete on price.

Securing strong relationships and shelf space with major international retailers presents another formidable barrier. Hilton's long-standing partnerships, reinforced by consistent quality and collaborative product development, create a loyalty that is hard for new entrants to break into, especially given ongoing supply agreements in 2024.

Navigating complex and evolving global regulations, including stringent food safety and sustainability standards that gained prominence in 2024, adds considerable cost and time to market entry, further limiting the threat from new competitors.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of establishing state-of-the-art processing facilities. | Significant deterrent due to substantial upfront investment needed. |

| Economies of Scale | Hilton's £4.2 billion 2023 revenue indicates large-scale operations. | New entrants face difficulty matching cost efficiencies derived from scale. |

| Distribution Access | Established relationships with major retailers. | Challenging for newcomers to gain equivalent market access and trust. |

| Regulatory Compliance | Adherence to complex international food safety and environmental laws. | Increases time and cost for new entrants to achieve market readiness. |

Porter's Five Forces Analysis Data Sources

Our Hilton Food Group Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry association publications, and market intelligence from leading research firms. This comprehensive approach ensures a thorough understanding of competitive dynamics.