Hilton Food Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hilton Food Group Bundle

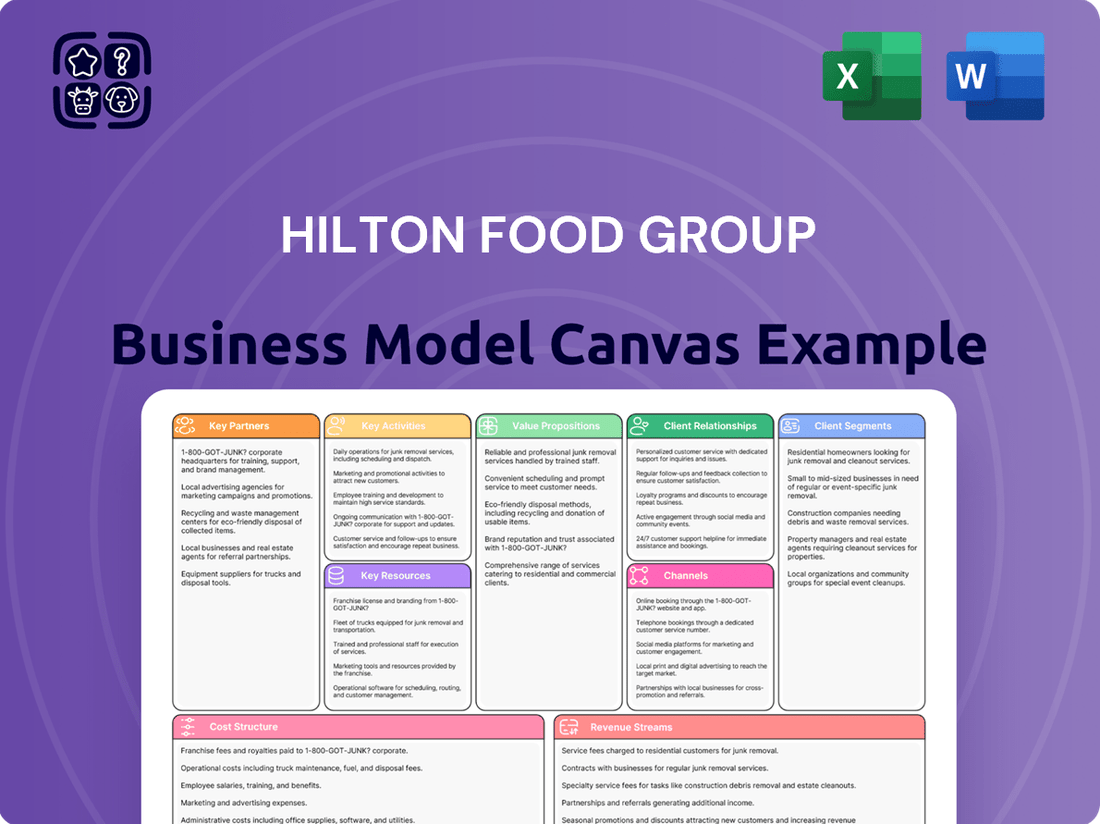

Unlock the strategic blueprint of Hilton Food Group's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and efficient cost structures to deliver value to their diverse customer segments.

This in-depth analysis reveals Hilton Food Group's core activities and revenue streams, offering actionable insights for entrepreneurs and investors alike.

Ready to dive deeper? Download the full, editable Business Model Canvas for Hilton Food Group to gain a complete understanding of their market-leading strategy.

Partnerships

Hilton Food Group's retail partnerships are the bedrock of its distribution strategy, connecting its diverse product lines with millions of consumers. These collaborations are not just transactional; they are deep, long-term supply and service agreements with major international retailers. For example, in 2023, Hilton's largest customer, Tesco, accounted for a significant portion of its revenue, highlighting the importance of these anchor relationships.

These partnerships are essential for ensuring Hilton's packaged meat, seafood, vegetarian, and vegan products, along with its ready meals, reach a vast customer base effectively. The open-book, transparent model employed in many of these agreements fosters trust and ensures that both Hilton and its retail partners benefit from maximized volumes and shared value. This collaborative approach is key to Hilton's continued growth and market penetration.

Hilton Food Group actively collaborates with technology and automation solution providers, notably Agito, to integrate advanced robotics and enhance its automated food processing operations. These partnerships are crucial for boosting operational efficiency and minimizing labor dependency, ensuring Hilton remains competitive through technological advancement.

In 2024, Hilton Foods continued to invest in these technological integrations, recognizing their impact on productivity and cost management. The company's strategic use of automation, supported by key technology partners, directly contributes to its ability to handle high volumes of food processing while maintaining stringent quality standards.

Furthermore, Hilton leverages its internal technology capabilities, such as Foods Connected, to offer data-driven insights and optimize supply chain performance. This dual approach, combining external expertise with in-house innovation, solidifies its position as a leader in technologically advanced food manufacturing.

Hilton Food Group's success hinges on its key partnerships with raw material suppliers, ensuring a consistent flow of high-quality meat and seafood. These relationships are crucial for maintaining product integrity and supply chain reliability.

In 2024, Hilton continued to emphasize supplier diversification, a strategy that proved vital given global supply chain volatilities. This approach mitigates risks and ensures access to a broad range of ethically sourced and traceable ingredients, supporting their commitment to quality and sustainability.

Joint Venture Partners for International Expansion

Hilton Food Group actively pursues joint ventures to fuel its international expansion. For instance, their partnership with NADEC in Saudi Arabia, announced in late 2023, signifies a strategic move into a key Middle Eastern market. This approach allows Hilton to enter new, high-growth territories with a capital-light model.

These alliances are crucial for leveraging established infrastructure and customer bases. The ongoing collaboration with Walmart in Canada exemplifies this, enabling Hilton to tap into a significant retail presence. Such ventures are designed to accelerate market penetration and capitalize on existing distribution networks.

- NADEC Partnership (Saudi Arabia): A strategic joint venture to establish a significant presence in the Middle Eastern market, leveraging local expertise and market access.

- Walmart Collaboration (Canada): Continues to utilize Walmart's extensive retail network for efficient product distribution and market reach within Canada.

- Capital-Light Expansion: These partnerships enable Hilton Food Group to enter new geographical markets without the substantial upfront investment typically required for wholly-owned subsidiaries.

- Leveraging Existing Networks: Joint ventures allow Hilton to benefit from the established customer relationships and logistical capabilities of their partners, accelerating growth.

Food Service Partners

Hilton Food Group extends its reach beyond traditional retail by forging crucial partnerships within the food service sector. A prime example is its collaboration with Fairfax Meadow in the UK and Ireland, a move that significantly diversizes Hilton's customer base and penetrates new market segments.

These food service alliances are vital for Hilton's growth strategy, enabling them to tap into different distribution channels and cater to a broader array of consumer needs. By working with entities like Fairfax Meadow, Hilton Food Group can leverage established networks and expertise within the hospitality and catering industries.

- Diversification: Partnerships with food service businesses like Fairfax Meadow allow Hilton Food Group to move beyond its core retail relationships, accessing a different customer demographic and sales volume.

- Market Penetration: These collaborations enable Hilton to gain a stronger foothold in the food service industry, which often has different supply chain requirements and consumer preferences compared to retail.

- Operational Synergies: Collaborating with established food service partners can lead to operational efficiencies and shared logistical benefits, ultimately enhancing the group's overall profitability and market presence.

Hilton Food Group's key partnerships are crucial for its operational efficiency and market expansion. These include collaborations with technology providers like Agito for automation, ensuring advanced processing capabilities. The company also relies on strong relationships with raw material suppliers, vital for maintaining product quality and supply chain resilience, as seen in their 2024 focus on supplier diversification amidst global volatilities.

| Partnership Type | Key Partner Example | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Retailers | Tesco, Walmart (Canada) | Distribution, Revenue Generation | Maintaining anchor relationships, leveraging networks |

| Technology & Automation | Agito | Operational Efficiency, Cost Management | Investing in automation for productivity |

| Raw Material Suppliers | Diversified Suppliers | Product Quality, Supply Chain Reliability | Mitigating risk through diversification |

| Joint Ventures | NADEC (Saudi Arabia) | International Expansion, Market Entry | Capital-light entry into new markets |

| Food Service | Fairfax Meadow (UK/Ireland) | Customer Diversification, Market Penetration | Accessing new consumer segments and distribution channels |

What is included in the product

This Business Model Canvas for Hilton Food Group outlines a strategy focused on supplying high-quality, own-brand food products to major retailers, emphasizing efficient supply chain management and strong customer relationships.

It details how Hilton Food Group leverages its sourcing, processing, and logistics capabilities to deliver value and secure long-term partnerships within the competitive grocery sector.

The Hilton Food Group Business Model Canvas offers a clear, visual representation of their operations, simplifying complex strategies for easier understanding and internal alignment.

It acts as a pain point reliever by providing a single, digestible page that streamlines strategic discussions and decision-making for the entire organization.

Activities

Food processing and packaging is central to Hilton Food Group's operations, transforming raw ingredients into a diverse array of products like meat, seafood, vegetarian, and vegan options, alongside prepared meals. This transformation occurs in state-of-the-art facilities designed for both quality and efficiency.

In 2024, Hilton Food Group continued to invest in its processing capabilities, aiming to meet growing consumer demand for convenient and diverse food options. The company's commitment to advanced technology underpins its ability to deliver high-quality, safely packaged goods across its various product categories.

Hilton Food Group prioritizes product innovation, consistently launching new and enhanced offerings. This includes premium meat selections and a variety of ready-to-cook meals, catering to diverse consumer tastes.

In 2024, the company's commitment to innovation is evident in its focus on meeting evolving consumer preferences. This strategic approach aims to drive growth within the protein categories they serve.

Hilton Food Group's key activities heavily involve managing a robust and efficient supply chain. This encompasses everything from procuring prime raw materials to ensuring timely delivery of perfectly prepared products to supermarkets. Their commitment to sustainability is woven into every step of this process.

Leveraging advanced technology is central to their operational strategy. Platforms like Foods Connected are instrumental in enhancing overall supply chain performance. This technology helps them meticulously manage quality control, track sustainability metrics, mitigate potential risks, and ultimately control costs throughout the entire value chain.

Automation and Technology Integration

Hilton Food Group prioritizes integrating cutting-edge automation and technology, including robotics, within its food processing operations. This strategic focus is designed to significantly boost operational efficiency and unlock greater production capacity.

By reducing reliance on manual labor, the company aims to mitigate labor-related costs and challenges, ensuring a more stable and predictable operational environment. This technological adoption is crucial for maintaining a competitive advantage in the dynamic food industry.

- Enhanced Efficiency: Automation streamlines processes, leading to faster production cycles and reduced waste.

- Capacity Expansion: Technology integration allows for increased output without proportional increases in labor.

- Cost Reduction: Robotics and automation can lower labor costs and improve resource utilization.

- Competitive Edge: Staying at the forefront of technological adoption helps Hilton Food Group maintain market leadership.

International Expansion and Market Entry

Hilton Food Group actively pursues international expansion by forming strategic joint ventures and forging new partnerships with retailers in untapped markets. This proactive approach is crucial for driving growth and diversifying revenue streams.

The company’s commitment to entering high-potential regions is evident in its establishment of new facilities and operational bases. For instance, recent expansions into markets like Saudi Arabia and Canada highlight this strategic focus.

Key activities in this area include:

- Strategic Market Identification: Researching and selecting new international territories based on growth potential and favorable market conditions.

- Partnership Development: Establishing joint ventures and retail collaborations to facilitate market entry and operational setup.

- Operational Establishment: Building and commissioning new facilities, including processing plants and distribution centers, to support local operations.

- Regulatory Compliance: Navigating and adhering to the specific regulations and standards of each new international market.

In 2024, Hilton Food Group continued to invest in its international footprint, aiming to replicate its successful domestic models in new territories. This expansion is designed to leverage existing expertise while adapting to local consumer demands and operational environments.

Hilton Food Group's key activities revolve around efficient food processing and packaging, transforming raw ingredients into a wide range of products. They also focus on continuous product innovation, launching new items to meet evolving consumer tastes.

The company actively manages a robust supply chain, from sourcing raw materials to delivering finished goods, with sustainability integrated throughout. Leveraging advanced technology, such as their Foods Connected platform, is crucial for quality control, risk mitigation, and cost management.

International expansion through strategic partnerships and new facility establishment is another core activity, as seen with their moves into markets like Saudi Arabia and Canada in recent years. This global reach is supported by ongoing investment in replicating successful operational models in new territories.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Food Processing & Packaging | Transforming raw ingredients into diverse food products. | Continued investment in advanced technology for quality and efficiency. |

| Supply Chain Management | Procuring materials, managing logistics, and ensuring timely delivery. | Focus on sustainability and leveraging technology like Foods Connected for performance. |

| Product Innovation | Developing and launching new and enhanced food offerings. | Meeting evolving consumer preferences, particularly in protein categories. |

| International Expansion | Establishing presence in new markets through joint ventures and new facilities. | Expanding footprint in regions like Saudi Arabia and Canada. |

Preview Before You Purchase

Business Model Canvas

The Hilton Food Group Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you're getting a direct, unadulterated view of the complete analysis, not a simplified sample. Once your order is complete, you'll gain full access to this exact, professionally structured document, ready for immediate use and adaptation.

Resources

Hilton Food Group's technologically advanced food processing facilities are a cornerstone of their operations. These sites feature high levels of automation and robotics, streamlining processes from preparation to packaging. This technological edge allows for efficient, large-scale production while maintaining stringent quality standards.

In 2024, Hilton Food Group continued to invest in these capabilities. For example, their expansion into new markets often involves upgrading or building facilities with the latest processing technology. This commitment ensures they can meet growing demand and maintain a competitive edge in a fast-paced industry.

Hilton Food Group's success hinges on its skilled workforce, boasting employees with deep expertise in areas like food processing, innovative product development, and efficient supply chain management. This diverse talent pool is essential for the company's ability to adapt to evolving consumer tastes and technological advancements in the food industry.

In 2024, Hilton Food Group continued to invest in its human capital, recognizing that its people are a key resource. The company's operational excellence and capacity for innovation are directly linked to the specialized knowledge and dedication of its team across all functions.

Hilton Food Group's strong retailer relationships are a cornerstone of its business model, underpinned by long-standing partnerships and robust contractual agreements with major international retailers. These alliances, cultivated over years, are not merely transactional; they represent a deep level of trust and mutual benefit.

These established ties ensure a consistent and predictable demand for Hilton's products, providing a stable revenue stream. For instance, in their 2023 annual report, Hilton highlighted the ongoing strength of their partnerships with key UK supermarkets, which continue to be a primary driver of sales volume. This market access is invaluable, allowing Hilton to efficiently distribute its products across wide geographical areas.

Beyond just sales, these relationships foster collaborative opportunities. Retailers and Hilton Food Group often work together on product innovation, tailoring offerings to meet evolving consumer preferences and market trends. This shared approach to product development not only enhances customer satisfaction but also drives growth for both parties, creating a symbiotic ecosystem where success is mutually reinforced.

Proprietary Technology and Data Platforms

Hilton Food Group's proprietary technology, particularly its Foods Connected platform, is a cornerstone of its business model. This platform offers advanced data analytics for enhanced supply chain management, driving significant operational efficiencies.

The intellectual property embedded in these platforms directly supports Hilton's commitment to improved traceability and sustainability across its operations. For instance, in 2023, the company reported that its sustainability initiatives, supported by its technology, led to a 10% reduction in food waste across its UK operations.

- Foods Connected Platform: Enables real-time data capture and analysis for optimized logistics and inventory management.

- Enhanced Traceability: Provides end-to-end visibility of products from source to shelf, crucial for food safety and quality assurance.

- Operational Efficiency Gains: Contributes to cost savings through better resource allocation and waste reduction, as evidenced by the 2023 waste reduction figures.

Financial Capital and Robust Balance Sheet

Hilton Food Group's financial capital and robust balance sheet are fundamental to its operational success and strategic ambitions. This strong financial foundation allows for continuous investment in state-of-the-art facilities and cutting-edge technology, ensuring efficiency and competitiveness. In 2024, the company's ability to generate consistent cash flow is crucial for funding its ambitious growth plans and navigating market fluctuations.

The company's financial strength directly underpins its capacity for strategic expansion, both organically and through potential acquisitions. A healthy balance sheet provides the necessary stability and borrowing capacity to pursue these opportunities, reinforcing its long-term growth trajectory and market resilience.

- Financial Capital: Hilton Food Group maintains a strong financial position, enabling consistent investment in its operations.

- Robust Balance Sheet: A healthy balance sheet provides the stability required for long-term strategic initiatives and market resilience.

- Cash Flow Generation: Sufficient and reliable cash flow is essential for funding ongoing capital expenditures and strategic expansion projects.

- Investment Capacity: The company's financial strength allows for significant investment in facilities, technology, and market development.

Hilton Food Group's key resources include its advanced food processing facilities, which are highly automated and utilize robotics for efficient production. The company also relies on its skilled workforce, possessing expertise in food processing, product development, and supply chain management. Crucially, strong retailer relationships and proprietary technology, such as the Foods Connected platform, are vital assets that drive operational efficiency and market access.

Value Propositions

Hilton Food Group's value proposition centers on providing a broad selection of high-quality, pre-packaged food items. This includes meats, seafood, and a growing range of vegetarian and vegan options, alongside convenient ready meals.

This extensive product diversity caters to a wide array of consumer needs and dietary choices. For instance, in 2024, the demand for plant-based alternatives continued to surge, a trend Hilton is well-positioned to capitalize on with its expanding vegetarian and vegan offerings.

The company's commitment to quality ensures that consumers receive reliable and appealing food products. This focus on excellence across its varied portfolio, from traditional proteins to innovative meat-free options, underpins customer loyalty and market competitiveness.

Hilton Food Group excels at creating innovative food solutions directly inspired by what consumers want. This means they're constantly developing new product ranges and premium options that really resonate with shoppers. For instance, in 2024, they continued to focus on expanding their plant-based and convenience meal offerings, a trend showing significant growth.

These consumer-led innovations are crucial for their retail partners. By offering fresh, exciting products, Hilton helps supermarkets stay ahead of the curve and cater to ever-changing tastes. This responsiveness ensures that their partners remain competitive in a dynamic market, directly addressing consumer demand for quality and variety.

Hilton Food Group enhances supply chain efficiency and reliability for retail partners through advanced automation and integrated services. This focus ensures consistent product availability, a critical factor for customer satisfaction and sales. For example, in 2023, Hilton Food Group reported a 5.5% increase in revenue, partly driven by their ability to maintain robust supply chains even amidst global disruptions.

Sustainability and Ethical Sourcing Commitment

Hilton Food Group's dedication to sustainability resonates strongly with today's market. Their focus on reducing greenhouse gas emissions, with a target of a 40% reduction in Scope 1 and 2 emissions by 2030 from a 2019 baseline, directly addresses growing environmental concerns. This commitment is a key value proposition for retail partners and end consumers who prioritize ethical and eco-conscious sourcing.

The company's efforts extend to improving packaging, aiming for 100% recyclable, reusable, or compostable packaging by 2025. Furthermore, their robust animal welfare standards and stringent supply chain integrity checks build trust and appeal to a discerning customer base. In 2023, Hilton Food Group reported a 10% reduction in food waste across its operations, demonstrating tangible progress.

Hilton Food Group's sustainability initiatives offer a clear advantage:

- Environmental Responsibility: Tangible actions like GHG emission reduction targets and waste minimization appeal to environmentally conscious stakeholders.

- Ethical Sourcing: Strong animal welfare policies and supply chain transparency meet the demand for ethically produced goods.

- Consumer Trust: A proven commitment to sustainability enhances brand reputation and fosters loyalty among consumers.

- Retailer Partnerships: Aligning with retailers' own sustainability goals strengthens business relationships and market position.

Strategic Partnership and Collaborative Growth

Hilton Food Group positions itself as a crucial ally for retailers, fostering collaborative relationships aimed at achieving enduring, mutually beneficial growth. This partnership extends to joint efforts in innovating new products, exploring new markets, and enhancing operational efficiencies.

By working hand-in-hand, Hilton Food Group and its retail partners can unlock significant shared value. For instance, in 2023, Hilton Food Group reported a 10.1% increase in revenue to £4.7 billion, demonstrating the tangible results of such strategic collaborations.

- Retailer Collaboration: Hilton Food Group actively partners with major retailers, sharing expertise in product development and supply chain management to meet evolving consumer demands.

- Market Expansion: Joint ventures and strategic alliances enable both Hilton and its partners to enter new geographical markets, leveraging combined resources and market knowledge.

- Operational Enhancement: The company works with retailers to streamline operations, reduce waste, and improve efficiency throughout the food production and distribution process, contributing to better margins for all involved.

Hilton Food Group's value proposition is built on delivering high-quality, convenient food solutions, encompassing a wide range of proteins and expanding plant-based options. This commitment to quality and variety directly addresses evolving consumer preferences, a trend highlighted by the continued growth in demand for meat-free alternatives throughout 2024.

The company's operational excellence is a key differentiator, focusing on supply chain efficiency and reliability. This is supported by significant investment in automation and integrated services, ensuring consistent product availability for retail partners. For instance, Hilton Food Group reported a 5.5% revenue increase in 2023, partly attributed to its robust supply chain capabilities.

A strong emphasis on sustainability further enhances Hilton's appeal. With targets for emission reductions and fully recyclable packaging by 2025, the company aligns with growing consumer and retailer demand for ethical and environmentally responsible products. In 2023, they achieved a 10% reduction in food waste, demonstrating tangible progress.

Hilton Food Group actively fosters collaborative relationships with retailers, working together on product innovation, market expansion, and operational efficiencies. This partnership approach has yielded significant results, with revenue climbing to £4.7 billion in 2023, a 10.1% increase that underscores the success of these joint ventures.

| Key Value Proposition | Description | Supporting Data/Fact |

| Product Quality & Variety | Broad selection of high-quality meats, seafood, and plant-based alternatives. | Continued surge in demand for plant-based options in 2024. |

| Supply Chain Efficiency | Automated and integrated services ensuring reliable product availability. | 5.5% revenue increase in 2023, driven by supply chain strength. |

| Sustainability Commitment | Focus on emission reduction and eco-friendly packaging. | 10% food waste reduction in 2023; 100% recyclable packaging goal by 2025. |

| Retailer Collaboration | Partnerships for product innovation, market expansion, and operational improvements. | 10.1% revenue growth to £4.7 billion in 2023 from strategic alliances. |

Customer Relationships

Hilton Food Group prioritizes long-term strategic partnerships with its major retail clients, fostering relationships built on transparency and shared goals for sustained growth. These collaborations often involve open-book accounting and a joint commitment to innovation and efficiency.

In 2024, Hilton's strategy continued to emphasize these deep partnerships, which are crucial for its supply chain integration and market penetration. For instance, its agreements with major UK supermarkets are designed for mutual benefit, ensuring consistent quality and supply.

Hilton Food Group actively partners with its retail customers, fostering collaborative product development. This joint effort focuses on enhancing existing products, elevating them to premium status, and creating entirely new product lines.

This customer-centric approach ensures that Hilton's product portfolio is finely tuned to meet precise market demands and evolving consumer preferences. For instance, in 2023, the company reported that its collaborative product development initiatives contributed to a significant portion of its revenue growth, with specific examples of successful new range launches in the UK market driving double-digit percentage increases in sales for key retail partners.

Hilton Food Group prioritizes strong relationships by offering dedicated account management to its retail and foodservice clients. This approach ensures a deep understanding of partner needs, leading to tailored solutions and seamless operations.

This focus on customer service is crucial for maintaining long-term partnerships. For example, in 2023, Hilton Food Group reported that over 90% of its revenue came from long-term contracts, underscoring the success of its relationship-driven model.

Technology-Enabled Engagement

Hilton Food Group actively uses technology to strengthen its connections with customers. Platforms like Foods Connected are central to this strategy, offering advanced tools for supply chain management.

This technological integration allows Hilton to provide customers with valuable, data-driven insights. These insights help customers understand and improve their own supply chain performance, fostering a more collaborative and transparent relationship.

- Data-Driven Insights: Foods Connected provides real-time data analytics, enabling customers to monitor inventory levels, predict demand, and optimize logistics.

- Enhanced Visibility: Customers gain end-to-end visibility across the supply chain, from sourcing to delivery, reducing uncertainty and improving planning.

- Operational Efficiency: By leveraging these technological tools, customers can streamline their operations, leading to cost savings and improved product availability.

- Collaborative Platform: Foods Connected acts as a central hub for communication and collaboration between Hilton and its customers, facilitating smoother transactions and problem-solving.

Joint Investment in Growth Opportunities

Hilton Food Group actively pursues joint investments with key customers to capitalize on emerging growth prospects. A prime example is their collaboration with Walmart in Canada, a strategic partnership designed to unlock new market access and product categories. This approach underscores a mutual dedication to shared future success and expansion.

These customer relationships, built on shared investment, are crucial for Hilton Food Group's market penetration and category development. By pooling resources and expertise, they can more effectively enter new territories or introduce innovative product lines. This collaborative model fosters a strong sense of partnership and shared risk, ultimately driving mutual growth.

- Walmart Canada Collaboration: Demonstrates a joint investment strategy to expand market reach and product offerings.

- Shared Commitment to Growth: Highlights the mutual dedication to future success and market development through partnership.

- Unlocking New Opportunities: Facilitates entry into new markets and categories by leveraging customer relationships and shared capital.

Hilton Food Group cultivates deep, long-term relationships with its retail partners, focusing on transparency, collaborative product development, and shared investment. These partnerships are supported by dedicated account management and advanced technology platforms like Foods Connected, which provide data-driven insights and enhance supply chain visibility.

In 2024, Hilton's strategy continued to leverage these strong customer ties, which are fundamental to its integrated supply chain and market expansion. The company's success in 2023, with over 90% of revenue from long-term contracts, highlights the effectiveness of this relationship-centric approach.

Key aspects of Hilton's customer relationships include collaborative product innovation, leading to successful new range launches, and joint investments with major clients like Walmart in Canada to access new markets and categories.

These collaborations ensure Hilton's offerings align precisely with market demands, driving mutual growth and operational efficiency for both parties.

Channels

Hilton Food Group's primary sales channel involves direct supply to major international retailers, a strategy that spans across the UK, Europe, Asia Pacific, and North America. This direct-to-retail model is crucial for their operations.

The company delivers a diverse range of products, including packaged meat, seafood, vegetarian, and vegan options, alongside ready meals, directly to the distribution centers of these retail partners. This streamlined approach ensures efficiency in their supply chain.

In 2023, Hilton Food Group reported a revenue of £4.2 billion, with a significant portion of this driven by their direct supply relationships with these large international retailers. This highlights the effectiveness of their channel strategy.

Hilton Food Group leverages extensive food service distribution networks, significantly broadening its market presence beyond typical grocery retail. This strategic channel allows them to efficiently supply a diverse range of food products to restaurants, hotels, and catering businesses, tapping into a substantial segment of the food industry.

In 2024, the food service sector continued to be a vital component of Hilton Food Group's operations, contributing to their overall revenue growth. Their established relationships within this sector enable them to meet the specific demands of food service clients, ensuring timely delivery and product quality.

Hilton Food Group leverages its proprietary technology platforms and dedicated supply chain services to function as an integrated supply chain partner. This channel offers customers end-to-end solutions, streamlining operations from sourcing to delivery.

This comprehensive service model is designed to significantly enhance operational efficiency for Hilton's clients. For instance, in 2024, the company continued to invest in its logistics infrastructure, aiming to reduce lead times and improve inventory management across its network.

New International Facilities and Joint Ventures

Hilton Food Group's expansion into new international markets is significantly driven by establishing new processing facilities and forming joint ventures. This strategy allows them to directly serve customers in these regions, bypassing traditional import channels and building local supply chains. For instance, their joint venture in Saudi Arabia, established in 2023, is a prime example of this approach, aiming to tap into the growing demand for protein products in the Middle East.

These new ventures act as crucial channels for market penetration and operational efficiency. By setting up local processing capabilities, Hilton Food Group can reduce logistics costs, improve product freshness, and tailor offerings to local preferences. Their recent expansion into Canada also exemplifies this, with the establishment of new facilities designed to cater to the North American market.

- Saudi Arabia Joint Venture: Established in 2023, this venture aims to build a significant presence in the Middle Eastern protein market.

- Canadian Expansion: New processing facilities in Canada are designed to enhance supply chain capabilities for the North American market.

- Market Entry Channel: These facilities and ventures directly serve as points of supply and customer engagement in new geographic territories.

- Operational Efficiency: Localized processing reduces lead times and logistical expenses, improving overall cost-effectiveness.

Digital Platforms for Supply Chain Management

Digital platforms are vital for Hilton Food Group's supply chain operations, acting as conduits for supplier and customer engagement. These platforms enhance efficiency and transparency throughout the network. For instance, Foods Connected is a key digital tool that facilitates streamlined communication and data sharing, directly impacting operational effectiveness.

These digital channels are not for direct consumer sales but are indispensable for managing supplier agreements and customer orders. They provide real-time visibility into inventory levels, delivery schedules, and quality control metrics. This digital infrastructure is critical for optimizing logistics and ensuring product freshness from source to shelf.

- Supplier Integration: Digital platforms enable seamless integration with a vast network of suppliers, allowing for better forecasting and procurement.

- Customer Relationship Management: They facilitate efficient order processing and communication with retail partners, improving service levels.

- Supply Chain Visibility: Real-time data tracking across the entire supply chain enhances operational control and risk management.

- Data Analytics: These platforms generate valuable data for performance analysis, identifying areas for cost reduction and efficiency gains.

Hilton Food Group's channels are primarily business-to-business, focusing on direct supply to major international retailers and the food service sector. Digital platforms are integral for managing these B2B relationships, enhancing supply chain efficiency and transparency.

The company also utilizes new processing facilities and joint ventures as crucial channels for penetrating new international markets, allowing for localized supply chains and direct customer service.

In 2023, Hilton Food Group reported £4.2 billion in revenue, with a significant portion attributed to these direct retail and food service channels.

The company's investment in its logistics infrastructure in 2024 aims to further optimize these channels by reducing lead times and improving inventory management.

| Channel Type | Key Activities | 2023/2024 Impact |

| Direct Retail Supply | Supplying packaged meat, seafood, vegetarian/vegan options, and ready meals to major international retailers' distribution centers. | Core revenue driver, supporting £4.2 billion revenue in 2023. |

| Food Service Distribution | Supplying restaurants, hotels, and catering businesses through established distribution networks. | Continued contribution to revenue growth in 2024, tapping into a substantial market segment. |

| New Market Entry (Facilities/JVs) | Establishing local processing facilities and joint ventures in new international markets (e.g., Saudi Arabia 2023, Canada). | Facilitates direct customer service, reduces logistics costs, and improves product freshness in new territories. |

| Digital Platforms (e.g., Foods Connected) | Managing supplier agreements, customer orders, and providing supply chain visibility for B2B partners. | Enhances operational efficiency, transparency, and data analytics across the supply chain. |

Customer Segments

Large international supermarket chains and retailers represent Hilton Food Group's foundational customer segment. These partners, spanning Europe, Asia Pacific, and North America, demand substantial volumes of high-quality, consistently supplied packaged food products. Hilton's operational strength is deeply intertwined with meeting the rigorous needs of these major players.

In 2024, the global retail food sector continued its robust growth, with major supermarket chains consistently investing in supply chain efficiency and product quality. Hilton Food Group's ability to deliver on these fronts is critical, as evidenced by their ongoing partnerships with leading retailers who rely on their expertise for packaged protein solutions.

Hilton Food Group's food service segment targets businesses that act as intermediaries, supplying a wide array of food products to restaurants, catering services, and other institutional buyers. This strategic move diversifies their revenue streams beyond the grocery sector.

By expanding into food service, Hilton Food Group taps into a significant market, catering to the consistent demand from the hospitality and institutional sectors. For instance, the UK food service market was valued at approximately £54 billion in 2023, highlighting the substantial opportunity.

While Hilton Food Group directly partners with retailers, the ultimate beneficiaries of their offerings are the end consumers. These consumers purchase Hilton's diverse range of packaged meat, seafood, vegetarian, vegan products, and ready meals from supermarkets and other retail outlets.

Hilton's strategic emphasis on product innovation and maintaining high quality directly addresses evolving consumer preferences and demand. For instance, the growing consumer interest in plant-based options, a trend evident across major markets, drives Hilton's development in their vegetarian and vegan product lines.

Consumer purchasing decisions at the retail level, influenced by factors like price, convenience, and perceived quality, ultimately shape the success of Hilton's products. In 2024, the global packaged food market continued to see robust growth, with consumers increasingly seeking convenient, healthy, and sustainable options, aligning with Hilton's strategic focus.

Partners in Emerging Markets

Hilton Food Group is actively cultivating new relationships with partners in emerging international markets, notably in the Middle East and North America. This strategic expansion targets geographical customer bases that represent significant growth opportunities. For instance, Hilton Food Group's presence in Saudi Arabia signifies a key entry into a rapidly developing consumer market.

The company's venture into Canada also highlights its commitment to diversifying its international footprint. These emerging markets are crucial for future revenue streams and market share expansion.

- Middle East Expansion: Targeting markets like Saudi Arabia, a region with a growing demand for high-quality, protein-based food products.

- North American Presence: Establishing a foothold in Canada to tap into established yet evolving consumer preferences.

- Geographical Diversification: Reducing reliance on existing markets by building new customer relationships in previously untapped territories.

- Growth Opportunities: Leveraging the unique consumer dynamics and economic development in these emerging regions to drive sales and brand recognition.

Technology and Automation Clients (via Foods Connected)

Following the partial divestment of Foods Connected, Hilton Food Group now serves a broader range of external food companies and meat processors. These clients leverage the Foods Connected platform primarily for sophisticated supply chain management solutions.

This segment is crucial for optimizing operations, with clients utilizing the platform for enhanced quality control measures and robust sustainability tracking. For instance, in 2024, Foods Connected reported a significant increase in platform adoption among independent food manufacturers seeking greater transparency and efficiency in their operations.

- Supply Chain Optimization: Clients use the platform to streamline logistics, reduce waste, and improve inventory management across their food production processes.

- Quality Assurance: The platform facilitates rigorous quality control checks at various stages, ensuring product integrity and compliance with industry standards.

- Sustainability Reporting: Businesses rely on Foods Connected for tracking and reporting on environmental impact, ethical sourcing, and carbon footprint reduction, aligning with growing consumer and regulatory demands.

Hilton Food Group's customer base is diverse, encompassing major international supermarket chains and retailers who are their core partners. They also serve the food service sector, providing products to intermediaries that supply restaurants and catering businesses. Additionally, the ultimate consumers who purchase their packaged food products in retail outlets are a key, albeit indirect, customer segment.

The company is actively expanding into emerging markets, particularly in the Middle East and North America, to broaden its geographical reach and tap into new growth opportunities. Furthermore, following the divestment of Foods Connected, Hilton now supports external food companies and meat processors by offering advanced supply chain management solutions through the platform.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Supermarket Chains & Retailers | High volume, consistent quality, packaged food products. | Continued investment in supply chain efficiency by major retailers. |

| Food Service Sector | Intermediaries supplying restaurants, catering, institutions. | UK food service market valued at approx. £54 billion in 2023. |

| End Consumers | Purchasers of packaged meat, seafood, vegetarian, vegan products. | Growing demand for convenient, healthy, and sustainable options. |

| Emerging Markets (ME, NA) | Geographical expansion for growth. | Presence in Saudi Arabia signifies entry into a rapidly developing consumer market. |

| External Food Companies/Processors | Utilize Foods Connected for supply chain management. | Increased platform adoption by independent food manufacturers in 2024. |

Cost Structure

Raw material costs represent a substantial component of Hilton Food Group's expenses, primarily driven by the sourcing of meat, seafood, and components for their expanding range of vegetarian, vegan, and ready-to-eat meals.

For instance, in 2023, the company reported that commodity prices, particularly for meat, had a notable impact on their financial performance, underscoring the sensitivity of their cost structure to market volatility.

These price fluctuations directly influence profitability, making efficient procurement and hedging strategies crucial for maintaining margins in a competitive market.

Operating and production costs for Hilton Food Group are primarily driven by the sophisticated nature of their food processing operations. This includes significant expenditure on energy to power technologically advanced facilities, ongoing maintenance for specialized machinery, and the upkeep of automation and robotics essential for efficiency. In 2023, the company reported its cost of sales was £3.5 billion, reflecting the scale of these operational expenses.

Wages and salaries for Hilton Food Group's extensive workforce, encompassing production, logistics, and management, represent a significant component of their cost structure. For instance, in 2023, employee-related expenses, including wages and benefits, amounted to £154.6 million, highlighting the substantial investment in their human capital.

To address the impact of increasing labor expenses, Hilton Food Group is actively pursuing automation initiatives. These investments in technology are designed to enhance efficiency and reduce reliance on manual labor in key operational areas, thereby mitigating the upward pressure on costs.

Distribution and Logistics Costs

Distribution and logistics form a significant part of Hilton Food Group's expenses. These costs encompass the crucial movement of finished products from their processing plants to a wide array of retail and food service clients. This includes managing warehouses, operating their own vehicle fleets, and covering fuel expenses, all vital for timely delivery.

The company's commitment to integrated logistics solutions, while enhancing service, also contributes to this cost base. For instance, in their 2023 annual report, Hilton Food Group highlighted significant investments in their supply chain infrastructure to improve efficiency and capacity, directly impacting these operational costs.

- Warehousing: Expenses related to storing products before distribution.

- Fleet Management: Costs associated with maintaining and operating their own transportation vehicles.

- Fuel Costs: The fluctuating price of fuel directly impacts the cost of transportation.

- Integrated Logistics Services: Investments in technology and personnel to manage the end-to-end supply chain.

Investment in Technology and Capital Expenditure

Hilton Food Group's cost structure heavily features investment in technology and capital expenditure. This includes ongoing spending on new technologies and automation to boost processing efficiency. For instance, in 2023, the group reported capital expenditure of £53.1 million, a substantial increase from £33.4 million in 2022, reflecting these strategic investments.

These significant capital outlays are essential for expanding and upgrading processing facilities, directly impacting long-term operational efficiency and growth potential. Such investments are critical for maintaining a competitive edge in the food manufacturing sector.

- Technology Adoption: Investments in advanced automation and processing technologies.

- Facility Upgrades: Capital allocated for expanding and modernizing existing processing plants.

- Efficiency Gains: These expenditures are aimed at improving productivity and reducing operational costs over time.

- Growth Enablers: Technology and capital expenditure are fundamental to supporting the group's expansion plans and market penetration.

Hilton Food Group's cost structure is significantly influenced by its raw material procurement, with commodity prices for meat and seafood being key drivers. Operating expenses are substantial, encompassing energy, machinery maintenance, and automation for their advanced processing facilities. The group's investment in technology and capital expenditure, totaling £53.1 million in 2023, is crucial for efficiency and expansion.

| Cost Category | 2023 Impact/Data | Notes |

| Raw Materials | Commodity prices impacted performance | Sensitivity to market volatility |

| Operating & Production | £3.5 billion (Cost of Sales) | Energy, maintenance, automation |

| Wages & Salaries | £154.6 million (Employee-related expenses) | Investment in workforce; automation to mitigate increases |

| Distribution & Logistics | Investments in supply chain infrastructure | Warehousing, fleet management, fuel |

| Capital Expenditure | £53.1 million (Increase from £33.4m in 2022) | Technology adoption, facility upgrades, growth |

Revenue Streams

The sale of packaged fresh meat products is Hilton Food Group's primary revenue engine, driven by supplying major international retailers with high-volume, quality meats. This segment consistently demonstrates market outperformance and robust volume expansion, underpinning the company's financial strength.

Hilton Food Group generates revenue primarily through the sale of packaged seafood products to its retail partners. This segment is a cornerstone of their business, demonstrating robust performance and a substantial contribution to overall profitability.

In 2024, the seafood division, particularly in the UK and Ireland, has exhibited improved operational efficiency and market penetration, solidifying its position as a key revenue driver for the group.

Hilton Food Group's diversification into vegetarian and vegan products is a key revenue stream, directly addressing the growing consumer demand for plant-based options. This strategic move allows the company to tap into a rapidly expanding market segment.

Despite a challenging market environment, Hilton Food Group views the sales of these alternative protein products as having significant long-term revenue potential. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong future outlook for this category.

Sales of Ready Meals and Convenience Foods

Hilton Food Group generates revenue through the production and supply of ready meals and convenience foods. This segment caters to a growing consumer preference for quick and easy meal solutions, broadening the company's product offerings.

In 2024, the ready meals sector continued to be a significant contributor to the food industry's growth, driven by busy lifestyles and demand for diverse culinary options. Hilton's involvement in this area allows them to tap into this expanding market.

- Ready Meal Production: Hilton offers a range of ready-to-eat meals, from single servings to family-sized options, often developed in partnership with major retailers.

- Convenience Food Expansion: Beyond traditional ready meals, this stream includes other convenient food items designed for ease of preparation and consumption.

- Market Demand Alignment: This revenue stream directly addresses the increasing consumer need for time-saving and accessible food choices in their daily lives.

Supply Chain Services and Technology Solutions

Hilton Food Group diversifies its income beyond direct product sales by offering specialized supply chain services and cutting-edge technology solutions. This strategic move leverages their extensive operational expertise and technological advancements.

A key component of this revenue stream is the Foods Connected platform. This sophisticated system provides clients with advanced tools for data-driven supply chain management, enhancing efficiency and transparency for external partners.

This segment not only supports Hilton Food Group’s internal operations but also creates a valuable B2B revenue opportunity. For instance, in 2023, the company continued to invest in and expand the capabilities of its Foods Connected platform, aiming to onboard more external partners seeking optimized supply chain solutions.

- Revenue Generation: Beyond selling food products, Hilton Food Group earns income from its supply chain services and technology solutions.

- Foods Connected Platform: This proprietary technology offers data-driven tools for managing and optimizing supply chains.

- Clientele: The services cater to external clients looking to improve their own supply chain operations.

- Strategic Value: This stream enhances operational efficiency and creates a recurring revenue model.

Hilton Food Group's revenue streams are multifaceted, encompassing the sale of fresh meat and seafood, the growing market for vegetarian and vegan alternatives, and the provision of specialized supply chain technology services.

In 2024, the company has seen continued strength in its core protein offerings, while the plant-based segment is poised for significant expansion, reflecting evolving consumer preferences.

The Foods Connected platform represents a strategic move to generate recurring revenue by offering advanced supply chain management solutions to external partners.

| Revenue Stream | Primary Offering | Key Drivers | 2024 Outlook |

|---|---|---|---|

| Packaged Fresh Meat | High-volume, quality meats for retailers | Retail partnerships, volume growth | Continued market outperformance |

| Packaged Seafood | Seafood products for retailers | Operational efficiency, market penetration | Robust performance, key contributor |

| Vegetarian & Vegan Products | Plant-based protein alternatives | Growing consumer demand, market expansion | Significant long-term potential |

| Ready Meals & Convenience Foods | Convenient, easy-to-prepare meals | Busy lifestyles, demand for diverse options | Continued sector growth |

| Supply Chain Services & Technology | Foods Connected platform, data-driven management | Operational expertise, technological advancements | B2B revenue opportunity, partner expansion |

Business Model Canvas Data Sources

The Hilton Food Group Business Model Canvas is informed by a blend of internal financial reports, operational data from their supply chain, and extensive market research on consumer preferences in the food sector. These sources provide a comprehensive view of their current operations and future potential.