Hexcel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexcel Bundle

Hexcel operates in a dynamic aerospace and defense sector where supplier power can significantly impact costs and lead times. Understanding the intensity of this force, alongside buyer bargaining power and the threat of substitutes, is crucial for strategic planning.

The full Porter's Five Forces Analysis for Hexcel provides a comprehensive deep dive into these competitive pressures, offering actionable insights into Hexcel’s market position and potential vulnerabilities. Unlock this detailed breakdown to inform your strategic decisions and gain a competitive edge.

Suppliers Bargaining Power

The bargaining power of suppliers is significantly influenced by the concentration of raw material providers. For companies like Hexcel, which relies on specialized materials such as carbon fiber precursors, advanced resins, and specific chemicals, the number of available suppliers for these critical inputs is a key factor.

If there are only a few dominant suppliers for these essential raw materials, they can wield considerable pricing power. This concentration means these suppliers may have greater leverage in dictating terms, increasing prices, or even controlling the availability of materials, thereby impacting Hexcel's production costs and supply chain stability.

For instance, the carbon fiber market, a core component for Hexcel, has seen consolidation. In 2023, Toray Industries, a major player, continued to invest in expanding its capacity for carbon fiber production, underscoring the importance of such large-scale suppliers. This concentration can translate into higher input costs for downstream manufacturers if these few suppliers choose to exercise their pricing power.

Hexcel's reliance on highly specialized composite materials significantly strengthens the bargaining power of its suppliers. If these raw materials are proprietary or possess unique performance characteristics that are difficult to replicate, Hexcel has fewer alternatives, giving suppliers leverage.

For instance, in the advanced aerospace sector, specific carbon fiber prepregs or resin systems often have unique formulations developed over years of R&D. Hexcel's 2023 annual report highlights its commitment to advanced materials, suggesting a dependency on suppliers who can consistently meet stringent aerospace specifications. This specialization limits Hexcel's ability to switch suppliers without incurring substantial costs or compromising product quality.

Hexcel faces significant switching costs when changing suppliers for its advanced composite materials. These costs can include the lengthy and expensive requalification processes for new materials, which often require extensive testing to ensure they meet stringent aerospace and defense industry standards. Furthermore, Hexcel might need to retool its manufacturing equipment to accommodate different material specifications, adding another layer of expense and complexity.

Supplier's Ability to Forward Integrate

Suppliers’ ability to forward integrate into Hexcel’s composites industry represents a significant bargaining chip. If a key supplier, for instance, a resin or fiber producer, were to begin manufacturing finished composite parts, they could directly compete with Hexcel. This potential threat forces Hexcel to maintain favorable terms with its suppliers, as the alternative of facing them as a direct competitor is costly.

Consider the chemical industry, a primary supplier to advanced materials manufacturers. Major chemical companies possess the technical expertise and capital to potentially move downstream. For example, if a large carbon fiber precursor supplier decided to invest in its own weaving or prepreg operations, it could disrupt Hexcel's supply chain and competitive landscape. This is particularly relevant as the aerospace and industrial sectors continue to demand more integrated material solutions.

- Suppliers' Potential to Compete: The threat of suppliers entering Hexcel's market by producing finished composite parts.

- Leverage in Negotiations: This potential competition enhances suppliers' bargaining power, allowing them to dictate terms more effectively.

- Industry Examples: Chemical companies supplying raw materials to composites manufacturers are prime candidates for forward integration.

- Strategic Implications: Hexcel must manage supplier relationships carefully to mitigate the risk of direct competition from its own material providers.

Importance of Hexcel to Supplier's Business

Hexcel's reliance on its suppliers significantly influences its bargaining power. If a supplier derives a substantial portion of its revenue from Hexcel, Hexcel gains leverage. Conversely, if Hexcel represents only a minor part of a supplier's overall sales, that supplier holds greater power, as they can more easily absorb the loss of Hexcel's business.

For instance, consider a specialized raw material supplier. If Hexcel is one of only a few customers for this unique material, the supplier's dependence on Hexcel is high. However, if the supplier has a diverse customer base, including other aerospace manufacturers or industrial clients, Hexcel's purchasing volume becomes less critical to the supplier's financial health.

This dynamic is crucial for Hexcel's cost management and supply chain stability. Suppliers with less dependence on Hexcel may be able to command higher prices or dictate more favorable terms, impacting Hexcel's profitability and operational efficiency.

- Supplier Revenue Dependence: The percentage of a supplier's total revenue generated from Hexcel is a key indicator of bargaining power.

- Customer Diversification: Suppliers with a broad customer base are less vulnerable to losing a single client like Hexcel, thus increasing their leverage.

- Impact on Hexcel: High supplier dependence on Hexcel can lead to more favorable pricing and terms for Hexcel, while low dependence can result in increased costs and supply chain risks.

Hexcel's suppliers possess significant bargaining power due to the specialized nature of the advanced composite materials they provide. This power is amplified by the high switching costs Hexcel incurs when changing suppliers, which can involve extensive requalification processes and potential equipment modifications. Furthermore, the threat of suppliers integrating forward into Hexcel's market by producing finished composite parts gives them considerable leverage in negotiations.

The concentration of suppliers for critical raw materials like carbon fiber precursors and specialized resins also bolsters their position. For instance, the carbon fiber market, a key input for Hexcel, features major players like Toray Industries, whose capacity expansions in 2023 highlight the influence of large-scale suppliers. This limited supplier base means these entities can dictate terms, impacting Hexcel's production costs and supply chain stability.

Hexcel's ability to negotiate favorable terms is also affected by the supplier's dependence on its business. If Hexcel represents a small portion of a supplier's revenue, that supplier has less incentive to accommodate Hexcel's needs, potentially leading to higher prices and less favorable terms for Hexcel.

| Factor | Impact on Hexcel | Supporting Data/Examples |

|---|---|---|

| Supplier Concentration | Increases supplier leverage, potentially raising input costs. | Consolidation in the carbon fiber market, with key players like Toray Industries expanding capacity. |

| Switching Costs | Limits Hexcel's flexibility and strengthens supplier positions. | Requalification processes for aerospace-grade materials can be lengthy and expensive. |

| Threat of Forward Integration | Creates competitive pressure, forcing Hexcel to maintain good supplier relations. | Chemical companies supplying raw materials have the potential to move into finished composite part manufacturing. |

| Supplier Dependence on Hexcel | Low dependence enhances supplier bargaining power; high dependence favors Hexcel. | Suppliers with diverse customer bases are less vulnerable to losing Hexcel's business. |

What is included in the product

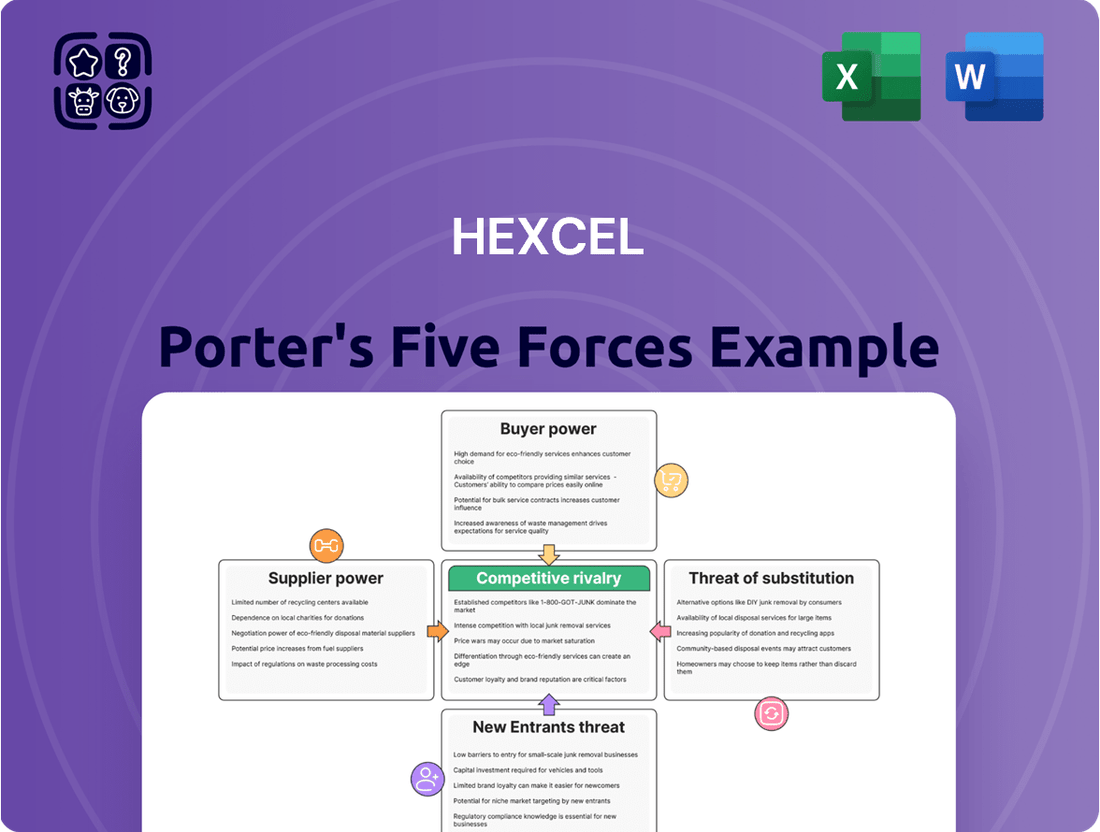

This analysis unpacks the competitive forces shaping Hexcel's industry, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Quickly identify and quantify competitive threats with a visual breakdown of each of Porter's Five Forces, enabling targeted strategic responses.

Customers Bargaining Power

Hexcel's customer concentration, particularly within the commercial aerospace sector, significantly influences their bargaining power. A limited number of major aircraft manufacturers, such as Boeing and Airbus, represent substantial portions of Hexcel's revenue. For instance, in 2023, Hexcel reported that its largest customer accounted for approximately 17% of its net sales. This high dependence on a few key players grants these customers considerable leverage, enabling them to negotiate more favorable terms due to the sheer volume of their purchases.

Hexcel's major customers, primarily large aerospace manufacturers like Boeing and Airbus, possess significant resources and technical expertise. These giants could potentially develop their own in-house capabilities for producing advanced composite materials, thereby reducing their reliance on external suppliers like Hexcel. This threat, even if not fully realized, grants these customers considerable bargaining power.

Hexcel's advanced composite materials, often custom-engineered for specific aerospace and industrial applications, tend to be highly differentiated. This specialization means that for many customers, particularly in the demanding aerospace sector, switching to a competitor would involve significant re-qualification and engineering efforts, thereby increasing switching costs and reducing customer bargaining power.

For instance, in 2024, the aerospace industry continued to rely on Hexcel's materials for critical components where performance and reliability are paramount, making direct product substitution difficult. The high degree of technical integration and performance requirements for Hexcel's carbon fiber composites in aircraft structures generally translates to substantial switching costs for buyers, limiting their ability to drive down prices.

Price Sensitivity of Customers

Hexcel's customers, particularly those in the aerospace sector, exhibit relatively low price sensitivity. This is primarily because advanced composite materials represent a small fraction of the total cost of an aircraft, often less than 5%. In 2023, Hexcel reported that approximately 70% of its sales were to the commercial aerospace market, a sector where performance and reliability are paramount, outweighing minor price fluctuations.

The overall economic climate can indirectly affect price sensitivity. During periods of economic downturn, customers might scrutinize costs more closely. However, the long lead times and rigorous qualification processes for aerospace materials mean that switching suppliers due to minor price differences is infrequent, reinforcing Hexcel's pricing power.

- Low Cost as a Percentage of Final Product: Advanced composites are a small component of overall aircraft manufacturing costs.

- High Switching Costs: Extensive qualification and certification processes make it difficult and expensive for customers to switch material suppliers.

- Performance Criticality: The superior performance characteristics of Hexcel's materials in terms of weight reduction and fuel efficiency are highly valued, reducing the focus on price alone.

- Market Concentration: The specialized nature of advanced composites means fewer alternative suppliers exist, further diminishing customer bargaining power.

Availability of Substitute Products for Customers

The availability of substitute products significantly impacts Hexcel's customer bargaining power. If customers can easily switch to alternative structural materials, like advanced plastics or engineered wood, their leverage increases.

In 2024, the aerospace and defense sector, a key market for Hexcel, continues to explore material diversification. For instance, the increasing adoption of advanced composites in commercial aircraft, while a strength for Hexcel, also means that if Hexcel's pricing or supply chain becomes unfavorable, airlines and manufacturers might accelerate their evaluation of alternative composite suppliers or even different material classes, if performance and cost metrics align.

- Substitute Material Availability: Customers in industries like aerospace and defense have a growing number of material options beyond traditional Hexcel products, including advanced polymers and metal alloys.

- Supplier Diversification: The market for advanced structural materials is becoming more competitive, with an increasing number of global suppliers offering similar or alternative solutions.

- Price Sensitivity: When substitute products offer comparable performance at a lower cost, customers are more inclined to switch, thereby increasing their bargaining power.

- Technological Advancements: Innovations in materials science can rapidly introduce viable alternatives, potentially eroding the market position of established suppliers like Hexcel if they do not keep pace.

Hexcel's customers, particularly major aerospace manufacturers like Boeing and Airbus, wield considerable bargaining power due to their significant purchase volumes and the critical nature of Hexcel's advanced composite materials. In 2023, Hexcel's largest customer represented about 17% of net sales, highlighting this concentration. While Hexcel's products are highly differentiated and switching costs are high, the potential for customers to develop in-house capabilities or explore alternative material suppliers, especially if pricing or supply chain issues arise, remains a factor.

| Customer Factor | Impact on Hexcel | 2023/2024 Data Point |

|---|---|---|

| Customer Concentration | High (Major aerospace OEMs) | Largest customer ~17% of net sales |

| Potential for Backward Integration | Moderate threat | Aerospace giants possess technical expertise |

| Switching Costs | Low for customers | High qualification and certification needs for Hexcel |

| Price Sensitivity | Low | Composites <5% of aircraft cost |

Full Version Awaits

Hexcel Porter's Five Forces Analysis

This preview showcases the complete Hexcel Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the advanced materials industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full access to this professionally formatted analysis.

Rivalry Among Competitors

Hexcel Corporation faces a competitive landscape in advanced composites, particularly within the demanding aerospace and defense sectors. Key rivals include companies like Toray Industries, Mitsubishi Chemical, and Hexcel's own strategic partner, Safran. The sheer number and significant technological capabilities of these direct competitors create an intensely competitive environment.

The intensity of rivalry escalates due to the presence of numerous players possessing comparable strengths in material science and manufacturing processes. This means that market share gains are hard-won, and companies must constantly innovate and optimize to maintain their position. For instance, in 2024, the aerospace industry's continued demand for lightweight, high-strength materials fuels this competition, with each player striving to capture a larger portion of contracts for next-generation aircraft programs.

The advanced composites market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 6.5% to 7.5% through the mid-2020s. This expansion is largely driven by increasing demand in aerospace, automotive, and wind energy sectors. While this growth is positive, it also means that companies are actively vying for market share within a dynamic and expanding landscape.

However, even within a growing market, the intensity of competition can be influenced by the pace of that growth. A moderate to strong industry growth rate generally suggests that companies can expand their revenues by capturing new customers or increasing sales to existing ones, potentially tempering direct head-to-head rivalry. For instance, the aerospace sector, a major consumer of advanced composites, has seen sustained demand, allowing established players like Hexcel to benefit from increased production rates by major aircraft manufacturers.

Hexcel's advanced composite materials, particularly in aerospace and defense, offer significant differentiation. These high-performance products are engineered for specific, demanding applications, making direct substitution by competitors difficult. For instance, Hexcel's lightweight, high-strength carbon fiber composites are critical for fuel efficiency in modern aircraft, a feature not easily replicated by standard material suppliers.

The high degree of product specialization and the rigorous qualification processes required for aerospace components create substantial switching costs for Hexcel's customers. Once an aircraft manufacturer integrates Hexcel materials into its design and production, changing suppliers involves costly re-engineering, re-testing, and recertification. This technological lock-in effectively dampens competitive rivalry by making it economically prohibitive for customers to switch to less specialized or unproven alternatives.

Exit Barriers for Competitors

Competitors in the advanced composites market face significant hurdles to exiting, primarily due to the highly specialized nature of their assets. Manufacturing facilities and equipment for producing advanced composite materials are often custom-built and lack alternative uses, making them difficult to sell or repurpose. This high asset specificity traps capital, discouraging companies from simply shutting down operations.

Furthermore, many players have deeply invested in research and development, building proprietary technologies and intellectual property. These intangible assets represent substantial sunk costs and are intrinsically tied to the company's identity and expertise, fostering an emotional attachment that complicates divestment decisions. For instance, a company that has spent decades perfecting a unique carbon fiber manufacturing process might be reluctant to abandon that legacy, even if market conditions are challenging.

- High Asset Specificity: Specialized machinery and facilities for composite production are costly and have limited resale value in other industries.

- Significant R&D Investments: Accumulated knowledge and patented technologies create substantial sunk costs, making exit financially difficult.

- Brand Reputation and Customer Relationships: Established trust and long-term contracts with key aerospace or automotive clients can be hard to sever.

- Skilled Workforce Dependency: The need for specialized engineering and manufacturing talent means that retaining employees is crucial, further complicating closure plans.

Fixed Costs and Capacity Utilization

Hexcel operates in an industry characterized by substantial fixed costs, particularly in the manufacturing of advanced composite materials. These high upfront investments in specialized equipment and facilities create a significant barrier to entry and also influence competitive dynamics among existing players.

When demand falters, companies with high fixed costs, like those in advanced composites, face immense pressure to maintain high capacity utilization rates. This is because the cost per unit decreases significantly as output increases, making underutilization financially detrimental. Consequently, this often leads to aggressive pricing strategies and intensified rivalry as firms fight to secure sales and cover their substantial overheads.

- High Fixed Costs: The advanced composites sector demands significant capital for R&D, specialized manufacturing plants, and advanced machinery, often running into hundreds of millions of dollars.

- Capacity Utilization Pressure: Companies must strive for near-full capacity to achieve cost efficiencies, making them vulnerable to price competition during periods of lower demand.

- Rivalry Intensification: The drive to cover fixed costs can fuel price wars, especially when major customers, such as aerospace manufacturers, experience production slowdowns.

- Strategic Implications: Hexcel's ability to manage its fixed costs and maintain high utilization rates is crucial for its profitability and competitive positioning against rivals like Toray Industries and Mitsubishi Chemical.

Competitive rivalry within the advanced composites market, particularly for Hexcel, is intense due to the presence of numerous technologically capable players like Toray Industries and Mitsubishi Chemical. This rivalry is further amplified by the industry's growth, as companies vie for market share in a dynamic landscape. For instance, the aerospace sector's demand for lightweight materials in 2024 fuels this competition, with each player striving to secure contracts for new aircraft programs.

The high degree of product specialization and rigorous qualification processes for aerospace components create substantial switching costs for Hexcel's customers, dampening direct rivalry. Once integrated, changing suppliers involves costly re-engineering and re-testing, making it economically prohibitive to switch to less specialized alternatives. This technological lock-in is a key factor in moderating competitive pressures.

Hexcel's competitive rivalry is shaped by the significant barriers to exit for its competitors. Highly specialized manufacturing assets lack alternative uses, trapping capital and discouraging companies from exiting the market. Furthermore, substantial investments in R&D and proprietary technologies represent sunk costs, creating an emotional and financial attachment that complicates divestment decisions.

The advanced composites industry is characterized by high fixed costs, which pressure companies to maintain high capacity utilization. This often leads to aggressive pricing strategies and intensified rivalry as firms fight to cover their substantial overheads and achieve cost efficiencies. For example, during periods of lower demand in the aerospace sector, this pressure can fuel price wars among key players.

| Key Competitors | Primary Markets | 2024 Market Share Estimate (Illustrative) | Key Differentiators |

|---|---|---|---|

| Toray Industries | Aerospace, Automotive, Industrial | 15-20% | Broad material portfolio, strong R&D |

| Mitsubishi Chemical | Aerospace, Automotive, Industrial | 10-15% | Integrated supply chain, advanced polymer science |

| Hexcel Corporation | Aerospace, Defense, Industrial | 12-18% | Specialization in high-performance composites, customer partnerships |

| Solvay | Aerospace, Automotive, Energy | 8-12% | Advanced materials for demanding applications, sustainability focus |

SSubstitutes Threaten

The threat of substitutes for Hexcel's advanced composite materials is significant, particularly from traditional metals like aluminum and titanium, which remain prevalent in aerospace and industrial applications. For instance, in 2024, the global aerospace market continued to rely heavily on aluminum alloys for fuselage and wing structures, representing a substantial portion of aircraft material usage. While composites offer weight savings and performance advantages, the established infrastructure, lower initial cost, and proven track record of metals present a persistent challenge.

Customers frequently weigh the cost-effectiveness and performance of alternative materials against Hexcel's advanced composites. For instance, while aluminum alloys offer lower upfront costs, their weight-to-strength ratio is significantly inferior to carbon fiber composites, leading to higher fuel consumption in aerospace applications. This performance gap often justifies the premium price of Hexcel's offerings.

The compelling balance of price, weight, strength, and durability offered by substitutes is a key driver for customer switching decisions. In 2024, the automotive industry's increasing demand for lightweight materials to meet emissions standards has spurred innovation in steel and aluminum alloys, making them more competitive on a cost-per-unit-weight basis. However, for high-performance applications where extreme strength and minimal weight are paramount, Hexcel's composites remain the preferred choice.

Hexcel's customers, particularly in the aerospace sector, exhibit a low propensity to substitute due to stringent regulatory approvals and the extensive re-engineering required for material changes. These high switching costs, coupled with the critical performance demands of aircraft components, make alternative materials a significant undertaking. For instance, the Federal Aviation Administration (FAA) certification process for new aircraft materials can take years and involve substantial investment, effectively locking in existing material suppliers like Hexcel.

Technological Advancements in Substitute Materials

Technological advancements are continuously enhancing the performance and cost-effectiveness of substitute materials, posing a significant threat. Ongoing research into traditional materials like advanced alloys and high-performance polymers is making them more competitive against specialized materials. For instance, breakthroughs in aluminum alloys are improving their strength-to-weight ratios, making them a more viable alternative in sectors traditionally dominated by composites.

Innovations in material science are also creating entirely new substitutes. Developments in nanotechnologies and advanced ceramics are yielding materials with unique properties that can directly compete with existing offerings. The global advanced materials market was valued at approximately $120 billion in 2023 and is projected to grow, indicating a rising competitive landscape for established material providers.

- Enhanced Metal Alloys: Innovations in aerospace-grade aluminum and titanium alloys offer improved performance at lower costs compared to carbon fiber composites.

- Advanced Polymer Development: New high-strength, temperature-resistant polymers are emerging as substitutes in automotive and construction applications.

- Ceramic and Nanomaterial Progress: These materials are finding new uses in electronics and high-wear applications, potentially displacing traditional materials.

- Cost Reduction in Substitutes: Manufacturing process improvements are lowering the price point of advanced traditional materials, increasing their appeal.

Switching Costs for Customers to Adopt Substitutes

Customers considering substitutes for Hexcel's advanced composite materials would face significant switching costs. These can include the substantial expense and time required for redesigning aircraft components to accommodate different material properties, potentially impacting structural integrity and aerodynamic performance. For instance, a shift from carbon fiber composites to traditional aluminum alloys might necessitate entirely new design iterations and extensive stress testing. The 2024 aerospace market, valued at over $900 billion, relies heavily on proven material performance, making such transitions particularly arduous.

Retooling manufacturing processes represents another major hurdle. Adopting alternative materials often demands specialized equipment, new fabrication techniques, and significant workforce retraining. This complexity can add millions to the cost of switching, especially for large-scale production lines accustomed to Hexcel's materials. Furthermore, the rigorous requalification process for any new material in aerospace applications, involving extensive safety and performance certifications, can take years and incur millions in testing expenses, effectively acting as a strong deterrent to substitution.

- Redesign Costs: Aircraft component redesigns can cost millions of dollars, impacting timelines and budgets.

- Manufacturing Retooling: Investment in new machinery and specialized training for alternative materials adds significant capital expenditure.

- Material Requalification: The lengthy and expensive certification process for new aerospace materials can take 2-5 years and cost upwards of $10 million per material.

- Supply Chain Integration: Establishing new supply chains and ensuring compatibility with existing manufacturing workflows presents complex logistical challenges.

The threat of substitutes for Hexcel's advanced composite materials is moderate, primarily stemming from traditional metals like aluminum and titanium, which remain dominant in many aerospace and industrial sectors. While composites offer superior weight-to-strength ratios, the established infrastructure, lower initial costs, and proven reliability of metals present a persistent competitive pressure. In 2024, the global aerospace industry, a key market for Hexcel, continued to rely heavily on aluminum alloys for a significant portion of its structural components.

Customers often balance the performance advantages of composites against the cost-effectiveness of substitutes. For instance, while aluminum alloys are cheaper upfront, their greater weight leads to higher fuel consumption in aircraft, often justifying the premium for Hexcel's lighter materials. The automotive sector in 2024 also saw increased innovation in steel and aluminum alloys to meet emissions standards, making them more competitive on a cost-per-unit-weight basis.

The propensity for customers to switch to substitutes is generally low in high-performance sectors like aerospace due to significant switching costs, including extensive re-engineering and rigorous regulatory approvals. The Federal Aviation Administration (FAA) certification process for new aircraft materials, for example, can take several years and involve substantial investment, effectively locking in established material suppliers like Hexcel.

| Substitute Material | Key Advantages | Hexcel's Composite Advantage | 2024 Market Context |

| Aluminum Alloys | Lower initial cost, established infrastructure | Significantly lighter, higher strength-to-weight ratio | Dominant in aerospace fuselage/wing structures; improved alloys gaining traction |

| Titanium Alloys | High strength, corrosion resistance | Even lighter, better fatigue resistance in some applications | Used in critical aerospace components, but expensive |

| Advanced Steel Alloys | High strength, lower cost than titanium | Lighter, better stiffness | Increasing use in automotive for lightweighting |

Entrants Threaten

Establishing production for advanced composite materials, like those Hexcel specializes in, demands immense capital. Think billions of dollars for state-of-the-art manufacturing plants, specialized machinery, and extensive research and development. This financial hurdle alone is a significant deterrent for any potential new player looking to enter the market.

The advanced composites industry, where Hexcel operates, is heavily reliant on specialized knowledge, patents, and intricate manufacturing processes. New entrants face a significant hurdle in replicating or acquiring the deep technical expertise and established intellectual property that Hexcel possesses. This proprietary technology acts as a formidable barrier, requiring substantial investment in research and development to even approach Hexcel's capabilities.

Established players like Hexcel benefit significantly from economies of scale in their advanced materials production. This means their cost per unit decreases as their output increases, a hurdle for newcomers. For instance, in 2023, Hexcel's substantial investments in manufacturing capacity allowed them to spread fixed costs over a larger volume, giving them a competitive edge over smaller, less established firms.

The experience curve also plays a crucial role; as Hexcel has produced composite materials for decades, they've refined their processes, reducing waste and improving efficiency. This accumulated knowledge translates into lower production costs that new entrants would struggle to match initially, making it difficult to compete on price without reaching a similar level of operational maturity.

Access to Distribution Channels and Customer Relationships

New entrants face considerable difficulty in establishing robust relationships with key aerospace and defense customers. These relationships are built on years of proven performance, reliability, and deep integration into existing supply chains. For instance, securing a contract with a major aircraft manufacturer often involves extensive and lengthy qualification processes that can take several years to complete, making it a significant barrier for newcomers.

The established trust and long qualification cycles are critical deterrents. Companies like Boeing and Airbus have deeply entrenched relationships with their current suppliers, often involving proprietary technologies and rigorous testing protocols. A new entrant would need to demonstrate not only competitive pricing but also an equivalent or superior level of quality and reliability, a feat that requires substantial investment and time to achieve.

Furthermore, existing supply chain integration presents a formidable obstacle. Suppliers are often deeply embedded in the manufacturing processes of established players, with shared systems and just-in-time delivery schedules. Breaking into this tightly knit network requires not just product innovation but also the ability to seamlessly integrate into these complex logistical frameworks, a challenge that significantly raises the threat of new entrants.

- Customer Loyalty and Switching Costs: Major aerospace and defense firms exhibit high customer loyalty due to the critical nature of their products and the significant costs associated with switching suppliers, which can include recertification and re-tooling.

- Long Qualification Periods: The qualification process for new aerospace materials and components can span 3-5 years, demanding substantial upfront investment from potential entrants with no guarantee of eventual adoption.

- Existing Supplier Integration: Established suppliers are often integrated into the proprietary manufacturing processes and IT systems of major OEMs, creating a high barrier to entry for newcomers seeking to offer alternative solutions.

- Brand Reputation and Trust: Decades of reliable service and proven performance build significant brand equity and trust, which new entrants must painstakingly replicate to gain traction in this risk-averse industry.

Government Policy and Regulations

Government policy and regulations significantly influence the threat of new entrants. For instance, in the aerospace sector where Hexcel operates, stringent Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) certifications are mandatory for materials used in aircraft. These certifications involve rigorous testing and documentation, adding substantial time and cost to market entry.

Compliance with evolving environmental standards, such as those related to emissions or material recyclability, can also pose a barrier. Companies looking to enter the advanced composites market must invest in processes and technologies that meet these requirements. For example, the increasing focus on sustainable aviation fuels and materials means new entrants need to demonstrate compliance with emerging environmental regulations, which can be a costly undertaking.

- Certification Hurdles: Obtaining necessary certifications from bodies like the FAA and EASA can take years and millions of dollars, deterring smaller or less capitalized new entrants.

- Environmental Compliance Costs: Adhering to stricter environmental regulations, such as those concerning material lifecycle management and emissions, increases the capital expenditure and operational costs for new companies.

- Trade Policies and Tariffs: Government trade policies and tariffs can impact the cost of imported raw materials or finished goods, creating an uneven playing field for new entrants who may rely on international supply chains.

The threat of new entrants in the advanced composites market, where Hexcel operates, is generally low. This is primarily due to the substantial barriers to entry, including high capital requirements for specialized manufacturing facilities and extensive research and development. For instance, building a state-of-the-art composite production plant can easily cost billions of dollars, a significant deterrent for most potential newcomers.

Furthermore, the industry demands deep technical expertise, proprietary technologies, and established intellectual property, which are difficult and expensive for new players to acquire or replicate. Hexcel's decades of experience have allowed them to refine processes and build a strong reputation, creating an experience curve advantage that new entrants would struggle to overcome quickly.

Customer loyalty and the lengthy qualification processes within the aerospace and defense sectors also present formidable challenges. Major clients often have deeply integrated relationships with existing suppliers, and switching involves significant costs and time for recertification and re-tooling. For example, the qualification period for new aerospace materials can span three to five years, demanding substantial upfront investment with no guarantee of success.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact (as of 2024) |

|---|---|---|---|

| Capital Requirements | High cost of specialized plant and equipment, R&D investment. | Significant financial hurdle. | Estimated $1B+ for a new, advanced composite manufacturing facility. |

| Technical Expertise & IP | Need for specialized knowledge, patents, and complex manufacturing processes. | Difficult to replicate Hexcel's capabilities. | Hexcel holds hundreds of patents related to composite materials and processes. |

| Economies of Scale | Lower per-unit costs with higher production volumes. | New entrants struggle to compete on price. | Hexcel's large-scale production in 2023 contributed to cost efficiencies. |

| Customer Relationships & Qualification | Long-standing trust, proven performance, and lengthy approval cycles. | Time-consuming and costly to gain market access. | Aerospace material qualification can take 3-5 years. |

| Government Regulations & Certifications | Stringent safety and environmental standards (e.g., FAA, EASA). | Adds significant time, cost, and complexity to market entry. | Certification processes can cost millions of dollars. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hexcel is built upon a robust foundation of publicly available data, including Hexcel's annual reports and SEC filings, alongside industry-specific market research reports and competitor financial statements.