Hexcel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexcel Bundle

Explore the core components of Hexcel's innovative business model. This comprehensive Business Model Canvas breaks down their customer relationships, key resources, and revenue streams, offering a clear view into their strategic approach. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Hexcel's strategic alliances with major aerospace original equipment manufacturers (OEMs) like Airbus and Boeing are foundational to its business model. These are not just customer relationships; they are deeply integrated partnerships that often span decades and involve co-development and long-term supply agreements for critical composite materials.

These vital partnerships ensure a consistent and substantial revenue stream for Hexcel. For instance, in 2024, approximately 40% of Hexcel's total sales were generated from Airbus and its extensive network of subcontractors. This highlights the immense reliance Hexcel has on this single, albeit massive, customer relationship.

Furthermore, Boeing and its associated subcontractors represented another significant portion of Hexcel's business in 2024, accounting for 15% of its sales. The stability provided by these long-term contracts with industry giants like Airbus and Boeing is a key factor in Hexcel's predictable demand and operational planning.

Hexcel actively partners with industry leaders, universities, and government agencies to pioneer next-generation material technologies. A prime example is their ongoing collaboration with Arkema, focusing on thermoplastic composite solutions for the aerospace sector, targeting reduced environmental impact and more economical assembly of critical structural components.

Hexcel’s business model hinges on strong relationships with its supply chain partners for critical raw materials. The company procures essential components like resins and carbon fiber precursors from a select group of key suppliers, with some materials being sourced exclusively from a single provider. This reliance underscores the importance of robust supply chain management.

Effective management of these partnerships, often facilitated by advanced planning solutions, is vital for Hexcel to maintain consistent production schedules and fulfill its commitments to customers. In 2023, Hexcel reported that approximately 75% of its raw material purchases were from suppliers located in the United States, with the remainder sourced from Europe and Japan, highlighting a geographically diversified but concentrated supplier base.

Recycling and Sustainability Collaborations

Hexcel actively collaborates with industry leaders like Fairmat to create a circular economy for its advanced composite materials. This partnership focuses on recycling carbon fiber prepreg waste generated from Hexcel's European manufacturing sites.

This strategic alliance is designed to significantly reduce landfill waste and incineration, thereby enhancing Hexcel's environmental footprint. The recycled materials are then transformed into new composite products, finding applications in various commercial sectors.

- Closed-Loop System: Partnership with Fairmat establishes a closed-loop recycling process for carbon fiber prepreg.

- Waste Diversion: Over 280 tons of prepreg material were repurposed in 2024, diverting waste from landfills and incineration.

- Sustainable Products: Recycled composites are developed for commercial markets, promoting resource efficiency.

Joint Ventures and Technology Coalitions

Hexcel actively engages in joint ventures and technology coalitions to drive innovation and market expansion. For instance, a notable coalition in Utah is dedicated to advancing all-electric air vehicles, a key area for future air mobility. This collaborative approach allows Hexcel to share development costs and accelerate the adoption of new composite technologies.

These partnerships are crucial for Hexcel's strategy, enabling access to new markets and specialized expertise. While Hexcel previously held a 50% stake in Aerospace Composites Malaysia Sdn. Bhd. with Boeing Worldwide Operations Limited, the company consistently seeks out alliances to bolster its international presence and technological prowess. These collaborations are vital for staying at the forefront of advanced materials development.

- Strategic Alliances: Hexcel leverages joint ventures and coalitions to accelerate market advancements and technological development.

- All-Electric Air Vehicles: A specific example is a coalition in Utah focused on developing all-electric air vehicles for advanced air mobility.

- Global Footprint Expansion: The company explores strategic alliances to broaden its international reach and enhance its technological capabilities.

- Past Joint Venture: Hexcel previously had a 50% ownership in Aerospace Composites Malaysia Sdn. Bhd. with Boeing Worldwide Operations Limited.

Hexcel's key partnerships are central to its business, primarily with major aerospace OEMs like Airbus and Boeing. These relationships, often spanning decades, involve co-development and long-term supply agreements for advanced composite materials, ensuring a stable revenue base.

In 2024, Airbus and its network accounted for approximately 40% of Hexcel's sales, while Boeing and its subcontractors represented another 15%. This deep integration highlights the critical nature of these customer partnerships for Hexcel's operational planning and predictable demand.

Beyond direct customers, Hexcel collaborates with industry leaders, universities, and government agencies to drive material innovation. Partnerships with companies like Arkema focus on developing next-generation thermoplastic composites, aiming for reduced environmental impact and more efficient assembly processes.

Hexcel also fosters strategic alliances for sustainability, such as its collaboration with Fairmat to recycle carbon fiber prepreg waste. In 2024, this initiative repurposed over 280 tons of material, diverting it from landfills and creating new composite products for commercial markets.

| Key Partnership Type | Primary Partners | 2024 Sales Contribution (Approx.) | Strategic Focus |

| Aerospace OEMs | Airbus, Boeing | Airbus: 40% Boeing: 15% |

Long-term supply, co-development of critical composites |

| Technology & Innovation | Arkema, Universities, Government Agencies | N/A | Next-gen materials, thermoplastic composites, sustainability |

| Sustainability & Circularity | Fairmat | N/A | Recycling of prepreg waste, waste diversion |

What is included in the product

A detailed breakdown of Hexcel's business model, covering its advanced composite materials for aerospace and industrial markets, emphasizing its value proposition and customer relationships.

This model outlines Hexcel's key resources, activities, and cost structure, providing insights into its operational efficiency and strategic partnerships.

It streamlines complex strategic planning, offering a clear, visual representation of Hexcel's value proposition and customer segments.

Activities

Hexcel's primary activity is the continuous research and development of advanced composite materials. This involves significant investment in technology to create lighter, stronger, and more efficient solutions. For instance, Hexcel actively develops new carbon fibers, such as their HexTow® IM9 24K, and advanced prepregs, like the rapid-curing HexPly® M51.

These R&T efforts are directly tied to meeting the evolving demands of high-performance industries, particularly aerospace and defense. By pushing the boundaries of material science, Hexcel ensures its products provide a competitive advantage for customers seeking weight reduction and enhanced structural integrity. This focus on innovation is a cornerstone of their strategy to maintain market leadership.

Hexcel's manufacturing and production of composite materials is a core activity, leveraging a global network of advanced facilities. They produce a wide array of structural materials, including critical components like carbon fibers, prepregs, honeycomb structures, and specialized adhesives. This extensive product portfolio serves demanding industries requiring high-performance lightweight materials.

The company places a strong emphasis on operational excellence and efficiency to support escalating production demands, especially from the commercial aerospace industry. For instance, in 2023, Hexcel reported a significant increase in its commercial aerospace segment revenue, reflecting this growing demand and their ability to scale production. This focus means they are constantly working to optimize their existing manufacturing assets and processes to boost output capacity.

Hexcel actively markets its advanced composite solutions to key industries, emphasizing lightweighting and performance benefits. They showcase these capabilities at major global events like JEC World and the Paris Air Show, directly engaging with potential clients.

The sales force focuses on securing new contracts and nurturing relationships with major players in commercial aerospace, space and defense, and industrial sectors. This direct engagement is crucial for driving growth and reinforcing Hexcel's market position.

In 2024, Hexcel's commitment to showcasing its advanced materials at industry-leading events like the Paris Air Show directly supports its sales pipeline. The company reported a net sales increase of 10% to $2.4 billion for the fiscal year 2023, demonstrating the effectiveness of these marketing and sales efforts.

Supply Chain Management and Optimization

Hexcel's key activities heavily involve sophisticated supply chain management and optimization to navigate its complex global operations and dependence on specialized raw materials. The company actively employs advanced planning and real-time tracking systems to ensure its production schedules precisely match customer demand, thereby boosting delivery dependability.

Leveraging digital transformation, Hexcel utilizes platforms like DELMIA solutions. This integration allows for better alignment across its worldwide manufacturing sites, directly impacting its ability to meet customer needs efficiently. For instance, in 2023, Hexcel reported that its supply chain initiatives contributed to improved on-time delivery rates, a critical factor in the aerospace and defense sectors it serves.

These efforts are crucial for ensuring the consistent and timely provision of high-performance composite materials. The company's focus on supply chain resilience was particularly evident following disruptions in 2020-2022, prompting further investment in digital tools and strategic supplier partnerships to mitigate future risks.

- Advanced Supply Chain Planning: Implementing robust forecasting and inventory management to anticipate and meet fluctuating customer orders for specialized composite materials.

- Digital Transformation Integration: Utilizing digital tools, such as DELMIA, to enhance visibility and control across global production and logistics networks.

- Customer Demand Alignment: Ensuring manufacturing output is closely synchronized with specific customer requirements and delivery schedules, particularly for the demanding aerospace industry.

- Delivery Reliability Enhancement: Focusing on operational efficiency and risk mitigation within the supply chain to guarantee timely and consistent product delivery, a critical performance indicator.

Sustainability Initiatives and Recycling Programs

Hexcel actively pursues sustainability by focusing on reducing its environmental footprint. This includes significant efforts to lower greenhouse gas emissions and minimize waste sent to landfills, demonstrating a commitment to operational efficiency and environmental stewardship.

A core activity involves developing innovative solutions for recycling and upcycling production materials. For instance, Hexcel's partnership with Fairmat is designed to transform carbon fiber prepreg waste into valuable new materials, contributing to a circular economy.

These initiatives are crucial for meeting both overarching global sustainability targets and the increasing expectations of customers for environmentally responsible products and processes.

- Environmental Impact Reduction: Hexcel is dedicated to lowering its greenhouse gas emissions and waste generation.

- Recycling and Upcycling: Developing methods to repurpose production materials, like carbon fiber prepreg waste, is a key focus.

- Circular Economy Contribution: Collaborations, such as the one with Fairmat, aim to create value from waste streams.

- Meeting Stakeholder Expectations: These efforts align with global sustainability goals and customer demand for eco-friendly practices.

Hexcel's core activities revolve around pioneering research and development in advanced composite materials, ensuring product innovation to meet stringent industry demands. Their manufacturing prowess lies in producing a diverse range of high-performance composites, from carbon fibers to adhesives, with a strong focus on operational efficiency to scale production. Furthermore, Hexcel actively engages in direct sales and marketing, highlighting the lightweight and performance advantages of their materials at key industry events and through building strong customer relationships.

Supply chain management is critical, involving sophisticated planning and digital integration to ensure timely delivery of specialized materials globally. Finally, Hexcel is committed to sustainability, actively pursuing waste reduction and developing innovative recycling solutions, such as their partnership with Fairmat, to contribute to a circular economy.

| Key Activity | Description | 2023/2024 Data/Examples |

|---|---|---|

| Research & Development | Developing next-generation composite materials. | Investment in new carbon fibers and rapid-curing prepregs. |

| Manufacturing & Production | Global production of advanced composite materials. | Increased commercial aerospace segment revenue in 2023. |

| Sales & Marketing | Promoting composite solutions and securing contracts. | Participation in Paris Air Show; 10% net sales increase in 2023 ($2.4 billion). |

| Supply Chain Management | Optimizing global logistics and material flow. | Use of DELMIA solutions; improved on-time delivery rates in 2023. |

| Sustainability Initiatives | Reducing environmental impact and promoting circularity. | Partnership with Fairmat for waste repurposing. |

Preview Before You Purchase

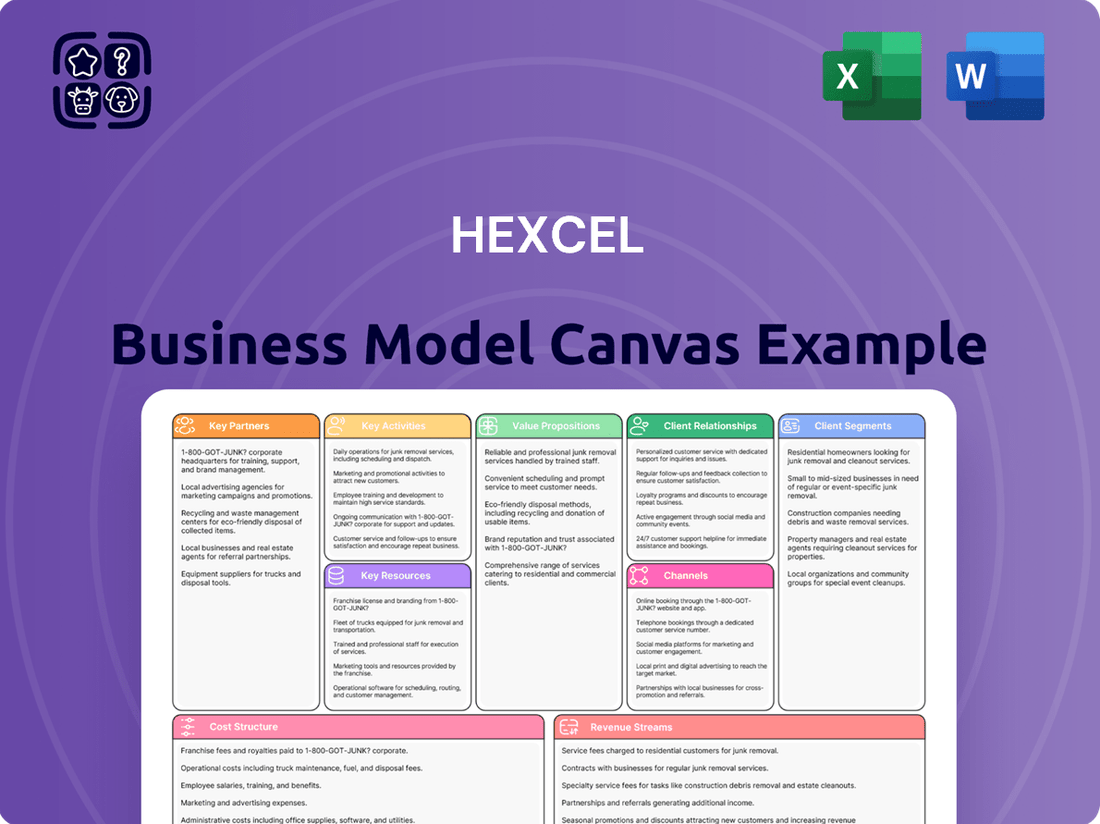

Business Model Canvas

The Hexcel Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. You can be confident that the professional, ready-to-use Business Model Canvas you see here is precisely what you'll gain access to, allowing you to immediately begin strategic planning.

Resources

Hexcel's proprietary technology and intellectual property are cornerstones of its business model, encompassing unique material formulations and advanced processing techniques. This IP portfolio includes well-known brands like HexTow® carbon fiber, HexPly® prepregs, HexWeb® honeycomb, and HexBond™ adhesives, all of which are protected by patents, providing a significant competitive edge.

These patented innovations allow Hexcel to manufacture highly specialized, high-performance composite materials essential for demanding industries such as aerospace and defense. For instance, Hexcel's advanced composite materials are crucial for lightweighting aircraft, contributing to fuel efficiency; in 2023, the aerospace sector represented a significant portion of Hexcel's revenue, underscoring the market's reliance on its technological capabilities.

Hexcel actively safeguards and enhances this intellectual property through continuous investment in research and development (R&T). This commitment ensures the ongoing creation of next-generation composite solutions, maintaining Hexcel's leadership position and ability to meet evolving customer needs for lighter, stronger, and more durable materials.

Hexcel's global manufacturing and research facilities are a cornerstone of its business model, featuring a robust network spanning the United States, Europe, and Asia. These strategically located sites house advanced machinery essential for producing high-performance materials like carbon fibers and prepregs.

In 2024, Hexcel continued to leverage this infrastructure, with operations in over 20 countries. This extensive footprint allows for efficient, localized production and a significant advantage in providing timely technical support to its diverse customer base across aerospace, defense, and industrial sectors.

Hexcel's human capital, including its highly skilled engineers, scientists, and manufacturing professionals, forms the bedrock of its innovation and operational excellence. Their deep understanding of material science and advanced composite manufacturing processes is critical for developing next-generation solutions and upholding stringent quality standards.

This specialized talent pool is indispensable for Hexcel's current production capabilities and its pursuit of future technological breakthroughs in advanced materials.

Strategic Raw Material Supply Chain

Hexcel's strategic raw material supply chain is built on securing reliable access to high-quality inputs, like specialized resins and carbon fiber precursors. This is a cornerstone of their operations, ensuring consistent product quality and availability.

The company cultivates relationships with key, often specialized, suppliers predominantly located in the United States, Europe, and Japan. This geographical diversification helps mitigate risks and ensures access to critical materials.

- Supplier Relationships: Hexcel maintains close ties with its specialized raw material providers, often securing long-term agreements.

- Geographic Concentration: Key suppliers are primarily based in the US, Europe, and Japan, reflecting a focus on advanced material production hubs.

- Supply Chain Resilience: Ensuring the stability and resilience of this supply chain is paramount to Hexcel's ability to meet production targets and customer demand, especially in the aerospace sector where lead times are critical.

- 2024 Outlook: While specific 2024 supplier data is proprietary, Hexcel's reported investments in capacity expansion for carbon fiber and related materials underscore the ongoing importance of a robust raw material pipeline.

Financial Capital and Robust Balance Sheet

Hexcel's robust financial capital is a cornerstone of its business model, fueling significant investments in research and development. This financial strength allows the company to pursue innovation and stay ahead in advanced materials.

A strong balance sheet provides Hexcel the flexibility to navigate economic downturns and pursue strategic growth opportunities. This financial resilience is crucial for long-term sustainability and market leadership.

Hexcel concluded 2024 with a solid financial performance, demonstrating its capacity to generate substantial cash flow. The company anticipates this trend to continue into 2025, supporting ongoing operational needs and expansion plans.

- Financial Strength: Hexcel's healthy financial position enables consistent investment in R&D and capacity expansion.

- Economic Resilience: The company's robust balance sheet allows it to effectively manage economic fluctuations.

- Strategic Investment: Financial capital supports Hexcel's pursuit of strategic growth initiatives and market opportunities.

- Cash Flow Generation: Hexcel finished 2024 with strong cash flow and projects continued generation in 2025.

Hexcel's Key Resources are its proprietary technology and intellectual property, a global network of advanced manufacturing and research facilities, a highly skilled workforce, a resilient raw material supply chain, and substantial financial capital. These elements collectively enable Hexcel to develop, produce, and deliver high-performance composite materials critical for demanding industries.

The company's intellectual property, including brands like HexTow® and HexPly®, provides a distinct competitive advantage, allowing Hexcel to maintain leadership in specialized material solutions. By continuously investing in R&D, Hexcel ensures its IP portfolio remains cutting-edge, meeting evolving market needs for lightweight and durable materials.

Hexcel's global operations, spanning over 20 countries in 2024, facilitate efficient production and localized customer support, reinforcing its market position. This extensive footprint, combined with a specialized talent pool of engineers and scientists, underpins Hexcel's innovation and operational excellence.

The company's financial strength, evidenced by its solid performance and cash flow generation at the close of 2024, allows for sustained investment in R&D and capacity expansions, ensuring long-term growth and market leadership.

| Key Resource | Description | Strategic Importance | 2024 Relevance |

|---|---|---|---|

| Proprietary Technology & IP | Patented material formulations and processes (e.g., HexTow®, HexPly®) | Competitive differentiation, market leadership | Continued demand from aerospace for lightweighting solutions. |

| Global Manufacturing & R&D Facilities | Advanced production sites in over 20 countries | Efficient production, localized support, scale | Supported global supply chains and customer needs across sectors. |

| Human Capital | Skilled engineers, scientists, manufacturing professionals | Innovation, quality control, technical expertise | Drove development of next-generation composite materials. |

| Raw Material Supply Chain | Reliable access to specialized resins and precursors | Product quality, production consistency, resilience | Investments in capacity expansion highlighted pipeline importance. |

| Financial Capital | Strong balance sheet, robust cash flow generation | R&D investment, capacity expansion, economic resilience | Enabled strategic growth and operational continuity through 2024. |

Value Propositions

Hexcel's core value is delivering advanced composite materials that significantly reduce weight while boosting performance and durability. This allows clients to create products that are not only lighter but also stronger and more resilient.

These material advantages translate directly into tangible benefits for customers. For instance, in the aerospace sector, lightweighting achieved through Hexcel's composites leads to substantial improvements in fuel efficiency and operational range. A prime example is the impact on composite-rich aircraft like the Airbus A350 and Boeing 787, where these materials contribute to an impressive 25% reduction in fuel consumption.

Hexcel's advanced composite materials, like carbon fibers and prepregs, offer an unparalleled strength-to-weight ratio and remarkable durability. This translates into lighter, tougher, and more corrosion-resistant components, extending product lifespans significantly.

In 2024, the aerospace industry, a key market for Hexcel, continued to prioritize lightweighting for fuel efficiency. For instance, the Boeing 787 Dreamliner, which extensively uses advanced composites, aims for a 20% improvement in fuel efficiency compared to previous models.

This superior strength is crucial in demanding sectors like aerospace and defense, where structural integrity is non-negotiable. Hexcel's materials enable the design of complex, resilient structures that can withstand extreme conditions, ensuring safety and performance.

Hexcel's dedication to cutting-edge innovation is a cornerstone of its value proposition. The company consistently channels significant resources into research and development, ensuring it remains a leader in advanced composite materials. This forward-thinking approach translates into tangible benefits for its customers, offering solutions that push the boundaries of what's possible in aerospace and defense.

This commitment to innovation is clearly demonstrated by Hexcel's development of next-generation products like rapid-curing prepregs and advanced carbon fibers. These materials are specifically engineered to meet the demanding requirements of future aircraft designs, providing enhanced performance and efficiency. For instance, Hexcel's investment in R&D for advanced carbon fibers directly supports the trend towards lighter, stronger aircraft structures.

Customized Solutions for Diverse Applications

Hexcel's value proposition centers on delivering highly customized composite solutions designed to meet the exacting demands of a wide array of applications. Their extensive product portfolio is not a one-size-fits-all offering; instead, it's meticulously engineered to be adapted for specific customer needs across diverse industries, from aerospace to industrial sectors.

This adaptability is crucial. For instance, in the aerospace sector, Hexcel provides materials optimized for the unique requirements of commercial aircraft, military helicopters, and even specialized components. This means tailoring solutions for varying part sizes, intricate designs, and the potential for automated manufacturing processes. In 2023, Hexcel reported that over 80% of its revenue came from aerospace and defense, highlighting the critical role of these tailored solutions.

- Tailored Material Properties: Hexcel engineers composites with specific strength, weight, and thermal characteristics to match application performance requirements.

- Process Optimization: Solutions are developed with consideration for manufacturing efficiency, including compatibility with various curing cycles and automation levels.

- Application-Specific Development: Collaboration with customers ensures materials are precisely suited for their intended use, whether it's a large aircraft structure or a small, high-stress industrial part.

- Broad Industry Reach: The ability to customize extends Hexcel's reach across commercial aviation, defense, space, and industrial markets, demonstrating versatility.

Commitment to Quality and Supply Chain Reliability

Hexcel's unwavering dedication to quality is paramount, ensuring world-class performance across its product lines. This focus translates directly into supply chain reliability, a critical factor for its clientele.

For instance, in 2024, Hexcel continued to prioritize stringent quality control measures, a cornerstone of its operations. This commitment is vital for aerospace and defense sectors, where even minor deviations can have substantial consequences.

The company’s operational excellence and precision in managing its supply chain instill deep confidence in customers regarding both product integrity and dependable delivery schedules. This reliability is not just a promise but a necessity for the high-stakes programs Hexcel supports.

- World-Class Quality: Hexcel maintains rigorous standards to ensure superior product performance.

- On-Time Delivery: The company is committed to dependable and punctual delivery to meet customer needs.

- Supply Chain Precision: Operational excellence underpins a reliable and efficient supply chain.

- Customer Confidence: This dual focus on quality and reliability builds trust, especially in critical industries.

Hexcel's value proposition is built on providing advanced composite materials that deliver exceptional strength-to-weight ratios and durability. These materials enable customers to create lighter, stronger, and more resilient products, leading to significant performance improvements and extended product lifespans.

In 2024, the aerospace industry, a primary market for Hexcel, continued to emphasize lightweighting for enhanced fuel efficiency. For example, aircraft like the Boeing 787 Dreamliner, which extensively uses advanced composites, aim for substantial fuel savings compared to older models.

Hexcel's commitment to innovation ensures it offers cutting-edge solutions, such as rapid-curing prepregs and advanced carbon fibers, designed for future demanding applications. This focus on R&D directly supports the development of next-generation aircraft structures.

The company also offers highly customized composite solutions, meticulously engineered to meet specific customer needs across various industries, including aerospace, defense, and industrial sectors. This adaptability is crucial for optimizing performance in diverse applications.

Customer Relationships

Hexcel cultivates deep customer connections via dedicated account managers and robust technical assistance. This focus on partnership is evident in their collaborative efforts with major original equipment manufacturers (OEMs) and their supply chains, ensuring Hexcel's solutions align with dynamic industry requirements.

The company's global network of technical centers plays a crucial role in this relationship, driving innovation, product advancement, and responsive customer service. This integrated approach fosters a truly collaborative environment, reinforcing Hexcel's commitment to client success.

Hexcel cultivates long-term strategic partnerships, often on a sole-source basis, with major aerospace manufacturers like Airbus and Boeing. These collaborations extend to co-developing advanced composite materials and their applications for upcoming aircraft models, fostering deep customer integration.

This close alignment from the initial design stages significantly raises switching costs for these key clients, effectively securing Hexcel's position. For instance, in 2024, Hexcel continued its role as a primary supplier for critical structural components on programs like the Boeing 787 and Airbus A350, underscoring the depth of these partnerships.

Hexcel actively collaborates with aerospace customers to navigate the complexities of production rate changes. This proactive engagement ensures Hexcel can adapt its supply chain and manufacturing to meet evolving customer demands, a critical factor in supporting the aerospace industry's growth trajectory.

For instance, in 2024, Hexcel continued to demonstrate this commitment by aligning its operations to support the anticipated ramp-up in build rates for key commercial aircraft programs. This strategic alignment is vital for maintaining strong customer relationships and capturing market opportunities.

Value-Added Services and Problem Solving

Hexcel goes beyond simply supplying advanced composite materials. They actively engage with customers to solve specific engineering and manufacturing challenges, thereby adding significant value. This commitment is evident in their development of specialized products like rapid-curing prepregs, which can drastically cut down production times for their clients.

Their focus on problem-solving extends to optimizing manufacturing processes. Hexcel creates materials specifically configured for automated assembly, directly addressing customer needs to reduce labor costs and improve throughput. This positions Hexcel as a crucial partner in enhancing operational efficiency.

Hexcel’s strategic approach is to act as a collaborative partner, tackling complex engineering issues alongside their customers. This deep integration fosters innovation and ensures that clients receive not just materials, but comprehensive solutions tailored to their unique requirements.

- Reduced Assembly Costs: Hexcel's materials, like their optimized prepregs, contribute to lower manufacturing expenses for clients.

- Improved Manufacturing Efficiency: Products designed for automation streamline production lines, enhancing output.

- Strategic Partnership: Hexcel actively collaborates on complex engineering problems, moving beyond a transactional supplier role.

- Innovation in Material Science: Development of advanced materials like rapid-curing prepregs directly addresses customer needs for faster production cycles.

Commitment to Sustainability Collaboration

Hexcel actively partners with its customers on sustainability, showcasing how its advanced composite materials, like carbon fiber, enable significant reductions in aircraft weight. This directly translates to improved fuel efficiency, with estimates suggesting that a 1% reduction in aircraft weight can lead to a 0.5% decrease in fuel burn. In 2024, Hexcel continued to emphasize these benefits, highlighting how its materials are crucial for meeting the aerospace industry's ambitious emission reduction targets.

Furthermore, Hexcel is a leader in collaborative recycling initiatives, working with aerospace partners to find innovative uses for retired carbon fiber components. For instance, research and development efforts in 2024 focused on repurposing cured composite materials into new products, diverting waste from landfills and supporting a circular economy model. This commitment to end-of-life solutions for its materials strengthens customer loyalty and aligns with growing global demand for sustainable supply chains.

- Weight Reduction Impact: Hexcel's lightweight materials contribute to substantial fuel savings for aircraft operators.

- Emission Reduction: By enabling lighter aircraft, Hexcel's products directly support the aerospace industry's drive to lower carbon emissions.

- Recycling Collaboration: Hexcel partners with customers on recycling aerospace carbon materials, fostering a circular economy.

- Environmental Goals: These collaborations help customers achieve their own corporate sustainability objectives and environmental targets.

Hexcel's customer relationships are built on deep collaboration and value-added support, extending beyond material supply. They act as strategic partners, co-developing solutions for complex engineering challenges and optimizing manufacturing processes for clients.

This close integration, evident in sole-source agreements with major OEMs like Boeing and Airbus, significantly increases switching costs and fosters long-term loyalty. For example, Hexcel's role in supplying critical components for the Boeing 787 and Airbus A350 in 2024 highlights the depth of these enduring partnerships.

Hexcel's commitment to customer success is further demonstrated through its proactive engagement in production rate adjustments and its focus on sustainability, including collaborative recycling initiatives for composite materials.

These efforts not only enhance operational efficiency for clients by offering solutions like rapid-curing prepregs and materials for automated assembly but also support their environmental goals through weight reduction and fuel efficiency improvements.

Channels

Hexcel relies heavily on its direct sales force to cultivate relationships with major players in commercial aerospace, space and defense, and industrial markets. This direct engagement is crucial for understanding and meeting the complex technical specifications of original equipment manufacturers (OEMs) and their supply chains.

This direct model fosters deep customer intimacy, enabling Hexcel to offer highly customized material solutions. For instance, in 2024, Hexcel's focus on these key sectors meant its sales teams were instrumental in securing contracts for advanced composite materials used in next-generation aircraft and defense systems.

Hexcel operates an extensive global manufacturing and distribution network, featuring numerous facilities strategically positioned across the United States, Europe, and Asia. This widespread presence is fundamental to its business model, enabling the efficient production and delivery of advanced composite materials to a diverse international clientele.

This robust network ensures Hexcel maintains proximity to its key customer bases, facilitating timely and cost-effective distribution. In 2023, Hexcel reported that its manufacturing footprint spanned over 20 sites globally, underscoring its commitment to localized production and supply chain resilience.

Hexcel leverages industry trade shows and conferences like JEC World and the Paris Air Show as crucial channels. These events are essential for unveiling new composite material advancements and demonstrating cutting-edge applications to a global audience of aerospace and industrial professionals.

Participation in these high-profile gatherings directly supports lead generation and partnership development. For instance, Hexcel's presence at the 2023 Paris Air Show allowed for direct engagement with key decision-makers, contributing to their robust sales pipeline.

These conferences are instrumental in solidifying Hexcel's position as a market leader by showcasing their technological expertise and fostering direct relationships with current and prospective clients, driving future business opportunities.

Company Website and Investor Relations Portals

Hexcel's official website and its investor relations portal are crucial digital touchpoints. These platforms are designed to offer comprehensive details on Hexcel's advanced composite materials, target markets like aerospace and industrial sectors, and recent company news. They are key for communicating financial results and strategic updates.

These channels are vital for transparency, providing stakeholders with direct access to critical documents. Investors, potential customers, and the public can easily find annual reports, transcripts of earnings calls, and press releases. For instance, Hexcel’s 2024 financial reports, detailing revenue and profit figures, are readily available, ensuring informed decision-making.

- Website Accessibility: Provides 24/7 access to company information, including product specifications and market applications.

- Investor Relations Focus: Dedicated section offering financial reports, SEC filings, and investor event information.

- Transparency and Disclosure: Facilitates open communication regarding performance, strategy, and corporate governance.

- Information Hub: Serves as the primary source for official company announcements and historical data, supporting research and analysis.

Technical Documentation and Learning Resources

Hexcel utilizes comprehensive technical documentation and extensive learning resources as a key channel to engage its customers. These resources, including detailed product selector guides and online learning libraries, are crucial for educating the market about the advanced properties and diverse applications of Hexcel's composite materials.

These readily accessible online platforms serve as a direct conduit for technical support and knowledge transfer. They empower customers to effectively leverage Hexcel's cutting-edge composites in their design and manufacturing endeavors, ensuring optimal performance and utilization.

- Technical Documentation: Hexcel offers detailed datasheets, application guides, and processing manuals, ensuring customers have the necessary information to implement their advanced materials.

- Product Selector Guides: These tools simplify the selection process, helping customers identify the most suitable composite solutions for their specific project requirements.

- Learning Libraries: Hexcel provides webinars, case studies, and training modules that deepen customer understanding of composite technology and its benefits.

- Online Accessibility: The majority of these resources are available via Hexcel's website, providing continuous access for customers worldwide.

Hexcel's channels are primarily direct, focusing on building strong relationships with key industry players through a dedicated sales force. This approach allows for deep customer intimacy and tailored solutions, especially critical in the highly technical aerospace and defense sectors. For example, Hexcel's sales teams were instrumental in securing significant contracts in 2024 for advanced composite materials for next-generation aircraft.

Customer Segments

Commercial Aerospace Manufacturers represent Hexcel's most significant customer base, driving approximately 63% of its 2024 net sales. This critical segment relies on Hexcel for advanced composite materials essential in building modern aircraft.

Key clients within this segment include industry giants like Airbus and Boeing, alongside their extensive network of subcontractors. These manufacturers utilize Hexcel's composites for high-volume production of widely adopted commercial aircraft such as the A350, Boeing 787, and the A320neo family.

Beyond large commercial airliners, Hexcel also serves manufacturers of business jets and regional aircraft, further broadening its reach within the commercial aerospace sector. This diversification highlights the widespread applicability of Hexcel's composite solutions across various aviation categories.

Hexcel's space and defense contractors are crucial customers, relying on advanced composite materials for critical applications. These include components for fighter jets like the F-35, heavy-lift helicopters such as the CH-53K, and the ubiquitous Black Hawk. The demand for these high-performance materials is driven by ongoing modernization efforts within global defense forces.

In 2024, Hexcel observed a modest uptick in sales from this segment, underscoring its continued importance. This growth trajectory is supported by sustained and robust global defense expenditures, indicating a positive outlook for Hexcel's involvement in these vital programs, from rocket motors to satellite structures.

Hexcel's Industrial Applications customer segment encompasses a broad array of sectors, including automotive, energy, sports and leisure, and marine. The company is strategically narrowing its focus within this segment, prioritizing markets that can best leverage its advanced carbon fiber capabilities.

Specifically, Hexcel is intensifying its efforts in the automotive sector and other industries that demand high-performance, value-added carbon fiber products. This strategic pivot aims to capitalize on Hexcel's established expertise, originally honed in the demanding aerospace sector, to drive growth in these industrial markets.

In 2023, Hexcel reported that its Industrial segment revenue was approximately $714 million, representing a significant portion of its overall business. The company's commitment to developing lightweight, strong materials for these applications is a key driver of its strategy.

Original Equipment Manufacturers (OEMs)

Hexcel is a vital partner for Original Equipment Manufacturers (OEMs) who embed Hexcel's advanced composite materials into their sophisticated products, such as aircraft and wind turbines. These collaborations typically involve extended supply agreements, demanding highly specialized and tailored material specifications to meet stringent performance requirements.

The success of Hexcel is intrinsically linked to the manufacturing output and order pipelines of its primary OEM clients. For instance, in the aerospace sector, major OEMs like Boeing and Airbus rely on Hexcel for critical structural components. In 2024, the aerospace industry continued its recovery, with Airbus delivering 735 aircraft and Boeing delivering 544 aircraft, underscoring the significant volume Hexcel supports.

- Key OEM Relationships: Hexcel's business model is built on deep integration with leading OEMs in aerospace and industrial markets.

- Customized Material Solutions: The company provides highly engineered composite materials tailored to specific OEM product designs and performance criteria.

- Production Rate Dependency: Hexcel's revenue and growth are directly influenced by the production volumes and order backlogs of its major OEM customers.

- Long-Term Contracts: Many OEM partnerships are secured through multi-year agreements, providing a degree of revenue predictability.

Customers Seeking Lightweighting and Performance Solutions

Hexcel serves customers across various industries who are intensely focused on lightweighting and boosting performance. These clients, whether in aerospace, automotive, or industrial sectors, are driven by the need to improve fuel efficiency, lower emissions, and extend the operational life of their products. For instance, the commercial aerospace sector, a key market for Hexcel, saw significant demand for lighter materials to achieve better fuel economy, with airlines actively seeking ways to reduce their carbon footprint. In 2024, the push for sustainability and operational efficiency remained paramount.

These customers are looking for advanced composite materials that offer superior strength-to-weight ratios. This directly translates into tangible benefits like increased payload capacity for aircraft or enhanced acceleration and handling for vehicles. Hexcel's value proposition is built around providing these cutting-edge solutions that enable their customers to achieve these critical performance enhancements, thereby gaining a competitive edge.

Key customer priorities include:

- Weight Reduction: Minimizing material mass to improve energy efficiency and operational range.

- Enhanced Strength and Durability: Ensuring product longevity and resilience under demanding conditions.

- Performance Improvement: Achieving higher speeds, better fuel economy, or increased load-bearing capabilities.

- Sustainability Goals: Meeting regulatory requirements and consumer demand for environmentally friendly products through reduced emissions and longer lifespans.

Hexcel's customer base is primarily segmented into Commercial Aerospace Manufacturers, Space & Defense contractors, and Industrial Applications. These segments are united by a need for advanced, lightweight composite materials that enhance performance and efficiency.

The company's deep relationships with Original Equipment Manufacturers (OEMs) are central to its strategy, involving long-term supply agreements and tailored material specifications. Hexcel's revenue is closely tied to the production rates and order backlogs of these key partners.

Customers across all segments prioritize weight reduction, enhanced strength, and overall performance improvements. Meeting sustainability goals, such as reducing emissions, is also a critical driver for their material selection.

| Customer Segment | 2024 Sales Contribution (Approx.) | Key Customers/Applications | Customer Priorities |

|---|---|---|---|

| Commercial Aerospace | 63% | Airbus, Boeing (A350, 787, A320neo), Business Jets, Regional Aircraft | Weight Reduction, Fuel Efficiency, Performance |

| Space & Defense | Significant Contribution | F-35, CH-53K, Black Hawk, Rocket Motors, Satellite Structures | High Strength, Durability, Performance under Extreme Conditions |

| Industrial Applications | Approx. $714M (2023 Revenue) | Automotive, Energy, Sports & Leisure, Marine | Lightweighting, Performance Enhancement, Value-Added Solutions |

Cost Structure

Hexcel invests heavily in Research and Technology (R&T) to stay ahead in the advanced composites market. These costs are essential for developing next-generation materials and processes that meet evolving customer needs in aerospace and industrial sectors.

In 2024, Hexcel's commitment to innovation was reflected in its R&T expenses, which represented 3.0% of its net sales. This significant investment fuels the creation of new composite solutions and advanced manufacturing techniques.

Hexcel's manufacturing and production costs are a significant part of its business model, driven by the complex processes involved in creating advanced composite materials. These expenses include the sourcing of specialized raw materials, the direct labor required for skilled production, and the energy needed to power its global manufacturing sites. In 2023, Hexcel reported cost of sales of $1.9 billion, reflecting these substantial operational outlays.

Fluctuations in key input prices, particularly for raw materials like carbon fiber precursors and resins, directly impact Hexcel's cost of sales and, consequently, its gross margins. Energy costs are also a considerable factor, given the energy-intensive nature of composite manufacturing. For instance, a notable increase in energy prices during 2023 could have put pressure on the company's profitability if not adequately managed through hedging or efficiency improvements.

Selling, General, and Administrative (SG&A) expenses represent the operational overhead not directly tied to manufacturing Hexcel's advanced composite materials. These costs encompass salaries for sales, marketing, and administrative teams, alongside expenditures for office space, legal counsel, and corporate governance. In 2024, Hexcel reported SG&A expenses at 9.3% of its total sales, reflecting a strategic investment in market presence and customer engagement.

Capital Expenditures for Facilities and Equipment

Hexcel’s capital expenditures are crucial for its global manufacturing operations, covering facility maintenance, upgrades, and expansion. These investments directly support increased production capacity and the integration of advanced technologies to meet evolving market demands.

For the fiscal year 2025, Hexcel has projected its capital expenditures to remain below the $100 million mark. This strategic allocation of funds ensures the company stays competitive and responsive to industry trends.

- Facility Maintenance and Upgrades: Ongoing investments to keep manufacturing sites operational and efficient.

- Capacity Expansion: Funding for new equipment and facility improvements to boost production output.

- Technology Adoption: Capital allocated for incorporating new technologies to enhance product quality and manufacturing processes.

- 2025 Expenditure Forecast: Anticipated capital spending to be less than $100 million.

Supply Chain and Logistics Costs

Managing Hexcel's complex global supply chain for advanced composite materials, such as carbon fiber and resins, incurs significant expenses. These include the costs associated with international shipping, maintaining specialized warehousing for temperature-sensitive materials, and managing inventory levels to balance demand with production capacity. For instance, in 2023, transportation and logistics represented a notable portion of Hexcel's operating expenses.

Hexcel actively pursues supply chain optimization strategies to mitigate these costs while ensuring product availability and adapting to market shifts. This involves enhancing logistics networks and improving inventory forecasting accuracy. For example, Hexcel reported efforts to streamline its distribution channels in its 2023 annual report, aiming for greater efficiency.

Disruptions within the supply chain, a recurring challenge in the aerospace and defense sectors, can lead to escalated costs. These can arise from geopolitical events, natural disasters, or supplier issues, impacting lead times and increasing the need for expedited freight. Hexcel’s resilience planning is crucial to manage these potential cost overruns.

- Transportation: Costs for moving raw materials and finished goods across continents, often requiring specialized handling.

- Warehousing: Expenses for storing advanced materials in climate-controlled facilities to maintain product integrity.

- Inventory Management: Costs associated with holding raw materials and finished goods, including capital tied up and potential obsolescence.

- Risk Mitigation: Investments in strategies and systems to buffer against supply chain disruptions and their associated cost impacts.

Hexcel's cost structure is dominated by manufacturing and production expenses, reflecting the complex nature of advanced composites. These include raw material sourcing, skilled labor, and energy-intensive processes. In 2023, Hexcel's cost of sales reached $1.9 billion, underscoring these significant operational outlays.

Research and Development (R&T) is another critical cost area, with Hexcel investing 3.0% of net sales in 2024 to drive innovation in materials and processes. Selling, General, and Administrative (SG&A) expenses, representing 9.3% of total sales in 2024, cover essential corporate functions and market engagement.

| Cost Category | 2023 Actual (USD) | 2024 Projection (as % of Sales) | Key Drivers |

|---|---|---|---|

| Cost of Sales | $1.9 Billion | N/A | Raw materials, labor, energy, manufacturing overhead |

| R&T Expenses | N/A | 3.0% of Net Sales | New material development, process innovation |

| SG&A Expenses | N/A | 9.3% of Total Sales | Salaries, marketing, administrative overhead |

| Capital Expenditures | N/A | Below $100 Million (2025 Forecast) | Facility upgrades, capacity expansion, technology adoption |

Revenue Streams

Hexcel's commercial aerospace sales are its primary revenue driver, accounting for a substantial 63% of its 2024 net sales. This segment encompasses advanced composite materials crucial for manufacturing commercial aircraft, business jets, and regional planes.

Key customers like Airbus and Boeing rely on Hexcel's innovative materials, directly linking the company's revenue to global aircraft production volumes.

Hexcel’s revenue from the space and defense sector is a vital and expanding source of income. This growth is fueled by the increasing need for advanced, lightweight materials critical for military aircraft, helicopters, and various space programs. For instance, in the second quarter of 2025, this particular segment experienced a robust 9.5% increase compared to the same period in the previous year.

This positive performance is further bolstered by ongoing global defense modernization efforts and the rapid expansion of the space economy. These macro trends create a sustained demand for Hexcel’s specialized composite materials, reinforcing its position in these high-value markets.

Hexcel earns revenue from selling its advanced composite materials, like carbon fiber, for various industrial uses. These materials are sought after in sectors such as automotive, where they reduce vehicle weight for better fuel efficiency, and the energy industry, particularly for wind turbine blades. In 2023, Hexcel’s Industrial segment contributed approximately $300 million to its total revenue, showcasing its growing presence beyond aerospace.

Sales of Composite Materials Products

Hexcel's primary revenue engine is the sale of its advanced composite materials. These include essential components like carbon fibers, specialized reinforcements, and prepregs, which are the foundational elements for creating high-performance composite parts.

Customers purchase these materials to integrate into their own manufacturing processes, building everything from aircraft components to automotive structures. In 2024, the Composite Materials segment alone generated net sales of $1,531.0 million, underscoring its significance.

- Core Products: Carbon fibers, specialty reinforcements, and prepregs are key offerings.

- Customer Use: Clients utilize these materials for their own manufacturing of composite parts.

- 2024 Performance: The Composite Materials segment achieved $1,531.0 million in net sales.

Sales of Engineered Products and Structures

Hexcel generates income through the sale of its Engineered Products and Structures. This segment focuses on creating and selling composite structures and precisely machined honeycomb components. These advanced parts find their main use in the aerospace industry, contributing to components such as engine nacelles and aircraft panels.

In 2024, Hexcel's net sales from its Engineered Products segment reached $372.0 million. This highlights the significant contribution of these specialized composite solutions to the company's overall revenue.

- Revenue Source: Sales of composite structures and precision machined honeycomb parts.

- Primary Market: Aerospace applications, including engine nacelles and aircraft panels.

- 2024 Performance: Net sales for this segment amounted to $372.0 million.

Hexcel's revenue streams are primarily driven by its advanced composite materials, which are essential for various high-performance applications. The company also generates income from the sale of engineered products and structures, further diversifying its financial base.

The commercial aerospace sector remains Hexcel's largest revenue contributor, with sales accounting for 63% of its 2024 net sales, totaling $1,531.0 million for the Composite Materials segment. The space and defense sector is also a significant and growing revenue source, demonstrating a 9.5% increase in Q2 2025 compared to the prior year, driven by global defense modernization and space economy expansion.

Industrial applications, including automotive and energy sectors, contributed approximately $300 million in 2023, highlighting Hexcel's expanding reach beyond aerospace. The Engineered Products segment added $372.0 million in net sales in 2024, primarily from composite structures and honeycomb components for aerospace.

| Revenue Segment | 2024 Net Sales (Millions USD) | Key Products/Applications |

|---|---|---|

| Composite Materials | 1,531.0 | Carbon fibers, reinforcements, prepregs for aerospace, automotive, energy |

| Engineered Products and Structures | 372.0 | Composite structures, honeycomb components for aerospace (engine nacelles, panels) |

| Space & Defense (Growth Indicator) | N/A (Segment specific data not provided for 2024) | Advanced materials for military aircraft, helicopters, space programs |

Business Model Canvas Data Sources

The Hexcel Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and extensive market research on aerospace and industrial sectors. These diverse data streams ensure a comprehensive and accurate representation of Hexcel's strategic positioning and operational realities.