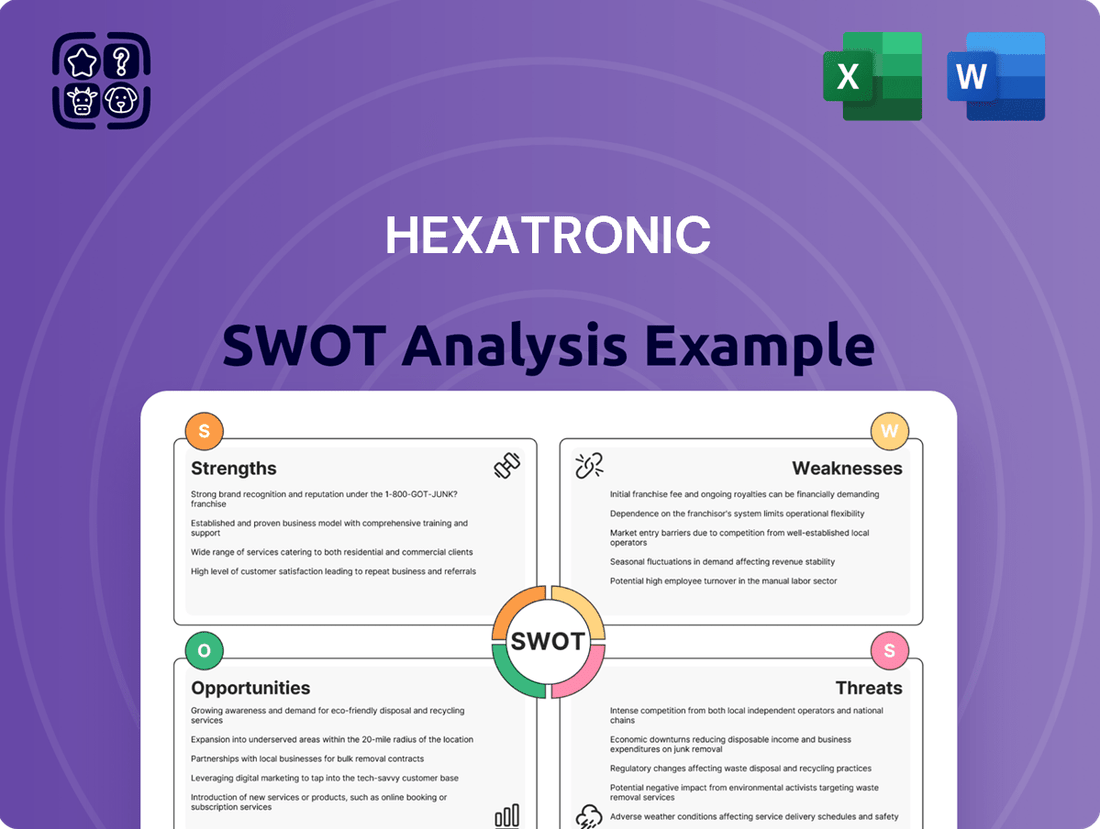

Hexatronic SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexatronic Bundle

Hexatronic's robust market position is bolstered by its strong technological innovation and established distribution channels, key strengths that drive its growth. However, understanding the full scope of its competitive landscape and potential regulatory hurdles is crucial for informed decision-making.

Want to truly grasp Hexatronic's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a professionally written, fully editable report, packed with actionable insights and financial context, perfect for investors and strategic planners.

Strengths

Hexatronic boasts a truly comprehensive portfolio, covering the entire fiber optic infrastructure lifecycle. This means they can provide everything from the initial design and planning stages right through to installation and ongoing maintenance, making them a single source for communication network needs.

This wide-ranging product and service offering allows Hexatronic to effectively serve a diverse client base with varying project scopes and requirements. For example, in 2023, their Group Net Sales reached SEK 9,771 million (approximately $930 million), demonstrating the scale and breadth of their operations and the demand for their integrated solutions.

By acting as a one-stop-shop, Hexatronic can significantly enhance customer loyalty and deepen market penetration. This integrated approach simplifies procurement and project management for their clients, fostering stronger relationships and potentially leading to repeat business across their expansive product lines.

Hexatronic's strength lies in its diverse market applications, with products and systems serving critical sectors like telecom, data centers, and industrial networks. This broad reach across high-growth areas, including the expanding 5G infrastructure and the ever-increasing demand for data center connectivity, significantly reduces dependency on any single industry. For instance, the telecom sector is a major driver, with global telecom capex expected to reach $234 billion in 2024. This diversification not only provides resilience against sector-specific downturns but also opens up substantial opportunities for market penetration and revenue growth as these industries continue their expansion.

Hexatronic's core business directly fuels the global digital expansion, a powerful and persistent megatrend. Their products and services are essential for the increasing demand for faster internet speeds, robust cloud infrastructure, and the proliferation of connected devices, positioning them for continued relevance.

End-to-End Service Capability

Hexatronic's end-to-end service capability is a significant strength, offering clients solutions that cover the entire lifecycle of communication networks. This comprehensive approach, from initial design and planning to installation and ongoing maintenance, simplifies project management for customers. For instance, the company’s focus on the full value chain allows for greater control over quality and delivery timelines. This integrated model also fosters deeper client relationships and creates opportunities for recurring revenue streams through service agreements and future upgrades, enhancing long-term client retention.

This end-to-end service model translates into tangible benefits for Hexatronic. It allows the company to capture a larger share of the project value and build a more resilient revenue base. By managing all stages, Hexatronic can better anticipate and address potential issues, leading to more efficient project execution. This capability is crucial in a market where reliability and seamless integration are paramount. For example, in 2024, the telecommunications infrastructure sector saw increased demand for integrated solutions, a trend Hexatronic is well-positioned to capitalize on.

- Full Lifecycle Solutions: Hexatronic manages network projects from conception to operation.

- Streamlined Project Execution: Clients benefit from simplified project management due to a single point of contact.

- Recurring Revenue: Maintenance contracts and upgrade services create stable, ongoing income.

- Enhanced Client Relationships: The comprehensive service offering fosters deeper partnerships and customer loyalty.

Specialization in Fiber Optics

Hexatronic's deep specialization in fiber optics places it as a key player in a technology vital for today's communication needs. This focused expertise translates into advanced technical understanding and a commitment to ongoing innovation within its core business. As fiber continues to be the essential foundation for high-speed data transfer, Hexatronic's specialized knowledge provides a significant competitive advantage in this critical market. For instance, the global fiber optics market was valued at approximately USD 10.2 billion in 2023 and is projected to grow substantially, highlighting the demand for specialized providers like Hexatronic.

- Focused Expertise: Deep technical knowledge in fiber optic technology.

- Innovation Driver: Continuous development in its core area of fiber optics.

- Competitive Edge: Strong positioning in a critical and growing market segment.

- Market Relevance: Alignment with the increasing demand for high-bandwidth infrastructure.

Hexatronic's comprehensive end-to-end solutions, covering the entire fiber optic lifecycle, simplify complex projects for clients and foster strong relationships. This integrated approach, from design to maintenance, enhances customer loyalty and market penetration, as seen in their 2023 Group Net Sales of SEK 9,771 million. Their broad market applications across telecom, data centers, and industrial networks, supported by a global telecom capex forecast of $234 billion for 2024, ensure resilience and growth opportunities. Furthermore, Hexatronic's deep specialization in fiber optics, a market valued at USD 10.2 billion in 2023, provides a significant competitive advantage by aligning with the accelerating global digital expansion.

What is included in the product

Delivers a strategic overview of Hexatronic’s internal and external business factors, detailing its competitive advantages and potential market challenges.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Hexatronic's reliance on the telecommunications sector makes it susceptible to the cyclical nature of capital expenditure. Telecom operators and government initiatives often dictate the pace of fiber optic infrastructure development, meaning investment can ebb and flow. For instance, a slowdown in major government broadband deployment programs, which were significant drivers in prior years, could directly impact Hexatronic's order intake.

Economic downturns pose a significant threat, potentially leading to reduced spending on new network rollouts and upgrades. This could translate into lower revenue and profitability for Hexatronic as projects are delayed or scaled back. The company's financial performance is therefore closely linked to broader economic health and the investment appetite of its core customer base.

Hexatronic's reliance on key raw materials like glass, plastics, and metals for its fiber optic products presents a significant vulnerability. Global commodity price swings directly affect the cost of goods sold. For instance, if copper prices, a component in some cables, see a sharp increase, this could squeeze Hexatronic's margins if they can't fully transfer those costs to buyers.

Hexatronic operates within a highly competitive fiber optic market, facing numerous global and regional competitors. This crowded field puts constant pressure on pricing, making it crucial for Hexatronic to innovate and manage costs effectively to keep its market position and financial health. For instance, the global fiber optic market was valued at approximately USD 14.5 billion in 2023 and is projected to grow, but this growth attracts many players.

Geographic Concentration Risk

Hexatronic's significant reliance on specific geographic markets presents a notable weakness. A substantial portion of its revenue could be tied to particular regions, leaving it vulnerable to localized economic downturns or shifts in market demand. For instance, if a large percentage of sales in 2024 were concentrated in, say, Northern Europe, any economic slowdown or increased competition within that specific area would disproportionately impact Hexatronic's overall financial performance.

This geographic concentration exposes the company to heightened risks from regional political instability or adverse regulatory changes. A new trade policy or a change in government in a key market could disrupt operations and sales channels more severely than for a competitor with a more balanced global footprint. This lack of broad diversification means that challenges in one area can have a magnified effect on the company's bottom line.

The potential for this concentration risk is underscored by the nature of the fiber optic infrastructure market. While Hexatronic supports global expansion, its current revenue streams might heavily favor established markets. For example, if a significant majority of its 2024 revenue originated from just a few European countries, any disruption in those specific markets could create substantial headwinds. This could manifest as:

- Dependence on a few key markets: A large revenue share from limited regions heightens vulnerability.

- Exposure to regional economic cycles: Downturns in concentrated areas can significantly impact overall sales.

- Vulnerability to localized regulatory changes: New laws or policies in key markets can disproportionately affect Hexatronic.

Reliance on Large Infrastructure Projects

Hexatronic's significant reliance on large infrastructure projects presents a notable weakness. The company's revenue stream can become quite lumpy, as success is tied to winning and completing these major undertakings. Delays or outright cancellations of these substantial projects can cause considerable fluctuations in earnings from one reporting period to the next, making financial forecasting more challenging.

For example, the telecommunications infrastructure sector, a key area for Hexatronic, often involves multi-year build-outs. A slowdown in government spending or private investment in these areas, which can occur due to economic downturns or shifting political priorities, directly impacts Hexatronic's project pipeline and therefore its financial results. This dependence means that Hexatronic is particularly vulnerable to macroeconomic shifts that affect large capital expenditures.

- Project Dependency: A substantial part of Hexatronic's revenue is linked to the successful execution of large, long-term infrastructure projects.

- Earnings Variability: The timing and success of these projects can lead to significant swings in the company's earnings.

- Risk of Delays/Cancellations: Delays or cancellations of major projects can severely impact financial performance in specific periods.

- Vulnerability to Economic Factors: Economic downturns or changes in government infrastructure spending can negatively affect Hexatronic's business.

Hexatronic's reliance on specific raw materials, such as glass, plastics, and metals, exposes it to price volatility. Fluctuations in global commodity markets can directly impact the company's cost of goods sold and, consequently, its profit margins. For example, an increase in the price of copper, a material used in some cable components, could squeeze Hexatronic's profitability if these higher costs cannot be fully passed on to customers.

The company faces intense competition within the fiber optic market, with numerous global and regional players vying for market share. This competitive landscape exerts constant pressure on pricing, necessitating continuous innovation and efficient cost management to maintain market position and financial health. The global fiber optic market was valued at approximately USD 14.5 billion in 2023, a growing but crowded space.

Hexatronic's dependence on a few key geographic markets presents a significant vulnerability. If a substantial portion of its revenue is concentrated in specific regions, the company becomes susceptible to localized economic downturns or shifts in market demand. For instance, a heavy reliance on sales in Northern Europe during 2024 could mean that an economic slowdown in that area would disproportionately affect Hexatronic's overall financial performance.

| Weakness | Description | Impact |

|---|---|---|

| Raw Material Price Volatility | Dependence on commodities like glass, plastics, and metals. | Affects cost of goods sold and profit margins; e.g., copper price hikes. |

| Intense Market Competition | Presence of numerous global and regional competitors. | Puts pressure on pricing and requires constant innovation and cost control. |

| Geographic Market Concentration | Revenue heavily tied to specific regions. | Heightens vulnerability to localized economic downturns and regulatory changes. |

Full Version Awaits

Hexatronic SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing Hexatronic's strategic positioning. This professional document details their Strengths in fiber optic technology, Weaknesses in market diversification, Opportunities in 5G expansion, and Threats from competitive pressures. Invest in this comprehensive analysis for actionable insights.

Opportunities

The relentless global expansion of 5G networks, coupled with the ongoing enhancement of existing broadband infrastructure, creates a substantial need for robust fiber optic backhaul and last-mile connectivity. This sustained demand directly benefits Hexatronic by driving consistent sales of its core fiber optic products and solutions. For instance, the global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2028, showcasing the immense scale of this opportunity.

The relentless expansion of cloud computing, fueled by AI and big data, is creating a massive demand for data center infrastructure. This trend directly translates into a significant opportunity for Hexatronic, as these facilities rely heavily on advanced fiber optic cabling and connectivity solutions. Estimates suggest the global data center market size was valued at approximately USD 276.5 billion in 2023 and is projected to reach USD 632.1 billion by 2030, growing at a CAGR of 12.9% during the forecast period.

Hexatronic is well-positioned to capitalize on this growth. The need for high-speed, high-density fiber optic infrastructure within these expanding data centers offers a substantial and growing market. As data traffic continues to explode, the requirement for robust and scalable connectivity solutions will only intensify, directly benefiting companies like Hexatronic that specialize in these areas.

Governments worldwide are actively investing in digital infrastructure, with many national broadband initiatives underway. For instance, the United States' Broadband Equity, Access, and Deployment (BEAD) program alone allocates $42.45 billion to expand broadband access. This focus presents a significant opportunity for Hexatronic to engage in large-scale fiber optic network deployments and national connectivity projects, directly benefiting from these substantial public sector funding streams.

Growth of IoT and Smart City Initiatives

The expanding landscape of the Internet of Things (IoT) and smart city projects directly fuels the demand for robust, high-speed network infrastructure. Hexatronic's fiber optic solutions are perfectly positioned to capitalize on this trend. These initiatives, from connected transportation systems to smart energy grids, generate and require substantial data volumes, making fiber optic networks indispensable. This creates significant new market opportunities for Hexatronic as cities worldwide invest in upgrading their digital backbone.

Estimates suggest the global IoT market is projected to reach over $1.5 trillion by 2025, with smart cities representing a significant portion of this growth. For instance, a report by MarketsandMarkets forecasts the smart cities market to grow from $40.6 billion in 2023 to $92.6 billion by 2028, at a compound annual growth rate of 17.9%. This surge necessitates the deployment of advanced connectivity solutions like those offered by Hexatronic.

- Increased demand for fiber optics: Smart city infrastructure, including sensors, cameras, and communication nodes, relies heavily on high-bandwidth fiber optic cables for reliable data transmission.

- New market segments: Hexatronic can tap into the growing market for smart utility management, intelligent traffic systems, and public safety networks.

- Scalability and future-proofing: Fiber optics provide the necessary scalability to accommodate the ever-increasing data generated by IoT devices, ensuring long-term network viability.

- Government and municipal investments: Many governments are actively funding smart city development, creating a direct revenue stream for companies providing essential network components.

Strategic Mergers and Acquisitions

The fiber optic market remains quite fragmented, and this presents a significant opportunity for Hexatronic to grow through strategic mergers and acquisitions. By acquiring other companies, Hexatronic can quickly expand its presence into new regions or gain access to valuable, cutting-edge technologies that complement its existing offerings. This consolidation trend in the industry means that acquiring market share through M&A is a viable path to strengthening its overall competitive standing.

Hexatronic's strategic M&A approach could lead to substantial benefits. For instance, acquiring a company with advanced testing equipment could enhance Hexatronic's product quality and reliability. In 2024, the global fiber optics market was valued at approximately USD 13.5 billion, with projections indicating continued growth, making it an attractive landscape for consolidation.

- Geographic Expansion: Acquire companies with established sales networks in underserved markets.

- Technology Acquisition: Integrate new technologies, such as advanced optical networking solutions, to broaden the product portfolio.

- Market Share Growth: Consolidate smaller players to increase market dominance and leverage economies of scale.

- Synergistic Efficiencies: Achieve cost savings and operational improvements by integrating acquired businesses.

Hexatronic is well-positioned to capitalize on the global surge in demand for high-speed data transmission, driven by 5G expansion and data center growth. The company can leverage its fiber optic solutions to meet the increasing need for robust connectivity in smart cities and IoT applications. Furthermore, strategic mergers and acquisitions offer a clear path for Hexatronic to expand its geographical reach, acquire new technologies, and consolidate market share in the growing fiber optics industry, which was valued at approximately USD 13.5 billion in 2024.

Threats

Global economic slowdowns, particularly those experienced in late 2023 and projected into 2024, present a significant threat to Hexatronic. These downturns can curtail capital investment by key customer segments like telecom operators and enterprises, directly impacting demand for the company's fiber optic solutions. For instance, a general economic contraction could see projected infrastructure spending in the European telecom sector, a key market for Hexatronic, face downward revisions.

Sustained inflationary pressures further exacerbate this threat by increasing Hexatronic's operational costs, from raw materials to logistics. If these rising costs cannot be fully passed on to customers, profit margins could be compressed. The European inflation rate, which remained elevated through much of 2023, directly impacts the cost of goods for companies like Hexatronic, potentially creating a margin squeeze if pricing power is limited.

The fiber optic market is crowded, with both global giants and nimble regional companies vying for market share. This often translates into aggressive pricing tactics, which can put downward pressure on the average selling prices of Hexatronic's products.

For instance, in early 2024, industry reports indicated a slight softening in average selling prices for certain high-volume fiber optic cables due to increased supply from manufacturers in Asia. This intense price competition directly threatens Hexatronic's profit margins, necessitating a strong focus on cost management and product differentiation.

If Hexatronic cannot effectively counter these price pressures through innovation, superior product performance, or efficient operational strategies, its profitability could be significantly impacted. Maintaining healthy margins will be a key challenge throughout 2024 and into 2025.

While fiber optics is a mature technology, the telecommunications landscape is constantly evolving. The threat of disruptive innovations, such as advanced wireless solutions or entirely new communication paradigms, could potentially lessen the demand for physical fiber infrastructure in specific use cases. For instance, the ongoing development of 6G wireless technology, with its projected speeds and low latency, might offer viable alternatives for certain data transmission needs currently served by fiber.

Supply Chain Disruptions and Geopolitical Instability

Hexatronic's extensive global manufacturing and reliance on international supply chains expose it to significant risks from geopolitical instability. Events like trade disputes or regional conflicts can interrupt the flow of critical components, as seen with global supply chain issues impacting many electronics manufacturers throughout 2021-2022, leading to production slowdowns. These disruptions can result in shortages of essential raw materials, elevated shipping expenses, and extended lead times for finished goods, directly affecting Hexatronic's ability to meet demand and maintain its profit margins.

The company's exposure to these threats is amplified by its distributed manufacturing footprint. For instance, a conflict in a key manufacturing region could halt production, while increased tariffs or sanctions could drastically raise the cost of imported components. This vulnerability was highlighted in late 2024 as ongoing geopolitical tensions in Eastern Europe continued to disrupt logistics networks and increase energy prices for manufacturers across the continent.

- Geopolitical Risk: Ongoing international conflicts and trade tensions pose a direct threat to Hexatronic's global supply chain.

- Logistics Costs: Increased freight rates and potential import/export restrictions can significantly inflate operational expenses.

- Production Delays: Shortages of raw materials or components due to disruptions can lead to missed production targets and delayed customer deliveries.

- Profitability Impact: The combination of higher costs and potential revenue loss from delayed deliveries directly impacts Hexatronic's bottom line.

Adverse Regulatory Changes and Trade Barriers

Hexatronic faces potential headwinds from evolving telecommunications regulations, which could necessitate costly adjustments to its product offerings or operational processes. For instance, shifts in data privacy laws or network neutrality regulations could impact the demand for certain fiber optic solutions.

Furthermore, the company's global reach exposes it to the threat of increased trade barriers. New tariffs or import restrictions in key markets, such as the United States or European Union, could significantly raise the cost of goods sold or limit market access. In 2023, global trade protectionism saw a notable uptick, with nearly 3,000 new trade restrictive measures reported by the WTO, impacting various sectors including electronics and manufacturing.

Stricter environmental standards, particularly in regions like the EU where Hexatronic has a strong presence, could also pose a challenge. Compliance with new regulations on materials sourcing or end-of-life product management might require substantial investment in research and development and supply chain adjustments.

These regulatory shifts and trade impediments could lead to:

- Increased compliance costs impacting profit margins.

- Restricted market access hindering revenue growth opportunities.

- Supply chain disruptions due to new trade policies or material restrictions.

Intensifying competition within the fiber optics sector, characterized by aggressive pricing strategies from both established global players and emerging regional manufacturers, poses a significant threat to Hexatronic's profit margins. For instance, industry analysis from early 2024 indicated a slight downward trend in average selling prices for certain fiber optic cable types due to increased production capacity from Asian suppliers.

The rapid evolution of telecommunications technology presents a risk of disruptive innovations, such as advanced wireless solutions, potentially diminishing the long-term demand for traditional fiber optic infrastructure in specific applications. The ongoing development of 6G technologies, promising ultra-high speeds and low latency, could offer competitive alternatives for certain data transmission needs.

Hexatronic's reliance on global supply chains exposes it to vulnerabilities from geopolitical instability, including trade disputes and regional conflicts, which can disrupt component flow and increase logistics costs. This was evident in late 2024, where ongoing geopolitical tensions in Eastern Europe contributed to logistical network disruptions and higher energy prices for manufacturers.

Evolving telecommunications regulations and increasing trade protectionism, with a notable rise in trade restrictive measures globally in 2023, could lead to higher compliance costs and restricted market access for Hexatronic.

SWOT Analysis Data Sources

This Hexatronic SWOT analysis is built upon a foundation of credible data, drawing from official financial filings, comprehensive market intelligence, and expert industry evaluations to provide precise and informed strategic insights.