Hexatronic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexatronic Bundle

Gain a competitive edge with our comprehensive PESTLE Analysis of Hexatronic. Discover how evolving political landscapes, economic shifts, and technological advancements are directly impacting the company’s trajectory. Understand the social and environmental factors that shape consumer behavior and regulatory compliance within the fiber optic industry. Arm yourself with actionable intelligence to refine your market strategy and anticipate future challenges.

Unlock a deeper understanding of the external forces at play for Hexatronic. Our expertly crafted PESTLE analysis dives into the critical political, economic, social, technological, legal, and environmental factors influencing its operations and growth. Equip yourself with the insights needed to make informed investment decisions and strategic planning. Download the full version now for immediate access to this vital market intelligence.

Political factors

Governments worldwide are prioritizing broadband expansion, recognizing its critical role in economic development and digital inclusion. For instance, the United States' Broadband Equity, Access, and Deployment (BEAD) program, with its allocated $42.45 billion, is a prime example of this commitment, aiming to connect millions of unserved and underserved households.

These substantial government investments directly fuel demand for the very infrastructure Hexatronic specializes in, particularly fiber optic networks. Such initiatives translate into tangible market opportunities, as deployment projects require extensive planning, materials, and skilled execution.

The pace at which these funds are released and the specific eligibility criteria for projects under these programs can significantly influence the timing of market activity and the overall project pipeline for companies like Hexatronic.

Geopolitical stability significantly impacts Hexatronic's global footprint, particularly its intricate supply chains and access to key markets. Shifting trade policies and international relations can introduce volatility, affecting the cost of raw materials and finished goods. For example, potential tariffs on telecommunications equipment could increase operational expenses, though Hexatronic's strategic decision to establish local production facilities within the United States, as seen with its acquisition of W. L. Gore & Associates' fiber optic cable business in 2024, helps mitigate some of this risk by reducing reliance on imported components.

The regulatory environment, encompassing permitting processes and network deployment standards, significantly influences the pace and expense of fiber optic infrastructure expansion. Favorable regulations that simplify and expedite development can accelerate Hexatronic's project timelines and enhance its market penetration.

For instance, in 2024, Sweden, a key market for Hexatronic, continued to refine its digital infrastructure policies, aiming to reduce barriers to fiber deployment. The Swedish Post and Telecom Authority (PTS) has been actively involved in ensuring fair access and promoting competition, which indirectly benefits companies like Hexatronic by fostering a more predictable operating landscape.

Defense and Energy Sector Investments

Government spending and strategic investments in defense and energy are significant drivers for Hexatronic, especially within its Harsh Environment business. These sectors often require robust and specialized fiber optic solutions to ensure reliable communication in challenging conditions, directly benefiting Hexatronic's offerings.

National security priorities and the ongoing development of critical infrastructure are key political factors influencing demand. For instance, the US Department of Defense's budget for fiscal year 2024 included substantial allocations for modernization and technological upgrades, many of which rely on advanced communication networks.

- Increased Government Spending: Defense budgets globally are rising; for example, NATO members committed to increasing defense spending, with many aiming for 2% of GDP, fostering demand for secure communication infrastructure.

- Energy Transition Investments: Governments are investing heavily in renewable energy projects and grid modernization, creating opportunities for fiber optic deployment in these critical infrastructure build-outs. In 2024, significant EU funding was allocated to green energy initiatives.

- National Security Focus: The emphasis on national security directly translates to investments in resilient communication systems, a core area for Hexatronic's Harsh Environment products.

- Infrastructure Resilience Programs: Political mandates for enhancing critical infrastructure resilience, particularly in the face of cyber threats and environmental challenges, support the need for durable fiber optic solutions.

Data Protection and Cybersecurity Regulations

Governments worldwide are tightening data protection and cybersecurity regulations, creating a demand for secure and reliable communication infrastructure. This trend directly benefits companies like Hexatronic, whose fiber optic solutions are inherently suited for high-security data transmission, essential for compliance with mandates like the GDPR and emerging national data localization laws.

The increasing complexity and stringency of these regulations, particularly concerning data breaches and privacy, underscore the critical need for robust network security. Hexatronic's advanced fiber optic technology offers a significant advantage in meeting these evolving requirements, bolstering the security of data centers and telecommunication networks.

- GDPR Fines: As of early 2024, the General Data Protection Regulation has resulted in fines totaling over €2.8 billion for data protection violations across the EU.

- Cybersecurity Spending: Global cybersecurity spending was projected to reach $231 billion in 2024, reflecting the heightened focus on data security.

- Data Breach Costs: The average cost of a data breach in 2024 reached $4.73 million globally, emphasizing the financial imperative for strong cybersecurity measures.

Government initiatives worldwide, such as the US BEAD program with its $42.45 billion allocation, are significantly driving demand for broadband infrastructure, directly benefiting Hexatronic's fiber optic solutions. Political stability and evolving trade policies can impact supply chains, but Hexatronic's 2024 US production expansion mitigates some of this risk.

Regulatory frameworks, like Sweden's efforts to streamline fiber deployment, create a more favorable operating environment for Hexatronic. Furthermore, heightened national security concerns and increased government spending on critical infrastructure, including defense and energy transition projects, bolster demand for Hexatronic's specialized Harsh Environment products.

The increasing stringency of data protection and cybersecurity regulations globally, exemplified by GDPR fines and projected 2024 cybersecurity spending of $231 billion, further amplifies the need for Hexatronic's secure fiber optic solutions.

| Factor | Description | Impact on Hexatronic | Relevant Data (2024/2025) |

| Government Broadband Initiatives | Public investment in expanding internet access | Increased demand for fiber optic infrastructure | US BEAD Program: $42.45 billion allocated |

| Geopolitical Stability & Trade Policy | International relations and trade agreements | Affects supply chain costs and market access; US production expansion mitigates risk | Hexatronic acquired W. L. Gore & Associates' fiber optic cable business in 2024 |

| Regulatory Environment | Permitting, deployment standards, data privacy | Streamlined regulations accelerate projects; data security mandates drive demand for robust solutions | Sweden's PTS actively involved in fiber policy; GDPR fines exceed €2.8 billion (early 2024) |

| Defense & Energy Spending | Government investment in critical infrastructure | Boosts demand for specialized, resilient fiber optic solutions | Global cybersecurity spending projected at $231 billion in 2024; NATO members increasing defense spending |

What is included in the product

This Hexatronic PESTLE analysis offers a comprehensive examination of the external macro-environmental forces influencing the company, broken down into Political, Economic, Social, Technological, Environmental, and Legal categories.

It provides actionable insights for strategic decision-making, highlighting potential threats and opportunities shaped by current market and regulatory landscapes.

Provides a concise version of the Hexatronic PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Global economic growth is a major driver for Hexatronic's business, particularly its investments in digital infrastructure like fiber optic networks. When economies are performing well, businesses and consumers tend to spend more on technology and connectivity, fueling demand for Hexatronic's solutions.

In 2024, the International Monetary Fund projected global growth at 3.2%, a steady rate that supports continued investment in digital infrastructure. This healthy economic environment encourages companies to expand their fiber optic networks to meet rising data demands and support digital transformation efforts across various sectors.

The trend towards increased digitalization, accelerated by events in recent years, means that robust economic conditions translate directly into greater demand for high-speed, reliable internet. Hexatronic is well-positioned to capitalize on this, as strong economic performance often correlates with increased enterprise spending on network upgrades and new deployments.

Rising interest rates, like those seen with the Federal Reserve's policy adjustments throughout 2023 and into early 2024, directly impact Hexatronic's Fiber Solutions market. Higher borrowing costs for network operators and their end customers can curb enthusiasm for new fiber optic deployments, a key growth driver for Hexatronic. For instance, if a telecom company's cost of capital increases significantly, their planned network expansion might be scaled back, impacting demand for Hexatronic's passive optical components and cabling.

This increased cost of financing translates into potential price sensitivity among buyers, forcing Hexatronic to navigate a more challenging pricing environment. Operators might delay projects or seek more cost-effective alternatives if financing becomes prohibitively expensive, directly affecting Hexatronic's revenue streams and market share in a competitive landscape. The overall economic climate, influenced by central bank policies aiming to control inflation, creates a direct link between macroeconomic interest rate trends and Hexatronic's operational and sales performance.

Fluctuations in raw material prices, such as copper and fiber optic components, directly influence Hexatronic's production expenses and overall profitability. For instance, the price of copper saw significant volatility in late 2023 and early 2024, impacting manufacturing costs across various industries.

Disruptions in global supply chains, as experienced during recent geopolitical events, can lead to delays and increased logistics costs for Hexatronic. These disruptions can affect the availability of essential components, forcing production adjustments and potentially impacting delivery timelines for their fiber optic solutions.

Hexatronic's strategic investment in a new US manufacturing facility is a key initiative to bolster its supply chain resilience. This move aims to reduce reliance on overseas production and mitigate risks associated with international shipping and potential trade barriers.

By enhancing local manufacturing capabilities, Hexatronic can achieve greater control over its production processes and potentially reduce lead times for North American customers. This localized approach is designed to create a more stable and predictable cost structure for their product offerings.

Market Competition and Price Pressure

The fiber optic market is quite competitive, and this often leads to customers demanding lower prices. We're seeing some competitors carrying excess inventory, which can exacerbate this price pressure. For Hexatronic, this means we really need to concentrate on bringing our costs down and becoming more efficient in our operations.

To stay profitable, Hexatronic must differentiate itself by highlighting its complete system solutions. This approach helps us stand out from competitors who might only offer individual components.

For instance, in 2024, increased supply chain efficiencies and strategic sourcing initiatives have been key focuses. Many players in the telecommunications infrastructure sector reported efforts to optimize inventory levels throughout the year.

Hexatronic's strategy involves not just selling fiber optic cables, but providing integrated systems that simplify deployment for customers. This value-added approach is crucial in a market where commoditization is a constant threat.

- Increased competition: The fiber optic market is characterized by numerous players, leading to intensified rivalry.

- Price sensitivity: Customers are increasingly sensitive to pricing due to overstock situations among some competitors.

- Cost reduction imperative: Hexatronic must prioritize cost efficiencies and operational streamlining to maintain margins.

- System differentiation: Offering comprehensive, integrated fiber optic solutions is vital for Hexatronic to stand out and command value.

Currency Exchange Rate Volatility

Currency exchange rate volatility poses a significant challenge for Hexatronic, a global player. Fluctuations in exchange rates can directly impact the company's reported financial results, particularly when translating revenues earned in foreign currencies into its reporting currency, likely SEK. For instance, a strengthening SEK against currencies where Hexatronic generates substantial sales could lead to lower reported revenues and profits.

The impact of currency movements is evident in Hexatronic's financial reporting. For example, during the first quarter of 2024, Hexatronic noted that currency headwinds had a negative effect on its reported sales and earnings. This underscores the importance of monitoring and managing currency exposure.

To navigate this, Hexatronic may employ hedging strategies to mitigate the risks associated with adverse currency movements. The company's exposure varies across different markets, with significant sales in regions like North America and Europe, each subject to distinct currency dynamics.

- Impact on Revenue: A stronger SEK can reduce the value of foreign currency sales when converted back to the reporting currency.

- Profitability Concerns: Exchange rate losses can directly eat into Hexatronic's profit margins.

- Reporting Challenges: Volatile exchange rates can make it difficult to provide consistent and predictable financial forecasts.

- Hedging Strategies: Hexatronic likely utilizes financial instruments to manage currency risks, though these can also incur costs.

Global economic growth directly fuels demand for Hexatronic's digital infrastructure solutions. The IMF projected global growth at 3.2% for 2024, indicating a stable environment that encourages investment in fiber optic networks and digital transformation. This positive economic outlook translates into increased spending on high-speed connectivity by both businesses and consumers.

However, rising interest rates, such as those implemented by the Federal Reserve through 2023 and into early 2024, increase borrowing costs for Hexatronic's customers. This can lead to scaled-back network expansion plans and heightened price sensitivity, impacting Hexatronic's revenue. For example, increased capital costs for telecom operators might delay new fiber deployments, affecting demand for Hexatronic's components.

Fluctuations in raw material prices, like copper, and supply chain disruptions can directly affect Hexatronic's production expenses and delivery timelines. Building a US manufacturing facility is a strategic move to enhance supply chain resilience and mitigate these risks, aiming for greater control over production and costs.

Currency exchange rate volatility, particularly with a strengthening SEK against major sales currencies like USD and EUR, can negatively impact Hexatronic's reported revenues and profits. The company likely employs hedging strategies to manage these risks, as seen with currency headwinds noted in Q1 2024 reporting.

| Economic Factor | Impact on Hexatronic | Supporting Data/Context (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for digital infrastructure (fiber optics). | IMF projected 3.2% global growth for 2024. |

| Interest Rates | Increases customer borrowing costs, potentially slowing network expansion. | Federal Reserve policy adjustments through 2023-2024. |

| Raw Material Prices | Affects production costs and profitability. | Volatility observed in copper prices late 2023/early 2024. |

| Currency Exchange Rates | Impacts reported revenue and profit due to translation effects. | Strengthening SEK in early 2024 noted as a headwind by Hexatronic. |

Preview Before You Purchase

Hexatronic PESTLE Analysis

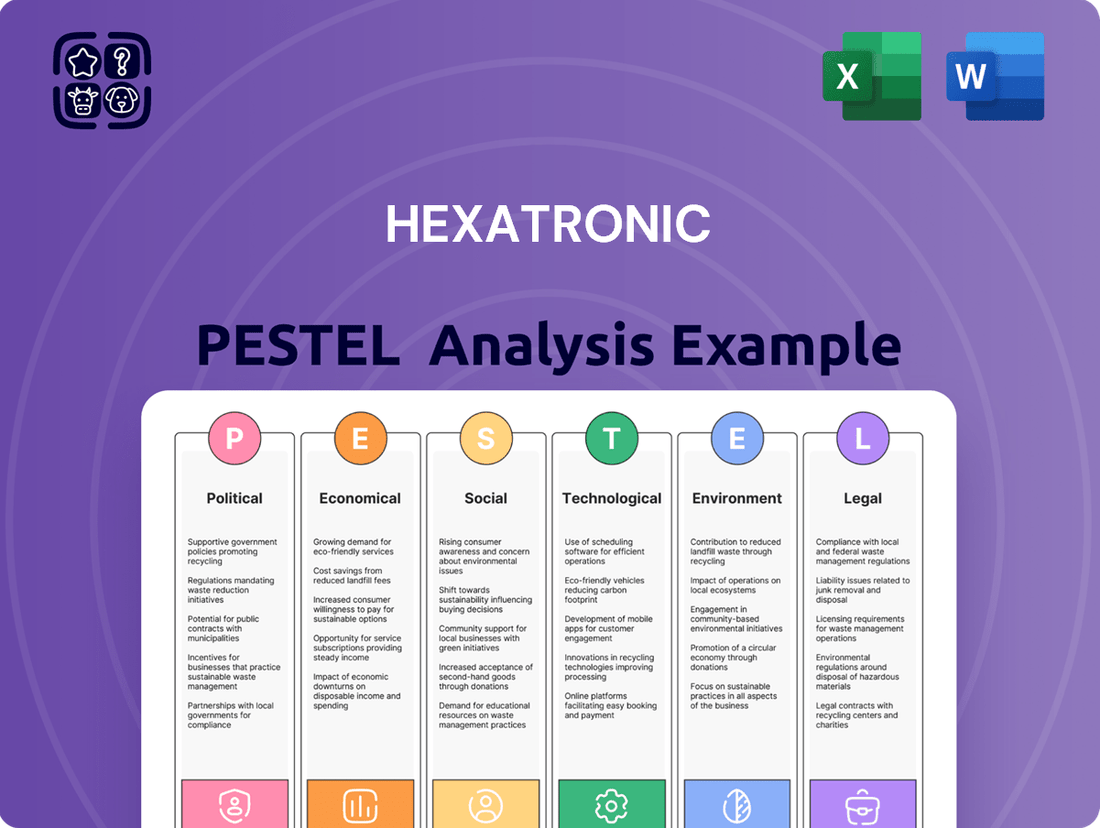

The preview shown here is the exact Hexatronic PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hexatronic.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive strategic overview.

The file you’re seeing now is the final version—ready to download right after purchase, offering actionable insights for Hexatronic's business strategy.

Sociological factors

Societal reliance on robust internet is surging, fueling demand for fiber optics. In 2024, the global fiber optic market was valued at approximately $55 billion, with projections indicating continued robust growth driven by these societal shifts. This increased need for high-speed connectivity, essential for remote work, online learning, and digital entertainment, directly supports Hexatronic's core business.

Global urbanization continues to accelerate, with projections indicating that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This trend directly fuels the growth of smart city initiatives, which rely heavily on advanced digital infrastructure. Hexatronic's fiber optic solutions are crucial for building these interconnected urban environments, supporting everything from smart grids to enhanced public services.

The demand for high-speed, reliable connectivity is paramount in smart cities. This translates to a significant market opportunity for fiber optics, as they are essential for the massive data flow required by smart transportation systems, IoT devices, and digital public safety networks. For instance, smart city projects often involve deploying thousands of sensors and cameras, all needing robust fiber backbones.

Government initiatives to close the digital divide are a significant sociological factor. For example, the US Broadband Equity, Access, and Deployment (BEAD) program, part of the Infrastructure Investment and Jobs Act, allocated $42.45 billion in 2024 for expanding high-speed internet access, particularly in rural and underserved communities. Hexatronic's fiber optic solutions are instrumental in supporting these crucial deployment efforts, directly contributing to greater digital inclusivity.

Workforce Skills and Talent Availability

The availability of skilled labor for fiber optic network design, installation, and maintenance is a critical factor for Hexatronic's growth and operational efficiency. A persistent shortage of qualified technicians and engineers can directly impede the pace of fiber deployment, leading to significant project delays. For instance, in late 2024, reports indicated a 15% year-over-year increase in demand for specialized telecommunications technicians across North America, outstripping the available supply.

This talent gap not only slows down projects but also drives up labor costs, impacting the overall profitability and competitiveness of fiber optic infrastructure companies. In 2025, average hourly wages for fiber optic technicians are projected to rise by an additional 8-10% due to these supply-demand imbalances. Hexatronic must actively invest in training and development programs to secure a robust pipeline of skilled professionals.

- Skilled Labor Demand: High demand for fiber optic technicians in 2024-2025.

- Talent Shortage Impact: Project delays and increased labor costs are prevalent.

- Wage Inflation: Expected 8-10% wage increase for technicians in 2025.

- Hexatronic's Strategy: Need for investment in workforce training and development.

Consumer Behavior and Data Consumption Growth

The ever-growing appetite for digital content, fueled by streaming services and immersive online experiences, is a significant sociological driver for Hexatronic. Consumers are increasingly reliant on high-speed, dependable internet connections to access everything from entertainment to essential communication tools. This trend directly translates into a sustained demand for robust fiber optic networks capable of handling massive data flows.

Data consumption per user is on a steep upward trajectory. By 2024, global mobile data traffic was projected to reach over 160 exabytes per month, a figure expected to more than double by 2029 according to Cisco's Annual Internet Report. This surge is largely attributed to the proliferation of the Internet of Things (IoT) devices and the increasing use of cloud-based applications by both individuals and enterprises, necessitating continuous upgrades in network infrastructure.

- Increased Data Demand: Global mobile data traffic is expected to exceed 160 exabytes per month by 2024, indicating a substantial need for bandwidth.

- IoT Proliferation: The expanding ecosystem of connected devices, from smart homes to industrial sensors, contributes significantly to overall data consumption.

- Cloud Adoption: Businesses and individuals are increasingly migrating to cloud services for storage, processing, and software, driving demand for reliable network access.

- Digital Lifestyle: Societal shifts towards online entertainment, remote work, and digital communication create a persistent need for high-performance internet infrastructure.

Societal reliance on robust internet is surging, fueling demand for fiber optics. In 2024, the global fiber optic market was valued at approximately $55 billion, with projections indicating continued robust growth driven by these societal shifts. This increased need for high-speed connectivity, essential for remote work, online learning, and digital entertainment, directly supports Hexatronic's core business.

Global urbanization continues to accelerate, with projections indicating that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This trend directly fuels the growth of smart city initiatives, which rely heavily on advanced digital infrastructure, requiring fiber optic solutions for data flow.

The demand for high-speed, reliable connectivity is paramount in smart cities, translating to a significant market opportunity for fiber optics. This is evident in smart city projects often involving the deployment of thousands of sensors and cameras, all needing robust fiber backbones for essential data transmission.

Government initiatives to close the digital divide are a significant sociological factor. For example, the US Broadband Equity, Access, and Deployment (BEAD) program allocated $42.45 billion in 2024 for expanding high-speed internet access, particularly in rural and underserved communities, where Hexatronic's solutions are instrumental.

Technological factors

Continuous innovation in fiber optic technology is a significant driver for companies like Hexatronic. Advancements in cable design, such as micro-cables, coupled with increasing transmission speeds and more efficient installation techniques, directly contribute to enhanced network performance and overall efficiency in telecommunications infrastructure. For instance, Hexatronic's Viper Ease micro cables are designed for faster and simpler installation, reducing deployment costs and time.

The ongoing global rollout of 5G mobile networks is a significant technological driver for Hexatronic. This expansion directly fuels demand for robust fiber optic backhaul infrastructure, essential for 5G's high speeds and low latency requirements. By 2024, over 300 million 5G connections were projected globally, a number expected to climb significantly by 2025, underscoring the growing need for Hexatronic's specialized fiber solutions.

Hexatronic's fiber optic products are crucial for connecting the dense network of small cells and base stations that characterize 5G deployments. As operators expand their 5G coverage, the intricate network of fiber optic cables required to support these sites represents a substantial market opportunity. The increasing investment in 5G infrastructure, estimated to reach hundreds of billions of dollars globally in the 2024-2025 period, directly translates to greater demand for Hexatronic's core offerings.

The exponential growth of data centers and the widespread adoption of cloud computing are creating a massive demand for robust, high-speed, and low-latency network infrastructure. This trend is particularly beneficial for companies like Hexatronic, whose core business revolves around fiber optic solutions essential for this connectivity. For instance, the global cloud computing market was valued at an estimated USD 600 billion in 2023 and is projected to grow significantly, underscoring the need for advanced networking capabilities.

Hexatronic's Data Center business unit is strategically aligned to meet this escalating demand. As data volumes skyrocket and the need for efficient data processing intensifies, the company is well-positioned to supply the critical fiber optic cabling and connectivity solutions that power these digital hubs. The increasing reliance on cloud services for everything from data storage to complex analytics directly translates into a greater requirement for the high-performance network components Hexatronic provides.

Artificial Intelligence (AI) Integration in Networks

Artificial intelligence is significantly transforming network operations, offering enhanced capabilities for real-time monitoring and predictive maintenance. This integration directly benefits companies like Hexatronic, which supply fiber optic network solutions, by boosting their reliability and scalability. For instance, AI can analyze vast amounts of network data to identify potential issues before they cause disruptions, a critical factor for the high-speed data transmission that fiber optics enable. The global AI market in telecommunications was projected to reach over $10 billion by 2024, highlighting the substantial investment and adoption of these technologies.

The application of AI in network management allows for more efficient resource allocation and automated fault detection. This technological push supports the growing demand for robust and high-performance networks, a key market for Hexatronic's offerings. By leveraging AI, network providers can achieve greater operational efficiency and improve customer experience through more stable connectivity. Studies in 2024 indicated that AI-driven network optimization can reduce downtime by up to 30% and improve network performance by 15-20%.

Hexatronic’s solutions are well-positioned to capitalize on the AI integration trend in networking. The increasing complexity and data traffic within modern networks necessitate intelligent management systems, which AI provides. This technological synergy enhances the value proposition of fiber optic infrastructure, ensuring it can meet future demands for speed and reliability. The continuous advancements in AI algorithms are expected to further refine network diagnostics and management capabilities throughout 2025.

Key technological factors driving AI integration in networks include:

- Advancements in machine learning algorithms enabling sophisticated pattern recognition for network anomalies.

- Increased availability of big data from network traffic, crucial for training AI models.

- Development of edge computing capabilities allowing AI processing closer to network devices for faster response times.

- Growth in 5G and IoT deployments, creating a larger and more complex network environment requiring AI for efficient management.

Development of Specialized Cable Solutions

The demand for specialized fiber optic cables, particularly for harsh or demanding environments like defense, energy infrastructure, and subsea installations, is a significant technological driver. This need pushes advancements in material science and intricate cable design to ensure durability and signal integrity under extreme conditions. Hexatronic's strategic focus on its Harsh Environment segment directly caters to this specialized market, offering solutions engineered for resilience and reliability in these challenging sectors. For instance, the increasing deployment of offshore wind farms and the ongoing modernization of military communication networks in 2024 and 2025 underscore the growing importance of these robust cable technologies.

These specialized solutions are critical for maintaining high-speed data transmission and network stability where conventional cables would fail. The innovation in this area is not just about physical protection but also about developing cables that can withstand extreme temperatures, high pressure, corrosive elements, and electromagnetic interference. Hexatronic's commitment to this niche is reflected in its product development pipeline, focusing on advanced materials and manufacturing processes to meet stringent industry standards. The global market for harsh environment fiber optic cables is projected to see substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 7% from 2023 to 2028, reaching billions in value by the end of the forecast period.

- Innovation in Material Science: Development of new polymers and protective jacketing to withstand extreme temperatures and chemical exposure.

- Advanced Cable Design: Engineering for high tensile strength, crush resistance, and flexibility in subsea and tactical applications.

- Market Growth Drivers: Increased investment in renewable energy infrastructure (e.g., offshore wind), defense modernization programs, and expansion of communication networks in remote or challenging terrains.

- Hexatronic's Niche: Focus on providing reliable, high-performance fiber optic solutions for sectors with critical uptime requirements and harsh operational conditions.

Technological advancements in fiber optic technology, such as Hexatronic's micro-cables, are crucial for improving network efficiency and reducing installation costs. The global expansion of 5G networks, projected to exceed 300 million connections by 2024 and continue growing, directly fuels the demand for Hexatronic's high-performance fiber optic backhaul solutions. This growth is further amplified by the booming data center and cloud computing markets, which saw the global cloud computing market valued at an estimated USD 600 billion in 2023, requiring robust networking infrastructure.

The integration of Artificial Intelligence in network management, with the AI in telecommunications market projected to surpass $10 billion by 2024, enhances network reliability and scalability, benefiting Hexatronic's offerings. AI-driven network optimization can reportedly reduce downtime by up to 30% as of 2024, making robust fiber optic networks even more vital. Hexatronic's solutions are positioned to leverage these AI advancements, ensuring their fiber optic infrastructure meets the increasing demands for speed and dependability in complex networks throughout 2025.

Specialized fiber optic cables for harsh environments represent a significant technological driver, with the market for these cables projected for substantial growth. Increased investment in renewable energy and defense modernization in 2024-2025 highlights the need for durable, high-performance solutions. Hexatronic's focus on these demanding sectors, where uptime is critical, aligns with this trend, driven by innovations in material science and cable design for extreme conditions.

Legal factors

Telecommunications regulations and licensing are critical legal factors impacting Hexatronic's operations. Strict requirements in many countries dictate market entry and the scope of business activities, necessitating careful navigation of diverse legal landscapes. For instance, obtaining the necessary licenses can be a lengthy and complex process, directly affecting time-to-market for new products and services.

Compliance with these evolving legal frameworks is paramount for Hexatronic to conduct business and expand internationally without facing penalties or operational disruptions. Failure to adhere to licensing agreements or regulatory standards could lead to significant fines or the revocation of operating permits, impacting revenue streams and market presence. As of early 2025, the global telecommunications sector continues to see regulatory shifts, particularly concerning data privacy and network security, requiring ongoing legal vigilance from companies like Hexatronic.

Data privacy and security laws are increasingly shaping the technology landscape. Regulations like the General Data Protection Regulation (GDPR) and emerging cybersecurity mandates place significant obligations on companies to safeguard sensitive information within their network infrastructure. Hexatronic's focus on secure fiber optic solutions is a direct response to these evolving legal requirements, providing a foundation for robust data protection.

The financial implications of non-compliance are substantial. For instance, under GDPR, fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. This underscores the critical need for solutions that facilitate adherence to these stringent legal frameworks, a need Hexatronic's offerings are designed to meet.

Hexatronic's fiber optic components and systems must meet stringent international and national product safety and quality standards. This includes adhering to regulations like those set by the International Electrotechnical Commission (IEC) for optical fiber communication systems and national standards bodies such as ANSI in the United States. For instance, the IEC 60794 series specifies requirements for optical fiber cables, ensuring their durability and performance in various environments.

Compliance with these standards is critical for Hexatronic to guarantee product reliability and prevent potential failures in critical infrastructure. Failing to meet these benchmarks, such as incorrect attenuation values or connector integrity as outlined in IEC standards, could lead to service disruptions. In 2024, the global market for fiber optic connectors alone was valued at approximately $6.5 billion, with quality and standardization being key purchasing drivers.

Adhering to these quality benchmarks significantly reduces Hexatronic's liability risks, particularly in sectors like telecommunications and data centers where network uptime is paramount. Product recalls or failures due to non-compliance can result in substantial financial penalties and reputational damage. Maintaining high quality also builds and sustains customer trust, a vital asset in a competitive market where performance and dependability are non-negotiable.

Labor Laws and Employment Regulations

Hexatronic, operating globally, navigates a complex web of labor laws and employment regulations. These vary significantly by country, impacting everything from minimum wage requirements and working hours to termination procedures and employee benefits. For instance, in 2024, many European nations continued to see shifts in employment legislation, often aimed at improving work-life balance and employee protections, which could necessitate adjustments in Hexatronic's staffing models and associated costs.

Changes in these regulations can directly affect operational efficiency and strategic planning. The Broadband Equity, Access, and Deployment (BEAD) program in the United States, for example, while driving demand for Hexatronic's fiber optic solutions, also brings with it specific labor requirements and potential for increased labor costs due to demand for skilled workers in deployment. In 2023, the U.S. Bureau of Labor Statistics reported that employment in telecommunications installation was projected to grow 4% from 2022 to 2032, a rate faster than the average for all occupations, indicating potential wage pressures.

- Global Compliance: Hexatronic must adhere to diverse national labor laws concerning wages, working conditions, and fair employment practices.

- Regulatory Impact: Evolving labor laws can influence operational expenses and strategic workforce management.

- Skilled Labor Demand: Initiatives like the BEAD program can intensify competition for skilled labor, potentially driving up wages.

- Workforce Trends: A projected 4% growth in U.S. telecommunications installation jobs by 2032 suggests a tightening labor market.

Intellectual Property Rights and Patents

Hexatronic's ability to protect its intellectual property and navigate patent laws is fundamental to its success in developing new technologies. This involves both securing its own groundbreaking innovations and ensuring it doesn't infringe on existing patents held by competitors. For instance, in the telecommunications sector, where Hexatronic operates, patent disputes can be costly and disruptive, impacting market access and product launches. The company's R&D investments, which reached SEK 201 million in 2023, underscore the importance of this legal framework for safeguarding future revenue streams.

The company must actively manage its patent portfolio to maintain a competitive edge. This includes filing new patents for its advancements and carefully monitoring the intellectual property landscape to avoid potential legal challenges. A robust IP strategy is essential for Hexatronic to monetize its innovations and prevent others from freely exploiting its technological breakthroughs. Failure to do so could lead to significant financial losses and damage to its market reputation.

- Patent Filings: Hexatronic's commitment to innovation is reflected in its ongoing patent applications, which are crucial for protecting its proprietary technologies in fiber optic solutions.

- Freedom to Operate: Thorough analysis of existing patents is vital to ensure Hexatronic products do not infringe on third-party intellectual property, preventing costly litigation.

- Licensing Agreements: Strategic licensing of its own patents can create new revenue opportunities, while judiciously licensing others' IP can accelerate product development.

- Global IP Strategy: Protecting intellectual property across key international markets is essential, given Hexatronic's global presence and the varied patent laws in different regions.

Hexatronic's operations are significantly influenced by competition law, ensuring fair market practices and preventing monopolistic behavior. Adherence to antitrust regulations is crucial, especially in the consolidated telecommunications infrastructure sector. For instance, mergers and acquisitions by competitors or Hexatronic itself are subject to review by regulatory bodies to ensure they do not unduly stifle competition.

Contract law forms the backbone of Hexatronic's business relationships, governing agreements with suppliers, customers, and partners. Ensuring these contracts are legally sound and enforceable is vital for managing risks and ensuring smooth project execution. As of early 2025, the global demand for high-speed internet, fueled by initiatives like the European Digital Decade targets, means that Hexatronic's contractual agreements for fiber deployment are critical for its growth trajectory.

| Legal Factor | Description | Impact on Hexatronic | 2024/2025 Relevance |

|---|---|---|---|

| Competition Law | Regulations preventing anti-competitive practices. | Ensures fair market access; M&A activities are scrutinized. | Consolidation in telecom infrastructure requires vigilance. |

| Contract Law | Governs business agreements (suppliers, customers). | Essential for risk management and project execution. | Critical for fiber deployment contracts driven by digital initiatives. |

Environmental factors

The growing global emphasis on sustainability and mitigating climate change is a significant driver for Hexatronic. This trend directly boosts demand for their fiber optic solutions, as these are inherently more energy-efficient than traditional copper infrastructure. Customers increasingly seek suppliers with strong environmental credentials, making Hexatronic's commitment to green practices a competitive advantage.

Hexatronic has publicly committed to science-based targets for greenhouse gas (GHG) emission reductions. Their ambition is to achieve climate neutrality, a goal that resonates strongly with both their customer base and evolving regulatory landscapes. This proactive stance demonstrates their dedication to responsible operations and aligns with the broader shift towards a low-carbon economy.

In 2023, Hexatronic reported a 14% reduction in Scope 1 and 2 GHG emissions compared to their 2021 baseline, underscoring their progress towards their climate targets. This achievement is crucial as companies worldwide, including Hexatronic's key clients in the telecommunications and data center sectors, are facing mounting pressure to decarbonize their operations and supply chains.

Hexatronic's commitment to resource efficiency and circular economy principles significantly shapes its manufacturing and product development. The company actively pursues strategies to minimize waste and incorporate recycled materials, aligning with growing global environmental regulations and consumer demand. For instance, in 2023, Hexatronic reported a continued focus on optimizing production to reduce material consumption, contributing to their sustainability targets.

Hexatronic's manufacturing operations and expansive network infrastructure inherently demand significant energy. This consumption presents an environmental challenge that the company actively addresses. For instance, in 2023, Hexatronic reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 28% compared to 2022, highlighting progress in energy management.

The company is strategically increasing its reliance on climate-neutral energy sources across its facilities. Simultaneously, Hexatronic is implementing measures to enhance overall energy efficiency. These initiatives are crucial for minimizing its carbon footprint and aligning with growing global demands for sustainable business practices.

Environmental Regulations and Compliance

Hexatronic's commitment to environmental stewardship is underscored by its mandatory compliance with a range of environmental regulations. These cover critical areas such as emissions control, the management of hazardous substances, and responsible waste disposal, all of which are essential for maintaining operational legality and minimizing ecological impact.

Adherence to international standards like ISO 14001, a framework for environmental management systems, further solidifies Hexatronic's dedication to sustainable practices. This certification not only signals their proactive approach to environmental responsibility but also often serves as a competitive advantage in an increasingly eco-conscious market.

For instance, in 2024, Hexatronic reported that its environmental initiatives contributed to a 5% reduction in energy consumption across its manufacturing facilities. This aligns with broader industry trends where companies are actively seeking to lower their carbon footprint.

Key aspects of Hexatronic's environmental compliance include:

- Emissions Management: Strict adherence to air and water quality standards.

- Hazardous Substance Control: Compliance with regulations like REACH and RoHS.

- Waste Reduction and Recycling: Implementing strategies to minimize landfill waste and maximize material reuse.

- Environmental Management Systems: Maintaining certifications such as ISO 14001 to ensure continuous improvement.

E-waste Management and Product Lifecycle

The increasing volume of electronic waste (e-waste) from retired network components presents a significant environmental challenge. Hexatronic's commitment to eco-design and product durability directly tackles this by aiming to extend the usable life of its products, thereby reducing the frequency of disposal and the subsequent generation of e-waste. For instance, the global e-waste generation reached 62.4 million tonnes in 2022, a 13.2% increase from 2014, highlighting the urgency of responsible management strategies.

Hexatronic's approach considers the entire product lifecycle, from material sourcing and manufacturing to end-of-life management. This holistic view ensures that environmental impact is minimized at every stage. The company's efforts in developing more sustainable product designs contribute to a circular economy model within the telecommunications sector.

Key aspects of Hexatronic's environmental strategy include:

- Eco-design principles: Incorporating environmental considerations into the initial design phase of products to minimize resource use and potential hazards.

- Product durability and longevity: Developing robust and long-lasting network components to reduce the need for premature replacement.

- Materials selection: Prioritizing the use of recycled and recyclable materials in product manufacturing.

- End-of-life solutions: Exploring and implementing responsible methods for managing products at the end of their service life, potentially through take-back programs or partnerships for recycling.

Hexatronic is actively managing its environmental footprint, driven by global sustainability trends and regulatory pressures. The company has set ambitious science-based targets for GHG emission reductions, aiming for climate neutrality. In 2023, Hexatronic reported a notable 14% reduction in Scope 1 and 2 GHG emissions compared to their 2021 baseline, demonstrating tangible progress.

The company's operational efficiency is also evident in its energy consumption. In 2024, Hexatronic achieved a 5% reduction in energy consumption across its manufacturing facilities due to its environmental initiatives. This focus on energy efficiency and the increasing use of climate-neutral energy sources are central to minimizing their carbon footprint.

Furthermore, Hexatronic is committed to resource efficiency and minimizing waste, incorporating recycled materials and adhering to eco-design principles to combat the growing issue of electronic waste. Their dedication is reinforced by compliance with environmental regulations and certifications like ISO 14001, ensuring responsible operations throughout the product lifecycle.

| Environmental Metric | 2023 Data | 2024 Target/Progress | Relevance to Hexatronic |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 14% (vs. 2021 baseline) | Continued reduction | Demonstrates commitment to climate neutrality and operational efficiency. |

| Energy Consumption Reduction (Manufacturing) | Not specified | 5% reduction | Highlights focus on operational efficiency and cost savings. |

| E-waste Generation | Global e-waste reached 62.4 million tonnes in 2022 | Focus on eco-design and product longevity | Addresses a critical environmental challenge and enhances product lifecycle management. |

PESTLE Analysis Data Sources

Our Hexatronic PESTLE analysis draws from a robust blend of official government publications, reputable financial news outlets, and leading market research firms. This ensures that our assessment of political, economic, social, technological, legal, and environmental factors is grounded in current and authoritative information.