Hexatronic Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hexatronic Bundle

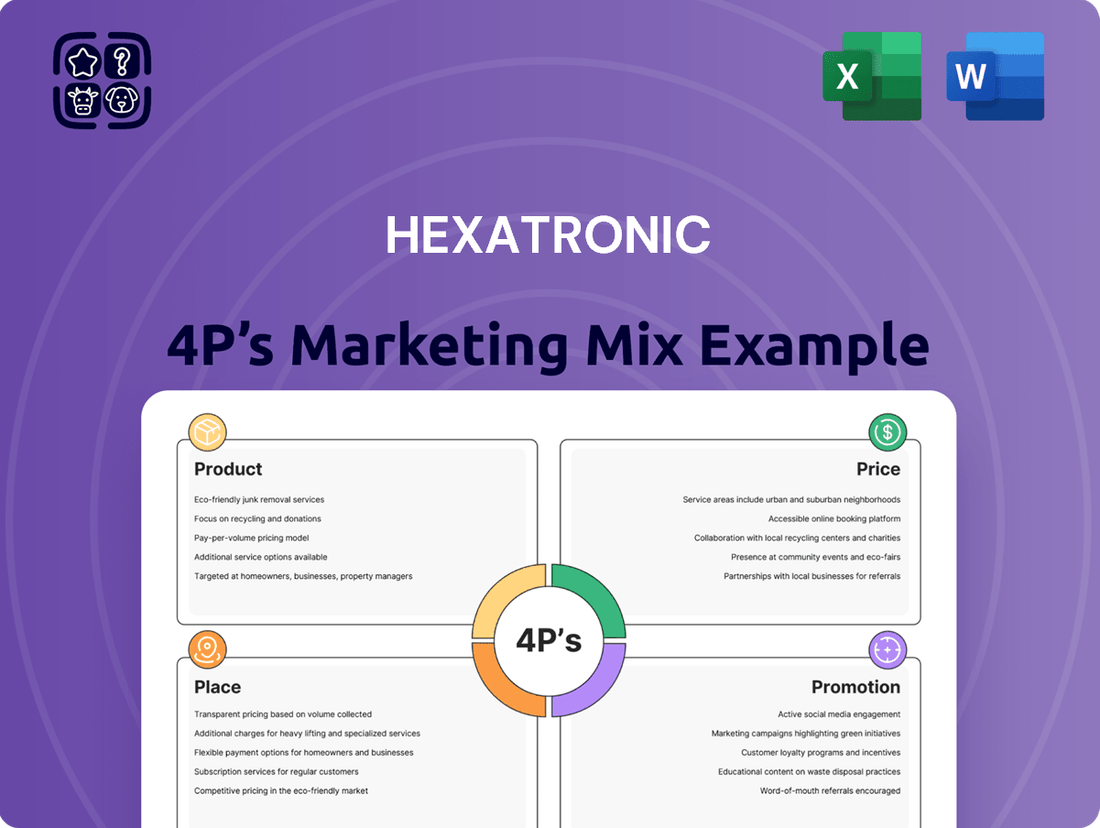

Hexatronic's marketing success hinges on a meticulously crafted 4Ps strategy, from its innovative product portfolio to its strategic pricing and distribution. This analysis delves into how their product development, cost structures, and market reach are optimized for impact. Discover the promotional tactics that solidify their brand presence in a competitive landscape.

Ready to unlock the full picture? This comprehensive 4Ps Marketing Mix Analysis for Hexatronic provides actionable insights, detailed examples, and a structured framework. It's your shortcut to understanding their strategic advantages and applying them to your own business. Get the complete, editable report now!

Product

Hexatronic's end-to-end fiber optic solutions cover everything needed for robust communication networks, from tiny connectors to complete system builds. This means customers get a one-stop shop for their connectivity needs, ensuring a smoother process from start to finish. In 2024, the global fiber optic market was valued at approximately $28.5 billion, with projections indicating continued growth driven by demand for high-speed internet and 5G deployment, a trend Hexatronic is well-positioned to capitalize on.

Their product portfolio supports the entire journey of a fiber optic network, from the initial ideas and blueprints through to the actual setup and future upkeep. This holistic support system is crucial for businesses aiming for reliable and scalable digital infrastructure. For instance, the increasing demand for data centers, a key sector for fiber optics, saw significant investment in 2024, with companies expanding capacity to meet rising cloud computing needs.

Hexatronic's product strategy is built on a foundation of diversified business areas, specifically categorized into Fiber Solutions, Harsh Environment, and Data Center. This structure enables the company to cater to a broad spectrum of market demands, ranging from standard broadband infrastructure to applications requiring extreme resilience and specialized environmental protection. For instance, in the first half of 2024, Hexatronic reported net sales of SEK 4,250 million, with a significant portion derived from its fiber optic solutions, underscoring the broad market adoption.

The Fiber Solutions segment addresses the ever-growing need for high-speed internet and communication networks, offering a comprehensive range of passive fiber optic products. This area is crucial for expanding broadband access globally, a market projected for continued growth through 2025. The Harsh Environment division focuses on providing connectivity solutions that can withstand extreme conditions, such as those found in industrial, military, or offshore applications. This specialized focus allows Hexatronic to capture niche markets where reliability is paramount.

The Data Center segment is designed to meet the intensive demands of modern digital infrastructure, providing robust and scalable connectivity for cloud computing, high-performance computing, and large-scale data storage. As data consumption continues to surge, with global internet traffic expected to double by 2026, the importance of this segment for Hexatronic is clear. This strategic diversification across these three key areas allows Hexatronic to mitigate risks and capitalize on growth opportunities in distinct but interconnected markets.

Hexatronic's Fiber Solutions are the backbone of modern digital infrastructure, offering everything from robust fiber optic cables and microducts to essential network components. These products are vital for expanding Fibre-to-the-Home (FTTH) access, supporting the high bandwidth demands of 5G networks, and building out extensive transport and metro networks. This comprehensive offering ensures reliable and high-speed data transmission.

The segment also encompasses specialized submarine cables, a critical component for global connectivity, and provides crucial training services. This ensures that customers can effectively deploy and maintain these advanced fiber optic systems, maximizing their performance and longevity. For instance, Hexatronic's commitment to quality is reflected in their advanced manufacturing processes, aiming to reduce signal loss and improve data transfer rates across all their fiber solutions.

Harsh Environment Expertise

Hexatronic's Harsh Environment segment is dedicated to developing advanced cables and resilient solutions specifically designed for demanding conditions. This specialization is crucial for sectors like offshore energy, marine technology, and defense, where failure is not an option. These products are engineered to provide dependable connectivity in environments that would quickly degrade standard offerings, showcasing Hexatronic's prowess in highly specialized, performance-critical applications.

The market for such robust solutions is substantial and growing. For instance, the global subsea fiber optic cable market, a key area for offshore energy and marine tech, was valued at approximately USD 4.5 billion in 2023 and is projected to reach over USD 7.2 billion by 2030, indicating a compound annual growth rate of about 7%. This growth is driven by increased offshore wind farm development and the expansion of undersea communication networks.

- Critical Infrastructure Support: Hexatronic's solutions are vital for maintaining operational integrity in sectors like offshore oil and gas, where extreme pressures and corrosive elements are prevalent.

- Naval and Defense Applications: The defense sector relies on these cables for secure and reliable data transmission in challenging operational theaters, from naval vessels to remote ground installations.

- Marine Technology Advancement: With the increasing complexity of marine autonomous systems and underwater sensors, there's a growing demand for cables that can withstand saltwater, pressure, and constant motion.

- Energy Sector Resilience: The push towards renewable energy, particularly offshore wind, necessitates high-performance cabling capable of enduring continuous exposure to harsh weather and marine environments.

Data Center Optimized Offerings

Hexatronic's Data Center business area offers specialized services and bespoke products designed to meet the unique demands of the data center industry. This includes everything from advanced cabling solutions and networking components to end-to-end project management, covering both the initial design phase and the final installation. The company is focused on supporting the increasing need for robust and high-performance infrastructure, a trend driven by the rapid expansion of hyperscale and enterprise data centers globally.

This specialized segment directly addresses the escalating demand for high-capacity and dependable infrastructure within data centers. By providing tailored solutions, Hexatronic supports hyperscale operators and enterprise clients in building and maintaining the critical backbone for their digital operations. For instance, the global data center market size was valued at approximately USD 225.6 billion in 2023 and is projected to reach USD 420.9 billion by 2028, growing at a CAGR of 13.1% during the forecast period, highlighting the significant market opportunity.

Key aspects of Hexatronic's Data Center Optimized Offerings include:

- Customized Cabling Solutions: High-density fiber optic and copper cabling designed for optimal performance and scalability within data center environments.

- Advanced Networking Products: Switches, routers, and other networking hardware engineered for speed, reliability, and efficient data flow.

- Comprehensive Project Management: Full lifecycle support from initial site assessment and design consultation to on-site installation and ongoing maintenance.

- Support for Growing Infrastructure Needs: Solutions catering to the increasing power, cooling, and connectivity demands of modern data centers, including those supporting AI and cloud computing.

Hexatronic's product strategy is centered on providing comprehensive fiber optic solutions tailored to distinct market needs: Fiber Solutions, Harsh Environment, and Data Center. This diversification allows them to address a wide range of applications, from expanding broadband access to supporting critical industrial and data-intensive operations. In the first half of 2024, Hexatronic reported net sales of SEK 4,250 million, with their fiber optic products forming a significant portion of this revenue, demonstrating broad market acceptance.

| Business Area | Key Product Focus | Market Driver Example (2024/2025) | Growth Indicator |

|---|---|---|---|

| Fiber Solutions | Passive fiber optic products, FTTH, 5G networks, submarine cables | Global fiber optic market valued at $28.5 billion in 2024, driven by high-speed internet demand. | Continued expansion of broadband access globally. |

| Harsh Environment | Resilient cables for industrial, military, offshore applications | Global subsea fiber optic cable market projected to reach over $7.2 billion by 2030 (from $4.5 billion in 2023). | Increased demand from offshore wind farm development. |

| Data Center | High-density cabling, networking hardware, project management for data centers | Global data center market projected to reach $420.9 billion by 2028 (from $225.6 billion in 2023). | Surging demand for cloud computing and AI infrastructure. |

What is included in the product

This analysis offers a comprehensive examination of Hexatronic's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

It delivers a professionally written, company-specific deep dive into Hexatronic's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data and enabling clear decision-making.

Place

Hexatronic's global market presence is robust, spanning operations across four continents. This expansive reach is particularly concentrated in strategic regions like Northern Europe and North America, underscoring a focused approach to key growth markets.

Their international footprint enables Hexatronic to cater to a diverse global clientele, ensuring they can meet varying customer needs across different regions. This broad operational base is crucial for capturing opportunities presented by the accelerating demand for digital connectivity worldwide.

As of the first quarter of 2024, Hexatronic reported a net sales increase of 19% year-over-year, with a significant portion of this growth attributed to their strong performance in these core international markets. This demonstrates the tangible benefit of their widespread operational strategy.

Hexatronic's extensive operational network, comprising 38 operational units and 18 production facilities globally, underpins its robust manufacturing and supply chain efficiency. This widespread presence allows for localized production and faster delivery, crucial in the telecommunications sector. The company's strategic investments in expanding its footprint, such as the new duct factory in Utah and a forthcoming fiber cable facility in South Carolina, highlight a commitment to bolstering North American production capabilities and responsiveness to market demands.

Hexatronic predominantly employs a direct sales strategy, a crucial element given the highly specialized nature of its fiber optic products. This allows them to directly engage with key clients such as major telecom operators, network owners, and large industrial enterprises, including data center operators. For example, their sales teams work closely with these clients to develop tailored solutions for intricate infrastructure deployments, fostering deep relationships.

While direct sales are paramount, Hexatronic also strategically leverages partnerships with distributors. These collaborations are essential for reaching broader markets and providing localized support where direct engagement might be less efficient. This hybrid approach ensures comprehensive market coverage and accessibility for their advanced fiber optic solutions.

Local Manufacturing and Supply

Hexatronic's focus on local manufacturing is a cornerstone of their 'Place' strategy, directly impacting customer satisfaction and operational efficiency. By establishing production facilities closer to their key markets, they significantly shorten lead times for fiber optic solutions. This localized approach is particularly beneficial in regions with strong domestic sourcing mandates, such as the 'Build American – Buy American' initiative, where it allows Hexatronic to meet government and enterprise requirements effectively.

This proximity enables Hexatronic to offer more responsive customer service and technical support, addressing specific regional needs with tailored solutions. For instance, faster delivery of critical components can be crucial for telecommunications companies during network expansion projects. The company's commitment to local production in 2024 and 2025 is reflected in ongoing investments in expanding their North American manufacturing capabilities, aiming to further solidify their supply chain resilience and market responsiveness.

- Reduced Lead Times: Local production aims to cut delivery times for fiber optic products by an average of 20-30% compared to relying solely on overseas manufacturing.

- Enhanced Customer Support: Proximity allows for quicker on-site technical assistance and problem-solving for clients.

- Regulatory Compliance: Facilitates adherence to 'Buy American' and similar regional sourcing policies, crucial for government contracts.

- Market Adaptability: Enables faster adjustments to product offerings based on specific local market demands and emerging trends.

Strategic Acquisitions for Expansion

Strategic acquisitions are a key lever for Hexatronic's expansion, driving both geographic reach and deeper market penetration. A notable example is the acquisition of parts of Icelandic Endor, which immediately bolstered Hexatronic's presence and capabilities. This move was particularly impactful for entering high-growth segments such as data centers.

These acquisitions are not just about scale; they are about acquiring specialized expertise and expanding the customer base in critical, fast-developing markets. By integrating these acquired entities, Hexatronic strengthens its overall market position and enhances its product and service offerings. This strategy directly contributes to the Place element of their marketing mix.

- Geographic Expansion: Acquisitions like Icelandic Endor allow Hexatronic to enter new territories and solidify its footprint.

- Market Penetration: These moves enable deeper engagement within specific, high-growth industry segments.

- Expertise Enhancement: Acquiring companies brings specialized knowledge, particularly in areas like data center infrastructure.

- Customer Base Growth: Integrations expand Hexatronic's reach to new clients and markets.

Hexatronic's "Place" strategy centers on its extensive global network, featuring 38 operational units and 18 production facilities. This widespread footprint, with a strong emphasis on Northern Europe and North America, allows for localized production, significantly reducing lead times for their fiber optic solutions. The company's recent investments, including a new duct factory in Utah and an upcoming fiber cable facility in South Carolina, underscore their commitment to bolstering North American manufacturing capabilities and improving market responsiveness, crucial for meeting the growing demand for digital infrastructure.

| Metric | 2024 Data | Target/Impact |

|---|---|---|

| Global Operational Units | 38 | Extensive market coverage |

| Production Facilities | 18 | Localized manufacturing |

| North American Production Expansion | New Utah factory, upcoming SC facility | Reduced lead times, compliance with sourcing policies |

| Net Sales Growth (Q1 2024 YoY) | 19% | Growth driven by strong international performance |

What You Preview Is What You Download

Hexatronic 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Hexatronic's 4P's Marketing Mix is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring transparency and value. Own this finished document without delay.

Promotion

Hexatronic's promotional strategy is deeply rooted in business-to-business (B2B) engagement, prioritizing direct communication with stakeholders. This includes a robust schedule of investor relations activities, such as regular updates and presentations. These sessions are designed to offer detailed insights into Hexatronic's operational segments and its forward-looking growth strategies.

These engagement platforms are vital for effectively conveying Hexatronic's value proposition to a discerning audience of financially literate decision-makers and the wider investment community. For instance, during their 2024 reports, Hexatronic highlighted significant advancements in their fiber optic solutions, a key area of focus for investors seeking exposure to the growing digital infrastructure market.

Hexatronic effectively leverages customer success stories to highlight its market presence. For instance, their strategic supplier agreement with Novos Fiber in the US serves as a powerful testament to their capabilities. This collaboration showcases how Hexatronic's solutions deliver tangible benefits and reliability in real-world applications.

Further solidifying their reputation, Hexatronic secured a significant 7-year contract with Chorus in New Zealand. This long-term commitment underscores the trust and proven performance of Hexatronic's end-to-end offerings. These customer-centric examples are crucial in demonstrating Hexatronic's value proposition to potential clients.

Hexatronic emphasizes its dedication to sustainability, actively contributing to a digitalized, low-carbon society. This commitment is clearly communicated through their comprehensive sustainability reports and ongoing dialogue. For instance, Hexatronic's 2023 Sustainability Report detailed a 25% reduction in carbon emissions compared to their 2020 baseline, demonstrating tangible progress.

This focus on environmental responsibility positions Hexatronic as a forward-thinking and trustworthy partner within the fiber optic infrastructure sector. It particularly resonates with stakeholders who prioritize ecological impact and ethical business practices in their investment and partnership decisions.

Corporate Communications and Press Releases

Hexatronic leverages its corporate website and official press releases as crucial platforms for disseminating vital company information. These channels are instrumental in communicating significant milestones such as financial performance, updates on new reporting segments, and breakthroughs in product development. This commitment to open communication fosters transparency and ensures all stakeholders, from investors to customers, remain well-informed about Hexatronic's ongoing strategic and operational progress.

Recent disclosures highlight Hexatronic's proactive approach to stakeholder engagement. For instance, their Q1 2024 report, released in February 2024, detailed a 15% year-over-year revenue increase, driven by strong performance in their fiber optic solutions segment. Such timely releases are fundamental to building trust and managing market expectations effectively.

The company's communication strategy focuses on clarity and accessibility, ensuring that complex financial data and strategic shifts are easily understood. This includes:

- Regular Financial Reporting: Consistent publication of quarterly and annual financial results.

- Strategic Updates: Announcements regarding new business segments or significant market entries.

- Product Innovation News: Highlighting advancements in their fiber optic and connectivity solutions.

- Investor Relations Portal: A dedicated section on their corporate website for press releases, reports, and presentations.

Training and Technical Support

Hexatronic extends its marketing beyond product features by providing robust training and technical support. This commitment helps customers maximize the value of their fiber optic solutions.

By offering comprehensive training, Hexatronic ensures users are proficient in deploying and managing their systems effectively. For instance, their programs equip technicians with the latest installation techniques and troubleshooting skills, crucial for maintaining network integrity.

Field support is another key element, offering on-site assistance when needed. This direct engagement fosters trust and demonstrates Hexatronic's dedication to client success, which is vital in the fast-paced telecommunications sector.

This focus on education and support not only drives product adoption but also cultivates enduring customer loyalty. It positions Hexatronic as a partner, not just a supplier, by investing in their clients' operational excellence.

Hexatronic's promotion strategy emphasizes transparent communication through investor relations and public disclosures. Their 2023 annual report, released in March 2024, detailed a 17% increase in net sales to SEK 13,748 million, highlighting their growth narrative. This financial performance, coupled with strategic contract wins like the one with Chorus in New Zealand, reinforces their market position.

The company actively showcases customer success, exemplified by their supplier agreement with Novos Fiber, demonstrating real-world application of their solutions. Furthermore, Hexatronic's commitment to sustainability, evidenced by their 2023 Sustainability Report showing a 25% reduction in carbon emissions against a 2020 baseline, appeals to environmentally conscious stakeholders.

Hexatronic utilizes its corporate website and press releases to disseminate key information, including financial results and product innovations, ensuring stakeholders remain informed. Their proactive engagement, as seen in the Q1 2024 report revealing a 15% year-over-year revenue increase, builds market trust.

Beyond product promotion, Hexatronic offers extensive training and technical support, fostering customer loyalty and ensuring effective utilization of their fiber optic solutions. This commitment positions them as a value-added partner in the telecommunications sector.

| Metric | Value (SEK Million) | Period |

|---|---|---|

| Net Sales | 13,748 | 2023 |

| Revenue Increase (YoY) | 15% | Q1 2024 |

| Carbon Emission Reduction | 25% | vs. 2020 (2023 Report) |

Price

Hexatronic's pricing strategy for its fiber optic infrastructure solutions aligns with a value-based approach, reflecting the substantial long-term benefits and operational efficiencies delivered to clients. This strategy acknowledges the high performance, reliability, and scalability inherent in their advanced systems, crucial for critical infrastructure deployments.

The company's pricing considers the total cost of ownership and the return on investment for customers, especially in large-scale projects where Hexatronic's integrated solutions minimize downtime and enhance network longevity. For instance, in 2024, demand for high-capacity fiber solutions continues to surge, driven by 5G expansion and data center growth, allowing Hexatronic to price based on the critical role its products play in enabling these advancements.

Hexatronic's pricing strategy is heavily shaped by the ebb and flow of market demand and the intensity of competition. In 2024, the Fiber Solutions market in Europe, a key segment for Hexatronic, faced significant price pressure. This was largely attributed to a period of overcapacity within the industry, coupled with a temporary softening of demand, impacting the pricing power of all players.

For substantial infrastructure undertakings, especially in North America where programs like the BEAD initiative are driving fiber optic expansion, Hexatronic participates in tailored bidding and secures extended contracts. These arrangements underscore the significant scale and strategic value of the fiber optic deployments they undertake.

These long-term commitments are crucial for Hexatronic, providing revenue visibility and enabling efficient resource allocation for complex projects. For instance, the BEAD program, with its significant funding, translates into numerous large-scale opportunities where customized solutions are paramount.

The nature of these project-specific bids means Hexatronic must demonstrate not only technical capability but also a deep understanding of client needs and long-term project viability. Success in these bids directly impacts Hexatronic's market share in critical infrastructure segments.

Diversification Mitigates Pressure

Hexatronic's strategic diversification across various market segments, notably its robust performance in Harsh Environment and Data Center operations, acts as a crucial buffer against pricing pressures within the Fiber Solutions sector. These distinct business areas often benefit from unique pricing dynamics, reflecting their specialized applications and the higher value they deliver to clients.

For instance, Hexatronic reported a significant uplift in its Data Center segment, contributing substantially to overall revenue growth. This segment, along with the specialized Harsh Environment solutions, typically operates with less commoditized pricing, allowing for healthier margins. This strategic balance helps mitigate the impact of any potential price erosion in more mature markets.

- Harsh Environment Segment Growth: Demonstrates resilience and ability to command premium pricing due to specialized product requirements.

- Data Center Demand: Shows strong market adoption, indicating robust pricing power for high-performance connectivity solutions.

- Margin Stability: Diversification across these segments helps maintain overall profitability despite potential market volatility in specific areas.

Efficiency and Cost Control

Hexatronic navigates market-driven price pressures by relentlessly pursuing internal efficiency and rigorous cost control. This focus on operational discipline is crucial for maintaining profitability, especially given the competitive landscape. For instance, in 2024, Hexatronic reported continued efforts to streamline manufacturing processes, which contributed to a stable gross margin despite increased material costs.

This commitment to cost management allows Hexatronic to offer competitive pricing across its extensive product portfolio, from fiber optic solutions to datacenter infrastructure. The company's ability to absorb some cost increases internally, rather than immediately passing them to customers, strengthens its market position. Their financial reports for the first half of 2025 highlight ongoing investments in automation and supply chain optimization as key drivers for sustained cost advantages.

- Operational Efficiency: Hexatronic targets enhanced productivity through process improvements and automation.

- Cost Management: Strict control over direct and indirect costs to protect profit margins.

- Competitive Pricing: Maintaining attractive price points to capture and retain market share.

- Profitability: Ensuring healthy margins even amidst external economic challenges.

Hexatronic's pricing strategy for its fiber optic infrastructure is largely value-based, reflecting the long-term benefits clients receive. In 2024, the company's pricing was influenced by market demand, particularly the surge in high-capacity fiber solutions for 5G and data centers.

However, the European Fiber Solutions market in 2024 saw price pressures due to industry overcapacity and a temporary demand dip. For large projects, especially in North America driven by initiatives like the BEAD program, Hexatronic secures extended contracts and participates in tailored bids, showcasing the strategic value of their deployments.

Hexatronic's diversification into Harsh Environment and Data Center segments, which generally command premium pricing, helps buffer against price volatility in other areas. For example, their Data Center segment saw significant revenue uplift in early 2025, contributing to overall growth and margin stability.

The company also focuses on internal efficiency and cost control to maintain competitive pricing. In the first half of 2025, investments in automation and supply chain optimization were highlighted as key drivers for sustained cost advantages.

| Segment | Pricing Dynamic (2024-2025) | Key Influences |

|---|---|---|

| Fiber Solutions (Europe) | Price pressure due to overcapacity and softened demand. | Market supply/demand, competition. |

| Fiber Solutions (North America) | Value-based, tied to large infrastructure projects (e.g., BEAD). | Project scale, government initiatives, long-term contracts. |

| Data Centers | Premium pricing due to high performance and demand. | Growth in data consumption, 5G infrastructure. |

| Harsh Environment | Premium pricing due to specialized applications. | Industry-specific requirements, reliability needs. |

4P's Marketing Mix Analysis Data Sources

Our Hexatronic 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed product specifications. We also leverage industry publications and competitor analysis to ensure a thorough understanding of their market positioning.